Being a greedy buy-to-let landlord, I was super excited earlier this year to hear about soaring rents in London, tens of viewings for each property, and would-be tenants engaged in bidding wars.

Music to my ears, because my London buy-to-let was coming to the end of a three-year tenancy.

I was going to cash in big time!

Let’s see how it worked out.

The sitrep

The property in question is an ex-local-authority three-bed freehold house in Tower Hamlets. The tenancy that was coming to an end was paying me £1,900 per month. (Down from £2,000 in 2019).

I’ve now re-let it for £2,400 a month for three years. Good, but given those headlines not as good as I thought it might be:

- It’s let to three migrant workers, who earn about £75,000 between them. (They are cleaners and waiting staff).

- The £28,800 they’re paying in rent is nearly 40% of their gross pay. I’d argue they are paying the maximum they can afford. (Wages should be higher, but that’s another story)

- It’s let and managed through an agent, who takes roughly 16% plus VAT plus a load of other sundry stuff. It totals a bit more than 20% of the rent.

- Other annual costs add up to a bit more than 10%. (My estimate, based on my long actual costs over the years).

- If we assume (optimistically, but it makes the maths easy) 30% all-in costs (excluding financing) then this property earns: £2,400*12*(100%-30%) = £20,160 net.

- Zoopla thinks the house is worth £700,000. That is wildly optimistic IMHO; it’s clear their machine-learning algorithm hasn’t seen the place. Let’s call it £600,000.

- The gross yield is £28,800 / £600,000 = 4.8%. That doesn’t seem so bad.

- Costs bring that down to £20,160 / £600,000 = 3.36% net (before financing)

Now if that was all there was to it, these figures might seem reasonable and fairly dull. You’d not be biting my hand off to buy this asset, would you? But nor is it an obvious sell.

You could even argue I’m getting a greater than 3% inflation-linked return. Not terrible by any means.

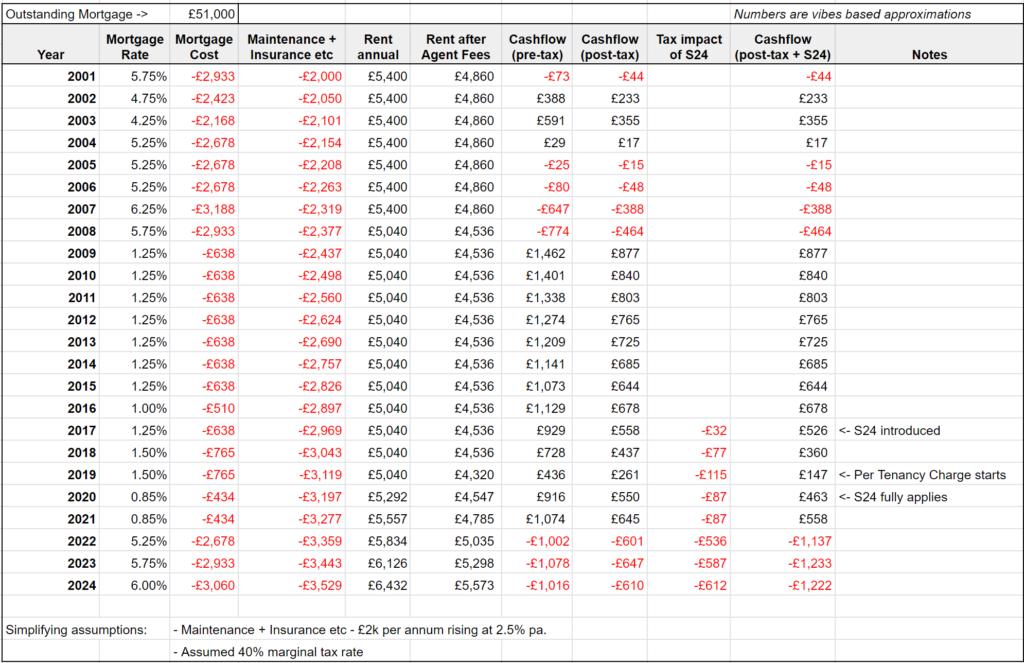

Mortgages and taxes

A few years ago a piece of stinging legislation – Section 24 of the 2015 Finance Act – changed the economics for greedy buy-to-let landlords like me.

In the post-Section 24 era, you have to pay tax on the rent (after all non financing costs) at your marginal rate.

You then you get a (lower) tax rebate for 20% of your financing costs. Which was a clever ruse. Because for many people, it pushes them into a higher tax band. Very often the 60% bracket between £100,000 and £125,000.

For this property I have a £300,000 (so 50% loan-to-value) fixed rate mortgage. The rate is around 2%. (This fix will last about four more years. Phew!)

The mortgage costs me 2%*£300,000 = £6,000 a year.

Let’s add all this up together:

I’ve also included the sums for a pre-Section 24 universe in the three rows at the end of this table as a comparison.

A few things stand out here:

- The 60% tax rate is beyond ridiculous. It’s random and illogical.

- Section 24 is also pretty ridiculous. (And no, I don’t care that regular homeowners can’t offset their mortgage interest against tax – touted as making Section 24 ‘fair’. Homeowners don’t have to pay income tax on their imputed rent either, do they?)

- After tax, our greedy buy-to-let landlord is getting anything between £11,000 and £3,000, depending on their tax bracket.

- Which one applies to me? The second from the right.

Earning 54bps on £600,000 is certainly nothing to write home about. But arguably what matters for our yield calculation is not the capital value of the property, but rather the ‘equity’ we have in it.

That is, how much ‘cash’ would we have if we sold it and paid off the mortgage?

On the face of it this appears to be:

£600,000 – £300,000 = £300,000 equity.

As you can see above, using the equity figure obviously makes the returns look a little better. Still I’d not exactly be thumping the table to get into this position.

Wait: it gets worse

All this maths is at the existing rate on my mortgage. But what if my fix was expiring today and I had to remortgage?

The lowest rate I could get is 5.3% (plus £2,000 in fees). I’ll explain how I can be so certain of this in a minute.

First let’s run the stress test:

Ugh, pass the sick bag.

