Getting a dream tenant for their buy-to-let is, well, the dream of most landlords.

A tenant who pays on time, tidies up, and refrains from crack parties on a weeknight will make landlord life so much easier

Investing in property isn’t like buying an index tracker. Property is much messier. Buildings and their inhabitants can let you down.

Indeed the consensus around places like Monevator is that buy-to-let is more hassle than it’s worth. Property investing is for the Homes Under The Hammer crowd who don’t know any better.

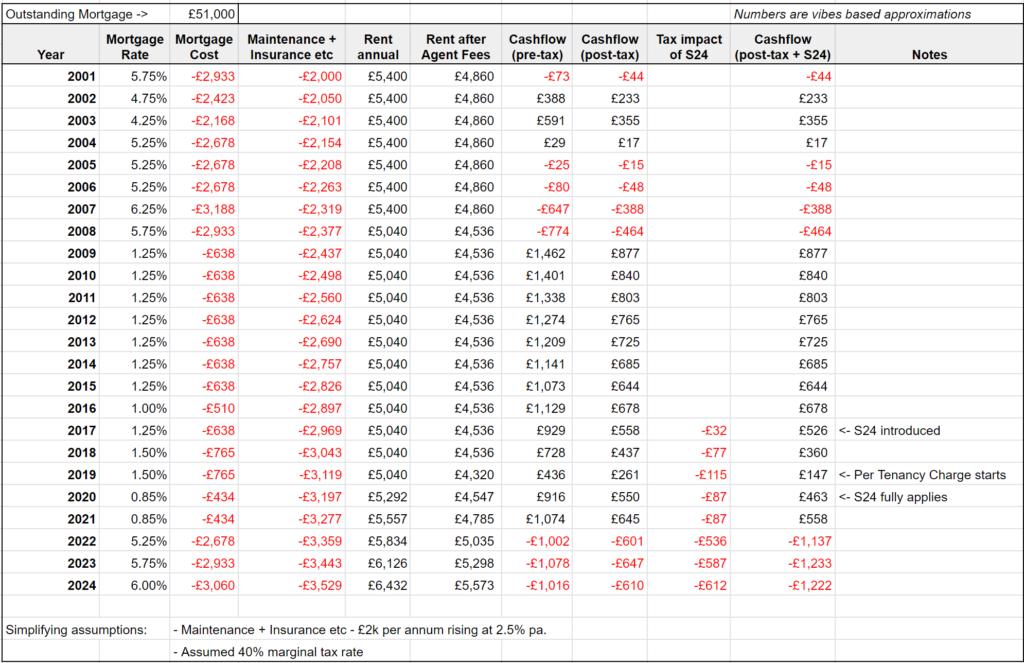

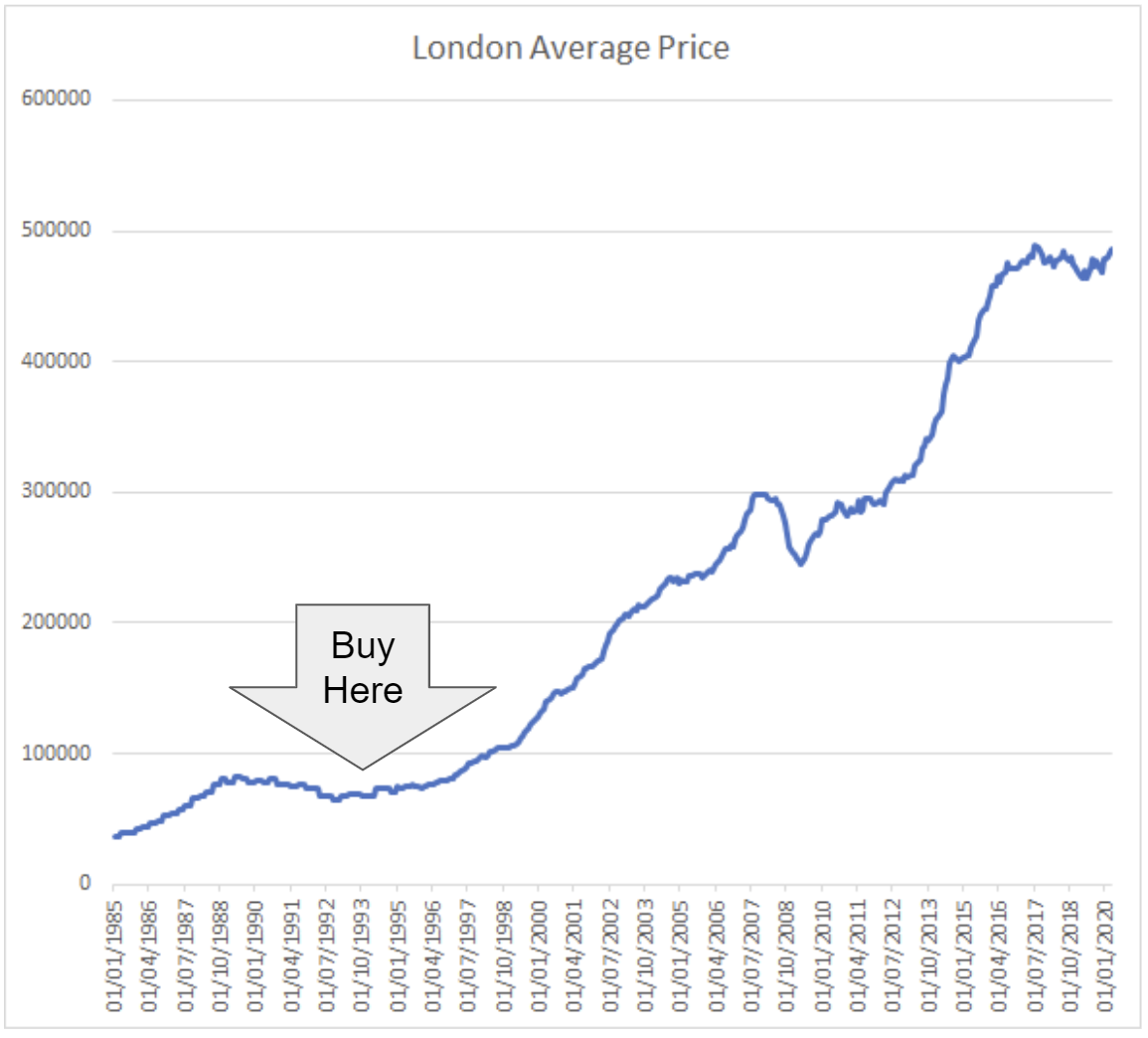

And I’d agree its glory days are behind us.

But where I differ from many of the Monevator faithful is I’m not leery of real estate as an asset class. Nor of having a stonking big mortgage.

Despite my love of the stock market, I’ve long believed owning your own home is the best investment the average person makes. 1

Homes are typically bought with a mortgage. That mortgage is a forced saving scheme that gets the average person socking away money for 25 years. The mortgage also leverages up an initial deposit, hugely boosting the returns from even modest house price growth over the long-term.

Mortgages are a major reason why most of the Haves Have, while the Have-nots are still renting.

Mortgage is an eight-letter word

Despite these dreamy qualities, mortgages get the same cold shoulder as buy-to-let from many seekers of financial freedom.

Indeed there’s a band of Pay Off You Mortgage First militants who show up whenever you mention the M-word on the Internet.

Presumably there’s some kind of bat signal. But it must be pretty targeted, because while YouTube is flooded with heavily-viewed and Liked videos urging you to continually remortgage and re-up your buy-to-let empire, I get taken to task simply for not immediately paying down my big interest-only mortgage the first moment I’ve got some spare cash.

Now, I do get where the anti-mortgage brigade are coming from.

A mortgage – like all debt – introduces risk.

Mortgages are usually cheap and they’re secured against an asset (your house) and today most banks bend over backwards before repossessing.

