This is my take on the important elements of a bond fund / ETF 1 webpage.

By running through the info that I pay careful attention to, my hope is that new investors will find it easier to understand bonds and to do due diligence on an asset class that many find confusing.

- If you’re doubtful about the wisdom of owning bonds, learn more to see why they may still be a good investment.

- If you’re truly a bond refusenik you can also check out my equity-orientated article on how to read a fund factsheet.

Diving into a bond fund

I’ll illustrate my approach using the webpage for iShares Global Government Bond ETF (IGLH).

iShares fund webpages are pretty good overall. They contain much that you need as well as plenty that you don’t.

Other fund providers offer similar fare, but the data may be labelled differently.

If any of the information below is AWOL from a bond fund webpage or factsheet then I mark it down versus other candidates on my shortlist.

Fund name and overview

Fund names can reveal quite a lot of information, which makes up for them being about as memorable as a robot’s serial number.

Our fund names explained piece reveals what’s in a boring name.

Several funds may share a similar name but actually invest in materially different sub-asset classes.

It’s like going to a big family gathering, when you’re age seven, and meeting an endless parade of uncles and aunts. They all seem friendly but you’re mystified as to how they relate to you.

A fund family tree can reveal a hierarchy of spin-offs (known as share classes) that differ by currency, cost, income distribution, and so on.

Note down the ISIN number, SEDOL, or ticker. This way you can guarantee you’ll get the same product when you later search for it via your broker’s platform. Don’t rely on the fund name.

iShares have a nice dropdown menu just under the fund name that reveals your choice of share classes.

Vanguard doesn’t always list its funds’ available share classes, but the passive giant typically offers both Accumulating and Income flavours. Check your broker or dealing platform to see if it offers the version you’re after.

Investment objective

Check the fund’s description mentions the sub-asset class you expect the fund to track.

For example: ‘developed world government bonds’.

I also look for a phrase like ‘…tracks the performance of an index…’ to affirm I’m definitely dealing with an index tracker.

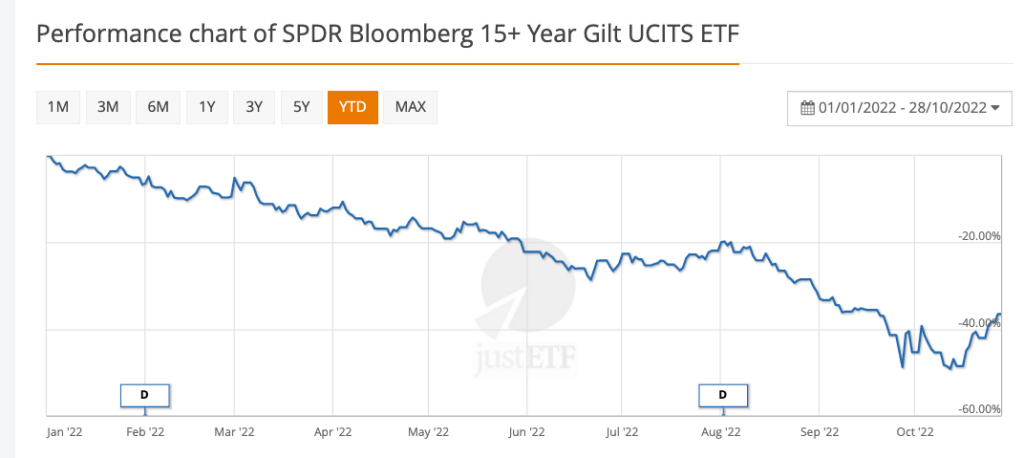

Performance

Past performance is not the big deal many people think it is.

You can’t tell anything from one-year returns and not much from three years.

Five years gives you a sense of how well the fund matches up against its rivals. Ten years is far better, and about as much data as you can expect for free.

But what really matters is your strategic asset allocation and the role your fund fulfills in that.

