Note: DeFi is the Wild West of even the wildest frontiers of investing. Seriously, messing about with DeFi makes punting on GameStop look a hobby for widows and orphans. This piece is for general interest and the (mis)education for those who want to know more about the Byzantine realm of DeFi. It is definitely not advice to do anything.

Like Fight Club, the first rule of crypto is: don’t talk about crypto. Unless you’re a crypto ‘bro’ on the Internet, that is.

In which case the rule seems to be to never discuss anything else.

But back in what we increasingly must call ‘real-life’, mentioning crypto to your friends will probably prompt one of several judgements:

- You’re a boring nerd.

- You’re an idiot for promoting a pyramid scheme.

- You’ve gotten rich out of it but they haven’t, and now they feel inadequate.

- They assume you’ve gotten rich out of it – but you haven’t, and now you both feel inadequate.

None of which will do much for your social life.

We’re among a different sort of friends here, however. And let’s face of it – most of us are Type 1s.

So let me tell you a story.

Bank error in my favour

A year or so ago I accidentally made £1 million in a small cap crypto-mining stock, simply because my bank wouldn’t let me send money to Coinbase.

Yes. Really.

Afterwards I rectified the banking situation, just in case I should need to buy any crypto again.

I wasn’t particularly looking to ‘do’ anything in crypto, mind you. I just wanted to make sure the pipes were clear if I got the urge.

Soon enough that opportunity presented itself.

Pump and dump

So-called pump and dump schemes are rife in the crypto world. Long illegal in the real-world, crypto and social media have given them a new lease of life.

Here’s how it works. An organized group of insiders quietly buy up a lot of some small cap coin. They then promote it to their followers, who in turn buy it up and further ‘pump’ it on social media – until at some point everyone ‘dumps’ it onto whomever was last in.

Apart from the initial insider buying, all this unfolds over a few seconds. It’s an ultra-high-frequency Ponzi scheme. Prices sometimes go up 500% or more in a few seconds after the target coin is announced.

Having been something of a market micro-structure geek in a previous life, I thought all this was quite interesting. Especially if I could identify the coin that the promoters were quietly buying it up, pre-pump.

Musing on Twitter about the likely identity of the next such coin, I fell in with some other people trying to do the same.

And we sort of did.

Well, once, and only once, the first time, we guessed right.

We made quite a lot of money in about five minutes. It felt great at the time. But it also gave us a great deal of false confidence .

The truth is we’d just got lucky.

And despite many hours of work – and money spent buying the wrong coins – we never repeated the trick.

Also whilst we’d never actively promoted anything, it raised the question of whether we were taking advantage of the same suckers as the promoters?

So we gave up.

Mental accounting

A healthy dollop of mental accounting and house money bias meant I kept this pot in cryptocurrency.

Indeed I’d learnt quite a bit about the crypto ecosystem in my explorations. (Not least that it contained a lot of scammers.)

So I set myself up for the long haul. I got a hardware wallet, bought a few coins I liked the sound of, and then put the rest in stable coins.

The question then turned to how to maximise the yield on these assets.

DeFi lending

My first introduction to decentralized finance (DeFi) was lending my stable coins on platforms like AAVE.

The concept here is pretty simple. A borrower posts collateral, say Ether. They then then borrow against it, at a loan-to-value (LTV) of say 30%.

If the price of Ether falls such that the LTV rises to 60%, for instance, the Ether gets sold automatically.

But why would people want to borrow stable coins against their crypto?

Two reasons:

- Tax. Let’s say I have $10m worth of Bitcoin that I bought eons ago for circa $0 (I don’t for the record), and I want to buy a house worth $2m. I can sell $3m worth of Bitcoin, pay capital gains tax of $1m, buy my house, and be left with $7m worth of Bitcoin. Alternatively, I can borrow $2m against my Bitcoin, buy the house, pay no tax, and still have $10m worth of Bitcoin.

- Leverage. Is 200% annualized volatility not exciting enough? A crypto whale might do the same trick but buy more Bitcoin with the money they’ve borrowed. This is pretty alien to me – I prefer to apply leverage to low volatility assets like property or bonds – but each to their own.

All this is managed through smart contracts, so there’s no need to trust anyone. (Okay – it’s slightly more complicated than that).

