I assume every investment I make could leave me with nothing.

I don’t expect it – in the case of cash and UK gilts I think it’s extremely unlikely – but I don’t bank on 100% guarantees.

Apparently sensible people complain on TV watchdog shows about losing all their money on corked wine funds or punts on plots of greenbelt land or timeshare apartments without plumbing or an airport within 50 miles.

And we who-know-better feel sorry for them…

…but we also snicker a bit at their gullibility.

Didn’t they see the risks?

Wasn’t it obviously a gamble?

Well, yes. Yet you still see supposedly sophisticated investors calling for criminal investigations when any old high stakes blue sky penny share goes bust.

Or retired people on Radio 4 admitting they lost half their net worth when their shares in RBS or Barclays went into the dunk tank in the financial crisis.

Very often such people were employees at the companies during their working lives.

They’d never normally dream of putting so much money into one company. But their familiarity with its logo and the office wallpaper of yesteryear makes them contemptuous of the risks today.

I even see smart passive investors putting all their money into one fund, or one broker, or into the hands of one adviser.

Sure the risks of something going wrong seem tiny.

Yes your money should be ring-fenced, segregated, held in your own name if everything is properly in order.

But why take the risk that it isn’t?

Every investment can fail you

When I buy individual shares, I assume the company can go bust – even if it is one of the largest companies in the world.

But my prudent paranoia goes much further than that.

Here are just a few examples of how seemingly safe and widely-used financial products could conceivably damage your wealth:

- Stock markets can and will crash. (Obviously… but people seemed to forget it during the last crash).

- Inflation can devastate long-term bond returns. (Obviously… but people today are buying German 30-year bonds yielding 0.65%).

- ETF providers could get into trouble, putting ETF investments into jeopardy at worst, or at least disrupting their smooth trade.

- Banks who are not members of your country’s compensation scheme can go bust or suffer a bank run.

- Investment companies can perpetuate fraud, from dipping their hands in the till right up to a Madoff-style Ponzi scheme.

- Banks and other financial companies can fail, with knock-on consequences for the investment products they stand behind.

- Electronic brokers or registrars could get into difficulties or suffer some form of collapse that destroys or renders inaccessible a record of who owns what.

- Ring-fenced assets might not have been properly – legally – ring-fenced.

- Safeguards against these or other failures can break or be unable to deliver. Or – more likely – there can be big delays in getting restitution.

- Insurance schemes set up to compensate you can run out of money.

- You may not even be as well-protected as you thought because that harmless-sounding ETF you bought was actually domiciled overseas.

- Cash under the mattress can be stolen.

- A government could appropriate the money in government-backed bank accounts, or default on repaying its own bonds, or make holding gold illegal.

- Your country’s currency could be devalued, so that even though your nominal net worth remains the same, your wealth is diminished compared to your overseas peers.

- Your country could suffer an economic collapse, even if the rest of the world chugs along fine.

- The communists could take over and outlaw all private property.

Clearly some of these events are far more likely than others – most are very unlikely – and there are some real Black Swans in there.

(Good luck guarding against a revolution that starts in Surbiton!)

But it’s vital to consider all risks – however vanishingly remote – in order to appreciate the potential value of the safeguards against them.

How then can we protect our wealth?

Everything from portfolio diversification and investing overseas to dividing your cash savings between different banks are sensible steps towards protecting your wealth.

I use a few different stock brokers, for instance, and have cash in several different bank accounts.

However I know I am running risks.

I only have a paper share certificate in one company (a non-listed one). Everything else is held electronically with online brokers in nominee accounts.

If the electronic record system collapsed for some reason, my share investments could be in peril.

I have also held synthetic ETFs in the past – and would do so again in moderation – despite the risks of synthetic ETFs versus physical ones.

Indeed I have very few physical or real-world assets.

I don’t even own my own home – the one kind of asset that almost all flavours of government tend to treat more reverentially than they do ‘fat cat’ assets like shares, bonds, and cash (at least until you reach genuine fat cat levels and your house has a front lawn they can really park their tanks upon).

I do have a pitifully small amount of gold tucked away in a vault, but despite my best intentions I haven’t added to it.

I think there is a case too for keeping a few gold coins or similar fungible assets somewhere secure near to hand that you can access in a crisis.

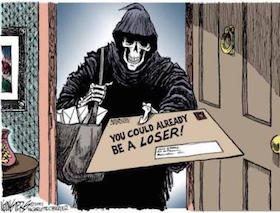

Don’t be a loser

Ultimately, you have to be pragmatic and live in the real world.

