Good reads from around the Web.

Now that he’s just three years from financial freedom, blogger R.I.T. is rethinking how much he can withdraw from his retirement portfolio.

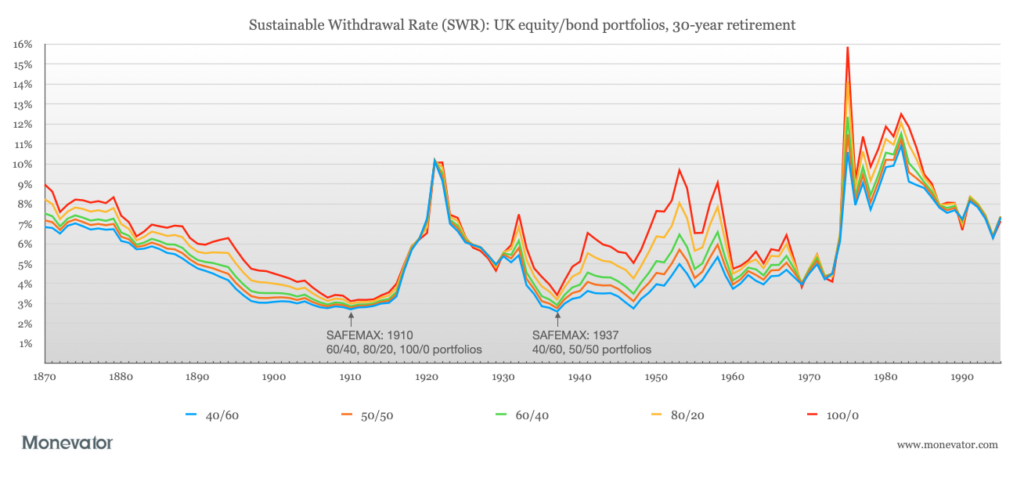

This week he decided that for a UK investor, 3% looks much safer than the oft-quoted 4%:

Staying with only UK stocks and bonds in your portfolio and following the 4% Rule over a 30 year period would have resulted in you running out of assets 23.8% of the time.

To be 100% “safe” you have to drop to a safe withdrawal rate of 3.05%.

Switch to global stocks and bonds and the news isn’t much better. 100% “safety” and your safe withdrawal rate is still only 3.26%.

The comments following the article are also worth reading. There are some real-life stories from the frontline of early retirement, and more than one millionaire who doesn’t think a million is enough.

I tend to think a million is the bare minimum for me today, the way I intend to do it – which is to replace my drawn earnings from work with investment income and not to touch my capital. (The pot can mainly go to charity when I’m gone, to make me feel less terrible about a life obsessed with finance!)

But if you intend to run down your capital, then your numbers will be very different. A million may well be overkill, depending on your retirement age.

Let’s have a few opinions: What’s your number for a safe withdrawal rate, and what size pot do you need to get it?

And at what age does that enable you to retire?

From the blogs

Making good use of the things that we find…

Passive investing

- Inner peace through index investing – Canadian Couch Potato

- Why do ETF yields differ? [Canadian, but interesting] – CCP

- How robo-advisers could re-invent indexing [For geeks] – Kitces

Active investing

- Becoming an ISA millionaire, John Lee style – Stockopedia

- Running a dividend income retirement portfolio – UK Value Investor

- Notes from the London Value Investor Conference – Market Folly

- Adam Sandler and complacency risk – A Wealth of Common Sense

- More thoughts [via a comment] on the PEG ratio – iii blog

Other articles

- The gift of not worrying about money – Mr Money Mustache

- Keys to writing about investing – Clear Eyes Investing

- Why compound interest won’t help you retire early – SLIS

- Buy-to-let investing – the low-risk way – Under The Money Tree

- Life lessons with a golfing psychologist – FIREStarter

Product of the week: The Telegraph reports on a new investment trust, P2P Global, that invests in a portfolio of peer-to-peer loans from the likes of Zopa and Ratesetter. It’s targeting a 6-8% yield. Interesting, but this is an unproven model so tread carefully.

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site.1

Passive investing

- It’s time to check your risk tolerance – Roth/CBS

- Inside Larry Swedroe’s portfolio – Swedroe/ETF.com

Active investing

- Change your environment to invest better… – WSJ

- …or perhaps start meditating – Bloomberg

- Knowing a business versus its valuation – The Value Perspective

- The real reason hedge funds have underperformed – Fortune

Other stuff worth reading

- So, you think you’re rational? – Housel/Motley Fool

- What happens to your pension when you retire abroad – Guardian

- London house price rise at fastest rate ever; £588 a day – Telegraph

- The towns that offer the best buy-to-let returns – Telegraph

- And there’s crowd-funded BTL [Beware: Unproven!] – ThisIsMoney

- Millionaires: How to invest in an English vineyard – ThisIsMoney

Book of the week: A smart entrepreneurial friend of mine insists that Ricardo Semler’s The Seven-Day Weekend is the best book ever written on business. I’ve finally ordered my copy.

Like these links? Subscribe to get them every week!

- Reader Ken notes that: “FT articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.” [↩]

Comments on this entry are closed.

Thanks for including my article about mortgages and getting out of debt in your excellent reading list. Its great to be in that company!

Not sure I agree with the 3% SWR – I have done my own calculations based on 4% – but I will be re-reading the RIT article carefully as its important to read stuff that challenges our assumptions every now and again.

Interesting comments on the RIT blog. My medium goal term is to generate £2k in passive income per month via HYP, Dividend growth stocks, equity ETFs, bond ETFs. This year I reckon I should finish with £15k -£17k pa. I have a house paid off and significant cash sitting on the sidelines waiting for cheaper assets. Also have a significant SIPP. I guess I could call it a day right now but my work is stimulating and relatively enjoyable. My view has changed over the last few years and I’ve come to the conclusion I need to carry on doing some form of work just for my mental health. The point about FI is that it gives you choice and helps you sleep at night knowing if you get an idiot of a boss or the company downsizes or you become too ill to work you will always have a safety net. Utopia is to be FI and love doing your job.

