The 4% rule went viral because it was billed as simple and safe (*coughs a noise that rhymes with bullwhip*).

The 4% rule went viral because it was billed as simple and safe (*coughs a noise that rhymes with bullwhip*).

Unfortunately, the 4% rule is not safe.

Nor is it simple, once you put the nuance back.

The story is seductive – that you can withdraw 4% a year from your portfolio and never run out of money.

This is often known as a safe withdrawal rate (SWR). Unfortunately the 4% version is about as reliable as that other withdrawal method you’ve heard of.

Got a portfolio of £1 million? The 4% rule claims you can safely withdraw £40,000 in year one, adjust that amount by inflation in year two, and so on, every year until the happy hereafter.

The 4% rule also gives us the rule of 25. Want to live the life of Reilly on £40,000 a year?

£40,000 x 25 = £1 million

That’s the sum you need to amass before you can hit the beach.

Simple as that. At a stroke of the calculator anyone grappling with a defined contribution pension can treat it like it’s one of those turnkey defined benefit, gold-plated jobs!

If only.

The 4% rule: the things they forgot to tell you

Where to begin?

The 4% rule doesn’t include taxes. The £40,000 figure above is gross income. You’ll need to live on less after tax.

Worse: the investment growth assumptions that underwrite the rule assume no capital gains, dividend or interest taxes. If your investments aren’t completely shielded from tax then you’ll need to lower your SWR.

The 4% rule doesn’t include investment costs. Fund charges and platform fees chip away at your annual returns and leech the SWR. Financial planner and researcher Michael Kitces explains that the answer isn’t as simple as deducting your portfolio’s total OCF from the SWR either.

(Another thing to note: the 4% rule reinvests dividends. If yours are spent or taxed then fuhgeddaboudit.)

The 4% rule applies to 30-year retirements. If you live longer than 30 years then the failure rate creeps up unless your SWR goes down.

Financial planner William Bengen, whose research inspired the 4% rule, recommended a 3% SWR to see you through 50 years or more.

The 4% rule uses US historical returns. Bengen’s original portfolio comprised:

- 50% US equities

- 50% US intermediate government bonds.

Bengen then used historical annual returns from 1926 onwards to discover that an initial withdrawal of 4% would have enabled retirees to live out the next 30 years on a constant, inflation-adjusted income, without running out of money, come hell or Great Depression.

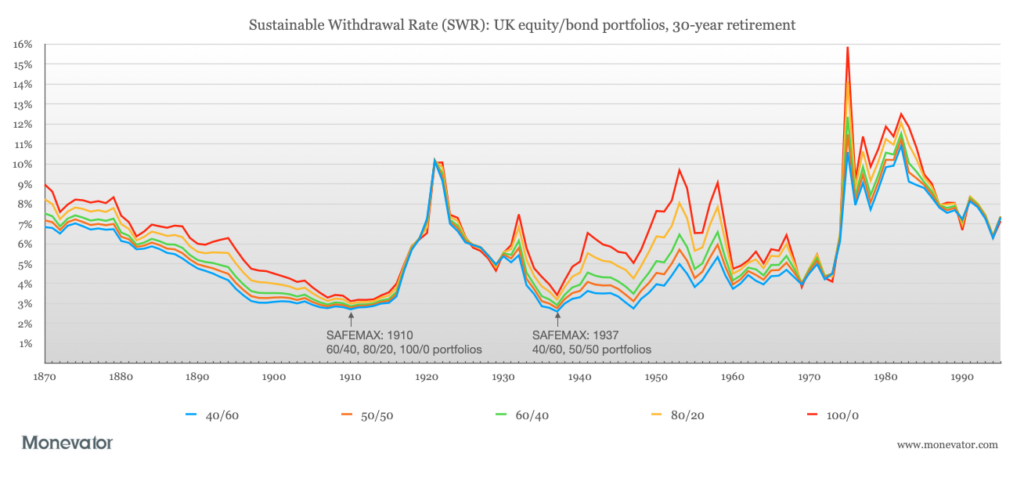

That’s nice, but remember the US enjoyed super-powered investment returns during the period studied. Other developed countries did not fair so well. Retirement researcher Wade Pfau calculates:

- The UK’s SWR as 3.36%

- Germany’s as 1.01%

- Japan’s as 0.27%.

- Even the global portfolio only made 3.45%

Apply the 4% rule to Japan and your money ran out one third of the time. In the worst case, your money evaporated in just three years!

Pfau and others even doubt that Americans can rely on future returns being so kind.

Known safe withdrawal rates will fall if a future sequence of returns is worse than anything currently stinking up the historical record.

What can you do with that information? Well, some researchers have worked on the link between current asset valuations and SWR. You’re advised to choose a more conservative SWR when valuations are high, while you can live a little when valuations are low.

Incidentally, the 4% rule even fails in the US when you use a different dataset. Many retirement researchers argue that the sample sizes are too small anyway.

The 4% rule applies to a specific asset allocation. Change the 50-50 US equities and intermediate government bonds split and you’re playing a different game. Bond heavy portfolios (say over 65% bonds) have historically sustained lower SWRs, especially over longer time horizons.

Sticking with allocation, UK investors shouldn’t use US SWRs – but you should appreciate that UK SWRs aren’t appropriate either if you’ve got a globally diversified portfolio.

Bengen and others have shown that diversifying into certain risk factors can improve your SWR. What about other assets such as REITs or gold? Will they improve your chances? The future is uncertain.

The 4% rule’s definition of success is probably not yours. Some SWR studies apply a sneaky ‘success’ rate. They count a SWR as sustainable if it only failed 5% or 10% of the time. The famed Trinity study did this. I think this is acceptable, but you may not. Either way it’s not ‘safe’.

Failure itself is defined as people running out of money before they run out of time. You spent your last dollar as you expired on the final stroke of midnight, December 31st, on the 30th year of your retirement? You’re a success baby!

This definition of failure keeps things simple but it’s not realistic. Most people aren’t oblivious to plummeting portfolios. They won’t fling themselves off the cliff edge like an Olympic lemming. Many will slow down their spending before it becomes unsustainable. People also cut spending in scenarios where the situation looks dire but hindsight tells us things ultimately worked out just fine.

Sadly, you don’t know which it is at the time. People cutback early because they can’t predict if they are history in the making, or whether they’re living through just another close shave for the 4% rule. In other words, living the rule can be pretty scary without a Plan B.

The 4% rule is inflexible. What if you need to spend more than your SWR allows? I don’t mean you have the occasional bad year. I mean something changes that proves your original income estimate to be off-base. Maybe you have unforeseen health costs, or a newly dependent family member. Perhaps there’s no obvious lifestyle creep but your personal inflation rate constantly outstrips headline inflation. Within five to ten years you’re spending way more than planned.

A high SWR like 4% gives you little room for manoeuvre when high spending meets poor returns. Everybody needs a more flexible plan than the basic 4% package suggests.

What if you spend too little? The selling point of a SWR is that it’s supposed to survive the nightmare scenarios. If life turns out better for you – and most of the time it does – then you could have spent more before you were gonged off. All the other caveats notwithstanding, Kitces shows that the 4% rule typically does leave large sums of spare lolly on the table.

Now that’s a good problem to have, especially for your heirs. Whereas, if you definitely want to leave something for your heirs, well, that’s not the 4% rule’s bag. It assumes capital depletion is A-OK. If it’s not then you’re into the expensive world of capital preservation.

So, you can spend too much or too little! Which is it? Well, naive application of the 4% rule can lead to either. It’s a rule of thumb not a strategy.