A thought experiment. In this stress test scenario, how much would I have to increase the rent to break even on a post-tax cash flow basis, assuming I am a 60% taxpayer?

Well, because I only keep 40% of any increase, quite a lot. In fact it would require about a 50% increase to £3,600 per month. (Certain costs are somewhat fixed, others are not. That makes the estimate fuzzy).

Since my rival 20% taxpayers and corporate landlords would still be breaking even without such a hike, obviously I couldn’t do that. Plus it would equate to 58% of the tenants’ gross income.

Section 24 to me seems like just an excuse to charge higher earners yet more income tax.

But surely I could get a cheaper mortgage?

This is where the real fun begins. No, actually, I couldn’t.

This house is in Tower Hamlets. This London borough has an Additional Licensing Scheme under which it essentially deems all houses that are rented and occupied by tenants that do not form a ‘family unit’ to be Houses in Multiple Occupation (HMOs).

A conventional HMO usually involves: rooms let individually, short tenancies, the landlord being responsible for ‘shared’ areas, and so forth.

My house is not that. It’s just a regular house that’s let jointly to three sharers under one normal assured shorthold tenancy agreement.

However Tower Hamlets arbitrarily designating it as an HMO has also sorts of repercussions:

- I have to pay Tower Hamlets £569 every five years

- I have to comply with sundry additional health-and-safety regulations. Most of which are completely sensible best practice anyway, like having a mains fire alarm and so forth.

- Randomly we’ll have an inspection. Whereby:

- I’m responsible for the tidiness of ‘communal’ areas. Never mind that I’m also obligated to not interfere with my tenants’ peaceful enjoyment of the property.

- The tenants might have to swap all the furniture between the bedroom and the sitting room. Why? Because the bedroom is ‘too small’ according to the HMO rules. Never mind that there’s a large kitchen and enormous sitting room. And that it was Tower Hamlets that built this property in the first place. The compromise agreed to enable me to have three tenants is that they use the sitting room as a bedroom and the bedroom as a sitting room. And I’m sure this is what they do.

- I can’t change the mortgage provider. HMO mortgages are much more expensive, but my existing lender has agreed to ‘grandfather’ me, because it recognizes that it’s not really an HMO. But regular lenders now won’t touch it.

- My insurance is more expensive for the same reason.

- Presumably the open-market value of the property is reduced. Because, given its circumstances, the only likely purchaser is another landlord who would face all these issues as well.

Note that, if, for example, I let to two siblings and a friend, and one of the siblings started a sexual relationship with the friend, then they’d be a family unit and I wouldn’t have to bother with all this. Even though nothing of any relevance has changed about the people or the building…

Ironically the situation has encouraged me to run the numbers on turning it into an ‘actual’ HMO. If I’ve got to adhere to all this stuff anyway, why not get a higher rental income?

(Is this really the incentive the council intended, I wonder?)

Fault lines

In any properly functioning country, we wouldn’t need these silly rules. People would simply move out of crap housing and live somewhere else.

We’d need empty houses for them to move into, of course. That would require we build more houses.

But it’s much easier to blame greedy landlords and too-many Johnny Foreigners than to actually let people build houses.