These sort of arrangements are one reason why crypto is so volatile – automated liquidation cascades from leveraged platforms.

Anyway, lending on these platforms could net me mid-single-digit yields on the USDC stablecoin.

I don’t like the more popular Tether (aka USDT), because it seems so obviously dodgy. For a while I even tried depositing USDC on the AAVE platform, borrowing USDT, selling it for USDC, and then depositing the USDC back in AAVE.

Effectively that created a position where I got paid to be short USDT. But I suspect we may be waiting a long time for that situation to blow up.

Incidentally, if you’re earning yield in one of the centralised exchanges like Coinbase, they are just doing this sort of thing on your behalf – for a cut.

Much simpler and maybe worthwhile from an admin perspective.

Liquidity provision

Soon enough even this got pretty boring. So I started experimenting with Automated Market Makers (AMMs) and liquidity provision on platforms like Uniswap and SushiSwap.

AMMs are a central DeFi building block. They enable users to swap one token for another in a trust-less fashion.

I’m not going to get into the mechanics (others have). In simple terms, you supply a pair of tokens (ETH and USDC, say) and you’re betting that the fees earned outpace the losses from being arbitraged.

The risks?

The biggest is the deceptively-branded ‘impermanent’ loss (there’s nothing impermanent about it) if one asset moves a lot versus the other asset.

And of course ever-present smart contract risk.

Yield farming

The hyper-competitive nature of DeFi means that protocols (coins and tokens) are competing with each other all the time.

Hence they’ll often pay you (in yet another pointless token) for providing liquidity on their platform, as opposed to someone else’s.

You want to sell these ‘reward’ tokens as soon as you can. They aren’t really useful for anything else – they are ‘down-only’ assets.

But why not automate the process, constantly sell the rewards, and invest the proceeds back into the liquidity pool?

Doing it manually is a bore – but there’s an app for that. So-called ‘yield optimizers’ get it done whilst adding another layer of smart contract risk.

And guess what? These all compete with each other too, so they’ll pay you in some other pointless token to use their yield optimizer.

And so on and so on. You can see why people call this stuff ‘Money LEGOs’.

(The lingua franca of crypto is American English, so no, not ‘Money LEGO’.)

More DeFi hot air gas

The amazing thing about the whole space if you come from a traditional finance background is the rate of innovation.

Teams build platforms that attract billions of dollars of Total Value Locked (TVL) in a few weeks or days. That’s less time than it would take to get your idea on the product committee’s agenda for discussion back in the centralised world. Let alone actually build anything.

There are downsides. Many of these are scams (so-called rug pulls) for a start.

Also, you’ve got to keep moving your money to get the best returns. Every time you do, you pay a bit of ETH, called ‘Gas’. And that can really add up.

In fact you can go to fees.wtf to see how much you’ve spent:

[Details obscured for privacy.]

Um, $11,000 in transaction fees? Fees.wtf indeed!

I thought this stuff was supposed to cut costs by removing the middleman?

Picking up pennies

Soon enough I was seeking out cheaper blockchains, which, once you’ve ‘bridged’ over to them, open up whole new ways of getting confused. But at least less expensively.

Before you know it you’re:

- On the Binance Smart Chain staking your Cake-BNB LPs on Pancakeswap to earn CAKE that you then stake in its auto-compounder to earn still more CAKE.

- Using Solona and the appropriately named tulip.garden to leverage yield-farm some Samoyedcoin-USDC (with obviously the borrow on the $SAMO leg – leaving you net short the ‘shitcoin’).

- On Terra using the Mirror Protocol to run a delta-neutral long/short farming strategy, but obviously using Spectrum to auto-compound and earn extra $SPEC on the long-leg, to effectively earn 40% or more on UST.

And no I’m never going to say any of those sentences aloud.

Eventually you come across a flowchart like this1:

You think you understand it. You even start to think about putting the trade on.

But then you remember….

