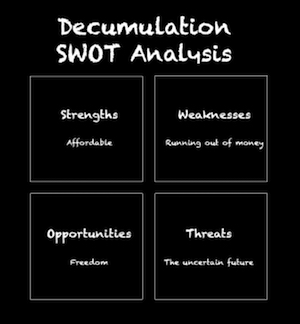

Living off your investments is the ultimate goal of financial independence (FI) and the trickiest part to get right. This phase is known as decumulation and it’s the part of the journey I’m about to embark on.

My objective is simple:

- Drawdown enough income so that Mrs Accumulator and I can live without needing to work.

- Maintain a decent quality of life.

- Not run out of money before we die.

The key is to allow plenty of margin for error.

Our decumulation plan needs to cope with volatile market conditions, flawed assumptions, and the fifth law of thermodynamics: Grit happens.

What I’ll present – over three detailed articles – is our genuine, all-our-skin-in-the-game plan to meet this challenge.

This is no longer theoretical for me and Mrs A..

It’s the rest of our life.

My plan rests on the best practical research I’ve found over many years, fitted to our personal situation.

It’s resistant to the main threats that bedevil many decumulation strategies:

- A long life – also known as longevity risk.

- Inflation risk.

- Living off volatile assets – sequence of returns risk.

I’ve built in multiple safety features. But I know there are no guarantees.

Decumulation: time to get personal

My plan’s core components will be relevant to other decumulators, FIRE-ees, and near-retirees, regardless of our different circumstances.

Customisation is critical though, so here’s a list of our particulars:

- Time horizon: 45 years

- Chance we both live another 45 years: 8%

- Decumulation method: annual withdrawals based on a sustainable withdrawal rate (SWR) from a portfolio of volatile assets such as equities and bonds.

- Capital preservation required: No

- Legacy required: No

- Back-up sources of income: State Pensions due in approximately 18 years. Small Defined Benefit (DB) pension for Mrs A in the future. Ability to work if required, or as desired.

- Inheritance: No

I’ve decided not to share our personal numbers. This plan scales regardless of wealth or income. I’ve left clues all over the Internet, anyway.

It may be helpful to know that we got here on relatively modest five-figure salaries and plan to live on less than the annual median household income.

That’s quite tight, which is why the plan is bold in some respects.

I’d love to take a ‘safety-first’ retirement approach. To rely more heavily on less volatile instruments such as defined benefit pensions, annuities, and index-linked government bonds.

Sadly, that route is unaffordable for us. But it’s definitely worth investigating if you have greater means.

My final, overriding, set-up point: my job has been fairly all-consuming for more than two decades. I’d like to live a fuller life now.

That entails risk.

That’s life though, so I’ll try to offset the risk via:

- Multiple back-up plans

- Awareness of the failure points

- Conservative assumptions

- Not believing this is fire-and-forget

Living life now means not waiting until we can live off the dividends or fund a conservative 3% SWR.

But a naive 4% SWR is too risky, in my view.

So how can I use more sophisticated decumulation techniques to deploy our wealth more effectively, without turning retirement into a decades-long tightrope act?

The first step is understanding what an acceptable failure rate is.

Failure is negotiable

Standard SWR studies define failure too narrowly.

If the simulated portfolio’s wealth hits zero before the end of its time horizon then it’s a fail.

But we humans can run out of life before we run out of money. If I flatline before my wealth does then… success!

Well, sure. Kinda. Sorta.

The point is that SWR failure rates are less risky when you factor in your own mortality.

If Mrs A and I have a 10% chance of both being alive in 45 years, and our portfolio has a 10% chance of giving up the ghost in that time (at our chosen SWR) then our actual failure rate is:

0.1 x 0.1 x 100 = 1% chance of running out of money and both of us being alive to worry about it.

That’s a 99% success rate! Always look on the bright side of death.

I’m assuming here that the portfolio will more easily support one person than two.

That matters, because there’s a 49% chance that at least one of us will be around in 45 years.

One person won’t be able to live half as cheaply as two, but the portfolio will definitely last longer if it isn’t financing my chocolate habit.

The upshot is I’m comfortable picking a higher SWR – based on a 10% failure rate – when it’s twinned with a reasonable life expectancy for both of us.

Remember, we only stand an 8% chance of both being around in 45 years, so I’m still choosing an optimistic life expectancy. There’s a 2% chance we’re both here in 50 years time.

Also, SWR sims don’t account for humans noticing when the bank balance is draining at an alarming rate.

In real life people put the spending brakes on years before their portfolio sparks out. (More on this later.)

- We’ve written before on life expectancy for couples.

- Try running your numbers on a life expectancy calculator.

Next!

Decumulation diversification

SWR research is generally based on single-country portfolios split fifty-fifty between equities and conventional government bonds.

In a nutshell, US-based historical studies may be too optimistic. But non-US studies don’t account for the contemporary advantages of global diversification.

Research into asset-class diversification generally shows a modest uptick in SWR.

As a UK investor I’m not going to bank on history repeating the stellar US asset returns of the past century.

But I’m happy that a diversified global portfolio could replicate historical developed world returns. Those were scarred by two world wars, after all.

Here’s my de-accumulation asset allocation:

Growth – 60%

- 20% World equities

- 15% World multi-factor (Size, Value, Quality, Momentum)

- 10% UK equities

- 10% Emerging Market equities

- 5% REITS

(Note: there’s approximately 2% more UK exposure in the World funds.)

Defensive – 40%

- 15% UK gilts (long, intermediate, and short durations)

- 15% World index-linked government bonds (Hedged to £, short duration)

- 5% cash (currently it’s 10%)

- 5% gold (I don’t own this yet)

Most of my holdings are in cheap index trackers, though I will use active funds when I don’t have a good passive investing alternative.

I won’t use high-yield funds because I think that a total return strategy beats an income investing strategy.

Decumulation portfolio rationale

Here’s a short (ish) explanation of my decumulation portfolio choices. Happy to debate any of it in the comments after.

Growth

The expected returns of our equity holdings should provide the real returns we need to sustain our income over the decades. A strong equity allocation along with our State Pensions is our best protection against longevity risk.

It’s that or troughing out on deep-fried Mars Bars and cigarettes for the next 30 years. YOLO!

Adding a multi-factor holding to my equity split increases diversification at the price of higher fees, mitigated by the hope of slightly higher returns. This is debatable, optional, and may well be a slim hope.

Threats

The volatility of equity returns exposes us to sequence of returns risk. That is the chance that a poor run of market conditions sends our portfolio into a death spiral we can’t escape.

Another threat is high inflation whittling away the value of our defensive assets over the long-term.

Defence

Our defensive assets reduce our sequence of returns risk – as well as the stress of watching our main income source collapse during a market crash.

Conventional government bonds are likely to outperform other assets during a steep market decline.

Short duration bonds and cash guard against rising interest rates but they are much less effective than longer bonds when equities bomb.

(Cash sometimes outperforms bonds, especially in inflationary scenarios. It’s also easier to get change from a tenner than a 10-year gilt at Tesco.)

Index-linked government bonds are best against runaway inflation. Equities do badly in these scenarios. Equity inflation protection asserts itself in the medium to long-term, but linkers can pay your bills today.

We’ll hold linkers and conventional bonds in a 50:50 ratio.

Structural problems with the UK’s index-linked gilt market explain why I use developed world linkers.

For conventional bonds, choose a global government bond fund or total global bond market fund if you prefer. Just make sure it’s hedged to the £ (to eliminate currency risk) and that it’s overwhelmingly concentrated in high-quality bonds.

Match your bond fund’s duration to your time horizon to reduce interest rate risk.

Gold is a wild card that can perform when nothing else works. It’s typically uncorrelated to other assets and, in recent years, has spiked when people think the financial system is circling the drain.

I see gold as a one-shot wonder. It’s a shotgun blast in the face of some crisis occurring during the first 10-15 years of decumulation.

That early period is when we’re most exposed to sequence of returns risk. After that gold will be discarded like an empty weapon because its long-term returns are poor.