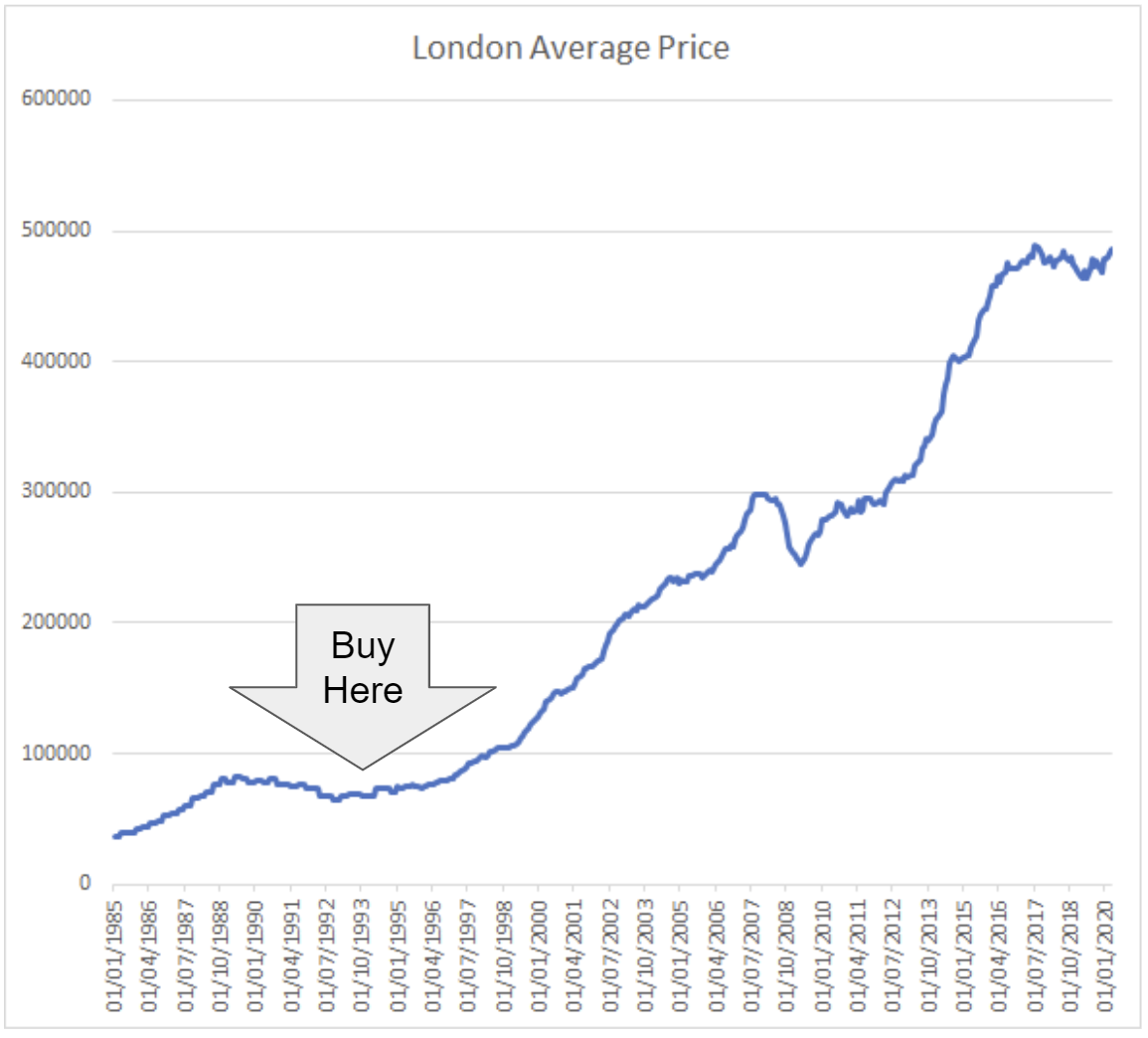

Looking at that graphic, I wonder what the problem could be?

Won’t capital growth make up for it?

Will I make a killing if I sell my flat in years to come for megabucks?

Who knows. But my guess would be no. The easy money in London property was made long ago.

I’ve always let this property to immigrants (despite the government’s best efforts to make doing so more difficult) and the mood music there isn’t great.

Besides, I wouldn’t want to be running cash-flow negative in the hope of ‘making up for it’ with capital gains. Especially when such gains may yet be subject to ‘windfall’ taxes or whatever else politicians fancy inflicting.

Why not give up on the greedy buy-to-let landlord game?

I could just sell the property, of course.

If I then took my £300,000 equity and put it in my ISA (over a few years) I would have no trouble earning, say 4% p.a. in risk assets. (Which is what property is too, incidentally).

That would earn me £12,000 a year in income.

I could put the money into a FTSE 100 tracker. This would pay a 4% long-term inflation linked yield. It would cost 7 bps in fees. (iShares ticker ISF.L).

That fee is 1.7% of the ETF income, as my buy-to-let letting agent might like to note. Also a FTSE tracker will never call me to complain about leaky taps.

However on top of it not being a great time to sell property:

- I don’t really have £300,000 of equity.

- I can’t be bothered.

- There isn’t anything I want to do with the money. (I can afford to fill our ISAs already.)

Why don’t I really have £300,000 in equity?

Let’s run the numbers. If I sold it, I’d have to pay off the mortgage and pay capital gains tax (CGT):

Anyone who’s still paying attention is going to immediately say: “Hold-on-a-minute, if you bought it for £100,000, why have you got a £300,000 mortgage on it?”

Yeah, you got me. Back in the heady noughties I increased the mortgage to release cash to use as a deposit on other BTL properties. I’ve long since sold them all.

In a sense I’ve already had my cake and eaten it on this one. I’ve essentially extracted all the profit.

So on the one hand, I’ve ‘made’ half-a-million quid in capital gains. Not to be sneezed at. But at the same time it wouldn’t take that steep a fall in house prices (about 20%) before I was in negative equity (after capital gains tax).

For the record, in reality I wouldn’t have to pay quite so much CGT. Holding growth stocks outside of tax shelters and dabbling in crypto means I have losses available to offset the gain.

Also, I can’t be bothered

Just the added tax complexity of selling induces anxiety. I completed on the last property I sold shortly after the government introduced new rules that required the CGT on UK property to be filed and paid within 30 days of the sale. (It’s now 60 days).

Again, this system appears to exist out of spite rather than for any real reason. Something that becomes clear if you have any interaction with it:

- It’s separate from the annual self-assessment process.

- You have to file an on-line, one-off, intra-tax-year process, where you can elect to offset carried forward losses and the CGT allowance and so on.

- You pay any tax due (in my case tens of thousands of pounds).

- I had to do all this myself, because my accountant isn’t capable of doing anything within 30 days.

- After the end of the tax year you file your self-assessment. In my case I’d realised other losses, so my CGT bill should be zero.

- Naturally it’ll all come out in the wash of self-assessment, like offsetting your payments on account or whatever, right? Wrong.

- The special ‘UK Property’ gains tax system is not ‘connected’ to the self-assessment system in HMRC. Guess who’s responsible for sorting the mess out?

- Rather than net out the difference and send me a refund, I have to go and amend the original UK Property CGT filing and my self-assessment to ‘move’ some of the losses from the self assessment to the UK Property filing.

- To be clear, HMRC didn’t tell me this. My accountant did. And I can see no way you’d know that this is what you needed to do otherwise.

- I amend the original UK Property filing. Pretty much every page warns me that because I’m amending it after the 30 days deadline I’m likely to have to pay fines and penalties. Possibly jail time.

- I amend the self-assessment as well.

- Wait for the refund, right?

- Of course not. HMRC writes to tell me that I’m owed a refund. But it doesn’t have any way of paying the refund. Could I please phone them?

- Phone the number on the letter where, with dull inevitably, they know nothing about it. Spend the best part of a day going round different HMRC departments.

- Finally I get to the right person.

- HMRC will pay me my refund within 90 days. Yes, you read that right. I have to pay the tax within 30 days, but it gets 90 days to pay me the refund. (This is over a year since I paid the tax).

Now tell me that isn’t anything other than vindictive?

I suppose that in the politics-of-envy country we’ve become, anything that inconveniences greedy buy-to-let landlords is fair play, right?

There’s absolutely no motivation to sort it out. It doesn’t cost HMRC anything. And what am I going to do, pay my taxes elsewhere?

Chance would be a fine thing.

What’s the plan?

The plan is to bury my head in the sand and hope that something turns up in the three to four year window that I’ve bought myself.

The mortgage is fixed for four more years, and I’ve just agreed to a new three-year tenancy. A lot can change in three years. Interest rates might fall, rents might rise, my tax circumstances might change, Tower Hamlets might drop its stupid HMO rules, Section 24 might be repealed. (Okay, I was joking about the last two).

In the meantime I carry the (net-of-mortgage and tax) value of the property on my personal balance sheet as ‘a doughnut’ and ignore the income.

But maybe it’s not a complete waste of time and effort, after all. Because where are the migrants I just let the place to from?