But you’re still more vulnerable with a mortgage than without.

When I took out my mortgage, I admitted to a friend it was the first time I’d felt nervous about money in decades. Because it was suddenly possible for me to concoct a (far-fetched) scenario in which shares went to zero, my house plunged in value, too, I lost my income, and I was left bankrupt.

Whereas in my debt-free Bohemian days, bankruptcy was impossible.

It’s true, too, that paying off a mortgage delivers an instant, known return.

Pay down £50,000 of your mortgage and you’ll definitely save all the interest you would have otherwise have paid on it.

That’s a precise return. None of the ups and downs of the stock market, and usually more attractive than the fluctuating returns from cash at the bank, too.

There are even tax benefits to paying off a mortgage versus saving cash.

You’re your own landlord

All this came to a head recently as I wondered what to do with a six-figure lump sum I’d conjured up by panicking prudently realizing some capital gains before the last Budget.

I considered everything, from the early repayment of some of my mortgage to buying an investment property in the provinces.

But for me, not paying off my mortgage – and investing the money instead in other assets – still seemed to offer the best balance of risk, reward, and a simpler life.

I mean a simpler life compared to potential buy-to-let headaches, of course.

And my conclusion was hugely enhanced by knowing that I would never find a dream tenant for my buy-to-let who’d be as good to me as … me.

You’re a dream tenant

As a home owner, I effectively rent my house to myself.

This isn’t a fanciful metaphor. There’s a concept called imputed rent that we need to get into some day, which represents the housing services you enjoy by living in your own home.

Some countries even tax homeowners on this notional rental ‘income’.

So yes, I am a landlord already – and my property has the perfect tenant:

- I look after it like nobody else would.

- My rent is never late.

- In fact, I’ve done a deep dive on myself and my financials are spotless.

- I love the furniture, the garden, and the area. I’m in no rush to move!

- There will be no illicit smoking, pets, or neighbour-baiting parties here.

Perfect! I should really send myself a bottle of bubbly this Christmas.

Dream tenant or demanding drain?

Of course you’re not the perfect tenant in every way, not even for you.

You know exactly what buttons to press to get your landlord – you – to accelerate that refurbishment, or to buy a new sofa. Which could be costly.

(Slightly) more seriously, you don’t scale.

You can only be your own tenant in one place at a time. Perhaps two if you buy yourself a commercial property within your SIPP and work from it.

Beyond that, you’ll have to risk a third-party if you want to own more properties.

Alternatively, you could buy yourself a bigger home, get a bigger mortgage, and seek exposure to residential property via listed housebuilders, or the few trading companies that own it such as Mountview Estates or Grainger.

But many people are already over-exposed to residential property. Buying more global equities is probably a better bet.

Method in the mortgage

The main benefit of having me as a tenant is risk reduction.

I am much more comfortable running a sizeable debt this way, compared to if I was relying on a stranger to cover my mortgage via a buy-to-let rental.

Also note that I don’t increase my exposure to the property market by not paying down the mortgage.

My exposure to residential property is the value of the asset that is my home. The size of the mortgage I finance that ownership with is irrelevant.

Still, having a mortgage does ‘gear up’ my overall investable wealth.

I could use mortgage debt to increase my exposure to property (by getting a bigger home or an investment property).

Instead, I’ve effectively deployed it to own a larger basket of shares, high-yielding bonds, REITs, Bitcoin, cash, and various other types of assets.

I am much more comfortable running a big debt this way, compared to if I was relying on a stranger to cover my mortgage via a buy-to-let.

A strategic bet

It can be helpful to look at common financial constructs through a new lens.

For example how a mortgage is money rented from a bank.

Or how a landlord is someone who borrows money on your behalf.

Similarly, don’t overlook your qualities as a home-owning tenant.

Of course I don’t expect the mortgage haters to call up Halifax tomorrow about a five-year fix, just because they read this article.

