I watched the new three-part Netflix documentary Eat The Rich this week. And I got nostalgic for an experience I took almost no part in.

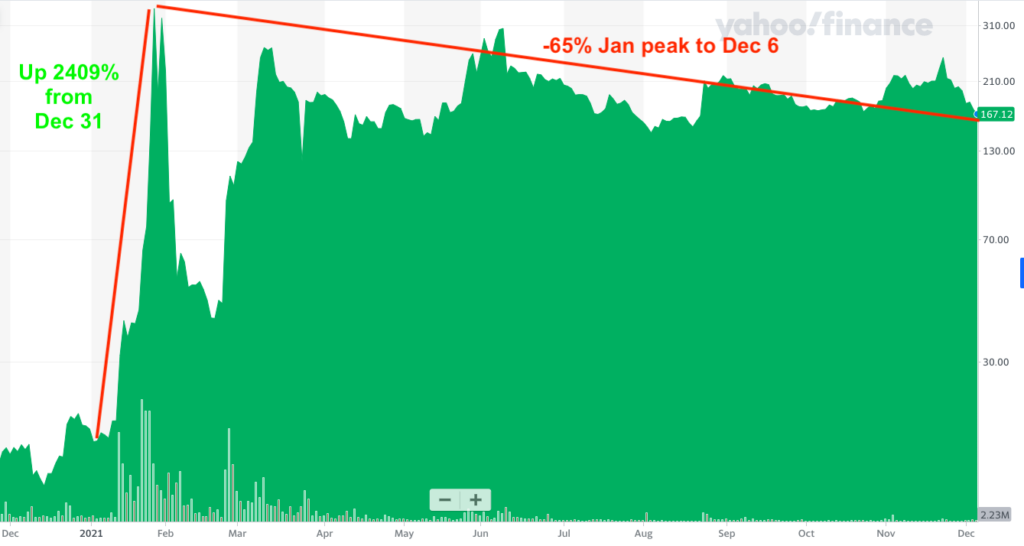

The documentary centers on GameStop’s brief life as a meme stock, culminating in the short squeeze in January 2021 that sent its price parabolic.

Fortunes were made and lost in a day. At least on a mobile screen.

Eat The Rich presents a comprehensive Big Short-flavoured overview of the whole saga. The run-up, the peak, and the party-pooping aftermath.

We see the perspective of all the key players, too, although only a couple of Wall Street pros took part.

“I like the stock”

I knew the pandemic lockdown trading boom was big at the time. But only really because I saw its impact on several listed companies I follow, like Hargreaves Lansdown.

I’d also laughed along with the memes and the lingo. Stonks, diamond hands, HODL, and all the rest. But again, only when it bled on to Twitter or the blogs.

I imagine 20 years ago I would have been in the thick of it. Time flies, and investing bulletin board posters become old bloggers.

Maybe that’s why even though my sole, tiny contribution to the drama was to urge GameStop traders to dump their shares if they still owned them – just before the peak as it happens – I was a bit sad to have missed the craziness.

Perhaps not what you’d expect from a website about sensible investing?

True, I’m the naughty active one in these parts.

Yet by its end the meme stock frenzy had almost nothing to do with the ‘proper’ investing principles that relics like me employ. Not for 99% of the participants, anyway.

It probably had more in common with a riot.

There was a similar energy and even a (fickle) camaraderie that was intoxicating.

Chasing meme stocks and bragging about your blowups on Wall Street Bets is about as far from passive investing via index funds as you could imagine.

It’s very bad for your wealth. It also appears to have been a hoot.

Down and out in London and Wall Street

I don’t want to imply that my tracker-philic co-blogger The Accumulator doesn’t know how to have a good time.

You’d better hope you’re not nearby when he discovers an ETF with a 0.04% lower ongoing charge figure. Something is liable to get broken in the celebrations.

But let’s face it, passive investing is mostly boring and it even feels wrong. We do it because it’s the best way to secure long-term wealth. It will never inspire a movie.