Triple threat

Does the age of negative interest rates, QE, and government bazookas mean we’re in for secular stagnation, rampant inflation, or stagflation on steroids?

Your guess is as good as the next clairvoyant. I’ll hedge my bets with that mix of equities, linkers, and gold.

In times past, I’d probably have been 50:50 split across bonds:equities on the eve of decumulation. Now I won’t go below 60% equities. I believe I can tolerate the extra risk.

If I couldn’t handle this large (ish) equity allocation, I’d need a bigger portfolio to sustain the same income. I believe high equity valuations and low to negative bond yields heighten the risk of anaemic returns over the next 10 to 15 years.

A diversified portfolio in itself is only worth a small SWR raise, so I’ll also use a dynamic asset allocation strategy to try to squeeze a bit more juice out of my pot. This means my equity allocation could hit 100% if the market stays down for years.

Before I check out

In my next post I’ll explain how I plan to employ dynamic allocation – and dynamic withdrawals – to finesse my plans. Subscribe to make sure you see it.

Take it steady,

The Accumulator (though not for much longer)

Comments on this entry are closed.

Nothing like doing something for real to really test out your financial belief & strategy.

We pulled the trigger two years ago now and it’s gone pretty well financially. Some shockers and some upsides. But absolutely – never underestimate the ability to adapt as needed.

Portfolio-wise, similar on the equity side, a different defence strategy. Plus a different view on the UK given a higher probability for us not remaining in the UK long-term. Which makes a difference I think?

I also somewhat target towards tax allowances, e.g. some div shares, some interest income etc alongside CGT and personal allowance usage. Never at the cost of investing in something I don’t believe in but when there’s a choice, it can make a big difference to that real return post tax & inflation. I.e. the one we really care about!

Exciting times ahead though! Look forwards to the next part…

@TA:

Good post – nice to see how you envisage the various moving parts interacting from here on.

I note that you assessed safety first as too expensive – I can understand that conclusion. However, have you considered a partial floor, ie some safety first. In due course, your state pension(s) will provide such a Floor and that might be a natural flooring level to aim for in the lead up to those events?

There are many good posts on risks or threats as you called them. Pfau has written extensively on this matter, and IIRC there is a free ebook available at the Retirement Researcher site. My personal favourite is from the late great Dirk Cotton, see: http://www.theretirementcafe.com/2017/07/retirement-is-risky-business-heres-list.html

One of the few distinct advantages DC schemes have over DB schemes is that the Pot survives death intact. Thus, in your circumstances, survivor scenarios are probably less problematic than had you been using a single DB scheme as your Floor. I am assuming you and Mrs A (or is it soon to be Mrs D?) are actually married?

IMO, there is one key risk you may have possibly over-looked: your spending. For example, spending shocks or unavoidable tax increases, etc. FWIW, I think this is the single most important data point post jumping ship. Others will no doubt disagree, but there is an absolute level of spend that is truly essential to survive and you do not want to find out a few years down stream that you have under-estimated.

Just a quick note to say that while we’re delighted to hear comments and even constructive criticisms, it’s a fair bet that having blogged about this subject for 10+ years, there’s absolutely nothing mainstream that @TA has overlooked 🙂

We discussed income floors back in 2013:

https://monevator.com/the-most-important-goal-for-every-retiree/

The other thing to remember is this is a three-part post. The original post was over 4,000 words long!

Clearly excessive, even for our talking-for-Britain standards.

So I chopped and reshaped it into a three-part series. Various risks will be discussed in part three.

I know it’s tricky (you don’t know what’s coming!) but ideally comments should focus on what’s in the article not what isn’t, at least until we get to part three. That way we have the best focused conversations for maximum reader utility.

In summary, part one is as above, part two is about dynamic asset allocation and withdrawal and the chosen SWR, and part three is about risks, back-up plans, and inflation issues including hednonic inflation.

Cheers!

@TI:

Fair enough. We all have blind spots!

Editing is never easy; and on that theme a sentence based on your final para towards the start of the post may have been helpful.

Well done

We are further down the road (both 74) -and survived-so far!-learnt some lessons

On retiring -1 at 57 the other at 60

We spent the same amount in retirement as working-lots of free time -travel etc-will this continue- probably because even though old and travel less need better grades of accommodation etc -difficult to rough it as you get older

Withdrawal % rate stayed the same but released more income as value of portfolio continued to increase

Reduced complexity of investments as aged-for the sake of myself-other thing’s to do and wanted to sleep at night

Now 3 funds only-U.K. Tracker,World ex UK tracker and global bond tracker

(All in Accumulation format)

Plus a “high interest “ cash account with 2 years living expenses kept topped up once a year by selling units in our 2 ISAs and 2 SIPPs

Joint bank account and Visa credit accounts (easy to keep track)

Use Visa credit for all payments-easy to track-months credit leeway for day to day expenses payments

I do the money and disinterested wife has to understand the process

Easier for the kids who will take over at some stage

A financial spreadsheet is mandatory for us

We use Quicken 2004 and enter weekly

Continually reconcile with the Bank -joint current and visa credit account

Easy to spot scams-had a few over the years

Home page set up so each of us knows our current financial situation-no arguments!

I noticed that over the years my wife notes how we are doing and will remark on our current finically position

She does most of the day to day spending and therefore the most Quicken entering

That’s enough for now!

xxd09

Another great post @TA (sorry, @TD now?), good luck!

Although this is ignoring the whole point of the ‘I’ bit of ‘FI’ and removing yourself from the workplace and all the bs that comes with that, what are your thoughts on possible part-time work as a backup or to supplement retirement income, if needed?

I’m still a long way off FI, but see on various blogs people reaching FI and then choosing to work part-time, if only for a small supplement of income and not relying completely on their portfolios or SWR, or because they miss the social interaction after pulling the trigger, or just want to gradually pull out, or for other reasons (like the FIRE members we see in the US working part-time for the healthcare benefits from their employer etc – glad to be a UK resident at times, less so recently!) For the record, I’m mid-30s, currently in year three of 30% saving goal and aiming for FI at 55/60 or shift to PT work within the next ten years. I’m sometimes saving more but will need to shift a little towards cash in the next few years for upsizing house – the only house move I plan for the next 30/40 years – and a growing family) One concern for me would be leaving an industry and employment, then struggling to get back in, if needed, a few years down the line. But I already feel the irrelevance of my place within my industry, the longevity of my office (I work for the UK office of an overseas based tourist board) and currently going through what I suspect is the first stage of eventually them deciding not to have offices overseas or within local markets) andfor role in my ways, which is one motivation for having a plan for FI and getting out! (I use FI rather than FIRE, I don’t want to ‘retire’, I just want to do what I want to do, when I want to it.)

Thanks for another very interesting read (you are keeping us all going in lockdown!). I worked part-time in a much lower paid/grade (related field) role for a time after leaving my main career/profession and it certainly helped with the transition – switching from an accumulation to a decumulation mindset is not easy. After a couple of years I was ready to give up work entirely (though never say never!). It just felt right. I am currently making decisions about how much secure floor I can afford and when (topping up some DB pension at 60). Your posts make good timing.

Your growth assets add up to 65%, but the header says 60%.

@Andy — Oops! Cheers for that. My fault in chopping around @TA’s original table insertion.

We tend to front load spending in retirement because the assumption we will spend almost nothing by the time we hit our 70s.

I’m struck by a few things when it comes to spending that might challenge that. For example, what are the chances of technology making the previously impossible, possible?

For example, I would dearly love a trip into space – and in my lifetime that’s moved from near impossible to possibly being somewhat possible for the price of a decent car in the next decade or two.

We can’t cheat death (yet), but it seems to me that the biggest amount spent on healthcare is in the last year (month!) or so of life – and that there will be enormous advancements over the next 2-3 decades. If I hit my mid 70s, and there’s an accumulation of health related breakthroughs that mean I can live well for another decade or three I’d sure like to be able to afford them – even if the NHS won’t pony up.