Ukraine.

That’s something positive, anyway.

If you enjoyed this, follow Finumus on Twitter or read his other articles for Monevator.

Comments on this entry are closed.

Look on the bright side; its a bit healthier than that crypto yield farming you were advocating earlier in the year …

The minimum bedroom size seems to be a new thing in the HMO world. Over the summer I had the joy of much knocking and crashing as the student landlord next door had to knock an upstairs wall through and repartition the area so ‘bedroom 3’ met the new criteria.

Yes agreed, property in the UK is a ballache now, don’t forget if you rent to someone whose visa has ran out, you can also face jail time!!!

I sold mine when I bought my home and to be honest, haven’t looked back.

Hi, I have a similar flat in Edinburgh with similar rent in Edinburgh, also an HMO with 3 students. I would also sell up and move money into funds if I could be bothered. The rents admittedly are high but there are so many deductions now it is just not worth the hassle.

Just to one-up you on the landlord misery. I am borrowing 230K on my BTL mortgage, currently paying 440 a month interest only at 2.18%. That deal finishes at Easter, then what? The rate and payments double maybe? AND the Scottish government brought in emergency Covid legislation that does not allow us to raise rents for sitting tenants.

Really good article. Found myself nodding along – am in a similar boat.

As you note, exit is a pain and loses loads through tax – my conclusion is that I need to really sweat the asset to make it work so will redevelop/extend/refurb. (I need this like a hole in the head… the idea that BTL is a passive income stream is laughable).

On the plus side, with your effective equity being lower it does improve your return on that investment, e.g. 2.7% at the 60% marginal rate.

Like you say, the whole setup seems vindictive: targeting people who are well off enough not to get sympathy from someone doing a “real” job but not so much that they are donating to the political parties who set the rules. None of the taxation or legislation around BTL seems to address the issues raised in the comment section of Guardian articles on related issues: I also believe lack of housing supply is the main culprit.

It can feel like a personal attack by the HMRC as the tax rules are completely different if you did the same thing as a company (although this is also made complicated enough only to be worth doing for larger portfolios).

I would however count capital growth as part of the return on investment – you mention it in passing but if property prices increased by 10% last year that could be £50k (£550k + 10% = £600k), or £20k at your worst-case tax rate… that looks good against a £118k “investment”. Of course prices can also drop and the main issue I found is that housing is highly illiquid: you can’t sell a couple of windows to pay for getting the car fixed.

At least you are admitting what you are – a greedy landlord (even if only in jest). A number of my friends don’t regard themselves as landlords because it’s only a small BTL/a relative left it to them and it goes against their self image as kindly hippie progressive types. Usually such conversations are conducted in sotto voce and accompanied by much clearing of throats. IME, such people usually make the worst landlords as they don’t take their responsibilities seriously and tend to be grasping after every penny.

The writing has been on the wall for individual landlords for a while now. I doubt the news is going to get any better in the future.

Good post from a greedy (if slightly woke) BTL Landlord.

I’ve been banging the drum about the unfairness of the housing market from before everyone else realised there was a boom (talking 2005 HPC days here).

It seems a bit odd that we view property as an asset in the UK when it’s really a liability – as you can see with all of our costs and fees plus the unmentioned big items like new roof, kitchen, floors etc… that need to be done).

Instead, we’ve treated a vastly expensive (to buy and keep) liability as a magical cash cow that gives us free money for infinity.

So, is it fair that after the property rose in value massively, that holding an appreciated asset becomes unprofitable (on a P/L sense – let’s ignore the precipitous falls we may soon get in House Prices!) – I think not.

It’s ridiculous that 40% of 3 salaries go to pay for the rent on one property. It’s unsustainable and deeply unfair. Don’t ask me – read the Resolution Foundation (https://www.resolutionfoundation.org/publications/an-intergenerational-audit-for-the-uk-2022/)

And high housing costs hurt not only renters, but even owners are a having a hard time of it. Try paying off an Interest Only Mortgage when you are broke? my own post on it here: https://wp.me/pa5Of8-ZP

Still, you are £100,000 richer and that’s after making a monthly profit! You’re the winner here (even if high house prices have made us all losers)

You seem to be confusing what Tower Hamlets Selective Licencing defines as an HMO and what Mortgage Lenders define as an HMO. On the face of it, you have more mortgage options than seem to think. You also seem to be favouring long-term fixed rates. You can, even in today’s market, get trackers at 3.09%.

20% of your rent to a letting agent? Not in Tower Hamlets but that seems rather high to me.

You considered Incorporation to exit the Section 24 nonsense?

My god you are a great writer/teacher! A real waste of talent not having you teach the future generation.

Thanks for the walk through. Nicely balanced report with the acknowledgement about having your cake and eating it already!

I havent ventured into BTL so had never bothered to do the numbers. I had wondered how profitable / tight things were with reduced tax allowances and increased rates and then what CGT looks like in a real world example when it comes to sell. Now I have it in one post. Cheers.

Letting has always struck me as having a second job. I have worked with many people who have found BTL a complete pain, sorting out broken washing machines because the tenants never bothered to clean the filter, toilets that will not flush, etc. I remember someone having a tenant that somehow broke the bath. Added to the hassle is then the ever present risk of getting a Tenant From Hell. The ones that trash the place, stop paying rent and eventually vanish just before the bailiffs come round.

I feel I am an even more hated species than a BTLer – a much derided second home owner. We only let family and friends use the holiday home. I have considered going down the holiday let route, but apart from having to prepare the place for letting and the regular hassles it is the big fear of the Tenant From Hell that puts me off. If ever we needed the money I think we would probably just sell the property, or downsize our main home, or maybe sell our main home and move in to the second home. Selling our primary residence and moving in to the second home would mean dodging the CGT bullet.

Interesting to see your figures, thanks.

According to the HMRC website, it would seem that you are allowed only to claim the tax credit on the interest on a loan only up to the initial purchase price of the property.

Which means that, on your figures, what you call the tax rebate will be £400, not £1200.

Is that not correct, or have you found some way around that?

