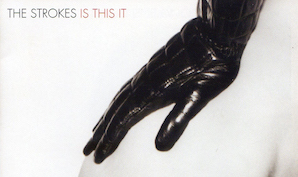

A friend and I once debated the meaning of Is This It, the opening salvo of New York punk miserablists The Strokes.

When I listened to the song, I heard a singer lamenting how he’d stepped over the long-awaited threshold into adulthood, only to discover that being grown-up mainly consisted of sitting around in half-arsed house parties saying everything was rubbish before trying to get off with whoever was left after the trains stopped running.

Ho hum.

My friend’s take was different. She heard two lovers realizing it was over. Their moment had come, and this was It.

Actually she was sort of more a girlfriend. And then we sort of split up.

Anyway… I thought past my meandering love life to remember this song and that debate over the weekend as I pondered the bond market.

Because dear readers, it seems the end of the bull run for bonds might just have begun.

Or at least that the delirious love affair is over.

Is this it?

If you’ve been paying attention to the markets recently then, well, you haven’t been paying attention to my co-blogger.

Monevator’s index fund champion rightly says you should ignore market noise, invest passively, and take up a less hokey hobby such as astrology.

Of course, I think you should do that, too.

But then I am – according to said co-blogger – the “Captain Jack Sparrow of investing”.

Which, incidentally, is definitely the greatest compliment I’ll ever receive this lifetime (initially prompted by mention of my “deviant wild side” over on a new UK money blog).

What I think they mean is I turned dark long ago.

I invest actively as opposed to passively for my sins, and I’ve been watching the recent volatility in the bond markets with a mixture of interest, glee, and a little bit of dread.

Surfs up at Bond(i) Beach

Here’s a taste of the turmoil courtesy of The Wall Street Journal [Search result]:

Markets are being convulsed by the latest collision between two grand, opposing forces: the soft demand for goods and services that has hamstrung economic growth and forced down interest rates in practically all the world’s large nations, and the expansive central-bank policy that officials from Europe to Japan and China are deploying in a bid to bolster anemic spending and investment.

The collision has fueled a sharp upswing in volatility, reflecting large price swings as investors scramble to position themselves for perceived changes in the economic outlook following large price increases in many stocks, bonds and other assets.

Quite the drama! The yield on the German 10-year bund has doubled in just a few weeks, for example, albeit off very low levels.

Indeed it’s a sign of how weird the times are that the German 10-year yield soaring to the lofty heights of 1% and its US equivalent approaching 2.5% has caused all this anxiety.

If you’re a newcomer to investing (or you’ve just not seen many long-term graphs) you might need a reminder about just how unusual these very low rates of recent years have been.

Check out this graph of the US 10-year’s yield over the past 150 or so years:

Source: Multpl.

See the massive spike in yields that’s now causing so much hand-wringing?

No?

It’s on the far right of the graph.

It’s that tiny red blip that you’ll need to enlarge the image to see, and then move your head in until you’re three inches from the screen…

Anyway, as you’d expect my active investing supercomputer mind has been whirling through what this all means and calculating the second-by-second trades that I should make in order to own the optimal portfolio.

Either that or I’ve just been watching and pondering the fun to come if and when rates do rise a lot, the tide goes out, and as Warren Buffett says we get to see who has been swimming without their Speedos.

(Hey, that Captain Jack Sparrow comparison doesn’t just attach itself like a snowflake in wintry shower. You have to earn it in a blizzard!)

Take it on the chin

So Is This It? And if so, what should you do about it?

Well, let’s think back to that Strokes’ song.

If you’re a passive investor, your attitude should be something akin to my interpretation of the singer’s predicament.

In other words, The Strokes would say you should shrug your shoulders, admit that investing life has its ups and downs, and accept that if This Is It then your bond returns are going to be lousy for a year or three but your shares might make up the difference. They usually – but not always – do.

It can be painful to hold an asset when it starts going down. But remember that as a passive investor you don’t pretend to know when such a move will start or stop.

Soon enough (no, not immediately, but over the medium-term) steadily rising bond yields will start to soften the blow of falling bond prices, as the income from your existing bonds holdings – and the capital recycled as your short-term bonds mature – is reinvested into new bonds sporting a higher yield.

For anyone holding bonds in a fund, that will happen automatically, in time. Rebalancing your portfolio will probably help cushion the blow, too.

If you’re still a regular saver like many Monevator readers then so much the better. When bonds prices fall, you’ll be able to buy more at cheaper prices!

Remember, government bonds are anyway primarily in your portfolio as a source of relative stability and security – especially in bad economic times – not for their returns.

If you were relying on a 1.5% yield to compound to fund your retirement, then you weren’t doing it right.

Don’t do what I do

Now, I’ve been challenged a few times by readers in our comments about why I (or “we”, as Monevator) generally take this sort of line on government bonds – such as in this article on the point of bonds by my co-blogger – when I freely admit I personally think government bonds are too expensive, their prices are distorted, cash offers far better returns for private investors, and accordingly I have held no traditional bonds for almost all of the past several years?

My answer is:

(a) I am a deviant active investor, remember, and…

(b) …much more importantly, if you’re a passive investor then you’re a passive investor.

I expanded my reasoning in a blog comment last month, arguing:

The alternative approach would have been for me (/us) to suggest passive investors do what I’ve done, and to write an article saying “time to sell all your bonds”.

But this is not passive investing, and honestly I could have written that article in 2013 and 2014, and maybe even 2012.

Overall it’s probably better I didn’t.