None of this is meant to impugn Bengen’s original research. It was groundbreaking and he clearly flagged his assumptions back in 1994. The 4% rule has taken on a life of its own, whereas Bengen’s work was only meant to be part of the puzzle. What’s often missed is the advances made in retirement research since.

You can devise a strategy from the wider body of knowledge. See McClung and also our post on how to work out a more sustainable withdrawal rate.

Step one is understanding that living off your money is as much art as science. And step two is knowing that the 4% rule does not work as popularly advertised.

Take it steady,

The Accumulator

Bonus appendix: 4% rule maths

Year 1 income: Withdraw 4% of your starting portfolio value.

500,000 x 0.04 = £20,000 annual income

Year 2 income: Adjust last year’s income by year 1’s inflation rate (e.g. 3%):

£20,000 x 1.03 = £20,600

The 4% SWR only applies to your first withdrawal. Every year after you withdraw the same income as year 1, adjusted for inflation, regardless of the percentage that removes from your portfolio.

Year 3 income: Adjust last year’s income by year 2’s inflation rate (e.g. 2%):

£20,600 x 1.02 = £21,012

And so on. Until the end. Which this is. At least it feels like it.

Comments on this entry are closed.

I had a slightly different take on the 4% SWR a few years ago :-

http://eaglesfeartoperch.blogspot.com/2016/09/safe-withdrawal-rates-with-respect-to.html

1.5% portfolio growth above inflation might seem an easy target to the uninitiated, but I’ve only managed to achieve it in three out of the last five years !

I wonder if anyone has done any modelling of life cycle spending. As my parents approach their 80s, they don’t go out much except to their local cafe a couple of times a week and spend very little on stuff as they have everything they need. I imagine a decrease in spending might be true of the elderly in general (assuming, of course, they have their medical care sorted out)

There are other issues with both the 4% rule and the analysis in the post.

– Firstly, people treat the 4% rule as a law of nature. All it is is the results of a back-test on data from a particular time in history. The worst case scenarios encountered so far are not necessarily going to be the worst cases encountered during the lifetimes of people investing today.

– The distinction between US and UK investor results are moot these days since investors in both countries have access to pretty much identical investment choices so there is no real reason why a UK investor should expect different outcomes unless of course they invest with a home country bias.

– Finally the rule looks good on paper but a key question in practice is how the swr calculation is actually done. The value of a typical portfolio fluctuates each day and can easily move 2-3% in a week giving substantially different withdrawal amounts. The search for precision is therefore misplaced since market data has a huge amount of noise in the short term.

The best way to use these is to use some basic parameters as a guideline rather than trying to be too precise – so withdrawing about 3% is probably going to be OK whatever your asset allocation and 5% of above will probably cause a few hairy moments during a long retirement.

Sounds a bit life the Mehrabian myth: https://www.youtube.com/watch?v=7dboA8cag1M

For me the problem with the 4% rule is that it doesn’t take valuation into account. So if it’s 1999 and the FTSE 100 (for example) is at 7,000 with a 2% dividend yield, your 4% withdrawal will come from 2% dividends and 2% from selling fund units.

In general, the 2% from dividends isn’t a problem because dividends tend to increase ahead of inflation. It’s the 2% raised by selling some of your fund which can potentially cause problems in the long-run.

Contrast that 1999 FTSE 100 with today’s FTSE 100 which has a dividend yield of slightly more than 4%. Today’s investor (assuming they’re invested 100% in the FTSE 100, which isn’t a very good idea) can withdraw 4% without even withdrawing all of the dividend. And they can very probably increase that income with inflation and still not eat up all the future dividends. And by not selling any shares or units and even reinvesting the left-over dividends, it’s very likely (in my opinion) that the funds would continue to grow and therefore outlive the investor.

So as with all these things, valuations matter.

Perhaps a sensible alternative to simply having a 2%, 3% of 4% withdrawal rate is to withdraw whatever income your funds produce, up to some sensible limit like 4%, and if the income doesn’t cover the full amount, top up with a small amount of fund sales, perhaps 1%. So if you were a FTSE 100 investor in 1999, when yields were 2%, you’d have to either accept a maximum income of 3% (2% dividend plus 1% capital sales) or keep saving up until you reached the point where you could draw 4% without having to sell off too many shares (e.g. no more than 1% or so).

@John — Agreed. Obviously I’m a heretic active investor, but as I said to @TA when we were discussing this post, I do think the wider thinking on this is moving back a little bit more towards the direction of my ‘live off the income generated, don’t touch your capital’ preference:

https://monevator.com/try-saving-enough-to-replace-your-salary/

(Not moving anywhere close to it, of course. None of the SWR literature I’ve read cares about the difference between capital and income, for arguably justifiable theoretical reasons.)

All these SWR calculations focus on *what you can take*.

I think I’d rather focus on *what my portfolio generates* and set my spending sights accordingly.

However there’s no denying this just swaps one set of problems for another. They are just problems I think I’d prefer. 🙂

The big two snags of course is it probably requires more money (though as ‘safe’ SWRs are nudged down, probably less than it once seemed) and that it leaves huge – potentially seven-figure – sums on the table by design at death. (Even if you say “heck, I’ll switch to spending it in my late 70s”, first you might live until you’re 90+ and second it probably would have helped more to have spent more in your 60s and 70s.)

I accept for most people the search for a modifiable-SWR strategy will need to continue.

BUT if you’re still planning in your 20s/30s (or 40s and you have made some decent progress already), you’re looking to use your money as a tool and you’re willing to get hands-on, you don’t hate work/earning money (so can work a bit longer or differently or part-time) and you’re prepared to be flexible with respect to income, spending and timings, I think striving to create an income stream is worth considering as an alternative approach.

Get to say £1m to £1.5m, spread your money across a bunch of good equity income investment trusts, bonds ETFs, and a few diversifiers like commercial property, cash, and perhaps gold, and direct all the income payments into an income smoothing system if you like and live on what comes out the other end year one and I doubt you’ll have many problems.

Or if you do, so probably will someone running a ‘sell your capital’ based SWR rule, too.

I accept my approach is more hand wavy and fuzzy — and arguably off-topic for this thread — so I’ll leave it here and look to do my own post in the future. 🙂

What I won’t be offering though are back tests or similar. Part of the point of my thinking is to build a sensible system based on what is available, not mine data for what was possible. 🙂

*takes cover*

@Lemsip — Good points, but I think the first two are alluded to in the post to be fair. The last point on *when* to do the SWR calculation is very interesting — not sure I’ve heard that addressed before, but I haven’t exhausted the literature like many. 🙂

@Investor

Agree with a lot of your approach.

As someone who was lucky enough to accumulate the kind of sums you allude to in my 40s and is also an active investor, the approach I use now that I don’t have a paycheck is as follows :

– I set my core living expenses at a conservative level – currently around 3% of portfolio. This takes care of general needs without accounting for discretionary spend like holidays etc which I withdraw depending on market performance.

– Aim to keep 2 years of expenses in cash at all times and monitor quarterly. If this bucket goes down and I top it up unless markets are very weak ( as in end of last quarter) else let it run down till the portfolio is near its previous high water mark.

– Focus on total return. I invest in companies which re-invest most of their earnings or buy back their own shares and I can make my own dividend at a time of my choosing. Despite the UK financial press being dominated by dividend devotees and selling capital being anathema, it makes no difference provided the company is creating value. For example if a company buys back 3% of its shares and issues no dividend and you as a shareholder sell 3% of your shares each year , the economic effect is identical.