You need to concentrate on the fact that £1m or $1m isn’t what it used to be even 5 years ago for 3 reasons

– high inflation in prices (esp housing)

– rock bottom asset yields

– rising longevity

If you are in your 40s and you want to retire you are looking at a 50 year retirement horizon being entirely feasible

As a minimum you need the flat or house wholly owned plus £2m with a rock solid safe 2% withdrawal rate

That will buy you £20k a year each (I’m assuming a couple here) gross with most it hitting your bottom line to spend. Net you’d have about £350 a week to include holidays, car running costs, local taxes, home repairs etc which seems enough

The reason for the 2% withdrawal rate is you will be encountering all sorts of ebbs and flows in 50 years

Not to mention in one of these very fashionable “global cities” £1m doesn’t actually buy you very much

So all told I reckon £3m/$5m as a maximum for the gold plated early retirement ticket

If you are willing to work part-time during your retirement, give up your car/holidays/eating out or just live in a cheap place obviously you can take chunks out of that

IMHO there is one key but obvious point here.

There is so much uncertainty around retirement planning that it doesn’t make sense to plan a single strategy to last for (perhaps) 30 years. Flexibility is vital.

A second thought that gets lost in all the ‘can’t wait to give up my job’ talk is that being completely idle (as well as being very expensive) may not be good for you psychologically. Unless you have a very absorbing hobby or intellectual interest idleness very commonly leads to boredom and social isolation.

The third thought is that quite a few people never live long enough to enjoy their retirement. For every above-average-longevity-good health 85 year-old there will be someone who didn’t make it and another person in such a poor state of health they possibly wish they hadn’t. (Sorry to be depressing).

On the narrow question of the SWR, having read Wade Pfau and others I think 4 % is far too optimistic. So my ideal strategy is based on maximum flexibility.

– Start off slowly at 2.5 – 3% withdrawal AFTER expenses.

– If possible keep a part-time side income – every £5,000 a year earned is worth £200 K of capital (assuming SWR 2.5%)

– if you are lucky with good returns in the early years then increase withdrawal a bit

– depending on personal circumstances and prevailing rates it may even be worth annuitising some of the capital. By guaranteeing a minimum income you are basically insuring yourself against living too long. This will allow you to have a higher withdrawal rate in the early years of retirement when you are more able to enjoy it.

If you don’t have a FS/DB pension to cover “heating and eating”, then I don’t regard £1m as being enough to retire on either. I agree with Neverland (it had to happen eventually!) and closer to £2m in pensions is far safer, and perhaps slightly less if a fair chunk of that is in ISAs to keep tax under control.

I think the amount of money that you need to retire really depends on the individual.

Someone who lives in London, who wants to continue living there, have a nice car, eating out, having a few holidays abroad a year will need a substantial amount of cash to keep up their desired lifestyle.

Someone living up north who owns their home, likes low cost entertainment and is happy travelling cheaply, then a much smaller stash of cash is needed.

Let’s be clear that we are talking about retiring voluntarily in some comfort. The vast majority of people will retire with far less than £1m assets and most of them will manage without dining on tins of dog food.

I agree with MrsFF about location being key. You probably need a few £100k, anything up to an extra £1m, just to cover the higher price of a house in London and much of the home counties. (Even if you have paid off your mortgage, there’s still an opportunity cost, because the capital tied up in your house could still be earning extra investment income if you moved somewhere cheaper.)

Also, we should not forget the state pension. £7696 pa, index linked. Double for a couple. OK, you don’t get it until you are 66, or maybe even later by the time us young uns get there, but it does mean you perhaps can feel fairly safe using 4% SWR, knowing that if you find that returns have been unusually poor and you start seriously eroding your capital you can, in your late 60s, cut back your withdrawals by £7k because you can instead spend your state pension.

Furthermore, the question, as asked, seems to be relevant if you want an SWR you could safely set at retirement and never need to consider if it needs to be adjusted. If that’s what you want, then fine, but for me this is excessively cautious. As long as you monitor how it is panning out you could spot at an early stage that your capital is starting to erode and a small amount of corrective action (like a tiny tweak on the tiller of a supertanker) should slowly put you back on course. You could cut back slightly on expenditure a bit. Or do a bit of work. That need not mean going back to 9-5 serfdom, because you just need to replace a small cut in your withdrawals. If you have valuable know how or experience, do some consultancy; become a paid gardener a day a week; do some paid dog walking; do some e-bay trading.

Well, we live in our own house in a gritty Northern city, but I still wouldn’t feel comfortable knocking work on the head at age 55 without something well north of £1.5m between SIPPs and ISAs.

Yes, we do enjoy quality food, drink, cars (2nd hand!), etc. and when flying we do like to be near the pointy end in a seat that goes flat, but we’re prepared to work/save hard now to give ourselves a chance of still being able to do this in our dotage.

Worst case, we end up with an excess of retirement assets, but that’s a quality “problem” to have!

The “lowest ongoing fees of any trackers available in the UK” – Fidelity has cut the ongoing charges on its seven tracker funds: https://www.fidelity.co.uk/investor/tracker-funds/our-range.page

@ivan

Usually I agree with your posts but you are ignoring the fact that black swan type events are a fairly regular feature of our highly leveraged financial system

I think you are being optimistic about the sustainability of the current welfare state with a rapidly ageing population also

@gadgetmind

If that’s the lifestyle you want to maintain, then I’d agree with your figure. If its achievable then why not? But if the only way to achieve it is to keep working when one is desperate to stop, one could easily manage with far less. It’s all about trade offs.