I shall watch this with close interest being in a very similar position although probably a few years older (guessing at ages….). In my case a modest DB pension commencing in a few years time should thankfully give me an important foundation should other investments underperform. I enjoy the column – thanks for your work! Of course one of the key questions is what are we going to do with this new found time and freedom – I have a list but must admit its rather like a leap off a diving board into an opaque swimming pool which could be lovely and warm or a bit chilly!!

Having ‘retired’ early in 2018 I am interested in this and a few things come to mind.

1. Being early retired does not mean no income. Without really trying a few consulting projects have landed in my lap which I can do with relatively little effort (15-20 hours a week). Which i think usefully fills in time I might just fritter away.

2. I fully expect spending to decline later in life – by how much I don’t know. Most of the models which look at retirement spending are US based and they show that spending on healthcare increases significantly. While I expect an increase in health care costs living in the UK it won’t be anything like that in the US.

3. Tax is a big worry. The inheritance tax threshold is perilously low for anyone with a decent retirement home and package of retirement assets and I simply hate the thought of paying all that hard-earned over to the tax man. I would love to spend it but ….frankly….what exactly do I need that I don’t already own?

Long time lurker here… congrats TA, waiting to see where this goes with parts 2 & 3. I am about 1 year away from FIRE myself and keen to see the decumulation plan (and others’ comments). I plan to be travel-heavy and therefore have fairly high spend during my mobile years, but want to balance this against a sensible growth strategy and SWR.

Hi both,

Another interesting and useful topic, thanks. I look forward to the next two posts.

We’re (hopefully) only a few years behind on our journey, so thoughts of which assets to use to decumulate have been in my mind recently.

I’m interested to know whether this allocation is what you’ll switch to at point of retirement, or if it’s been this way for some time, in preparation? Or have you been all-in on equities and will now switch?

I suspect it’s somewhere in between, but it would be good to know your thoughts on what you did in the few years up to this point.

Cheers

@TA – a most excellent series! I can’t wait for parts 2 & 3.

And great timing for me personally as I’ve reached skinny-FI and want to do the RE bit too. Just not sure about the timing. Couple more years I reckon.

@TA, interested to see you have changed your mine about a 50:50 portfolio in retirement. Is that because modelling suggests it would have too little appreciation to match your plan, or a change because of current circumstances?

(Asking because I am adjusting our own retirement investments back to 60:40 – in our case it is because I fear that in a low interest rate environment the volatility risk of bonds has a bigger downside tail than upside).

Yeah I am similar to @Brod in that that I am at FI, but just barely.

I am working on my decumulation strategy, but that partly includes some level of income generation even if only $10-15K a year unless the markets continue to wow. I am working on my plan, but I also think that dynamic asset allocation strategy is the only way to go unless you have really hit Fat FIRE with a huge buffer to live off dividends and a conservative portfolio.

Gotta make a plan and then make adjustments during downturns.

@ Michelle – I’m glad FIRE is going well for you. What’s been the biggest adaptation you’ve had to make?

@ Al Cam – thanks for the link, that is a great news. It was sad to hear of Dirk’s death recently. A timely reminder to get on with life.

You’re absolutely right, I could think of the State Pension as a floor. I tend not to because it’s almost 20 years away, but I have a bare bones budget in mind that is our de facto floor in the meantime. I’d front-load this spend if I had to, knowing that the State Pension could save the day eventually.

I’m gonna cover spending flexibility in the next post, and I suspect those tax rises you mention are in the pipeline.

@xxd09 – thank you for the insight. Like you, managing the money has naturally fallen to me. I make regular reports which aren’t meticulously scrutinised but are appreciated all the same. (I think.)

I read an interesting piece recently that theorised that couples use each other like extra RAM. Delegating separate functions to each other for parallel processing but thinking of each other as part of the same unit. I kinda like that.

@ JDW – you’re very wise to sense the winds of change and prepare. If the worst doesn’t happen then you’ve only got more options. Agree with you that it’s the FI that’s important. I’m retiring to something, not nothing. Something means doing projects I find interesting / meaningful / fun. If I’m paid to do them, then so much the better.

I think earlyretirefree is right. A lifetime of contacts makes it relatively straightforward to pick up projects – unless your industry is in crisis that is.

@ G – Agreed. I don’t buy into the idea of declining retirement spend for exactly the same reasons. I cover this more in part 3, but part of ‘sleeping at night’ for me means sticking to conservative assumptions rather than trying to load everything in favour of splashing the cash now. So I haven’t modelled declining spend – hopefully that’ll mitigate against health shocks later or someone invented the elixir of youth.

@ Gary – Bar the gold I’m there now. Made the last of my bond allocation moves a couple of years ago.

@ Jonathan B – historic modelling says 50:50 is fine but so is 80:20 if you can handle it. My timeline is relatively long and current yields aren’t going to wring much out of bonds which suggests trimming your exposure if you can. I’d like to be relatively conservative for the first few years but I have the risk tolerance to accept 60:40 for now and higher if that’s where the dynamic asset allocation takes me over time.

Look forward to the rest of the articles. Presumably the editor will intervene if the answer looks like it might be……4% pa

Thank you @TA I have really been looking forward to you tackling this subject, so glad @TI has made it into a series.

I’m a few years behind you. Do you intend to keep your cash allocation at 5%? I was planning to keep approx. 3 years income as cash, but I was planning to manage the portfolio without a % cash allocation, so the cash will be extra.

Think your description of gold as ‘one shot’ is really interesting, I notice you have not bought this to you intend to do this in a single go or drip feed to pound cost average buying your allocation? I’m undecided about Gold, although I use a mix of active funds in addition to my passive core and this includes a couple of IT’s with a gold allocation.

Interested that your UK allocation is higher than a passive world portfolio, interested to understand reason?

This is an active decision, but although I’m planning a total return strategy, I am planning to include some “Alternatives” e.g. infrastructure, renewables, etc for their income generating ability.

Really looking forward to parts 2 and 3.

@Whettam -I’ve got (what used to be) 10% gold. Like TA said, it marches to it’s own beat. It got above my 20% of target rebalancing band so I sold back down to 10% and now, for whatever reason (stocks doing well? QE? who knows) it’s now down to about 8%. I won’t top up.

I’ve also got about 15% cash in a mortgage offset account and 5% in Premium Bonds. The PBs destined for ISA next year but not sure how to account for the offset account but I don’t include it in my FI fund. Maybe I should but since the mortgage payments come out of the offset it’s (mentally) accounted for. it’ll go down to zero with the mortgage. I guess on a massive draw down I could sweet talk the Financial Controller to let me have a flutter but i dunno… I’ll keep about £3k in PBs, because it makes me feel like a high roller. If I never post again it’s cos my lottery numbers came up tonight… Thanks for all the fish!

At the risk of mentioning something obvious, presumably Mr and Mrs A already qualify for the maximum state pension. For anyone who doesn’t and intends living 3 or more years beyond their pension age it’s usually worth paying voluntary NI contributions to fill any gaps.

The ultimate line of defence might be ordering one’s life such that if all else fails and only pensions remain, then at least a modest home and a modest diet are going to be sustainable.

First of all, TA, very best of luck as you embark on this next stage, and thank you for sharing your thoughts.

I’m excited to read the upcoming posts, as I’m borderline obsessed with this decumulation stuff even though it’s quite a way off for me – minimum 10 years and 15+ would be more realistic.

Your asset allocation is interesting. Everyone will have a different view. My thoughts for what they are worth:

Even 40% defensive assets seems on the high side to me for a 45 year time period, though of course there is a lot of debate about this. But my reading of Karsten Jeske’s work in particular suggests no more than 30% is optimal. I’m interested to see how the dynamic allocation works.

Personally I’m all out of the US market (except my US SCV ETF) on valuation grounds, so would get non-US regional funds rather than the World one, but that’s obviously an extreme departure from the global portfolio 🙂

I like the multifactor allocation – how are you getting this?

Government bonds – ugh. But I understand why they’re there.