To quote from the Revenue:

“Interest on any additional borrowing above the capital value of the property when it was brought into your letting business is not tax deductible.”

Having let out a single property for 30 odd years Ive concluded that the majority (not all) of tenants are numpties in some way or other. Furniture swaps, carpets burnt, garish redecorations, skipped months rent, rules on no smokers/pets ignored, unneeded call outs, and more. Many of those years were run at breakeven or loss (starting in the era of interest rates ~10%), but yes greedy landlords. Brave enough to take on an unlimited interest rate liability landlords. The illiquidity is a double edged sword, as it helps not to sell for the longer term providing you survive of course (many didn’t after 2008).

With short term lets the interest is still off-settable I believe. Time to close that loophole, given the shortage of long term rental supply?

Doesn’t the financial decision boil down to what return are you likely to receive on £118k? The after tax and costs exit capital? I haven’t worked through the figures, but surely it is a matter of risk and expected reward on the current £118k that matters, compared to another similar risk/reward investment? Diversification comes into it as well I suppose.

What is the energy rating of the property? Probably lousy unless you have improved it, and as I understand it legislation is coming in that will require let property to have improved energy ratings in a few years time. I am not clear on the specifics, but have you factored that cost in?

I’m a tenant with three others in a shared house and I agree on the absurdity of HMO rules. Our landlord almost didn’t get his license extended because of it (I think he was asked to install these heavy, self-closing fire doors in all rooms?) Practically that would’ve meant that we had to move out and make space for a proper family, although we were happily living in the house for over a year at that point, and the landlord very happy with our custom (no trashing the place and other stuff that us Tenants From Hell are expected to do). We were lucky that a dissident council employee suggested that we shall claim to be two lesbian couples instead of “just” four friends who decided to share their living space together – this would make us a “family unit”. The council wouldn’t dare question it, because who wants to get into trouble over discrimination?

Jonathan #14 is correct – the tax credit is only on the mortgage amount up to the value of the property on the date the property entered into the BTL business.

So if you bought for £100k 20 years ago and is now worth £600k, tax credit only on max £100k loan I’m afraid. You will need to recalculate those returns!

But section 24 isn’t all bad for everyone, particularly for basic rate taxpayers. The tax credit can be used in future years if not used up in any one particular year. And unlike allowable expenses, you don’t waste any tax credit at all as by default you only ever use up to the personal allowance or the 20% of rental profits.

So section 24 has actually been a good thing for some landlords.

Hang on. You invested £100K and you are earning from it £20,160 pa gross. And if you sold up you would get your capital back (plus a bit). Seems pretty good to me.

The fact that you used it as security for a separate transaction is neither here nor there, the loan interest (and its tax treatment) should surely be set against that different investment.

While it is interesting to read about the regulatory challenges of being a landlord (which doesn’t encourage me!) basically it is that extra work and compliance that justifies such a large return.

I’ve made myself ill over being a landlady. I’ve no mortgage so not got intrest rate worry, about but index tracker funds are so much easier!. My yield is 4 .3% after all my expenses. The only reason I’m sticking is diversification. What I really dislike is being responsible for someone’s welfare. Home. I hate the new rules that may come in. We are loosing more of what little rights we have as landlords.

Is it a valid question to ask how does Airbnb compares?

@Jonathan B, I think you have a very solid point. This is a person who’s put £100k in, taken £200k out and continues to make 20k a year from working people whilst moaning how hard he has it. I think greedy is a kind description and it is heartening to hear institutional lets are putting downward pressure on rents.

I’m ideologically opposed to BTL and put the equivalent of a deposit into shares. Now btl is suffering hopefully people will limit to themselves to one home on economic as opposed to just moral grounds. I’ve absolutely loved owning a home and hope the three tenants get their chance one day

You’re paying an agent to manage the place and you’re still getting calls about leaky taps??!

My view is all jobs with “agent” in the title should be eliminated. eg Estate agents, recruitment agents, letting agents. Maybe not secret agents… Anyway, letting agents – you exist to line their pockets, that is all.

My OH has properties she has rented out for more than 20 years. She uses an agent only for tenant finding, ie to put the property on Rightmove and do the required checks. She meets potential tenants herself and chooses based on her perception of who will be the most reliable tenant. She explains how the rental will work, what the tenant is responsible for, what she will do as the landlord and in what timescales. The tenants generally appreciate the honesty and the lack of a useless agent in the middle. If they don’t like the ground rules, they don’t have to take the property.

It’s not perfect (we’ve had some challenges over Covid with one tenant not paying rent when they were supposed to, now resolved) but, touch wood, it’s mostly bearable and a whole lot better than paying an agent 10%+vat or more for diddly squat, which, as you calculate, can be a reasonable chunk of the net yield.

It’s definitely more work, but the properties are a useful diversification from the rest of our portfolio, which is a bunch of trackers.

@all — Very interesting comments. I had steeled myself ready to mount a defense against a lot of complaining about rich person’s problems against a backdrop of tiny violins, but refreshing to see there’s not much of that. And of course it’s a relevant observation up to a point. I also can see why some people are flat-out opposed to BTL, though there will always be a need for rental property and I’m not sure it’s obviously always better in the hands of institutions (which will ultimately be working for the assets of richer people anyway. Better resourced, from a tenant’s perspective I guess, but also potentially more capable of being institutionally sub-par and legally dominant etc).

Anyway ultimately this site exists to give various lens into how we can (or cannot) best put our money to work for financial freedom (i.e. not just a Tracker Funds R Us. Not quite! 😉 ) And I think given the torrents of property-ganda on YouTube, TikTok, and everywhere else @Finumus’ piece was a candid, self-aware, and revealing snapshot. Lots to learn about how to view assets — and very real human frailties — and lots to think about.

@mike — Did you used to post as ‘mike’ on TMF many many decades ago? Foil of one Bailystock and all that? Reading you my pattern matching bells are ringing, mike being a very common name notwithstanding. Perhaps just a coincidence. 🙂

There’s another reason you probably don’t have 300k of equity in the property: the mortgage rate moves from 2% to 5.3% but the value of the property doesn’t change? At 5.3% it seems any potential purchaser would be foolish to buy with a cap rate of less than 6% – 7%. On 28.8k of revenue, the value is probably roughly in the 410k – 480k range.

