Look into investing for rental income in the UK, and you’ll invariably be told to purchase your buy-to-let property through a limited company.

Old property codgers and young influencers are united: it’s a no-brainer.

Well, perhaps senility is setting in at Monevator Towers, but I don’t see the case for acquiring a buy-to-let property through a limited company as completely clear cut.

At least, not for me. And probably not for all of you.

I’m thinking here of people who’d invest in just one or two buy-to-lets (BTLs) to create an income to help fund their (early or other) retirement.

Sure, if you’re a budding property mogul (like every second YouTuber it seems) then build out your BTL empire through limited companies.

Similarly, if you’re a high-earner and hence a higher-rate tax payer and you expect to stay that way – maybe even into retirement – then yep, No Brains Required. A limited company is the best choice.

But everyday escapees from the 9-5?

The likes of my co-blogger, The Accumulator, who aims to sustain him and his missus on an annual income in the £20-something thousands?

In that case there are pros and cons.

Owning a BTL in your name might actually be a better route, as we’ll see.

Why own rental property?

First a quick summary of why you’d invest in a buy-to-let for income.

Here at Monevator, we focus on the liquid, low-hassle advantages of shares, bonds, and their various fund incarnations.

However it’d be silly not to see how valuable a rental property can be.

Indeed in most corners of the UK and in the media – where property appears to be ‘my pension’ under some ancient Trade Descriptions Act – the argument hardly needs to be made.

For millennia, give or take the odd rough patch, the rich stayed rich by owning property (and land) and charging the common oiks for using it.

A skim through The Sunday Times Rich List shows little has changed.

It’s not easy to get wealthy via real estate, starting from scratch.

But as a way of preserving wealth got some other way, it’s tough to beat.

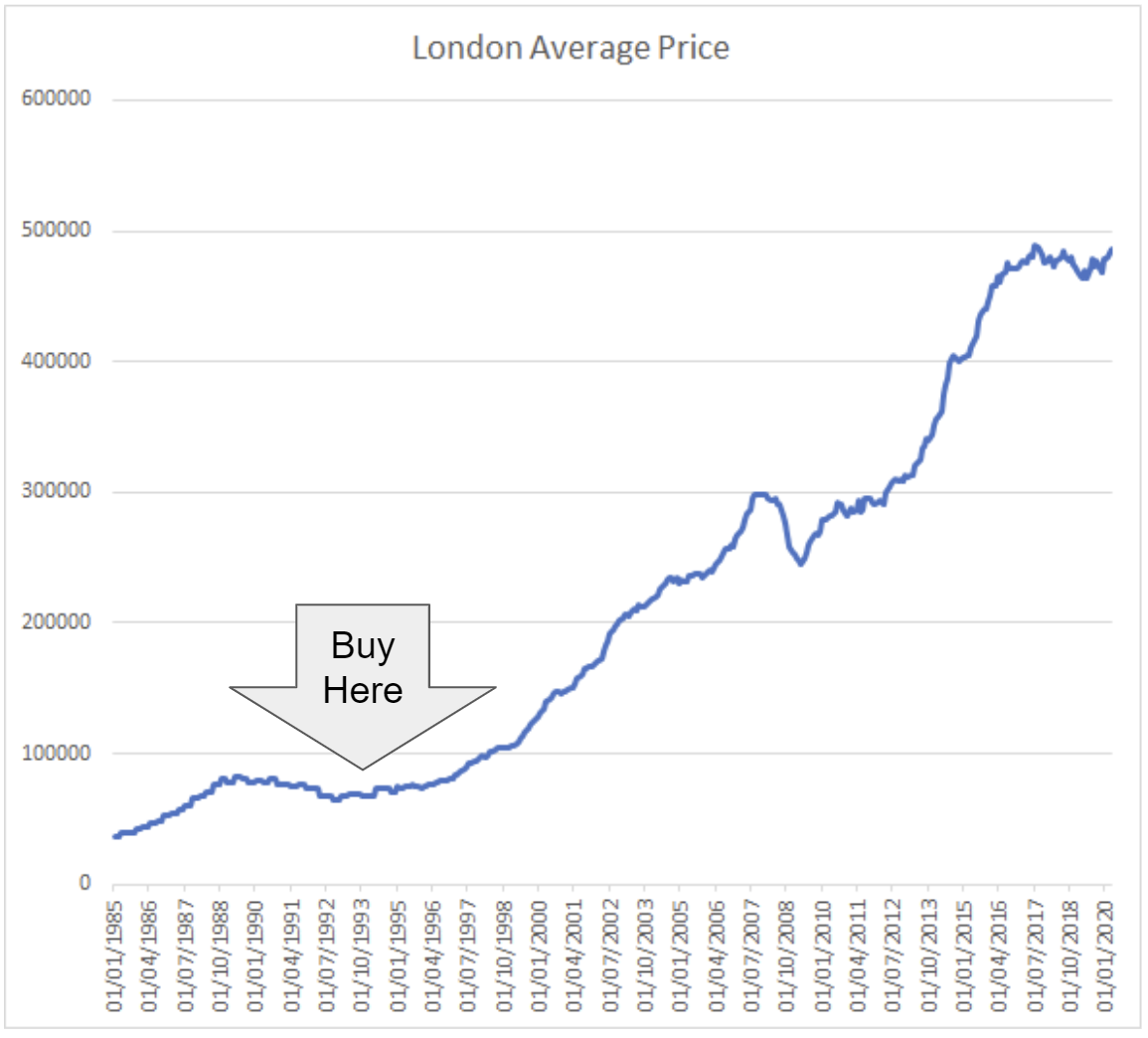

In the UK, property prices have mostly been rising since World War 2, even after adjusting for inflation:

Source: Economics Help

Lots of people are angry about this, of course. But that’s for another day.

The point is while it’s subject to fluctuations like all risk assets, residential property has – over time – preserved (and grown) spending power.