Why? Because bonds did their job over those years – and as a bonus they conspicuously didn’t crash.

Abandoning passive investing at the first hurdle would have been bad enough. But it wouldn’t even have worked out for you! Being supposedly smarter and more pro-active would have been the dumb move, as things transpired.

Many people, including me, started calling the bull run in bonds overdone seven years ago. (Many before that, to be honest).

Let’s quote a couple of senior bankers from Credit Suisse and BNP Paribas speaking in 2008:

“It’s a bubble as over the long term these low yields are unsustainable,” says Dominic Konstam, head of interest rate strategy at Credit Suisse.

“At some point the Fed will exit its liquidity programmes and there is no way these interest rates are sustainable.” […]

“People who lost money in stocks are now lending money to the US government for 30 years at a yield of 3.30 per cent,” says Rick Klingman, managing director at BNP Paribas.

That sounded very canny in 2008. Yet as we know, yields kept coming down for many years afterwards. And anyone who sold their government bonds in 2008 might have felt especially terrified regretful as stocks fell into the abyss in March 2009.

Remember, those bankers were the experts. All they did was think and trade bonds all day. Still they got it wrong.

Why should you know better?

Or me, for that matter. For example, I wondered again on this very blog – this time in 2013 – whether it was finally time for bonds to blow up.

And for a while it looked like we were on, as yields actually did march higher for six or so months.

But then, yields went back to what they’ve been doing for three decades.

Falling:

Graph via Bloomberg.

Like this, over the years, betting on the top of the bubbly bond market has almost become a ‘widow maker’ trade for professionals if they were foolish enough to go into it in massive size without the mental flexibility to get back out again when it was obvious it was going against them.

At some point someone will look very smart by calling the end of the bond bull market, on the record.

(Perhaps this here post is my attempt. Take your pinches of salt!)

Nevertheless many, many people have been made to look silly for years by getting it wrong.

So I’d say beware of abandoning a carefully determined passive strategy just because it seems “obvious” bonds are overheated and the sell-off has begun.

Perhaps, but it’s looked like that many times before – and more importantly you’re either passive, or you’re not.

If you’re passive, you shouldn’t care.

Deep, man

I appreciate it feels frightening to think you’re dumbly holding on to an asset class that might be on the brink of multitrillion dollar spanking.

Surely you should sell?

But why?

What do you know that the market doesn’t know?

What do I know?

The whole reason to be a passive investor is because you believe – and the evidence shows – that most people know diddlysquat better than the market.

Including most professionals, as demonstrated by their market-lagging returns.

And if a pervasive lack of market-beating edge is true of equities, then it is surely doubly true of the far deeper and more liquid bond market.

Bond flows make the equity market look like a car boot sale!

In that light, saying you don’t want to hold bonds because you think they look expensive is – for a passive investor – at least as silly as saying you think GlaxoSmithKline’s new drug is going to boost profits in Africa and so the shares are cheap.

Really?

Or – what’s that you say? Central Banks have obviously distorted interest rates?

Don’t you think the market doesn’t know that?

As we’ve seen above, those bonus-bagging bankers we love to hate have been preoccupied with the very low yields on bonds for nearly a decade.

All that ‘obvious’ information should be reflected in bond prices.

Foretold is not foreseen

Now, it’s very important to appreciate that none of the above means bond prices can’t or won’t crash.

Some people seem to equate the statement “the market knows best” with “prices won’t change, or be shown to be wrong in hindsight”.

What believing in a generally efficient market really means is that to all intents and purposes, all public information and all the arguments for and against every position are already reflected in prices – or at least they will be before you can profit from them.

As an analogy, let’s say you and I were both at the race track, where a red car is racing a blue car.

We are standing on the corner of the track, waiting for the cars to show themselves, and we decide to make a bet about which car will be out in front when they come around the bend.

Without getting into the mechanics of betting, the fact is one of us will be right and one of us wrong when the cars do actually show themselves – but before the cars come around the corner, there might have been equally good arguments to say blue was beating red, and vice versa.

Good arguments, one winner.

It’s the same with bonds. Yes, prices look high, but they have for years. They might crash, or we might go into deflation, or Central Banks might keep buying them up for a generation.

From a passive point of view all these ifs and buts and maybes are summed up in their price. So you may as well buy, hold, and rollover your bonds, and get on with your life.

Bottom line: If you’re a passive investor, then you’re a passive investor. Set your portfolio up according to your risk tolerance, and look forward to doing much better than most active investors over the long-term, even if every year some particular smarty pants does better over the short-term.

Nothing more for you to see here. If you like you can skip to the suggested reading at the bottom!

What’s an active investor to do?

Still here? So you think you’re an active investing smarty pants, eh?

Fair enough. Let’s toss some hot air around.

Look, I am not really sure that this is the start of the rout for bonds – but as I wrote the other day on Monevator I believe it’s probably the beginning of the end and the lows are in.

In the short-term, quantitative easing from the ECB and the Bank of Japan should continue to keep yields relatively low (and hence prices relatively high) – but that’s on a multi-year comparative view.

Given how stupendously low yields did get – such as the ridiculous negative yields on German bonds we saw back in March – it seems to me very plausible to think that rates will indeed be kept low, but not this low.

I always felt it was more likely to be the markets then the Central Bankers who dictated when rates rise. And we might be seeing that happen today (albeit talked-on by Fed Chair Yellen and co, who likely never wanted to scare us into really considering deflation.)

As I said in my article ‘It’s always calmest before the crash’ back in April:

I’ve no more idea than anyone else how or when this slow death of yield ends.