If you decide an asset class belongs in your portfolio, then make sure:

- Your fund properly captures that market – see the benchmark index section below.

- It’s not outclassed by its peers. (I’ve explained before how I use past performance to compare the best bond funds on the market.)

It’s irrelevant that a particular global government bond fund lost 1% over the last three years, provided other global government bond funds lost much the same.

Don’t worry if your fund trailed a competitor by 0.5% in one year. Subtle differences in index composition and fund methodology can easily explain that away. Your fund may well beat the pack next year.

However if your pick consistently underperforms its near-rivals by that amount or worse, on a five-year view, then investigate why.

If your fund always lags when you compare like with like, then switch to another.

Key facts

iShares’ ‘Key Facts’ mostly just need a quick eyeball to check nothing is amiss.

Net assets or Assets Under Management (AUM)

Small funds are vulnerable to closure if they don’t attract enough investment cash. Assume new funds will get 12-months to prove themselves profitable.

Anything over £100 million in assets under management should be okay.

Remember you don’t lose your money if your fund closes. Its underlying assets still retain their market value.

However your shares will be sold on closure of the fund. That could trigger Capital Gains Tax, if your fund isn’t tucked inside your tax shelters.

You also run the risk of an adverse market movement when you’re sitting in cash.

Your provider may offer two AUM figures.

A larger one labelled ‘fund’ or ‘umbrella’ is liable to be the sum of the master fund’s share classes.

Go with the smaller figure, which concerns your particular sub-fund.

Currency

Your exposure to currency risk depends on the currency your fund’s underlying assets are priced in.

Remember, you are still taking currency risk if you choose a GBP (British Pound) version of an unhedged fund that invests in overseas securities.

If your global bond fund holds US, Japanese, and German securities, say, then you’re exposed to the pound’s exchange rate versus those country’s currencies.

Terms like base currency, denominated currency, or fund or share class currency refer to the currency your fund reports in. These are simply accounting terms.

Trading currency means the currency the fund is bought and sold in on your local stock exchange. That makes no difference to currency risk but choosing GBP can save currency conversion fees.

You’re only shielded from currency risk if your bond fund explicitly states it is hedged to GBP or if it only holds securities priced in pounds.

- Dive deeper into currency risk and the hedging decision.

- For more on global government bond funds.

Ongoing Charge Figure (OCF) / Total Expense Ratio (TER)

Your fund’s headline cost is a key metric. Cheap is good and less is more when it comes to fees.

But neither the OCF nor TER include all charges due.

Fund providers routinely deny us the complete picture because they’re not harried into full disclosure by the regulator.

For instance, transaction costs add up like baggage fees on a budget airline flight.

I give bonus transparency points to providers who publish transaction costs on their fund’s webpages. Xtrackers does this, for instance.

Vanguard scores half marks because it publishes its extra expenses – but only in an obscure PDF squirrelled away on its website.

If iShares does us a similar service then it keeps it quiet like a shameful family secret.

You can uncover the impact of undisclosed charges using this tracking difference technique.

Product Structure / Replication Method

Physical means your ETF actually holds the assets it claims to track.

Duh, yeah. So what?

Well, you’d think that it’s de rigueur but it’s not…

Because in contrast synthetic means your ETF typically does not hold the assets it aims to track.

Instead, investors’ cash is ploughed into a derivative that matches the return of the fund’s index.

Synthetic ETFs get to the same place as physical funds by way of ever-popular financial engineering.

The term synthetic has an image problem nowadays. Hence these synthetic ETFs are usually branded as ‘indirect replication’ or ‘swap’.

But I don’t particularly discriminate between physical and synthetic because both types usually come bundled with counterparty risk, anyway.

Methodology

Sampled or optimised means the fund doesn’t hold every last security covered by its index. Very few funds do because small and illiquid securities rack up costs while making little difference to your returns.

You can use tracking difference to test whether the methodology’s deviation from the index has historically cost much by way of return.