Accept that every time you invest, you take a risk with your money.

Do all you can to minimize those risks. Work through the alternatives. Spread your wealth around. Look for antifragile opportunities. And banish the word ‘guaranteed’ from your mind.

If you do all that then hopefully we’ll never have to hear on the radio how you lost the lot, never have to sigh, and never have to feel guilty for snickering at your foolishness.

Comments on this entry are closed.

6:19 Lay not up for yourselves treasures upon earth, where moth and

rust doth corrupt, and where thieves break through and steal: 6:20 But

lay up for yourselves treasures in heaven, where neither moth nor rust

doth corrupt, and where thieves do not break through nor steal: 6:21

For where your treasure is, there will your heart be also.

Straight talking as always. Good article. The old adage “don’t put all your eggs in one basket” pretty much sums it up mind…

Crikey. You, sir, was once charged with viewing sunrise as a bullish indicator.

There are some risks you can’t hedge. Even guns and ammo don’t help if your fellow humans and mad and bad, the smart part there is knowing when to let it go 😉

Diversification is good. Up to a point, Lord Copper

I thought this damn blog told us only a couple of weeks ago to put all our money into a single world index fund and then sit back and go fishing?

You have gold?

Really?

That “barbarous relic” ?

You old swivel eyed loon of a gold bug you!!! 😉

What other secrets are you hiding??? 🙂

@Peter — Indeed. Easy said than done though, and not that easily said. 😉

@Mikkamakkamoo — Yes, but I’m paid by the word around here. (Hah! I wish… 😉 )

@ermine — I am bullish by temperament when it comes to investing, but (a) that’s partly by design because I’ve observed optimism pays and (b) not how I am about almost anything else. Generally I’m a gloomy Celtic poet type. So my particular combination gives me twice the reason to be cautious when I’m 90% in equities, as I was last year, if that makes any sense? It’s about being alert, not blind or dogmatic. 🙂

@DaveS — Well, that was Lars not me but I don’t think this article is incompatible with his exactly. He made the case for buying global equities as a basket, not trying to be cute by second guessing regional weightings and so forth. He also strongly advises investors hold (a fair amount) of top-rated government bonds (so UK gilts for us) due to the risk of an equity crash. And his book urges you to think about your total exposures (e.g. your house or pension as an asset).

A reader who agreed with him *and* with me might, say, split the equity portion of their portfolio between two different global tracker funds, from two different fund providers — perhaps one as an index fund and one as a physical ETF for good measure. And then hold those two different funds at two different brokers.

By doing so you’ve completely changed your ‘Black Swan’ risk profile — the chance of losing everything, or more likely for it getting stuck in limbo for a period of time while things are sorted out.

Maybe it takes 10 minutes more to set up, and 10 minutes more paper work to read a year. Still plenty of time for fishing! 🙂

Being pragmatic and wielding the Pareto principle like a sword is the key, I think. Taking ‘losing the lot’ risk off the table is a top priority for me.

Also, I hope we all understand this blog doesn’t exactly “tell anyone” anything, it’s all suggestions and food for thought, although I take your meaning. 🙂

@Dragon — It’s an insignificant holding currently, not even 1%, though as I’ve written before I’d be happy to take it to 2-5% over time, in the right circumstances, presuming I wasn’t too rich. (Unlike some of the truly (madly) rich I’d probably cap my gold exposure, in the same way you’d only take on so much cover when you buy insurance).

If I do get close to a 5% holding then I’m pretty sure holding so much gold will slightly reduce my long-term returns.

But having seen its popularity in 2008-2010 I buy the safe harbour argument, and it will probably feel good to own it in such times. Emotions matter for long-term investing.

“Sadly” I don’t think the gold bugs will let me in their club on those grounds, even if wanting to own a small portion also gets me booted out of Buffett’s. 🙂

My gripe with splitting holdings across two brokers is you’re then doubling up on the fees (for a fixed fee broker, obv. If you’re charged on a %age basis it doesn’t matter how many you split it acorss.) This is contrary to my attempts at keeping costs as low as possible.

@dgos — Yes, that’s the price you pay. You’ll have to weigh up the advantages and disadvantages, and as you say think about the best cost structure for your needs. I wouldn’t do it and pay the price if I was just starting out and my portfolio was very small relative to my net annual savings. I would definitely pay it if it wasn’t.