But I suspect it will be with a bang, not a whimper.

The value investors at Schroders made a similar point that month:

What we are seeing now are investors who have forgotten about the risk of rising rates – a significant risk in itself – and who are confusing calm markets with stable ones.

In the context of history, one might think only a Mad Hatter or a March Hare would consider negative real yields as an acceptable reward for owning government debt – and yet here we are.

Curiouser and curiouser.

Since we opined back in April, the very low yields have indeed reversed themselves. Yet if yields were to go back up to even 3%, you’d still have to squint to see the rise on a long-term chart.

Yields fell beyond that to fall to phenomenal lows by Western measures.

To me, that final dip into negative territory is looking more and more like it was a technical quirk caused by ECB buying or a last hurrah by deep-pocketed active punters such as hedge funds.

The point anyway is that yields can still stay historically low due to Central Bank measures whilst also rising sharply from those barmy lows.

It’s not a contradiction to say both can happen.

Indeed, I think that both probably is happening.

But they were our friends!

To complicate matters, the reversal of long one-way bets often cause strange dislocations to come to light in the markets.

So I suspect that years of near-zero interest rates and the coincident very low government bond yields will have wormed their way into some hitherto stable parts of the system.

For example, annoying (and often wealth threatening) as it can be to be part of an emerging consensus, I agree with commentators who argue that all the Central Bank bond-gobbling of recent years has likely made the bond market less liquid than we were used to in the past.

Add to that the partial demise of Investment Bank prop trading caused by recent regulation, and the result is likely to be more volatility in bonds than we’ve come to expect.

The sheer mathematics of very low bond yields makes volatility more likely, too.

Mario Draghi, ECB president, said as much a week ago:

“We should get used to periods of higher volatility.

At very low levels of interest rates, asset prices tend to show higher volatility.

The Governing Council was unanimous in its assessment that we should look through these developments and maintain a steady monetary policy stance.”

Draghi’s warning that he’s not too bothered about volatility or the feelings of nervous investors added further to the turbulence of recent days.

In the long-term, others should step in to exploit any profitable volatility that regulation-constrained big banks are now shying away from.

Hedge funds and specialist smaller banks will do what the big boys can’t if there’s a profit in it.

But we’re not in the long-term yet. First we have to get there.

And if the volatility picks up pace, it probably won’t help matters that about 30% of the current crop of traders have never seen US interest rates rise.

People young and wizened alike are perennially surprised by the speed with which an asset class can go down, after it has spent many years slowly creeping up.

I imagine the same will eventually hold true for government bonds, too.

There she blows!

So what should the takeaway be for us naughty active investors, besides be sure to have some popcorn ready to watch the drama unfold?

Obviously, you probably don’t want to be owning a lot of European government bonds at microscopic yields, unless you believe that Europe will be mired in deflation for decades.

Actually, if that sounds like you then you’ve probably already missed your chance to bail out at the price highs – the German 10-year yield is already back up at 1%, and I have a hard time seeing it going all the way down again. 1

For the rest of us, beyond rate tarting your would-be fixed income money across a few decent cash deposit accounts (my choice for the past year or three) or even buying more premium bonds, it’s also worth looking out for knock-on consequences in your other holdings.

For starters, don’t expect government bond yields to soar and yet the corporate bonds or even more so the junkier high-yield bonds you may have bought into to escape unscathed.

As government bond yields inch back towards something respectable, some money should flow out of the riskier options, hitting their prices, too. Thus the impact will be felt along the curve.

Same goes for ‘bond proxy’ equities paying stable dividends (think Reckitt Benckiser, Diageo, REITs and infrastructure funds and the like).

That said, some of those have already correct to an extent, and I don’t think the over-valuation is as egregious as it was in my opinion for government bonds.

Equity investors never really, truly, bought into what ultra-low bond yields seemed to be saying. If they had then the stock market could have been justifiably on a P/E of 30 or more!

It’s also worth being alert for systemic issues if things do get really jumpy, as Matt Levine discussed last week on Bloomberg View:

The biggest worries revolve around the possibility of herding among bond investors and around those investors’ funding models.

The worry is that there is one dominant model of bond investing, in which giant mutual funds and exchange-traded funds buy and hold every newly issued bond that comes along.

Those funds offer their investors the ability to withdraw money pretty much any time they want.

But if bond prices crash, investors will want to take their money out, the funds will need to sell, and all those giant bond funds that provided the bid for bonds on the way up will turn into sellers on the way down.

The growing popularity of ETFs and so-called liquid alts that can give the illusion of liquidity (through holding illiquid assets in a quoted and theoretically easily-traded vehicle) may mean this is a bigger risk than it was in the past.

One rate to rule them all

You might not think any of this matters to you if you don’t own any bonds or bond funds or ETFs or anything else bond-like.

But good luck with seeing all your equities keep their value (in the short-term, at least) if the bond market starts to gap up and down – let alone if you start to read headlines about funds being temporarily closed to redemptions and so forth.

I’m not predicting that’s going to happen (you haven’t strayed onto a doomster blog) but it is a possibility given how long and strong the bond bull run has been.

Remember, all your investments can fail you – and in the short term volatility can reign supreme, whatever logic dictates.

If panic breaks out, it will likely take everything with it, for a while.

Even if there isn’t some sort of panic, rising bond yields could still be bad for shares.

That’s because in theory, all assets are priced off the so-called ‘risk-free rate’, which is basically the yield on a government bond.

