Like most people, I can get behind the idea of being rich. Filthy rich. Ideally right now.

And if that’s due to a lucky YOLO bet on a stock going to the moon then so much the better.

The problem is I’d have to be very lucky. Because I don’t even make those bets.

No, I dutifully punch my ticket on the passive investing slow-train while everyone else – apparently – quaffs champagne on a first-class Hyperloop to Easy Street.

It’s hard not to wonder where it all went wrong.

Every book I read is out the window. Forget diversification. Forget due diligence.

Just follow a two-step process:

- Plonk your cash down on a meme stock, crypto-currency, or SPAC.

- Drown in money.

Simple!

Not exactly. Because being inherently more furrowed-brow than laser-eyed, I can’t quite shake a nagging question.

What happened next?

Having fun staying poor

The headlines typically only report rags-to-riches tales or train wrecks.

But how are things going if you only jumped aboard some of 2021’s biggest investing thrill rides when they were hot?

And you forgot to get off?

Forget ‘follow the money’, let’s follow the emojis! 🚀🚀🚀

The tracks of my fears – The following collection of meme stonks, crypto-assets, and ETFs all triggered my hype alarm this year. Share price charts are from Yahoo Finance, denominated in US dollars. The Y-axis is log scaled, which is the right way to present prices but makes the peak-to-trough look less exciting than a linear scale. I’ve tracked the price level from a notional date of 31 December 2020 to show what could have happened if you bought in before Peak Froth.

GameStop

GameStop was the poster child for the WallStreetBets David vs Goliath story that blew everyone’s minds in January 2021.

A ragtag band of Redditors – armed only with rocket emojis and pump-action call options – supposedly had institutional short-sellers on the run.

How did it work out?

If you’d dropped some coin on GameStop at the end of last year, your position had spiked more than 2,400% by 28 January.

Behold that first jagged peak in the graph – soaring over blasted earth like the Dark Tower.

And, by some black magick, you were up more than 12,000% if you’d bought GME shares that were going nowhere way back in July 2020.

But as The Investor wrote at the height of GameStop mania:

GameStop isn’t worth $22.5bn. It just isn’t. The company should try to raise capital while it can at this price, because it won’t stay here.

It didn’t. Like gravity, the fundamentals eventually brought us back to Earth. If you bought in at the peak then you’ve lost 65% as I write this.

You’re still up 768% on bets placed on 31 December, mind you.

How firm are your diamond hands now?

AMC

The world’s biggest cinema chain AMC was shuttered and mired in debt when meme-stonk status (and free popcorn) put a rocket up the shares.

Turned out this trip to the moon involved a crash landing six months later. AMC is down 60% from its high.

You’re 1,226% to the good if you’d bought on December 31 2020. Damn my low horizons.

Virgin Galactic

Is Virgin Galactic heading for Zero G, or zero gees? As you can see the stock is prone to cratering.

Excitement mounts whenever everyone’s favourite Earthling emigrant threatens to leave the planet. But since going parabolic in February, the shares have plummeted like the oxygen levels in a depressurised spacecraft.

Virgin Galactic is down -75% from the peak and down -39% from our 31 December 2020 waypoint. Cue emergency klaxons!

Dogecoin

Is this a joke? Yes, and a crypto-currency.

Dogecoin began as a satire on Bitcoin. But rearrange the following into a beyond-parody late-capitalism spectacle and you’re up over 15,800% in four months:

- A Reddit fanbase

- Mischievous tweets from Elon Musk

- A doge meme logo

If you’d somehow foreseen that 2021 would be the year of the doge, then you’re up 3,748% since 31 December 2020.

But if your strategy hinged on Elon’s latest Tweet, you’re down 75% since the top.

Theme ETF

A lifetime ago, a videogame called Theme Park taught Gen X how to exploit a captive audience. If you loaded your popcorn products with salt, then you’d sell bucket loads more sugary drink to thirsty punters as they tooled around your rollercoasters.

Purchasers of salty thematic ETFs will also be familiar with rollercoaster rides. Sprinkled with the promise of ‘disruptive innovation’ to get your mouth watering, these ETFs were lapped up in 2021.

But did these exciting investments justify the hype?

