This is the story of how I found myself over the pension Lifetime Allowance (LTA) and what I’m doing about it. It does not constitute investment advice. I use ‘pension’ and ‘SIPP’ interchangeably to mean a Defined Contribution pension. (Sadly, I’ve no experience of Defined Benefit schemes.)

I started with the best of intentions. Sometime back in the 1990s I began putting all my earnings above the higher-rate tax threshold into my pension.

I was fairly sure the higher-rate years wouldn’t last long – my nagging imposter syndrome was itself no phony!

After a while I’d still not been found out. And so with other calls on my money – ISAs, property investment, family – I moderated my contributions.

All told, there was only a few hundred thousand pounds in my SIPP when the £1.8m Lifetime Allowance for pensions was introduced in 2006. So it didn’t seem particularly consequential at the time. There was certainly no urgency to worry about going over the pension lifetime allowance.

The LTA felt even less consequential in the immediate market wreckage of the Global Finance Crisis. Everything was down, including my portfolio.

Pumping up my pension

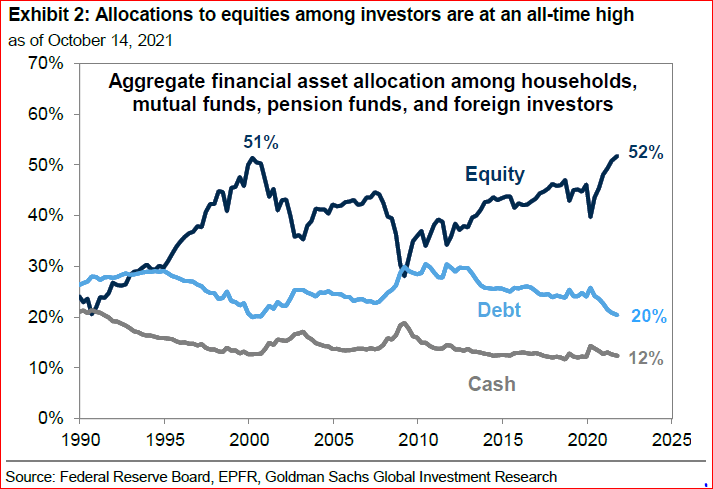

Fast-forward a few years. Asset prices recovered, and I continued to squirrel away my contributions. The chances of my hitting the LTA increased.

As the tax system got more draconian, I therefore got more tactical. I only contributed to my pension when I was getting an effective 50-60% rate of relief. When paying the ‘additional’ rate, for example, or because of the annual allowance taper or the child benefit claw-back.

It was starting to look like I might be a higher-rate tax payer in my retirement.

Nevertheless, I kept contributing – because who ever knows what’s going to happen?

Psychologically I’d prefer to see money go into my pension – even if it faced an uncertain future – than to see it wiped out today in tax.

Once it’s gone it’s gone, after all.

Allowance down. Portfolio up

I didn’t apply for LTA protection for a couple of reasons. But the main one was that once you take this action, you have to stop contributing.

I had ended up in a job with the sort of arrangement where my employer put in 4% if I put in just 3%. So even if more additions did take me over the LTA, contributing still seemed just about worth it.

By this time they’d cut the allowance to £1.5m. Meanwhile my SIPP was worth about £800,000.

Still plenty of room, you’d think?

Tax tail wags investment dog

What investments did I hold in my SIPP?

Well, US equities.

And why US equities?

Because under the reciprocal tax-treaty, UK pension funds, including SIPPs are treated as tax-free entities by the US tax authorities (the IRS).

Even more amazing, some brokers and custodians are actually sufficiently well organised that they apply the correct rules so that you don’t pay dividend withholding tax on US equities in a SIPP.

There was a time when this really mattered; when you got a 4% yield on US stocks, that’s a 60bps per annum uplift (15%x4%).

I appreciate that doesn’t sound like much. But it’s £6,000 a year on £1m. Every little counts.

The US equities market is roughly half the world market cap. So I’d keep that half in the SIPP and the other half in ISAs and suchlike.

Even better – you can hold foreign currencies in a SIPP. This means that when your US stock pays dividends, you can re-invest 100% of those dollars back into more US stocks, paying more dividends. All without your broker gouging your eyes out with a currency exchange spread that you could drive a bus through.

Lovely, you would think.

Or perhaps more an example of being too clever by half?

2016: Under a cloud and over the pension lifetime allowance

All at once, a bad thing and then a very bad thing happened in quick succession.