The excess returns you’d hope to get from shares (for taking on the risk of seeing your money clobbered hither and thither, especially in the short-term) is the ‘spread’ over this risk-free rate, also know as the equity risk premium.

If yields on bonds rise then either the equity risk premium has to shrink – or else shares have to sell-off to maintain the spread.

Which will happen?

Who knows!

The spread has been very wide in recent years, again indicating equity investors never believed very low bond yields were sustainable in the long-term.

When you’ve heard pundits say things like “sure, shares look expensive but compare them to bonds” to justify markets that seem high on other measures such as CAPE, that’s implicitly what they’ve been pointing to.

However, in a prolonged sell-off bonds will eventually no longer look dear, and anyway the spread will likely narrow sharply.

Quantitative easing and multi-century low interest rates have messed with the picture a bit – normally you might expect UK interest rates to be 5% at least at this point in the cycle – but that buffer won’t last forever.

To be clear I am definitely not saying shares are about to crash!

But I am saying that smugly standing by in a bond rout while patting your equity portfolio on the head like it’s a tame lapdog could come back to bite you.

Equities are far riskier than bonds in the short-run. Always.

Finally, you might try to hold more equities that could benefit if and when rates rise.

Personally I loaded up on US and UK banks a few weeks ago. Certain insurers might be another option.

Stroke play

So is this it, or Is This IT?

Time will tell, but the choppiness, the fear, the sharp moves off the extreme looking lows that some still reached to justify… when the bond bull run does end, this is surely what it will look like…

Further reading:

(Incidentally, notice the dates on those articles. They’re evergreen really, but they also indicate again for how long this question has been being asked).

- Remember, yields rise as bond prices fall, so confusingly sometimes us chin-scratchers will talk about a ‘crash’ in prices while other times we’ll talk about ‘yields soaring’. Both mean the same thing, but it’s usually best to talk in terms of yields with bonds, for various reasons I’ll explain another day.[↩]

Comments on this entry are closed.

“I invest actively as opposed to actively for my sins” – damn, that’s some nuanced active investing! 🙂 (I presume you meant to say ‘passively’?)

@Moongrazer — Oops, thanks! 4000 words, the old brain starts to wander (as I’d imagine anyone who makes it to the end will agree… 😉 ) Fixed now.

I really dislike this article. Unless I’m mistaken, it goes on and on and on, and the final lesson is: you should continue to invest in bonds, despite the bleak atmosphere because…that’s what you’re supposed to do as a passive investor.

Which is an absolutely trite point. You effectively define a passive investor as one who doesn’t shift no matter what, and then go on to use that definition to explain why you should not shift.

Was 4000 words really necessary?

This does seem to have been the main theme lately. Personally I don’t own any bonds as I’m a 100% equity man, but my son has some bond ETFs held passively in his passive portfolio. If he asks me about the bond market crash I’ll suggest he take your “shrug your shoulders” approach, although at 5 years old I’m not sure he would appreciate such sage advice.

Blimey. I’m exhausted reading that Magnus Opus, TI. Must be all the nodding from here in the choir.

Calling the top isn’t the issue for bonds: bonds provide the risk-free rate while you wait for equity valuations to fall. In the recent bond market there’s been a large non-profit-seeking buyer driving yields down, but as a private investor you have access to more than one risk free rate — in particular one that doesn’t have such a clumsy bull in the china-shop: government-backed bank savings.

While I can get 300 at the bank and 215 on VGOV, the bond ownership situation is clear: buy only if you are a speculator not an investor. Call the top if you dare, set stop losses.

When I can get 4% inflation-linked risk free, I’m staring at my safe withdrawal rate if I hold to maturity. Would I fancy a bit of that? Too right. Anywhere in between and I’m so passive I don’t even cast a shadow.

@Mathmo

The government issued a 50 year index-linked gilt paying 4 1/8% +RPI in 1992 (might not have been issued at par of course)

Coupon on the last 54 year index linked gilt issued in 2014 was RPI+ 1/8%

Of course the UK’s finances have improved immeasurably since 1992….

I’m sorry, but what does this mean:

‘Personally I loaded up on US and UK banks a few weeks ago. Certain insurers might be another option’

??

@algernond — Remember, I’m an active investor and that whole second section was really for any naughty kindred spirits. i.e. If you have to ask then please don’t follow me down this route! 🙂

But for completeness, US banks should be able to improve what’s called their net interest margin in a rising rate environment — essentially they can cream more than the current pittance between what they earn on loans and pay on deposits. In addition they own plenty of cash-like stuff that they’d do better earning a higher yield on, albeit the valuations of such stuff might take a short term hit.

Insurers are similar, in some ways. An insurer like the UK listed Admiral keeps a ton of cash on its books that’s currently earning nothing. Five or ten years ago this cash was a profit centre. Insurers are trickier though because most own big bond portfolios that will take a short term hit before they see the benefit.

If bold one might even look for companies like AGA which have huge pension deficits. As rates rise the changing discount rate they must use to evaluate their liabilities could seriously reduce these deficits…

Another great read and very interesting – all the way to the end! I actually run both active and passive (my pension is passive, ISA is active). Its hard to shrug your shoulders on the crashes, but ultimately, thats why I do passive as well – I know I wont always beat the market, and I can’t time it so why add stress to my life to do that? As long as *on average* it keeps ticking up over the longer term (I have >15 years before I can access it) then I am happy. On the active side, I am with you and hold no bonds, nor have done for some time and not likely to any time soon (unless there is a massive crash of course!) – and scarily I have a fair bit of banks, already up on when I bought them by a bit! Lets see if my gamble (lets be fair, it is that!) on some of the supermarkets will pay off. And that again is why I have passive as well!