Not a big fan of buying gold, a volatile asset that is merely expected to keep pace with inflation in the long term, near to its all time high in real terms. Good in theory, but theory should yield to valuation here IMO (my target price is $800/ounce).

When we get very old, if we were to go bankrupt for running out of money (if you were actually able to spend it) – theres no way you’d be chucked out onto the street – they would probably have to find a care home for you before they can evict you

You simply need enough money to last till then. Since inheritance isnt a concern I’d usually suggest an annuity but a centarian/centurian/however you spell it wouldn’t need to worry about bills

@Matthew — I presume you don’t have much experience of being a very old person with no money in a care home living off the mercy of the State.

Yes, you’ll get fed and watered. But you’ll still be a human being, with thoughts, feelings, and a desire to enjoy your day. And very little opportunity to, save what your wits and social skills can wrangle.

“Count no man happy until the end is known” – Sophocles

Really interesting update. Your strategy feels quite low risk to me given your combined state pension -18k seems to cover 65% of your spending – 28k and presumably covers most of your bare bone spending. Yes there is political risk but I find it hard to believe it will affect you both. You can draw on your state pension in 20 years and so with forty per cent in defensive assets again it’s hard to see too many scenarios that blow this strategy out of the water – rampant inflation combined with rising interest rates here would not be pretty. But again you’ve a massive indexed linked bond in the form of your state pension given how much of your spending it covers.

You also presumably have living costs covered – presume you don’t rent? – so again that’s a big piece of the ‘floor’ if so? The other risk is psychological – last years suck out isn’t what I mean – it’s a decade of anaemic performance punctured by extreme volatility as the 1970’s or 2000’s demonstrated. Even if that doesn’t blow you off course, it wouldn’t be much fun in 100 per cent risk assets. For that reason 40% in defensive assets seems sensible. A long way away but once you get closer to drawing the state pension I would think closely about increasing equities allocation by say ten per cent. to hedge longevity risk further.

I assume you plan on re-balancing each year and assessing spending.

The other issue is work – again it looks as if you could, at least for the next ten years, subject to unexpected ill health, pick up even basic work that would pay for a substantial amount of your expenses so that is another substantial buffer – the issue is the impact on your happiness in doing menial work. So concentrating on interesting projects that have the potential to reduce the pressure on your portfolio seems the way forward.

Again super helpful, not least because your position is nothing like mine and I don’t have your defensive bulwarks to fall back on.

Looking forward to the next few pieces.

@TI – not old but I work with a lot of elderly, I’m thinking that with loss of mobility and possibly dementia we wont want to/be able to do much more than eat or go to the toilet or watch tv, let alone, we’d be lucky to simply be alive and lucky to not have pain – so money sort of loses its meaning when it makes no difference to your life and you have no dependants.

At most just live in the bungalow you want for as long as you can

As a guesstimate 85-90 before arthritis limits us too much?

Broadly in line with your thinking @TA, with the exception of 5% cash. This would be appropriate for someone with personal business or other illiquid holdings, but yours are 100% hyper liquid. Are you sure you don’t just like the number 5? I’d consider cash as outside the portfolio but up to you.

“I see gold as a one-shot wonder. It’s a shotgun blast in the face of some crisis occurring during the first 10-15 years of decumulation.

That early period is when we’re most exposed to sequence of returns risk. ”

When does exposure to sequence of returns risk fade away? I guess it is when you have had a good sequence of returns, putting you in a position where you can weather a bad spell. Do you have a view on calculating that?

@TA – This is great! As someone who is considering pulling the plug soon as well, this is the series that I have been waiting for. Thanks, TA!

While I am still in the accumulation phase, I have been trying to get as much data as possible on portfolio performance. I’m not sure what asset allocation is really best to adopt in these crazy times of ultra low interest rates and QE, you see? So, while I make sure that the total allocation is very ballanced, diversified, and sensible, the stash is divided into sub-portfolios held with different brokers for extra safety. Yes, it’s a bit of a nightmare to rebalance! But it does allow me to study the real world behaviour of each different portfolio very easily. I get data meticulously each week and analyse them periodically. The Covid crisis drawdown was a unique opportunity to understand how each allocation behaved following that shock and how long they took to recover.

Personally, I think the bond allocation is spot on. I’m waiting to pull the trigger and am just 33% equities at the mo. If/when I retire, I’ll consume 0.4% a month for 12 years until I can draw the state and small DB pension (if I don’t, I’ll just move the 0.4% into equities.) Assuming no real return if Global markets go nowhere, I’ll be left with 40% of my SIPP mostly all in equities and the pensions. That’s plenty of floor. At which point the kids are gone and we can downsize the house and live off state and DB pensions, SIPP and the house capital we’ve released.

Sure, I’ll miss most of any upside from the markets, but I’ve protected my capital.

@Marcus – Big ERN’s done loads of fabulous work on this. Try:

https://earlyretirementnow.com/safe-withdrawal-rate-series/

That’s where my reverse glide path above comes from. Should have credited him. My bad.

Just remember, his analysis only uses a US 60% large cap and 40% 10 Year Treasuries portfolio and the returns/SWR might need to be reduced a bit for other portfolios.

I would be interested to know which funds you use, especially for the multifactor part. I have used offerings from ASI and Invesco.

Also I was looking at the Vanguard US Government Bond fund (hedged to GBP) as an alternative to Gilts. Reasons include lower duration (7 vs 14 years), higher yield, and historically higher negative correlation to global equities, which are after all 50% US. Does this make sense or am I missing something?

Quick technical question about the ONS median income data. It gives £29k as the median ‘equivalised’ household income – what’s the standard household there? Two adults?

And (you don’t have to answer this) are you aiming for less than the median income for all households or for retired households (which is significantly less at about £25k). Interestingly the retirement living standards project reckons on £29k for the ‘moderate’ lifestyle for a couple. I guess all these numbers are normative to an extent. I certainly think more normatively than absolutely when I’m trying to judge income requirements far into the future (and for that reason I think using wage or GDP inflation is a better measure of long term cost of living increases than price inflation, even personalised)

@bingo #23

Yes, I was going to make the very important voluntary NI contributions point had you not already done so. To all I would say, if allowed at this stage @TI/TA, be careful about thinking of the state pension as a tolerable “floor”.

Fast forward to the point where two state pensions may have become just one, and do a brutally honest income/expenditure budget, including the cost of keeping a roof over your head, the cost of necessary “tech”, the cost of the repair/replacement of white goods etc, the cost of some form of transport, and of course the cost of feeding and clothing yourself: how many of you really know the detailed lie of the land in your nearest supermarket and can “rattle off” what your weekly bill there would be, let alone be able to do your own healthy “cheffing”?

“Heat or eat” might be an exaggeration but I wager your budget won’t leave you with much if any “rainy day money”.

Ever since your post announcing your imminent FIRE status, I have been waiting for this article – here it is! Thankyou so much! As usual, another excellent article, a bit of friendly hand holding in an uncertain world. Having semi retired last year, currently living off cash saved for the purpose, I am about to start de cumulation very soon ( not sure when yet). Very much looking forward to reading your next article and hopefully more about your forays into the other side of FIRE…as an avid monevator follower for several years – Thankyou both so much for your cheerful, witty, (irreverent!) upbeat company on this journey!

@Marcus(#30), @Brod (#33):

See in particular, part 38 at: https://earlyretirementnow.com/2020/07/15/when-can-we-stop-worrying-about-sequence-risk-swr-series-part-38/

@Brod (#32):

Interesting plan – are you holding the balancing c.10% (or approx. 2 years expenditure) in cash for contingencies or have I misunderstood?

Also intrigued about your intended timings e.g. is it your intention to operate this plan (inc. moving any unspent budget into equities) monthly, or annually, or ….?

I look forward to the articles. With a 45 year time horizon and 18 years to state pension you are younger than I assumed. I wonder how closely your portfolio matches the slow and steady portfolio. I have a bequest objective and want to cover potential care home fees for my wife ( I assume she will outlive me) and these are rather like balloon payments which hitch up the threshold for ruin/ ‘failure’.