Securities lending return

Many funds lend out your securities to short sellers (including active fund providers that often neglect to mention it, incidentally).

Your provider’s lending policy should be published. Some portion of the fees earned may be paid to the fund, which should nudge up its returns.

Securities lending exposes physical funds to counterparty risk, however.

I don’t worry about this risk but I’m aware of it. I think of it as a tie-breaker situation.

Ideally, my choice will keep its securities under lock and key. If it lends them out, then I want the highest possible share of the profits.

But if one fund lends and regularly beats my other candidates then yeah, I’ll probably take jam today.

Domicile

Where is the fund based and regulated? Most ETFs are quartered in Ireland and Luxembourg. The UK regularly crops up for funds, as opposed to ETFs.

A UK domicile offers you the comfort of the FSCS compensation scheme.

Ireland and Luxembourg’s equivalents are much less generous.

Ireland’s double-taxation treaties give it a withholding tax edge over Luxembourg.

Benchmark index

Trackers track indexes. That’s their job so make sure you get the right match. Google the index and read its factsheet.

Think about:

- What market does the index track?

- Does that market adequately capture the asset class returns you’re after?

- Is the index widely used by the industry? If not, why not?

- Can you find good information about the index?

- Is the index diversified? If not, does that matter?

- Do the index holdings overlap with other funds you own? That can mean the fund is redundant in your portfolio.

- Does the index guard against over-concentration by capping the weight of its constituents? If not, do its rivals?

Other Key Facts

Risk rating – I don’t think this offers much in the way of genuine information. Still, if you think that you’re buying a low-risk fund but the rating indicates Indiana Jones-style adventures ahead… that could be a sign something is wrong.

UK reporting status (UKFRS) – Check it’s a yes, otherwise you may pay excessive tax.

UCITS – Again, we’re after a straight yes. This is comforting EU regulation that was transposed into UK law after Brexit.

Use of income – Distributing or Income means interest will be paid into the account of your choice – handy for retirees. Accumulating or capitalising means the fund automatically reinvests your payouts – handy for accumulators.

Minimum investment – Don’t be thrown if this says something like £100,000. That is directed at institutional investors, not us. Look for the product on your investment platform. If stocked then you’ll be able to invest the minimum decreed by your broker – £50 or whatever.

Portfolio characteristics

These elements are key to understanding what you’re getting from a bond fund:

Yield to maturity (YTM)

This is the annualised return you’d expect to receive if you invest in a bond and hold it to maturity (accounting for its market price and the remaining interest payments, which are assumed to be reinvested at the same rate).

Providers will often display other yields but yield to maturity is the only one you really need. That’s because you can use it to compare similar bonds that vary by price, maturity date, and coupon rate.

The Investor wrote a classic piece about the most common bond yields.

Maturity

We often talk about short, intermediate, and long bonds on Monevator. Those lengths refer to the average maturity dates of a bond fund’s holdings:

- Short-dated bond funds are the least risky, least rewarding and least sensitive to interest rate changes.

- Long-dated bond funds are the most risky, most rewarding (potentially) and most sensitive to interest rate changes.

- Intermediate bond funds sit somewhere in the middle. They hold short and long bonds, along with medium maturities, in a diversified portfolio.

See the duration metric below for a practical measure of your fund’s interest rate risk.

- Short bond average maturities are five years and less.

- Long bond average maturities are 15 years and more.

- Americans think of five to seven years as the intermediate maturity sweet spot. But gilts skew longer.

Long bond funds should have a higher yield to maturity and duration than short bond funds of a similar type.

Duration

Duration can be used to gauge your bond fund’s sensitivity to interest rate changes:

As a rule of thumb, a bond fund with a duration of 7 will:

- Lose 7% for every 1% rise in its yield to maturity.

- Gain 7% for every 1% fall in yield to maturity.

Whatever your bond fund’s duration number, that’s roughly how big a gain or loss you can expect for every 1% change in its yield.