Better yet, let out your property to tenants, and you can expect the income you receive to rise, too:

Source: Office for National Statistics

True, rents have softened recently in some cities, thanks to the Covid pandemic. But short-term fluctuations aren’t the point with property.

Real estate is a long-term asset. Prices and rents have risen faster than inflation for generations.

Buy a decent property with fair rental potential, and you can reasonably expect to enjoy a rising income throughout your retirement years.

It’s not all kerching!

Before the peanut gallery gets going, let’s agree there are other factors to consider with rental property.

Tenants can be a hassle. Houses can fall down. And do you really want to be refitting a two-bedroom flat on the sixth floor in your seventies?

But this article isn’t about all the issues with buy-to-let. I’m just pointing out that rental properties have appealing characteristics. Bought right, they can play a role in a diversified retirement income strategy.

Personally, I’d always consider a mix of different assets. Rather than devolving down to the usual Internet stance of A Is Good but B Is Evil.

There are many ways to skin a cat, as they say (although I can only think of one ghastly method. Pretty horrid, even if you’re not the cat.)

With an open mind, let’s crack on!

The BTL boom

Buy-to-let used to be so easy, as Simon Lambert noted back in 2015:

… £1,000 invested into buy-to-let in 1996 would be worth £14,900 at the end of 2014.

It comfortably beat all other assets. The same £1,000 invested in shares would be worth £3,119, while a cash pot grew to £1,959.

ThisIsMoney, 16 April 2015

In the 1990s, City boys with bonuses and 50-somethings paranoid after pension scandals found they could deploy newly-competitive BTL mortgages to outbid first-time buyers for the proverbial two-bedroom flat.

Finance the purchase with an interest-only mortgage, rent it back to the poor sods you priced-out, and boom!

Literally. UK house prices soared.

Lots of new landlords got legions of renters to finance growing portfolios of buy-to-lets. If you weren’t worried about a price crash (alas I was) then the economics of leveraging up even as rental yields fell were compelling.

It all got a bit embarrassing for politicians. Governments like high house prices, but the affordability argument was becoming impossible to ignore.

Conservative politicians were torn between promoting home ownership and the perception that it was becoming concentrated in fewer hands.

That didn’t matter at first – landlords being more a Tory’s natural constituency than public sector renters, say – but the numbers got silly.

Why limited companies are even a thing with buy-to-let property

Thus it was oddly enough a Tory government that began to turn the tide.

Various bungs to help first-time buyers get into the market and compete with landlords were extended. (Whether sensibly or not.)

And a more hostile environment for landlords came into being.

Within just a few years an additional stamp duty rate for the purchase of second homes was introduced. Capital gains tax breaks on BTLs you’d previously lived in were harder to qualify for. And – slowly, but most significantly – the economics of using a mortgage to finance a buy-to-let were squeezed. Hard!

In Ye Good Old Days, a landlord set all of their mortgage interest payments on a BTL against the rental income. They only paid tax on what was left.

But since April 2020, landlords cannot set any interest expenses against rent. Instead there’s a tax credit worth 20% of the interest payments.

This is bad for higher-rate taxpaying landlords using mortgages. It means much higher tax bills and a lower net income.

The tax maths as a higher-rate tax-paying BTL owner

Let’s suppose that higher-rate taxpayer Bob gets £1,000 a month rent on his BTL and his mortgage interest expenses are £700.

Prior to the new rules, Bob could have set his annual interest-only mortgage cost of £8,400 against his £12,000 of rental income.

That left £3,600 in profit, of which £1,440 went to tax (levied at 40%) and £2,160 ended up in Bob’s pocket.

Today, however, Bob is liable for tax on the £12,000 of rental income at his highest rate of 40% – so £4,800. He is only able to reduce this with the 20% tax relief on the £8,400 interest payments, which equates to a £1,680 credit.1 This means £3,120 goes to HMRC.2

Bob still has his mortgage interest to pay, so his total costs are £8,400 plus £3,120 in taxes. Deducting both from the £12,000 income leaves just £480 in Bob’s bank account. (And that’s ignoring all Bob’s other expenses).

A dramatic collapse in net income from £2,160 to just £480.

Note that if Bob was a basic-rate taxpayer, nothing has changed. Under the old system he’d have paid £720 in tax.3 Under the new system, basic-rate Bob has a £2,400 tax liability, but gets the same £1,680 tax credit. Hey presto: £2,400-£1,680 = £720 tax to pay, as before. Bob’s net income would be £2,880.

Tax under limited company ownership

When a limited company owns rental property, it’s treated like any business with income and expenses. This means the entire mortgage interest cost can be set against the rental income (again, along with various other expenses, which I’m ignoring for simplicity).

Corporation tax is paid on the resultant profit.

This makes a rental property owned by a limited company a much more lean, mean profit machine.

For example, let’s assume for now all the numbers stay the same. (In practice expenses would likely be higher with a limited company).

Income of £12,000 minus £8,400 in interest payments leaves £3,600 profit. At a corporation tax rate of 19%, that sends £684 to HMRC, leaving £2,916 in net profits.

On the face of it a stellar slam dunk for limited company ownership! But keep reading. (Spoiler: It’s more complicated.)

Other pros and cons of purchasing a buy-to-let property through a Limited Company

These tax changes are why BTL landlords have rushed to set-up limited companies (or SPVs4 as they like to call them. It’s just a sexier name for a limited company with a relevant tax code).

But there are other advantages – and disadvantages – to owning and letting out property this way.

Advantages of owning BTLs in a limited company include:

- Profit being taxed at lower corporation tax rates, as above.

- Some mortgage providers may be satisfied with less onerous stress tests on a property’s ability to cover the mortgage (but should you be?)

- In theory you have limited liability, since it’s the company not you that owns the property. However you’ll probably have to give personal guarantees to get a mortgage, and directors can be sued, too. Also many landlords take out comprehensive insurance against mishaps, anyway.

