It’s been nearly three years since I last talked about financial independence (FI). I’ve been keeping my head down because The Investor threatened to send the boys round to give me a lesson in volatility if I missed another Monevator: The Book deadline.

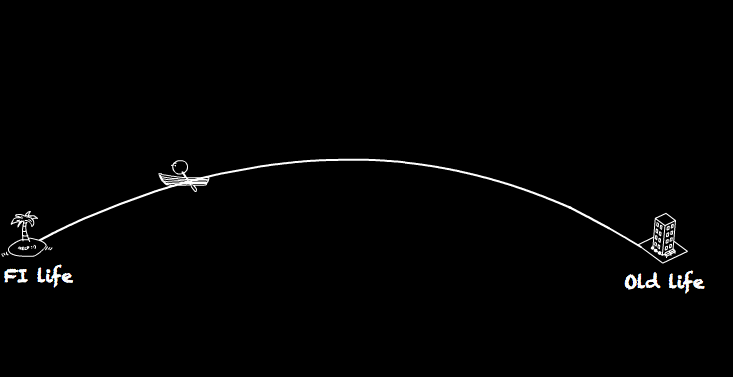

I was three years into a ten-year FI journey and feeling the pain. The launch party excitement lay in the past. The reality had become an endless trudge through mental Siberia.

Much has changed

I passed the halfway point on my calendar in 2018. I passed the halfway point on the spreadsheet in 2017.

Now I’m three-quarters done. That changes a man.

The FI dream feels real. The way ahead looks like a downward glide. Is it me, or are those milestones spaced a little closer together now?

I can report that:

- Passive investing works.

- Setting big, hairy, audacious goals works.

- Saving a massive proportion of your income works.

- Ditching consumerism works.

The mechanics work. The rest is down to the human.

Nothing succeeds like success

Now I can sense freedom on the wind, I’m as happy as a Bisto Kid floating on gravy.

I’ve stopped worrying about the process. Frugal living is not a chore anymore. Mrs Accumulator and I have absorbed it into our systems like friendly bacteria.

But we’ve also lowered our optimisation guns. We weren’t going to last ten years – much less the rest of our lives – if we pinched every penny.

We planned on a £20,000 per year FI income back in 2013, when we first tried on our FIRE suits.

That amounts to £22,515 in 2018 according to the Bank Of England’s inflation calculator.

But we’re banking on £25,000 per year now. We’ve loosened our belts a notch to allow for a slightly fatter FIRE.

Playing with the numbers

We got another boost through ongoing financial education. The original plan called for a stash of £666,000 to declare FI at a 3% SWR (Sustainable Withdrawal Rate).

The standard 4% rule was and is too risky. But there are techniques to help you manage a higher SWR without inviting disaster.

It’s not a free lunch. They may mean you have to cut spending during rocky periods. You will have to run a more flexible and challenging deaccumulation strategy. I’ll go into more detail in future posts but the pioneering book Living Off Your Money shows you one way to go about it.

The knowledge upgrade means I think a 4% SWR should work for us. Especially as I previously left the State Pension out of our plan. As my free bus pass draws ever closer, it’s probably time to stop overlooking what is likely to be our most reliable source of future income.

Here’s the maths:

Divide £25,000 FI income by 4% SWR

Our stash requirement = £625,000

So that explains how those milestones moved closer together. I converted them to kilometres part way through!

I haven’t spent all my time cooking the books. We originally aimed for a 67% savings rate. We’ve actually nudged over 70% every year, bar a 60% blow-out in 2015.

This. Is. Doable.

Snag party

Our savings have mostly gone into pensions. Problematic!

Our 40s are waning and at this rate we will be theoretically FI – but marooned from our assets for a few years. Diverting new funds to go into ISAs will bridge the gap but also muller our savings rate, so we could still be half a decade from journey’s end at this point.

I’m also finding time to peel back more onion layers from my neuroticism.

What if FI isn’t for me? What if it’s a mirage? What if I find a new laundry list of things to be unhappy about? Except this time they won’t be external problems like getting up on a Monday – rather a bestiary of personal demons like loss of purpose, identity and structure.

The upside of FI is that I’m less worried about a financial deluge sweeping us away. We can’t defend against every risk but at least these days we live in a house on stilts.

The downside is that now I’ve freed up that brainspace, it’s as if I’ve nipped down to the anxiety exchange to see what other troubles are available.

I think the answer here is working on one’s self. The great thing about the FI journey is that it causes you to reexamine everything about your life.

I’ve mostly been trying to find out what really matters to me through books.

Here’s a few I’ve found helpful.

Being a better version of yourself

Man’s Search For Meaning – Viktor Frankl

An incredible book on how to live. Frankl’s insights are powered by his experience as a psychiatrist and Holocaust survivor.

The Road To Character – David Brooks

Case studies of inspiring figures who lived before the Age of Celebrity. Brooks’ thesis is that even the ‘greats’ are not the finished article out of the box. We can become better versions of ourselves as we learn to give more of ourselves.

Meditations – Marcus Aurelius

Wisdom from the most powerful man in the world – in 161AD. The Roman Emperor’s insight stands the test of time nearly 2,000 years later.

Hope for the future

Healthy At 100 – John Robbins

Why old age doesn’t have to mean decrepitude. Inspiring lessons from the Blue Zones: remote communities that seemingly enjoy better health than the West, and whose members often live vigorous, purposeful lives well into their 90s or even 100s.

The Better Angels Of Our Nature – Steven Pinker

The case against the ‘World is going to hell in a handcart’ brigade.

The Righteous Mind – Jonathan Haidt

Why does our society seem so hopelessly split? Can we heal the divisions and build greater tolerance for those who disagree with us?

Staying on course

Midlife – Kieran Setiya

Combating the midlife blues.

The Antidote – Oliver Burkeman

Ya, boo to ‘don’t worry, be happy’ positive thinking. Embrace uncertainty and insecurity with this secular mash-up of Buddhism and Stoicism.

Status Anxiety – Alain de Botton

Advice on resisting the dessert trolley of consumerism.

If this reading list is anything to go by, we’ve known the secret of flourishing for two thousand years. It’s just we’re spectacularly ill-adapted to acting on it.

I’m working on rewiring myself as best I can. I’d love to know if you are too.

Take it steady,

The Accumulator

Comments on this entry are closed.

Fantastic post, Accumulator. I passed frugal FI a year or two back – but otherwise our situations are very similar. Mid forties, house is paid for, the pension about as loaded up as it needs to be – but it would be a rather frugal existence to survive on savings until I reach 55 or thereabouts (even assuming they don’t move that goalpost!)

For now, I’m still working but gone part-time and changed role to increase the fun quotient. For the last year or so, I’ve focussed on improving overall happiness levels through strategic use of time and money (ie experiences over stuff, doing more in my local community, taking part in group activities with a diverse range of people, learning new skills, meditation, revisiting things I enjoyed as a child but with an adult twist, massive news diet, tweaking nutrition). I am taking the view of hoping for the best longevity of health wise – but being mindful of the worst in terms of making sure I do things I’ve always fancied doing (a couple of peers have died in recent years). Overall, I’m more open to experimenting with new ideas and so far I’m pleased to report that it is working.