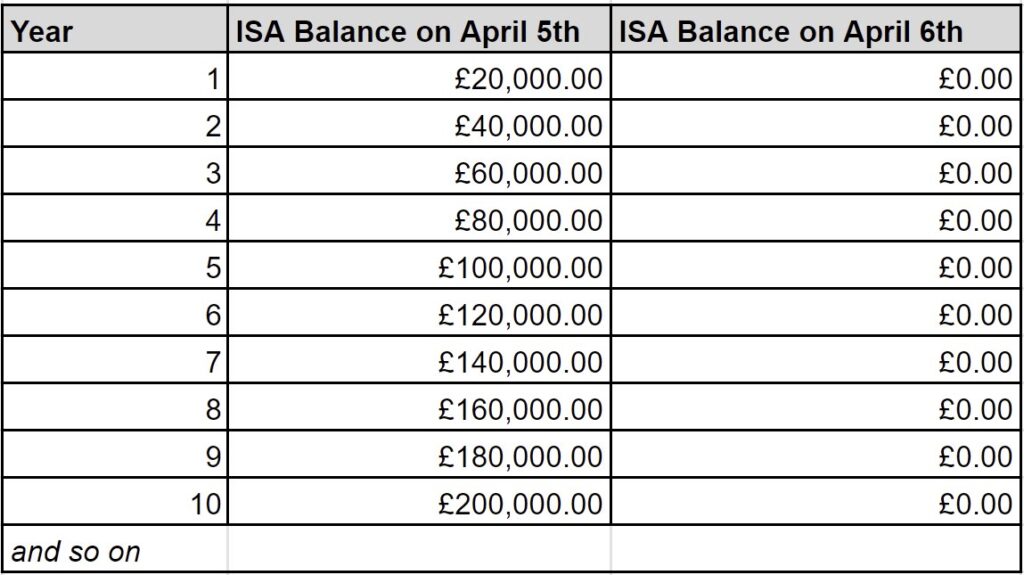

Yes, you pay tax on your DeFi gains

It may be news to some of my fellow Guardian readers (“Crypto is burning the planet and is only used by crooks”) but you pay taxes on all of this.

Taxes should be simple. I’ll just give my ETH address to my accountant, and we’re good right?

After all, it’s all publicly on the block chain, isn’t it? My accountant can surely just look it up on Etherscan? In fact I should be able to provide my address to HMRC and it can send me a bill, right?

Sadly that’s not the world we live in.

Whilst HMRC has published some good guidance, there’s still a lot of reporting stuff on a ‘best guess’ basis.

Some tax tips

Monevator is not able to give tax advice. However here are a few things to be aware of:

- Do not believe anyone who tells you that tax is only payable once you convert crypto to real money. This is nonsense. Swap ETH for BTC and that’s a sale of the ETH and a purchase of the BTC. There are capital gains tax (CGT) considerations.

- The native reporting currency of crypto is USD. There’s always an extra leg on cost / proceeds calculations to turn it into sterling (GBP).

- There’s a lot of transactions on which both income and capital gains tax are effectively payable. If you receive ‘rewards’, you pay income tax on their value when you receive them. You also form a cost basis, because you will pay CGT on any gain when you sell them. Far more likely though is the opposite problem: their value will fall. When you sell you probably won’t even receive enough proceeds to cover the income tax to pay. Nice!

Tax complexity is a deterrent from engaging in the racier stuff. It’s not the paying that’s the problem. It’s the paperwork.

The lack of any sort of tax wrapper – such as an innovative ISA – or failing that just a simplified reporting regime is frustrating.

Crypto bros get about as much public sympathy as BTL landlord though, so I can’t see this changing any time soon.

Why is there money to be made in DeFi?

In my experience you can make fairly low risk returns of 10-30% per annum in DeFi, at least at the moment.

Which leads to the obvious question: how come?

If we pop our Efficient Markets Hypothesis (EMH) hats on, there’s a few possible explanations:

- Reasonable pricing for risk. These yields represent the correct pricing for all the risks: smart contract flaws, bugs, rug pulls, hacks, legal issues, wrench attacks, self-custody risks, tax risk, and so on. Most of these are uncorrelated with the other risks I take in, say, equities. To be clear, I’m not saying crypto prices are uncorrelated with equities. As we’ve been reminded in recent weeks, these are risk assets like any other – and stablecoin pegs will probably not be maintained in extreme risk-off scenarios. What I am saying is that the risk of my MetaMask wallet getting hacked is not correlated with stock prices. Which all suggests, from an efficient frontier perspective, that there’s a place for a small allocation to defi in a wider portfolio.