A very timely article for me as I look ahead to a major career upheaval in just over 12 months time, and consider my options.

Much of the advice I have read on asset allocation has used the usual suspects (i.e. equities, bonds, cash, property, gold etc) and I do like the more generic ‘growth’ and ‘defensive’ allocation pots with their subsets (rather than defensive equity assets).

Given the deteriorating value of my own bond funds recently, it has really made me realise that their function (for me) should be to not lose value rather than grow which the classification of your pots expresses most succinctly.

I have seen plenty of discussions about asset allocation (focused on equity and bond mix) to survive retirement. I found this article to be very interesting http://www.caniretireyet.com/the-best-retirement-withdrawal-strategies-digging-deeper/ and whilst readers may not agree with the conclusions the food for thought is clear and succinct.

My simple brain does like to think in percentage terms when it comes to the retirement. You have stated your timeframe is 45 years therefore the question I had is (ignoring inflation etc) how years worth of “planned annual expenditure” do you have in your pot now? So how many do you need to grow to meet this timeframe? (Or do you have it covered already and only need grow to cover inflation?)

To me, it is easier to think of it in ‘number of years’ rather than ‘percentage growth terms’. I think it will make the maths easier when you do an end of year review, “have we spent more or less? Why?” then “how many years do I have in my pot now after accounting for the year’s inflation?”; particularly when/if you rebalance.

Just my 2 pence.

Mark

@TA Really pleased to see this Decumulation series landing on Monevator, its timely as I am transitioning to Decumulation later this year and have been avidly reading much of the material reffered to in the comments. Like you we have no-legacy requirement and that opens up the possibility to spend some of the property equity at some point late in retirement. FWIW our home is valued at roughly 50% of the current Portfolio value so in theory if that was invested the portfolio it might finance another 15+ years of living expenses. How to factor the property value into the decumulation strategy is something i am really struggling with at the moment, hoping @TA or other readers may have some suggestions to share

Excellent article and I am looking forward to the subsequent parts.

The only thing that strikes me is that this may be heading towards a lot of complexity. Fine if you can handle it, but how does Mrs Accumulator feel about your plan? We started a new drawdown strategy about a year ago and I had to whittle it down to the bare bones before my wife deemed it to be acceptable. Even then I had to promise to make it simpler still in the future.

@Cigano99, I consider our property to be part of plan B.

@Al Cam – umm… I presume (0.4% of bonds x 12 months x 12 years) +33% equities = 90%? I’ve 10% Gold so maybe that’s where the missing 10% is? It’s my one shot “the sky’s fallen in.” Otherwise you’ve lost me.

I won’t be consuming ALL 0.4% but 0.3% (so a target 3.5% WR), 0.1% back into equities. And, at the moment, ii are offering one “free” trade a month, so I’ll do it bi-monthly. Or every two months and it shouldn’t cost me owt. Not terribly convinced this offer will last 50 years, but it’s a start. My floor will be index linked and liveable, so I only need to get past the first 12 years really. Then whatever’s left is fun money or to help the kids out.

@Matthew @TI

Regarding providing for one’s very final years, I’m with Matthew. It’s lack of capability, whether physical or mental, rather than lack of money that usually sends one to a care home. If the plan is to move into a private facility offering near one-to-one care, then all other post retirement spending probably pales into insignificance. And even with that, most very elderly people sadly reach a stage where money can do little to improve their state of (un) happiness.

@Brod:

Thanks for the info.

Got it – your “missing” 10% is gold.

Which begs the following question – what, if anything, are you planning to use for an emergency fund (EF)? IMO, your EF can also be used to smooth month-to-month variations in spending.

I do not know about you, but our monthly expenditure is very variable, and much more variable than our annual expenditure – thus the question about intended timings. For info, our annual spending range (min to max) is at least 2:1, but on a monthly basis it is more like ten times this! Thus, I have tended to look at things annually and hold an (instantly accessible cash) EF of at least 1 years spending too.

I am some four years plus into a not entirely dissimilar plan (bridging the Gap until SP’s & DB come on stream) and have found that I have been quite reluctant to push any surplus (vs planned spend) directly back into equities.

What I have done instead is up the equities exposure of my upside Pot. However, this can only continue for so long.

@Gigano99 – I view our home as deep reserves, I guess this is very similar to @Naeclue’s plan B. I understand from earlier @TI note (#3) that Part 3 will discuss Risk.

@Naeclue:

RE: “We started a new drawdown strategy about a year ago and I had to whittle it down to the ….”

I remember the post where this topic arose and our subsequent discussions well. I entirely agree with you that KISS becomes increasingly important!

@bingo (#23)

“For anyone who doesn’t and intends living 3 or more years beyond their pension age it’s usually worth paying voluntary NI contributions to fill any gaps.”

This is a thing I’ve been thinking about quite a bit recently. I’m 42 (state retirement age currently 68) with a hope of giving up work mid to late 50s. I have 10 years for which I can make voluntary NI contributions which at the current rate would cost me £7,956 (assuming I paid for all 10 years).

The gov.uk website advises that “each qualifying year on your National Insurance record after 5 April 2016 will add about £5 a week to your new State Pension.”

I’ve been trying to weigh up whether buying the extra years or putting the £7,956 into my SIPP (with, hopefully, its gains over 26 years before state pension age) would be best – presumably you think the former? I’m not overly sure why but I’m leaning towards the latter at the minute.

There has been some discussion of ones house as a part of peoples savings plan-an idea that is a hardy perennial

This especially understandable when this item currently seems consumes so much of ones capital

However it not a good road to go down

A house is where you and your family live their lives out of the pouring rain

It will always be needed in some form throughout your whole life

That is its primary (and arguably its only) purpose

Therefore it is best not to include it in your portfolio

Downsizing and reverse mortgages are some of the ways to realise the monies invested in a house but these are not a very satisfactory solutions-to be used in an emergency only

Buy the smallest house you live with satisfactorily and get your remaining monies invested in Pensions and ISAs which are liquid and easily available

A house is a necessary living expense like insurance and should be treated as such

xxd09

Thankyou for sharing this information. I’m so itching to see the actual numbers involved but fully respect you for not disclosing, I’m just interested to see how mine match up as I’m 23 months away from being FI on paper with a predicted outgoing of mid £20’sk using state pension as a possible “luxury” safety net. Using a principle of about 500k not including a few pensions bringing in 15k.

Thanks again for sharing your journey with us

Just evaluated my portfolio using your Growth and Defensive assets criteria, which I commented about above) and found that my percentages are 61%:39% (though I haven’t yet broken them down into the subsets).

Not sure if that is “great minds…” or “fools seldom…” !!

(But really it did make me smile.)

Mark

I think I am 14 years down the road from TA , 3 1/2 years to go for State Pension.

Adjusted for inflation I started with a similar sum and it worked out, retiring in late 2007 with a 90+% Equity portfolio.. yes, I experienced sequence of returns risk for real, a timely switch of assets gave a good recovery…. Cash reserve is very useful.

14 years on, spending is 2% to 3% and inflation adjusted capital is 100%+ up.

Still 90% equity … of course I have only one experience and it was ok, there were many alternatives that didn’t happen. ( I was sufficiently competent not to make errors but clearly there is a large chunk of luck)

I think a few years income in hand and flexibility to reduce expenditure is very helpful. I could reduce expenditure in a future crisis to around the median income level and the drawdown would be less than 1.5%

I must admit the 40% bonds would be a cause of FOMO for me, but is clearly the level to provide comfort, However the extra return that a high allocation may bring can provide a much larger pot and if it works out, a huge increase in the safety margin longer term.

A great article TA which has got the everyone talking. It’ll do us good, in this ‘era of the binge’ to wait a week for another thrilling instalment. I can’t wait to hear what dynamic approaches you gave chosen. I guess your plans for your gold allocation are really part of that wider picture.

I’m not convinced multifactor will earn its keep. What will you benchmark against?

