With the UK sliding into recession, war ruining Ukraine, and inflation stalking the High Street, now may not seem like a good time to invest.

Perhaps it’d be best to keep your financial powder dry? To wait for better days?

That makes perfect, intuitive sense – until you step back and look at the bigger picture.

In the long run, equities go up

The bigger picture looks something like this: the most reassuring chart in investing…

Data from JST Macrohistory 1. November 2022.

The chart shows inflation-adjusted, UK stock market total returns2 surging through 150 years of upheaval and periodic catastrophe.

Despite the regular, tragic punctuation of financial and human carnage, equities kept rising over the long-term.

And whatever challenges we’re facing now, they’re unlikely to be as disastrous as the devastation wrought by the one-two punch of World War One and the Spanish Flu.

Or the Great Depression followed by World War Two.

The UK’s worst stock market crash was the -73% real terms decline that played out over 32 months of misery from 1972 to 1974.

You can see the gouge it tore in the graph above during the years of stagflation in the 1970s.

But progress eventually resumed. Just as it did after the Dotcom Bust (-44%) and the Global Financial Crisis (-43%).

Even the recent Covid crash barely registers in retrospect.

Investing is one damn thing after another

Perhaps our current woes auger the next calamity? Maybe it would be best to batten down the hatches for now?

Time will tell. But the world is always troubled.

Here’s a catalogue of threats that menaced investors in the years that followed the Global Financial Crisis:

- 2010 – Greek bailout, The Flash Crash

- 2011 – EU debt crisis, double dip recession, US downgrade

- 2013 – The Taper Tantrum, US government shutdown

- 2015 – Chinese stock market crash

- 2016 – Brexit referendum, Trump election, Fed rate hike jitters

- 2018 – US-China trade war, quantitative tightening

- 2019 – Inverted US yield curve, Great Stagnation warning

- 2020 – Covid, running out of Netflix shows in lockdown

- 2021 – Covid, Evergrande liquidity crisis, global energy crisis

- 2022 – Inflation surging, Russia invading Ukraine, deepening energy crisis, global downturn

Scares and setbacks continually close in on us like the walls of the Death Star’s trash compactor.

In fact you could reach back into history and put together a list of cascading crises, dire prophecies, and apocalyptic warnings for almost any year.

But there’s no point living like that.

On a personal level it would mean never stepping into a car, or dating, or going outside.

Financially, it’d mean measuring your wealth in prepper stockpiles rather than in the stock market.

To achieve anything like the (272,700%) growth of £1 shown on the chart, we must accept some risk and uncertainty.

We can stay the course by keeping our eyes on the prize, not the temporary reversals.

Pain is why you are paid

Many of the market’s biggest opportunities have followed its most dramatic falls.

Prices rocket when investors eventually realise they overreacted to the last shock.

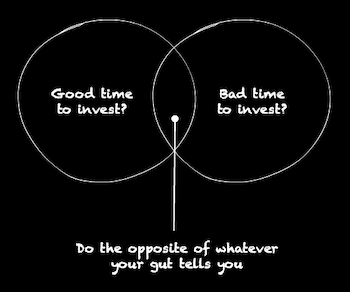

But human psychology guarantees you’ll fail to grasp those moments if you don’t upgrade your mental firmware from the basic fear and greed package.

Greed sucks us into rising markets. Think 19th Century Gold Rush or 21st Century Crypto Bubble. We’re like moths to the money flame.

Then we get burned. Fear takes over and instructs us to: “Freeze! Just chill for a while. Let’s wait and see what happens.”

And then all of a sudden the market marches on without us. We miss most of the rally…

…until eventually greed overwhelms our fear again – dragging us back into the action because nobody wants to miss the last train to Fat Stacks City.

This is the chimp version of scissors, paper, stone. Greed beats fear. Fear beats greed. We flip-flop in time to the market’s beat, but out of tune with the opportunity.