- Arbitrage constraints. This theory holds that there’s friction between the crypto and real-money worlds, particularly from an institutional perspective. This constrains arbitrage. Why else would pension funds invest in junk bonds yielding 3% a year, when they could deposit in Anchor Protocol and earn 19.5% a year? I believe these constraints must exist, at least to some degree. But why don’t rich individuals already in crypto bid away these opportunities? Maybe double-digit annualized returns on stablecoins isn’t enough excitement when they believe they can make a 1,000% return on SHIB INU, or whatever.

I suspect there’s a bit of both going on.

Either:

- The whole space will blow-up. Yields are currently high because of the demand for stablecoins to speculate on ‘proper’ crypto. In a long bear market for crypto the demand won’t be there. Hence yields will fall.

- Alternatively maybe institutional money will eventually find the market. Again, yields will then fall.

Either way, yields will fall. It’s only natural. Markets always get more efficient as they mature. Hence why I’m making hay while the sun is shining.

WAGMI! But please please read that disclaimer we started with.

You can follow Finumus on Twitter or read his other articles on Monevator.

- If anyone knows the source we’d love to link to it. [↩]

Comments on this entry are closed.

After watching the Line Goes Up video on YouTube and doing some reading my mind is finally, most definitely made up. The whole crypto space is just a ridiculous, unnecessary waste of energy and resources. Solution looking for a problem indeed.

The sooner this scam dies the better.

What a fascinating rabbit-hole.

“In my experience you can make fairly low risk returns of 10-30% per annum in DeFi, at least at the moment.

Which leads to the obvious question: how come?”

Applying Occam’s Razor, the simplest explanation is that this is not “fairly low risk”.

It’s complex, volatile, relies on fly-by-night markets and smart-contracts using insecure protocols.

Still, a great article!

-Stuart

-Stuart

Wow, I couldn’t even pronounce some words 🙂 Nice article!

Thanks for the article, Finimus. Like some of my fellow commenters, I’m highly sceptical that crypto in its current form isn’t anything more than a speculative asset rife with scams – but the blockchain genie won’t be put back in the bottle.

You mention that one of your biggest gains from exposure to crypto came from holding a mining company. That ship has sailed, but what would you now recommend for an investor unwilling to wade into the dizzying complexity you describe? What should one do in a bog-standard S&S ISA?

@Thomas Elliot

VanEck do a ‘Digital Assets’ ETF (DABG/DAPP), which I’m using as a Crypto proxy in my SIPP / ISA. Correlates well with BTC at the moment…

Fascinating article @Finumus – perfect timing for me, as I’ve entered the rabbit hole on this recently.

took me a while to work out if this was serious or a parody. it has reassured me that crypto is not for me!

Tether is primarily backed by Bitcoin, or real fiat USD loans collateralized against Bitcoin (the opaque “commercial paper” for the “audit”?). It’s likely over-collateralized but it’s not backed 1:1 with USD.

Tether mint say 50% (number pulled out my ass) of the value of their Bitcoin holdings, and people use those Tether to buy more Bitcoin, driving up the price further. They were able to establish this fiction via their ties to Bitfinex (the bitcoin exchange) and as long as long-term net demand for crypto stays high it won’t pop.

It’s entirely conceivable UST/BTC crashes and drags real USD/BTC and USDC/BTC down with it, and imho the yields you can get lending your stablecoin reflect that risk.

Thank you.

Confirms my decision to give that area a miss.

@Wonky

I agree that the Line Goes Up video was well worth a watch to really spell out some of the big problems in the crypto/defi/NFT space and why I won’t be touching it with a barge pole!

Very good, balanced and informative piece Finimus. I’m nowhere near as clued up as you; my minor dabbling so far has really only brought home the point that you – unlike many DeFi types – flag very clearly: that gas fees mean you have to invest a pretty decent chunk (£5,000+?) to make this worthwhile, at least on the Ethereum mainnet.

I’m looking at some of the alternatives, but I’m unconvinced that the extra hassle is worth moving away from the likes of Crypto.com, Celsius and BlockFi (other providers are available etc.) where you can get 10% pa and the process is so much easier. I’ll probably persevere though as it’s such an interesting space.

Loved reading about your adventures, Finumus. Good luck gun-slinging in that arena. Sounds like you’re earning every penny. Or Gwei.