Finally, specifically on the subject of income floors and additional NI contributions, I am increasingly concerned that the Pensions forecasts available from the UK govt are misleading us all into thinking we will receive more than we’ll actually get. I’m now off to check that you haven’t already covered this 😉

That’s an incredibly comprehensive decumulation plan. Thanks for sharing.

I’m 56 and trying to decide when to pull the pin. I wanted to go out at 55, but it wasn’t economically feasible, so I shifted my FI date to 60. I could work part-time and go out now, but I make six-figures at my day job and it doesn’t seem logical to trade that in for low-paying jobs and gigs with no health insurance. I’m better off hanging in there for a couple more years.

I look forward to reading the next segment.

I’m puzzled by the multi-factor growth component. In the article you referenced, yes, there’s some out-performance over a 1 year period.

Yet, when I compared it to SWDA ( iShares Core MSCI World UCITS ETF) just now, then clearly the multi-factor is underperforming SWDA on any measured time period: more than 3%, 4% and 2% on 1, 3 and 5 years respectively.

This sounds expensive.

@MarkC

When I looked at paying voluntary NI for extra pension it was unbelievably good value.

1)

So you pay £8k out, on average 5 years before the pension starts

2)

£8k buys ~ £50 a week £2600 a year extra pension (index linked)

3)

Based on annuity rates of 2.5% this means the £2600 extra pension is worth ~£100k

4)

£8k in a Sipp plus tax relief plus 6% growth pa is £15k ish, so likely less than £1k pa income

In fact probably too generous, I’d buy the credits as soon as possible!

B

Ps if you like you can put money in the Sipp until you have to pay the top up, and get value from both.

PPs I’ve paid top ups for the last 5 years and now I’m “full”, one less thing to think about

Thanks for another great article!

I am also holding a decent percentage of my portfolio in factor funds. I see it as a hedge against the risk that pure passive investing (ie a global tracker, which is the bulk of my portfolio) turns out to be inefficient somehow – eg too much concentration on the biggest couple of names, passive flows pumping up those names even higher above fair value, etc – and we get a correction away from those names.

I have been using the Size and Value factors to do this – Size because the smaller companies are by definition not held as much in a market-cap weighted tracker, and Value because it should be taking both company fundamentals and current market price into consideration (and also because the current top-weighted stocks are growth stocks).

I’m not currently using Momentum as when I did some quick research I saw it only rebalances every 6 months which strikes me as a bit slow to capture “momentum” in the internet era (let alone the Reddit-style bandwagons which are perhaps the real momentum trades!)

Quality – I’m not familiar with this and its use cases but will take a look

I also noted that the individual factor funds have fees of 0.3% each, rather than the 0.5% of the multi-factor fund – so it seems you can save a few basis points by holding them separately

@Peter

TA may answer for himself, but the case for investing in risk factors is not based on returns over 1-5 year time periods – even 5 years is far too short when considering the expected performance of volatile assets.

Over the very long term, risk factors (at least long/short factors as measured by academics) have delivered returns in excess of the market, and which are uncorrelated with the market – the holy grail. There is huge debate about, amongst other things, whether these factors will still do this now everyone knows about them, and whether private investors can capture them using long-only funds. But five year returns are neither here nor there.

TA has written some good articles about factors in the past, which I would recommend.

@MarkC (#49) & @Boltt (#57):

FWIW, I agree with @Boltt’s conclusion at #57.

Just in case you do not know:

a) the purchase price generally increases as time goes on; and

b) usually you can only go back a max of 6 tax years – there is currently a TIME LIMITED “SPECIAL OFFER” to allow you to go back farther associated with the introduction of the New State Pension.

BTW, if you can find a way to access Class II NI rather than Class III then that is even better value for money – believe it or not!

Royal London publish a very comprehensive explanatory document called, from memory, something like: Topping up your State Pension which is attributed to Steve Webb – the former LibDem pensions minister who was central to introducing the New State Pension.

@MarkC;

I have just noticed your age.

Please be aware that under the new scheme if you end up with >35 qualifying years you will get no extra state pension from any surplus years/contributions.

You may also have some entitlement under the old scheme too – which could further complicate the matter.

Take a look to the Royal London guide – it is comprehensive if a bit hard to follow; but that is only because the rules are really complicated!

Rumour has it that HMG will try again to get rid of Class II too – but that is just speculation.

@c-strong

Just saying that today I can’t see any out-performance from IFSW compared to SWDA, over 1, 3 and 5 year periods. It’s just not there.

Perhaps, as you suggest, 5 years is just not long enough, although, TA did write in the article he mentioned: “In all honesty, we’ll need a minimum of three to five years of data before we’re judging on anything more than noise.”.

Who knows. Maybe the 10-year return will look different. Annualized under-performance over the last 5 years is currently 2.44%. Expecting IFSW to catch up with SWDA, requires IFSW outperforming SWDA by ~ 2.56% annually during the next 5 years.

Nothing is impossible. But that’s not a bet I would make. I hope I’ll be proven wrong, for all those that invest in IFSW.

What happens if China becomes the dominant economy in the world, as USA has been òver the last 100yrs? I believe China only forms a small part of any global etf/fund, as most of its companies are not internationally listed. Would that mean that your Global fund would only be covering less that 50% of the global economy (and the less vigorous part at that)?

The Meaningful Money Personal Finance Podcast with Pete Matthew just aired an episode with Abraham Okusana of Timeline which discusses decumulation from a data based perspective which was quite interesting.

To summarise, we tend to spend less on average in retirement (traditional ages) and this slowly trends down with time. Some interesting discussion of care costs and using your house as an asset for these costs and reasonable time frames to use.

I have no affiliation with the show or Abraham/Timeline, just listened to the show yesterday and it reminded me of this article.

Making sure you you fully qualify for the state pension is a must as the returns from topping up are substantial. One other thing worth considering is delaying the state pension. Last time I looked, delaying by 1-2 years gave a much better return than buying an index linked annuity with the forgone payments. It will not suit everyone, but worth looking into when the time comes, especially for those thinking of buying an annuity.

@ Mr Optimistic – you know how this movie ends, right?

@ Whettam – yes, after I draw my annual income, I’d maintain cash around 5%. That would keep us going for 2 years on the bare bones budget in dire circumstances. We have short duration bond holdings too, and they behave a lot like cash.

Over time I’ve come to think of cash (outside of my stipend) as A.N. Other asset, so it’s properly integrated into my asset allocation now.

Tilt to UK equity is because I pay my bills in pounds. Mitigates against currency risk. Perhaps because we vote to rejoin Europe tomorrow. I’m sorry. I’m sorry. Wrong thread! I didn’t mean to bring this back up

Think I’ll drip-feed into gold given it’s recent run-up.

I get why you’re thinking of infrastructure et al.

@ Seeking Fire – nice analysis. I agree, it’s pretty low risk, especially because we can cut spending hard in extremis. Am also with you on the probability of the political risk. Debating state theft is great comment thread fodder though

Yes, own the house and 100% equities is deffo too scary in decumulation.

@ Ben – haha. I do like the number 5! Half of 10. Keeps it simple for me Interested in your thoughts on why you separate cash from the portfolio?

I’ve come to have renewed respect for cash as an asset. Especially after I discovered how it often behaved differently to equities and bonds in a crisis:

https://monevator.com/how-to-protect-your-portfolio-in-a-crisis/

Also, I can get higher interest rates and shorter maturities on some cash than I can on government bonds.

@ Tom Baker – Cheers! I think your analytical brain would have a lot of fun with the 30-day free trial of Timeline.

@ C-Strong and Jon B – Re: Multi-factor:

https://monevator.com/building-a-multi-factor-portfolio-with-ishares-factorselect-msci-world-etf/

@ Jon B – That’s a very interesting idea re: US Treasuries. I’ve written a piece about this:

https://monevator.com/do-us-treasury-bonds-protect-uk-investors-better-than-gilts/

I think there is a danger in assuming the golden track record of US assets continues but I can certainly see the argument for diversifying your government bond holdings at a reasonable cost.