I have my investment portfolio across four brokers/fund groups. I’m paranoid. 🙂 Just two gets most of the catastrophe/funds-in-limbo risk off the table. (Note to “guns and baked beans brigade” — no, not *all* risk).

Perhaps a bigger concern to me is that by increasing the number of fund managers you go with, for example, you’re more likely to have money with the one that in a blue moon does have a problem.

I can see why somebody might decide that Vanguard, specifically, is so vast and systemically important that they’d risk using them as their sole fund manager.

I’d personally still not go with just Vanguard, but if I did I’d split the Vanguard funds across at least two platforms/custodians/whatever.

Very sound advice, good to see I am not the only one who is paranoid. You do have to get the right balance though. I hold my SIPP with one provider on convenience and cost grounds, but nothing else is with that broker and my wife’s SIPP is held at a different broker. Same with ISAs. I have split my ISA in the past but it is a pain to manage if you spread things around too much. I hold VCTs in certificated form.

Well worth making sure you are actually diversifying as well, e.g. Halifax Share Dealing appears under a few different guises and seemingly different banks may share a single FSCS protection.

One other thing I do, chore that it is, is to download every contract note and broker statement to my own computer. I had a dispute with a broker a few years ago and these were invaluable. Also, make sure your computer is encrypted, virus protected and backed up (and the backups are encrypted).

p.s. nothing wrong with “German 30-year bonds yielding 0.65%” as part of a diversified portfolio. I hold them along with 30 year US Treasuries and 30 year gilts. I even held undated War Loan until the government stole them from me a few weeks ago.

Arguably, the “golden rule” for survival in investing, as in most if not all aspects of life, is never to have a golden rule; instead, use 360° eyes and ears and be ever adaptable. Sense is excluded from a closed mind.

@Naeclue “….. 30 year …..”

(Curiosity) how long to maturity?

Great article, if just slightly scary to be reminded of these risks, even though I already knew about them. As a passive investor, I sometimes wonder if I’m overcomplicating things not just shoving all my assets in Vanguard LifeStrategy funds, but the idea of my entire portfolio being in the hands on one company, no matter how big, respected or systemically important, would stop me sleeping at night.

I was already drifting towards world equity tracking before your recent articles on it and I am now definitely heading in that direction, but the reality is I’m not going to chance the Irish-domiciled ETFs so in practice I have no choice but to “over-complicate” things with a mixture of developed and developing world trackers, chosen from different fund managers, despite the conceputal appeal of holding a single fund and all the rebalancing happening automatically and without temptation to tinker.

I also split my holdings over two ISA platforms and a different SIPP provider. More would be nice, but there’s a shortage of independent fixed-fee platforms, and I think having too many platforms just means you risk not being able to keep a close enough eye on them all, so there is definitely a trade off here. “Don’t put all your eggs in one basket” vs “Put all your eggs in one [or a few] basket[s] and watch it like a hawk”.

I’m also toying with having at least one of my three platforms registered at a different physical address (of a trusted family member) to reduce the potential impact of stolen physical documents in the post. (I had some non-investment related problems with identity theft recently, which was a bit of a wake-up call.) This might be a bit overly paranoid, but on the other hand it doesn’t really seem to have any downside.

At least articles like this reassure me I’m not the only person to think like this!

This is what the billionaires do with their fortune: diversificate. They prefer preservation of their wealth through diversification to the chasing of the yields. But never forget they need much smaller portion from their wealth to live than an average man who ponders about 4% safe withdrawal rate.

Thank you for a thoughtful post on Maundy Thursday when at the Last Supper the fragility and fickleness of life were contemplated before the crash of betrayal and injustice.

We too could easily be betrayed or betray others for a few silver coins. And with a kiss at that. We could duck, dive and diversify to achieve riches and avoid loss but at what cost? We may end up down a well like Judas or being ill, lonely or having our house burn down.

Ultimately fear is the driver. Or paranoia. Same thing. Interestingly, a YouTube video of Richard Branson’s recent ‘Pitch to Rich’ campaign expresses this fear as an energy that leads to achievement and helps to make others’ lives better. Hmmm.

How different a message to that of the biblical angels who proclaim:

“Do not be afraid” so that we can love and help others. Everything else is a noisy smoke screen.

You’ve found another of my weak spots. I don’t do this, and I have wondered many times if I’ll regret it.

