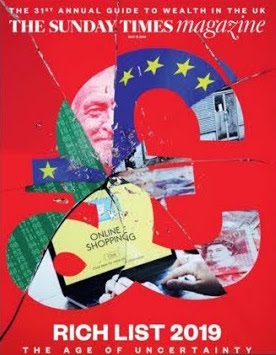

I have long had a guilty fascination with The Sunday Times’ Rich List.

I remember its launch in the 1980s. It seemed a fanciful publication. As a teenager in a comp in the provinces, I saw TV skits about yuppies in London getting rich, but I doubt my family knew a higher-rate taxpayer. The Rich List was about as real as the Lord of the Rings.

Later, as a lefty student and then a mildly hedonistic 20-something, I continued to check in with the annual tally of the UK’s top 1,000 multi-millionaires. My parents kept it for me to read on my visits, and I watched as the List was transformed from a running scorecard of post-1066 jockeying to feature more financiers, entrepreneurs, and later oligarchs and other wealthy incomers.

Then, somewhere around the LastMinute era 1, digital start-ups became sexy and I became more annoyed that I hadn’t made my fortune.

True, it was hardly surprising. I was working in a low-paying media job mostly for the perks. I hadn’t started a dotcom, and indeed I hadn’t even begun investing!

But that’s what the Rich List does to you.

Just as other people are frustrated by six packs in Men’s Health or long legs in Cosmo, the future founders of financial blogs probably can’t help comparing themselves to the Monaco-going Joneses.

Friends (or acquaintances) in high places

Of course I should write a bit here about how enjoying an ice-cream on a windy British beach with your loved ones is the height of life’s riches.

Or how you can live like a billionaire on the cheap.

Certainly my co-blogger would pen a missive about the folly of chasing unicorn-founding unicorns.

Agreed, yes yes, the denizens of the Rich List have more money than most of us will ever need (some of them may be excused a requirement to fund small private armies in suspect states) and there’s much more to life than money. I learned that young, too.

Still, it would have been nice to have made the cut by now. I manifestly haven’t – I’m not sure I would even if the supplement was expanded to the thickness of a Yellow Pages. (There’s a lot of asset-rich oldies out there nowadays.)

Adding to my angst, the Rich List is no longer the outright fantasy it was back when Kentucky Fried Chicken was my birthday treat.

I’ve met hundreds of very rich people in the years since then. I’ve several wealthy friends (universally good sorts, but I pick them that way) and there are even a few people on the Rich List who’d reply to my emails. One or two I might conceivably have dinner with. And most of them got on to the list in the time I’ve known them.

So it Can Be Done. Just has not by me!

In the compound

This isn’t a shocker. I tried starting a business with some friends a decade or so ago but bailed out after a couple of years. It wasn’t for me.

Investing is for me, but even here I’ve not pursued some opportunities that presented themselves. (Specifically, I’ve never tried to set up or even get a job running a fund. Maybe that wouldn’t have worked out either – I didn’t pursue the slender openings for a reason – but who knows.)

So that leaves compounding my own wealth, on a decent but pretty average by successful Londoner standard’s income.

Is it feasible? Can you invest your way onto the Rich List?

Zero-ing in on millions

I turn reflexively to the last page of the Rich List first, to see the current cut-off. This year it’s £120 million to make the final 1,000.

Can I compound my way onto the List before I’m more likely to trouble the obituaries?

Obviously we need an expected return rate to plug into the Monevator compound interest calculator. And since my last dalliance with revealing more about my active investing stalled, I don’t propose revealing precise figures here.

Additionally, my income is still rising and I’m not even rich enough for savings not to make a big difference to the final sums.

I’m also now using leverage, effectively, with an interest-only mortgage set against my flat.

And I’m only going to do rough-and-ready sums anyway. This is just a thought experiment, not a submission to the FCA!

In consideration of all that, let’s pick a reasonable ‘rate of wealth growth’ (ROWG) to plug into the compounding machine.

- If I consult my investing logs, I can see that over the past ten years my ROWG has been about 23% annualized.

Nice!

However that’s growth pretty much from the nadir of the financial crisis – a time when I was literally selling possessions to buy more shares.

Clearly that was a generational basing opportunity for anyone who wants to produce a high ten-year return figure. What about over five years?

- My five-year annualised ROWG comes down to about 16%.