In contrast even when they’re losing money, the Reddit traders make a show of it.

Here’s a typical post from this week:

Source: Wall Street Bets

Piloting a $280,000 portfolio to an 80% loss in less than 18 months takes some doing. You might even be tempted to snicker.

Yet – albeit in their scabrous and hilarious way – the comments that followed on Reddit are overwhelmingly supportive.

The community understands the desire to gamble all on escaping from corporate life. Not the slow and steady way we do it, but ultra-speedily.

And for a few brief months in the midst of the lockdowns and at the height of a speculative bubble, it was possible. For a lucky few, anyway. All from making highly-levered bets on a free share trading app.

Many people did achieve life-changing wealth – at least for a while. A minority may even have got out before the implosion.

But as a counterpoint, the best comment for Monevator purposes is buried deep in that thread above:

Source: Wall Street Bets

‘Impressive’ in a Wall Street Bets context hails the seeming immolation of yet more of this trader’s money.

However in this case, his retirement funds were tucked safely away in trackers.

And there the bear market that we boring sensible investors have bewailed has been – relatively-speaking – a life-saver for the down-and-out Reddit day trader.

There’s a lesson in that. But the Monevator audience is not really the one that needs to hear it.

So long and thanks for all the memes

While Wall Street Bets lives on, meme stock mania for now is in the 2021 history books. (Along with a lot of other weird stuff from that year.)

Nearly all the runners and riders long ago saw their share prices crash back to reality.

And you’d at least that hope the extremely over-sized yet complacently held professional short positions that made GameStop’s price gains so explosive – and blew up at least one hedge fund – are in the dustbin of posterity, too.

But even so, it won’t be the last time a collective trading mania takes over the markets.

We’re all still getting more connected, not less. And the greed, desperation, or economic injustices that motivated so many into recklessness have hardly gone away.

The same forces of social media and virality have also driven changes at the business end of investing.

For example, a plethora of baby venture capital start-ups were founded during the boom on the back of podcasts and newsletters. It’s yet another way of using the distribution superpower of the Internet to pool capital.

You even see viral mobs at work with reviews for Eat The Rich on Rotten Tomatoes.

Critics love the series. However the audience says it’s diabolical. Presumably the Reddit faithful disapprove of the filmmaker’s even-handed approach and so they have voted it down en masse.

Similar ‘review bombing’ was seen a few weeks ago with Amazon’s Rings of Power spin-off. It undermines the legitimacy of what we once called user-generated content – which was meant to be a special forte of the Internet era.

One by one our vanities are blowing up.

The people in this country have had enough of discounted cash flows

The very low audience rating for Eat The Rich seems unfair to me.

But perhaps trying to tell the whole story fairly only guaranteed it would equally piss off everyone.

We live in an age where you must be either for or against something. Even-handedness is a weakness. There are no shades of grey.

Indeed the same wicked social media dynamics that made meme stock trading so potent we also see in everything from domestic politics to the culture wars to calls for a nuclear confrontation with Russia.

Experts are, famously, out. Reducing complicated positions to a mouse click – a like or a cancellation – is the order of the day.

That’s how the Conservative Party ends up voting against the guy who tried to admit to the fragile economic situation we’re in – and instead for the woman who just said she’ll fix it, the way you used to bang on a TV to get the picture working again.

Fewer people seem prepared to take the difficult path. Whether it be analyzing a company’s accounts or a politician’s pitch.

One week a deeply troubled computer game retailer’s valuation rockets from $2bn to $24bn then straight back down again.

Another week the gilt market blows up.

It’s almost like the experts were on to something.

Divided by dividends

Being old-fashioned though, I thought the documentary did a good job of covering the GameStop story from different perspectives.

In Eat The Rich we see hedge fund managers as over-paid and self-regarding economic vandals. But we’re also reminded that they’re stewards of the capital of pension funds and university endowments.