– Through a combination of luck and long term active investing, a large proportion of my investments are in my ISA so tax is fortunately not a consideration for the most part.

– I run a very concentrated portfolio ( less than 10 positions) and expect it to be more volatile than the market and its the price you have to pay if you want reasonable ( which I define as 8% or above) long term results. Most people would see it as unnecessarily risky but I am more comfortable with this approach for the time being. May change if I stop enjoying it though and part of the reason I keep a 3% guideline in case something blows up in my face !

I think the fact that the SWR, in most scenarios, leaves far too much money on the table makes it unsuitable as a general approach (ie for the 95% of people who are not able to accumulate £1m investment portfolios). It’s hugely inefficient. The ‘withdraw only income’ approach is even worse from that point of view, with the added hazard of encouraging people into yield seeking investment strategies, which are more risky.

I personally think strategies that envisage people living wholly off investment portfolios are essentially niche activities, not well suited to human psychology and budgeting approaches. Most people need a modest, reliable floor income (such as the state pension provides, or ideally maybe 50% more) plus a wedge of savings to spend more flexibly, probably in the early part of retirement. The bigger the wedge the more scope for frivolous spending. Then the house can be raided to provide for care later on.

Of course the 4% ‘rule’ is nothing more than a rule of thumb, but rules of thumb are generally pretty helpful as long as it’s appreciated that flexibility and adaptability are needed too.

@John – “So as with all these things, valuations matter.” You are of course correct. I have read McClung’s excellent book (Living Off Your Money) and he describes a method (supported within his downloadable spreadsheet) whereby the initial withdrawal rate is set up based on current valuation levels (e.g. CAPE, Tobin’s Q and what not). I cannot recommend the book highly enough. He has obviously put an enormous amount of work into it.

Interesting stuff. I use 4% for planning and I’m happy that it does a good enough job for where I am now. For me, the key is “what does failure look like?”, I’m okay with the possibility of cutting spending or looking for some sort of paid work for a while. I also need to consider the risk of dying or getting seriously ill before FIRE and having left it too late.

This is way off my beat, but I just wanted to add on some more stuff about tax.

It is easy to forget or not believe in things that we haven’t experienced, so some/many FIRE people may not be familiar with the extraordinarily high rates of tax on investments in the 70s – rates that Mr Corbyn might be drawn towards if he got into power.

I am not trying to say that such extremes will happen, just that Capital Gains rates are at historic lows at present, and Income Tax is pretty respectable, so it doesn’t seem unfeasible that they could go up.

So if I was going to do a rough model of future cash streams, I’d want to build an extra buffer in to allow for future tax rises on dividends and gains.

Oooh. I’m glad you have opened this can of worms and I for one would welcome more perspectives on the theme of retirement spending.

I am in the early retiree, ‘spend income plus a little bit’ camp but if I were looking to spend down my portfolio in retirement I think VPW from the Bogleheads is well thought through without suffering from false precision.

https://engaging-data.com/will-money-last-retire-early/ gives a slightly different perspective to the mountain of other stuff out there. Uses US data of course but I put in investment fees of 1.5% when modelling a mostly equity portfolio to approximately account for historical difference in long term returns (US c.6.5% vs global c.5%). What I found really interesting was being able to model ‘spending flexibility’ to get a sense of impact on portfolio longevity.

Keep up the good work.

Well, yes, we’d all reduce our spending, or maybe pick-up a part-time job for a few years. But what if the few years turns into 20?

EarlyRetuirementNow has a great series on this:

https://earlyretirementnow.com/2018/02/07/the-ultimate-guide-to-safe-withdrawal-rates-part-23-flexibility/

and parts 24 & 25. And he covers type II errors.

And I’ve always been a little suspicious of living off the Dividends – they get cut, you’re only investing in a sub-set of the market. And if it was that easy, why wouldn’t everyone do it? All the Acxtive Fund Managers can just go home. (Big ERN doesn’t like that either, see parts 29-31 of his series.)

My strategy? I’ll have a floor provided by the state pension and a smallish (£5k-6k) civil service pension and use my SIPP/ISAs for luxuries to top up my pensions. I’m hoping for 3% CAGR for my Globally diversified SIPP for 14 years until I want/need it (about half what portfoliocharts.com reckons I’ll (historically) achieve.

But, like us all, I’ll play the hand I’m dealt. A flexible approach is the best we can do, especially looking 30-40 years ahead.

SWR’s unfortunately something I have started to obsess about too much. When I first got interested in the idea of early retirement came across the 4% rule and but soon binned this idea.

But one other factor (and this one is in your favour is the state pension), the extra 16-17k p.a. (for couples) could be a significant help in planning to retire early and then reduce withdrawal rate when your state pension starts.

I know that some planning FIRE ignore this because they believe it may in future disappear. I must admit I’m not ignoring it (I can’t afford to) I agree that in future a chancellor will probably do something to state pensions or all pensions for ‘wealthier’ individuals e.g. NI, mean test, etc. But I am hoping (and therefore planning) on something from this to help out and I’ll reduce my withdrawal when it kicks in.

An annuity would give you something like 4% with 90% peace of mind (as in fscs protection), drawdown is more for luxuries like inheritance, or for putting off an annuity till rates are higher

SWR is a topic I find very interesting. It seems like the FI community mostly agree on how to accumulate for FI/FIRE, but nobody has come up with a sure way to safely withdraw. It’s a puzzle without a definitive solution, but lots of interesting ideas.

I second @Brod. Early Retirement Now has written some of the most comprehensive analysis of SWR methods. Well worth a read.

There’s something to be said for having a safe income floor. That could be in the form of a small DB or state pension plus using a portion of your pot for an annuity. ERN provides some math on how to calculate a starting SWR given a pension that may kick in 5 or 10 years into early retirement.

Having two thirds of my investments in a UK pension, one thing I find overly complex is pension withdrawals. At present it sounds like you could end up being taxed inefficiently if you’re not careful.

The reason there is no “foolproof” SWR method is simply that any method will need to be applied in a future environment which is unknown and could contain curveballs the likes of which history does not have data points for. That is why I find it best to start with around 3% at the start since most of the risk lies in the first 5-10 years. Once this is navigated, it should be possible to re-evaluate.

Just about the only thing I feel pretty sure about is that in today’s environment bonds will give a negative real return compared to equities given current yields and the interest rate environment so they are more risky than equities at the moment. Therefore my allocation is cash for 2 years ( roughly under 7%) and the rest in Equities and this differs from the traditional 60/40 portfolios researched in other very different interest rate environments.

Floor & Upside strategy (from the days when I knew how to write short posts)

https://monevator.com/secure-retirement-income/

https://monevator.com/the-most-important-goal-for-every-retiree/

I think the most obvious risk is data mining. SWRs and withdrawal rules (GK, harvesting) are very sensitive to the retirement horizon and specific data set used. For example including the period 1900-1925 in an analysis for a UK 40-year retirement period will knock 0.8-1.1% off the SWR, even on portfolios with a strong global component. Despite this, some authors still exclude those first two decades in their UK analysis. Why?

It’s not unreasonable to see flaws in say naive Monte Carlo approaches. Unfortunately, the corollary is not that historical back-testing is robust. A 100-150 year historic record is quite limited when you might be considering a 40-60 year retirement. Without postulating market collapses, you can create perfectly reasonable scenarios, not in the historical record, that kill many withdrawal strategies such as GK or harvesting.