ARK Innovation ETF

How can you go wrong investing in genomics, fintech, space exploration, AI and robotics? Well, for now, it seems the market thinks your growth stock holdings are massively overvalued…

(The Investor is an admirer of this ARK’s Noah – superstar stock-picker CEO Cathie Wood – and he wants me to show ARK’s full 2020 performance. Yeah this ETF gained 153% in 2020. But that was then, this is now. And that’s the point!)

Defiance Next Gen SPAC ETF

A Special Purpose Acquisition Company (SPAC) sounds like something that Sacha Baron Cohen would invent to entrap a Tory minister.

Turns out it’s a shell corporation that lists on the stock exchange, and is otherwise known as a blank cheque company.

SPACs are marketed to ordinary investors as a way of tapping into the riches of private equity.

Some SPACs are even celebrity-endorsed. The likes of Jay Z, Shaquille O’Neal, and Serena Williams have all gotten involved.

Sounds like a winner, right?

The US Securities and Exchange Commission (SEC) felt moved to mention:

It is never a good idea to invest in a SPAC just because someone famous sponsors or invests in it or says it is a good investment.

Rize Medical Cannabis And Life Sciences ETF

You can’t blame anyone for investing in a Cannabis ETF when 11 out 12 bathrooms on the parliamentary estate recently tested positive for drugs.

But cannabis profits have gone up in smoke since the high in February.

That’s a shame because a joint select committee working to the sound of Big Ben’s bongs could really nurture grassroots support for this issue.

I’m sorry if I’ve made a hash of this analysis. [Sacked! – Ed]

Hubbly bubbly

The rolling wave of manias in 2021 doesn’t necessarily mean a huge market bubble is due to burst.

In fact, I’m relieved to see that subsequent losses in every one of these fad-stocks have released some pressure.

The best explanation I’ve seen for 2021’s rampant speculation is that Covid created a reservoir of savings out of stuck-at-home citizens. In 2020 this birthed a new generation of bored share traders. Surplus cash flooded the markets and pumped up prices across asset classes of every description.

I guess we’ll all feel the pain when that liquidity drains away?

Best of luck to anyone who walked into the casino and came out smelling of roses and money. I hope you hang on to your windfall.

As for the rest of us not relying on blind luck, let’s keep the passive investing faith.

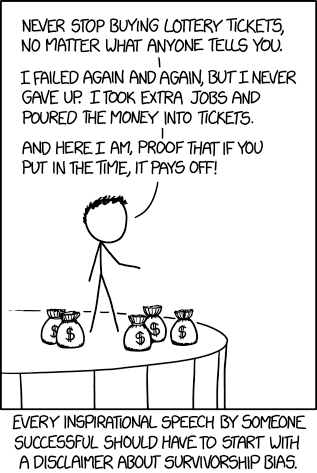

The market mints winners and losers every day.

The tricky bit is that failure is silent, while success is noisy.

Take it steady,

The Accumulator

Comments on this entry are closed.

Early in 2019, I started putting monthly monies, into a new platform ( Tickr ) whose offerings were entirely composed of thematic ETF’s. I chose ‘Climate Change’, which was composed of 3 ETF’s, Clean Energy, Global Water, and Green Bonds. I chose the ‘balanced’ version, which comprised the 3 in approximately equal ratios.

2.5 years on, I sold up. Approximately 25% return on monies put in. The platform’s target audience is millennials. I’m not, and decided that the volatility of the Clean Energy element ( iShares ) was too much for me. Also the constant marketing urging me to subscribe this or that ‘partner’ outfit to save the world, offset my carbons, etc, etc.

No complaints, really. I had some capital appreciation. I learned more about my comfort zones, both in terms of financial volatilities, and also my tolerances or otherwise for raw marketing.

Nice piece @TA.

A few years ago, I likely would have succumbed to the hype, to be honest. No more. Slow, steady and diversified.

I am still convinced, as you point out, it was largely a combination of boredom, increased cash due to less spending. I would add the increase of the new no-fee trading platforms into the mix too. (I don’t think they are a *bad* thing, indeed I am planning on moving from HL in the year ahead, but in many ways I prefer having a trading fee, as it makes me really think about things before buying or selling anything.)

An issue I have with the theme ETFs (and therefore a reason I don’t touch them) is many are often only closely based on the theme, with potentially a lot of filler in the underlying holdings (For example, that famous Space company Netflix appearing as a holding with the Ark Space ETF – perhaps the theme includes showing Apollo 13?)