The Reddit day traders are portrayed as self-reliant iconoclasts but also, at points, as clueless dummies.

Lawmakers and regulators are simultaneously asleep at the wheel, in cahoots with Big Finance, and sympathetic to claims the capital markets have been ‘rigged’ against the little guy.

Oh and they’re also clueless dummies. (Everyone gets that treatment.)

Sensible observers know all these things can be true at different times.

Yet it’s also indicative of yet another facet of modern life. Our implicit trust in the structures surrounding us really does seem to be breaking down.

Very few celebrate bankers as The Masters of the Universe these days. Not many more would raise a glass even for captains of industry.

Like everyone involved in investing – apparently – they’re all said to be out only for themselves, one way or another.

Even you sensible investors who find a spiritual home at Monevator should get used to being called names.

Sometimes we’re the strivers, responsibly taking control of our financial futures. Giving up hedonistic pleasure today to ensure we’re not a burden in our old age.

Other times though, we’re layabout rentiers making money off the labour of others. Which makes us fair game for windfall taxes on our firms and higher rates on our dividends and other profits.

Which is it? Are investors part of the solution, or does society believe we’re actually a problem?

Eat the rich, the poor can have cake

If a pundit or politician wants to make the case for nationalizing the utilities or the railroads, then the dividends legitimately paid out to shareholders or pension funds are a green light to confiscate their gains.

On another day, when it’s time to encourage people to invest in start-ups or to make more capital available to growing companies, then the government courts investors with warm words and even special vehicles like ISAs or VCTs.

It used to be that different parties might hold these different views.

Now it’s as likely to be the same politician on a different day.

It’s hard not to get cynical. But there’s an even bigger problem.

As I suggested last weekend, it all reveals a society that is deeply uncomfortable with the capitalism that has facilitated much of the societal richness we see around us. From infrastructure to state pensions.

Perhaps we feel we can afford to be cavalier about capitalism, snug in the bounty it has provided. There’s surely some truth in that.

But I believe people are also distrustful because they believe that capitalism betrayed them. Most clearly with the financial crisis of 2007 and 2008 that animated the meme stock traders. But also with the steady rise of inequality at the high-end, and the winner-takes-most dynamics of the Internet era.

It is a dangerous direction of travel. As I wrote back in 2012:

I believe it’s a responsibility of all of us who support free markets – let alone those of us who hope to profit from them via investing – to stand up and be counted, and to be sure we can justify any aspect of the system that we defend, rather than indulging in fantasy politics of any persuasion.

I hope we do not come to regret not doing more to defend capitalism – including from itself.

I guess even fewer people were reading Monevator ten years ago than I’d realized…

Because while the tools of investing – from cheap tracker funds to free share trading to abundant information – have only gotten better, the image of investing in most people’s eyes has not.

That’s how you end up with a public that can call for windfall taxes without wondering how and where their pensions are invested.

And it’s how smart young people who two decades ago might have been reading Warren Buffett and preaching capitalism as a force for good end up believing that by rallying together via a trading app they were going to smash the system.

Its just another stock bubble

20-25 years ago ordinary people were trading stocks on the internet focusing on tips on bulletin boards like yahoo finance and motley fool they found using netscape

Then interest rates rose and it all came crashing down

Many of those amateur day traders became monevators boring passive investors i’ll warrant, wheedling their way up the corporate greasy pole

I hadn’t noticed Europe or America becoming less capitalist in the last 25 years

Great stuff – I’ve long theorised that the reason Pension providers & Wealth Managers (St James Place) get away with such bad practices & high charges is because it is on such a boring subject that nobody wants to engage with – so it is easier to screw people over. I wish we had more people like Martin Lewis, who has a broad platform to spread common sense.

I particularly liked these:

“That’s how you end up with a public that can call for windfall taxes without wondering how and where their pensions are invested.”