@Neverland

I agree with you about the state pension to a degree. I’d rather not depend on it still being there in 15 years, at least for the basics of living. But I think there’s a pretty good chance it will be there and it is crazy to just ignore it.

The trouble is, where do you draw the line with black swan proofing? What about possible wealth taxes or other punitive taxation? You could end up working for ever, just in case.

It depends a lot on what weight you give to the value of being able to retire 5 or ten years earlier than you otherwise would.

Those I worry about are the people with lifestyles way beyond my own yet who have no retirement plans that can replace even half of what they “need”.

I’ve been putting 50% of of my salary (via sacrifice) into a pension for many years, and banging additional money into S&S ISAs, because I want the option to retire early without having to drive a banger and only be able to go on holiday with Ryanair once a year.

Of course, if the wheels fall off my plans, I’ll graciously cut back because I’m entirely capable of cooking for myself, performing basic (and not so basic!) DIY and car fettling, and can even get a good night’s sleep in an economy seat.

I guess I agree with ivanopinion in that most people will retire with way less than £1m.

I thought a reasonable guess for a 100% equity retirement pot (which I realise is probably not going to be that common) was £500k. With a 4% yield it pays out £20,000, and both income and capital can reasonably be expected to beat inflation over the long run. £20k income seems reasonable if the house is paid off, there are no commuting/costume costs of working and you don’t live some crazy magazine lifestyle.

My parents probably live on about half that (plus state pension) and they’re as happy as larry.

> A second thought that gets lost in all the ‘can’t wait to give up my job’ talk is that being completely idle (as well as being very expensive) may not be good for you psychologically.

Compared to the daft mind games and metrics and target lab-rattery work became I’ll stick my X in the box next to idleness anytime 😉 There’s a precious sweetness to not being a rat on a wheel anymore. But each to their own.

In practice it’s not possible to entirely escape occasionally attracting money if there’s something I can do that nobody else has the skills to do. But it’s to be avoided where possible IMO. I’m firmly of the clean break school of thought.

I’m with ivanopinion – no financial plan survives contact with the enemy intact, and it largely depends on what state of mind you’re when when you conceived it. I have spent generally a lot less than I expected, but notably more on red wine – I went up the quality scale rather than quantity. To expect to set a single SWR and forget is odd. Retirees can vary their spending ‘twixt wants and needs just as wage-slaves can, indeed since they have control of their time they have greater flexibility to shift the time/money balance. F’rinstance I don’t have any desire to paint the front of my house, that bores me. But I could do it were I short of the wedge.

I sold my business in 2005 at 43 and, effectively retired with the £600k the business fetched, £200k from years of saving and a pair of pension funds worth a similar amount, plus a mortgage-free house of similar value; all this between two of us. Excluding the house, then, just over a million between us.

Even allowing for the horrors of 2008, and moving to a house double the value of the old one (and far too many cars…), we are very close to our highest ever total net worth – about £40k adrift right now.

We use the same simple technique we used right at the start when we had nothing at all: we spend less than we earn. Except for the house purchase, we have managed to live by that mantra. It is very effective. In years when the income is down, we economise.

@ ermine. I guess on the ‘clean break vs wind down gradually’ decision there is a large element of personal preference. At the moment it wouldn’t appeal to me to not have some kind of routine but I guess that could easily change nearer the time… I agree that no financial plan survives contact with the enemy and the need to be flexible

To be fair to RIT and Prof Pfau (and The Investor), I doubt they actually think anyone just sets a SWR and sticks to it come hell or high water. Its just that you have to pose a simplified question, otherwise the answer is full or ifs and buts and is not much use.

Whether it is fair to conclude that most of us should only be using a SWR of 3% (indexed) I’m not sure, but Pfau’s figures do illustrate that a lot of caution is needed. If you are counting on 4% SWR to give you just enough to live on, without any wiggle room such as cutting back on the £50 bottles of red wine, you are taking a significant risk.

Having followed to the Pfau paper (http://r-center.grips.ac.jp/gallery/docs/10-12_revised.pdf), i was interested to see (page 13) that the worst years to retire in the US were the late 1960s. People unlucky enough to have retired in these years (with only a lump of capital to invest to generate income) are the most likely to have run out of capital (or, more likely, to have been forced to start spending less). I would guess this is because of the rampant inflation of the 1970s. The lesson seems to be that inflation is the biggest threat. It would be interesting to see whether there’s a portfolio that would have been more resilient. (20% gold or commodities?)

Also interesting to see that switching heavily to bonds in retirement is a dreadful idea, based on the figures from an earlier study, using mixes of US bonds and US equities. See http://www.bogleheads.org/wiki/File:TrinityTable3.jpg. With equity of at least 50% and a SWR of 4%, you had at least a 95% chance of sustaining that SWR for 30 years. With equity of 25%, your chances fell to 71% and with 100% bonds your chances fell to 20%.

Many thanks to TI for the hat tip today. Some great thoughts and comments already which is what my original post was all about spurring on. Why the thanks. Simply, if I can present content which makes readers think again. Then after thinking spurs on some debate because of that new data about things that just roll off the tongue of so many (a Google search for 4% Rule reveals 85,400,000 results), even if they decide to stay on their current course, means I’ve succeeded in my aims. It’s all about getting as much data as possible so that you can DYOR.

…and important data it is. Live in the UK and follow the 4% Rule blindly, which many websites quote without all the caveats and if history repeats then a lot of people are going to be in trouble.