Thanks again.

“That’s a shame because a joint select committee working to the sound of Big Ben’s bongs could really nurture grassroots support for this issue.”

Fantasticly written! A genuine laugh here!

> failure is silent, while success is noisy

Success has many fathers, but failure is a bastard 😉

@JDW > new no-fee trading platforms into the mix too

Surely all that is going on is you don’t pay a fee but the spread mysteriously increases?

Thought this observation was spot on

‘..failure is silent, while success is noisy’

How true.

Incidentally pleased your graphic conforms to the norm, rocket going from bottom left to top right in accordance with the natural order of things.

@Ermine

Re: “Surely all that is going on is you don’t pay a fee but the spread mysteriously increases?”

The fee free brokers seems to be less about stinging with a large spread but more about passing info about what’s being ordered to the market makers and the market makers paying for that info and the deals being passed their way……..

One of the things that I think gets forgotten often with these things is that when the price is soaring, picking the right moment to sell is stressful and very difficult.

I dare say that a tiny handful of people have an average sale price close to the peak value, as the majority sell off in a bear trap on the way up.

Of course, those that survive the bear traps are exactly the kind to not recognise an impending bear market and end up clinging on to a dead cat as it decomposes.

@ermine – indeed, as market makers often pay for order flow, an innovation brought to you by that upstanding financial innovator, Bernard Madoff.

I made (Revolut tells me) $1800 and change from the Gamestop rollercoaster, and about the same from BTC over the past year. It’s a useful pressure valve in more ways than one – as the excitement over meme stonks left my SIPP and ISAs almost completely untouched save for the annual top-up and rebalance. Looking back over a decade of trading mistakes, that probably indirectly made me a five figure sum by leaving well enough alone.

Ommission of Bitcoin suggests its not a fad #bullish #moon

@TA. Nice. What it shows is that the “taxi driver” index is still valid. Once even the taxi driver (perhaps now the Uber driver) is talking to you about GameStop, ARK etc, it’s time to sell. Once they start swearing about how much they lose, probably time to buy again.

My biggest current fund investment has, in it’s entire history, never made more than 36% in one year. It’s biggest up month is just 6%. So no 153% return like an ARK in 202o or cryptocrap like returns. But it’s also never lost more than 3% in any year. It’s worse drawdown from high to low is 7%. No obscene 50% drawdowns. It only loses money 1 month in 8. Average return a bit over 14%/annum or about 4% more than the S&P over the same period.

It’s boring but over 32 years it’s total return is 6500% (S&P over same period 2400%). Compounding while minimizing losses works absolute wonders. It does the job without the fireworks, without any headlines. Taxi drivers would never have heard of it. I sleep well at night.

‘How can you go wrong investing in genomics, fintech, space exploration, AI and robotics?’ Indeed! – though if you look at the cap weighted tech heavy indexes of the Nasdaq and SOX (Semiconductors), these are up 17%and 35% respectively YTD. The SOX covers the 30 largest semiconductor companies and has done better than Arkk over two years and comparable over five with less volatility. Tracking these indexes would seem a good way to add some of the higher returns potential of tech while avoiding the next Richard Branson.

Read a nice reflective post yesterday from a (mostly) passive investor who bought a little of the ARK innovation fund at the top:

https://impersonalfinances.com/top-of-arkk/

Zx spectrum – any more clues on your anti taxi driver fund? Slow and steady does mean we can sleep and night and as i get older and more weathly it seems to have more importance than when i was younger. Certainly the days of penny stocks or nowadays meme currency are far behind me. Its odd really but when you want to get rich its easier to think how quickly can i do that rather than how can i best guarantee such an outcome. Happy Christmas to all.

@ Trufflehunt – your story chimes with me. My equivalent experiment was/is factor investing. It’s only natural to express our views on the world, and to try to get ahead at the same time. We’re not nuns.

I agree that it’s key to learn more about ourselves in the process and not to fall so much for the hype that we go ‘all in’ on anything.

@ JDW – Cheers for the LOL re: Apollo 13. Great point about theme ETF filler. IIRC theme ETFs are designed and marketed specifically at retail investors. Sadly that tells us everything we need to know.