So many people think of property like some kind of lottery ticket with a guaranteed jackpot (looking at you boomers!). Can’t blame them really though, when interest rates have only gone in one direction for 30 years everyone looks like (and starts to think they are) an investing genius. However, all those paper gains are in the process of disappearing as financial gravity is turned back on, interesting times ahead.

The vacant property % is very interesting – tiny by comparison to other countries, but probably a function of property values and population growth in the uk.

I saw a report from 2011 that referenced 25m unused UK bedrooms – had a very quick look but couldn’t see a country comparison of free bedrooms.

Seems to me we need to utilise and monetise these rooms ASAP – it’s got to be easier than waiting 20 years to build 2m homes.

On BTL – I’m winding down 2 sold 3 remaining. It’s more work and more stress than buying shares. Leverage/mortgage is the magic – 100% of the growth for 10% down payment – without leverage BTL would a very different less interesting proposition.

Now I’m older (wealthier) and wanting simplicity I’d quite happily sell them all bar one (it’s nice to have emergency accommodation!)

Very useful article Finumus

@JABA – Agreed – one would expect values to be gently / significantly falling soon.

@Mike – Also agreed – I run a few properties that we manage ourselves. It’s more work but tbh you give it to an agent and the service is universally terrible.

@No Free Lunch / Jonathan – That’s also my understanding. You can borrow up to the initial value of the property when you acquired. You cannot keep pulling out any increasing value of the equity as you can in the US.

@Naeclue – The legislation is likely / not 100% confirmed yet to require properties if they want to be let to be EPC C rating or above by 2025 (2028 for existing tenancies). 50% of the housing stock is EPC D rating and it’s not clear that they can be EPC C rating without major surgical changes – the main issue is houses with solid walls and then putting on external insulation or retrofitting internal 50ml minimum. This could cause major major problems in the rental market potentially. Also the people who conduct these EPC’s often have minimal training and it’s highly subjective. Check any EPC for a block of flats and you’ll see different ratings. I had one conducted and it was a D, got another person in and got a B :).

My investments are unlevered , generate a middling single digit return and tbh have been somewhat of a pain. It’s hard to recommend it unless you have an edge – I have a friend who has a lot, does them much better than me, but he buys better, has more skills in this area etc etc.

The institutional market is an interesting one – One would expect these to be bought up by overseas investors. Next stop will be people moaning that they are spending their whole lives paying rent to some overseas investor etc. Which is true.

imho the housing market in this country has been used as a vehicle for people to pull wealth from the future into the present. It’s now grinding to a halt and will exacerbate the fall in standards of living albeit it’s [potentially] good for those not owning property. It’s a major major problem along with every thing else that we’ve kicked the can down the road and is now punching us in the face….

Disclosure.

I am both a (non HMO) BTL Landlord and involved in carrying out safety checks for HMO properties.

What I can guarantee is that standards would drop like a stone if LAs were not as stringent with their HMO rules.

I cant understand how 3 immigrant workers or students or any other combination sharing a 3 bed house can be perceived as anything other than HMO.

On the financials. Something you bought for £100K. Remortgaged for £300K , thats £200K tax free btw, is like the perfect no money down deal.

You are still turning a profit after costs and another £300K of equity is still sitting there.

Oh and that £200k you pulled and invested elsewhere may have compounded into even more profits.

I have, although on a smaller scale, had similar scenario, but look on it as good fortune

Great article! I was in a similar position with a 3 bed ex local authority flat in Tower Hamlets mainly occupied by my son and a succession of friends during their (long) student years, financed by unbelievably good Barclays offset mortgage that we already had on our own house.

Never made me much income because I was too soft on them rentwise and their capacity to break stuff was breathtaking.

But the final straw was the motorway pile up of Tower Hamlets regulations (I had already become a licensed landlord – an earlier wheeze for certain areas of Tower Hamlets – I did do everything properly), then the imminent additional licencing regulations, EPCs on the horizon, plus the very small print at the bottom of one letter saying that as freeholder they might just be considering adding extra storeys to the low rise block as this was now permitted.

So son was turfed out to make his own way in the world (with some transitional support from Bank of M&D of course). I sold quickly to the landlord of the next door flat who had the stomach for the HMO battle, ran his letting as a business and viewed the whole thing much less emotionally.

There was a delicious moment on a train on holiday in Europe this summer when my phone flashed up with the number of the owner of the flat below (who seemed to have me on speed dial) and I could happily tell him that whatever the problem was, leaks, noise, objects in the stairwell, it wasn’t mine any more!

I learned that I am not the sort of person who could comfortably be a commercial landlord. I didn’t make much money (but didn’t lose it either, thanks to the rise in property prices) but did gain some satisfaction from providing a decent and stable home for a young family member and several other not well off young people for 8 years.

Housing and emotions can be too closely entwined. I don’t feel the same way about my managed funds!

Ah, well.

Presumably it’s your choice to do this in Tower Hamlets.

And I find it rather difficult to accept, in general, that property is a risk asset.

Reluctant landlord when my mother moved into care ten years ago. She requested I take on an old friend at a peppercorn rent ( property market has never been my passion! ) who had fallen on hard times. After a couple of years a new tenant moved in above and used the bath for the first time in years. The drains had become partially blocked by tree roots causing a back flow and s**t storm in my poor tenant’s flat down below. I had an old friend who lived locally acting as agent and amazingly he was able to find a real life Winston Wolf to come round and clean up the mess. However everything had to be replaced in the flat and I doubt I broke even in the several years before she passed away and I managed to sell.

Fast forward 10yrs and I was repeating the process with my mother in law. I couldn’t talk the in laws out of moving into the rental market. After a few months a friend of the tenant’s visited was walking in the garden when he stood on the wooden cover of the cesspit which promptly collapsed. No laughing matter he almost drowned! The thing that amazed me was there was no attempt at legal action.

Missed a bullet on that one. Now happily invested in trackers and yesterday even bought bonds for the first time. Much more predictable than rental. They either go up or down or stay where they were.