Gold – yes, I have a similar ‘ugh’ feeling after recent price spikes. But I am where I am. I’m decumulating now and it could be a get-out-of-jail card when I need it most. I’ll hold my nose, drip-feed in and vow not to hold it for the long-term (by which I mean 20 years or so).

@ Vanguardfan – I was just trying to give people my ballpark rather than nail it down specifically. Mostly because I don’t want to anchor the discussion too much to a particular number. I think the plan I’m outlining scales but we’re executing it against a pretty modest five figure number. This is no fatFIRE. Absolutely happy to debate the pros and cons of my approach though.

@ Phillycheese – hey, thank you! Much appreciated.

@ all interested in whether or not to “max out” their state pension(s).

I have been in receipt of mine (full) for quite a while now, and it is the best of best friends! It reliably trundles in every fourth Friday, come hell or high water, cocking a snook at the travails of the Bitcoins and Gamestops of life.

Highly recommended.

@kraggash – If china grew in stature itd also grow its way into a global/ developed world index without you having to do anything, its automatically adjusting from our perspective like when companies enter or leave an index or rise or fall within it, and i wouldnt worry about taking your gains from america and putting it into china if america was to sink, since traders do that rebalancing for you – like say by indexing you benefitted from enron, etc despite them going bust because money was taken off the table for you

We’ve got an article on that… 😉

From 2010:

https://monevator.com/cash-and-your-portfolio/

@Mark C

To add to others comments, the gov.uk website allows one to quickly check one’s NI contribution history and one’s state pension entitlement based on those contributions to date. Even those who expect to have 35 or more years of contributions on reaching pension age may benefit from buying extra years if they have previously (before ‘new state pension’) had an occupational pension and been ‘opted out’ of paying full NI contributions.

@ Mr Optimistic – other than selling the family home, is there an insurance product that covers that scenario?

@ Cigano99 – I’m sure someone else will have thought more deeply about your property question than me but, could you convert it into theoretical income by multiplying its market value by your SWR?

Or perhaps you could look at the rates you can get on equity release products?

Personally, like Naeclue and Al Cam I think of the house as Plan B.

[Side note: Wade Pfau wrote an interesting article about using equity release as an income supplement from age 65 and found that it upped success rates by alleviating risk on the portfolio.]

@ Naeclue – Mrs Accumulator is massively against it. It’s open warfare in The Accumulator household. Ha. OK, not really. Mrs A is fully onboard, but if I go down then there are emergency instructions: essentially, switch to Vanguard LifeStrategy 60, ring The Investor for advice, and draw X amount, adjusting for inflation.

Happily there are other people clued up on finance in our wider family, too.

If I make it into our seventies then I’ll strongly consider annuitising to simplify things and take advantage of those sweet, sweet mortality credits.

Did you simplify so you can both ‘drive’, and how simple did you make it?

@ SueJ and Mattthew – I read a couple of pieces from the States claiming that the average stay in a care home amounted to a matter of months. Does that sound right to you, or way off base?

@ Miner – haha. We’re not dissimilar – sounds like we’ve got less in pensions and more in portfolio. I’d rather be in your shoes

@ MarkR – it must be “great minds”. It must be.

@ Hariseldon – Wow! Well done. What was 2008 like with 90% equities and being a novice decumulator?

@ Nearlyrich – Thank you! Agreed about the multifactor. It certainly hasn’t earned its keep so far. Benchmark against MSCI World.

@ Peter – yes, that article was written a while ago and it’s been a torrid time for factor investors ever since. The question is: do you judge by recent performance? Or, if you buy into the theory then do you hang in there and hope your time will come?

There are a number of reasons why factor investing is something of a punt – I definitely wouldn’t invest if you don’t buy the theory, or think it’s likely obsolete, or can’t abide the FOMO. I take nothing for granted. Value has been off the pace for a decade. That’s not unusual, but it could also mean it’s had its day. Factors are certainly riskier than sticking to the vanilla index.

@ Mr Slow – yes, I see multi-factor as more of a diversification play too. Here’s a bit more on Quality:

https://monevator.com/how-to-invest-in-the-profitability-or-quality-factor/

@TA – in this country off base but I see the iller ones who won’t get better and bear in mind that people might be more likely to avoid care support and struggle in the US where they might not have the same welfare system and where theres more expectation to leave an inheritance.

Short care stays might be short because of death…

Also dont forget the option of equity release, if you dont draw it then the care system might, then you or the mrs have less reason to avoid accepting care if you need it

@ C-Strong – Loving your comments but I’d like to debate one point. I’ve come to the conclusion there is ’no optimal’.

For a really good encapsulation of this, see table 3 of this paper by Wade Pfau:

https://core.ac.uk/download/pdf/211600279.pdf

It shows an equity allocation of anywhere between 33% and 72% lies within 0.1% of the best SWR for a 40-year period with a 90% success rate.

In other words, ‘optimal’ data-points are highly contingent on the inputs. Vary them slightly and you’ll get a different optimal.

I’m a massive fan of Karsten AKA Early Retirement Now – his work is brilliant. But it’s based on historical US returns, which isn’t ideal from a UK investor’s perspective.

I can also torture Timeline’s global historic returns until it reveals that optimal is 100% small cap. I can’t bank on history repeating itself with that degree of accuracy.

Essentially different researchers reach different conclusions that can turn on details like using a different US historical returns database, or different government bond maturity.

I think it’s better to think of the optimal allocation as a range rather than a single number.

@ Matthew – yes, the tenor of the articles was definitely that the ‘end was nigh’ for many at that point which brought the averages down.

You’d think that one day this mess will be fixed and we’ll be paying higher taxes as a result but have a better system because of it.

@Al Cam – when to use the Gold? Well, if Equities are down and Bonds are down, Gold is more likely to be up? Maybe? Flight to safety as it were.

So EF is currently mortgage off-set account but I’ll have to off-set the diminishing off-set in 5 years or so as the balance won’t be enough. But currently ii don’t charge for drawdowns so I’ve got gold, equities and bonds to sell too and the receive the cash relatively promptly. Unless I can get redundancy, I’m not pulling the plug till Xmas 2022 so I’ve time to refine the approach (not sure plan is justified.)

@matthew – normally, for most counties, agreed. But I am not at all sure if that applies when the class A shares are (were?) not not really available to foreign investers, and their goverment has such a large ‘interest’. Atm, China forms a part of the smallish Asia/Emerging markets holding in an all-world fund, and I suspect its actual position is somewhat larger (depending on how you measure it!)

@TA and others who have commented that their home is outside their portfolio and is really “Plan B” I totally concur, I think many people with kids will do as my parents have done and see their home as insurance against care costs, and if it survives that, its will become the bulk of the legacy that they want to pass down to their Kids/Grandchildren and theres nothing wrong with that ! For @TA and those of us that have no immeadiate wish to leave a legacy the house is a rather large asset to leave to charity once the last of us departs the earthly life 🙂 What i would like to do is spend a tad more in the early days of retirement knowing that separate to the portfolio we have a large illiquid asset which could be equity released, downsized or even used to fund an annuity if we chose to rent a home in a retirement village or similar in our 80’s. At the moment all options are open and i’m certainly not proposing to include the value of our home in the portfolio which we will soon start drawing down !! but at some point ideally while one or both of us are still alive it does need to be “Decumlated” as we have no desire to leave it to HM Gov.

@Brod:

To quote von Moltke: “No battle plan ever survives contact with the enemy.”

IMO good FI planning is no different – but, the enemies may initially be less obvious! If my experience is anything to go by, clarity will come quite quickly for some issues and the others will de-mist in due course. I would imagine that most things will have been satisfactorily resolved by around half way through your Gap.

Looks like you will also have the advantage of a good few relevant Monevator articles to browse too!

An end of career redundancy can be a great sweetener – engineering such an outcome takes some skill and/or luck. But it is worth remembering that such a scenario often works well for the employer too.

Best of luck.