Great to see Accumulator posts back on the menu.

Is the book all but finished then?

You’re ahead of the game in realising reaching FI is no panacea. Good to have considered that possibility before you get there.

What will probably happen is that you’ll just move a rung or two up the ladder in terms of the questions you ask yourself, i.e. you’ll have to figure out some other meaningful challenge to fill the gap that’s left and those challenges will be a bit higher-level and more abstract

with the benefit of hindsight, I wouldn’t wait in order to move on sequentially to post FI goals. If you can dream up what those subsequent goals might be then get going on them in parallel as soon as possible.

that way you’re guarding against getting run over by a bus before you’ve done something valuable but also you’ll blur the FI finishing line leaving yourself less vulnerable to any feeling of ‘is that it?’ – in other words, a bit of ‘transition management’ could be a wise move

More of an incremental rather than big-bang approach to it all. My feeling is that is less psychologically wrenching, but for sure, as RIT has shown, a lot less exciting and entertaining so might not generate as much useful content for the monevator magazine.

good luck with it all

I read Frankl’s book a while ago. I remember the story of the man who’s shoes had disintegrated on the morning he was supposed to march to work, he just sat on his bed sobbing, no doubt aware of his fate!

In my kitchen I have a tap that when turned on clean hot water comes out! I have a machine that washes my clothes! I have another machine that keeps food preserved for months! I have a horseless carriage that carries me wherever I want to go! I’m grateful for these small miracles.

Two books I want to read are:

The Gulag Archipelago, by Aleksandr Solzhenitsyn

A World Lit Only By Fire, by William Manchester

Interesting post. Is the £25k per person or for both of you? Do you have children and own the house you live in outright (no rent but upkeep on the house)? RIT uses a similar number but he has no children and I’ve always assumed his allowance is for him only and his partner has their own allowance.

Moving your SWR from 3% to 4% seems counterintuitive. The Monevator S&S portfolio has an SWR of 2.79% (using 50bp of fees) over a 40-year sample horizon and 2.58% over a 50-year horizon mapping it’s asset allocation to the DMS dataset. To raise it, I’m assuming you’re planning on using dynamic asset allocation and dynamic withdrawal rates. DAA seems effective (then again Hindsight Capital never loses money) but I find DWR (say GK guardrails) to be useless. The volatility of the income stream is just too high. Be interested to see what you guys have come up on this in a later post.

@Rob — It’s insane, isn’t it? I read a lot of history when I was young (including The Gulag Archipelago when I was too young, I think pre-teens or shortly after) and combined with going into hospital a couple of times before I reached my 20s I think it set me up for being happy (or as happy as I get…!) that I wasn’t being shot or made to shoot people etc and subsequently more than satisfied with my decadent graduate student lifestyle for decades.

If memory serves, I think RIT does have kids..

@ZXSpectrum48k I was also curious about the £25k. Personally, £25k for my family would be one heck of a struggle – we do have a child to look after though.

It’s something I am always trying to discover. Just how much do people need in retirement? Some people do manage to retire on a very small income.

@TA “The Better Angels of Ourselves [sic]” – Steven Pinker

Clicking on the link, I see that the book is actually called “The Better Angels of Our Nature”. Also, looking at the one star reviews, there appears to be legitimate, very heavy, criticism of Pinker’s methodology and conclusions.

Scan it with your “anti-gullibility software” before reading would seem to be a necessary caveat for the tome, or perhaps better still, don’t read it at all!

@Rhino @ZXSpectrum — I believe @RIT has said he has no kids and I believe his number is for his whole household to be self-sufficient. But I don’t follow the personal details of FIRE posters’ lives as closely as some so I may be wrong.

These arguments invariably tend to descend into edginess (obviously we’re not at all seeing that here as yet, just forewarning!) but I think £25,000 is easily liveable outside of London if you own your own home, especially with no kids. (The Accumulator has discussed some of his home ownership before. E.g. https://monevator.com/investing-versus-mortgage-risk/.)

From memory the median *household* income outside of London isn’t much more than £25,000! And many of those people will still be buying a home / renting — not to mention trying to save for their own old age. Plenty will have kids.

So I think £25K-ish in today’s money with only maintenance housing costs can certainly be done, and it isn’t a state of penury.

Of course on the other hand we have the Guardian or ThisIsMoney profiles of people who can’t get by on less than £100,000 a year. Which is why this subject gets so toxic. It’s pretty clear it’s a personal decision to a great extent. We should try to respect each other’s lifestyle decisions as much as possible, I think, while still reserving the right of course to debate the maths! (Again not saying anyone isn’t doing that here, just trying to ward it off from others, in advance! 🙂 )

(Also a good point to mention this whole low-ish (cough median cough) income FIRE thing is so much easier in the UK than the US because we have the NHS…)

As for the SWR, first please remember the S&S passive portfolio is a model portfolio, not exactly how @TA invests, so it isn’t a guide to that.

But anyway the main changes to his thinking came through the McClung book he mentions in the post. (With some extra thoughts from here I believe).

I will leave @TA to say more on the SWR if/when he gets time off his work slavery, because I only follow the discussions of it for general interest.

Personally I believe two things — that precise SWR are utterly pointless outside of a vague fat middle band, so don’t sweat the tails, and that in reality anyone who retires early with anything like enough money to realistically think of being supported by a 4% SWR is going to be able to cut their cloth if things get rougher than expected, so again don’t sweat it.

If the entire world and hence all global assets “go Japanese” let alone early 20th Century Chinese, well you’re screwed. But what are the chances? You only live once, to set against them…

Similarly, if you are a frugal sort who retired before 50 with say £1m and the world basically continues as it has for the West but at some point a rough market (/inflation) means you have to drop your spending from £25K to £22K for a few years, or work Thursdays and Fridays, or what have you, I strongly suspect you can. (Someone will say “but what if you’re ill”. Well, good thing you had some time to yourself before you got ill then, eh? 🙂 Presuming FIRE didn’t make you ill! 🙂 )

But anyway I am a loose cannon on all this stuff and I don’t actually expect to never earn an (optional) income so I’ll leave it to the SWR aficionados to debate. 🙂

@Factor — Eek, thanks, I should have caught that myself after hearing 100 podcasts wax lyrical about it last year. Personally I think the world is (/was, until a few years ago) getting appreciably better, but I don’t think our natures are improving, I think more of the world has fairly robust systems and rules of law. And as ever I leave out the environment here, where all the Hans Rosling happiness hits the buffers for me.

I think our natures are such that if there was a ground war in Europe that went on for a few years there’d be horrors galore. Same as there ever was. And similarly if we were all trapped on a boat running out of food. Civilization exists outside of ourselves.

haha – maybe RIT will swing by to clarify?

when kids first came along I wondered what all the fuss was about, expenses stayed largely static for a year or two – but like the boiling frog, they creep up over time and mine have pretty much doubled in size now over an 8 year period (thats expenses – the kids have more than doubled in size). Inflations a chunk of that, and I have consciously (with difficulty) loosened the reins a little but kids are (for me) demonstrably significant to the bottom line!