For one thing, there’s nothing wrong with paying off your mortgage. It has loads of benefits – emotional and psychological as well as financial – and not everyone wants or needs to boost their returns.

But equally there’s nothing intrinsically wrong with having a mortgage, either, especially at today’s low rates. It’s all a matter of knowing what you can afford and can comfortably handle.

With a dream tenant in place to meet the interest payments, a mortgage might be the safest way to enhance your investing returns.

It sure beats YOLO-ing on meme stonks!

- There’s no need to explain how *you* make 80% a year trading out-of-the-money options or whatnot. I said the ‘average’ person. 🙂 [↩]

Comments on this entry are closed.

Really good article – totally enjoyed reading it. Thank you

An interest only offset mortgage is the closest thing I could find in the UK to what our US cousins call a Home Equity Line of Credit – HELOC. A line of credit which can be drawn upon and which is secured against the value of your home. I currently have a 1.4% fixed interest rate on the mortgage. I’m salting away a cash pile to address sequence of return risk during the early stages of Financial Independence. Every pound I manage to stuff away in the offset account reduces the mortgage interest payment however the cash sits ‘in limbo’. I can take it out again at any point in the future so long as I don’t pay off the mortgage. For example, a major market dip in the first 5 years or so of living off accumulated investments. It has taken quite a while to get over the psychological hurdle of planning to jack in my current sole source of income with a mortgage still ‘hanging over my head’. I have a choice. Work hard for two more years to simply pay off the mortgage or take the next step and expect my current investments to be able to achieve the same at some point in the next 10-12 years.

I feel seen!

Brilliant article.

I also have no plans to enter into buy to let as it seems like way too much hassle despite the potential for greater returns via leverage.

I’m also not going to pay down my mortgage any more than I have to. I do plan to pay it off before I retire or move to part-term though.

I was – for four or so years – an ‘accidental landlord’ after my mother died.

I had two dream tenants – one was employed as a gardener at Chatsworth and was one of those odd folk who liked to bring his work home with him. My garden never looked so good. Unfortunately his partner moved to Brazil and he went with.

The second used to own a hotel (I never did quite grip how he ended up renting) and was extremely competent at DIY. He’d ocassionally call me up and we’d have conversations like:

Tenant: “The register plate on the woodburner has rusted through.”

Me: “Oh, crap, I’ll sort out someone to come round.”

Tenant: “Don’t be daft. I went to [local metal fabricator] and had one made. You owe me twenty quid.”

It’s still less hassle not being a landlord though, overall it was some of the most stressful money I’ve ever earned.

I admire those that can look at only the cold, hard numbers and ignore the psychological aspect of being mortgage free…

I am taking a balanced (fudged?) approach and doing a bit of column A and column B… Out of the regular savings pot, about half is currently going into mortgage overpayments and the rest into ISAs and pension.

Yes, returns should be much better in the investments than our current mortgage rate, but the comfort from knowing we will be mortgage free a lot earlier than the standard term is just too much to stick to the regular repayments.

I bought my first house in 2003 and cleared the mortgage in 5 years. I kept that house and then later bought a family home with my partner and we paid cash. My first house is rented on a consent to let which ends in about 6 months. The tenant is a work colleague but I’m facing a bit of a dilemma. The tenant pays below market rates as I wanted it rented out quickly.

The mortgage on the property is a fully offset interest only at 1.5%. If I just simply look at the figures I’d probably make a better ( and simpler ) return by drawing some of the offset funds down and investing them whilst keeping the property empty.

As some have commented, I notionally cleared my mortgage as quickly a possible for the psychological effect of fully owning my own home. Had I invested the funds I’d probably have made more money but I’ve enjoyed the security of knowing I own the property. Renting out property is stressful even if you have a dream tenant.

I’ve recently discovered Dave Ramsey on youtube and like the simplicity of the Baby Steps. Which seems to involve investing 15% of your income in pension/SIPP/ISAs (perhaps for the UK you could put any income taxed at 40%+ in a pension wrapper) and then hitting the mortgage with any spare cash left.

