What caught my eye this week.

I know we only recently revisited the meme stock mania of 2021, when I reviewed the Netflix documentary Eat the Rich.

But there’s no better post to flag up today than Alexander Hurst’s epic variation on the theme in the Guardian this week.

The title – How I turned $15,000 into $1.2m during the pandemic – then lost it all – sets the stage.

But there’s more than just ‘loss porn’ to Hurst’s account, as we’re shown how suddenly coming into money warps your thinking:

I stopped searching for 50 sq meter one-bedroom apartments in central Paris and instead started browsing €1.5m lofts with rooftop terraces, or scrolling through Sotheby’s listings in French Polynesia, drooling over a small private island I could buy for $890,000 – as in, I could actually buy it.

It wasn’t hard to rationalize it. After all, my Amherst classmates had grown up going to vacation homes and boarding schools, and were destined to inherit large transfers of property or investment wealth.

I would not; instead, I felt the impending burden of my parents’ underfunded retirement accounts looming.

The piece really spoke to me: Hurst feels like a brother from another mother who went down a rabbit hole I avoided only by being born 20 years earlier.

And it takes guts to admit to such losses – and the truths that lie behind them – in public.

As my co-blogger wrote when he revisited the bursting of the 2021 bubble:

The market mints winners and losers every day.

The tricky bit is that failure is silent, while success is noisy.

Generally that’s true – but this time has been different.

The Reddit traders paraded their successes and failures very publicly throughout their epic bender.

Maybe that’s why this time we’ve been given an account of the morning after.

The first trillion is the hardest

Notes from the meme stock boom are not easy reading for the squeamish, what with all the leverage and the roll call of trading tools like options and shorts – as well as plenty of obscure small cap stocks.

But the truth is you can lose a lot of money just fine with everyday investing into some of the biggest companies in the world.

As Ben Carlson says over at A Wealth of Common Sense this week in recounting the fall from grace of Meta (nee Facebook):

I’m not trying to pour salt in the wound here for people who own these stocks.

This is just a not-so-gentle reminder that stock picking is extremely difficult, even over the long run and even for best-of-breed corporations.

On the way up you kick yourself for not investing in name-brand companies with stellar stock performance.

Then when they inevitably crash you begin to wonder if those gains are ever going to return.

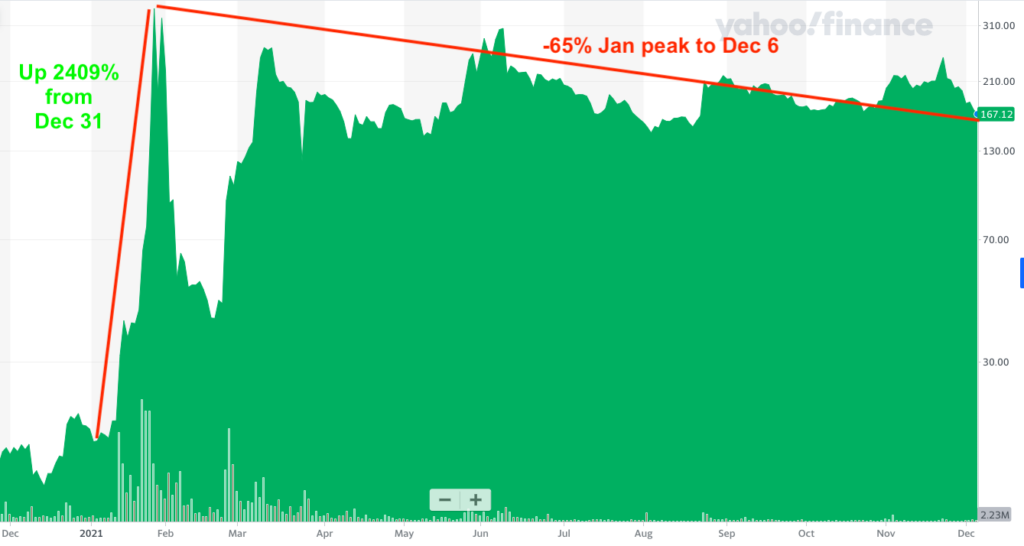

For those who don’t follow the market with a magnifying glass like me and Ben, this chart shows how Meta has left the trillion-dollar market cap club:

Despite being one of the most successful and profitable companies of all-time, Meta has now been beaten by a diversified index fund over the past decade.