There are also disadvantages to going down the limited company route:

- Limited company mortgage interest rates have fallen, but rates are still higher than the best personal BTL rates.

- You’ll probably need to use an accountant, and do more paperwork.

- That will add extra expenses to running your rental property.

It’s worth noting too that a limited company still has to pay the extra 3% stamp duty payable on additional homes. So you’re not dodging that.

And corporation tax is rising, as per the March 2021 Budget. The limited company advantage might theoretically be trimmed.

The new 25% rate will only begin to be phased in for businesses with profits over £50,000, though – which will exclude the vast majority of ordinary landlord’s portfolios. (For the time being, anyway).

End of story? Not for basic-rate taxpayers

By now you might think owning a BTL through a limited company has an unassailable edge, even for the humblest landlords in retirement.

Income is the point, right? And on the face of it, limited companies clearly chuck out more cash.

However in some circumstances that might not be the case.

Remember my note above that the tax changes didn’t alter the economics for basic-rate tax payers?

Well that might be a throwaway side-note for high-earners looking to build out chunky rental portfolios.

But for basic-rate taxpayers – such as a great many retirees, especially FIRE5 devotees who pull the plug early – it’s a very big deal.

My sums above showed limited companies deliver higher cashflow at the per-property level.

But you must extract the money from the limited company to spend it!

And it’s here the picture gets more nuanced for basic-rate payers.

You might get a higher income than if you own your BTL through a limited company

This is not something those empire-building property gurus focus on. Good luck to them, but know that using a limited company for one or two properties might actually result a lower income for you.

The issue is that corporation tax isn’t the end of the story.

When you come to remove money from your company – as you would if you were living off the rental income – you’d normally do it as a dividend.

Depending on your other sources of income, there could be dividend tax levied at:

- A basic-rate of 7.5%

- A higher-rate of 32.5%

- Or even 38.1% if you’re a retired oligarch paying the additional rate

You do get a tax-free dividend allowance of £2,000, which helps.

But remember dividends from other sources (such as shares held outside of shelters) count towards that £2,000 allowance.

We saw that as a private landlord, basic-rate taxpayer Bob paid only £720 in tax and got an income of £2,880 from his BTL.

If Bob had acquired his BTL inside a limited company, we’ve also already seen the company would have been left with £2,916, after corporate tax.

Now let’s say Bob extracts this as a dividend, and is able to use his full dividend allowance. In his case £916 is liable for tax at 7.5%, which means £68.70 goes to HMRC and Bob is left with £2,847.

That’s slightly less than he got as a private landlord.

Worse, if Bob had already used up his dividend allowance elsewhere, his net income falls to £2,697.

The net income from the limited company would probably be even lower still in practice. Bob would have accountancy bills to pay of £1,000 or so a year, albeit these are also expenses that will reduce corporation tax.

All told, it’s not hard to see the annual income after expenses and taxes from the limited company falling towards the £2,000 mark.

Other complicating factors

I could give other examples that made things look better or worse.

The important thing is to apply the numbers to your own situation.

When you do so, there are other issues you need to consider.

Most importantly, rental income might push you into a higher tax band.

This is especially important if you’re not using a limited company, since the full rental income is going to be added to your income from other sources.

With a limited company, you might want to make payments into your own pension, which is a more tax-efficient way of getting the money out.

Indeed, in either scenario, an early retiree will likely have various income levers to pull.

For example you might reduce the drawdown from your SIPP to keep your pension income plus rental income below key tax thresholds.

There’s also the usual opportunities for shenanigans for couples involving who owns what.

But this post is already insanely long, and I can’t cover every scenario.

The point is to think carefully about what you hope to get out of any rental property, and where you are in life.

Then run the numbers for yourself.

Two’s not a company, but three or four…

With all this written, I would probably invest in buy-to-lets through a limited company if I ever go down this path.

That’s because if you don’t intend drawing the income for a long time, it’s definitely more tax-efficient to keep the profits inside the company.

Retaining more profit means more money to put into your next purchase.

Also, the more rental properties you own, the more you spread the limited company hassle factor – and your accountancy fees, too.

And if you want to invest with other people, you’d best do it through a limited company (or possibly a limited liability partnership, but please do your own research on that). It’ll be the proper way to structure it, legally.

Finally there may be estate planning advantages with limited companies. Consult your professional advisors if that’s a factor for you.

Know your limits

I suspect the government wants to see the whole rental sector inside limited companies. That way it can better monitor – and regulate – what’s going on.

So maybe things will get even harder for landlords operating outside them.

What’s more, even if you only intend to own one or two rental units, you might unexpectedly become a higher-rate taxpayer further down the line.

Moving existing BTL properties into a limited company will be an expensive pain. So you may decide it’s better to start that way.

Fair enough.

But if you are on the cusp of retirement and you just want to buy and let out a flat or two to add £500 a month to a fairly modest retirement income, I’m not sure it’s worth the bother.

Do your own sums though, and figure out what works best for you.

Many readers have lots more experience with property than me, and I’d be interested in your insights. Remember my modest use case: I agree you should always acquire a larger portfolio of buy-to-lets through a Limited Company, or if you’re a higher-rate payer. Also let’s please minimize the landlord name calling and predictions of property Armageddon, for the sake of a good discussion. Thanks!

Comments on this entry are closed.

Wow, a comprehensive post TI,

Having not long shifted an accidental buy to let, (it was bought for my mother in law and turned into a BTL after her passing) I’m glad to be out of the business. Even using a letting agent, the hassle from the tenants we had on a newish (2012) build was not worth the income. From 2012 to December 2020 we made 4 % capital gain which was eaten by solicitors fees. The yearly rental income after expenses and tax was less than 4% average and the liquidity was not great at eight months from advertisement to completion, incurring council tax.

Hassle all the way.

Exposure to property is now taken care of solely in our primary residence and I am glad of it.