Pinker has a marmite quality to him. The best opposition to hell-in-a-handcart I’ve read so far was The Rational Optimist, Ridley is a brilliant writer. There’s not many that could be utterly convincing arguing that its ecologically imperative to burn as much fossil fuel as possible?

I’d say Haidt is pretty essential reading and Burkeman and de Botton are very entertaining.

I would strongly argue that you need to deeply read some literature on any topic for you to truly absorb it.

Maybe I’m just a bit old-fashioned – but when I was a student you had to absorb complex information in solid (paper) form.

Fast forward to the present day and my attention span is so much shorter that I skim through many things and when it comes to Personal Finance and FIRE, there is no shortage of material written on the internet for you to read.

And the problem with reading occasional interesting articles that pique your interest and look like fun about FIRE is that a lot of any topic is not that interesting, not fun and certainly don’t contain between 400-600 words for easy digestion.

I have an old copy of Your Money or Your Life and I’ve followed all the stages and have read it from cover to cover. The steps that you need to take are as much a mind-set shift as just saying “I’m going to become financially independent”.

And when it comes to reading articles or blogs – it’s so much easier to read something that agrees with what you already think. It’s like following the path in a walk through the woods. What you should be doing is going off-piste and finding your own path – it’s only by doing that that you understand more about something that you’ve just learned from following others.

From GFF who’s on a digitaldetox and realises that his brain is destroyed by phonescreens)

I think TI hits the nail on the head pointing out that someone who has the wherewithal to save 25 times annual expenditure has a vanishingly small chance of ever being hard-up. The two decimal places in ZXs calculation highlight the difference between the theory and the practice.

The dividing line between good and evil runs through every human heart as they say…

Some people live on only universal credit and food banks, so running out of money needn’t cause retirement failure. That to me provides a baseline which frugal living has largely prepared me for. Overcaution about running out could make us the richest people in the cemetery

https://www.jrf.org.uk/report/minimum-income-standard-uk-2018

The The Joseph Rowntree Foundation says £40k/family. So, taking out kids and having paid off a mortgage, maybe £25k for a couple would be fine.

Personally, if I am considering food banks in retirement, then I would consider that a failure. I expect in retirement that I will retain my present lifestyle in full, minus the work!

I will have a teenage daughter in retirement, so I’ll aim for the £40k mark for our family. By coincidence, that figure is what I was aiming for all along 🙂

@Rhino. I’m perfectly aware of the difference between theory and practice. Rates are quoted to a minimum of 2dp by market convention. Such a convention implies nothing about the uncertainty or margin of error. I’ve always thought that Feynman nailed it when he wrote on his blackboard: “what I cannot create, I do not understand”. So I didn’t simply read numbers out of a book with no thought for what they mean. I did those calculations myself and can switch between numerous data sets, so I’ve got a pretty good feeling for the error margins. I’ll say no more since I have clearly raised peoples’ ire.

@ZXSpectrum48k — You wrote: “I’ll say no more since I have clearly raised peoples’ ire.”

I hope you don’t think that includes me! You’ve never written a comment I’ve read that’s raised my ire (though a couple have gone over my head. 🙂 ) Trying to make sure you didn’t reach this conclusion was why I said a couple of times in my comment that I didn’t think anyone had said anything untoward/unhelpful so far! 🙂

@AAJ @all — It looks like median household income was a bit higher than I thought (inflation, eh?! 😉 ) checking in with the ONS here:

https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/householddisposableincomeandinequality/yearending2018

They are estimating UK disposable household income at £28.4K.

“Disposable” is after direct taxes, so probably similar to a tax-efficient early retiree who made good use of ISAs, SIPPs, and various allowances along the way (although it’s also after Council Tax, of which there’s no avoiding.)

As I commented above though and the FIRE gurus rightly stress, once you’ve reached ‘your number’ you’re no longer saving, whereas these people presumably still are.

I agree £40K sounds like a better lifestyle to me, but as I mentioned above there’s a difference between what any particular person would like, what another can get by on, and the crossover of what’s achievable given the risk, as @Matthew says, of running out of life before money. 🙂

haha – you certainly haven’t raised mine. You’ve just blown my mind with how quickly you managed to crunch the relevant numbers! I imagine those rubber-keys may have been starting to melt?

Very interesting discussion all. Some thoughts:

1. I think it’s entirely possible to live on less than £20k once housing costs (rent/mortgage) are excluded. Certainly, my old lady does it!

2. 4% is a punchy SWR for the UK. I’m looking forward to reading your post TA. Several pieces of research have shown that 4% is pushing it in the UK. Running figures from actual investable UK funds, over about 25 years a 4% WR (fixed, monthly) would leave you with almost zero cash today. 3% would leave you with just about the same amount today as when you started. [health warning: I’ve never had the calculations checked externally!]. I agree with TI’s points about false precision and if you’re savvy enough to save that much, sweating the decimal places isn’t worth it.

3. I found Better Angels of our Nature a really hard read. I got over halfway then gave up. Definitely the worst book (of 25) I read last year. I’d also concur with what @factor notes from some Amazon reviews, there are some questionable stats in the book.

I wouldn’t use benefit levels as a baseline. Out of work benefit levels for a single person with no disabilities are, imho, very very low (£73 per week plus less than 100% rent and council tax support. No support for housing costs for owner occupiers).

I work for Pensionwise in a low income part of the country, so I see a lot of people, of absolutely all income and capability levels, on the brink of retirement. Many single people with paid off houses offer up £1000 per month as the amount they are happy to live on (more than three times benefit levels). Today I saw a couple bringing home £2100 per month and saving well on that, who were planning on £1300 per month (excluding large expenses). So £25k net is certainly possible. Another useful source of data for aspiring fat FIRE types is the Which survey that David Sawyer linked to a while back. This gives ‘comfortable’ retirement spending in the real world of about £36k net for a couple, iirc.

Children drive spending up, of course.

And on the subject of SWR I am with TI and TA – precision isn’t going to be helpful over decades. There will be an element of adapting/winging it.

@vanguardfan – it doesn’t sound like much I admit, but if you sum up the values of things, say approximately

£73/w cash

+£40ish/w value of council tax benefit

+£100/w value of renting a 1 bed flat in the middle of nowhere

+£20/w food bank value

= £233ish/w

= over £10k a year with no need to save, which minimum wages were a decade or so ago. Some workers live on this sort of expenditure just to be able to save.

It wouldn’t be luxury, but you’d survive, and if you couldn’t pay bills you probably wouldn’t care too much. There is no help to homeowners true, since they expect you to sell up, which itself would tide you over for a while

And if you’re going to risk running out of cash, its best to do so when you’re too old to do stuff or facing nursing home anyway.