For love not money

When I used to write more about my naughty active investing – that stands in such contrast to the Monevator house view and the wise posts of my co-blogger – I was sometimes accused of hypocrisy.

Why was I telling people they should invest in boring index funds, when I do something completely different?

Was I keeping all the good stuff to myself? Did I think I was better than everyone else?

That sort of thing.

Follow that link to learn more about why I’m still a stock-picker and an active trader, for my sins.

But let’s be clear about one thing.

I haven’t increasingly told people over the years that they’ll almost certainly do better with index funds despite my being an active investor.

On the contrary, I know all the market’s capricious whims. The agonies and ecstasies, as Ben puts it.

And I say you’ll almost certainly have a more pleasant life if you invest passively because of my experiences as an active investor!

Enjoy the weekend, and the many great links below.

From Monevator

How to choose a bond fund – Monevator

Worst job in the world: Bank of England governor – Monevator

From the archive-ator: 101 ways to save money – Monevator

News

Note: Some links are Google search results – in PC/desktop view click through to read the article. Try privacy/incognito mode to avoid cookies. Consider subscribing to sites you visit a lot.

House prices will fall 10% in 2023, according to estate agent Savills – This Is Money

How will the Bank of England’s hike to 3% interest rates affect you? – BBC

BoE tells investors to rein in excessive expectations for rate hikes – Bloomberg

UK private wealth portfolios down by up to a third [Search result] – FT

The over-50s leaving the UK labour force – Guardian

Products and services

Vanguard to explore giving more voting power to index fund investors – Pensions & Investments

UK pensions: it’s easy to cut fees [Featuring a handy link to Monevator] – Guardian

The lucky customers being paid to use power this winter – This Is Money

Which shops offer the best value lunchtime meal deals? – Which

Open a SIPP with Interactive Investor and pay no SIPP fee for six months. Terms apply – Interactive Investor

Britain’s biggest energy suppliers to offer discounts for off-peak usage – Guardian

Falls in UK mortgage rates predicted as BoE signals dovish outlook [Search result] – FT

What to do if you need to remortgage – Which

Homes for sale in conservation areas, in pictures – Guardian

Comment and opinion

The present defines the past – Of Dollars and Data

News you can’t use – Humble Dollar

George Soros: issuing perpetual bonds would show that Sunak is serious [Search result] – FT

How to combine annuities and drawdown to maximise retirement income – This Is Money

Morgan Housel: little rules about big things [Podcast] – Morningstar

Why Americans don’t feel crushed by this year’s big bear market – The Irrelevant Investor

The capital allocation approach to household budgeting – Humble Dollar

Why rough edges in financial markets remain – Abnormal Returns

Breaking the cycle of financial shame – Morningstar

Building a risk-free 4.36% paying 30-year withdrawal portfolio with US TIPS [US but interesting] – Alan Roth

At the company retreat – Indeedably

Spending money mini-special

The money value of time – Young Money

J.D. Roth: money won’t magically fix all your problems – The Fioneers

Minimalism, ‘lagom’, and critical consumption – Money With Katie

Naughty corner: Active antics

The power of not having a view – Behavioural Investment

Revisiting the case against value – Validea

There’s only one problem with low-volatility portfolios: the price – Advisor Perspectives

Armageddon or time to get back in? – Investing Caffeine

Covid corner

Scientists have their eyes on several ‘Deltacron’ crossover Covid variants – Fortune