In April 2016 the LTA was reduced to £1m. That was annoying.

But not half as annoying as what came in June, which, for me personally, was pretty devastating: Brexit.

Sterling, predictably, depreciated sharply. The pound value of my completely US Dollar-denominated SIPP soared up and over the pension lifetime allowance, without even touching the sides.

Not that this was any silver lining to the Referendum result for me. I’d rather live in a rich multi-cultural society and be well-off in hard currency terms, than live in a poor insular one and be nominally rich in a devalued currency.

But apparently not everyone felt the same way.

No point crying over spilt milk

Apart from a brief market swoon in March 2020 – when it looked like my LTA problem might be solved for me – I’ve been well over the pension lifetime allowance ever since.

In retrospect I should have done things differently. Perhaps there are some lessons for the reader in here:

- I shouldn’t have contributed so much when I was younger. But in my defense, there was no LTA then. So it is, in effect, a bit like retrospective taxation – especially with respect to the 25% tax-free amount. Lesson: don’t trust the government.

- My wife has fewer pension assets than me. I should have had my employer contribute to my wife’s pension, out of my salary sacrifice. This would have got money into her pension, with tax relief at my marginal rate. I only found out this option when I read about them closing the loophole! Lesson: pay more attention.

- I shouldn’t have concentrated my non-Sterling exposure in my SIPP. But in my defense, what other country in history has voted to devalue its own economy? Lesson: populism doesn’t work for complicated issues.

- I should have changed my asset allocation, maybe in the depths of the March 2020 crash. But in my defense, I didn’t know US equities would go on to nearly double while the world economy largely stayed on its knees. Also rebalancing is difficult. Some of the US-listed ETFs in this portfolio are irreplaceable, because of – cough – an EU rule called PRIIPS. (The irony isn’t lost on me) Lesson: pay more attention, again.

- I should have given more serious thought to this issue before The Investor asked me to write an article about it a couple of weeks ago. Lesson: pay more attention, again, again.

I guess the meta-lesson for readers is to start thinking about this issue early.

Where we are today

The value of my SIPP is now far over the pension Lifetime Allowance.

- At the margin it’s a reasonable assumption that gains in my SIPP will eventually incur a 55% LTA charge.

- Outside the SIPP, assets that don’t produce an income will attract a 20% capital gains tax (CGT) rate.

Let’s first run through the conventional wisdom of what one should do in these circumstances.

Stop contributing

There’s no point now I’ve hit the LTA – a bit of convoluted maths indicates the 55% penalty rate I’ll pay on taking my money out will at the least undo the 40% tax relief I got putting money in.

But… I’m in an employer’s matching scheme that means it costs me 20p for every £1 in my scheme (up to a fairly low limit).

I’ll get 45p of that, after the LTA charge.

[Editor’s note: Individual tax situations vary hugely, and the maths may be different for you. Read the comment thread after this article for a good discussion of this!]

Decrease risk in the SIPP

Wise heads say I should concentrate my growth investments outside the SIPP, and just use the SIPP for the bond allocation.

We all hold a 60/40 equity/bond portfolio, right? So I should have the bond bit in the SIPP, high-yielding equities in my ISAs (or my Family Investment Co), and no-yield equities outside of the tax wrappers.

With bond yields where they are, returns from that asset class aren’t going to shoot the lights out after all.

With any luck the LTA will rise with inflation again. Eventually it could catch up with the value of my SIPP, which will have had very little growth in the meantime from those bonds. Heck, I could just leave it in cash.

This is all fine in theory. But I have a few issues.

Firstly, it assumes that there’s a couple of million pounds outside the SIPP for the equities allocation.

Then there’s psychology. I’ve noticed that it’s easier for me to stomach high volatility in the tax wrappers than outside. There’s some mental accounting, whereby losses in the tax wrappers are somehow less real (and therefore less painful) than losses outside them.

Why? I guess because the funds in tax wrappers won’t be touched for a very long time, if ever. In contrast funds outside are money I could use to pay for groceries or school fees.

Tellingly, my SIPP was my best performing investment account by a country mile for a very long time – and also the least accessible. (Though perhaps this was down to me being (un)lucky. It was only the withholding tax issues drove the asset location decision.)

Finally, rebalancing out bonds into equities from this pot is a problem, should it be required, because we effectively can’t move money out of the SIPP any time soon.

Increase risk in the SIPP

On the other hand, all losses in the SIPP now effectively get a 55% tax rebate.