@phario — Feel free to ignore it. We do like to waffle around here! 🙂

I’m not saying it was a great article, and obviously it was long, but I could easily have written 10,000 words and still scratched the surface (especially when it comes to the active investing side of the equation).

Like a lot of important things, the point that a passive investor should keep being a passive investor is either trite or profound. Or both! I wrote a lot of words to try to explain why that was the case, but clearly it didn’t work for you. Fair enough.

Perhaps if you’d spent 3-5 years fielding literally hundreds of comments and emails from self-declared passive investors asking whether they should sell their bonds then you wouldn’t think it quite so forehead slappingly obvious what the response should be. 🙂

The question on the fate of bonds and what to do about it is of the type that is only “easily” answered by either those who know very little or else those who are lucky geniuses…

The rest of us will have to muddle through…

@Neverland — good spot, that one (1992 issued 2030 Gilt 4 1/8%+RPI).

Why are my boots not already full of that? Well personally I was too busy drinking at university in 1992, assuming that I would never get old or worry about retirement (why oh why isn’t Monevator compulsory reading for all school kids?)

Also, prevailing yields were 924 at the time. 924! Oh heady days.

And the FTSE was 2,600. *weeps*. Doing the Buffet calculation, each extra £1 pint in the college bar has cost me as much as trendy luxury Zone 1 cocktail.

Anyway, I’m getting off-topic and I don’t want to be told off… Excellent article TI. As you know – my favourite topic of recent weeks!

As for banks, passive types like myself with a developed world cap weighted equity index in their portfolio already have significant financial/banking exposure.

@Mathmo @Neverland — I think the reason very few people were filling their boots with that stuff was because the stock market had been on a tear for a decade and it was about to keep marching higher. Now anyone operating then can look back ruefully and slap themselves! 😉

I similarly marvel when I consider cash and bonds yielding 6-7% or more at the top of the Dotcom bubble in 2000. (You had a choice, people! 🙂 Not like us today… 😉 )

I wasn’t invested in equities then, but I like to think I’d have bailed and overweighted some bonds or preference shares instead.

But how much of this is hindsight? There’s always something knocking about that nobody wants (such as equities in 2009!)

For example, the floating rate preferences shares I mentioned a few years back have been inching up:

http://monevator.com/floating-rate-bonds-as-a-hedge-against-rising-interest-rates/

They could be valuable securities to own from here if Bank Rate ever got back to 5%, let alone if it got back to 8-12% range of the late 1980s — especially if it took the stock market down on the way… But Bank Rate will never be back at 5%, will it? 😉

Maybe commodities will look dirt cheap retrospectively in a few years when India becomes the new China and lifts 500 million out of rural shacks, getting them electric cars along the way. Who knows? (Deeply off-topic myself now…)

Thanks for the comments all!

Those floaters are fascinating, TI, I can’t believe you were hiding them from us like that (in a well-explained indexed public blog-post).

INVR now at 550p yielding 288, and threatening 545 in a 2% BoE world. Compare with Investec 2022 which yields 582 already. That’s got 490 of credit risk sitting on it (compare: SSE 2022 at 85 over gilts). Investec seems to rate around the same as Santander and a long way off the big banks.

In a 5% BoE world, it’s over 10% for as long as Investec stay in business.

Very interesting product. A bit worse than the fixed income equivalent with rates below 2%, but amazing if rates take off. Holdable within a wrapper. I wonder what price you can actually get it at.

Somewhere this reminds me of GWB ‘this sucker’s could go down’…

That Strokes single is the devil of a job to get free out of youtube

Alas, that’s the rub! 🙂 Horrible spreads. I’ve never managed to buy either inside the Ask price (though I’ve not tried to work them through a flesh and blood broker). INVR is not quite terrible as it looks, in a way, because you can often sell above the bid. So while it’s currently quoted at 500p/540p, you could probably dump a modest amount for about 520p. (Of course that’s because nobody else wants to do so right now…) CEBB is even sillier.

They were very interesting to me two to three years ago, but I struggle to add to INVR now (I sold CEBB some time ago when I needed the cash for some silly trade or another) because some rate recovery seems already priced in. I think that’s because the mechanics of the coupon ironically kept them attractive even as perpetual yields fell further (because they had a fixed positive component).

Needless to say, caution required, not for widows and orphans or passive investors who sensibly watch for 10 basis point cost hits. (I repeat, the spread with these weird securities can be 10%!)

@ermine — For a retired person without a care, you do seem to love saving time with acronyms! Each to their own, but I’m forever having to Google what you’re talking about… 😉

depressing article.

Indeed, TI. With a 10% cost to get in and out (nearly 4 years of yield!), low price volatility and liquidity and all that credit risk, I can’t see that being anything other than a very long play of a reasonable size rather than a side-punt…and I can’t see myself making a single B- rated bank the core of my retirement income. I probably ought to buy some for the next generation.

Incidentally, extending that measure, you can get in and out of ISF for 3bp — about 3 days’ net yield. VUKE is about a week. VGOV is 26 days and ERNS 32 days yield. Hmmm. I like this measure. I hope they haven’t already named it after someone else.