@ Carrot – Thank you. There was probably another paragraph of that nonsense that TI and I edited out between us. Sometimes you gotta know when to stop 🙂

@ Mr Optimistic – haha. As you know it’s very important to follow the one-way system in space 😉

@ G – that’s such an important point. How many people actually sell at the top? How many people are left holding the bag when the smart money flees the scene?

The easiest media story in the world to write is: “You’d be a millionaire right now if you’d invested £1000 in Hot Stock X on [insert cherry-picked date here]. Rinse and repeat ad nauseum.

@ FitandFunemployed – my point is more about succumbing to hype rather than commenting on the viabilty of any security.

AMC and GameStop are going concerns and, right now, you could have made serious money if you got in before the mania kicked off.

But you get screwed if you buy in once everyone’s hollering “There’s gold in dem hills!” See ZX’s point about the ‘taxi driver index’. I guess that replaces the shoe shine boy indicator from the eve of the Great Depression.

Two things stand out to me about crypto today:

Nobody I’m listening to about crypto is only investing in Bitcoin. The crypto space is so fast-moving that any individual coin could be superceded by innovation or regulated out of existence.

It’s tulip time! People are investing in things they don’t understand because it looks like fortunes are being won and lost.

Crypto is like a super-massive black hole of hype right now. It’s sucking everyone in. Including me. I find it fascinating.

@ ZX – congratulations. As ever you provide a tanatilising glimpse of what’s possible when you combine investing self-knowledge with exceptional analytic insight and an edge in a market.

You’ve said below you have a low risk tolerance. When I think of the retail investor equivalent of your approach I reach for off-the-shelf examples like the Permanent Portfolio or the Golden Butterfly. (I’m talking about practical ways to control volatility rather than smashing the S&P 500.)

Does anything else come to mind for you for readers who’d like an alternative to 100% in YOLO stocks?

@ Calculus – that’s an interesting angle. I’m not dissing ARK as such. To me it’s just an obvious example of the hype cycle in 2021. I’ve had a fair few exchanges with people who say: ‘tech and health are the future so it’s a no-brainer. But they miss the valuation piece. Market history is littered with industries that changed the world but left investors out of pocket.

@ TI – thanks for that. That’s it in a nutshell. My ego is constantly slapping me about for missing out on amazing opportunities without considering the counterfactual. I think the writer is spot on that the “lesson needs constant reinforcement.” Investing is not as easy as it sounds.

When you’ve experienced long term compounding of a simple equity portfolio in real time, you realize that when you get to a certain “critical mass” of compounding, you get “meme stock” like returns on a consistent and reliable basis, rather than through a low probability, haphazard means. And conducting this within a Roth IRA has even greater benefits.

It takes patience and an iron will to hold for the long term and not be seduced by the sexy “get rich quick” schemes that pop up now and then and divert your $$ away from this process.

Sitting tight with a very conservative portfolio of 30/65/5 -equities/bonds/ cash -global index trackers-3 funds only

6% growth this year

Withdrawal rate at 3%-admittedly Covid influenced ie less holidays

Sleep at night- no stomach acid

Will do this 75 year old!

xxd09

I think that as tempting it is to jump on the bandwagon, most people end up losing out.

Ok, the success of bitcoin or Tesla points out that we can all be winners if we believe but the truth is that the most money can be made by being a investment influencer – you buy at £6 and tweet about it and next it’s at £15 then £25 and by the time Johnny come lately pits in a few thousand furlough bucks at £200 a coin/share the smart money moves on. The bubble is only sustained by it appearing in the Telegraph as a safe bet – made by someone who bought last week at 180 and will sell at 220. Cannabilstic capitalism.

I’m not an influencer and I’m ok with it, so I withdrew from chasing ten baggers long long ago and follow a boring get rich slowly with ETFs approach.

The only downside is that there’s no soap opera drama over what’s the most momentous investment to make. It’s quite boring really, like investing should be.

Merry Christmas Monevator!

I’ve purchased crypto for £3k. This is a lot of money for me but not as much, that if I loose it, my life will dramatically change. This crypto (let’s call it) investment is now worth £2k.

Before purchase I have made up some rules what needs to happen to trigger the sale:

1) 10 years passed since purchase.

2) When the value goes to £4k in a space of a year.