There is also the debate over whether using CPI as the inflator is too optimistic. The differential between the CPI inflator and say the wage inflator (which some argue may be a better proxy for the standard of living) can become large over a 40-60 year period. So if you were living on the average wage in 1977 of £3k/annum, then you would now be living on £17.7k with an RPI adjustment. Average earnings, however, are now £26.2k. So you’ve gone from being average to more like 25th percentile. When I used to work on strategic asset allocations for global endowments, most of them saw “standing still” as around CPI+1%, rather than CPI flat, to adjust for this effect. This knocks 1% off every WR instantly. Now add a wealth tax of 1% and suddenly 4% is 2%. Ouch.

On a theoretical point, SWR and many withdrawal rules (Guyton-Klinger, harvesting) violate the Bellman equation (‘Principle of Optimality’) because the are time inconsistent. By comparison, valuation based approaches, VPW etc can satisfy this principle.

@vanguardfan +1. The mechanics of how to wind down a portfolio whilst maintaining an asset allocation is also an issue. Living off the yield guarantees you will leave unspent money: ok if you have a bequest motive and can afford it. Also equity in house is really a bequest motive unless you have zero children. That’s why I don’t regard my house as an investment: it’s illiquid. Taking all the yield also raises the question as to how this reduces the growth of the portfolio. If you want it to maintain real value, will it do so if you suck out the income?

I think the 4% Safe Withdrawal Rate “rule” should only be considered as a guideline based on a specific historic model. I prefer to use natural yield as my guide, in my case 4.19% at the end of February. That’s a good measure assuming the income can grow to match the price inflation you experience. I think both approaches are useful guides for planning whether accumulating or decumulating.

I would, and am using, tax free ISA’s, and the capital gains and income tax allowances to minimise taxes. My natural yield is after incurring individual investment trust charges, whilst low platform fixed fees and minimal transaction charges are budgeted for as part of my spending. I aim to be flexible on both spending and investing according to future circumstances. Recently conditions have been favourable with spending stable, or any increase below price inflation, whilst investment income has increased above price inflation helped by some re-investment of income and a slight tilt to higher yield investments. This could change of course and taxes and inflation could both rise in the future.

Thanks TI for the thoughtful article. In my view, the utility of the 4% rule is not the way it tells you what to do with your money when you retire – it is the simplicity with which it gives you a measure of progress as you save in the long long years before retirement: frankly the hardest bit about accumulation is cutting through all the crap and indecision and getting on with it. Yeah – I know it’s wrong, but it gives me a simple and fair way to estimate how I’m doing and whether I need to make course corrections.

When it comes time to kick back, I know that I’m extremely unlikely to follow a rigid rule for expenditure, and will have to do a lot more thinking at that time. Having about 25 years of expenditure in the bag will feel like a good starting point…

On a side note, I wish that annuities were a more transparently and liquidly traded asset class – and indeed perhaps that will be an innovation over the coming years – as pricing up annuity equivalents is a great comparitor for the swr.

When I model I ignore inflation, as it makes the numbers unreal, and remember that “natural yield” is total return, so both dividends and capital gain over inflation, say 3%+1%, so selling assets slowly isn’t a problem.

If you ask someone of working age what they need, they will think in terms of salary, not expenditure, and the different taxation regime in retirement helps a lot reducing the numbers.

But the biggest issue is that you don’t spend at constant rate. Its likely to higher at first (all those bucket list items), but drop a lot as you become a homebody, with the care uptick likely to be funded from house sale. So retiring at 4% is more realistic, as you’ll be spending 3% after a decade anyway, even less with state pensions kicking in.

If the market falls, delay some bucket list items.

A problem is, if you promote a SWR of less than 4%, the average person in the street may well say ‘why bother investing at all?’

In more ‘normal times’ interest rates were such that you could at least keep up with inflation with no risk. So a bunch of money in the bank (or with Ernie) and a 25 year timescale from retirement at 67/68 might look pretty good.

What a lot of reaction this article has provoked.

Everyone has their own view on things but it’s worth remembering that the SWR is just a piece of theory and I don’t think it’s actually been tested by anyone in practice.

And when I say practice, I mean that if you are actually in FIRE mode and your fund is depleting, maybe you’ll go on fewer cruises and downgrade from champers to cava.

if you are able to control and change your spending then you should be able to get by – and you can always earn more money one way or another.

Finally, the SWR of 2/3/4% is just the worst case scenario to prevent running out of money – at other times, people would be able to retire on a SWR of 6 or 8% without any problems.

it’s ridiculous that in the face of 50 years of retirement and the SHTF that you wouldn’t be able to do something to improve your position

@Kraggash – but the average person isn’t trying to retire at 40/55/whatever and hope it lasts 40 or 50 years. The average person’s retirement starts at 67 for 20 years and is funded mostly by the state pension. So if you say to them you save £4, and we’ll give you £1 and when you need the money after you’re 55 it’s yours, but you’re better off waiting till you retire at 67, it becomes a different proposition.

Were you to say to everyone, you save £2, and we’ll give you £1 up to, say, a saving limit of £250,000 (and let’s index link it to wages, not CPI/RPI) and you can keep any growth you achieve and you’ll also get the state pension which we’ll index link to wages, then I think pensions become what they were originally supposed to be – something to support you when you retired at state pension age with a modest income.

@Brod @Kraggash — Yes, I do think there’s a fair bit of (constructive) heat in this discussion because one contingent are discussing how to strategize to leave the workforce / retire / whatnot at 40-50 (i.e. early) and most of the rest are talking about conventional retirement ages (which was where the original research was aimed at of course, and some of whose practitioners would possibly blanche at the idea of people applying their back-tested SWR numbers to retirements that begin at 40!)

Not sure what the solution is — I welcome both groups having the discussion on Monevator — but perhaps where disagreement flares up people might want to state their perspective / camp. (As you guys have done.) 🙂

Really enjoying the article and comments. I’ve been trying to work this out as I suspect (hope) I am 10 years out from quitting work. Part of the issue is the one variable no one can usually predict which is the day you’ll stop needing an income stream which makes the predictions difficult – so at the moment I’m using 90 for planning purposes.

I’ve then worked out what I think I need by decade (more at the beginning, less at the end). I’ve then taken the total I predict I’ll have the day I quit and then subtract each year what I think I need ensuring the total at the end doesn’t end up a minus number.

I’m not planning on leaving anything other than a house and a few small gifts so the plan is to spend as much as possible. I’ve also factored the state pension in – so if I needed £20k and had £8k state pension I’ve deducted £12k from the balance…my spreadsheet works something like this (all figures are illustrative):

Age Starting Need Remaining Growth Balance

66 256000 18000 238000 7140 245140

67 245140 10000* 235140 7054 242194

68 242194 10300** 231894 6957 238851

*Withdrawal amount reduces as £8k state pension is assumed

**Annual “need” increases by inflation.

This carries on until age 90! If the plan doesn’t work out it’s: cut back, sell the house, or back to work. Or if things do better and the balance at the end of the year is higher than expected then it’s either extra spending (or more likely) savings for a rainy day. That’s the plan anyway – any thoughts (or obvious holes I’ve missed) appreciated.

The variables (inflation, growth, need), can all then be tinkered with to model different scenarios, and it avoids the need to calculate an SWR with the target of as close to zero as possible at the end.

Plus One for the McClung book, very helpful, huge amount of work and research has been done.

Future is unknown and unknowable, only the best guess based on the past can guide us.

Adapting to changing circumstances must be the most important thing we can do in retirement.

As well as the obvious danger of running out of money, it’s worth considering that undue caution may leave a lot of money on the table and a miserable retirement!