From my perspective Ivanopinion’s statement “To be fair to RIT and Prof Pfau (and The Investor), I doubt they actually think anyone just sets a SWR and sticks to it come hell or high water. Its just that you have to pose a simplified question, otherwise the answer is full or ifs and buts and is not much use.” is spot on. Just as I follow the PDCA (plan, do, check, act) process during my wealth accumulation phase I’ll also be doing the same continually during my financial independence, early retirement and retirement phases of life.

To answer TI’s questions. I’m going to start with a SWR of 2.87%. It’s an odd number but 0.37% is my current portfolio expenses leaving 2.5% for me. Out of that I have to then pay tax and get what’s left. I’m still not sure of my retirement age but at my current save hard and invest wisely rate with that SWR I’ll be financially independent at 45.

Id like an annual income of 15k so would need a pot worth 350k. next year will have 122k invested plus 55k cash hope this to rise to 200k in 10 years plus save and invest 12k per year on top. its the best I can do !!! love my job- self employed so im not trying to ‘escape’ from work early. no debts and already paid off my mortgage so feel ‘free’ already at 49.

hopefully state pension will be there for me at 68 , so maybe draw 4% till 68 and drop to 3% after. but we have to remember’ we make plans and God laughs’.

Pot of around £666,000 @ 3% withdrawal rate for an income of around £20,000 p.a. for two, not in London.

Circa another £100,000 emergency spondoolicks fund.

State Pension turns up 10 years later and suddenly I don’t know what to do with it all 😉

I’m 99.9999% certain the State Pension will still be there for as long as I need it. Nobody wants rioting pensioners in the streets.

Probably do a little part-time work up to 65 just to keep my hand in, ease myself off the work ‘drug’ and provide extra flexibility.

There seems to be lot of anchoring on millionaire status. If I needed that kind of money it would take forever and I haven’t got that long. There’s no need for it and I’m not going to let fear of the unknown get the better of living a life of freedom.

Ivan makes a lot of great points. First and foremost of which is that safe withdrawal rates are convenient academic short-hand. Few people blindly drive off the financial cliff spending X% per year without ever checking the road ahead.

Adjustment to circumstance is key including spending more if you’re doing well. There are other techniques other than SWR out there – dynamic withdrawal techniques that adjust spending up or down according to portfolio performance.

There’s evidence to suggest that annuitising some assets around age 70 – 75 can be more efficient than just relying on a portfolio too.

Much wisdom in these comments. People vary, their attitudes to work and experiences vary.

So far as financial planning is concerned, it would be very foolish to disengage one’s brain on retirement and stick with a rigid plan since so many things will change, health, relationships, tax and benefit regimes, inflation, interest rates etc

Regarding State Pensions, I don’t think they will disappear but I’d expect well-off pensioners to be treated less generously than today in order to head off intergenerational strife. I expect what I regard to be anomalies to be slowly removed: removal of enhanced personal allowances has already begun. If the proverbial hits the fan big time in the UK, I’d expect a Government of National Unity to implement measures which a single party could not do because of the electoral implications. Some obvious examples:

a) Merger of NI and income tax

b) Retrenchment of universal benefits such as winter fuel allowances, free TV licences, bus passes, free prescriptions etc

c) Removal of triple lock on pension increases

d) Limitations on new contributions to ISAs. (cf index-linked NSI certificates)

@The Accumulator,

Your point about purchasing annuities at age 70-75 is an interesting one which I’ve not seen before. Could make sense since annuity rates climb with age and ability to manage one’s portfolio is likely to diminish. Less attractive for those wishing to leave a wedge to their children though!

> it would be very foolish to disengage one’s brain on retirement and stick with a rigid plan since so many things will change

A feature of firecalc (server down as of 2014-06-01) that not many explore is the ability to tweak your withdrawal rate as your portfolio is tossed hither and thither by the winds of the business cycle.

So, come the next crash, you eat out less often, switch from Waitrose to Sainbury’s, fly economy, and keep the car a few years longer. As everything picks up again, you start living the slightly higher life again.

Another thought spurred by this discussion is that it makes annuities seem better value than is often supposed. An index linked annuity for a 65 year old male yields more than 3%, I think. If you want a guaranteed index linked income for the rest of your life then an index linked annuity might be a good alternative to restricting yourself to an SWR of 3% or even 2.5%, though I haven’t thought it through, so perhaps I’m not comparing like with like.

@RIT

I assume your figures for a portfolio of global bonds and equities include a large chunk of domestic securities corresponding to the country of the investor? Otherwise, I would have thought that if the portfolio was the same the SWRs for investors in different countries would be the same.

Or is the portfolio exactly the same but the different outcome is due to movements in the strength of their local currency compared with the currency of the securities in the portfolio? However, I’m not sure that makes sense. A German investor comes out worst in your figures, with 40% of retirement years failing to sustain 4% SWR. Germany had hyperinflation in the interwar years, so its exchange rate crashed, but I would have thought a global portfolio would have insulated against hyperinflation, because US$100 of income from US bonds/equities would have been worth millions of Deutschmarks. Perhaps the problem came from the strength of the DM in the 80s?

Annuitising after the cross-point of returns on annuities relative to SWR is a good move and one I’ve seen advocated on MSE quite often. At the moment it tends to happen between 60 and 70 unless there are health issues (which favour annuitising). For many people it is blocked because it consumes their capital and they want to pass it on to their children.

I’m planning on nearer to 5% withdrawal rate.

1 Over the last 2 decades, my investment approach has outperformed the market. Having worked hard to save all this money, I’m going to continue refining investment techniques to continue achieving some level of out performance.

2 Perhaps 4 or even 3% is a safer withdrawal rate. However, the plan is to include quite a lot of travel during retirement and enjoy myself. If 5% starts to deplete the fund too quickly, I can always scale back to nearer 3% if the need arises.