JimJim

Interesting read TI, and some tricky questions posed.

This is definitely one of those “speak to a professional adviser” scenarios (one who actually speaks tax and currently invests in residential investment property themselves). The right answer depends greatly upon the individual investor’s circumstances, both now and more importantly in their foreseeable future.

The only other thing I would add is that potential investors should carefully consider all the options, both in terms of asset class and jurisdiction. Given the change, uncertainty, and regulatory risk that English BTL investors have experienced in the last decade, there are easier markets in which to be a landlord.

Thanks @TI for an interesting post.

We have friends who are enthusiasts for BTL, in fact our last social occasion immediately before lockdown was a country walk with another couple when the guy told me how he was setting up a limited company for his BTL properties (to be fair, he has some justifications only skated over here and his wife is an accountant so could probably ensure everything is organised for minimal audit fees).

It is something we had never considered after a difficult period letting my (now) wife’s flat in the nineties; that involved various tenant disasters and a loss.

However we are aware our current very nice but maintenance-intensive house (listed property) might not be ideal as we get older. A few months ago my wife noticed a local house for sale that that might one day be an eventual downsize possibility; we didn’t do anything but have now realised if we spot another it might be seriously worth considering releasing savings to have a “plan B” place to live one day which would in the meantime create a BTL income to substitute investment gains.

Who knows whether it might happen (we are fairly picky), but at least it gives my wife an excuse to stop by every estate agent’s window! It would mess up any rational diversification strategy, but of course allow equity release from our current house if it became our main home. And until this post I hadn’t thought of the ownership implications, while I wouldn’t want to invest in financial advice before it became a realistic possibility there might be IHT benefits if it was done via a limited company with our daughter somewhere in the equation.

I will read the ensuing comments with interest …

Can a Ltd Co owning property contribute to a Director’s SIPP like other Ltd Co’s can, or are there rules to prevent this? If it’s possible, it’d result in an effective 0% tax rate until SIPP withdrawal, wouldn’t it?

@Dave — EDITED — Of course you’re right it’s 0%, I was having a late night brain failure. See further comments down the thread.

@Jonathan — Yes, as I briefly alluded to, I believe you can add shareholders to limited companies as part of estate planning. You’d want to talk to a specialist. (Of course I want to tax all inheritance above £100k or so at 80%, but luckily for you I’m not the chancellor!)

@JimJim @Indeedably — Good to hear your views. I’d possibly invest overseas where I have friends/family on the ground, otherwise for me it would just be too far outside my comfort zone!

Property damage. Theft of all the furniture. Weekly calls about the kettle boiling over because the tenant doesn’t understand what MAX means. Just some of the anecdotes from landlord friends, accidental or otherwise.

Would you invest in a company with debt in one illiquid asset depending on a series of single customers of uncertain means? If yes, BTL Ltd may be for you.

One to add to your limited company advantage list (unless I missed it) is that you personally would be lending your limited company the deposit or purchase monies (a directors loan). You’d then be able to extract that money back from your company without any personal tax implications by way of a directors loan repayment. Some even charge their companies interest on the loan….

Obviously you’re paying the 19% corporation tax on the (rental) profits in the company from which you’ll then repay yourself. But if you’d invested in your personal name you’d be paying full tax (higher rate etc) straight away out of those profits. If that makes sense. So it’s an advantage.

With property deposits typically 25% + that’s quite a lot back out at 19% before you have to look at the various other methods (salaries, dividends etc).

Clearly being able to control when you declare dividends is a great one too. So you can do some tax planning. I believe you can also have different classes of shares for family members to declare different dividend rates / inheritance tax plan etc.

Outside the scope of the article, but I believe furnished holiday let’s in your personal name still has very generous tax provisions. Hope you won that holiday cottage a couple of weeks back TI!

@TI Forgive me – not a tax expert – but employer pension contributions from a normal (trading) Ltd Co are indeed offset against corporation tax (and NICs too), leading to a 0% tax rate on the way in https://www.pensionbee.com/pensions-explained/pension-contributions/contributing-to-your-pension-from-your-limited-company

I don’t know how this applies to property holding companies, however.

Thanks for the article TI. I did find it an interesting read. I have a friend who went into buy to let and it has been a complete disaster for him but that’s more down to choosing a bad property (many repair costs) and multiple bad tenants. It’s one of the reasons even with what you have outlined I still opt for the easy armchair investing philosophy of owning stocks and bonds. I can’t quite bring myself to invest in property but I know it’s certainly still an excellent investment choice for many so I never knock it.

TFJ

pffft BLTs – I eat them for breakfast!

No doubt that using a limited company is an evolved form of buy to let

Surely a REIT is an evolution upon that – publicly tradeable, divisable, liquidish, isa/pensionable, slightly more diverse

And surely yer bog standard Global all cap index fund is a further evolution upon that – similar returns, far more diversification

Buy toilet is just more primitive, concentrated investing when people watch homes under the hammer and arent aware of other options to invest traditionally

(seriously, an auction on homes under the hammer – does person X win the auction? usually nobody would care, until that funky theme tune comes on,and then you get smug buyers who bidded over the odds just to be ont telly)

Also separate note – the Tories I’m pretty sure are not really allies of landlords like you might assume they are – the strongest predictor of voting Tory is home ownership, Tories want you all to be homeowners, not be suppressed out of it, they want you to have vested assets in the economy, and succeed at finding good work, so that you vote for their policies, they dont want to keep you poor like Labour. Supply side economics suggests removing inefficiencies – remove the taxman, remove middlemen like landlords, remove regulation that prevents housebuilding, etc

A really interesting and informative article.

So much so I’m going to save it to refer to as I need.

As a LL a major point has been missed and not accounted for in the overall income possibilities of rental property.

Guess what that is!?

The ability to receive the full contractual rent from a tenant.

A rental property viability is predicated on this oh so simple premise.