I’ve felt this way for a long time and i’m glad somebody shares the same view. America’s stellar returns *may now be a thing of the past and millenials face a 1 in 10 chance of living to 100 (ONS, 2017); I worry for the ‘FIRE’ proponents who have invested diligently, only to take get reckless after the finish line.

I thank monevator for having recommended MccLung’s book “Living off your money” sometime in the past. It is a seminal text on the subject, as far as i’m concerned. It proposes some bold practices which I haven’t the stomach to employ, but the information in the pages is invaluable nonetheless. Highly recommend.

To me 4% seems far to optimistic for people who may well be at the most conservative, risk-averse point in their entire lives. I read a morningstar article that offered 2.1% as a forward-looking SWR (100% success rate) using a global 60/40 portfolio (albeit with a slight home bias) for a 30 year retirement (Blanchett et al, 2016).

Well I retire in 2 months time at the age of 65 and one half having not had one days unemployment in 40 years and have benefited from dB schemes for most of that time, and generous salary sacrifice for the rest. Currently I sacrifice 50% of my salary in to the DC scheme. My state pension kicks in in 8 April by my election.

Based on a rather prudent ( aka mean spirit and pessimistic) view of what I can afford to take, my pension will be around £35k gross, comprising £25k floor of dB stuff and state pension, plus £10k drawdown.

Ok, salary wasn’t that high but FIRE aspirations seem optimistic to me given that’s what I managed in possibly the best economic times we will ever see and I don’t spend much, and have overpaid into my pensions in terms of Joe average.

Now I await an aggreived generation to bemoan their situation and demand wealth in the name of intergenerational fairness ( aka we want to eat our cake before we have earned it), demand an end to brexit – though not sure why we want to be European -and seek FIRE because this work thing really sucks but then we doubt our ability to actually earn enough to achieve it so let’s take a punt in stock markets ( or politicians who will give us money taken from others).

Just sayin’.

I’m cranky today, so be forwarned. To be blunt, but I thought the tone of this article was way over the top. Before the 4% rule, there was literally almost nothing to guide people on sizing their withdrawals to last. The 4% rule is a great piece of information, as long as you understand it’s limitations. To claim it doesn’t work is unsubstantiated hyperbole. To point out it’s flaws, however, is the beginning of wisdom.

If you want to rail against something, you can rail against every wet-behind-the-ear reporter who offers the 4% rule in an article without understanding what it is, why virtually nobody actually uses it exactly as described, and without noting both the pros and cons of applying this type of approach. That is the real crime being perpetuated upon retirees.

It’s interesting that the 4% rule seems to get used in a bunch of countries even though it was only done on US data. I wrote about how it would look for Australian investors and it is the same story there, the 4% rule works fine most of the time but there are definitely time periods where you’re not going to make it through a 30 year retirement let alone 50+ as you may be looking at with FIRE. https://aussiehifire.com/2018/11/21/sequencing-risk-the-trinity-study-and-the-4-rule-in-australia/

“Bengen’s original portfolio comprised:

50% US equities

50% US intermediate government bonds.”

I’m amazed at how often I see claims like this repeated. Bengen’s article is easily available on the web. It’s like they only read the first page of his article and then rushed to post about how he only tested a 50/50 allocation and ignored the next eight pages of his 1994 paper which began

“Note that my conclusions above were based on the assumption that the client continually rebalanced a portfolio of 50-percent common stocks and 50-percent intermediate-term Treasuries. What effect would other asset allocation schemes have on this conclusion?”

He then tested several other allocations

“Five possible asset allocations (0-, 25-, 50-, 75-, and 100- percent stocks) were matched against 8 percentages of first-year withdrawals (1, 2, 3, 4, 5, 6, 7, and 8 percent).”

In other words: no, the original 4% article by Bengen was not limited to a specific allocation and definitely not limited to a 50/50 allocation.

@TI > ‘live off the income generated, don’t touch your capital’ preference

Beware. I have lived this as far as day-to-day spending is concerning since leaving work. Initially I spent down savings and a SIPP I have to burn before drawing my DB pension, but now I spend annually roughly what my ISA now throws off as dividends, though I leave the ISA alone and spend the equivalent from the SIPP.

Using yield as a benchmark has two issues. One is it drives you towards yield, that’s probably OK for a retiree but not ideal for someone in the accumulation phase. I eventually threw in the towel with adding to the HYP though I still have it and switched towards VWRL, because: Lars, which drops my yield even more. Which leads to the second problem:

I believe it leads to significant underspending. When I left work six years ago I was shattered and just about crawled from the wreckage of my once professional career, I have never been tempted to enter the regular work bear-pit again. So I can’t say for those mythical souls who do this all as a controlled plan from their 20s. But after perhaps two years of recovery, I was still fearful of the world falling in, of the stock market going titsup, and generally the wolf knocking at the door.

I still have good health, and that is probably because I stopped working early, in that respect whatever I did with my finances was a win – health is something you can’t buy, and I pretty much always get at least 30 mins of exercise in my daily life, whereas my working self exercise was pretty much walking from the car park to the office, other than on weekends. There is a hill nearby that I failed to climb in my late 30s as a visitor because I ran out of puff, I do not find this a particular challenge now 20 years later and include part of it on a regular route. A lot of the win with retiring is getting control of your own time so you can waste it on things like walking, and watching the wheel of the year turn and the blackbirds starting to sing at the moment.

But I do wonder if I have lived less large over some of those six years because I wanted to retain the capital, it was your very saving enough to replace your salary article that led my fearful younger self that way. I will spend a lot more when I draw my DB pension because I will spend 80% of it as policy, the ISA will then be to defend the erosion of that pension to inflation, and to give me the future opportunity to buy some healthcare options I expect the creeping privatisation of the NHS to take away.

I am probably not old enough yet for it to have been a good idea to burn a lot of that ISA before drawing my main pension, but perhaps the natural yield limit is more one for the very early retiree. You sound chilled enough with work that you don’t need to retire early (though at your age I had no idea that the bell would toll for me, work-wise), in which case a natural yield limit may be too low for you IMO. You can’t take it with you. OTOH for the last ten years there has been a bull market, and indeed I designed the policy in the teeth of the GFC where the lower volatility of the income of a portfolio compared to its wildly fluctuating market value was a source of comfort that I could rely on it. Yield was cheap to buy then.

I still suspect with a yield-only philosophy you’ll end up the richest man in the graveyard, though 😉

@Ermine Your contributions always draw a wry smile from me as I seem to have plodded along many of the routes you have travelled, though I’ve managed to stay clear of the active investment and HYP merry-go-rounds. And gold.

I came significantly later to the self investment party than you too, I think, and benefitted from a more well-developed literature, like Lars Kroijer’s books as you mentioned, plus this blog and others. It is a huge transition from career into retirement that is difficult to grasp until you have made the jump, as your post highlights. And like you I experienced a quite unexpected change in my desire to pursue my career after I reached my mid 50s.

I’ve not thought this through very well, but my hunch is that early- and mid-life one can happily toddle along a career and retirement path that is relatively vague, as one always has the feeling that pretty much whatever happens, cock-ups can be fixed. And I suppose that is true, as most of your capital is actually not realised but is implied in the future value of your career. And with the outcome not being well-defined one has a tendency to uprate it – I imagine that’s one of Kahnemann’s cognitive biases. However, post-retirement, it dawns on you (well, me to be more precise) that that’s your lot. Apart from a few extra bob if Fancy Pants come in at 50/1 in the Grand National your financial resources for the rest of your life are nailed to the wall. That’s a pretty sombre thought, once you have experienced it.