The trouble with all this “oh I’ll just spend less” is that by the time you realise you have a problem it’s 10 years down the line – in your late 50s or 60s

Then your earning capability will be permanently diminished by then (Tesco don’t pay much)

Pays to be cautious

Re annuities.

We have to remember there are both pension annuities and purchased life annuities but I’ve not seen much mention of the latter recently. The tax treatment of the latter is different to the former since a healthy chunk of the income received is treated as returned capital and not considered income for tax purposes. Could look attractive for tax purposes if NI and basic rate tax get merged and or one is lucky enough to be a 40% tax payer in retirement.

Re: annuities

Annuities are sold by insurance companies and insurance companies have their foibles:

– there fondness for weasily small print

– the tendency to go bust

Ten years down the track how much did those Equitable Life policy holders get back? I seem to remember it was about 33% including interest

I won’t be putting all my eggs in the annuity basket for sur

@Neverland – all true and I wouldn’t put ALL my eggs in that basket either. Nevertheless I can see that depending on circumstances, tolerance for risk etc it may often make sense to annuitise a proportion of savings. The insurance of having a guaranteed minimum level of income an not having to worry about completely outliving your savings seems quite rational to me. Ermine’s suggestion of waiting until annuity yields approach the SWR makes a lot of sense to me.

I had forgotten about Equitable life and probably stupidly I hadn’t previously realised that the annuity holders got wiped out as well. Awful for them.

@Neverland, I believe currently the Financial Services Compensation Scheme protects a certain % of your annuity following the Equitable Life and other pension fund car crashes.

“The trouble with all this “oh I’ll just spend less” is that by the time you realise you have a problem it’s 10 years down the line – in your late 50s or 60s”

I agree. I said earlier that the answer is to monitor how things are going, so you spot at an early stage that the wind is blowing your supertanker off course and it only takes a small correction to move slowly back on course. However, I realise I was being a bit simplistic. Markets (and winds) fluctuate, so if the market falls or yields fall behind inflation, do you immediately conclude that a correction is needed? Well maybe, but then you might be cutting back unnecessarily, so perhaps you wait to see if the situation recovers. By the time you conclude that you are getting too close to the iceberg, you might need some emergency manoeuvres to overcome your momentum and avoid hitting it.

The point of an SWR is that it is a figure you can feel happy sticking with, even if you seem to be going off course and heading to the iceberg, because you are confident that history shows that eventually the wind will shift sufficiently so you don’t hit the iceberg.

So I agree you definitely don’t want to cut things too fine.

On the other hand, the trouble with being super-cautious is that you are trading off relatively small risks of unpleasant things (cutting back on spending or doing some work) vs the certainty of working an extra few (5? 10?), which is also unpleasant. Whether that trade off is worth it will depend on lots of factors, including each person’s subjective view of how unpleasant each option is.

Sorry, I meant “an extra few years”

Perhaps one other point that is relevant here is that, despite the Pfau figures, which are presumably based on general index performance, there are quite a few investment trusts that have increased their dividends every year for decades. The longest record is City Of London, which has raised its dividend every year since 1967 and has sufficient reserves to suggest it is unlikely to break the pattern any time soon.

This means that if the yield is acceptable when you buy the trust shares, you could spend the dividends and as long as they keep raising their dividend the yield (on your original investment) will keep increasing in subsequent years, providing at least some inflation-proofing. City of London is currently yielding 3.8%, which is a lot higher than Pfau’s SWR. (There are other similar trusts, eg Merchants, Murray Income)

What I don’t know for sure is whether the uplifts have always kept track with inflation. I can, however, see that the dividend uplifts since 2002 have way outstripped inflation, based on the following table: http://www.theaic.co.uk/aic/news/press-releases/investment-company-dividend-heroes-2

Over the last 12 years, City and Murray have nearly doubled their dividends, but inflation has been about 35% cumulatively. Merchants has increased by 38%, so it has matched inflation. Which looks pretty good, but perhaps their uplifts fell behind inflation in the bad old days of the 1970s?

Now, there’s no guarantee that they will maintain their dividend records the next 30 years, but they have managed to do so through the 1970s oil shocks and stagflation; various crashes including black Monday in 1987, the dotcom crash; Britain exiting the ERM; Take That splitting up; and global financial meltdown 6-7 years ago. That’s getting as close to certain as you can be in the world of investing.

I really liked the piece on “The Gift of not worrying about money.” Some great insight there, not to mention some valuable motivation. Thanks for all the great picks!

@Neverland,

Good point about the robustness of annuity providers. The father of a colleague suffered a massive cut in his Equitable Life annuity payments and I think he was around 75 at the time. Thus there was no way in which he could restore the loss to his finances.

A quick look at the Financial Services Compensation Scheme website does not reveal anything about annuities and there are a number of qualifying criteria for any claim of which all must be satisfied. (I have seen elsewhere that annuities are protected but the article did not mention purchased life annuities.)

In addition, even starting an annuity at 75, one may hope to receive an annuity income for 20 years or more and I wonder whether any financial services company over that period can be relied upon to make annuity payments over such a long period.

@neverland the average life-expectancy at 75 is around 87 – not 20 years. I only mention in case it effects anyone’s financial planning!

The 4% value is actually somewhat of a worst-case scenario in the 65 year period covered in the trinity study. In many years, retirees could have spent 5% or more of their savings each year, and still ended up with a growing surplus.

@Marcus

The trouble is, without perfect foresight you don’t know if it will turn out that your retirement period is one of the few when 5% would be too much. Indeed, these new Pfau figures (updating and widening the Trinity study) suggest 4% could be too much.

My withdrawal rate is my main worry. To achieve the income I’m targeting, I need to withdraw at around 4.5% pa between ages 55 and 67, before dropping this to just under 4% once state pensions kick in.