UNFORTUNATELY it is not so easy to ensure this rental income is received and therein lues the fundamental weakness of rental property.

When rent is paid everything in the garden is lovely.

The real problems beging when the rent for WHATEVER reason STOPS!

Such a problem tends to only occur for those LL with BTL mortgages.

Govt is sanctioning massive rent defaulting and has no intention now or in the future of assisting LL now or in the future of repossession of the rental property or of civil recovery of rental arrears.

RGI due to it’s necessarily onerous qualification requirements is impossible for most tenants to qualify for.

In the past 6 months Court cases have established that a guarantor may only be held liable by deed for the initial FTP.

Without these two protection measures a LL has to self-insure against a feckless rent defaulting tenant until eventually evicted.

This could literally be YEARS!!-

Govt will be making repossession even more difficult with the soon to be abolished AST and S21 leaving only the currently dysfunctional S9 process.

Govt has promised that it intends to upgrade the current not fit for purpose S8 process.

All S8 cases have to go to County Court unlike the current S21 process.

The County Courts simply aren’t set up to cope and NEVER will be with the numbers of repossession cases that wi result when S21 is abolished.

The question of sole trader or Ltd company is all very interesting but is NOT the big question that should be asked which is this

Can you afford to manage your particular rental property if a victim of a rent defaulting tenant whom could take years to evict?

DON’T consider you as a LL are so perfect and would have chosen tenants so wisely that you will never be a victim of a rent defaulting tenant.

Tell that to the LL who are currently suffering rent default losses of over £4.5 billion………………yep billions!

Even without a pandemic LL are subjected to losses annually of about £9.5 billion mostly caused by rent defaulting.

BTL is great when you have tenants who pay their FULL CONTRACTUAL RENT.

This rarely happens now.

Remember that any resources put aside for self-insurance against the risk of a rent defaulting tenant have to be built up again once used for the next tenant.

.

With it taking so long to repossess any sel-insurance funds will be rapidly used up.

Is the business and personal risk of being a mortgaged LL worth it?

That is the FIRST consideration.

Then you can decide in personal or company name.

The level of leverage obviously increases the costs of self-insurance.

Mortgage free LL are obviously at no risk of repossession from lenders if they suffer from a rent defaulting tenant.

Perhaps with very light leverage a LL might consider they could afford to self-insure such that they wouldn’t be at risk of lender repossession for mortgage default.

But even so the amount of required self-insurance funds would be considerable.

But it must be realised by leveraged LL that their whole personal financial circumstances rest on a stranger paying rent all the time on time.

In light of current and new regulations being introduced soon is this a viable concept!?

I suggest NOT which is why I as a very successful LL am getting out of the leveraged AST rental sector.

I simply cannot afford the costs of even 1 rent defaulting tenant.

Being mortgage free makes being a LL a far better business prospect.

Yes you would still lose a lot of income with a rent defaulting tenant but you wouldn’t usually risk repossession which could even result in a forced sale of your residential property to cover any mortgage shortfalls on the repossessed BTL property.

The inability to repossess a BTL property in a timely fashion from a feckless rent defaulting tenant completely undermines the AST rental proposition.

FHL of course AREN’T subject to ANY of the ridiculous repossession regulations that AST LL suffer from.

Of course FHL can require a lot of active management by the LL but just the mere fact that they aren’t subject to the current eviction regulations make investing in FHL a compelling investment.

Yes there is a risk that bookings might not generate sufficient income to generate sufficient income to pay a FHL mortgage.

But I would suggest such concerns are small beer compared to the very likely hazard of a rent defaulting AST tenant.

Prospective LL need to very carefully consider the big question I have detailed.

Once decided and if required then sole trader or corporate operation may be decided upon.

It should be recognised that 50% of the PRS comprises of properties with no mortgage.

25% are corporate properties with the remaining 25% being mortgaged sole trader LL who are the ones currently suffering S24 taxes.

S24 makes being a sole trader LL mostly pretty pointless unless you can reduce income as highlighted in the article.

For many existing LL it makes sense to sell up and deleverage or exit the AST PRS completely.

Short-term letting is another strategy that LL are using to avoid feckless AST Rent defaulting tenants.

AST letting is very risky due to the extreme difficulty in getting rid of rent defaulting tenants.

All AST letting investment should be considered through the prism of this simple truism.

Very interesting about btl,I’m a successful developer who borrowed money from rate setter who were fantastic from start to finish and at the end of my project we’re keen to lend to me straight away.unfortunatly

Rate setter don’t provide this facility any more is there any one out there who is lending to people like me .

@Dave — Sorry, I am literally blushing at my late night comment stupidity.

You’re right, of course it’s effectively 0% as other @Dave says, as it’s offset as an expense before corporation tax is calculated on net profits.

I even cited this just last weekend with a friend who I was vaguely talking about setting up a limited property company with, as one of the attractions!

I blame Google Finance being down with respect to Google Sheets integration, which is playing havoc with my mental state for the past 12 hours haha.

Thanks for the speedy pull-up. I’m going to edit the original reply not for my ego’s sake (I’ll leave this mea culpa here!) but to prevent any future confusion. Cheers!

@Matthew — Strongly suggest you play around with a spreadsheet and some return calculators before being so dismissive of property investing.

The key part you’re missing is leverage, which can work miracles on returns, especially if you repeatedly extract equity and re-lever.

Yes this increases risks, but IMHO it’s a world away from the risks of say investing in shares on margin or some other form of marked-to-market loan.

In theory REITs can provide some leverage benefit to an investor in their shares but (a) their gearing is always much lower (b) very few offer residential exposure in the UK (c) when the times are good they can trade at a premium anyway.

The trouble with property investing in the UK right now — aside from the regulatory climate that @Indeedably and others have mentioned — is high property prices, which makes starting yields very low and leaves little buffer for things going wrong.