@Mathmo — Indeed. I do wish I’d bought a *lot* more INVR in the mid-300ps when I first wrote about it. But it’s easy to forget that banks were still scarier prospects in January 2013. Perhaps it would have been more stomach-able if there’d been a few of these around from different issuers. (Nationwide’s CEBB did give a second chance when the Co-Op got into difficulties from memory, but again…)

A reader suggested in that original article to look at a couple of floating rate loan/bond funds, such as NBLS and AEFS. The difficulty I have with these is I’m completely in the dark really in terms of how to assess credit risk. They own loans to companies at the junkier end of the spectrum, and given you’d be buying for a rising rate environment, you’ve got to worry that in such a scenario defaults would go up, too. And then there’s the refinancing potential…

…and so back we are at cash. 🙂

@Investor

How can anything be cheap when the risk free rate ~ nil%

Fact is six years on we still have the same monetary policy we had when people were wondering if they should every investment bank in the world would collapse

I’d put it differently. How can anything be *expensive*?

(Obviously I don’t think that’s true, but it’s the flip side of the same argument. The spreads over the risk-free rate for say dividend paying equities are still well above historic norms etc).

Yes, it is a long article, I skipped the active bit but I appreciate the time, effort and humour in unravelling the many rationales behind opposing approaches.

I personally think your talent (barring your humour) is somewhat wasted on the very unacademic subject matter of investment strategy where so many think they know everything about it and few appreciate your unique pedagogical approach.

You are like a philosopher among bulls and bears on ice – to milk a recent analogy from Juncker.

Talking of cows on ice, http://youtu.be/bZU-owLWV3Q illustrates the active vs passive conundrum in less than 10 seconds in a manner that appeals to the masses.

With hindsight, TI, you should have bought a lot of government bonds when INVR was in the 300s as they have also done spectacularly well and at a lower liquidity cost…you can swap those into INVR now you’ve discovered the top of the bond market 😉

@neverland — if the risk-free rate were zero then the discount on future cashflows would just be the risk premium and corporates would be worth a lot.

As it is, the risk free rate definitely isn’t 0%. It’s around 2% in the UK on a 10-year horizon. The sterling yield map on fixedincomeinvestor is always a great read.

@Mathmo, Investor

Demographics is destiny

Demographics in Europe and Asia dictate that savings will become scarce in the future

~2% is pretty much close to nil in historic terms

If sometime can’t continue it will stop

Bond crash? Don’t mind if I do, my portfolio is perilously heavy in equities and needs a lot more before I can reach my target allocation!

Love the post, thanks TI

We don’t see enough of your naughty side in my opinion, after all passive might be best for most, but it is not so entertaining to read!

I agree a bond crash is more likely than not at some point, whenever that is. But I’ve not taken the time out to intellectually play the scenario forwards to see the possible impacts that might occur as a result.

Things are always under review, but at the moment whatever happens to my equity portfolio capital valuation as a result of a potential bond crash, I think my strategy will be to remain invested in my equity portfolio and to be content with the dividend income it throws off. For me a modest drop in capital valuation as a result of the change in the risk premium vs. bonds can’t hurt much more than my pride.

A great read, thanks.

Good article. One thing I have noticed down the years is the peculiar attitude some private investors, pundits and even professional investors (as mentioned in the article) have when it comes to bond markets. They really do believe they can outwit the bond markets, even though the least deluded amongst them would admit they cannot outwit equity markets.

Regarding the punt on US/UK banks, does the Investor think that the market has not realised that NIMs will rise when interest rates rise? Have all the banking analysts out there missed this possibility?

Anyone holding a portfolio of global capitalisation weighted trackers is already loaded up on banks and so will benefit from rising NIMs, assuming the market has not already priced this in…

On INVR – this is a preference share, which sits just above common equity when a bank gets wound up. Bank preference holders got bailed out once, but it will not happen again, even senior bondholders are not safe. The new resolution regime will see to it that the taxpayer never bails out bank bondholders again and especially not preference share holders.

Preference shares are in no way a substitute for gilts. I do own a few and some PIBS, which I picked up in the aftermath of the banking crisis, but I recognise them for what they are – risk assets just like ordinary shares. Albeit risk assets that throw off a lot of cash.

I would advise any reader of this blog to think carefully and research properly preference shares and subordinated debt before being tempted by the yields. Yields on prefs are not high because the market has mis-priced them.

Potential investors might like to look at what Lloyds Bank got up to recently – they tried to defraud private retail investors who held “Enhanced Capital Notes” (convertible subordinated debt) and given half a chance, no doubt Lloyds and other banks will turn on preference share holders if they think they have a chance of getting away with it. Against the odds, private retail investors managed to defeat Lloyds in the High Court – an amazing result, but I bet that took a lot of work.

Similarly, Co-op Bank preference share holders came very close to being completely wiped out a couple of years ago, way after many people thought the banking crisis was over. These sorts of things cannot happen with gilts.

@Minikins – You are *literally* too kind. 🙂 But thank you.

@Ric @Naeclue — Well, in just your two consecutive comments we have the rub of me writing about both passive and active on this site, don’t we? 🙂

On the one hand, I’ve written a bloated and apparently ‘depressing’ article that one reader at least was motivated to spend half a minute of their life they’ll never get back explaining to me why it was so rubbish and long-winded — partly because of the trite and waffling points I make about passive investing, which I made because I am trying to explain that most people shouldn’t even be thinking about this stuff.

(But why then would such a person want to read even half the 4,000 words about it you say? Yes, I sort of agree, in hindsight.)

That reader’s complaint is relevant because in my experience online, where one is moved to type to complain perhaps 50 were thinking it. 🙂

And now we have a warning that certain securities that I was careful to note are “weird”, “caution is required”, and “not for widows and orphans” even when writing a comment just referencing another article… we have a warning they are “in no way a substitute for gilts”, along with quite a long explanation of why they are not, when I’m not sure when anyone said they were?