I don’t like either of those percentages, so I either need to save more, plan to spend less in retirement (which would require a lengthy chat with Mrs Gadget!), or work for longer.

All I can do right now is save more, but our ever-changing pensions legislation doesn’t make that particularly easy.

So, you are saying that the trinity study is wrong and you are right?

@Marcus — Don’t really understand the somewhat confrontational tone there. You’re both (/the Trinity study is) right. If someone is happy to gamble on potentially running out of money, they can clearly spend more.

It’s the search for nearer-100% safety that pushes down the withdrawal rates (and which can make annuities attractive for some).

What a lot of you seem to forget is that there is always the capital itself, you may inherit or otherwise obtain extra money along the way, you will probably get a state and/or company pension and you may chose to work in “retirement”. Less doom and gloom and more factoring in some margin of safety please!

@Marcus

Best of luck, because that is what will determine whether you run out of money or not, just luck

There is a recent article on the huge dispersion of returns depending on the timing of when an investor started investing you should read in the Buttonwood section of the Economist ‘s website

I must confess I’m too lazy to link it but it might be a bit of an eye-opener for you

@gadgetmind

I expect 1 and 3 are the only options

Seriously have you looked at some of the longer established VCTs?

Obviously its heretical to suggest them but from what I gather of your tax position they might suit you because of the relatively short term nature of the 5 year commitment

@Marcus — The SWR research takes account of “the capital itself” — that is assumed to run down to zero. That is why they run out of money before dying in some fraction of cases.

Fully agree with you that there are positive surprises as well as negative ones. However insurance and margins of safety are typically about protecting yourself in case of negative scenarios. The better outcomes can take care of themselves!

I don’t think many people on this thread have forgotten about any of those things you’ve mentioned. In fact, I think they’ve probably over-thought all of them! 😉

You won’t hear me arguing that you can’t spend 4% of your pot (or more) and *most* of the time you’ll be okay. I don’t think anyone is saying that.

Again, the issue is “most”. Some people want to get that as close to “always” as they can. You have a different mindset, which is fair enough, but it doesn’t change the maths/historical precedent.

Incidentally I’m closer to your side of the camp than theirs. I presume I’ll go into retirement over-loaded with equities and withdrawing 3-4% or so a year, likely from dividends. I also presume I’ll never fully retire from earning. This is not the dogmatic approach to retirement, nor the safest.

Again, that doesn’t change the maths or make me “right” or you “wrong” to use your earlier terminology. It’s just my (current) personal assessment of the risks and rewards.

I’ve looked at VCTs in the past, and may look again in the future, but I’m currently making things work using pensions and ISAs while avoiding top rate tax. However, I’ve got some share-based bonuses hitting next year, and if the share price keeps going up …

@gadgetmind @neverland

VCTs caught my eye for the obvious tax reason. I researched them a bit and smelt danger. You might get very lucky but if not they are a fantastic way of transferring money from HMRC to the VCT managers. Basically the tax saving will be eaten up by charges over the years. The money managers never miss an opportunity to screw money out of the punters. (IMHO at least) – see Merryn Somerset Webb on the subject below.

http://www.ft.com/cms/s/0/3c658664-9567-11e3-8371-00144feab7de.html#axzz33UbU7jav

Add to the above the poor liquidity, the highly dispersed nature of the returns and the possibility that HMRC will revoke the tax-break if there are technical breaches by the managers (see below) and I am running a mile from them at present.

http://m.citywire.co.uk/money/hmrc-strips-tax-breaks-from-oxford-technology-vct/a740415

Annuities are “safe”, conventional ones, at least. Being insurance policies, 90% of the annuity is protected by the relevant legislation. Worse case is 10% loss. Last time conventional annuity failed, Henry VIII on throne, or so I understand.

RPI annuity for a non-smoker age 65 = 3.54%, smoker = 4.65%, joint life, with 65% spouse’s benefit = 2.91%. Or thereabouts.

The Annuity Puzzle is most interesting (really!)

See http://ssrn.com/abstract=1943599

I second TIs never stop working approach – trick is to dial it right back time-wise and ensure its something you like/love doing. This is definitely eminently feasible for bright and enterprising people (like this readership)

Then you have the awesome inverse situation of every £1 you earn being worth about 20-30 times what those pounds are worth that are generating your FI income.

How quickly would that get you out of a pickle if you had got your sums slightly wrong? very quickly is the answer..

Mr MM bangs on about this aspect all the time and probably rightly so as it takes a lot of (all?) the worry out of the SWR argument. Then it just comes down to have you got the cajones to actually take the plunge and ‘retire’

From seeing how a few other people have got on with early retirement you seem to start hanging out with a completely different group of people where random impromptu and interesting opportunities for work seem to pop up quite regularly.

@Mark Meldon the annuity puzzle was interesting reading, thanks for that. It highlights notable irrationality in my own thinking about the subject, and I am more in favour of annuities than general on here, and I am much less exposed to the SWR issue than most.

@the Rhino to me the never stop working approach looked less attractive as I got older, and I don’t think I’m the only one though of course it isn’t universal.

People often get more cantankerous, less tolerant of authority and even working for themselves simply more observant that every day is a larger part of their time left 😉

However, I do agree that it is hard to avoid the pesky problem of attracting money-making opportunities. I have avoided it by giving the proceeds to people who were prepared to deal with the bother of filling in tax returns and all that tedious paperwork. I will advise. I’ll be paid in beer and wine, occasionally trips abroad, but I’m not going to collect receipts and all that jazz. And if people don’t like it I’m not doing it – it’s my way or the highway. That’s what financial independence means. And it’s sweet.

Sometimes I’ll do a job pro bono. It’s exasperating for people because they have to catch my imagination, and it’s hard to get a yes, but generally if I take something on then I’ll do it out of personal integrity even if it overruns. Nobody owns an Ermine’s time but me. Perhaps it’s because of the way I left work that this is uniquely important to me.