Playing the market this way only increases the risk of buying high and selling low.

But wading in when your instincts scream: “Danger! Danger!” will increase your odds of buying low and selling high.

As Warren Buffett puts it: “be fearful when others are greedy and greedy when others are fearful.”

Is now a good time to invest?

Now is as good a time as any to invest because for the vast majority of people it’s time in the market that counts, not timing the market.

In retrospect, the historic traumas charted above proved brief downward squiggles on the great graph of historical returns.

Progress is not inevitable, of course. But we shouldn’t lament the lack of guarantees either.

Uncertainty is the gunpowder that propels our future returns. It’s exactly because of the risk of loss that investors demand the prospect of higher returns from equities.

No-one gets paid for betting on a sure thing. But buying a stake in the continued progress of humanity – and its main engines of productivity – has paid off for the past 300 years.

If you believe the arc of progress bends towards the good then owning a diversified portfolio of equities is a wise investment, alongside other useful asset classes.

Check out our guide on passive investing to see how to make it work.

Take it steady,

The Accumulator

- Òscar Jordà, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. “The Rate of Return on Everything, 1870–2015.” Quarterly Journal of Economics, 134(3), 1225-1298. [↩]

- We’re using UK stock market returns but the picture would be similar if you used the US or the World market. [↩]

Fair enough, but for balance, should we not mention Japan (from 1989, when it made up 50% of the world index) and then fell for c. 20 years?

Or the very high correlation of extreme valuations (e.g. on the CAPE) to subsequent zero or negative returns?

These long-term charts are all very nice – but I don’t know anyone who’d be happy (or able) to wait 10 or 20 years in a severe downturn.

Perhaps you have to have lived through the 1970s to know how painful that is.

Re: “Now is as good a time as any to invest because for the vast majority of people it’s time in the market that counts, not timing the market.”

Agree, but is this not somewhat dependent on your time horizon? That is, what makes sense for an averagely healthy person aged 30 may not necessarily apply equally to a sprightly nonagenarian.

@Paul — You were debating the merits of otherwise of CAPE / valuation / passive investing on this site in the years following the financial crisis, talking of bubble conditions in 2013 et cetera. In the end it became wholly disruptive to the site and I had to ask you to stop commenting, along with some enforcement (deleting etc).

I’m leaving your comment on here because that was now many years ago but I would ask you to please just say your piece and leave it rather than restarting those debates.

If I judge (in my wholly arbitrary and personal opinion) that your comments are likely to imply some kind of forecasting capacity that I don’t judge you (or most others) have or that will overall do readers much more harm than good then I’m afraid I’ll start deleting again.

Sorry if this sounds harsh to you (or new readers who haven’t got any memory of those days) but I’ve only had to ask/stop 4-5 people from commenting on this site in 17 years and I’m afraid you were one of them so I’m stating this now. Life is too short. 🙂

If you quite reasonably feel that this isn’t a place you want to share your views given this posture, then I quite understand and no hard feelings. 🙂

Cheers!

Obviously none of us have a time frame the length of that graph- we will inhabit a section only, however we also are rarely investing just the once. This potentially reduces the risk of us only investing before a big downhill. @TI linked to this a few years ago and I found it very comforting:

https://ofdollarsanddata.com/even-god-couldnt-beat-dollar-cost-averaging/

Windy

When you have spoken sense like this before in the last 12 years TA, it has paid me to listen. I’m glad to say the mindset may be sticking as I was ahead of the article this time!

I confess this was more from thinking about inflation where 10% nominal (0% real) kicks the ass out of -9% for not having it invested.

Nice to hear the reassuring mantra of “just keep investing” as the steady stream of news reminds us that somewhere in the world, it is going to hell in handbasket again.

If you’d like to read some of my gloomier stuff then fill your boots:

https://monevator.com/investing-biggest-falls/

https://monevator.com/bear-markets/

https://monevator.com/bear-market-recovery/

I’m planning a piece on Japan 1989. It’s an extraordinary crash we’ve referenced many times but most of the horror stories assume you were 100% invested in Japanese equities, invested only at the peak, and didn’t cost average before or after the crash.