Duration helps you assess the risk you’re taking, assuming you have a strong opinion about the future direction of bond interest rates.

There are multiple types of duration but it’s not worth losing sleep over the slight differences between them.

This piece on bond prices helps explain how interest rate changes impact bond yields.

Credit rating / credit quality

Credit quality is a verdict on the financial strength of the bond issuer as delivered by the main credit rating agencies.

The lower the rating, the greater the perceived risk that the borrower will fail to pay their debts.

All things being equal, investors demand higher interest rates from weak borrowers.

Annoyingly, many providers don’t publish an average credit rating for their fund’s holdings. Kudos to Vanguard who does.

So when you’re parsing your fund’s credit quality chart, be mindful of these thresholds:

- AAA is tip top.

- AA- and above is considered to be high-quality.

- BBB- and above is investment grade.

Anything below investment grade is junk. (That’s the industry term, not my opinion. Well, not exactly! A less evocative term for junk is ‘high-yield’).

Only investment grade to high-quality funds belong in the defensive side of your asset allocation.

Investors flee to quality in a crisis. So that’s when you need your bond funds to come through.

Beware – Some naughty providers feed you the index’s key characteristics and not the fund’s. That’s a serious transparency transgression.

Sustainability characteristics

Given the finance industry is deluged with greenwash, I don’t pay much heed to self-reported sustainability metrics.

If you think that sounds glib then please read this Monevator piece on the complexity of Environmental, Social, and Governance investing.

Here’s my take from the days when trying to do good was called Socially Responsible Investing

Holdings

I look at the Top 10 holdings to ensure they tally with what I think the fund does.

I’ll also check the Top 10’s percentage weights to verify my pick isn’t over-concentrated in comparison to its alternatives.

A diversification once-over isn’t necessary for gilt funds. All gilts are high-quality bonds priced in pounds. There’s no need to look under the bonnet.

I also stop short of wading through spreadsheets that name-check hundreds of holdings. I’m not qualified to judge individual securities.

What’s more, I’m not a masochist. This article not withstanding.

Exposure breakdowns

Reading the portfolio breakdown section is like checking the ingredients label on a supermarket food item. Write-off the calories, wince at the sugar content, then stare blankly at the long list of emulsifiers and other chemical mysteries.

Well, there’s no sugar in bonds but it’s worth corroborating there aren’t any other nasty surprises in store.

Returning to our iShares Global Government Bond ETF candidate, you may be surprised to see that the currency exposure on a global government bond fund is 99.6% pound sterling. However that simply confirms we’re definitely looking at the hedged version.

The currencies listed show you what currency risk you’re taking in an unhedged fund.

The geographic breakdown verifies this fund invests purely in the developed world. I don’t attempt to second-guess whether, for example, 7.35% German bunds is just the right amount, however. Knowing that is about as useful to me as wine notes:

“Oh, this bond fund has wonderful notes of coarse sausage, accented with wild French garlic, and a heavily hocked public sector. One can almost hear the creaking of the balance sheet.”

Sector / issuer splits are worth a shufty, especially in aggregate market funds. The weight of corporate holdings is liable to reduce your fund’s recession-resistance versus high-quality government holdings.

You should get credit quality and maturity breakdowns, too, but we’ve discussed what to look out for earlier.

Fund documents

Read the KIID and factsheet at least. The factsheet often contains useful, extra info.

Valuable nuggets can occasionally be plucked from the legalese spoil within the annual report.

Check the Reportable Income docs if your fund sits outside your ISA / SIPP tax redoubts.

Bond article survivors’ group

Peace be with you weary reader. It’s over! Please give me a shout-out in the comments if you made it this far.

It took me seven years to summon up the strength to write this beast. Hopefully it will help someone struggling with bond funds.

As for me, I’m off to have my head examined.

Take it steady,

The Accumulator

- An ETF is a type of investment fund, so I’ll use the term ‘fund’ when referring to generic characteristics shared by index trackers.[↩]

Comments on this entry are closed.