@all

I am very much in the lower end of the wealth spectrum of the commenters here – I have never been and never will be worth a million pounds in 2014 money. TBH when I see people wondering if a million pounds isn’t enough to retire on I can’t avoid the disturbing thought that an awful lot of our fellow countrymen will never earn a million pounds (if 2014 money) in a working lifetime of 40 years.

There’s another risk that we’re all running that hasn’t been mentioned on this thread. We’re all running out of time, one day every 24 hours. Each day your time on earth is getting shorter. You can save money. But you can’t save time. The next week will take 168 of your hours just as much as it’ll take of mine.

That’s why I decided to take charge of my time. I wish everybody well, and hope that you get the balance right between all the risks you’re running, of which running out of money is one and even one that can be addressed by insurance. If you want to feather-bed your kids then heck- annuitize half your money when annuities reach your SWR. But there are some tail risks you can’t hedge with financial instruments, and as you drive yourselves to 3%, then 2%, think about what those tail risks really mean.

Wade Pfau may be a genius but when I read that he claims somebody in Germany with a SWR of 0.84% would have been great and dandy I wonder about the good prof’s real-world savoir faire, and the spikes that the average is hiding. Let us take his example of Germany, the low water mark was 1911. Nevertheless, save over 100 times your desired income and you’re sitting pretty. I heard my great grandmother in Germany talk about those days, though I was a young child. She lost her life savings twice, once to Weimar and then again 30 years later. Clearly she didn’t have Pfau-esque savings, but even if she did –

You are asking an investor to have the cojones to hold a steady 50:50 shares/bond split through a devaluation in the currency of nine orders of magnitude. You may like to think you’re hard, but that’s a big ask. Maybe you are that hard but you still need to eat, and negotiable instruments become non-negotiable in times like that, because trust breaks down.

What helped that side of my family was having a base in town and having what we would now call a smallholding in a rural area. The currency was butter and eggs at times. At times people paid in muscle power.

There are risks you can’t hedge with financial instruments. The gold-bugs can put it away too. The Weimar inflation lasted 5 years. If you’re buying your bread with gold, you’ll probably attract some unwelcome attention, and what the hell do you take as change? Gold is a decent long-term store of value, But you gotta survive to the long term. Metal detectorists dig up quite a few hoards over the years…

Financial instruments can’t help you against societal breakdown. Prepping won’t either, you’ll shoot a lot of people and be tired and jumpy all the time because some of them will have mates you’ll upset – the world you’re making probably looks like one of those Mexican drug towns, without the electricity.

It’s who you know, what you know and where you are that are the only things that might help you – productive assets (land, seed, knowhow) hand tools and community might help, but it’s still a desperately long shot (largely because of all the preppers and other tooled up guys 😉 )

So if the 2% SWR starts to get important, there’s a case to be made that being poor in John O’Groats is probably safer than sitting on a £5million stash of financial instruments in London. Particularly if you need to black start the Internet to prove you own them 😉

For a gander at the sort of tail risks you could be up against take a look at the WEF Global Risks 2014 report. Having to black start the Internet, and even then a serious loss of trust in it, and the synchronous failure of the financial system in developed countries are up there as the most likely, it seems.

@Rhino

We work for oursleves and the reality is at least for us:

– the business is precarious (sp?) without constant attention could easily dry-up

– its not like we could just leave it and go somewhere with no communication tech for a month

– continuous time and effort reap extrapolating rewards, so being part time about it just likely to lead to meager/little rewards

Running your own business for the long term is not this easy nirvana that its painted to be in the personal finance blogging community

But who knows mebbe we’ve got the wrong business and there’s gold in them thar hills….

@Ermine

You’re probably aware of Goodwin’s law, right? 🙂

@Neverland, yes, my mother is German, and I am familiar with Godwin’s law, though I believe he-who-must-not-be-named was not the problem with the Weimar inflation, which predated that.

@ermine I’m loving your butter-barter-economy – no chance of osborne getting his greedy little mits on that. I imagine you to be pops out of a soft-focus 1980’s episode of the darling buds of may..

@ermine @neverland. Just a gentle warning to be careful (from a non-accountant so take with as big a pinch of salt as you wish).

Gifts in kind in lieu of payment for services are clearly treated by HMRC as taxable benefit in the same way that normal income is. I think the threshold where this counts is quite low too.

I have some personal experience of this but as I said I am

certainly not a tax expert.

Reading the comments about 2 million pound pots I am grateful for Ermine’s comments above and TA’s latest motivational article above this one so the younger folk don’t fling their arms up in despair.

Simply it is ludicrous to expect todays 20 (and 30) somethings to clear their 50k’s worth of student debt, scrabble to pull together a property deposit, pay their mortgage off and amass 2, or even 1 million in income generating assets in what is realistically a 20 year window (35-55) while you’re in your peak earnings band. Unless you are in the top 1-2% of earners, or create and sell a valuable business. Or inherit a pile of cash.

Giving up iphones and lattes is not going to be enough.

But that shouldn’t put people off aiming for some degree of financial freedom. Pay off the mortgage, build up assets of 500k-750k (and at least become a paper millionaire in total net worth inc home!), and work part time or run a side business to cover the shortfall in income. Much more realistic.

Plus I’ll be far too “cantankerous and intolerant of authority” 🙂 to be working fulltime into my 60s, even if thats possible.

And one more point, due to taxation it is a case of ever diminishing returns, your first half million is going to let you keep more pounds in your pocket than the second, which will still be better than the third, and so on. It becomes more and more painful to earn it (losing out on the valuable commodity of time as Ermine mentions) while keeping less and less.