Then as time ticks down one wonders whether decomposing time series of financial data will hold any enchantment when one’s arthritis is so bad and one’s cataracts so thick that it takes half an hour to type VRWL [sic] into a browser. Eventually I imagine one has to let go of the reins and either buy an annuity or stick it all into HY investment funds, as suggested by @Greybeard, and hope for the best. I sometime wonder if one of my children (now mid 30s) might be able to take over managing my portfolio when I can’t be bothered or am not albe to, but I’m not confident this is practical, or a fair thing to expect in any case. That’s still hopefully a fair way off, but you never know, and I suppose I’m just keeping my fingers crossed that I can keep everything ticking along OK until I enter the final few furlongs and be far enough ahead of the zombie horde that things will conclude OK.

It’s sort of a plan. I suppose.

@ IanH > And I suppose that is true, as most of your capital is actually not realised but is implied in the future value of your career.

This is the classic description of the slow exchange of human capital, which the starry-eyed fellow at the beginning of their career has in spades. That human capital is the future value of their work. They gradually exchange it through part of the human lifecycle for financial capital. Until the wellspring of human capital runs dry or fails in service, then as you say the financial capital is nailed to the wall, and the human capital is all out. I listen to some of the young folk on here, including our host, say they are happy to work as long as it takes and gets meaning from their work, and think, yes, that was me, once 😉 And it’s true, you read sometimes about people who carry on to their 80s and die in the traces. But unless there was something specifically and exceptionally bad about the place I worked, my feeling is that work gets tiresome for many people from their 50s on. Other things get more important to you as you get older, and work not so much. As Carl Jung said

For me a passion and meaning in Work fell into the morning of life.

I also don’t want to be wrangling and rebalancing a portfolio all the time in retirement, though I won’t have to for the basics as both my DB pension and my state pension if it hasn’t become means tested over the next 10 years are annuities. The HYP I will leave alone in the canonical HYP way, as far as rebalancing the passive part Vanguard and L&G and Ishares can fix this for me in ETFs, I have zero passion for passive investing, but it means I can get on with the rest of my life. I greatly appreciate Monevator, he held a light in the darkness of the financial crash that dimly showed a red thread leading through the maze to open air, and I am only a couple of years off when I would have retired from work normally. That I got from there to here with enough money was from the guidance given here. That I within spitting distance of the other side with significant capital left is due to sheer luck starting in the GFC perhaps combined with the significant underspending that a natural yield target sets.

Interesting journeys outlined here. In my case, the way things played out was that I made a conscious decision to walk away in my mid forties once I had enough despite enjoying the work and not being worn down by stress. Leaving a large paycheck voluntarily was the big issue.

The way I looked at it was based on control of time and having to cede control of my hours to others in return for a paycheck. It got to the point where the returns were rapidly diminishing each year.

I really enjoy analysing businesses and decided I had sufficient financial assets to spend my time developing these skills further and using them to generate enough to live on i.e become a full time active investor and that is what I do today. I think if you enjoy this sort of thing, these are skills which will increase and not diminish with age and that seemed to be the right shift to make before I hit 50.

Obviously you need a strong defence to play this game so risk management is paramount. On another note, as an active, concentrated investor I don’t think in terms of “natural yield” as there is nothing unnatural about the earnings that are retained by a company on my behalf and not paid out in dividends. These are accessible at any time by selling some shares at the time of my choosing, not dictated by others.

Obviously other considerations apply if the approach is passive and you are not looking at individual companies or tracking their earning and reinvestment choices.

@ermine — Thanks for your ever interesting contribution. 🙂 I mentioned up the thread I don’t want to derail @TA’s comments with my thoughts on living off capital, since they’re so at odds with his/mainstream. But just briefly, I wouldn’t suggest someone in a triage situation like you were in should have been considering this approach. The article you mention as influencing you is entitled “Try saving enough to replace your salary” not “try to live off whatever small income you happen to be getting from whatever assets you happened to have gathered”. 🙂 It’s an aspirational plan that needs to be adopted early not late in life. It’s not for standard retirement planning, and its benefits are not all about maximizing spending. Indeed there’s a strong chance it won’t. Also, to the comments from you and others about reaching for yield, most people pursuing this approach (which should NOT be most people) should certainly not suddenly become stock pickers. I am thinking more equity income investment trusts and similar.

For those who say “heresy, and anyway why do you think they will beat the market?!” I don’t, or at least not that’s not the point. I am pretty confident they will lag the global market (perhaps not the UK market) over the long-term. That is a price you pay for offloading the management of a 30+ year of rising dividends to a management team. You choose your trade-offs.

To be clear my current investing style is the usual buccaneering all over the place active idiosyncrasy you know and I try to keep off the site. 🙂 My vague long-term plan is to shift towards income generation when this gets boring. So it’s not an accumulation tactic for me. With that said, I think many of those who pursue an active approach might do better to focus on income than capital (though they’ll still likely lose to the market etc) provided they know all about the dangers of reaching for yield. (Most people will do worse reaching for quick capital gains, I believe).

Anyway I’ll write about this anon and we can have a bigger discussion then!

Cheers for all the great comments everyone.

16 years down the retirement route so experienced a lot and survived

My Portfolio has risen steadily in value all the time

The 4% rule was a good guide-just that a guide

It has been a long learning curve as it has been for all contributors here managing a Investment Portfolio for Retirement

With the added fact that if you get it wrong it’s cat food time!

My withdrawal rate is variable-around 3.5 -4%

Will it be this going forward?

I seem to spend exactly the same amount during retirement as I did working which was a wake up fact for me

Now middle 70s -3 Passive funds only-in ISAs and SIPPs

Sell chunks of stocks or bonds as required to keep a high interest BS Account filled with 2 years “salary”

xxd09

@all — Oops — Further edit, clarification. I mean the article entitled “Try saving enough TO replace your salary” of course.

And I now see that isn’t what the article is ‘officially’ called at all! 🙂 It’s been a while, and I was influenced by the giveaway URL slug and the way @ermine rightly paraphrased it. To be clear this is the article we’re talking about:

https://monevator.com/try-saving-enough-to-replace-your-salary/

@Fly By Night

Your calculation is very similar to mine (although I’ve used 100 for planning purposes!) and yes, I also plan to spend as much as possible.

As well as using the state pension as income floor, I will also have a DB pension, so everything else will just be a top up so I get my ‘annual income’.

However, as I’m hoping to stop working around 10 years before I can draw on either of these two, I need to make sure I don’t spend too much and there’s still enough in my pot for the top ups!

A fascinating discussion with, as usual, a whole bunch of thinking that went straight over my head.

However, I do think the concept of an SWR and the 4% rule have value. Through the excellent work of TA and like-minded folk, it is fairly simple to explain that a globally diversified portfolio of low-cost ETFs and funds with a focus on tax sheltering gains (legally) and minimising costs is the best bet for most people. With apologies to TI and other active folk, it seems to me that you do it because it is fun and you enjoy the challenge rather than you feel it is an intrinsically better route to growth.

So passive investing is a relatively simple story to get your head round. The non-expert and non-enthusiasts need an equivalent story to help them think about the answer to the question – “how much do I need to be safe in retirement?”.

We know there isn’t a definite answer, and yet we need to construct one. Starting with something like 4% SWR or the rule of 25x is a good way into deciding what your answer is. I confess that up to the point I heard about SWR and 4% it had not even occurred to me that there was a number and it was calculable. Not because I am unable to understand it, but because I hadn’t thought things through.