Kindle book bargains

No Rules: Netflix and the Culture of Reinvention by Reed Hastings – £1.99 on Kindle

How Will You Measure Your Life? by Clayton Christensen – £0.99 on Kindle

Why the Germans Do it Better: Notes From a Grown-up Country by John Kampfner – £1.19 on Kindle

Your Next Five Moves: Master the Art of Business Strategy by Patrick Bet-David – £0.99 on Kindle

AI image generators mini-special

Art will persist, but the old artists will be rendered into Soylent – Wired

The golden age of AI-generated art is here. It’s weird [Search result] – FT

Environmental factors

Europe’s climate is warming at twice the global average, says WMO report – Guardian

Beyond catastrophe: a new climate reality is coming… – New York Times

…but UN chief warns of doom without an historic climate pact – Guardian

Off our beat

Brexit: why did it all go to pieces? – Prospect

Troll posts on Twitter decline markedly on Russian public holidays – Klement on Investing

How do you make the perfect toy? – The Walrus

Cumulative versus cyclical knowledge – Morgan Housel

The surprising science between better relationships – Next Big Idea Club

Ballerina music box – Fortunes and Frictions

And finally…

“A world equity index tracker is the only equity investment a rational investor ever needs to own.”

– Lars Kroijer, Investing Demystified

Like these links? Subscribe to get them every Friday! Note this article includes affiliate links, such as from Amazon and Interactive Investor. We may be compensated if you pursue these offers, but that will not affect the price you pay.

Great piece (as usual!).

I find the whole post meme stock analysis, psychology and hopefully the learning and maturity of those involved interesting, with the strong awareness that just a few years earlier, very likely I also would have succumbed to the craze and lost.

Whereas here I am now – in a large part thanks this wonderful website and community – slowly accumulating (well, maybe not this year) with a diverse and mostly passive portfolio hovering around six figures, still in the game.

Ps nice to see that shout out to Monevator’s comparison tool!

The Indeedably link doesn’t appear to work for me, anyone else’s have the same problem.

@dharmesh yes it appears to be broken at indeedably’s end

@JDW in the future perhaps you’ll see this year as a good year if you’re still accumulating assets, they are cheaper now.

As someone who is largely passive with occasional tactical bursts of activity in the sidelines , it has been profitable over the last 2 years or so but whether that is worthwhile use of time ???

@Dharmesh @FBA — Cheers for flagging, yes it seems like an Indeedably problem. I’ve dropped him a note.

@Hariseldon i find it unlikely we’ll look back and find this year a good year.

Much of the opportunity from the drop in global stocks has been taken from us by the weak £, and its unclear if Rishi or Bailey can fix that.

Companies have started laying people off, or entering hiring freezes, and small businesses and their owners will soon face higher corporate, capital gains and dividend taxes…

The drop is house prices of 10% next year, if it turns out that way, will be washed out due to affordability having dropped 30% thru higher mortgage rates.

Investing over the next few years is going to to move from “index and chill” to anxiety about whether you should just pay down your mortgage or take a nice safe 5% in a long term savings account.

The writer in Prospect attempts to creates the same lazy and erroneous impression that Neverland had in these very comments – that Jeremy Warner was a leaver and his support for project fear is new and profound. Rather than a gotcha moment, to the contrary, a member of Project fear still believes Project fear (despite the 300,000 banking jobs having not gone)…nothing at all noteworthy about that.

Takes me back to the #despite brexit being added to every positive news story written by ahem certain institutions this past six years

@Hariseldon absolutely!

I got carried along in the investing hype/madness during the covid years. I should have (would have, could have, didn’t know any better…) sold when the local warehouse workers and fitter I work with in Kazakhstan were fully into it.