Once the mortgage is gone you are then free to invest as much as possible.

Dave’s Millionaire Next Door-style statistics seem to bear that out as working well for most people.

I think it is good to stay leveraged to UK property for much of your working life, at least that has certainly been proven to work incredibly well for the last couple of decades.

Not doing that can see you end up with ‘too little house’ and never able to move up the ladder if needed, or move to a better location for FIRE vs being able to downsize and free up cash if you have ‘too much house’.

There are limits to this though, and I certainly want to downsize and cash out by the time I get to my mid to late 50s instead of having too much net worth tied up in the house, and a mortgage combined with dependency on an ageist IT sector.

The maths are bit trickier with bonds. For instance I certainly don’t see the point of investing in gilts yielding 0.5% ahead of paying off mortgage debt at 1.5%. Perhaps unless you factor in tax relief on pension contributions + taking that segment of your portfolio as a 25% tax free lump sum and using that to clear the mortgage when you are 55/57 or whatever.

Are any Monevator readers using the PCLS to pay off their mortgage?

Great article. We bought our current house in 1992 with the help of what seemed a colossal mortgage at the time of £300k. Within 10 years that seemed distinctly below average amongst peers. Never paid a penny off it either. We could have done, but like @TI chose to stuff the money into PEPs/ISAs and we subsequently bought a holiday home.

Not reducing the mortgage definitely turned out to have been the right thing to have done. We did pay off the mortgage on our previous property, but mortgage rates were much higher in the 80s and doing that put us in a great negotiating position when it came to taking out the monster mortgage.

We switched mortgage every couple of years before finally settling on a flexible IO mortgage in 2004. That has been great for instant access cash deposits as the interest saved is of course not subject to tax. My only regret was in going for a 20 year term when 25 to 30 years was offered, so have to pay off in 2024. Not sure what I was thinking there.

Despite current low rates, I think it may be worthwhile reducing a mortgage for those on high rates because, eg because of a high LTV. A lower LTV opens up more opportunities for remortgaging onto better deals. Not an issue for us as we had a decent deposit from the sale of our previous house, but I know a few people who really suffered from landing on so-called “standard rates” after their discount period came to an end and finding it impossible to remortgage.

Yes, I’m afraid I might be one of those people who posts under every article like this about the joys of clearing a mortgage asap (or…ahem…buying with cash). Your psychology may vary, but there was a noticeable weight lifted as I realised I’d never be paying rent again and no-one could take the house away. It was worth every penny.

Removal of the biggest household bill acted as an accelerant on the pension as all of the savings on rent together with the money I was previously squirrelling away to buy the house were chucked into it. And I decided to go part-time as well. I reached FI about four years after buying the house.

The problem with planning to use the PCLS to pay off your mortgage is that it’s subject to political risk – at any point in the future the reigning government could change the rules. This isn’t far fetched; only a few years ago all three main political parties were fleshing out ideas about how to do so. If I recall rightly a couple of parties were planning to limit the PCLS to around £40,000. All has gone quiet on that front for the time being, but it’s one of those ideas – like cutting higher-rate tax relief on pensions – that’s likely to surface again and again in future years, and might actually make it into policy.

So much is to do with the psychology of money in this article.

Having suffered 15%+ interest rates on our first mortgage, the second offset mortgage we took out was a respite to paying the bank first every month. We kept the offset until they were paying us interest and that spurred us into the world of stocks and shares – I never felt capable of taking on the risk before then (we went through hard times in the nineties) and information about investing was hard to come by in the circles I moved in compared to today. The day we paid off the mortgage and opened stocks and shares ISA accounts was a turning point for us. I remember the conversation with the lady at I.F. the day we closed the account, to me it felt like the biggest thing, I had freed myself from the tyranny of the bank and the possibility of 15%+ interest rates grinding at my income every month. The land I grew plants on was mine! To the lady on the phone it was just another transaction – no trumpets, tick-a-tape, balloons or silly hats, just a friendly “can I help you with anything else today”. Leverage is not a comfortable thing for me. I am fortunate now not to need it.