I know, stupid rules but somehow I thought sticking to them is smart and the fact that I have any trigger sale rules at all is right.

Except the above, I’m a beginner passive investor and most of my portfolio is in index funds. So why did I buy crypto? The most honest answer is out of greed. But this was not the only reason. My other reason that was present in my head at the time of purchase was to test myself. To test my own ability to not sell in case things will turn out bad. Why test myself? Because theory is one thing and practice another. Because I hold much more money in my passive portfolio and never had a chance to go through the massive sell off there so far.

I did not sell crypto even after being down 60% at some point. I am proud of this fact. Will this mean I will also not sell if my passive portfolio looses 60% in value. I hope so, although in nominal terms these will be bigger losses to swallow. I often picture such event so I am better prepared mentally and tell myself that sell off is a good thing for me since I am at the beginning of my investing journey so this will be a good occasion to buy more than usual.

Also, I don’t know why people say that passive investing is boring. I think it depends on amount invested. If the portfolio is large enough then even typical daily swings might exceed a value of your salary. That sounds far away from boring to me.

@ Peter – the idea of getting into crypto as a way of testing your reaction to volatility is very interesting and makes a lot of sense.

Just to build on your point, I found that my risk tolerance did change as the amount I had at stake became life changing.

Knowing I could lose 50% of my life’s savings is a very different experience from losing 50% of naff all. The realisation crept up on me and I had to increase my bond holdings to deal with it.

I admire your honesty about greed being the primary motivation for buying crypto. Let’s face it, everyone’s in the same boat. The contemporary forumulation is FOMO. But what are we worried about missing out on? Boatloads of cash.

@TA. I’m not recommending readers invest in hedge funds. My biggest position has been essentially closed for a decade, the performance fee is 30% (albeit no management fee) and the redemption notice is 12 months. The diametric opposite of what retail and bloggers want!

Nonetheless, retail can take from this fund two concepts. First, diversification. This fund has over 200 teams, each with say 4+ managers. Each team is totally separated from the others. No collaboration, no sharing ideas, no seeing others positions or P&L. Doing everything from equity long-short, to interest rate curve trading, vol trading, commodities etc. Diversification over different strategies, not asset classes or countries, is the key.

The second idea is encapsulated by one word: discipline. The stop-loss is 5%, the max drawdown is 5%+ one third of the 12 month rolling P&L (so if you are up 15% over 12 months, you can draw down to 5% say). The max VAR 1% (so daily vol of around 0.5%, or 8% per annum). No exceptions ever. Protect the downside, protect the capital.

This is not a fund for those who have huge conviction, who believe in the superiority of their view. The Cathie Woods of this world wouldn’t last a week. She has no risk discipline. She has a faith based view, the equivalent of believing in gods or fairies at the bottom of the garden. It might be she is one of the very few who is truly brilliant. Much more likely it’s that the market regime and her faith have been well aligned. One day though that may not be the case.

So retail can’t buy my fund but retail can do both diversification and discipline. These are two concepts that are available to absolutely everyone.

@ A1Cam

The amount payable is already set for 2030 – increases in deferment are fixed at 5% pa, but once in payment annual inflationary increases up to 5%.

The deferment period was 25 years, so 1.05^25 worked our nicely! But clearly the lower the actual inflation the better I make out in real terms.

The DB pension is over a third of my net worth – which probably explains why I have an uncomfortable feeling in my stomach at the moment.

Aside – letting property to kids doesn’t make for frequent rent increases…

So you are saying all of these are now cheap and are a buying opportunity? (Joke!)

Some interesting observations. My biggest problem is timing my exit. I should really move to profit taking as these speculative assets rise. But I like to run them, until they drop!

However, they are my play money. My stakes are minimal and it keeps me from tinkering with my main index based passive investments.

Taleb suggests a barbell approach 80% in automatic get their slowly approach and 20% in highly speculative potential to go to the moon. I’m more like 5% in the highly speculative, which is still enough to keep it interesting.

The SOX index looks interesting. Any way to buy that on the HL or Vanguard platforms?

@OIMO. The VanEck Vectors Semiconductor UCITS ETF, SMGB, is available on HL and appears to fit the bill. Of course no recommendation, there are many that think the sector is overvalued etc!

Thanks Calculus!