After pure luck with investing in Tesla in early 2018, I seem to have done my best to offset my gains with heavy losses in other companies. As of right now, my losing investments are -15%, -78%, -36%, -32%, -61%, -47%, -58%, -69%

I do have 3 currently ‘winning’ stocks, but thankfully the vast majority of my savings are in index funds in my ISA. I’ll stick with that going forward and hopefully, in 5, 10, 20 years, my losers will climb back.

@bblimp

Thanks for the mention.

Given your full throated praise for the Truss government’s ill fated mini budget six weeks ago (note: the shortest serving prime minister ever) you will excuse me for expecting the exact opposite of everything you write to transpire

In fact latest polling indicates over a quarter of leave voters in 2016 would vote to join now putting a clear margin in favour of joining the EU – by a bigger margin than voted to leave in 2016 …

https://redfieldandwiltonstrategies.com/joining-or-staying-out-of-the-eu-referendum-voting-intention-19-august-2022/

Cue some hand waving and bluster from bblimp …

Having had lots of ups and downs with individual share purchases and being so close to 10 baggers and the like i can now say that whilst it was fun i would have been richer if i had invested more in a low cost global tracker. The pain of learning that beating statistics is well unlikely is a lesson learnt by me being poorer. So now i have a small dabble pot which is never never tracked whilst the larger global tracker quietly does the business. Admiting your flaws is tough so this compromise lets me pretend

@The Investor Why the Germans do it better is by John Kampfner not Peter.

I read it a few weeks ago, good to find a book exploring modern german culture.

After the Fall by Tobias Buck is also a good read, it’s in a similar vein but about Spain.

“UK private wealth portfolios down by up to a third” – FT actually says portfolios are off 10 to 13%, the balance is real terms loss from inflation/£ collapse, whereas same paper 2 weeks ago “Retail investor portfolios down 44% year to date” in the US means what it says. Not sure what the implications are of this.

While I am at it, NYT piece is excellent but wins a prize for poor editing for contaqihning the sentence: “Now, with the world already 1.2 degrees hotter, scientists believe that warming this century will most likely fall between two or three degrees.”

@neverland – yes it was sad wasn’t it, hopefully they can give growth another go once they’ve sorted the deficit out.

Oh and…there’s only one poll that matters.

What a superbly-written account. Thanks TI for linking.

”The piece really spoke to me: Hurst feels like a brother from another mother who went down a rabbit hole I avoided only by being born 20 years earlier.”

100% this. I too only missed this same outcome, in 2020, by being born *10* years earlier. I experienced a huge gain in 202o that allowed me to stop work when I please, but by that time I’d been through my own very drawn out and painful apprenticeship via three blockbuster-into-blowup trades over a period that spanned around 15 years. From starting trading in my early 20s to a point in my mid 30s I’d made and lost large multi-hundreds of percent gains three times, only for each time to keep hold and lose all the gain and much of the original investment. Sometimes multiple years’ worth of salary. (There was the occasional smaller scale success!).

By 2018 when I spotted an opportunity in a now moderately well-known AIM mining share, I knew what it felt like to make a big gain and lose it all. This time I made 2500% on what was going to be my deposit for my first house, and managed to keep hold of it. I sold, not long before a big drop. That one trade allowed me to retire this year in my mid 40s and buy my house mortgage free, literally life-changing. But still, reading the account brought back the same feelings of ‘keep holding for more’ that I experienced again this time, even though I’d experienced big gains and losses on three prior occasions. The key seems to be learning to be able to flip the brain from risk on to risk off without attachment. But most brains aren’t made for that kind of dual thinking, without first learning via painful episodes to engrain the response. It’s unnatural to not dream of more.

Interestingly it’s common in the resources sector to hear very successful well-known investors (Rick Rule for e.g.) comment that a large part of their success relied on one trade that multi-bagged among the many losers. That was the case for me too.

Today I still have a few high-flying, high octane investments in my pf, mostly in the various energy transition metals, but at a lower proportion of overall pf that won’t totally blow me up if they all fail. I also keep a lot in steady dividend-payers. My pf would still seem high risk to a 60/40 devotee but to me it’s almost passive 🙂

@TI:

Alan Roth post is indeed interesting, albeit US based. It provides a great real-world illustration of most of the points raised a week or so ago about building [inflation linked] bond ladders.