I’ve been looking at the possibility of mitigating some of that risk with 10-year fixed rate mortgages (which is what started me down this avenue, besides a recent cash windfall looking for a home) though I have to say I’m still not sure it’s worth the risk.

But personally, I never say never: https://monevator.com/never-say-never-again/

@Paul Barrett — Very valid comments which chime with some of the other research I’ve been getting through, although at least some experts seem more relaxed about the changes to eviction procedures. (E.g. The Robs on The Property Podcast).

I’d definitely be renting to higher-end ‘young professional’ type tenants, probably in London, rather than the ‘affordable Northern urban suburbs’ that seem beloved of the property influencers right now. But I appreciate that doesn’t get rid of default risk, and that even with insurance (a must) it’d be a hassle.

Thanks for your thoughts, but I wish you hadn’t used all those acronyms though! 🙂 I sort of had to scrunch my eyes to read through it, and some readers will dismiss it as spam in my experience.

As DH mentioned Directors Loans are a great way of extracting money from a limited company.

Closing a limited company down as you exit can become complicated with respect to tax.

Industrial property has been good to me, the present tenant pays a yield of 9%, on a 10 year repairing and maintaining lease, rents as a private individual with his wife, owns a house with a solid business that has run through Covid.

Capital gains are probably close to inflation but still an attractive, diversifying investment, worth a thought…

@TI -Shares contain leverage within and even then we dont feel comfortable being 100% in them (diversified as they are) let alone more than 100% through further leverage – who really needs that amount of leverage if on the other hand we’re talking about holding bonds for sanity (ie effectively deleveraging ourselves)?

I leverage my own house with slow mortgage repayment, thats enough leverage for me?!!

@paul barrett, you make some very important fundamental points but it would be useful if you could spell out abbreviations and I really wasn’t sure what a lot of them were…. (I know @TI made the same point above…)

The main takeaway, that with leveraged BTL you are risking a lot on the hope/expectation/assumption of good tenants, is really important.

My only experience of (accidental) landlording was pretty disastrous and ended with tenants doing a runner from their debts (or worse?) leaving the place like Marie Celeste (seriously…half peeled potatoes in the kitchen). Luckily we sold up for a good gain quite quickly, but we were naive and clueless, and shouldn’t really have been dabbling as amateurs.

Frankly I think this is a business which should be taken seriously and professionally.

I have no problem with this statement at all @Matthew, and good for you for understanding your own risk tolerances. 🙂

As I said in the article though, I strive (and surely fail myself from time to time) not to outright dismiss different investing strategies based on my own situation or even my own prejudices, which “buy toilet” as per your first reply I would suggest demonstrated. 🙂

They are all assets, income streams, market valuations, intrinsic valuations, liabilities, regulatory environments, risk, and reward.

Evaluate accordingly. 🙂

As an accountant, I get endless phone calls from clients saying that their mate or the bloke down the pub told them to put their rental property in a company.

As you very nicely set out above, it’s only really worthwhile if you don’t want to take the profit out, or if you have a large portfolio of properties. There is also the issue with taking out any capital proceeds way into the future if the property is sold and you want the money out of the company.

As with anything tax related, it’s always worth doing the sums and looking at what your non-tax goals and plans are in the longer term.

Nice article!

Forget about BTL. BTL landlords often destroy local communities. It’s obscene. Put your money in an index fund or a REIT and keep your life simple. You’re welcome 🙂

Hi all, long time reader, first time commenter.

AIUI most BTL companies will be classed as “close companies” (owned and controlled by 5 or fewer participants). Close companies were specifically excluded from the phased in lower rates of corporation tax for profits below £50k, so they’ll pay the full 25% corporation tax on all profits from April 2023.

Someone told me yesterday that the new 25% CT rate will apply to personal/family investment companies (no 19% starting rate for them). I am so glad I talked myself out of going down that route a few years ago.

It may be that the 25% rate will apply to all property SPVs as well. Does anyone know? If so that moves the argument even more against limited companies for small scale BTL. Income taxed at 25% CT, then 7.5% dividend tax results in a reduction of 31% in the hands of the LL, compared with about 25% now.

You forgot to mention ATED (annual tax on enveloped dwellings). Applies to any residential property worth over £500k, owned by a limited company.There’s a total exemption for properties let commercially, but you still have to claim the exemption – penalties are calculated by the day, without warning and are BRUTAL.

@Vroom — Do you have a source for the ‘close company’ status being applied to BTL holding companies please? Not saying you’re not right, but my initial research/soundings suggested this wasn’t the case. (E.g. Rob Dix on The Property Podcast, which is very well-established and respected).

@David – Worth mentioning, yes. Another directly comparable additional cost to add to going down the limited company route.

What about the tactic of taking out a directors loan worth the value of the property when you sell it to the LTD? Any opinion on that method / potential tax savings?

@Investor – Googling further suggests that you’re right.

Personal/family investment companies are typically close companies (owned and controlled by 5 or fewer participants) so will pay the full 25% corporation tax on all profits from April 2023.

But there is an exception for close companies that “exist for the purpose of trading or investing in land for letting”.

https://www.lexology.com/library/detail.aspx?g=cf4d482d-a3ed-459c-a2ee-5089c5ff713c

So maybe BTL property will need to be in a separate company to other limited company investments?

Or more correctly, a limited company that (only?) holds property is not classified as a close (investment-holding) company.

@Vroom — Cheers for following up. Yes, sounds like the beloved ‘SPV’ tag will be getting even more popular as accountants urge BTL investors to keep everything but property out of their BTL limited companies.

I believe some already think one property per limited company is the ideal. Perhaps due to its simplicity your accountant could do four such SPVs for the same price as one limited company holding four inside? I’m not sure.

Mortgage providers definitely want to see clean accounts and nothing else going on in the company except for property assets, income from those properties, and expenses and drawings.