“That’s how the Conservative Party ends up voting against the guy who tried to admit to the fragile economic situation we’re in – and instead for the woman who just said she’ll fix it, the way you used to bang on a TV to get the picture working again.”

Have a good weekend.

Having stayed out of it completely, I watched it last weekend out of curiosity (although nearly gave up after listening to the rapping trio).

I felt it was fair in that it took lots of angles (no doubt the low reviews are review bombing from certain sections). I hadn’t quite appreciated the full dynamics behind Robin hood as a platform and full the payment for order flow (let’s take down the system! Oh, wait).

I want to think it’s just a steep learning curve for many. Prehaps a few years ago, back when I started investing (aka day trading without any real clue other than hope), I would have been sucked in also, so very thankful for the thoughts and opinions of this blog and others who have played a big role in my financal maturity.

On one hand you sympathise, on the other take a quick look of some of the people featured in the doc and wryly smile.

Reminded me of a BBC article during the hype period that featured a few young hopefuls, including one 18 year old who wanted to get into investment banking but also ‘hold the people responsible for the 2008 crash to account’ and change the system, to the tune of his £30 loss, no less.

https://www.bbc.co.uk/news/business-55843829

I’ll stick to the slow approach of mostly passive and a side of investment trusts.

Ahh good ol’ Superstonk. I can (somewhat) proudly say “Been there, done that, got the t-shirt.”

(Seriously, I got the Diane Fossey GME shirt.)

It was a fun punt, but nothing more. I turned $1k into $3k and cashed out. I still have 4 (now 12) shares sitting in my abandoned Revolut broker account as a reminder of that experience. The sequels (AMC, BBBY) devolved into toxic, conspiracy fuelled communities that I didn’t want to be associated with. Now apart from the occasional 0dte fling, I can safely say I’m well shot of meme stocks.

Thanks, that’s this evening’s TV sorted!

I had a small punt on GME but had paper hands and sold as soon as I saw a sliver of green. I even ventured into r/wallstreetbets for a while but wasn’t sure if I should have been amazed or dismayed by the gains/losses being reported. I quickly realised that I didn’t belong in there!

> I believe people are also distrustful because they believe that capitalism betrayed them.

In the case of those who aspired to middle-class jobs or even decent skilled blue-collar jobs, I would say that the charge is a fair cop. The elephant curve is a thing.

As an example in the UK my Dad was a blue-collar fitter and raised children with his SAHM wife, paying off his mortgage in his late 40s.

His son worked in a professional job and was child-free, paying off the mortage in my early fifties. I did retire 13 years earlier in life than my Dad, because my decent white-collar job was destroyed by the GFC and global competition. As it turned out that was not such a bad thing, I won’t live those years again and the view was better outside the office than in, so I am not going to deny that aspect of capitalism worked for me, though I did have to take a risk piling into the post-GFC like those memestonkers, so I can’t hold too much against capitalism.

I was bright enough to work and add value in a premier industrial research facility, but I am nowhere near bright enough to work for Google somewhere in London, which is probably an equivalent. I don’t have a dog in this race by being child-free, but if I did, and they were similar ability, then the dearth of opportunity to get ahead if they were 21 compared to myself would jar me off. And I would consider this a stiffing by capitalism.

I can see the cogent argument made by Tim Harford et al that capitalism has overall lifted the lot of humanity, you don’t see the endless famines on the telly that you used to see in the 1970s and it was capitalism rather than Oxfam that fixed most of that. But the hollowing out of the UK jobs market into some lovely jobs and lots of lousy minimum wage jobs – it was capitalism wot dunnit, guv.

@ermine ‘dearth of opportunity ‘ Anecdotally, my recently graduated offspring have picked up decent jobs quite quickly, with STEM/finance subjects and willingness to travel a bit. Google would suggest that the graduate market is growing, although wouldn’t be hard to imagine turbulence ahead.