As for me being my own perfect tenant, I am most certainly not, looking at my house I would struggle to let it in the state it is in 🙂 but it is mine and I can keep it how I will.

JimJim

@semiPassive

I had planned on using the PCLS to payoff my IO mortgage – based on a combined DB DC pot, but taking the money solely from be DC pot.

Unfortunately Ermine pointed out this is rarely possible!! (They need to be in the same company or something along those lines).

My current plan is to sell a BTL and hope its value increases by ~75% in the next 10 years to match the outstanding mortgage on my house (+CGT). I’ll use the smaller PCLS from the DC pot to hopefully settle the BTL mortgage.

B

Ps talking of BTL hassle and unexpected expected bills – in the last 2 weeks I’ve spent £2k on a boiler for a small 1 bed, and I’m looking at £1k bill to meet the recent electrical inspection legislation, and the BMW engine bill is looking like £3k. I think I may do some part time contracting…the good news I’ve hit the 35 years for full state pension

@G (#10):

Re: I’d never be paying rent again and no-one could take the house away

I generally see this issue as you do.

However, your statement above is not 100% guaranteed for all time.

As another poster said recently: “sh*t happens”!

@SemiPassive, we are ones who used the PCLS to pay off the mortgage. When we did our planning for retirement we worked out that my DB pension plus drawdown of an achievable total for my wife’s DC pension would cover our expected (comfortable) expenses except for the mortgage. We had been overpaying the mortgage each month (since 2008, when we kept monthly payments constant when rates fell) but changed to pumping up our pension funds – in my case to AVCs close to the maximum which could be withdrawn tax-free as part of my PCLS, and exploiting the bit of my salary taxed at 40%. We had enough that the two PCLSs not only paid off the mortgage but topped up the savings we had drawn down to take advantage of pension tax benefits.

Whether or not paying off the mortgage is the best use of money (depends on how whatever you invest any lump sum instead in does, which you don’t know in advance), it is great for the psychology of retirement. Mortgage was by far the biggest monthly outgoing, and with that gone juggling finances is easy.

I agree with all the points made in the article, but I’d add a perspective.

I have a young family, and I own my 3 bed house outright. I really wish I could move into a slightly bigger house as cheaply and as easily as I could when renting!

Hi,

Can you direct me to any blog posts that you have which specifically compare investing in property with investing in stocks (yields, risks etc…).

PS: keep up the great work!

What are your thoughts on investing in property specifically to rent to students in areas near universities? Do you have any articles about this that you could point me to or is it basically the same as any other property investment?

@TI -You could go from I/O straight to equity release one day – if you have no dependants to worry about, then as far as you’re concerned the debt is gone.

I wouldn’t say necessarily that it’s safer to be mortgage free than mortgaged – “Title deed theft” – mortgages keep you safe from a potentially big danger.

Agree that you’re your own best tennant. Not just about risk but also efficiency – No tax on imputed rent or capital gains, no inefficiency need to pay an estate agent or landlords insurance. Also agree that the Imputed rent + capital gains, leveraged tax free on our own house is unbeatable, although I think imputed rent only has that value if you would hypothetically actually rent that house – i.e. if someone’s kids have flown the nest they don’t need a 4 bedroom and wouldn’t get the same value from it.

I also see leverage as a different kind of risk to the volatility we’re used to – not something you can just look away from. I personally think we are so vulnerable to something like future interest rate rises anyway through our equities, bonds, and our own mortgage, that we really don’t need more risk in that area with a second property – especially with the concentration of risk too.

Nice article.

I’d like to see you address the imputed rent concept at some point in the future.

I see lots of discussions on personal finance blogs/forums which could benefit from a greater understanding of this. For example, saving ratios , the opportunities for geo-arbitrage, reaching your FI ‘number’ etc.