I’m not knocking that warning, by the way Naeclue, you’re quite right, very articulate, and it’s nice for someone else to spell it out as I seem to spend all day caveating everything I write on this blog and a burden shared is etc etc. 🙂

I am just pointing out the inherent tension in Monevator’s schizophrenic soul, especially with my co-blogger not around so much — because he is, allegedly “writing the book”.

(Personally, I am starting to think he has succumbed to consumer temptation and discovered Netflix!)

While I’m on that subject, as you’d imagine I have indeed considered the fact that other people have noticed banks make money when rates rise and that this may be in the price. I know lots of people have considered it. In fact, some pundits have been banging on about that opportunity for 2-3 years.

Clearly I have bought because either believe (a) a sufficient number have nevertheless under-considered it or (b) because I think rates will rise more than most or more quickly or (c) because my investment in banks is more than just a play on rates rising (which it is — it’s a potential hedge as I hint above on the possible fall out from a big bond route) or (d) because I believe people have considered it but some sufficient number are still under-invested in banks for ‘yuck factor’ reasons related to the financial crisis (similar to the tobacco stock pricing error that I’d argue occurred for most of the past two decades) or (e) for several other factors, but it’s a Friday night and none of us should be here really so let’s get to the chase… or (f) all of the above. 🙂

I don’t really see what the solution is. The way this article has turned out (yes the critic is right, it’s not one of my best) and the tepid response to it shows there’s not really much of a future in trying to cover both stools with one post…

And certainly, writing “I have bought more banks” or whatever other active throwaway remark I might want to make but then adding a 500 word footnote *every time I do so* about Efficient Market Theory and the evidence that favours passive investing over stock picking etc etc etc is not going to be sustainable or fun for anyone.

If you think there’s some cognitive dissonance in reading someone writing about passive investing while constantly trying to outwit the markets in your day-to-day life, you should try living it! 🙂

Hence, you have the answer to your unspoken question Ric, as to why I’ve dialed back the active stuff here on Monevator.

It’s a bit of a regret, but equally I’ve often considered cutting it out completely. (My co-blogger for one has encouraged me not to, interestingly enough).

I have also considered several times putting the active stuff behind a paywall. That’d stop casual passive investors reading stuff they’d be better off not reading, it’d stop me having to write 4,000 words when only 2,000 would be sufficiently tedious for the reader because I wouldn’t have to be long-winded and even-handed in addressing ‘both camps’, and it’d help tackle the ‘Monevator monetization problem’, too

(To which end, little tip — don’t start a website where you tell people to invest in index funds, obsess over lowering costs, ignore fund marketing, avoid spending, etc etc. It’s good for the readers but terrible for the profit and loss account… 😉 ).

Around about this time someone usually comes along to say that I am an arrogant investing snob because I “believe that passive investing is good enough for the mob but that I am special and can win at active investing”.

But please don’t, I haven’t got the patience for it today, this week has been a long one for me and maybe it has for you too. Let’s just have a beer.

As politely as I can: I have reasons and evidence to believe I can beat the market, and I have seen nothing that convinces me that’s true for most and especially not “you” (i.e. any anonymous comment writer).

Active investing is incredibly hard and you have to be a ‘special’, which I write in euphemistic terms, to have any hope. You’re probably not. Like it or lump it. 🙂

Sorry, a bit of a rant, which I hope hasn’t come off more hostile than I meant it to. (I wasn’t supposed to be in this Friday night but — events. Grump grump! Best to all!)

Where’s the “buy me a beer” button? Two birds, one stone.

Hah! In my defense, I’d had a couple already when I wrote that comment. 😉

Thanks for a very comprehensive article. I admit despite the best efforts here (and elsewhere) to rectify the matter I still struggle to really understand bonds as an asset class. However, if we are using them in a passive portfolio to counter volatility in equities, and they remain relatively uncorrelated, is volatility in that class itself a bad thing? One of the investment books I read seemed to make that point (John Kay “The long and the short of it”).

Perhaps that was a little too cryptic. Bond volatility need not be the end of the world if two volatile asset classes remain uncorrelated. Are government bonds and corporate bonds splitting into two sub-classes which may become sufficiently uncorrelated? I recall comments about the potential correlation of corporate bonds and equity. Should a passive investor ensure that those two sub-classes are sufficiently differentiated to benefit from volatility when rebalancing their portfolio against the equity component (I hold four different types of bond fund with that aim).

@Hamzah — Yes, I think you have it exactly right. Historically *government* (not corporate bonds) have been sufficiently non-correlated with equities to reduce volatility, especially in sharp market downturns. (Corporate bonds are another matter altogether. I think most passive investors are best off ignoring them).

What some self-proclaimed passive investors, including many commenting on this site over the past couple of years, appear to want is to have enjoyed the success of their diversified portfolios over the past few years — and to draw comfort from the long-term returns historically of such portfolios — but to suddenly want to take an active investing decision to reduce/dump government bonds now they ‘look expensive’.

That isn’t passive investing, and as NaeClue says above it’s also somewhat amusing, given that bond markets — even potentially distorted by Central Bank buying — are surely at least as efficient as the equity markets.

This may appear a ‘trite’ point to at least one reader, but I really have not got the sense from such passive investors that they understand the contradiction, which is why I’ve belaboured it in some detail in this article. 🙂

An active investor might decide these are unusual times, that bonds have moved up extremely strongly along with equities, and that therefore any volatility cushion they might provide is very slender, and that in fact bonds are likely to be a source of loss alongside equities in a market correction.