Agreed. There might be a dearth of opportunity for the unlucky and/or average person, but possibly too much choice for others. A few years ago, my 8 year old nephew declared he was going to be a YouTube star (he didn’t pursue it), a year ago – now 12 – he created an NFT (but has yet to get around to listing it as his parents barely understand what he’s done, and failed set up the various accounts he needed to sell it). I wouldn’t say he is a bright lad, but he’s lucky enough to have a decent computer, an internet connection, is highly motivated by money and clearly has an entrepreneurial streak. I suspect he will be OK – and as said supplier of decent computer, I keep reminding him to remember his uncle G when he’s a crypto-billionaire. He is now talking about going to university to study computing.

Sobering comments around the future here with someone with a 3 year old wondering about schooling in the next few years . .

I certainly think it’s got harder now I don’t know how anyone can realistically say it hasn’t so I for one at perhaps the slightly younger end of monevator readers totally got the attraction of the meme stock craze as well as the guy with several million all in tesla shares that was never going to sell (wonder how hes doing now ?)

I was fortunate to buy my first home very very early and with minimal family help , Using shared ownership, setting my expectations realistically ( a 1 bed flat ) and rode the wave up during the early 2000s. I’m unsure if that will be possible now or at least not to the same extent

I was also highly motivated by money until my early 30s when I actually got to my target income and realised I better get myself some better goals as it turned out to be somewhat of a pyrrhic victory. this has been a long process but did lead me to the FIRE community so I’m thankful for that.

I feel at a burned out 42 how I imagine alot of people feel in their late 50s . Treading water and trying desperately to summon the energy for the last push. I’ve realised I don’t love money as much as I thought. What I wanted was security which I feel ive got.

I’m almost considering going the other way now, downsizing and virtually retiring. Sadly a (just) 7 figure net worth while incredibly privileged ( particularly with a divorce a few years ago) doesn’t go as far as it used to .

That for me is the issue nowadays the value of money has been massively eroded particularly since 2008 and I don’t think the average punter realises quite how much they’ll need to retire. You explain to people that they should be millionaires in retirement ( im in the south) and you’ll get some strange looks let me tell you.

So many people in my area have half milion to 600k homes and almost nothing else and now with interest rates rising the idea of downsizing and releasing equity seems naive at best. I cant see how a reckoning isn’t coming. I hope I’m wrong.

And so I continue with a view to being able to give my daughter a financial leg up while teaching her to steward it so it doesn’t get blown at 18

Pump and dump good:

https://www.theguardian.com/money/2022/aug/18/us-student-bed-bath-beyond-shares-meme-stock

Spoofing bad:

https://www.bbc.co.uk/news/explainers-51265169

Why is Jake Freeman allowed to take $110m out of the market using a pump and dump scam, but Sarao exploiting others badly made automated algorithms gets him a criminal charge?

Watched the 3 episodes of Eat the Rich last night. Enjoyed it. Worth a watch.

The gamification of personal finance is a massive issue – that particular cautionary tale wasn’t really pounded out enough in the film IMO. Even if the wider audience to benefit wouldn’t actually be watching.

Protections for (mainly) Gen Z and Gen Z Plus against their own attitudes to personal finance and some of those get rich quick romantic delusions, playing with financial fire and about disregarding the investing fundamentals simply weren’t underlined enough.

Regulators were way behind. Are still behind.

A few people need saving from themselves sometimes. Gamblers were simply dressed up as financial justice warriors. Egged on by the community. Crypto another story but no doubt similar.

We learn that David eventually got stuffed by Goliath not because Hedge Funds got one over the Common Man but more because they were up Goliath’s Goliath in the platform itself. Follow the money.

Less about Diamond Hands more about Invisible Hands.

A few thoughts are triggered by the comments.

Firstly some fairly downbeat views on jobs/career options seem to be at odds with the drumbeat heard around skills and tradespeople shortages surely? From my perspective there are still many ways to earn a very good living via both White and Blue collar roles (Caveat being I can’t comment on rural or extreme provincial locations) if a sensible course is charted.