@TI – (philosophy mode) in an abstract way you could consider property to be like a form of bond – the renter borrows the value of a house with a monthly coupon and the promise to repay the house to the landlord – you said once before I think that a landlord borrows money on the tenants behalf – in effect they are a financier that gets rewarded for taking on the extra risk of lending an entire property to someone who a mortgage lender would not – ie landlords accept weaker credit histories and lower deposits – risky customers who cannot buy

Also an interesting concept is Let to Let – very quick and cheap to scale up/down, you get paid for taking on tennant risk on behalf of other landlords (ie northwood) – but it is being arbritaged away somewhat

Anyway I think for most people a standard index doth contain property and most people are overweight in it

If someone wants to be highly leveraged, you have to wonder why – is their job really so bad and they cant find one they enjoy that can survive? Are they desperately short of pension for some reason – like some kind of sudden health problem? Think they need that level of risk to keep up with house prices?

Just that I believe that going more towards passive equities is a better risk-reward ratio than straying from the index and 100% equities should come sooner in the order of risk appetite than >100% property (more diversified without the risk of personal debt)

Great article, very informative and interesting.

I have considered BTL numerous times, but can never justify the hassle/reward balance.

As a higher rate tax payer I’d have to set up the PLC (and deal with the associated admin), manage the tenant/agency managing the tenant, be responsible for the property/repairs and all for MAYBE a few grand that I can’t take out the PLC anyway.

I can’t help but think there are other more simple ways to deliver, as per the article example; £2k per year.

Very interesting post @TI – thank you.

For those looking to invest, I would recommend having a look at PropertyData. It is a fantastic resource for understanding the expected yields and capital growth you can expect.

https://propertydata.co.uk/r/XKxmNWLl

Great article and something I’ve spent a lot of time weighing up over the last couple of years. One thing I don’t think you’ve mentioned is the £1000 Property Allowance you can use if you go down the personal ownership and income option. If you purchase property with spouse I think you can both claim the £1000 tax relief when putting the split income through your tax returns

https://www.gov.uk/guidance/tax-free-allowances-on-property-and-trading-income

Nice article.

What can still make BTL attractive is the ability to refinance if the value increases, thereby extracting part of the capital gain tax free. It might be easier to own the property outside a Limited Company to do this. My view is that the income is there just to pay interest and cover costs.

That’s a great idea. However, is this permissible? I vaguely recollect reading somewhere (on the HMRC website probably) that you couldn’t subsequently borrow more than you did when you first bought the property. It’s quite possible this has changed as a result of the recent landlord tax changes.

BTL pros:

* One of the most understandable ways to do a leveraged asset purchase for Most

* it’s a Tangible asset

* Historically favourable tax treatment – including lax monitoring by HMRC of rental payments

* Historically great returns, especially for those who go all in and build a big portfolio.

BTL cons

* Highly illiquid. if things are going wrong, you can’t get out with a couple of mouse clicks.

* Deeply socially corrosive. The advantage that ‘early entrants’ had to the housing market had made home ownership a huge struggle for current generations. The fact that many extract this equity and double down on their win is not good news. It’s disenfranchising people.

* You mark yourself out as a bit of a greedy ****, and increasing amounts of people see you as such

* it’s an incredibly boring way to invest Vs shares and crypto imho.

* Demographics and political risk – if you get a wave of younger people voting and a party who wants to crash the market, well, all that’s keeping it up are some pretty dodgy government props and a historical bias towards property investment in the Uk.

Not for me, thanks.

By coincidence David Byers in today’s (Saturday) Times has an article on the same subject.

@Warren Bogle

Further to my earlier reply, I have just found this:

https://www.rossmartin.co.uk/land-a-property/3000-interest-on-re-mortgaged-buy-to-let-property

where it states:

“HMRC Property income guidance from 2017

If you increase your mortgage loan on your buy-to-let property you may be able to treat interest on the additional loan as a revenue expense, as long as the additional loan is wholly and exclusively for the purposes of the letting business.

Interest on any additional borrowing above the capital value of the property when it was brought into your letting business isn’t tax deductible.”

It looks like there might be a disadvantage to your suggestion.

@Gizzard

Thanks for digging that guidance out, however, this only refers to the tax treatment of the remortgaged interest. The point I was making was that if you remortgage following an increase in value and increase your borrowing, the surplus debt you received is effectively tax free, for you to either invest in another property or put towards your retirement.

Let’s say you buy a property at £100k, borrow £80k. The value of the property increases to £200k, you remortgage at 80%, £160k, half goes to repay your existing debt the other £80k is yours tax free.

This is a great. It doesn’t clearly fall on one side of the fence it the other and that’s the way it should be as each individual may have different circumstances which would impact either option. However one key factor has been missed out, CGT. Personal landlords will have a CGT allowance where as LTD landlords will have no allowance. This is another key consideration in making a personal Vs LTD decision

Excellent article.

As a high rate earner plus rental income, increasing my SIPP contributions are an avenue i’ve used to keep myself as a basic rate tax payer since the mortgage interest relief rules were changed. In doing so I benefit from the 20% tax relief on mortgage interest. win win for my circumstances until the government moves the goalpost.

@Warren Bogle – yep. no CGT until you sell the property.

@Gizzard – yes you can, i’ve been refinancing strategically to release capital to help me maximise ISA contributions for myself and Mrs.

Great article TI thank you and great quality responses too! Another structure that’s being touted a lot is ‘mixed partnership’. TI I would love to see your analysis of that pleeeease ‘)

@ Matthew The leverage increases your return on capital invested. And your loan is eroded away by inflation over the long run. Increased risk and increased gains.

Government are always going to support house prices to some degree. A crash in prices is going to make any government look bad when it is common place in our country to seek the dream of home ownership, unlike in many other countries where renting is the norm.

Interesting point about there not being may REITs focussed on residential. That’s because the UK residential market has always traditionally been led by BTL investors in a way most other markets are not.