The odds of it coming to this are quite low, but I would say too much in bonds can increase risk of running out

To be honest too, I think the really poor and homeless deserve have a better deal than jailbirds, in a desperate situation I wouldn’t blame homeless people resorting to crime to get a roof over their heads, respect for those that don’t for sticking to their morals

How does £25,000 a year to spend compare with your current spend? That’s a good measure of what’s sustainable for you.

In respect of Safe Withdrawal Rate, I prefer to use natural yield as my guide. That’s a good measure assuming the income can grow to match price inflation. In my case the natural yield was 4.19% at the end of February, which is close to the yield of the FTSE All Share index.

I reckon £35k net for a couple, no debt, no mortgage. Theretirementcafe has done a number on swr, he hates the idea as a mechanism. However to get a feel for what is enough ok I guess: seem to recall an article by Pfau which was below 3% for the UK and that was after any fees.

The natural yield argument sounds ok early on but guarantees you will spend less than you could. Sooner or later you have to spend into the stuff. Isn’t that why you saved after all?

In addition to income you should also have access to capital for the big ticket items and ready to help your children if you have them. £200k wouldn’t be too much in my view.

Then there is how you manage risk with your just large enough pot. A chunk of the £25k needs to be an annuity to give a floor.

I think it’s a bad sign to be reading books to lift your mood. However, how about The Anatomy of Melancholy by Robert Burton 🙂

Nice to hear you are coasting down the other side of the FI mountain with ease TA.

Hopefully I’ll be there in 10 or so years time!

With the psychological side of things I guess it’s just a natural side effect of moving up Maslows hierarchy. You’ve sorted (pretty much) the security aspect financially, so your brain now naturally starts to look at the problem of self actualisation

Reading these comments, it is clear that unless you have a massive headstart (a few hundred k inheritance, made a killing in property during the boom) then without several years of high savings rates combined with high income you will struggle to ever retire early or ever!

I cant say that i am talking from personal experience but my fire plans are to quit work and have a more frugal lifestyle – get rid of the second car. Cook more at home. Fewer long weekends away and more considered travel. Get rid of wotk related expenses and the price you pay for convenience and time saving.

Strippong out housing costs – even a family should be able to get by on £25k a year – millions do so already!

If you don’t see that FIRE will be a change of your life then you haven’t thought about it right.

Thanks @TA – really enjoyed the post, and I’ve just been down a bit of a rabbit warren of old posts on how you got to where you are (well done for staying the course btw).

One thing particularly interested me from the comments on a previous article; @TI said you and he had nearly come to blows on whether or not to include home equity in your net worth. Did you ever get into the weeds of this anywhere else on the site? I’d love to read the counterarguments (FWIW I am firmly in the “no” corner on this).

Being just about FI, SWR’s have played on my mind more than I care to admit recently. I just wanted to share this bogleheads piece regarding the correlation between CAPE and SWR’s, which I found very useful.

https://finpage.blog/2018/02/28/cape-and-safe-withdrawal-rates/

As with being flexible with your drawdowns, @accumulator , I think choosing an SWR at the outset taking CAPE into consideration is another safeguard. Naturally, this is far from a precise science and ergo far from a perfect correlation. Still, to me it seems madness not to consider it.

I also wrote about this at greater length on reddit, should anyone be vaguely interested:

https://www.reddit.com/r/FIREUK/comments/asqpvd/the_moveable_feast_of_the_swr_and_the_problem/

It’s all two sides of the same coin, I think. Just another way of looking at it.

Housing equity is a very funny thing – the debt costs you next to nothing these days.

Our mortgage interest costs less than a new ford focus on pcp!

You can’t eat the equity, you can’t readily access it either and unless you are a moron (with an interest only mortgage) you need to pay it back one day.

Don’t own property? You still gotta live somewhere – move back in with family? Housesit? Become a nun/monk?

Rent is expensive (which is funny when mortgage costs are so low)

Even better – having a mortgage in FIRE means you need to supply your monthly repayment out of your FIRE assets – effectively buying bonds with your dividends.

Property is a double edged sword – it can be an asset and a liability. The best option might be to reduce your exposure in FIRE and downsize / use geoarbitrage to free ip the equity and make the question of whether it is an asset or not irrelevant.

What a cracking article and comment thread. Great post from TA, and an excellent comment by TI, which should be required reading on the SWR topic. I wasn’t aware of McClung’s book, and will be purchasing.

Steering clear of the SWR/how-much-you-need-to-live-on-a-year post-FIRE debate for a minute (I cover it in depth in my book), I just wanted to first say thanks to TA for the book recommendations. I am now £60 worse off (I drew the line at Pinker, I’ve read his THE SENSE OF STYLE book and while the man’s clearly bright as a button, I find him complacent in his writing, never using a simple word when a complicated one will do).

What I liked about the book recommendations was they weren’t obvious choices, such as THE SIMPLE PATH TO WEALTH, THE MILLIONAIRE NEXT DOOR or the excellent YOUR MONEY OR YOUR LIFE.

In a similar vein, here are some other good reads on topics related to financial independence, which I’ve read over the past year or two, which you might find of interest:

DIFFERENT (it’s good to be different), MAGIC OF THINKING BIG (MMM name-checked it on Tim Ferriss’s podcast as the formative read for him growing up), THE ARTIST’S WAY FOR PARENTS (who doesn’t love upside-down/back-to-front day), DEEP WORK (minimise distractions to get meaningful work done), QUIET (the power and benefits of being an introvert), BOUNCE (practice day after day after day), THE COMPOUND EFFECT (small actions become routines and eventually reach a critical mass), THE HAPPINESS TRAP (mindfulness), THE WAR OF ART (how to beat procrastination and make your mark), THE SUBTLE ART OF NOT GIVING A F*** (life’s a struggle. Pick the right one for you).

Cheers, Dave

@F&F — You wrote: “One thing particularly interested me from the comments on a previous article; @TI said you and he had nearly come to blows on whether or not to include home equity in your net worth.”

From one I did earlier:

https://monevator.com/why-house-is-an-investment-and-an-asset/

Enjoy. 😉

One necessary assumption of the SWR is that you will spend 100% of your income. For most people this is, of course, an absolute necessity. However, I suspect we too easily up the ante of perceived need to magically match growing income. In fairness, we are bombarded by enticements to buy stuff we rarely need. On the other hand, the kind of people who use websites like this are likely to be a bit more disciplined where circumstances allow.

My wife and I have an annual income from dividends of £53k but last year spent only £36k. We do not consider ourselves to be frugal in any way, having at least 3 holidays a year, eat out up to 5 times a week and partly support one adult son. We have no debt and own our house.

Being less materialistic than possible undoubtedly evolved from traumatic happenings about 19 years ago. If I read the following story written by someone else here I wouldn’t believe it. Trust me, it’s true.

My net assets fell to zero in the Asian Financial Crises, while I simultaneously became unemployable in my profession and the following year was laid low by the big C. I was therefore broke, unemployable and seriously ill. I never had a proper job again. Nice one!