I had an incident a few weeks ago where a major name broker sold my same shareholding in a US company twice. For a while I had thousands of pounds credited to my account that wasn’t mine. I wrote to them to tell them what had happened, but they didn’t reply. The anomaly did correct itself though, presumably when everything was properly reconciled at settlement date.

Scary, but not as scary as if I’d been thousands of pounds down instead of temporarily up…

A few question if I may, as I’m not 100% sure I understand about all this protection offered by the financial authorities etc..

1. If my broker goes bust, but I actually own a Vanguard tracker, I should be ok, as I still own it? So no need for compensation in this case (however getting my records to match up with what I own might be a challenge, but technically I still have ownership, right?)

2. If Vanguard go bust, and I bought through say Halifax Share Dealing, would I actually be protected by anything at all?

3. If I had say several hundred thousand to invest (over ISAs, SIPPs, and non-tax wrapped accounts) presumably the best way to do this would be across several brokers and several world tracker funds?

Not entirely sure I understand all the concepts of what exactly gets protected..

Cheers!

@The Investor – I should have put a smiley or something on my post, because it perhaps comes across as more serious than I intended. It’s more that I was very taken with Lars Kroijer’s recent article (I even bought his book, so job done!) and was relaxing in the simplicity and soundness of his approach, but reading your article now I’m all anxious again 😉

Thanks, as ever, for some great weekend reading. 😀

“Very often such people were employees at the companies during their working lives. They’d never normally dream of putting so much money into one company. But their familiarity with its logo and the office wallpaper of yesteryear makes them contemptuous of the risks today.”

This baffles me as well, I will partake in the company share option scheme to purchase shares (potentially) at a discount. But I will sell them pretty sharpish. My pension, employment and mortgage are already with the one company, which is quite enough! I can only assume it’s laziness as no one loves their employer THAT MUCH do they?

A bit a paranoia is a good thing, too much though and I would be burying my gold in the garden by the dogs bones.

I have to admit to have been taken by synthetic ETF’s in the past, say a leveraged one that promises twice the share movement (albeit at an increased cost over just a tracker). But I have never had the balls to go for it. I think as, a small part, of a balanced portfolio it is probably not the end of the world as long as you respect the increased risk and volatility it entails. Perhaps as my holdings grow I will head into the garden, dig up some gold and invest it in one of these. Any thoughts?

Mr Z

@Mr Zombie — Be very careful with all non-vanilla ETFs, such as short and leveraged flavours. The mathematics doesn’t work the way most people expect it to. I thought I’d written about leveraged ETFs before but apparently not, as I can’t find it! 🙂 Here’s the skinny on Short ETFs though:

http://monevator.com/short-etf-maths/

@DaveS — Ah, got you. 🙂 Must admit when I first started using the Internet back in the early 1990s (on a green screen terminal, believe it or not, Matrix style!) I *hated* smilies with all the poetry-reading passion I can muster. Nowadays I throw them about online like confetti. They do help!

@Kanine — Please click through the links listed in the article on words like “Risk” and (particularly) “domiciled overseas”. These are huge complicated topics that we’ve written 1000s of words on in the past and to be honest not always come up with satisfactory answers.

@Gregory — Yes, on that subject, I’ve linked to my view on what wealthy people do under “protecting your wealth” above. 🙂

@Minikins @All — Thanks for all your comments, especially on a holiday. 🙂

I truly hope and expect this article to seem like over-the-top paranoid hyperbole to most readers, even in 10 years time. For most people, the mainstream things will very likely work out fine.

However experience and wide reading has taught me bad things can and regularly do happen to some small fraction of the population — and to the many more who make downright crazy decisions, such as those I mentioned towards the start of the article.

If 1/100 readers might have done something dumb or dial back a risk after reading this and prevent some mishap, it could be literally millions of pounds of the Monevator Massive’s money saved. 🙂

Insurance always seems like a waste of money if things turn out for the best.

You’ve probably said something like this in the comments already, but I think to remove the “lose it all” risk someone could just split their holdings 50/50 between global stocks and bonds (as per Lars’ system) and hold that via two ETFs from two different ETF providers in two different brokerage accounts.

To lose it all in that situation would require a total economic collapse (at least in this country if not globally) at which point there are other more pressing things to think about (and gold won’t save you in that scenario because someone will just shoot you and steal it).