As soon as I did get to understand the SWR idea, I began to back off the 4% rule to fit my circumstances. Where did 4% come from? Do I believe it? No, I am more comfortable with 3% or less in a UK situation. The plan is to spend your last £ on your last day on earth? But I have an adult vulnerable child that I want to leave a chunk of money to. And so on. That puts me closer to the spend dividend yield position, but it is not fixed.

I spent a number of years working on longish range business strategy and learned that robustness to external shocks is often superior to optimised gain. I got used to imagining what might change and looking at these factors on a 2×2 matrix of probability and impact. You then focus most on the high probability high impact events. Low impact is less of a worry as – well they are low impact. High impact low probability events could be devastating but are less likely and in many cases, you can do nothing about them.

No portfolio strategy can survive confiscatory taxes by a future government, hyper-inflation, collapse of international trade due to climate change, pandemic disease, or being put up against the wall after the revolution for thinking that Brexit is a really stupid idea. So why worry about them? I know there are enthusiasts out there saying that the ‘fiat money’ system is about to collapse and gold is the only thing of real value, but I don’t rate the risk high enough to make it a core part of my investment and spending decisions.

I have a pretty good idea what my partner and I need to spend and do spend. Add on a bit as we age for jobs we can no longer do ourselves (a cousin got quite severe brain-damage falling off a ladder cleaning his gutters), take off a bit for reduced spending opportunities. Use the excellent ‘floor and upside’ idea. Keep a reasonable cash fund for the unexpected or the unplannable expenses (replacement car, new heating system etc). Invest passively. That’s it. The SWR fits into this list of factors that lets me judge whether I think we are OK or not.

I am sure the McLung approach is more sophisticated, but Black Swans will throw it off just as they will throw off an SWR calculation. From what I have seen of it and some of the underlying modelling work done by various experts, it is just too complicated for someone like me. If Vanguard created a fund that implemented the strategy I might be interested.

SWR as a rule of thumb is fine. The danger, as with any rule of thumb, is to carry on using it after it ceases to apply.

The reason the 4% rule “doesn’t work” is that investment returns over the next 30 odd years can’t be predicted according to a rule, neither can your personal health and lifespan. That doesn’t mean it is useless though, it is a fantastic starting point for planning whether and when you are on course to retire in sufficient comfort.

In practice everyone will need to adapt it for their own particular circumstances (and risk tolerance). In the UK we have the benefit of knowing there will be a floor income from state pension at age 67 and some, such as my wife whose early retirement in a week’s time has given us particular interest in this topic, will have further floor income from historic defined benefit pensions at various future dates: the calculations about how much funds are needed get modified around that.

Personally, as someone who would not want the risk of totally running out of money during vulnerable old age, if we did not have the benefit (me too) of DB pensions and planned retirement purely on the basis of investments I would look hard at whether I should use part of the assets to buy an annuity (despite unattractive rates). That would add to the state pension to create a “just about adequate” floor income guaranteed into our eighties and nineties, which any SWR drawdown would sit on top of and be amenable to discretionary adjustment. But that’s me and everyone will need their own strategy.

I’m setting out my own situation, 15 years into retirement, believing that there will be others in the Monevator family whose position is more or less akin to mine, or will be in due course, and who will be interested to see it.

All £K/annum

Occupational pension 10 net (paid monthly)

State pension 8 (paid 4 weekly)

Dividends 4 (from fully ISA’d and diversified set of income generating “premier league” ITs currently yielding 5% in total and individually paid with metronomic regularity every 3 months but conveniently different months, and whose total capital value has never been underwater despite the Brexit travails and is currently standing at +6%. I don’t intend ever to raid this capital).

In addition, I have a for genuine emergency only cash float of 15, raised via equity release, and will use the same method for car replacement at 100,000 miles in c.2023.

I take no medication and I sleep well 🙂

Has anybody done a ‘SWR for BTL property’ (ie what rental return you can expect over extended periods of time) I wonder?

A lot of people have decided that BTL property is their pension, and I get the feeling they would assume their capital is safe, and laugh at a 4% ‘withdrawal’ rate.

It seems to odd to “aim to replace your salary”, as that’s 1) highly taxed, 2) has extra costs for commuting etc 3) needs to support your saving costs. (1) and (2) are often mentioned, but (3) rarely is, as you switch from climbing that steep savings hill to coasting the other side.

There is strong psychology in viewing savings income as a badly paid job, when in fact anyone doing a spending breakdown might find they need a lot less, and suddenly switching from 4% SWR to 3% for peace of mind is much less painful.

@John B — It’s a totally different mindset. It’s not about doing SWR-type stuff at all. You might well want to carry on saving! It’s about achieving the most flexibility and freedom that you can, and making that an aim from an early age. (So it is very likely to be about earning more rather than skipping lattes, etc.) The downside is it’s very difficult. (Realistically, “your salary” is probably going to be (going to have to be) a salary of a few years ago by the time you hit “the number” if you’re on any sort of career / income progression, and if you want to do this under 70! 😉 )

Anyway, as I keep saying we can discuss it more when I do a specific new article on it. I think this thread is best left for conventional SWR discussion.

@Kraggash, I would suggest BTL is a good diversifier from stocks and shares, but if you can only invest in one, then max out on tax free investments such as S&S ISA first.

With BTL you are limited to withdrawing the profit after tax, and with repairs and void periods the income can vary from year to year. By contrast a SWR on a S&S portfolio aims to give a more stable income.

Where BTL does score, is providing an income regardless of whether the underlying asset value falls (i.e house prices decline), or when stock markets crash in which case not having everything in S&S is reassuring.

In terms of estimating the income after tax from BTL, that could be as little as 2% after expenses, voids, and tax, in some areas of London, but it would be more in other parts of the country.

Quality thread! Sorry I’ve missed it. It’s been quite the week. I agree with all who’ve said the 4% rule is a good tool for:

1. Realising there even *is* a number.

2. Getting you started.

The rule has the power to completely shift your mindset and then your path in life. The important next stage is discovering that the 4% rule number definitely won’t be your number, and hey, there might not be a ‘number’ afterall, as the deaccumulators who are actually living it seem to agree.

I agree I’d rather run a floor and upside strategy and that’s the reality for most of us thanks to the State Pension. At some point I’ll look seriously into annuitising to nail down more of the floor. Do any of the greybeards out there have insight into optimal age to get a good deal?

@ John in Co – You and I agree. You’ve summarised the point of the article in a nutshell: to use the ‘4% rule’ you must understand it’s limitations. Where you and I disagree is what the term ‘4% rule’ has come to mean. I think you’re saying the ‘4% rule’ is the original research with all its caveats. I’m saying the ‘4% rule’ is the unnuanced sugar pill spread by “wet-beind-the-ear-reporters” and quick-win bloggers. William Bengen’s paper didn’t use the term ‘4% rule’. I have complete respect for Bengen’s research, but in my view the term ‘4% rule’ is shorthand for the naive, popularised version.

@ TI – I respect the muddy, hand-waving approach the more I look into this, but I need something more systematic because I intend to live closer to the wire i.e. My plan relies on spending down the capital because I’m not prepared to grind out more years in accumulation until I can comfortably live off the income. I can see from your comments that you’ve already acknowledged this p-o-v; just can’t seem to stop my fingers from typing this anyway 🙂

@ Justus – Nicely taken out of context. Your quote is from my point that Bengen used US historical returns which are rather better than most other countries. His starting point was a 50:50 portfolio. To warn readers that they need to look at other research showing the international situation, it really wasn’t necessary to burn everyone’s time with another 300 words explaining that Bengen also used *US historical returns* to explore every other possibility under the sun. I’ve linked to his research so anyone can see his parameters for themselves.