Good luck,

Pat.

Interesting insight into the ins-and-outs of it. I remember when the changes to taxation calculation were introduced a few years ago and thought then that it definitely was no longer a business I’d encourage folk get into, as they easy money would be a thing of the past.

Seems to me that you should spend some money making it into a nice family home and sell it.

It’s sad the apparent political party of business consistently attacks the “small man”. It’s not only small BTLers which are being taxed / legislated out of business; this govt has pushed multiple small businesses out of existence in recent years.

It’s as if they want the big corporations to own and control everything, with everyone else being a PAYE serf, allowed to keep enough of their mediocre income to put food on the plate, but not afford more than 1 kid. Sad times.

@TI that was another Mike, but I was on that house prices board on TMF in the early 2000s too, under another moniker. 🙂

That forum was a hotbed of “house prices will surely crash soon” in the mid-2000s. The reckoning might have come with the GFC but nobody predicted more than a decade of near-zero interest rates fuelling the house price fire even more…

@Factor – 21 – Is it a valid question to ask how does Airbnb compares?

In my experience, massively more work. I have similar valued BTL & a FHL and the comparison is basically I do 100x more work on the AirBnb.

Key differences between the BTL & FHL are:

Admin – one lettings agent vs multiple websites (Airbnb/vrbo/etc)

Turnover – One 3 year contract vs 50-60 bookings per year

Communication – check in every 3 months vs at least 4 per booking (on booking, pre arrival, arrival, post trip)

Housekeeping – start of tenancy vs at least weekly clean + bedding + checks, grounds keeping

Maintenance – occasional issue vs regular repaints, high turn over of consumables, misc breakages

Fixtures – bed/white goods vs fully equipped (at least 10% of purchase price)

Reviews – barely exist vs massively important to rankings

Council – tenants responsibility for council tax vs registering for business rates / additional licensing, trade waste licensing & contracts

Mortgage rates – just moved to a 5 year 3.14% fix vs 6.75% for a FHL version (70% LTV)

So, even allowing for higher headline income from the FHL you have a lot more admin & work + a much higher cost base & on-going maintenance requirement.

@alex

Thanks, I’ve been considering using a parents home as FHL (furnished holiday let/ airB&B) in the future, but you’ve probably talked me out of it.

BTL is mostly an investment (with a little work) and FHL just sounds like work!

(But if I could delegate all of the work to my sister for a very small fee…..)

@Boltt – there are upsides to a FHL in terms of developing a whole range of new skill sets needed and having a holiday home you can use as well. But it is really something you should go into with eyes wide open as it is a business and brings in all that additional complexity.

I agree with G in #7 that the people who don’t treat BTL seriously are usually the worst landlords – with FHL the feedback is immediate and expectations are a lot higher and very different demographics i.e. BTL for 20-30 somethings who want somewhere to live, FHL potentially for a weekend to a mid-50’s professional who will quite happily raise every issue & also follow up on anything unsafe / illegal.

Mmm… the greedy landlord tag… we don’t call investors greedy in quite the same way do we…?

We are all looking for ways to make our money grow and work for us.

I am a small time BTL landlord and currently trying to sell my one and only property. I want out of the market due to the increasing rules and regulations (e.g EPC changes, EICR, licencing, the list goes on). I would have sold up sooner but COVID and a ban on evictions got in the way. The CGT change is the last straw as the allowance is halved from next April (I had already hit the exit button before this announcement). I doubt I will complete a sale before this change happens.

I became a BTL landlord as I needed somewhere to put my redundancy money and add a bit of diversification at the time. At that point it made sense, it does not now.

I pressed the button to exit BTL a few months ago when I gave notice to the tenant and had to wait for the tenancy to finish. The property is now up for sale. The Zoopla price for the properties I have been comparing have been at least 7% over-egged. When you look at the actual selling prices they are much less. I don’t believe the values on Zoopla…

I have let the agent put the property up at a higher price than I think it’s worth and then dropped it a few weeks later to gain some interest and viewings. Other properties in the area are also being reduced, so the price drops are beginning. I have had a few viewings now but only from other landlords who are punting offers (-6% knockdowns) and look for distressed small landlords exiting the market.

My property is worth far less than the figures you quote for yours so my profit will be very small, if I manage to sell at a profit! It has appreciated a little but nothing like the values you have. Its located elsewhere in the UK. If I make any profit it will be fed into ISAs as passive investment is now my path.

I think that in the future, rentals will be predominantly offered by professional landlords and big companies. Have a look at what’s happening in USA, I think the same thing will happen in the UK.

@Andy : “It’s as if they want the big corporations to own and control everything, with everyone else being a PAYE serf, allowed to keep enough of their mediocre income to put food on the plate, but not afford more than 1 kid. Sad times.”

I think that is called “The Great Reset”….

@AdamHosker – I have considered incorporation to avoid the Section 24 issue – the problem is that it’s a sale and repurchase – so you pay CGT, and stamp (plus extra stamp) – and the mortgage isn’t portable – obviously. And Ltd Co mortgages are still more expensive. Basically, if I’m going to go through the hassle of selling it, I’d be better off selling it to some other mug, than back to myself.

@trufflehunt – Indeed – but when I bought this property, ~25 years ago Tower Hamlets didn’t have these rules – so they are somewhat “retrospective” – in so much as they changed my existing rights.

@Factor – You can’t AirBnb a place full time in London, there’s a 90 days per year limit.

@Naeclue / @Seeking Fire / @ChrisW – EPC’s are very much a concern. Just another source of regulatory uncertainty. Again, just hoping something turns up. It’s currently D rated and it has a flat roof – so good luck with the loft insulation…..

Another solution to the CGT problem, that nobody’s mentioned, at least under the current rules, is to die. But I’m not planning on doing this any time soon – which gives the tax man plenty of time to change the rules to my (or my heirs) disadvantage.

Several people have suggested that I shouldn’t be claiming the financing tax rebate on all of the mortgage interest. Correct! Actually, I don’t – I still own one of the properties that I used the extra borrowing on for the deposit – and the rest is not claimed – but it was already a complicated enough story w/o going into this detail!