OOI, any reason you did not link to ERN’s latest post (2022 vs 2000/01), which IMO is just as interesting?

@ Al Cam – I was interested in the Alan Roth TIPS ladder too.

There are far fewer UK linkers than US TIPS so our ladder would have bigger gaps. & more so again if you built it out of low coupon linkers to maximise the CGT benefits (e.g. because you were building it outside of a tax wrapper such as an ISA/SIPP). Lower real yields at the moment too, but definitely something for a watchlist?

Thinking if/how we UK retail types could execute the US version he proposes. Interactive Brokers let you buy and trade these TIPS, they even let you place bids at mid or wherever you want. They also let you trade the FX at mid. So that leaves the forward FX risk (should you wish to hedge it) and the tax treatment.

Interactive Brokers offer a SIPP and an ISA (has anyone used these?) If you did your ladder in one of those, would you be exempt of all the US taxes?

I think(?) you can do derivatives in a SIPP but not an ISA? That would give you the option of hedging some of the forward FX using e.g. forward starting IMM dated FX (only for a year or so at a time with much liquidity, but would give you some hedging options and remove the need to roll the funding daily etc)?

The meme stock stuff reminded me of a favourite investment book (with a quite Monevator-esque title): “Why the best-laid investment plans usually go wrong”, by Harry Browne.

He basically advocates having a small ‘pocket’ of your portfolio to do all the crazy stuff – with the hope that psychologically that will ‘scratch the itch’ of speculation.

Separately I think some of the nuance in the Permanent Portfolio is generally missed in its reporting, but that’s for another day.

@all — Thanks for the interesting comments all! Trying to take something of a screen break (my left eyelid has started twitching again, never a good sign! 😉 ) but reading everything as usual.

@Al Cam — No reason, I didn’t read it! 🙂 I probably read 200-300 articles a week but never catch everything.

Here’s the link:

https://earlyretirementnow.com/2022/11/02/2022-worse-than-2001/

Interested readers might also want to check out this post of mine from March this year for more ideas/thoughts:

https://monevator.com/is-your-early-retirement-under-threat-from-an-unlucky-sequence-of-returns/

In the This is Money retirement income article, I’d love to know who is quoting A J Bell a joint-life inflation-linked annuity for a 65-year old with 60-year old spouse at between £5198 and £5970 per £100,000! The best HL can manage on their website is £4177 single-life inflation-linked for a 65-year old.

Seriously, though, there are two mentions in this article of deferred annuities, including by Steve Webb who is a respected commentator in this field. In The Accumulator’s bond duration article a little while ago, the consensus in the comments was that retirement income deferred annuities were not obtainable in the UK.

@Stevey Bee #12

Coincidentally, my son was awarded a prize by his school for the best result in modern languages, German, and the prize was the book Why the Germans Do it Better. I read the first chapter and was less than impressed. An exercise in vorurteil was my impression!

Ugh, Meta took me from a respectable 15% IRR in my “fun” portfolio to -15% in a month. Don’t do options kids.

A great article from Nick M this week on how the present defines our past in both investing and life. When I look back at this year as an annus horribilis for the portfolio, it will be tempered by the great year I’ve had in Asia and reconnecting with family and friends, largely being insulated from the chaos back home… and starting a new venture to boot.

Rumours are flying again (Telegraph) that higher rate tax relief on pensions is on the sacrificial altar.

Won’t be long until the only way to FIRE in this country is to work for a hedge fund and eat and sleep with the pigeons in Hyde Park

@Andrew >Much of the opportunity from the drop in global stocks has been taken from us by the weak £<

The opportunity is still available if there's a £-hedged version of your investment. For example, this morning two big S&P 500 ETFs VUSA and GSPX are this morning at 93.42% and 77.34% of their highs. It does require some faith in the £'s eventual recovery, of course.