OTOH, if you were a yen cost-averaging Japanese investor diversified across world equities and bonds you were fine over time. Not laughing, you wouldn’t have enjoyed it, but you were fine.

And that’s the point. If you can’t endure a lost decade then you probably shouldn’t invest. There’s a very good chance you’ll experience one. There are four in that UK chart alone.

Stay invested, stay diversified, buy equities on sale, and you’ll be OK.

I think whether or not now is a good time to invest will become academic to many people, as they won’t have the disposable income to invest regardless.

Bleak times.

If feels somewhat that the question isn’t whether it’s a good time to invest but whether you can afford to stay in cash for any surplus you may be throwing off notwithstanding some better rates for semi locked in deposits.

I believe one of the biggest threats to the markets – and wider spheres – is the climate crisis. We’ve just had COP 27 which failed to support a phasing out of fossil fuels so it’s very likely that we will see warming go beyond the 1.5C which the climate scientists have warned against for many years. I think investors have had a good run these past few years but I fear the risks are now much higher going forward.

I am investing now. Most of it in my pension, quite enjoying the discounts at the moment. Currently contributing 39% (29% from salary and 10% from employer).

Next few years will be rough when the mortgage is up for renewal so will have to substantially reduce my contributions to meet living costs.

diy investor (uk) your message struck a chord as I’ve been thinking exactly the same thing. Climate change is the elephant in the room that everyone seems bizarrely oblivious to.

Like many here I keep on plugging funds into a global equities tracker via my SIPP, ignoring the bumps. I have recently found myself pondering whether it might be time to start ‘diversifying’ into residential property and various other ‘essential’ asset classes. People have to live somewhere and have food and water etc. It’s becoming clear to me that humans are not going to cut emissions anything like fast enough to prevent a catastrophe. I’m sure behaviour will change dramatically when a catastrophe happens, and who’s to say when that may be, but by then it’ll be too late. I’m not sure the value of tech companies and a lot more besides will matter all that much when one in five people on the planet are living in the sea.

A lot of the solutions already exist, but commitment from earth’s inhabitants is severely lacking, and accordingly I’m not sure I want all my eggs in a global equities tracker, just in case.

There’s always an existential crisis looming behind humanity. Not minimizing the climate situation at all, but the chart includes two world wars and a nuclear cold war.

An escalation of warming would put many firms out of business but uplift many more (biosciences, carbon capture, electric cars etc). even within memory of this blog, petro firms made up 15% of the S&P by market cap in 2008 and are now at 3%.

If we’re taking about doomsday scenarios then the usual caveats apply ie your investments will be the least of your worries. If not, I’d keep DCA’ing and seeing how we adapt to a warming world.

@ His nibs – you’re right to hedge – to think about your economic lifeline should the world truly go to hell.

True diversification though is found in behaviour that currently looks extreme:

For example, the billionaire class purchasing New Zealand retreats and decommissioned nuclear missile silos in the Mid-West. Or the prepper fringe learning survival skills.

I can’t see the case for residential property ownership during a civilisational collapse, though an adequately defended farm might come in handy if food supplies are threatened. OTOH, it’s liable to be requisitioned by your local neighbourhood warlord.

There is a very smart ex-blogger out there who believes our current trajectory is unsustainable and has quietly spent his time learning skills such as carpentry and growing his own food. It helps that he enjoys it.

@ Mr jetlag – I subscribe to your view. In the 1950s many people thought nuclear war was inevitable. Not much point investing for the long-term if that outcome was nailed on.

I don’t want to minimise the climate crisis either – I am extremely worried about it. But it’s not clear to me that humanity can’t navigate it. We’re acting too late, too slowly, putting too many people in harms way, but it’s a big call to say we’re doomed.

mr_jetlag and The Accumulator: you make valid points but the world wars and the cold war were both of human origin and so was the solution.