@Thomas Elliott – Agree that the mining thing is likely over (I just got lucky there). I can’t really ‘advise’ anything. I don’t disagree with others here that it’s now getting a bit late to bother. There’s really no edge in trying to punt shit-coins and stablecoin yields have already fallen quite a lot (even since I wrote this over Christmas). I’m not sure I’d bother with the complexity now. There are a few listed options that you can hold in your ISA (like KR1 – NOT a recommendation), which will likely give you ‘beta’ exposure to the whole space, if that’s what you want.

@David “took me a while to work out if this was serious or a parody” – Thanks – I’ll take that as a compliment.

@c-strong Yeah, it’s not really worth doing anything on Ethereum at all unless you’re a ‘Whale’.

When I started reading this post, I thought that perhaps this would finally change my mind about investing in crypto.

But no, I was none the wiser by the end of it all, despite finding it a fascinating read, so will continue to watch with interest from the sidelines whilst others get rich (or not).

Thanks Finimus. I’ve been running some Uniswap LP positions over the last month, and its quite something. As I understand it impermanent loss only takes effect on cashing out, so its not necessarily permanent if prices return to the initial, and if its an upside move, then not so painful – within reasonable movement. I have thought of it as a hedge against a flat/meandering market.

V3 is interesting with the ability to concentrate liquidity within a chosen price range – and multiply the return accordingly. Higher APRs are possible then, but with the narrower the set price range its a bet against movement over time (getting back to breakeven after fees), or could be made as an active trade, with some prediction of the future. (The irony of not wanting the price to go up too quickly.)

I also wonder how the yields will trend long term (fee based as opposed to distribution) , perhaps dilution of the pool will be offset by increased trading volume. The move to Ethereum proof of stake may affect returns if gas prices are lowered, although who knows which way!

(Defi-labs have a nice tool for doing back testing.)

Thanks for that post, it was indeed very interesting. I was firmly against crypto and personally still am but I unfortunately succumb to the fomo and put a very small amount in a couple of things last year, it’s only like an extreme emerging markets percentage but still. I couldn’t invest any large amount in any of it as I really don’t believe in it long term in the slightest.

TFJ

Really good read.

I dipped my toe in defi last year out of curiosity… the products and rate if innovation are fascinating.

The tax headache means I’m not currently active. Massive headache (I had to write a program to pull daily eth prices to calculate my daily income in gbp from a rebalancing token).

I don’t see a tax wrapper for bleeding edge products any time soon but I sincerely hope we see both a clarification of tax rules and a reversal of the ban on simpler crypto derivatives like BTC backed ETNs in the nearish term.

Interesting view and excellent effort with misspelled Solana but hey!

Talking of Solana there is an option of staking directly though your wallet. You give away your vote but not your coins. The rates are not high about 6 % APY but you keep FULL custody of your coins. Staking means giving away your vote. Lending means giving away your coins / tokens.

Talking of gas fees they vary from coin to coin but the trend is to bring them down to zero (but not completely zero as you need some fees to run the chain). Staying with Solana the fees are <0.000002 Sol (1 Sol = $100) per transaction. However, you need to make a contract (rent 0.002 Sol) for every new coin / token but as you create a new contact only once you pay once. You can close the contract and get your rent back. Not sure why it called rent, sounds more like deposit to me. And because gas fees are so cheap you can rotate between DeFi platforms.

There are many reasons for people borrowing at high APY (NFT is the Zauberwort). For example, if you want to participate in exciting new projects you need to stake quite a bit of coins. However, only for a short time like a week or two. Often it is worth it so taking the risk and borrowing at 3x or to get something of value. Value is through the eyes of beholders of course.

My recommendation is to give it at least a try. Crypto is not Bitcoin. The bad reputation the crypto has is because of Bitcoin. There is so much more than ETH and BTC.

My main concern with crypto is that everything is literally chained to BTC/ETH. It looks like the herd of trading bots. That's probably the biggest systemic risk. Crypto "unchained" from these two bad boys we may be at the beginning of something beautiful. There is not much to do in Cryptoworld: do a bit of NFTs, buy a domain name, some virtual land, play some 80s style games, see trailers for upcoming decent games. But not much really. It reminds me of early Google Playstore.

Great to see balanced articles on amazing Monevator blog!

Brilliant writing @Finmus.