@TA, I am disappointed to find you don’t use the same due diligence when choosing a bottle of wine! From your care in looking to see what is behind the label on investments I had expected better.

Thanks for a brilliantly simple summary of the language and structure of the bond market. It has taken me 5 years to puzzle out empirically the answers to questions that your article provides with a hour’s reading. And the miracle of the internet is that you give me, a total stranger, the benefit of your wisdom and experience completely free!

I rather like the FT’s presentation on funds’ performance, especially the chart on “Risk Return”. This shows in easy form the performance/risk for your selected fund. Perhaps “standard deviation” and “R squared” and so on is not for everyone but the graph is very understandable.

@ Jonathan B – heh heh. I’d be even more of a lightweight than I already am if I took that long choosing booze.

@ Richard – cheers, I’m glad it helped. I get why bonds aren’t very popular right now but the lack of comments on the recent bond articles makes me think it’s time to knock them on the head.

Investors in European junk bonds are now accepting negative yields for the first time, according to the FT.

https://www.ft.com/content/9110c6a8-69f6-4cc0-9ec5-bad5daeacfb7

“It is a reach for yield,” said Ian Samson, multi-asset fund manager at Fidelity International. “High-yield bonds are one of our preferred ways to take risk at the moment because the investment outlook may be strong enough that we don’t get a big default cycle.”

Hmmm…

Fingers crossed behind his back? Although to be fair, it was qualified with a “may” 🙂

Excellent article. Shall bookmark and point people in this direction for jargon free and clear guidance. Thanks for this.

@TA I’m not sure that you should judge usefulness or interest by the number of comments. Maybe it’s just uncontroversial. I found the article useful, although there’s perhaps an effect of diminishing returns as I go from total ignorance, via analysis paralysis and the occasional hare-brained error, to an asset allocation that allows me to sleep at night, but also reduces my need to fiddle. Somehow the events in the markets move the dials (metaphorical) in my spreadsheet less and less. I find myself wishing for something to happen out there that would give me a reason to tweak. But what I’m going to do instead is go back to your 01/09/21 “Compare funds…”

article and see if I can diversify away from Vanguard for my bond holdings.

@Mr Horey Thanks for the link and the quote “…preferred ways to take risk…” – I can see what he’s saying there (I think), but those people really do speak a different language. Perhaps it happens when the risks you take are with other people’s money 😉

@TA, I think the lack of comments here is just an indication of the lack of argument against what is a very comprehensive post! It has a very important educational role on this site, and , having experience teaching for too many years now, audience silence is no indicator of a bad job.

I never read your posts without picking up more tools. Keep it up 🙂

JimJim

Sometimes an article is absorbing and maybe I will bookmark it but find I haven’t anything worth adding. If there were an ‘I found this useful’ button I would certainly have clicked it, but part of Monevator’s charm is that there is no such button.

I concur with the previous posts about the lack of comments on the subject of bonds. Look upon it as ‘silence is golden’. You don’t hear people chatting through a great play or concert,they’re absorbing what they’re experiencing.

Another brilliant article . I found this website 5 years ago and honestly I can’t capture in words how much it has helped me . I agree will all the comments here this article will probably go into my top 5 from this site . Bonds are the trickiest to understand and appreciate . When I take my pension outside my company scheme and into drawdown this article will be a go to must read again before I settle on my bond funds . Huge thanks

@ All – thank you for that extra reassurance. Sometimes when you deep-dive into a niche, you’re not sure if anyone else wants to come with you. I’ll put my Tiktok crypto channel on hold.

@ JimJim – Mrs Accumulator would heartily endorse your comments about silence as a teacher herself. Riot control officer would be a more accurate job description.

@TA

Yes, thanks for creating this definitive guide to understanding bonds. Your efforts are not in vain and, like others, I’ve not commented because I simply felt I had nothing insightful to add (and still don’t).