That said the single yet overwhelming counterbalance to those earning opportunities is the totally broken housing market. Perhaps a target of “Housing price inflation to be less than median earnings growth for next 15 years” would focus policies to deliver such a goal (Remove planning restrictions, new generation of direct social house building etc) and be a vote winner among the non-selfish parents demographic?

Regards the impression that “investing” currently has a bad name despite that not making any logical sense I very much agree. And even though MSE is mentioned above this is the one area I think Martin Lewis is actually a negative influence.

From what I’ve seen every time investing is mentioned by MSE there’s a tone of almost distaste around the concept. Almost a peg on nose “I couldn’t possibly be associated with something as dangerous as investing, it’s basically gambling don’t you know” tone. As much as it’s a fantastic resource for saving people money the fact someone who didn’t know any better come’s away with the impression the only thing to do with your spare cash is pay off your mortgage or get an extra 0.1% on a savings account is a sadly missed opportunity.

For example Monevators amazing Broker comparison table is surely a most read MSE article in another universe?!

@Calculus I would suggest that your example may be atypical, by the fact you are reading Monevator so your children have the advantage of a better off home background there 😉

Charge of anecdotalism accepted, this Thinking Allowed episode titled Futilitarianism starts off with a wider sample –

Personally I feel one of the biggest problems with capitalism in the uk is the real owners of the shares aren’t involved in the shareholders rights at all.

The pension funds take over all the decision making and all the right and become the proxy owner and in the process they gain far to much power and the real shareholders end up forgetting the benefits of capitalism and often the costs are so high the don’t even benefit from ownership.

Often the public are steered into really expensive products that dissolve all the benefits of share ownership,they take on all the risk and rarely see the spoils.

That’s probably why so many are turning against capitalism to a degree,also mate’s rates capitalism is making a mockery of the system.Certain companies and people are getting away with paying very little in tax and that sticks out more today because all the information is available for the public to see.

I suppose it’s only natural they start to ask what’s in it for them?

@steve b… The aims of MSE are fairly basic…. and the messaging has to be simple to get people to understand what their costs are (and anywhere they can reduce them) and typically how best to manage debt: e.g. paying off credit cards vs overpaying on mortgage vs savings. Their focus is not on financially savvy Monevator readers paying high rate tax with sizable nest eggs. I’ve noticed the language around investing has softened a bit and now reads to me like “you can do it, but don’t sue me if it goes wrong” and there are well known traps on the journey, e.g. picking a broker + funds while being mindful of numbers going down as well as up and expected timescales for investing.

@ermine Perhaps, although in defence they have been through a comprehensive in the provinces and not intentionally hot-housed for the big time 🙂

Resorting to some figures..

https://www.theguardian.com/education/2022/apr/11/uk-graduate-jobs-outnumbered-graduates-by-1m-in-2020-study-shows

@beeka I completely agree about MSE needing to be very simple, because general financial literacy is poor and the reading comprehension of the general public is even worse.

Just one example: not long back Martin Lewis’s advice was most people shouldn’t bother with Cash ISAs (because you get much better interest rates in regular savings accts and most people won’t hit the personal savings allowance anyway). Pretty clear, right?

I then saw multiple people on the MSE forums confidently spout that Martin Lewis had said that ISAs are pointless so you shouldn’t put your money in them at all.

I’m not sure someone who can’t tell the difference between a Cash ISA and a S+S ISA is going to be able to decipher a broker comparison table!

@Beeka @Sera Both very fair points and it is a difficult one to understand when personally more involved in self education around Finances. My own family seem to suffer that same form of ignorance so I should be aware of it!

There’s just part of me that cries when you see someone with their life savings in cash savings saying: “I’d never get involved with the stock market”.

Even the simplest “Make sure your work pension chooses the Growth not Cautious option if you are under 50” advice would nudge some people in the right direction you would hope.