This trend is shifting with a lot of institutional money now going into the Private Rented Sector (PRS). The investment thesis is partly built on the BTL market shrinking as a matter of government policy, but also on being able to offer a much better, more professional institutional product. The focus is currently on the major cities but it will inevitably become more regional as the sector develops.

The major UK public company is Grainger but that is distorted somewhat by the fact it owns a large regulated tenancy portfolio (low rent but you get reversionary value when the house is handed back when the tenant dies). Smaller names are PRS REIT and Residential Secure Income REIT.

Germany has huge public residential focussed names. Vonovia alone at c.£27bn market cap is about 15x Grainger. There is also Irish Residential Properties REIT.

For UK names, the assets are typically valued on balance sheet at a 4-5% yield and currently trade at a discount to NAV. It is a much simpler and more diversified way to get exposure to residential. If you want more leverage, a margin loan can get you that.

@martin – indeed increased risk for increased reward, although it’s a different type of risk than simply upping your equities – not just volatility that you can wait out, losses can exceed deposits, you can be a forced seller so wont necessarily recover. My main concern really is what rising interest rates if they happen could do to it – even if they support house prices, how much inflation would the boe tolerate? All your eggs are in one or three baskets with BTL – at least with a reit you might have country diversification for interest rates

I accept though that shares too are a vehicle for leverage because of corporate debt, but an index restructures itself and the debt isnt in my name…

But yes the gov would go to pains to support the house prices at avoid another bailout, but inflation could potentially make it difficult to keep rates low or print

Mortgaged Buy to Let v Bitcoin ? Is property still a worthwhile investment if you can achieve 6% yield on lending your Bitcoin without the hassle and operational risk of running a buy to let portfolio. (Assumptions – You have sufficient cash liquidity for 24 months and are taking long term investment view) £1Mn property purchase leveraged 75% LTV at 4% Fixed interest rate and 6% gross yield. £60K rental income nets to £45K after 25% overhead. Minus £30K finance cost provides £15K return on £250K equity (excluding stamp duty) 6% cash on cash return. What will be worth more in 5-10 years ? £250K of BTC or the £1Mn of property ?

As ever, a comprehensive and well-researched article. Thank you – and apologies for being late to the discussion.

(Incidentally, what I’ve been preoccupied with for the past week or so is tax work for one of our overseas properties. Initial returns are never fun)

While real estate is a BIG part of our portfolio (c.25% of our net worth and growing), I’ve been dissuaded from buying properties in the UK as a function of (1) tax changes and (2) less than friendly policies towards the landlords. There’s also a meaningful chance we might move back across the pond at some point.

That being said, your analysis is spot on. Beyond taxes, the real trick is finding a property with a high enough yield and good prospects for both rental and price growth. Most people underestimate just how challenging sourcing good deals is. On some occasions, it has taken us years of time to find our next investment. A low-effort endeavour it is not.

What makes things easier is (1) experience and (2) a good network of agents, mortgage brokers, lawyers, accountants, and property managers. However, these are hardly the things you will develop (or want to invest the time to develop) if you only own one or two properties.

The bottom line is I enjoy property investing (both the process and the returns), but it’s something to head into with both eyes wide open. For those with the patience, resources, and the long-term horizon, there’s very serious money to be made.

It was mentioned as an advantage of the Ltd route the option to pay into a SIPP resulting in zero tax rate (assuming below AA threshold). But wouldn’t that also be the case for holding the property in one’s own name? Instead of the company making the contribution saving corporation tax, the sole trader does it saving personal income tax. What am I missing?

@Rahul Shah My guess would be that £1M property would be worth more. For Bitcoin to reach the value of the property, it would have to quadruple and the property would have to just mark time. Given that the intrinsic value of Bitcoin is really what the next ‘fool’ is willing to pay you for it, there’s no *logical* reason for anything like that level of appreciation. At least property serves a useful purpose. But I fully accept that I may be proved to be wrong.

@theta As I understand it, it would depend on other income. Long term rental income isn’t counted towards “relevant earnings” for the purpose of tax relief on pension contributions, so you could contribute the equivalent of the rental income to the pension but you’d be relying on having that income from qualifying sources to allow you to get the relief.

Short term lets would be different, and do count as earnings.

Hi, other factors to consider.

If you put some money of your own into a company purchase of property (capital), you potentially get two benefits. Firstly, if you have other income and the loan was funded by personal borrowing, it is a loan to a close company which may qualify for tax relief against your personal income at your marginal rate.

Second as the company owes the directors money, company income can be extracted as repayment of the directors loan rather than being extracted as income. Loan repayment does not attract personal taxation. This means a deposit provided for the property from personal funds or borrowing can be extracted against future company income with only corporation tax being paid. You do need an accountant which does cost extra of course. In our case we have some properties owned personally and some in a company. The accountant has been well worth the cost.

I briefly looked into a BTL a few years ago – decided it wasn’t for me. I think if you are a company (LTD or not) with several houses in your portfolio, it may well be lucrative; but I was advised the amount I’d need to have in the bank as a reserve really wasn’t worth it for me. With fees, repairs, and in-between tenants – if you fall unlucky, there can be a lot of outlay.

@TI @Vroom The close companies that only do BTL to third parties will still benefit from the small profits rate (19% corp tax on up to £50,000 profits).

What’s missing from this post is that the more companies (including SPVs) you own the worse off you’ll be thanks to the new ‘Associated company’ rule being introduced. Every extra company will halve your lower small profits rate limit which initially is £50k. So owning 2 LTD companies will drop the £50k limit to £25k on BOTH companies. More than 19% corp tax will apply to both. And that’s regardless of the other company’s profits (it could be zero, doesn’t matter!).

Bottomline a landlord may be paying more tax if they own another company or have multiple SPVs.

I rarely post my own articles but excuse me this time! Examples here https://www.foxymonkey.com/budget-2021-company-investors/