Climate change likely will, and possibly already has, reached a point where changing human behaviour will not affect the outcome, unlike the examples you mention. It can speed it up or slow it down, but not reverse the overall trend. It’s why climate scientists are so adamant about 1.5C; wherever the critical threshold actually is the point is that you can’t exceed it with the intention of bringing it back under control later. It’s not like the budget deficit that keeps getting kicked down the road to be sorted out later.

It’s perhaps obvious to say but I’d compare it to the analogy of a snowball rolling downhill; it reaches a point where stopping pushing (aka adding more harmful emissions to the atmosphere) makes no difference because a critical threshold has been reached. The journey for humanity to stay within 1.5C requires us to stop pushing the snowball, from now, and to work as hard as possible to slow it down, also from now, to overcome it’s momentum. When I think of it like that I’m not quite so confident!

Point taken regarding residential property, I might struggle to get the rent paid unless I up my warlord ante.

nibs, the climate crisis is a great litmus test I believe of people’s baseline values and beliefs.

I believe a solution will be found to halt AGW, at the same I believe it will be hugely disruptive and painful and cause the collapse of governments and industries. Both of those things can be true.

If I believed it was out of human control, how does that change my behaviour in the here and now? I prefer to believe that we do control the outcome to some extent and that we will muddle through this in some way as we have through all the other crises past.

I emphasise belief since economics is the sum total of human behaviours which in turn is driven by human beliefs. There is no law of physics for GDP or stock returns. You can choose to believe we’re doomed, that’s ok. But I’ll keep DCA’ing, just in case.

@TA – wish I could edit comments, as I forgot to add, one of my good friends is a prepper with a house in the hills, shed full of tins, the works. He said his parents always have a good chuckle when they visit, as “they lived through the Cuban Missile Crisis” and didn’t think a shack in the woods would be any good when the world was on fire…

@mr_jetlag — I have a similar friend here in the UK. The problem in most breakdown scenarios isn’t the nukes, it’s that whoever got the guns first comes and takes what they want from you. 😐 (Okay, so you can have your own guns in the US but still works for ‘whoever organizes into a militia/mob with military weapons first’).

Regarding the edit button, I do consider it from time to time. I’ve seen problems in the past with forums with editing capabilities where people change their posts out of recognition to change their story etc. This can be solved with a timer, but that’s fiddle. Anyway noted, but this is off-topic for this post so I’ll leave it there. 🙂

@ Mr_jetlag and TI – like knowing a good car mechanic it’s always handy to have a friend like that 😉

@ His nibs – ha! I didn’t think of becoming my own warlord! One step up from becoming your own landlord.

More seriously, I think mr_jetlag is right when he says what are we to do from an investing perspective. I agree with you both that the change is likely to be tumultuous. But it’s far from clear it means the end of capitalism, much less the end of Western liberal society in some form, much less the end of humanity itself.

Perhaps if there is an analogy with the events in the chart then it’s with the eve of World War One. The prevailing international system seemed entrenched – four years later four empires had collapsed, the UK’s time as global hegemon was up, and Europe was in convulsions.

By the time yours truly arrives on the scene, some decades later, that version of society appears part history lesson part fairy tale.

Climate change is bigger in scale and more protracted in scope. I agree that to some extent it’s out of our hands. But so are world wars. They escalate beyond the ability of presidents, prime ministers and emperors to control them. Until catastrophe forces the change they could not will beforehand.

In other words, humanity will swing into action and hopefully it won’t be too late. Maybe our great-grandchildren will look at an upward pointing stock market chart in the future and wonder what the hell all that was about.

mr_jetlag and The Accumulator: I am inclined to agree with you, especially the painful/tumultuous part. It’ll be interesting to see how it plays out.