Yes and with student debt and mortgage, if you want children that’s your ‘peak earning’ 35-55 scuppered (if you ever want to see them)!

I think many people will be lucky to be in a position to quit work. But the real skill for a happy retiremenr or semi retirement will be in learning how to live a low cost but fulfilling life. I can’t truthfully say I am a great example at the moment, but I live in hope!

@Semi Passive…

It’s a challenge isn’t it… but one that seems quite worthwhile.

@SemiPassive — Quite right. Yet another reason to smirk in bemusement at those who bizarrely claim ISA use is optional for young savers…

“I had forgotten about Equitable life and probably stupidly I hadn’t previously realised that the annuity holders got wiped out as well. Awful for them.” Aye, it would have been had it actually happened, but it didn’t. It was only the With Profits annuity holders who got into trouble, poor sods, though it fell short of wipe-out. Similarly the mention above of Insurance Companies going bust – which? Even Equitable Life has managed to stagger to safety – I can’t think of one that went bust in my adult lifetime. When was the last time a British Life Insurer went bust?

Comparing buying an annuity at 75 with trying to preserve capital to bequeath – the capital will probably pay Inheritance Tax. That means you effectively get a 40% discount on your annuity. Buy, buy, buy!

Strictly speaking, the discount is a little less than 40%, because even if the annuity is bought with a non-pension lump sum, at least a portion of the annuity payments are taxable income. However, the income tax is going to be much lower than 40% IHT, so the point is still a good one.

I’m not sure I follow the logic to that. The putative annuity purchaser is never going to be paying IHT – its the beneficiaries of the estate that will do that. Annuitising destroys the capital so effectively its a 100% inheritance tax rate from the point of view of the beneficiaries!

I am however pretty favourable to the concept of annuitising enough to provide for your needs.

I think what dearieme is saying is that for every £100,000 you have (over the IHT threshold) when you die, this only “buys” you a £60,000 gift to them, whereas if you had bought an annuity you would have got £100,000 worth (or that amount minus however much it grew between when you would have bought the annuity and when you die).

However, it isn’t quite an either/or. If I decide not to buy an annuity it is not because I plan to put the money aside and not touch it so it goes in my will to my children. Rather, it would be so I can use it to live off, but as I don’t know when I’m going to die I’ll live off it in a way that I don’t erode the capital significantly. This means as a nice side effect there should be capital left when I die, so my children might get an inheritance one day. If the government confiscates 40% of it, well 60% is better than nothing.

I don’t disagree with your philosophy, but the hard part is predicting when you will die. I recommend not worrying about having too much money when you die. That is a good problem to have. As you get closer to the end you will better be able to predict things and deal with the situation then.

Also you are going to spend 40 years in a retirement. Thats not a small amount of time. Thats an entire second life. I like to think about it more like a B list celeb who makes all their money in their 20s and needs to survive the rest of their life on that income. There are a lot of ups and downs that could happen in that time. To think that I can predict all of that accurately 60 years in advance is unrealistic. All these retirement numbers are just educated guesses.

Good luck to you

I’m not afraid of inflation. Hyper inflation would be game over for all of us – but this is very unlikely in the US because of our reserve currency status. We do, however, have to pay attention to getting the budget closer to in balance, and reducing our dependence on foreign oil, thus getting our balance of trade deficit smaller.

In the classic book your money or your life, they have a very good section on inflation. They show that thinking people can deal with inflation. Buy used. If orange juice has spiked way up, drink apple juice. Bike around instead of driving.

It all depends on the ability of companies to raise their prices in times of higher inflation to maintain profits. I believe Benjamin Graham found that equities didn’t always keep up, hence the need to diversify into other areas like property.

Something that does concern me about inflation from a UK perspective is that essentials like food and heating fuel are rising at between 5%-10%, i.e well above the CPI. (This may be due to the weakened pound and our need to import these things, although rising world population, weird weather and depleting resources may also be playing a part).

That’s not a conspiracy theory by the way, it’s in the official government data. The reason our CPI is so low is that the average rate gets reduced by the weighting of consumer goods like clothes and digital cameras in the calculation – these are either rising more slowly or reducing in price.

6-7% ROI is completely reasonable. The whole point of the Couch Potato way of investing is that.. if one thing doesn’t do well, other stuff will.

I assume you’re investing in your ISA first? From my perspective, the UK’s tax regime is absolutely awesome. Ok, NI is a bit of a pain but hopefully you’ll get something back from that in time (140 quid a week – more than enough to live on, IMHO!).

I assume you are buying HUKX or VUKE, HMCX, H50E etc, etc. They have good MERs; buying on a “regular investment” with my broker (iweb) costs 2 pounds per transavtion, and as these are Irish domiciled there is no stamp duty (at least, I think that’s why – but you don’t get the dividend tax credit stuff).

*IF* you chug away at your pension (tax free lump sum at 55, I think?), fill your ISA your tax rate.. is not going to be high, assuming you aren’t earning hundreds of thousands – in which case, well, you don’t really have a problem, right?

Think about an investment property – it should return a few percent, and generally the value of the house should keep pace with inflation.

Couch potato and diversity works just as well in the UK as anywhere else, I think.

You do know the personal allowance is going up to 10k over the next couple of years, per person? Again IMHO – 10k is a lot of cash to spend, if your mortgage is done, and most of your money is in an ISA…

An example of optimal tax efficiency in the UK for your first half million could be to build up 167k in ISAs and 333k in SIPP. At 55 take out your tax free lump sum of 83k and drip that into ISAs over the next few years, perhaps leaving it in an equity income fund during the interim.

So you’d then be paying zero income tax on a potential income of 20k pa at 4% withdrawl rate.

Inflation or an unkind stockmarket may take their toll but then the state pension eventually kicks in to top things up.