The effect was traumatic and life changing.

Desperation forced me to devise a strategy that turned out to be very successful, aided by some good luck and fortunate timing.

It was horrific at the time but having had your worst fears actually come to pass has left us with the confidence that we could go back to subsistence living should markets collapse. It’s probably never as bad as you think.

TP2.

I think houses look like assets to me as well. I include the value of my residential property in the net-worth spreadsheet but, always willing to keep an open mind, I also have a column that doesn’t include it. You can have your cake and eat it in this respect?

I’ve just finished Hawkings latest book which I really enjoyed. Its a fair bit lighter than ABHOT and much more varied. It ties in well with some of TIs earlier comment on human nature as Hawking talks of genetically remodelling it to improve our prospects. There’s good stuff on AI, space exploration and time-travel as well.

It is extraordinary to think that he not only penned it using only a couple of muscles in his left cheek (I’m assuming the one on his face) but that he was also dead! There’s not many who could pull that off..

+votes for The Antidote, Status Anxiety and Meditations. All are worth the time spent to read and to re-read them. Lot’s of good stuff there. The only other one on the list I have (tried to) read is The Righteous Mind, which I found dreadful. That as humans we are swayed by emotion rather than logic for most of the time is hardly an original thought and is much better explained and illustrated in Thinking Fast and Slow by Kahneman and Influence by Cialdini. The nasty stuff is the view that right-wing thought has stronger moral underpinnings than left-wing thought. I beg to differ.

I agree that houses are assets, since you always retain the option to sell and rent instead. I think of it like a buy to let where youre your own landlord and you pay&receive imputed rent. The most tax efficient and lowest risk buy to let you could ever have

Of course houses are assets. Whether it makes sense to include them in your plans for creating an income stream after work will depend on, well, your plans.

I would suggest that for most people, at a minimum, the house will be their long term care self-insurance.

I think there is a huge risk of over-providing. Life is, in fact, finite, and there are good data to show that spending declines with age. SWR research is based on a very small failure rate, and has a high probability of leaving a large amount unspent.

I personally think that the annuity floor approach is one that suits human psychology pretty well. I know that my DB and state pensions will provide ‘enough’ (if I didn’t have a DB pension, I would plan to fund an annuity at say 70). Having purchased your longevity insurance, you then have a finite number of years to bridge depending on the age you want to retire. A much simpler concept than behaving as though you are an enduring endowment fund!

People can, and do, retire all the time, and it mostly works, if they are disciplined sensible types who can adapt.

£25k? Gross or net? Easy.

We have 2 children and survive very comfortably on about £1800pcm net. We have a 2005 Ford Focus which runs beautifully, a four bedroom house in a middling-nice part of South London, paid off the mortgage in 6 years. The kids go to the local school (we walk!) and we pay for music lessons, gymnastics, street dance, football, swimming, Kung-Fu. All x2, natch. Food bills are about £60 a week. We eat out once or twice a week. Our biggest bill is my wine (about £120-150 pcm for a case or so.) Heating is £55 pcm – we spent a lot on insulation and a Combi-boiler when we moved in and it’s paying dividends. Council Tax about £2,200? Water £30.

Oh, I’m forgetting the Childcare Vouchers of £243pcm, but we won’t need that in 3/4 years. So it’s currently a bit more.

My retirement plan is to have a floor income of £14/5k and use my SIPP to provide the emergency/fun money fund.

And yes, I have:

My 90% shoes (the ones I wear 90% of the time)

My young peoples shoes (I was weak…)

Running Shoes

Gym Shoes

Astro Turf boots

Walking Boots

Black DMs

Brown DM boots

Zip up black boots

Black super-smart brogues

Brown scuffed boots

and several that ought to be taken to the charity shop.

And probably more.

@brod – i think your sipp contributions and childcare vouchers ought to increase your entitlement to tax credits on that income, when childcare vouchers end i’d go all out on a sipp unless you want the accessability of an isa. No point considering a lifetime isa for you, probably.

Also ouch to the council tax, try natwest rewards or salamander 123?

@ ZX – £25K the pair! No kids, own house outright. Yes, you’re right on dynamic asset allocation and withdrawal. I doubt I’ll use Guyton & Klinger and I dare say you’ve seen the shoeing they got on ERN.

£25K gives us much more range than the £20K original plan. There’s plenty of headroom to cut if needed, but we can also cope with spikes. Several years of tracking expenses has taught me that sometimes the bills turn up like buses. The flexibility makes me sanguine about operating a higher SWR. As does a few mental shifts and having a back-up plan.

The mental shifts:

1. Much better adjusted now to the idea of doing some part-time paid work to keep my hand in / for fun / for structure / for a few extra shekels.

2. Failure wouldn’t mean running out of money as it does on a retirement researcher’s spreadsheet. It would mean adjusting to a lower standard of living.

3. The chance of failure has to be adjusted by the chance of anyone being left alive to fail. That lower the odds of failure significantly, admittedly with the unfortunate side-effect of my untimely demise.

Back-up plan: The State Pension seemed impossibly intangible when I first started planning. I put it in a box labelled ‘Emergency funds’ but it was more than a quarter of a century away so I left it that. But full State Pensions for two would amount to £17K out of the £25K. So the reality is the 4% SWR only need be sustainable for 17 years or so and then it can drop to much lower number if the sequence of returns has given us a beating.

@ Details Man & Mr Optimistic – SWR is for a global portfolio. UK only SWR’s are a little misleading. Anyone banking everything on the UK stock market needs their head examined. Also, you can ride higher if you’re prepared to cut back when needed. This wouldn’t be a FIRE and forget inflation-adjusted ‘4% rule’ job.

@ Factor – thanks for the spellcheck! I read every book with a sceptical eye. Though it sounds like you’ve read some reviews rather than the book? Why do you find the 4% of 1 star reviews more compelling than the 87% of 4-5 star reviews?

I’d be shocked if a book this ambitious didn’t provide fodder for critics, though generally it seems to be acclaimed. Regardless, you don’t have to put blind faith in the datasets to recognise Pinker’s case. (He spends plenty of time acknowledging the flaws in the data). But it’s the book’s perspective that’s so thrilling: attempting to trace humanity’s moral development across history.

As Rhino says, The Rational Optimist is good too, as is Hans Rosling’s Factfulness alluded to by The Investor.

@ old eyes – I didn’t takeaway from The Righteous Mind that Haidt believes the right-wing is morally superior to the left. I’ve watched and listened to him several times since and he labels himself a centrist. He’d say liberal if he was European. He spends his time in left-leaning academic circles however, and I think he pushes back against the tendency in that environment to dismiss the right out of hand.

Sounds like you have it right.

We are looking at similar figures for us – but the Lady thinks more travel and an annual ski trip are essentials.

£1800 pcm is hardly poverty but if you curently spend £3k a month it’s a 40% cut.

Sensible spending is critical to keeping things on track for FIRE.