@ The Investor This is what I think so. You are right, good stuff. http://monevator.com/preservation-of-wealth/

For paranoic Vanguard fans http://jlcollinsnh.com/2012/09/07/stocks-part-x-what-if-vanguard-gets-nuked/

OK, we are in Europe I know. https://www.vanguard.co.uk/adviser/adv/about-vanguard/about-us

@The Investor – thanks. That’s why I haven’t put anything in one yet, as I haven’t had the time to have a look into the maths behind it, so I will stay away! Might do some maths on it at some point though as it could be interesting 🙂

Mr Z

“I even see smart passive investors putting all their money into one fund, or one broker, or into the hands of one adviser.” I agree that’s mad. But as we age and get dimmer, keeping track of assets in many places becomes burdensome – even more so for the survivor.

“I even held undated War Loan until the government stole them from me a few weeks ago”: away with you. Calling a callable bond isn’t theft. Just wait until the Two Eds get going, that’ll be theft.

Seeing dearieme’s comment re the Two Eds reminds me… I’ve been wondering if we can expect pre-election coverage from Monevator on the parties’ financial plans etc, or will a discreet silence will be maintained until after the election and we get a commentary on the first budget of the new government?

“Your country’s currency could be devalued, so that even though your nominal net worth remains the same, your wealth is diminished compared to your overseas peers.”

Welcome to the Eurozone. But Mr. Draghi tells us that is will lead to 2% inflation which apparently is really really good for…

Don’t forget that governments could also outlaw the holding of gold: US Executive Order 6102 criminalized the possession of gold in 1933; this was only repealed by Gerald Ford in 1974.

@Vincent — That’s listed in the bullets already. 🙂

Question if I may please… If you split your holdings across two investment platforms utilising ISA’s with both, I understand you can only pay into one of them per financial year? As a monthly investor, I guess I’d have to alternate provider by year…

This is something that has puzzled me when I’ve considered expanding my portfolio beyond funds to ETF’s given my current provider (CSD) is probably not cost efficient for very occasional ETF purchases.

@Topman – “….. how long to maturity?”

Doubtless undated (thinking cap now back on!).

@LadsDad

Psst, wanna buy a one-eyed telescope? “Newly subscribed (paid in) money in the current tax year can only be held in up to one cash ISA and up to one stocks and shares ISA. However, provided the annual contribution limits are not exceeded significantly HMRC can be expected to forgive one transgression using too many accounts and merely post a letter reminding about the rules after the annual returns from ISA providers reveal the problem. ….. This should not be relied upon, as it is at HMRC’s discretion.” http://en.wikipedia.org/wiki/Individual_Savings_Account#Restrictions_removed_from_July_2014

@Topman

Thanks for the link, I’ll be sure to reference Wikipedia in my defence case ☺

I guess the one area that is hard to protect yourself against would be where you are fortunate enough to accumulate a reasonable Defined Contribution pension pot with the same employer (and therefore the same pension provider).

The only solution I could see to managing this risk would be to move jobs whenever the pot grew to a material size. Think I’ll have to let this play out whilst The Man is so generous with their contributions!

Thanks TI for the reminders.

Will be reviewing portfolio next week and maybe not using/overweighting global VWRL as core for much longer after all?

Maybe add back in some IWRD or heaven forbid add/beef up ITs?

Has really set me thinking!

Pareto Principle : Interesting!

“Pareto developed the principle by observing that 20% of the pea pods in his garden contained 80% of the peas.”

Our seed packets must be from the other defficient 80%!

@Steve — I don’t feel the need I did five years ago to do so much politics, I don’t think the situation is quite so dire, and where it is I don’t feel I have much to contribute that you wouldn’t hear elsewhere. I may do something on the party’s investing specific mutterings though. (E.g. The Lib Dems have spoken about a derisory £2K-ish CGT allowance).

@all — Thanks for the comments. I have the lurgy over the Bank Holiday weekend and spent most of it in bed / on couch with Netflix and Lemsip, so just popping in briefly. 🙂

Aaaaw poor Sniffelator! Rest up and wish you well soon, happy Easter! : )

@TI Thank you, that sounds good. Hope you’re back on your feet soon.

Nice post. It is one of those things that everyone really knows but we can become slack with it. You think “Oh, I will balance that all out later.”

One thing I am keen to do sooner rather than later is diversify my brokerage accounts. Currently, almost all my equity assets are held in one broker. Not something I am wholly comfortable with!

Thanks again for the timely reminder to be alert. Time to do something about it…