@Andrew, I agree that pension tax relief might be a tempting target. But it would be worthwhile if there was some compensatory change, for example to the lifetime allowance which has become a big problem for many (at least when investments are doing well).

On the other hand there seems to have been an annual sabre-rattling ritual over pensions with nothing ever happening.

As has been lamented here many times by myself but also many others (including most stridently the sadly departed @ZXSpectrum48K) the UK has voted itself to be poorer in the future, to have lower growth, and to be less dynamic. It also voted for lower immigration, but at least that part has not yet come to pass.

These things will increasingly put pressure on the State’s balance sheet over many years.

Obviously having seen anything positive in the Truss/Kwarteng proposals now looks foolish in retrospect, but while I thought it was contradictory and ill-timed (Push-me-pull-you as I said in my report at the time) it did at least identify that the UK has a big growth/productivity problem, and arguably a comfy-populace problem.

One trouble is that while they talked about lazy workers etc in their pamphlet, as far as I could see they were more likely to go after the poor and leave the likes of the triple-lock intact. While some pensioners in the margin certainly struggle, a huge bulk of the UK’s ongoing (and unproductive) wealth resides there, and at best will be passed on to their equally lucky children, leaving others locked out.

We saw the markets don’t like fiscal profligacy in the face of a rising rates/inflation, and the populace seems as in denial about reality as ever. (How often do you hear people reflect on the massive state spending in 2020 through the expensive lockdowns on furlough etc as a boon? It’s all but forgotten).

In short something has to give, short of an extremely unlikely albeit never impossible bit of luck (some equivalent of north sea oil, maybe an AI breakthrough pioneered and crucially retained in the UK, unlike say DeepMind which was soon mopped up by Google).

A flat rate of pension tax relief is probably ‘fairer’ (extremely bold quotes). I suppose the triple lock is okay given that pension income is taxed, so presumably some claw back. I think we’ll be lucky to see ISA allowances and the like go up for a long time. I imagine all the tax thresholds will be frozen indefinitely, although with a general election in a couple of years that’s obviously moot.

Unemployment is low, which is the one big bright spot. But aside from that I think the best we can hope for is say five years of in/out recession and slightly higher inflation chipping away at debt.

There’s plenty the sort of individuals that read Monevator can do to better their situation though! We live in hugely opportunistic times. 🙂

I don’t see much point in bemoaning the lost ways to wealth of yesteryear given our lack of personal agency, although we all do it from time to time, certainly including myself, not least because I have weekly articles to write. 😉

@TI (#26):

Your outcome for the foreseeable seems highly likely.

IMO, stealth seems to be the currently preferred vehicle of the exchequer.

You raise an interesting point re unproductive wealth. Would you care to expand on this a bit, e.g. what you mean and any suggestions you might have for resolving this issue. I ask as the usual UK approach is to somehow incentivise investment – often in the form of tax breaks – but there may be other ways/ideas?

The ‘comfy-populace problem’ will be a tough nut crack. FWIW, IMO this is largely a government own goal many decades and political flavours in the making! And, as you IMO correctly identify, any answers lie in the future and not in endlessly regurgitating the past.

@Al Cam — I’m not sure I’d have much different to add to the many others who’ve commented over the years to be honest. There does seem to be a gap between what is required and what is politically deliverable. And I’m bound to say (to your chagrin, regarding regurgitating!) that things took a deeper turn for the worst on that front in 2016.

Perhaps the damage caused by the country voting itself onto prison rations (GDP hit and potentially curbed workforce-wise) will eventually incentivize more investment in young people (/education) and skills as well as in technology/capex. The former in particular won’t be a quick fix though (many years) and it won’t undo the net damage IMHO. And of course we could have done it without making things even harder for ourselves first. Meanwhile we have a crucially important and growing bloc of voters (wealthy boomers and pensioners) who are not directly connected to the economic growth of the country anymore, and relatively insulated from the consequences of their voting, whether it be to oppose new housing (/new towns?) or higher wealth taxes, or to vote for foolishness like leaving the EU.