(Although , i am a bit hypocritical)

@ Chris – that sounds like a balanced and thoughtful approach. Do you see your current strategy as part of a transition period? Kind of a long goodbye?

@ The Rhino – re: book, it’s definitely the end of The Investor deadline-shaming me every other week He’s just got to edit it now. I hear you on developing a parallel approach. There’s been a few tales from FIers who jack in the job, move somewhere completely new and powerwash the rest of the slate clean too. That’d be too much upheaval for me. How long did it take you to adapt?

@ theFIREstarter – hello! I check in regularly to see how you’re doing on your blog. I agree about Maslow. I wrote then deleted a couple of paragraphs on levelling up the pyramid 🙂

@ GFF – you’re right, you’ve got to have something going for you to FIRE. Time or money or frugal genes or a spawny run of returns or ideally all of the above. If you don’t pull any of those levers then it isn’t going to happen. But, you can make the magic happen without going to extremes in any of those areas.

@ Dave – glad you enjoyed the post and thanks for the book tips. I’ve read a couple and enjoyed them – Quiet was surprisingly powerful. Hope your book is doing well.

@ Tahi – well done for bouncing back so comprehensively. It sounds like you’re having a whale of a time!

@ FitandFunemployed – Appreciate the comment! We did have a ‘frank exchange of views’ but, and I really hate to say it, The Investor was right. You should count your home as part of your net worth. From an emotional perspective, I get why you’re in the “No” camp. But The Investor’s a Vulcan – he cares not for your unnecessary human feelings.

“Our 40s are waning and at this rate we will be theoretically FI – but marooned from our assets for a few years. Diverting new funds to go into ISAs will bridge the gap but also muller our savings rate, so we could still be half a decade from journey’s end at this point.”

If it’s an option, a nice chunky (re)mortgage can bridge the gap between theoretically FI and being able to access those juicy pensions.

If switching to an ISA would muller the savings rate, are you sure you’re measuring the right thing? Any pension that is going to attract tax when extracted wants to be weighted accordingly when looking at savings rates IMO. Alternatively, putting money into an ISA to avoid paying tax later could be weighted higher. Not all pounds are equal. And if you need to spend money after FI but before you crack open the pension, then the pension has limited utility to you in your late 40s/early 50s.

I can see why it would be a nightmare (similar to interest-only mortgages), but it’s a shame no-one is offering a low-interest loan secured against pensions for people in this situation. But the masses would take it out for the wrong reasons and would cry to the papers. On the plus side it’d give the ermine some amusing fodder for a rant.

Regarding the process of RE. I’ve had enough funds to quit my career job for about 8 years. It took me about 4 years to fully absorb that that was the case. I havered about whether I should do it for another 2 years (my FI having been accidental – I’d been working towards a normal retirement probably in my late 50s). In my case, what has helped the transition is to do it gradually, halving my work hours initially. My other observation is that the mental shift follows the shift in activities, rather than the other way round. In other words, you start just doing the things you want to do, and this inevitably leads you to a different life. I’m now at the point of leaving the career job, but have in the process picked up a ‘fun job’ and various other personally driven projects. I still feel I am basically the same person, but it is much more fun to have autonomy and feel self driven, rather than being dumped on with tasks you don’t want to do by people you don’t really respect. I still have children at home, and a spouse who does not want to retire, so radical lifestyle changes are neither feasible nor very interesting to me.

So I’d say, just start doing what you want to do, and the rest will fall into place.

With the mortgage paid off, I’d be very happy with the investment income of £25k p.a., especially if it come from tax efficient vehicles.

We might all be Vulcans in about a generations time if Hawking is on the money?

Truth be told I haven’t adapted in any significant way – too busy! Probably crossed the line about 6 years ago but did nothing about it, time wasn’t/isn’t right to ease off on the work front as we’re just bringing a product to market after an 8 year R&D period. So its all hands to the pump. Its quite exciting as the orders start lining up and I can’t think of much worse than ducking out now, bit like running a marathon then jacking it in on the home straight..

I was perplexed that not a single member of the MV readership expressed an interest in investing in what is clearly going to be a huge British unicorn? I thought there were top investors here? Maybe everyone is too ethically orientated for miltech? 😉

Counting a home as part of net worth is absolutely right provided you also account the ongoing costs and, in particular, the opportunity cost as Matthew (post 34) points out when he talks about ‘imputed rent’. This is especially important for FIRE people.

Take two people:

Dave (SE England): three bed semi valued at 600,000, no mortgage and 400,000 investments (SIPPs and ISAs) net worth 1 million.

Julie (South Wales) three bed semi valued at 100,000 and 800,000 (SIPPs and ISAs) net worth 0.9 million.

Dave’s net worth is higher but Julie is much closer to early retirement or even there already. Julie’s SWR (suppose 4%) gives her an annual income 32,000 while Dave, currently, could only expect 16,000 per year.

To model it differently: Dave’s imputed rent is (say 4% of home value seems reasonable) 2,000 per month while Julie is only paying (herself) 333 pounds a month. It’s this difference in the spending when including the imputed rent that is problematic for Dave.

Of course Dave has options… the obvious being to sell up and move to South Wales. ‘Geoarbitrage’ is the term which I learned today thanks to GFF (post 29).

I’m not currently in the UK but, like Dave, I do have quite a chunk of equity (mostly through mortgage overpayment but also a chunk of bubble market) so could find myself in a similar position in a couple of years. I could happily move back to my home town (cheap area) release a lot of equity (should current valuations persist) and live a fairly comfortable FIRE life. The problem is persuading my wife and my kids who will likely still be at school age when I can start looking at some form of FIRE.

@Matthew – luckily that was our expenses rather than my salary. And the council tax is for the year and actually is about £1500 p.a., not £2,200.

I’m 53 and planning on going part-time for a couple of years in September as I worry about a sudden stop (at least my wife tells me I do.) I had a heart bypass last summer and with a 6y.o. and a 7y.o., I’ve got better things to do than meetings and minutes and chasing people to do what they’re supposed to. Exercise and learning piano and Spanish and cooking are the plans. And staying married to my wife too, of course. Which is no hardship 🙂

@Brod – £15 per head per week on groceries is seriously frugal (are you vegetarian), hats off to you on that stat! I have tried hard but can’t even get close to that..

I remember living with an East-German in the early noughties who was the living embodiment of frugality and even she, back then, spent £20 a week on groceries. She used to watch squirrels in order to pillage their nuts and she kept hundreds of apples in her bedroom from the trees in the back-garden.

We cook virtually everything from scratch, almost no ready meals and the kids eat a lot of pasta (and they’re still small). Bake our own bread (supermarket stuff is crap!) and own pizzas. No bottled water or owt.

Also, we shop 2/3 times a week and throw away very little.

And of course there’s no alcohol in THAT budget

Love reading everyone’s stories about their individual approaches to downshifting. So many ways to skin the cat! Thank you all

@ Playing with fire – I think I’m measuring the right thing. See what you think:

£12,500 personal allowance + 25% tax-free using UFPLS means any individual can withdraw £16,666 a year tax-free from a SIPP.