In my second point about specific asset allocation, I simply try to warn readers that different asset allocations change the game. Bengen recommended 50-75% equities, but debate rages to this day on that score and it can never be definitively settled given it relies on trade-offs and uncertain futures. The salient point for me in this regard, is that virtually all of the research I’ve read shows that being too heavy in bonds knackers your SWR in most scenarios.

@ Mr Optimistic – you seem to be in a great position. Happy retirement.

@ Factor – thank you for laying out. Again, that’s a position I’d be happy to be in.

@ Mathmo – *cof cof* that’s TA not TI.

+1 for various comments from Brod, Whettam, Vanguardfan.

@ Lemsip – Your comment about US and UK investors having access to same investment choices – I could interpret that as saying UK investors can therefore happily adopt popular US SWRs (I don’t think you meant this, I just want to clear up any potential for misunderstanding.) Wade Pfau’s international research is intended to show that not even US investors should rely on historical US SWRs.

@ Chris – yes, there is lots of research on life cycle spending. The general trend for the average bod seems to show a decline in spending as people reach old old age. However, are you the average bod? Some research shows that retirees with plenty of resources maintain high levels of spending throughout their lives. There’s a strong implication that retirees with limited resources spend less as they age simply because they have less to spend.

Urk, sorry TA

@TA. Re annuities. Obviously depends on the state of the annuity market, your health, spouse etc but the general advice I got was start to look at annuities again at about age 75. There will be a scientific way if doing it but life is too short.

Suspect life expectancy predictions are going to be shown to be too optimistic which hopefully will mean that life offices will be a bit more generous ( and transfer values for dB schemes will come down).

I’m still targeting an average 4% yield through a natural income portfolio of investment trusts and ETFs across global and UK equity income, commercial property and infrastructure (inc solar & wind energy) and bonds of various types.

While still in the accumulation phase for at least another 6 or 7 years, I’m effectively doing a dry run of the strategy and will be checking how the total yield compares each year to see if it will be consistent enough and rise with inflation. And to see what you actually get compared to the predicted yield.

Aware of the dangers of chasing yield, but its a pretty diversified portfolio across nearly 20 ETFs and ITs. All of them are distributing, so I can roll up the cash to make new purchases maybe a couple of times a year to keep trading costs down.

I can’t see a better way to get around sequence of return risks/selling in a bear market when I actually start taking the cash as income. Its like an automatic SWR.

You can always shift strategy to sell units in later retirement if it looks like you’re going to end up dying too rich.

Effectively it’s a lower SWR strategy. If your dividends are cut and you need the money then you can spend down some capital. All things being equal a lower SWR means less chance of running out of money, more chance of leaving a generous legacy to the cat’s home. Beyond that there’s just the chance of a high dividend strategy returning less than total market because of higher fees and less diversification.

@ NickC – thank you for the link to the calculator. Very handy. It says I won’t go broke even if I live to a 100. As long as I enjoy those historic US investment returns 😉

Also instructive to see how more likely I am to be dead than any other outcome.

Whenever I look at the long term performance of a fund, those offering higher dividends than an ETF of that sector provide much less total return. Almost as though companies make better use of retained profits for investment, rather than paying them out as divis.

TL:DR I think you reduce total return by chasing higher dividends.

Whatever swr you use, retirement and early retirement is a leap of faith into the unknown.

Our situation is that offcial retirement in our 60s looks more certain but the next 25 less so.

Ways round that? Answers on a postcard.

As mentioned above (#21) I’m guided more by natural yield than a 4% plus inflation safe withdrawal rate but having now reviewed the numbers my spending over the last five years has stayed below both guidelines. Capital growth has however been modest after the market falls last year. I aim to remain flexible on both spending and investing according to future circumstances and will continue to use natural yield as a guideline.

Maybe 4% swr wont work for US market in the future as the US has been ‘leading the way’ up to this point in time. Maybe its time for the rest of the world to start ‘leading the way’ with better returns, Maybe EM will emerge and provide fantastic returns going forward. If this is so, going forward, the 4% swr will be adequate.

Jim Collins over in the US does suggest US investers may need to diversify their portfolios globally in the future.

Hi Dawn, the market doesn’t pay you because you need it. Hopefully you have a Plan B.

More generally, good piece here on dividend / natural yield strategies: http://www.theretirementcafe.com/2019/04/a-good-many-retirees-seem-to-be.html

Good link. I’ve always believed the ‘spend only dividends’ strategy to be mainly about psychology. Problem is, what’s the chances of the SWR being the same as the dividend yield? And if you design your portfolio yield to fit your predetermined withdrawal rate, this is surely going to drive you towards an active strategy that is certainly going to involve more risk than a Lars type buy the world portfolio. Letting the withdrawal tail wag the asset allocation dog if you will!

@Vanguardfan — very much my view. I’m not sure I want my investment / withdrawal decisions driven by the CFO’s distribution preference or the prevailing tax regime.

I imagine a genuine SWR should be (must be?) very close to the rate you would get by buying an annuity. Both are pretty much risk free, and you generally have to increase risk to increase returns. Stocks are inherently risky, and if you try to eliminate risk by calculating a SWR, then you will be reducing the returns (in this case the money you take out of the fund).

SWR has a greater than zero expected wealth at the end, and annuity does not. While residual values tend to have fairly low effects on valuations that far out, some non-trivial probability residuals are really very large.

You might also wonder if the insurer needs to make a profit / charge a fee on top of the underlying economic risk and compare whether that is replicated in the SWR portfolio (wrapper charges? tax? sub-scale admin?).

I don’t agree with Retirement Café’s negative view on a spend the dividends only approach. Looking at five years of actual drawdown history from a predominantly UK equity portfolio, income returns have been reassuringly stable with an average yield of 4.05%, a standard deviation of 0.33%, and an actual range from 3.58% to 4.42%. Capital returns have an average of 0.97%, a standard deviation of 9.33%, and an actual range from -10.69% to +11.43%. Total returns have an average of 5.03%, a standard deviation of 9.43%, and an actual range from -6.45% to +15.60%. Relying on the dividends enables me to be more relaxed about the capital fluctuations. Not selling the shares enables me to benefit from future capital growth and from dividend increases. Spending about 12% less than the natural yield allows me to reinvest a little. My current natural yield is now above what the SWR would be and above the best flat rate annuities for my age.

@Mathmo – the ‘expected wealth’ at the end is irrelevent. Your dead. You could not spend it when you are alive, as you still need the SWR cash. Anyhow, an endowment has money left in it at the end as well – for the insurance company. So in both cases, it is not YOU who benefits from it.

In both cases, we are talking about SWR after costs (fund/platform versus insurer charges),

It’s a very short-term view to say that I don’t benefit merely because of my inevitable mortality event.

I do plenty of things which I will never see come to fruition, but derive satisfaction from the knowledge of doing the right thing.

Despite this, there’ s a greater fallacy at the base of assuming there’s the same economic activity going on behind the swr and the annuity. The statistical nature of one vs the single probability of the other and the economic rent of the insurer, together with the underlying investment constraints mean they are cousins, not siblings.

Indeed, Mathmo, but you are constraining the statistical nature of the one by imposing the S part of SWR. I.e. Safe = must not run out under any circumstances, or length of withdrawal period would bring the SWR down close to the deterministic return of the latter. Indeed, if not, why would annuity providers not seek to obtain the higher returns of the ‘statistical method’ if both approaches were equally safe?