In terms of specifics though, perhaps I could work up a post sometime for everyone to tear apart.

In the meantime, this new FT article corroborates our thinking in fiscal drag. I’m glad to see it leads with growing the inheritance tax take, which is at least a start and which long-term readers may recall I’m all for (versus the alternative of incrementally increasing taxes earned income – because the money has to come from somewhere):

https://www.ft.com/content/5cb99420-13a4-4ecd-b06d-16d812377a57

@TI (#28):

Although the paper is now a little dated, the chapter called “The Macroeconomic Implications of Saving in Retirement” from page 42 provides some possibly helpful quantifications, see https://www.researchgate.net/publication/297387424_Understanding_Retirement_Journeys_Expectations_vs_Reality

Great article as usual

The problems seem to be becoming more and more existential by the day as Reality relentlessly continues to catch up with Expectations

Our current generation of leaders were more “fixers “rather than “inspirers” so probably no way out there

I am reminded of my reading of several historical works of the fall of the Western Roman Empire which didn’t actually fall -was more usefully described as continued successfully but under new management !

It is striking for instance that the new Conservative party leaders are largely selected from ethnic minorities and women (Labour -where are you?)

Perhaps a section of society that actually appreciates what we have in this country (especially the ethnic minorities)

Whether this is enough of a change to turn the country around remains to be seen

It possibly means that we will have more of a chance than some nation states as radical changes of leadership ie installing “outsiders” is a proven and historically successful policy of turning round a failing state

xxd09

PS the Chinese empire over 5000 years has regularly and successfully replaced its leaders with over the border recruits (tough Mongol types) usually every 6 or 7 generations as each previous leadership became more and more inept

The civilisation continued-a lesson for us?

@TI Pardon the off topic but what happened to ZXSpectrum48K? I enjoyed his (I assume his) comments the most.

@LCN — As best I can tell he fell out with the site (/me) over what I would say is a misunderstanding of my feedback to his feedback.

Basically I didn’t (/don’t) think a particular aspect of his advice was actionable for the vast majority of readers of this site who aren’t hedge fund manager skilled/smart and who don’t have access to the vast majority of private / invite only / closed / huge minimum investment hedge funds he advocated. I suggested therefore that while personally always very interesting and welcome, we weren’t going to change the kind of advice we offer to readers to reflect his comments on the matter.

He seems as best I can tell to have taken it as saying his thoughts were somehow unwelcome (or even wrong in some way, for him) which wasn’t my intention.

I can well imagine if I was paid seven-figures for managing money then I might be sensitive to feedback from a personal finance blogger making low thousands from his investing website, but I don’t think my thinking was in the wrong here. (It’s worth noting perhaps I’d even asked if he wanted to write articles for Monevator, though I don’t blame him at all for saying that he did not want to, quixotic task that it is).

Obviously I’m sure he might put it / see it slightly differently, and the truth is probably somewhere in the middle. I expect we’re both a bit blunt and also sensitive, and online discourse is notoriously prone to falling out. 🙁

@TI thank you, seems like fair points. (I was worried it might be something more serious!) FWIW I think the site indeed has the right focus and is a great resource, but his comments were interesting mainly for the different perspective. I’ll keep lurking and reading all the same, thanks for the blog

@TI whilst agreeing that intergenerational fairness is a growing source of concern, I suspect that many pensioners would point out that they worked hard from an early age, without the opportunities for Gap years, travel etc which young people have today, and are now therefore only enjoying the fruits of their labour.

It’s also worth pointing out that many do a great deal in terms of free childcare, support, help with property purchases etc, as well, more widely, as making a large contribution to society through voluntary activities.