Multiply that by 25 = £416,650 in stash per person to support a 4% SWR.

Or multiply by 33.333 = £555,527 in stash per person to support a 3% SWR.

So saving into SIPPs gross of salary maxes tax relief and we’re not yet in a place where we’d expect to pay tax on the other side. State Pension notwithstanding.

ISAs at best fill up with savings from income taxed at 32% including National Insurance. That mullers our saving rate if you’re calculating your savings rate including tax – which I do.

I don’t think a savings rate need include a utility function that tells me I need ISA savings to bridge the gap to my pension. I know I need ’em, but progress will be slower than with the SIPPs.

I like your idea about using a mortgage credit line. That’s got me thinking!

Best thread on the site imo. Thanks everyone.

And the book list is great!

Re books. The Gulag Archipelago I thought poor: came out at the height of fame, rambling and needs editing. In the First Circle and One Day in the Life of….were much better and were the basis of the author’s reputation. Then there is Crime and Punishment by Dostoyevsky which I thought great as a teenager but never been back.

One thing that might be an issue is that footwear choices aren’t really a factor in any of the plots so you will get no lifestyle guidance there.

@TA. Hmm. Assuming UFPLS is still around and no rules change and the basic rate of tax stays where it is, and that we stay sober and aim for a 3% withdrawal rate, and forego further pension contributions in the face of MPAA.

First, for 40% tax payers the saving on investment is 42%, cf 32% for 20% taxpayers isn’t it ( this just for completeness)?

If you want to get to around £25k pa to sustain your frugal lifestyle ambitions and have no separate capital buffer to cover shocks and big ticket outlays then you need about an additional £10k of net income.

You are too young to factor in the circa £8k gross from the state pension, that comes later but still only adds around £6k needing £10k gross to get to £25k. So that adds 33x£2k = say £70k to the pot.

Setting aside the state pension as providing a floor, you need another £10k pa so that adds £330k gross, or who knows what net, to the treasure chest.

At least that’s the way I am judging things for myself so interested if I am being too conservative.

Thanks for the posts.

@TA #39 – “Why do you find the 4% of 1 star reviews more compelling than the 87% of 4-5 star reviews?”

Management by exception, aka if it ain’t broke etc, is my life m.0.

@The Accumulator – re: remortgage credit line.

They do exist and they’re free!

Simply get an off-set mortgage and put everything you borrow in the off-setting Savings Account. Voila! A lovely credit line on which you pay no interest. Pay the mortgage from that account and you have a slowly reducing slush fund for that Aston Martin!!! (I’m on the right side, right?)

It’s what we have.

Just be careful not to go to close to the edge and trigger a repayment event.

Oh, and you’re insulated against interest rates too as you should only be paying interest on a very small fraction of your mortgage. We can off-set up to 99.9% in the savings account or something before we’re forced to repay it all.

Re #53.

I was concerned about pension tax based on taking £25k out a year, but didn’t know whether that was out of one person’s tax allowance or two. (Also whether there are two 40%+ taxpayers?) Taking £25k out of one person’s pension would be enough to get me weighting the pension contributions.

I’m trying to get a mortgage on a mortgage-free house… it’s harder than I thought. Banks have a lot of questions about what I’m doing with the money and investing so that I can quit my job wouldn’t go down well. Scottish Widows seem to be a good fit, but won’t do an IO or offset. The assumption seems to be that I’m going to remortgage, spend the money on hookers and blow and then sue the bank for irresponsible lending, urgh.

@playing with fire – you could get an equity release mortgage, or sell and buy something else, maybe with a short gap to avoid the same questions.

Or you could rack up debt on 0% credit cards and then remortgage to clear them

You may even be able to remortgage to clear a margin loan, perhaps, but that’s more iffy

They seem happier if you spend the money on decorations, holidays, weddings, etc than invest, even though investing is more responsible than spending, I suppose they fear you’re going to day trade on margin

Golly, people get very passionate about not reading certain books don’t they?

Personally I really enjoyed Pinker’s “Enlightenment Now” followed by “Factfulness”.

Frankl has been on the TBR pile for a very long time (must read it). I liked The Antidote too – a sceptical self-help book.

I’ll add the others to the interesting list – all I need is that FI so I have time to read them!

@ MrOptimistic – I’m not sure I’m following you correctly, but I’ve had a go:

I think you’re saying you want £25K net income per year for one person, assuming 3% withdrawal rate. But to cover the unforeseen you’d be more comfortable with £35K. My calculation of that is:

£12.5K (personal allowance) x 1 = £12,500 (so far so good!)

£12.5K (net income) x 1.25 = £15,625 (gross income taxed at 20%)

Minimum income required = £28,125

£28,125 x 33.333 (@ 3% SWR) = £937,490 FI target.

State Pension = back-up.

But then there’s the extra £10K p.a. in back-up funds needed to seal the deal, or £12.5K gross.

Income required is now £40,625

£40,625 x 33.333 (@ 3% SWR) = £1,354,153 FI target.

Strewth, the extra £10K net increases the target by over 44%.

OK, but an extra £10K net gives you massive flexibility if you can actually live on £25K and the State Pension will ride to the rescue in later life. So let’s say that enables you to choose a 4% SWR.

£40,625 x 25 (@ 4% SWR) = £1,015,625 FI target.

This target is only 8% higher than the £25K one but takes into account the benefits of a more flexible plan.

Another way of looking at it, is you can withdraw £25K per year at a 3%SWR, safe in the knowledge that you’ve got a £78K emergency fund to handle shocks. And the State Pension still to come.

My apologies if I’ve got the wrong end of the stick, which I acknowledge I may well have.

Does anyone know a good way of calculating the impact of the State Pension on stash required to FI?

I have kind of assumed I’d need to divide FI into two parts. Part 1: Stash to fund life before State Pension at SWR matching that time period. For example, if FI is achieved 20 years before State Pension age, and a 20-year SWR is 6% then:

£25K x 16.666 (@ 6% SWR for 20 years) = £416,650

Part 2: Stash to fund life after State Pension at SWR matching that time period. For example, £25K – £17K (two full State Pensions) = £8K x 33.333 (@ 3% SWR for 30 years) = £266,664.

Total FI stash required = £683,314

I don’t know if that’s the right way to do it, I guess there’s a better way but I haven’t researched it. Does anyone know?

BTW, I made up the 6% SWR over 20 years for the purpose of the example. I’ll check properly some time.

@TA

I think what you have described is but one nuance of real retirement planning as opposed to finger in the air targets for stashes earlier on in the accumulation phase.

For example, in my case, which is not unique, we have:

one DB pension arriving at 60, one DB pension arriving at 65, two state pensions arriving at 67. Plus unknown amounts of earned income. And of course that’s before you even consider trends in spending – all the evidence suggests that spending declines with age.

I think some kind of cash flow modelling is really required, but haven’t looked into the tools available or the assumptions they use (I think generally they use a steady % increase to model investment returns which is clearly wrong).