If I ever need that much excitement in my life I have a better grasp of it now. Happily I don’t so I will avidly watch the show from the sidelines with the same enjoyment my grandma took from watching westerns on T.V. in the 70’s. (she never owned a gun to my knowledge).

You are a great addition to team Monevator. Please keep up the good work

JimJim

Feels a bit like the underpants gnomes in that I only understood the beginning and the end (but still caught a whiff of the excitement).

Thanks for this, a very useful, up to date and entertaining description of how bonkers this tulip bulb activity has become. I hate to think what economic damage will result when the whole thing comes tumbling down.

I especially loved this bit: “Alternatively, I can borrow $2m against my Bitcoin, buy the house, pay no tax, and still have $10m worth of Bitcoin.”

What could possibly go wrong there I wonder?

I have dipped my toe into Crypto recently.

Only very small. I have bought £100 of Solana and Etherium.

So far down %40 in a month. I am going to hold !

Sounds like if the Bank of England was into this stuff then we’d have the national debt sorted in no time LoL!

… more seriously, please, please, PLEASE reassure me that my bank isn’t allowed to speculate in this market with any customer deposits?

Good article, although I’m surprised you didn’t mention Hex. It is much more secure than the products you mention (is is triple audited, has no smart contract risk and has 100% up-time), and Hex stakes average 38% returns a year. 77 thousand wallets have staked $11B worth of hex for an average of just over 6 years.

@Jud, the writer may have avoided mention of Hex because of concerns it could be a scam. The writer may respond but anyone can do some searches on Hex and make up their own mind.

@MRN The crypto space is rife with scams and anyone interested in this space should investigate thoroughly before investing. People have been calling Hex a scam from the beginning in the same way they did with Bitcoin, which is (IMO) fundamentally due to a lack of understanding of the product. There’s literally a dedicated page on the Hex website (click the scam link at the top) addressing all such claims. If you learn how Hex works and still think it is a scam, be specific. A blanket ‘this sounds like a scam’ is not good enough.

@all — Appreciate the comments and interesting asides about various other cryptos et cetera. However I am not sure readers of these comments will benefit from a long debate about the merits or otherwise of a specific token.

There are better places on the Net for that kind of discussion. If we could focus please on the higher-level factors (which may include big picture reasons why the entire space is an opportunity or conversely a Ponzi scheme!) I think that’d be more useful to the more generalized readership here. Thanks 🙂

Great article as always @finimus – really enjoyed it. Like @jimjim’s gran it’s the same kick I get from watching Narcos on Netflix! A fascinating insight and thrill from another world!

Great article. I see a lot of similarities with how the internet started. It is just as complex and you’ll never feel like you have a grasp of the full picture (HMTL, HTTP, DNS, ISP, NAT, FTP etc).

It seems petulant to sit at the sidelines and shout “scammers” into the scrum with a sense of achievement.

Adding another tool to our toolbox is something to be celebrated. If it proves to be useful, we sure as hell will find out how. We are still feeling our way in the dark (and there will always be bad actors operating in the dark) but it is hard to not feel awe at the depth and breadth of human endeavour the technology has helped unlock.

If you make money along the way, all the better. If it all amounts to nothing, no matter. Nothing ventured, nothing gained.

One thing I’m struggling to understand with all these coins and schemes is what value to they bring to society?

I remember (and dabbled in!) playing around with Bitcoin in the early days, it was touted as a new currency, magic internet money that would free us from middlemen, remittance fees and help bank the unbanked.

That all fell out the window once the bubbles, speculation and mania took hold. No one talks about these things as currencies anymore, instead seeing them as a store of value/speculative investment, and no one can seem to explain the usefulness of it all other than “the numbers go up” and hoping they’re not the one holding the bag.

Sure, people are free to do what they want, invest it what they please, but I can’t see what the end result is other than everyone playing a game of hot potato.

At least with shares, IPOs etc you can sort of make a connection between your investments and the companies you invest in. With crypto I can’t see it.

“On Terra”. Ahhh. But hopium is hard to kill, and with the AI crowd, crypto maxis and tech accelerationists in full swing after the red sweep post 4 Nov maybe, just maybe, this time it is actually different 😉

Raoul Pal gives the Bull case today:

https://youtu.be/G2pC-zZGFBs?feature=shared

It’s either plain crazy or just brilliant, but – in either case – it’s twice as fun playing at 2x.