Short-dated out-of-the-money call options on a meme stock like AMC? Why not? YOLO! HMRC is going to pick up more than half the tab if it goes bad!

This feels wrong. But I’m still giving it some thought.

Get a divorce

This would be quite a bit of paperwork, but under certain circumstances pension assets are split on divorce. And my my wife’s pension assets are only about 15% of the way to the LTA…

There’s a point at which divorcing Mrs Finumus and then immediately re-marrying her might save us hundreds of thousands of pounds.

(I’ve not run this one by her yet).

Take the tax-free lump sum as soon as possible

Taking the tax-free lump sum at least reduces the extent to which the problem is compounding. The trouble is that that’s deemed an LTA benefit crystallisation event.

Do nothing

Currently, the first mandatory LTA test is at age 75. Fortunately that’s nearly 25 years away for me. It’s possible the rules will change during that time – probably for the worse, but possibly for the better.

The SIPP still has many advantages, including the multi-currency capabilities, the freedom from US withholding tax, and minimal paperwork compared to doing CGT submissions on a trading account.

My SIPP also falls outside my estate for IHT purposes (albeit after paying the LTA charge).

What have I actually done to my SIPP?

I’m still contributing to my pension to get the matching contributions.

I’m slowly reducing the risk level in my SIPP and increasing risk outside. In fact I’m going to explicitly let my leverage run a little hotter than previously, and offset this with short-term treasuries (essentially cash) in the SIPP.

And I’m practicing gratitude. I’m acutely aware of how fortunate I am to be in this position.

Other implications of going over the pension lifetime allowance

I’ve also made some wider changes in light of all this.

Decreased risk in my children’s SIPPs

My children are in their late teens. They’ve had SIPPs since they were born, and various people have made contributions on their behalf, contributing a maximum £3,600 p.a., gross and including basic rate tax relief. (How do they get tax relief when they pay no tax? Don’t ask me.)

These SIPPs are now worth over £100,000 each.

Whilst this still seems like a long way from the LTA, they might be lucky enough to be paying very high marginal tax rates sometime in the future. Compounded growth of all these early contributions might rob them of the opportunity to avoid those high tax rates by contributing themselves – because it will bring them closer to the LTA.

But who knows? They’ll be much regulatory uncertainty over their lifetimes.

Increased risk in the (grand)parents’ SIPPs

Note: What follows is based on my current, slightly hazy, understanding of the rules.

Now this might seem even more orthogonal to the original problem. But since we’re in the neighborhood anyway, let’s drive by.

Between my wife and I we have three surviving parents. All are comfortably off, all over 75, and all, sadly, mortal.

Each of the three have substantial sums in their SIPPs – which are in ‘flexible drawdown’ – but the sums are far below the LTA threshold.

In addition, in all but the most extreme of circumstances they likely have sufficient assets outside their SIPPs to last them out.

Historically we’ve taken a fairly standard approach to their investments – reducing risk steadily as they have aged and stopped working.

However, my review of the LTA situation suggests a slight change of direction.

The rules are complicated, but SIPPs can be inherited, fall outside the estate for IHT purposes, and the beneficiaries (in this case because the benefactors will be over 75 on their death) can draw down at their marginal tax rate (it’s treated as regular income for the beneficiaries).

The last time the LTA ‘benefit crystallisation’ test is applied is on death. The beneficiaries can pass on the SIPP, generation after generation, and weirdly, as soon as one of them dies under age 75, the whole lot can be taken out tax-free by their beneficiaries.

In case you missed it… the last time the LTA test is applied is on the death of the original beneficiaries.

What does all that mean? Clearly, as a family, we want the high return stuff in the oldies’ SIPPs. In an ideal world they’d be worth exactly the LTA on the day of their demise.

And then? This seems like a gaping loophole… but as I read it the pot can grow tax-free – forever. Theoretically, under the current legislation, you could leave it compounding, untouched, and completely tax-free, for centuries.

Of course they’ll change the rules long before that.

Any other ideas?

This has been a classic example of a ‘you only understand it if you can explain it to others’ situation.

Just writing this all down has forced me to properly confront a looming issue that I’d just been sort of ignoring for a while now – that my excess over the pension lifetime allowance isn’t going away, and some mitigation measures are appropriate.

I’m sure there are many other things I could do. Let’s hear some of them in the comments!

If you enjoyed this, follow Finumus on Twitter or read his other articles for Monevator.