What I tend to do for a simple back of the envelope calculation is just add up the spending requirements minus the known income streams, ignoring the effect of inflation and hence assuming that investment growth is zero in real terms.

@TA, cheers I’ll have to think about this! One point, if state pension is a significant factor, need to check that things still work post first death.

I always look at net income as that can be matched to spend, but I get net and gross mixed up from time to time.

As I retire in 11 weeks time it is a bit academic to me in terms of targets but useful for judging what I can safely take from the DC pot. I suspect I am being overly cautious with this and with my asset allocation. I will take the 25% tax free lump sum which throws more emphasis on asset allocation. One reason is to protect against future rule changes re UFPLS, the other to simplify filling in tax returns.

I also have dividends reinvested and not a handy extra as some seem to assume.

Can’t see anything wrong with your approach to state pension but perhaps just count on one to give margin and protect against rule changes.

Anyway, thanks for this post. Look forward to the book. Hope your proof reading is good :).

@matthew

Equity release minimum age is 55, so no good.

Remortgaging for credit card debt or margin loan has the potential to tank credit rating so you’d struggle to get a mainstream mortgage. I could get a mortgage with one of those shitty predatory places and look to remortgage soon after but there are high fees and I don’t want to give them the business.

Moving would work but takes a lot of energy and is expensive – surely it shouldn’t be that hard.

Hi all, been reading the site for around a year and thanks to all for the information (it helps me to realise I’m not the only ‘weird one’ wanting to step out of the mouse wheel!) I FIRE’d at 50, when I realised I could actually stop work if I wanted too and perhaps try it out. I’m now 54 and still trying it out….On the theme of yearly spend; I keep track all of my spend on bank downloads into a spread sheet each week. I own my own house and no longer have mortgage, or rent, and if it helps am a single male in the UK. If I keep an eye on spend it’s c £18k pa. if I’m lax it’s nearer £20k, I do have some nice vehicular toys etc and not quite a hermit (yet). I’m basically setting my next 30 years…ahem, spend based on the recommendations in Mr Mc Clungs: Living Off Your Money with a starting pot of c £650k (not including the ‘house asset’!). I use a self constructed spread sheet which takes account of straight line investment performance (3.5% which I can vary for modelling) swr and inflation with later addition of the state pension. Of course the big variable is future returns esp with CAPE high and potential government policy changes over this horizon. As for the staying on course ‘well-being’ wise, although I did work in a high pressure but well paying job, I had previously taken extended (up to a year) breaks in the past as a practice for FIRE, and ultimately my recommendation to anyone would be that to keep the brain active, I think it helps to be a ‘hobby type’ person or perhaps to go part time at first. I also think it’s a lot easier if your a more single-minded (dare I say introverted) type who hasn’t fallen for the keeping up with the Joneses commercialism and enjoys collecting things (ie money). I hope this info helps anyone else when constructing their own personal plan.

Thanks for dropping by We There Yet? Sounds like you’re having a whale of a time and I’m glad to hear your trial period is going well 😉

Really interesting to see this discussion pop up as I’m having quite a few struggles. As @Rhino mentions I’ve managed to shortcut my thinking to ‘being FI’ before actually getting there. I probably have at least 10years of work to reach that point on the balance sheet but I’m trying to put my mind in that place and answers questions such as, money no object, what would you do?

I’ve noticed this and the arrival of my daughter have caused an existential crisis of sorts. My work pays and can be interesting at times but I don’t get a sense of purpose from it, I also dont enjoy it a lot of the time but I know I need intellectual challenge.

Currently in a phase of rumination on the purpose piece for several months and not resulting in good things. Those that have been there and done it, what would they advise for enjoyment/fun in work?

Regarding a sense of purpose in my work, is this chasing a carrot attached to a moving vehicle?

It’s strange I’ve normally been so settled and confident in my approach but this seems to have knocked me for six and I’m unable to resolve.

Any advice from those of greater wisdom?

Hi Nick

Not sure if any of this will help but here goes and forgive me if I have slightly missed your point but this is how I rationalise the problem in my thought process.

Unless ones parents were/are extremely wealthy we are programmed from the day we are born to believe that going to work defines who, and what we are until we eventually get old retire and do ‘retired things’. This fundamental ingrained belief structure within ourselves, and within society, is an extremely difficult mental straightjacket to escape from and one that I still struggle with.

What does this mental struggle feel like? Well it’s hard to describe but here are a few thoughts;

Negative thoughts: I should be more productive, I am wasting time, I’m not supporting society, I am no longer a economic unit. Positive; I can do as I please, my time is now my own, all the options are mine, I still pay my taxes. Mmm.. opposing thoughts, a psychiatrist dream..

My approach to help resolve this ‘problem’ was to gradually reduce work whilst still preparing to FIRE (an acronym that I also dislike!) with periods of up to 1 year off which helped me to understand how it ‘felt’ I did this over a protracted period of time (roughly over 10 years; I worked freelance) Perhaps this is being FI before I got there?? I also kicked off a few start-ups to gain more flexibility with some success but its bloody hard work to create success and it became well, too much like 24/7 work not FI!

My solution after FI? I now I take the approach of mentally classing myself as someone who no longer works but could still ‘work’ if I wanted to. (disregarding the fact that I’d want so much flexibility that no one would want to employ me)… A glorious self-delusion that works for me until I too hopefully finally resolve this internal struggle (…come in and please lie on the couch sir..).

But prepare yourself. People still meet me, judge me (I don’t yet look old enough to be ‘retired’) judge me by ‘what I do for a living’. Then say; ‘your lucky’. But then their not interested how its achieved, or how they could also do it. Some even get hostile. I think this is because FIRE impinges on that fundamental ingrained human belief structure and essentially it ‘does not compute’ to the majority.

Sorry this comment is a little protracted but as TA recognised in the post it’s an important non-monetary part of FI that is often overlooked, and does indeed mean you will need ‘rewire yourself’ as well as your finances to be successful. Hope I helped!

WTY

In response to “We there Yet” which I have only seen for the first time today (new to site) I empathise fully with the judgemental “you look too young to be retired” or similar.

How can anyone look too anything to be anything? The upper levels of Maslows hierarchy of needs compels peeps to “surrender prejudice” and to “accept fact”.This incidentally has manifested in the B word which is very much in the lexicon of the English language at the moment. Prejudice has been revealed and for some the acceptance of fact is a step too far.

But enough of that. I’m not here to discuss politics.

I was attempting to say how should anyone look like anything. It’s as though those that do not possess the avian tall white, handsome, well spoken are not capable of anything significant. I was once told on Facebook ” you don’t look like a legal professional” . Oh ok.

So to the person that says you look too young to be retired, well bless this house. It’s worth considering he or she may know very little about you, the troubles you have encountered your share of the breaks in life, the sacrifices made. I could go on.

Any finally there will be those who may choose to accuse you of cheating. Ha. Bring it on. To be accused of cheating (so long as you haven’t) is the biggest compliment you could ever receive.

Jon.