What I’ve tried to say above is that while that sounds very smart and all, they’ve been saying that and being wrong for years now. I think they’ll eventually be right, is my best guess, but the record cannot be ignored because the point is this sort of strategy has *already* reduced their returns.

As you say and I say in the piece, shares *should* do better than bonds over the long-term enough to make up for bond losses, and rebalancing will help further. While the times are unusual and the bond situation looks extreme, the fundamentals of passive investing have not broken down here.

Which is what I was trying to address in the first part — why so many seem will to cast aside their passive strategy despite this…

@Investor – “(Corporate bonds are another matter altogether. I think most passive investors are best off ignoring them).”

That point is noted studying the composition of the variety of lazy portfolios discussed in related articles here. I was left to mull what Vanguard had in mind however when constructing their LifeStrategy funds (the initial reference model for my own fund blend)? Should government bonds still remain the vanilla option for a passive investor or should one try to understand what drove Vanguard’s selection of their bond fund components?

Simplistically, if one looks at the Morningstar box styles for a range of bond funds they span a variety of quadrants related to interest rate sensitivity and quality. One may blend varying international exposure and market capitalisation in the equity part of a passive portfolio. Seeing as the bond market is even larger and equally diverse, isn’t sticking to only government bonds rather restrictive?

I would just like to add to the “thanks, enjoyed the article” side. I struggle to “get” bonds, yes I know – they are really very simple……once you understand all their funny little ways. So I did appreciate all 4000 words – almost ;D

i’m a little puzzled by the suggestion that passive investors should avoid corporate bonds altogether. yes, corporate bonds will behave a little bit like equities (especially at the junk/high-yield end). but then equities from different sectors of the market are mostly highly-correlated with 1 another. passive investors wouldn’t leave a sector out on the grounds that it doesn’t add much to the other sectors; the passive approach is to hold a bit of everything. similarly, corporate bonds are another kind of securities issued by corporations, so why not hold a bit of them, along side your equity allocation?

of course, you shouldn’t fool yourself into thinking that corporate bonds can do the same job as government bonds only with higher yield. there is a spectrum of risk, from government bonds at the low end, via corporate bonds in the middle, to equities at the top (and perhaps small value equities at the very top).

i also have a more specific reason for holding corporate bonds: it lets me take a little equity-like risk with money i might want to use for a house purchase. pulling money out of bonds after a bond crash is not going to incur anything like the losses you might incur if you pulled money out of equities after a stock market crash. (incidentally, i don’t seem to have lost any money in bonds over the last month or 2. but then i’ve kept the average duration down to about 5 years.)

Just quickly on corporate bonds (just another manic Monday), certainly reasonable minds can disagree. But the evidence I’ve seen over the years has indicated to me that the risk/reward of corporate bonds is not favourable. You essentially take more risk than government bonds without getting the rewards of equities. (My rule of thumb is basically when corporate bonds do well, equities will do better.) David Swensen’s “Unconventional Success” makes this case pretty well, if I recall correctly. Costs may be a factor in his argument, too; I have a feeling he had a problem with corporate bond passives but I’d have to go back to re-read to make sure.

His book for one was published pre-crisis, so perhaps the stats are different now (though the equity stats would be off the charts in the US, so perhaps not).

Plus “by rights” corporate bonds should have suffered much steeper losses in what US writers now seem to be universally calling “the great recession”. Defaults were kept low by the what I suppose we must still call “extraordinary” near-zero interest rate policy, though these days it’s pretty ordinary! So that’s probably played with the statistics, too.

I don’t think a 5% or whatever corporate bond allocation is going to hurt, obviously, and it will probably dampen down short-run volatility. But I’m with those who’d say if you’re going to hold bonds for all that bonds offer, hold mainly government bonds in your own currency (assuming it’s US, UK, Euro) and aim to get your return from equities.

TI — Thanks for all the work; this has been my go-to-blog for investment information and discussions for quite some time. Given that TA is on book-leave, I wonder whether rather than having extra-long pieces incorporating two sub-pieces directed to different sets of audiences (the orthodox passive on one hand, and the voyeur-passive/semi-passive/active on the other) it would make sense to split them in two pieces — to be published in different days of the same week.

@allie @R — Cheers! Regarding splitting this article, I did consider it but the trouble with this topic in particular is every time you go into it you have to cover all the same ground again, at least if blog comments are anything to go by.

It hasn’t so much happened here, but when TA has written about bonds in the past you get all sorts of “obviously true” statements of the sort I’m railing against in this piece. So I felt I wanted to write at least one article that drained that out of the discussion and covered all the bases, to try to show there’s no easy answers here. (Or to knock people over the head into unconsciousness… 😉 )

So far this article is mainly notable for having been published almost exactly on the day that bond yield peaks — i.e. Far from the start of a bear market for bonds it marked a turnaround in sentiment and yields coming down again!

Clearly it’s ridiculously early days on that score, and I think Greece is more the issue here than the sort of long-term concerns (e.g. deflation) that could really justify a further prolonged period of falling bond yields, but still — it goes to show! 🙂

As a passive investor one of my biggest decisions is equity / bond split.

This great article has helped to remind me that I am not trying to understand or predict what is going to happen in the bond market, and that discipline is key; set out a strategy that de-risks over time and stick to it!

The article title is a great question, and one that could currently be justifiably asked every month, since as you suggest, it has to end at some time. As to when this is, who knows!

Thanks again for an excellent article.