We need to knock a bit off for inflation, so we can compare the £120m today with the same amount in 2040 or 2050. In practice the rich are getting richer ahead of the rate of inflation, but I’m going to ignore that to keep things simple. And who knows if it will last, anyway.

My investment returns would surely become constrained as my wealth grew in this (fantastic) scenario, although I’d hope to offset some of that drag with more direct investing in businesses and property, and perhaps a bit more debt-juicing. Savings will eventually be irrelevant to growing my net worth, too, whereas they have definitely been a factor in reality.

- I’m going to settle on a real 2 ROWG figure of 10%.

You may well feel that’s ludicrously high. Fair enough. As I say, all this is just for fun.

I will ignore the rampages of tax. I’ll assume everything is in a tax shelter and not withdrawn, or else is locked-up as capital gains.

Plug all that into the interest-upon-interest adder-upper, where does that leave me?

Well, unless I’ll be approaching my telegram from an equally geriatric King William to brighten up my mornings, I will probably not be making it onto the Rich List through my active investing prowess alone.

Stand down The Sunday Times!

Loadsamoney

What about you? Maybe you’re very rich already, much younger, or a true once-a-generation investing genius?

All of that will help. Could you become one of the UK’s 1,000 wealthiest simply by compounding savings from your 9-5?

Here are a few scenarios showing how you could hit that £120m in today’s money, and how long it would take to get there. (Position your mouse over the footnote numbers to see my assumptions.)

| Future Rich Listing Non-Professional Investor |

Starting pot | ROWG 3 | Years |

| Young inheritor 4 | £20m | 3% | 60 |

| The Next Spare Room Warren Buffett 5 | £20,000 | 17% | 46 |

| The New DIY George Soros 6 | £20,000 | 27% | 32 |

| Ultra high-earning global indexer 7 | £50,000 | 5% | 75 |

| The cryogenic investor 8 | £5,000 | 2% | 275 |

Note: You probably don’t want to try anything but saving-and-indexing at home. Especially the cryogenic stuff.

You can see the assumptions I’ve chosen for my table in the various footnotes. And I am sure that in the time it takes to read them, many of you will find objections.

Fair enough. This is just an arbitrary illustration of a few scenarios as a conversation starter. Feel free to plug in your own numbers. Let us know what you discover in the comments.

However I think the table does illustrate:

- Why nobody on the Rich List got there by investing their down-to-earth wages.

- Why it’s important to remember that even Warren Buffett first made his starting pot by running a hedge fund.

- Ditto George Soros, whose legendarily high returns weren’t actually achieved for a period as long as 32 years. (I strongly suggest you don’t use 27% for your sums. Try 7% if you’re bold.)

- It does help to start very rich to end up truly filthy rich, but even that’s not enough unless you take some risks. If our inheritor had put the family silver into a global tracker it would still take 37 years to turn their pot into the £120m in today’s money that’s required. Most rich people are more concerned with wealth preservation.

- Grow very old to get rich and be remembered.

- As I’ve said before, if you want to make easy money do something hard. Starting a business that becomes a household name – or at least big enough to get into scraps with governments – is the only real chance most of us have of making the Rich List. (That or starting a hedge fund.)

Deflated? Oh well, remember net worth =/= net wealth.

Feel better now? Thought not!

Who wants to be a multi-millionaire, anyway?

To conclude, I’ll stress that if I actually was loaded enough to be in the running for Rich List positioning, I’d do my damnedest to keep it a secret.

I’m a very private person. The last thing I’d want to see is a photo of myself in print standing next to my wife/dog/double oven trying to appear smugly relaxed.

When it comes to my Rich List daydreams, it’s more the thought that counts. Agreed, it’s not a good thought. It’s not a good competition. But I’m only human.

Luckily it seems the maths will save me from myself.

Anyone out there feeling punchier? (Any Monevator readers actually on the List?)

- c. 1999.[↩]

- i.e. Inflation-adjusted[↩]

- Inflation-adjusted, and unlike the ROWG figure I used above NOT including savings from income. Those are plugged in separately.[↩]

- Assume a 3% safety-first real return, no spending capital, no net savings from fun Trustafarian job.[↩]

- 20% annual returns, adjusted down 3% for inflation. Savings add flat £10,000 a year.[↩]

- 30% annual returns, adjusted down 3% for inflation. Savings add flat £10,000 a year.[↩]

- 5% annual real return. Saves flat £75,000 a year over period.[↩]

- Saves £10,000 a year, much kept in cash. Freezes her brain in a jar.[↩]

Comments on this entry are closed.