I would look at the profit calculation differently. If you liquidated, you would have £118k, so this is what you would have to invest in elsewhere if you sold. That is what I would look at when calculating the yield perhaps. You are getting a lot of cheap leverage via your mortgage. What sort of total return would you need elsewhere on £118k to replace that income, after costs?

Excellent article, details and calculations for what it really costs tp be a landlord.

I sold my BTL back in 2014 as I could see the true costs and hassle of being a landlord.

Plus the opportunity cost of having hundreds of thousands of pounds tied up in a property which is illiquid and at risk of loss of value if the local environment changes.

There would be a lot less amateur landlords around if they actually calculated the costs and behaved like professional landlords.

The problem is that whilst you have an accountant and follow the law practically everyone I’ve met who is a amateur landlord does not declare it for tax purposes and does not do self-assessment and so pay no tax on the rent. The HMRC seem incapable of finding these people and getting the tax owed.

No-one has mentioned the plans to end the no fault eviction, another nail in the coffin. Still, the real game with BTL is remortgaging when prices go up and getting money out tax free, all the day to day stuff is background noise. Also, buy and never sell, so you don’t have to worry about CGT.

Should property prices rise materially more than wages do? Why should it? Because otherwise there will be a point that it becomes unaffordable for everyone that wants to buy (and thus prices need to correct downwards, at least in real terms).

Perhaps over short-medium time frames it becomes overstretched (arguably such as now) but maybe we will see real prices fall over the coming decade or more.

Leverage distorts things and creates greater amplitude of moves. But there is no free lunch in leverage over a long enough period. Seems to be what we are finding out now.

So IMO you really do need to time the property market (together with location considerations) to do well out of it, primary residence excepted for various genuinely valid reasons. And being on the wrong side of timing can lead to pretty p!ss-poor results.

Owner occupier rates are close to historic highs (over last 100+ years). And government has been doing all it can to encourage home ownership. Surely this can’t be sustainable and a fall in home ownership from here on out could coincide with a fall in prices?

We might have one of the lowest unoccupied dwelling rates compared to other countries, but the better measure, as someone else pointed out, is number of unused bedrooms. The boomer generation are hoarding a lot of space (not just pure number of houses) because they simply don’t need to sell given their levels of wealth and government transfer payments.

Complete inefficiency that leads to all sorts of problems and contributes to the sh!ttiness of this country.

Forget to add to my post above about the unused bedrooms. There are roughly 25m unused bedrooms in the UK vs 25m total number of dwellings. Not sure how that compares to other countries, but for a pretty small country like ours, I would say that is a lot of wasted space.

Lot of this is not only a mass hoarding problem but also a cultural issue as well. Regional cultural differences between the West and the East – the West don’t seem to like staying with parents beyond a certain age whereas the East commonly are quite fond of sharing dwellings across two or even more generations. Even in the West these attitudes I think have changed between generations with the boomer generation perhaps more likely to share with their own parents for a longer time compared to boomer – millennials.

“the boomer generation perhaps more likely to share with their own parents for a longer time compared to boomer-millennials” (NFL above) – no, it’s the other way round. Amongst my generation (born 1950s, 1960s) living with your parents beyond late teens – or early 20s if you were one of the 10% or so who went to university – was almost a social taboo and certainly a real and public mark of a failure to grow up. Everyone I knew would rather have slept in the street than continued to live with their parents. Of this generation I only ever knew two people who lived with their parents beyond early 20s, and they were both the kind of incapable men who were likely to live with their parents until their parents died (as in fact one did; I lost track of the other).

Yes you are right that millennials are more likely to stay with their parents longer than boomers.

But is that mainly a function of the expensiveness of housing? Whereas in the previous generation housing was materially cheaper which led to people being more easily able to afford to buy earlier.

But that does not say anything towards attitudes/cultural behavioral differences across the generations. Indeed, that might be one of the main reasons why housing has become so expensive relative to previous generations.

Grainger is the only large (£3.6bn portfolio) listed residential property company in the UK. Their results presentations are worth reading for the market data. They quote 29% of gross income spent on rent as the UK average.

The UK has the most lax rental regulation in Europe which will not persist. It is practically unique in having no rent control so you currently get market rental growth. For comparison, Germany is the largest residential rental market in Europe (double that of France which is second) and has horrendously complicated rent control which delivers ~1% p.a. rental growth. You cannot remove a tenant. Berlin voted to expropriate residential property from landlords (in an advisory referendum) in Sep-21.

UK risk free (10y Gilt) is currently at ~3.2% which is higher than nearly all the yields you quote above. Granted those yields exclude future rental growth but the risk premium (to the extent it exists at all) does not appear sufficient.

Yeah lot of major countries do have some form of rent controls. US, Canada, China (hardly surprising), Germany, France, Spain, Australia all have rent controls with varying degrees of magnitude. We do have some form in the social housing sector, particularly in Scotland.

Will be interesting if it gets implemented more widely here. Perhaps if Labour get in in the next GE (not sure if it is their policy but may well be by then – demographics point towards it by 2030 latest imo – as boomers die off).

So if capital appreciation is just not there due to my reasoning in my previous post and rental growth is capped, it quickly can become a very poor investment, even compared to alternatives like bonds on “risk and hassle” adjusted basis. In a higher inflation regime, which arguably we are now in for sometime, it can get pretty ugly as an investment.

This article is based on the usual trick of assuming that the property has to be paid for by the tenants and gifted by them to the landlord (that “financing” line item is not a running cost).

In more reasonable countries rents cover at most 30-40% of the cost of paying for the property, landlords don’t expect for the tenants to pay for it and then also to pay a large extra to upgrade the landlord’s living standard too, and not just their balance sheet.

The problem with rent controls, as with any price control, is it distorts the market. This happens right here in the UK – council properties with below market rents being illegally sublet, or tenants no longer in need hanging on even when they should have left long ago (hello RMT bosses). Private landlords caught up in this nonsense exit the market, driving an even greater shortage of housing.

The solution is to build more houses. But we’re going to have to build a lot, lot more – the UK population has increased by 3.5 million in the last 10 years, and continues to grow at that rate.