For various reasons ‘we’ (incorrectly) compartmentalise our homes as a different type of asset class. The imputed rent concept helps me sharpen up how I think about my own situation, my options, approach to leverage, and so forth.

Very well written article. The numbers haven’t changed, but the framing of the proposition is terrific.

@TI – another good article. We see this as you do but depending on circumstances have done all of interest only, repayment and offset over payments.

@semipassive – its probable we will use my DC lump sum to clear any remaining mortgage amount at 55 for all of the good reasons people are mentioning above. But if the market is poor we have the option of waiting.

@Boltt – not sure about reference to “rarely being possible” – not aware of any restrictions – notwithstanding the political change point above this is the Lamborghini option after all?

This is something I debated last year when I received some inheritance – paying off existing mortgages (one BTL), buying a new BTL and/or investing.

Although it’s probably not the most profitable, the reduction in risk of reducing the mortgage payments was definitely worth more to me. I could have eliminated it but hedged my bets and did both – splitting it between additional pension/ISA investment and reducing my mortgage payments by about 40%.

@Alfonso. I have two relatively low-value 2 bed flats (~£85k each) in a slightly less desirable area near a city with multiple unis/colleges, but which are walkable distance to them, and a short train ride to other colleges. Not exclusively, but most of the time I have had students as tenants, both undergrad and postgrads.

In general it’s worked very well. I do use a letting agent to run it all, which reduces the stress considerably, and for students there is always a guarantor involved, usually a parent. The main issue I’ve had is that frequently they have only stayed one year, so there’s additional fees to pay each time a new tenant comes in – typically about 1 month rent. On the flip side, there’s a steady stream of new tenants – particularly just before the start of the academic year – so it’s rare to have more than a few weeks gap, sometimes it’s been less than a week. I’ve lucked out a couple of times and had tenants stay for multiple years.

I run them slightly differently from how people normally do BTLs – neither of them now have mortgages, so the risk of having no tenants is significantly reduced. They have given a steady and mostly consistent income since 2014/2017 respectively.

Having said that I did look at buying another BTL last year but with the increase in house prices over the last few years vs lower increase in rent I couldn’t easily get the yield to be higher than about 3-4%, compared with the existing flats at 5-8% (depending on expenses). I didn’t think it was worth the hassle this time.

@Knox Regarding your final point about the new yield being 3-4% Vs 5-8%. Isn’t it the case that your current yield is the lower value if you use the current house value in your calculations? And if you consider that too low, it might be worth selling up. Just a thought.

@andyJ

Here’s an example of my understanding:

DB pension £20k pa – HMRC value at 20x so £400k

DC pot £200k

Total HMRC valuation £600k

It’s not possible to take a £150k PCLS from the DC pot. Only £50k from the DC pot and whatever the terms are from your DB scheme offers (usually not very attractive).

I’d love it to be possible, that would sort my outstanding mortgage.

B

@Boltt – gotcha – that makes sense. Mainly a simple DC pot in question here.

@semipassive

Yes we used PCLS to pay off our mortgage last year. However our situation might be a bit different as ours is an offset mortgage and our lender has agreed to extend until I am 80 (another 22 years). I therefore now use the undrawn mortgage as a bond proxy I.e. Treat it as part of my 30% bond allocation. The repayment can also be viewed as me investing in myself because we have extra cash flow from lower mortgage payments.

However I do suffer a bit of FOMO and wonder whether I am being overly conservative as I have set this up to give me 15 years costs cover if I don’t want to sell equities.

Interesting article, I have used such leverage a few times, one time definitely worked out really well (used it to buy a flat for my daughter without having to inject any actual money), sometimes it didn’t lose but hardly worth the trouble, other occasions useful gains.

It’s a marmite thing….in an era of ultra low interest rates, interest only mortgage and never pay for the house perhaps ? Shares only ever go up ? Until they don’t……inflation wipes out the debt…unless you get deflation.

On a personal note I’ll follow Buffets advice of not risking what you have and need for what you don’t have and don’t need.