@Naeclue (#65):

Re state pension (SP), deferral rates in New system are nothing like as good as they were in old system – and lump sum option has gone too, IIRC.

Also, worth bearing in mind that under the New system there is zero survivor benefits in the SP – so, in theory at least, you could defer your way to a total zero pay-out situation!

@bingo (#70):

Good spot re contracting out deduction – but just be extra careful which system (old vs new) you are buying “missing” years in – I fell foul of this rather well hidden trap a few years back.

@Cigano99 #77

In case you are not au fait, bear in mind that equity release can only be accessed up to a certain proportion of the value of the property, even if there is no outstanding mortgage, and that the resulting drawdown facility (so called) will be far less than the amount of the actual equity.

@TA – Your idea of holding gold in case everything else has gone down got me thinking.

In the decumulation phase I wonder if there is any logic to holding a far larger number of funds, split into geographical areas / company size / factors etc. rather than just a few more general funds.

By doing this you might always be able to sell something that has gone up even if the markets generally are down or at least sell something that has not gone down as much.

@ Lloyd – Yes, I think that’s why Whettam is exploring infrastructure funds. Low Volatility is a factor that’s historically suffered less drawdown than the vanilla index (a bit anyway).

I tend to think of this like my multi-factor funds – some hope that it might work but be prepared for disappointment. Correlations go to 1 in a crisis and all that.

The evidence for bonds / cash / gold digging you out of a hole is much stronger.

Thank you again @TA both for the article and your detailed answers to mine and everyone else’s questions.

I must admit I have always struggled with my defensive allocation. I have an allocation, many would regard as too low, I’m only 3-4 years away from retirement and Defensives are only 25% of my portfolio. Although I have another 20% REITs / Alternatives, as you say evidence for Bonds is probably stronger. But I’m hopeful my ‘bond proxy’ infrastructure funds will continue to do a job.

I’m also really lucky to have an old with profits policy, which guarantees 4% pa until I’m 65. This is about 7% of my portfolio, not really a diversifier though, because it just does that nothing more or less. My initial plan had been to transfer out of this at retirement, but thanks to @A1Cam in another Monevator comment, my plan is to hang on to this and just drawdown from rest of portfolio.

I’m currently increasing cash and short term bonds in the portfolio, to prepare for taking tax free cash and I’m not comfortable topping up intermediate bonds currently.

With regards to property I agree it’s mainly a plan B. However we are planning to move shortly after we retire and we’ll downsize to a smaller property to release some equity, so it does factor in our plan.

@Whettam:

Looks like your with profits checked out as suspected!

Sometimes it is not a bad idea to take a second look at things.

@MarkC (#49) & @Boltt (#57) & AlCam (#60)

Here’s that Steve Webb article:

https://www.royallondon.com/siteassets/site-docs/media-centre/good-with-your-money-guides/topping-up-your-state-pension-guide.pdf

@Maximus:

Thanks – note that this document dates from the 2018/19 tax year, so any £-note amounts/costs may be out of date and watch relative durations , etc too.

And, as the document states at the outset, in the conclusion and several times in between: the rules , etc are complicated.

@A1Cam it did thank you to you again 🙂 for making me question my own rather daft logic. I think I just got a bit of a mental block that I should put all pensions into drawdown at same time. The approach actually has a couple of additional benefits too (1) I’m likely to exceed the LTA so this will actually delay that and (2) having now studied the T&C’s in addition to the 4%, there is a final bonus on the policy if you stay the full duration, this is subject to market adjustments, etc. etc. but could be a small additional amount at end.

Re this conversation about using a home as Plan B.

Of course all circumstances (and individual preferences) vary but I tend to conceptualize it using imputed rent meaning that I can put it on both sides of the assets/income equation.

E.g. Suppose, I have 1 million in (non-house) assets and a 1 million house. I’m drawing 30K (3% SWR) as income for expenses but I’m also calculating 3% imputed rent. My ongoing ‘real’ expenses are therefore 60K p.a.

The ‘Plan B’ therefore is a fairly drastic reduction of expenses by selling (or letting) the house and moving to (much) cheaper accommodation. I see living in expensive accommodation as a ‘Fat FIRE’ option.

Equity release has advantages (especially if there’s no legacy requirement) but that should really be modelled as a faster drawing down of capital/increasing the withdrawwal rate whilst not reducing expenses.

@TA, “Did you simplify so you can both ‘drive’, and how simple did you make it?”

Essentially so we could both drive, but I also appreciate simplicity. Prior to the change of tack, we had a very simple system. After allowing for some exceptional one off items (house improvements, new boat), the approach was to rebalance back to 60:40 once per year and set a budget to spend over the coming year of 3% of the value of the investments at the start. This was a budget, not a target and once I looked at it properly I could see that we were consistently underspending and the amount of underspend was rising, partly due to rising asset prices, partly due to accumulated underspending. Last year’s Covid crash was the catalyst for a rethink.

The goal was to give as much money to our kids as we could, whilst leaving in place sufficient assets to meet our likely needs and desires. In addition, if and when investments performed well we needed a way to determine how much more capital we could distribute.

We switched to something similar to a Buffett style 90/10 allocation, but with the 10 in cash rather than bonds, plus cash to take us through to state pensions. In a nod to McClung, we decided not to rebalance back into more equities, just out of them into cash, so we would not maintain 90/10. Unlike with McClung, dividends would not be reinvested and just get accumulated into the cash allocation, from which we spend. We have simple rules indicating when to sell equities and when to give away cash. Amount to draw is now based on our estimated spending, but again is a budget, not a target. We will review the spending estimate every few years.

Another simplification is that I have stopped trying to keep our asset allocation inline with targets. We are mostly cap weighted trackers weighted to approximate the FTSE World Index anyway, but have some small cap ETFs, a US REITs ETF and a US minimum volatility ETF. When we next sell I will check the allocation and sell so as to push the weights closer to where they should be, otherwise I am just going to leave it. I have been contemplating putting some of the US allocation into a US value ETF, but my wife may well veto that.

There are still plenty of complications. For example with minimising, preferably eliminating, CGT on investments outside tax shelters, whilst also keeping income tax down. We don’t draw from ISAs and have temporarily stopped drawing from SIPPs, so with time the unsheltered investments complication should go away as we get everything sheltered.

Another complication is with our SIPP investments. I only count 80% of the amount in SIPPs, to allow for tax, but I also deduct an amount based on what LTA charges I think we will pay when we each reach 75. Once we reach 75 this LTA complication goes away, unless the rules change.

I fear next week’s budget may add to complexity 😉

@Whettam:

No worries- you are welcome.

Managing an impending LTA impact is a very tricky dance. This may become even more tricky next week – but let’s wait and see.

I understand folks desire to keep any DB pensions within the LTA, and, IMO, using either phased retirement or an appropriate UFPLS schedule on any DC pensions can be helpful in this situation. I suspect you are not the first, or last person, who has assumed the only option is full crystallisation at one time.

As it happens, I did fully crystallise my DC in one go. But, I did this at the earliest opportunity as that way I could hopefully retain enough LTA headroom to take my DB pension at or near normal retirement age (NRA).

Swapping this order would almost certainly have led to a big LTA hit!!

I’ve been a follower of this site for a number of years and this has got me thinking about FIRE. I finally got around to putting some numbers into a spreadsheet and doing a bit of modelling. Having worked in the NHS for over 30 years I should be due 30/80th of my final salary plus a few years of the newer CARE scheme. If and when they rectify the age-discrimination case for public sector pensions I also stand to add another 7 years making this 37/80s plus my PCLS.

Plugging this into my modelling I find was suprised to find that I could probably retire early at 58 (taking a small hit for the actuarial reduction) and still have approx. 67% of my net salary if I at this age and use 50% of my PCLS). Once I reach my Normal Pension Age at 67 this will increase to 71% when the State Pension and other NHS CARE are added.

When doing their calculations do people have a figure in mind on which they can comfortably live (assuming for example that a mortgage is paid off) or a proportion of their current net salary (in my case around 2/3rds)?

@Grumpy T: