The life expectancy of a couple is much longer than any pair of individuals – more than a decade longer. If you’re taking responsibility for a retirement plan for two, you need to know what the odds are that both or one of you may make it to a ripe old age. Long life can drain your portfolio like Facebook drains the battery of an aging smartphone.

We’ve already looked at how to find good life expectancy data for individuals. But we need to go one step further to see how two hearts make one financial strategy.

(This counts for romance on Monevator.)

Survival probability

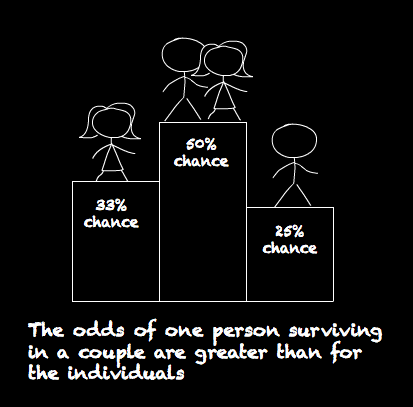

When you’re joined at the financial hip, it’s a big mistake to look at life expectancies separately. This table from a retirement research paper by Dr Paul Cox of the Birmingham Business School shows why. For a heterosexual couple:

Source: Helping consumers and providers manage defined contribution (DC) wealth in retirement, 2015. Dr Paul Cox.

The 50% chance that one of our two lovebirds still needs money by age 95 is much higher than the 33% probability for females, or the mere 25% for the males circling the drain.

And that’s for a UK couple born in 1950 who’ve reached age 65. For a matching set of Gen Xers, born in 1970, Cox calculates that the chances of one of them still being in business at:

- Age 95 = 60% probability

- Age 100 = 36% probability

Cox thinks the probability of one member of a couple surviving to age 95 and 100 is increasing by 3% every five years.

So individual life expectancies fly about as well as a paper aeroplane. Gambling your future security on a 50-50 bet of making age 95 won’t look smart if there are still bills to pay, your portfolio has waned, and you haven’t had the decency to fall off the log yet.

We need to settle upon a pragmatic degree of failure. For example:

“We’ll plan for a 50-year retirement because we accept a 10% chance that one of us will stagger on beyond that point, and a 90% chance that neither of us will.”

Then we need to personalise those odds with a projection of our shared life expectancy.

Enter the Longevity Illustrator

The Longevity Illustrator constructs survival probabilities for couples using US Social Security data. That’s good enough for our purposes – we’re looking for a plausible time horizon not a palm reading.

Enter your age, gender, and health deets, then watch your possible futures unfold in a few graphs.

Here’s the key table for an everyday couple – retirement planning obsessive, The Accumulator, and reluctant financial case study, Mrs Accumulator:

Our acceptable failure rate is 10%. The bottom row shows a 10% chance that one of us will last 50 years beyond our retirement date. I accept that Mrs Accumulator is the bookies’ favourite.

Our acceptable failure rate is 10%. The bottom row shows a 10% chance that one of us will last 50 years beyond our retirement date. I accept that Mrs Accumulator is the bookies’ favourite.

There’s a 10% probability that both of us could last 42 years. I need to target a portfolio size and sustainable withdrawal rate (SWR) that can provide a dual income for at least that long.

It does sting a little to see there’s only a 50:50 chance we’ll both be around for 30 years. We’d better make the most of the time we have.

Dr Cox’s work helps us put some UK context around that table:

Between ages 80 – 84 two thirds (65%) of all men and one-third (30%) of women are part of a couple. At age 85+ one-half (48%) of all men and 1 in 8 (13%) women are part of a couple.

The large drop in the proportion of women living in a couple is because the proportion of widowers rises.

This life expectancy post explains how to find UK mortality data suitable for your year of birth if you want to go the extra mile. You can calculate your own survival probabilities with the formula I’ll share in a bonus appendix below.

You should reduce your SWR if you need to live off your portfolio much over 30 years. There’s good evidence you should increase your equity risk if you want your wealth to last 40 to 60 years.

What does failure look like?

It’s important not to overdo fears of eating dog food in retirement. Failure rarely looks like bankruptcy. In practice the chance of living long enough to run out of money is smaller than it seems because it depends on two events:

The probability that your portfolio fails.

And

The probability that someone is left alive to rue the day.

For example:

There’s a 10% chance that one of you survives 50 years.

There’s a 10% chance your portfolio runs dry given your chosen SWR.

The probability that both events occur together is 0.1 x 0.1 x 100 = 1%.

That’s a 99% success rate. That’ll do me.

Besides, even a 1% fail case doesn’t necessarily mean you run out of money. It means you’ll need to lower your spending along the way to prevent your portfolio ebbing away.

That will probably happen naturally when your portfolio only has to support one of you – assuming your next move isn’t to shack up with some asset-less Condo Casanova. (I recommend prohibiting that in your relationship agreement.)

Still, one person can rarely live half as cheaply as two, as the Pensions Policy Institute warns:

The proportion of pensioners living alone has increased as a result of divorce becoming more prevalent at older ages and increased longevity leading to widows and widowers living for longer.

Living alone tends to decrease income due to the loss of a partner’s pension and reduce living standards as a single person requires more than half of the income of a couple to maintain the same living standards.

Hmm, divorce, yes, that’ll screw things up, so be nice.

Watch out, too, if the new State Pension is a fundamental part of your retirement calculations. Most people will inherit the square root of naff all from that quarter when their partner dies.

Finally, if your data points to long life then put an annuity on your ‘to do list’ for your early seventies.

Annuities are currently the best financial tool we have for buying lifetime income cheaply, aside from the State Pension. There are pitfalls to avoid, they are much misunderstood, and you need to live well into your 80s to come out ‘ahead’, but annuities are a great way to live long and prosper.

Take it steady,

The Accumulator

Bonus appendix: Survival probability calculation for a couple

Take the probability that you will be alive in 50 years, for example:

Jill = 25% chance

Jack = 10% chance

The probability that both of you will be alive in 50 years:

0.25 x 0.1 x 100 = 2.5%

To work out the probability that either of you will be alive in 50 years:

The chance that Jill will be alive but Jack will not: 0.25 x 0.9 x 100 = 22.5%

The chance that Jack will be alive but Jill will not: 0.10 x 0.75 x 100 = 7.5%

The chance that at least one of our pair will be alive in 50 years:

2.5% + 22.5% + 7.5% = 32.5%

Check out more investing maths fun with Monevator!

Comments on this entry are closed.

Proportion of widowers falls?

Easy way of calculating probability of at least one survivor is to calculate probability of both dead and subtract from one

Thanks for the article.

Even though annuities look “expensive”, they are probably a cheaper way to control longevity risk than holding an asset pile large enough to keep RORO (risk of running out) acceptably small.

Annuities enable one to pool risk with other buyers, and thus blunt the extreme outcomes.

The trick with buying an annuity is to never look back after purchase, but just build a lifestyle based on enjoying the regular, guaranteed income – one has made an irrevocable choice, and there’s no point worrying about previously-available alternatives.

Its not unusual for lovebirds to die soon after one another – a broken heart puts actual strain on your physical heart, even parental love (ie Sala’s dad).

Sometimes the widow(er) gets depressed, stops eating, etc

“Sometimes the widower gets depressed, stops eating, etc”: aye, and starts drinking. I’ve witnessed one alcohol-assisted death by broken heart.

“Most people will inherit the square root of naff all from that quarter”: older readers, or their children, might like to note that the old-style state pensions do hold the promise of some inheritable income for spouses, depending on the circumstances. Whether they still will under Mr Corbyn, or some other bogeyman, is anyone’s guess.

Has an annuity provider ever failed?

Was Equitable Life an actual annuity provider?

Annuities are 100% protected in the event of a provider going bust.

@Vanguard #7

Statutory protection?

@Factor #8

FSCS, so the statute would be the Financial Services and Markets Act 2000

“Has an annuity provider ever failed?” I understand not, or at least not in a couple of centuries. (Beware, amateur speaking.)

“Was Equitable Life an actual annuity provider?” Yes, but it didn’t fail. The annuities were all paid. People with With Profits annuities were browned off – but that was the risk they’d chosen to take.

> one person can rarely live half as cheaply as two

Half as cheaply would mean spending more.

@dearieme #10

Equitable Life – a cautionary tale indeed. For those who have the time and inclination, see https://en.wikipedia.org/wiki/The_Equitable_Life_Assurance_Society

This is a very relevant bit of information for me and the Lady – there’s a lot that goes into longevity and I think that it’s worth pointing out that it’s not just quantity of years but also quality.

So, as people in our 30’s (late 30’s you could say) – we’ve an eye to the future and that’s one reason I am very glad I have a DB pension that’ll pay no matter what happens (fingers crossed).

We could consider foreign annuities for a higher interest rate, and hedge the currency perhaps if that worried you, although protection will be different

@ GFF – I think you raise an excellent point. Quality of life expectancy is another topic again, and one that’s likely to be even more salutary and difficult to grapple with emotionally. Was listening to a podcast today, the speaker mentioned he used an app to age his face in a photo. He pinned the photo of his ’83-year-old’ self above his desk, as a reminder to take care of his health now on behalf of his future self.

@ Jonathan – agree 100% about not looking back after taking the annuity plunge. It’s worked out brilliantly for my mum, she knows what she has to spend and the worry born of uncertainty has gone. She does make the occasional dark reference to how long she needs to survive before she’s ‘in profit’. I live in fear of stumbling upon a scorecard one day.

@Factor12

I have a note somewhere of the financial pages in the Guardian urging me to open a With Profits policy with Equitable Life so that I would receive a substantial windfall when it demutualised, as it surely would.

The world is full of sure things that turn out not to be. Such as DB pensions, Mr GFF.

@ derieme – The old company DB fund is very healthy – even if the parent company has been through a tough few years. Over funded and I’m no longer employed there – so lowerish rick.

My thoughts are now do I cash it in and stick it in the SIPP for twice what the HMRC values it or keep it in place and have that as a pension floor come my 60th in the 2040’s.

My gut says everything has its price and the price is right more often that you are…

Back in 1996, I purchased a copy of ‘The Death of Inflation’ by Roger Bootle. Setting aside his views today on ‘Brexit’, much of what he said in his book came to pass. Of particular importance to me as an IFA was a couple of points he made about annuities (remember, they were pretty much compulsory until 2015). Bootle mentioned that, using an assumed annuity rate of 14% (about right for 1996), a £300,000 pension fund would provide an annual income of £42,000, which the pensioner will naturally think is there to be spent. But, of course, the income will carry on being £42,000 whatever happens to price inflation. In a world of persistent inflation, the pensioner’s real income will decline, therefore, year after year.

Bootle then went on to reinforce the idea of a real annuity, i.e., one linked to the RPI and said that in order to equalise their real income over their retirement, retired people should only consume that part of their annual income which represents a real annuity, and save the rest on order to be able to consume it later. But, of course, this is hopelessly complicated.

This resonated with me and, ever since, I have tried to persuade individuals to purchase a real annuity, with some success, I might add. But, few people find it attractive, for they do not like the low initial level for their pension which seems so much less ‘generous’ than an ordinary annuity.

Those of you with indexed DB pensions to look forward to will shed few tears for those with DC pensions and the truly tricky decisions that have to be faced!

@Factor12. Well I have a with profits policy with Equitable. Yes, they are proposing to close the fund and increase the uplift to 60% -70%, assuming court approval. The current uplift is about 30%. I have a COMP policy which might get an extra £5k but it isn’t in the bag. Can’t see they would be writing with profits policies now ( unit linked policies don’t qualify for the uplift).