In all of this is an element of seeing this from a very personal perspective, significant risks taken many years ago put me in a position where I need not take significant risks now. My younger self would have levered up to the limit !

@Gizzard. At the time I was looking last year the yield on my flats (they’re both identical and on the same street), using the current value, was still 5-6%. I did consider just getting a third one but was concerned that they all might need similar repairs at the same time.

I couldn’t find another one that fitted my criteria that yielded the same amount, at least not without a degree of upgrading, which I didn’t want to get into.

Also, I was looking at my investments overall and the percentage of property was going to be not insignificant. If the income was notably higher I might have been more comfortable with that.

With the increases in property value over the last year the yield is creeping lower (as the rent is fixed until I get new tenants). However, it’s still at a level where I’m comfortable to keep them to give some diversification to my income, both now (I’m self employed with a lumpy income) and in the future.

My biggest regret was paying off my mortgage – or rather I didn’t take one out when moving the next step up the ladder – at 40 years old. It was a nice feeling not to have the money going out each month, but financially it was not the best move. I could easily have bought a a much larger house (probably twice the price) which would have allowed me the pick of properties in a VERY nice area for the next move.

I am always perplexed by the idea that not having a mortgage and owning outright is somehow ‘safe’. There is no real security – having a paid off mortgage does not protect you from wider physical property issues like subsidence, terrible neighbours, the govt deciding to build a motorway behind your house, meteor strike etc. To me it is ultra-conservative, particularly in this day and age when banks will bend over backwards to not repossess your house. Indeed, in many leasehold properties, having a mortgage has SAVED the mortgagee by paying backdated ground rent and therefore staving off forfeiture proceedings.

I have 2 x BTL’S in London, I lived in both at subsequent junctures, kept it and bought another and moved into that one. Now I’m in a house outside of London with my family. And yes another mortgage. I actually tried to get an interest only residential mortgage so we could invest the capital we would have been paying in the markets, but we couldn’t get the finance so a repayment mortgage it is.

My advice for those looking to get into buy to let is : don’t do it unless you like property and want a little business. If you are already in it, then great, like myself I am following the path that has been set and I’m going with the flow, I’m not changing it now (partly because if I sold I would be forever looking at future sold prices of what my flat would now be worth when there is another major London property boom..). If you are not already in BTL and don’t want debt, then invest in your index funds, it will be no hassle and you’ll probably make the same amount. What I will say with BTL is that if you can pick the right property, and get good capital appreciation, while leveraged up, you can make a mint and supercharge your path to FI.

@Boltt(25) Using your example it would be possible to take the full £150k as PCLS from the DC pot only if it is an AVC associated with the DB pension. The downside is that in most cases, I believe, you have to take the AVC PCLS at the same time as you take the DB pension. The only way of taking it earlier is to transfer the AVC away, and then the available DC PCLS reduces to £50k as you show.

I was able to take the whole of my AVC as PCLS by waiting until I took my DB pension at age 65.

I seem to remember that Ermine’s dilemma to which you refer in (13) is that he had carefully funded his AVC to match the available combined DB/AVC PCLS and then had to consider the pros and cons of accessing them at different times.

Thanks DavidB, that’s good information to know. Especially for the lucky people who fit the criteria.

B

The article is an interesting take on the theme, although the Monevator audience is not the general public… as such readers will hopefully know that paying of the mortgage on your home is most likely personal preference

/ psychological (at least in these low-interest times). I’ve paid mine off but do consider the house value in my net worth calculations as I know I could sell + rent if I wanted to.

The article potentially suffers from survivor bias… with hindsight I wish I had gone for a bigger mortgage (+ better house) for my first property 20 years ago but felt it prudent to leave a little wiggle room in rates going up that just wasn’t needed. Sods law says it would have ended differently if I had gone for the extra £15k.

For most non-FI people, paying down the mortgage is simple to explain and better than nothing… at least until they are ready for passive investing / Monevator.