How it affects our behaviour and investing is very much down to the individual I think. It could mean redirecting retirement monies in some way, as I am contemplating. Maybe you decide you won’t fully retire and will instead explore other opportunities at and beyond traditional retirement age. Reassess lifestyle, health and ‘carbon’ footprint as these all feed into the investmemt approach. Explore different asset classes, different allocations, or place emphasis on only sustainable businesses.

This invites the question ‘what is sustainable?’ And who decides? A recent program revealed that Drax receives billions of pounds from the taxpayer in the form of grants for being ‘green’ and creating energy using biomass. All well and good until you realise they’re bulldozing primary Canadian forests to turn into pellets that are transported to the US east coast and shipped across the Atlantic. The green hypothesis is that the forest is replanted but that’s not happening and biomass is more carbon intensive per KwH of energy produced than the fossil fuels it’s replacing. Honesty and transparency is urgently needed if we’re to tackle this challenge collectively.

‘We’re doomed’ is far from my current standpoint (even if it reads differently!). I’m excited by lots of the developments I’m seeing. As suggested, this is a test of human behaviour. So far, as I see it, our collective behaviour isn’t reflecting the magnitude of the challenge, but I remain optimistic.

Dear accumulator

Currently £85k in savings @3.06 with Zopa from house sale. I withdraw the interest generated each month for overpaying mortgage and sometimes general spending. Savings are for refurb of new home hopefully this year or next, no rush until material costs cool hopefully. Now need to move all or part 85k from Zopa, at risk of earning more than 1k in interest. I have this years Isa allowance still open along with my Wife allowance so potentially 40k.. Without locking up in a fixed cash isa for 1 yr or 2yr any advice appreciated on continuing to generate max monthly interest )whilst keeping funds accessible to proceed with refurb should we decide to progress. We are not averse to investing some or all in stocks shares isa either, willing to take risk. Any advice/thoughts appreciated.

Hi Faith,

I’ve got a refurb war-chest too. Inflation on material costs is a nightmare right now!

OK, quite a lot of people put temporary savings into premium bonds. They’re tax-free, near instant access, and there’s always a chance you could strike it rich!

Martin Lewis has got a great article that translates the Premium Bonds prize rate into an interest rate you can compare with savings accounts:

https://www.moneysavingexpert.com/savings/premium-bonds/

I also use MSE to check savings rates. There’s a flexible Newcastle Building Society cash ISA paying 3.05% – it allows 3 withdrawals a year before you pay an interest rate penalty:

https://www.moneysavingexpert.com/savings/best-cash-isa/

Notice savings accounts can also help you earn a bit more interest once you hit the new tax year – if you can compromise on instant access but don’t want to fix for a year.

If your mortgage interest rate is higher than the cash interest rate you can earn (including any income tax you’d pay on savings) then look into an offset mortgage. Many Monevator readers use these to offset their mortgage payments while dipping in when they need cash. Obvs a new mortgage could incur set-up costs and I don’t know how competitive these section of the mortgage market is right now.

Finally, for a stocks and shares ISA, check out Money Market funds or ETFs. There are useful pointers in the comments thread of this piece:

https://monevator.com/vanguard-cash-interest/

I really need to write a post on money market funds. They use cash-like instruments but aren’t quite cash. That means they can offer a slightly higher rate but maybe slightly bumpier than cash sitting in an account.

Don’t invest in anything riskier than this with cash you don’t want to lose money on over the next few years. Do not gamble that money on shares.

You could very easily sustain a big loss in the stock market within a couple of years which would scupper your plans.

1. Track the indexes and/or pick better companies

2. Save more money to invest

3. Invest for longer. Time in the market – not timing the market.

This guy rams home the point only today (recommend playing at 2x speed, as sounds better, and saves time 😉 ):

https://youtu.be/TsptUaOqG-o?feature=shared

I love the way that this one (above link) uses a clickbait thumbnail to then deliver the exact opposite ‘stay calm and just carry on’ messaging.