You clearly could invest to £120m in 20 years using perfect market foresight. Just buy into each tech startup that took off, sell and move on. Plenty of doublings within a few months. You could probably do it by market timing, using daily variability you could get 100% a year, but I’d work hard at an anonymous trading system to avoid the Time Police.

The benchmark for material wealth is advancing. Most people in their 80s probably still use the word “millionaire” to describe wealth. The super rich are now the billionaires, and eventually the Rich List will have some trillionaires.

Although the rich may focus on wealth preservation, having even modest wealth allows you to invest some capital in more speculative areas for higher returns, knowing that the potential worst case loss would not materially affect your standard of living. Accumulating more money gets easier when you already have enough.

@W Neil

“Accumulating more money gets easier when you already have enough.” So very true.

Reminds me of Terry Pratchett, Men at Arms: The Play : “A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.”

This was the Captain Samuel Vimes ‘Boots’ theory of socioeconomic unfairness.

The Sunday Times Rich List is about as relevant to the UK as the Premier League is to the chances of the England football team

In 1989 seven out of ten people in the top ten were British. In 2019 only two are (Dyson and Radcliffe)… and they both dodge tax by living abroad

The most interesting thing about the 2019 rich list is the Sunday Times’ started publishing a list of the UK’s top taxpayers

The times are changing

A thought-provoking, and entertaining article, thanks.

The two main thoughts (which are probably exactly the same underlying thing) it provokes are:

* Survivorship bias: anyone on the list who got there by taking investment risks had achieved an outcome which is not typical for the group of people who took similar risks

* Getting into the Rich List is a rotten goal for an everyday investor. A better goal is to avoid poverty, even if that means foregoing all chances to achieve astounding investment results. When you enter a stock-picking competition, all that counts is winning, so take as much rewarded risk as possible; when building one’s wealth, on the other hand, one should limit excessive risk, because one has to live with the awful consequences of losing almost everything.

Just one small question: In these days of data protection, ID theft, obsessions with privacy and security, how does the Sunday Times know who are the richest and how can they put a figure to it?

If I had any chance whatsoever of being on the list, I’d make bloody sure that nobody knew.

You can’t get that rich using just your own money, you need other people’s be they investors in your own company ( or Ponzi scheme), customers or bank depositors before your getaway.

We could if there’s hyperinflation… Mugabe made more billionaires than anyone!

I think beyond several million it becomes an arbitrary, unspendable number

Use of leverage, maybe with some venture capital hit like theranos might do it, if it mattered

The problem of the rich list is that it shows you life’s winners and by extension you get survivorship bias.

Of course the guy setting up apple, yahoo or amazon did the right thing it’s not like there were blackberry, yahoo and pets.com.

Maybe it’s great vision, a pinch of the now ubiquitous “leadership” and a lot of hard and a lot of help and maybe privilege but most of all it is probably luck that makes biggest difference.

Maybe calling it the lucky list is more appropriate.

Luckily we don’t actually need £120m.

$1 million is classed as HNWI by some definitions, but at a SWR of 4% $1 million only brings in $40k a year & the slightly more attractive £1 million, £40k. It definitely IS possible to assemble a £1 million pot by 50 years, for a professional in a non-managerial job. However, this just buys financial independence, without additional luxuries. Yes, you can have the long haul flights and long holidays, but it is only rational to fly economy class and to carefully select nice budget hotels.

Get to £5 million and the SWR brings in £200,000 a year. At that level, I figure you CAN fly business class & stay in nice hotels. OR live in a very nice house (excluding the most expensive areas).

Someone saving £20k a year AND getting 20% per annum investment returns wrapped up in an ISA could reach £5 million in about 23 years. Both are very achievable. Whilst 20% return is way above average, there are small cap investors who manage it.

I think more realistic targets are the HM Revenue & Customs definitions of the “affluent” with £2 million plus and the “high net worth” with £10 million plus. Growth of 6% each year, net of inflation and spending would allow someone with £1 million to be “affluent” after twelve years and “high net worth” after forty years.