What caught my eye this week.

Here we are at the end of 2020 2021 – sorry, pandemic brain – and the final Monevator missive of the year.

And what a ride it was!

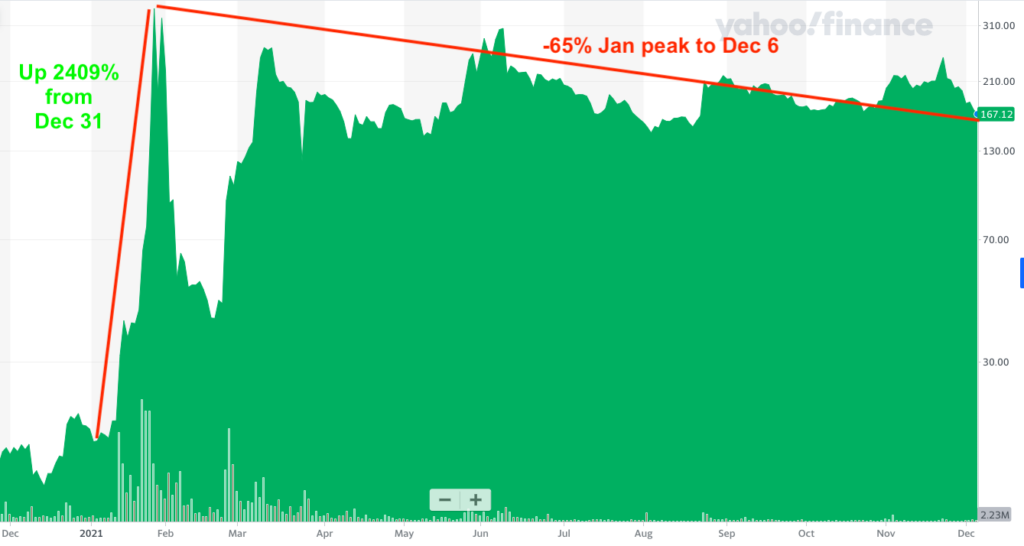

Remember the meme stock madness? The SPAC boom? The crypto-mania and the pixel painting that sold for millions?

The restaurants reopening and seeing your first menu for six months?

Party-gate, and our GOAT Prime Minister – greatest that is if you’re under-three-years old or you grew up in a Banana Republic?

The past 12 months had the lot.

Luckily reader Tim P. has inspired me to dodge the bullet of pontificating too much about 2021, or getting predictions about 2022 wrong.

He requested last-minute investing book ideas for Christmas presents.

And who am I to forego the chance to embed some Amazon affiliate links?

Those 2,632-word articles on the minutia of withdrawal rates don’t write themselves, you know.

Last Christmas

We’ve just been through the weirdest string of short-terms strung together for 24 months that most of us can remember.

And for investors they proved again the value of taking a long-term view.

However you called the big picture, the markets demonstrated themselves to be short-term confounding machines. Again.

Maybe you thought we’d see an economic depression as a novel virus swept around the world?

Or did you foresee the house price boom that actually resulted?

Maybe you predicted an almighty rally in US stocks – even on top of the past ten years of gains and sky-high valuations?

Or did you suppose instead that an insurgency into the White House would rattle US investors?

Perhaps you predicted a fourth or fifth or sixth wave of the virus? Maybe you guessed the UK government would try to renege on its feeble Brexit deal before the ink was barely dry on it?

Maybe, but even the go-nowhere UK market still went up in 2021.

Freedom

Trying to turn these headlines into profits is a hobby for masochists.

Day-trading is a buzz but a soft drug habit would probably be healthier. Most who try fail to add value. They just make themselves poorer.

Active investors should raise their time horizon, and then double it again.

Passive investors, as ever, would do best to tune out the noise and run their portfolio on rails.

Trust me, in 2021 owning index funds beat betting on interest rate rises or the whims of Reddit board readers.

Have you seen the S&P 500?

Bad boys

All of which is to say (note the seamless transition) that we should be trading less and doing nothing with our portfolios more.

Here are a few investing books to save you – or a loved one – from getting RSI by smashing the refresh button on your share dealing app.

A good book for a totally new investor

Keep things simple by giving a copy of Ben Carlson and Robin Powell’s new book, Invest Your Way To Financial Freedom. Both me and my co-blogger did what they say on the tin in our different ways. It’s not easy, but it is simple.

Why it might have helped in 2021: A well-constructed global portfolio serenely glided higher through bond sell-off fears, market churn, and endless worries about over-valuation. A win.

A book for those who think they know better

I suspect Morgan Housel is our most featured writer in Weekend Reading and for good reason. The Psychology of Money distills a decade of his distilling down centuries of lessons about money into one easy read.

Why it helped: Big picture, everything was rosy in a well-diversified portfolio in 2021. Yet there were still countless ways to lose money. It’s all about behaviour, as Housel will explain.

Next steps for your meme stock trading niece or nephew

The Art of Execution remains my go-to gift for active investors. Plenty of investing books will (claim to) tell you how to find superior share ideas. This is about the only one that explores what to do with them.

Why it helped: By luck – or thanks to reading this book – I sold my accidentally-owned Gamestop shares at the top. Kerching!

Indexing stalwarts

For many years we’ve recommended either Lars Kroijer’s Investing Demystified or Tim Hale’s Smarter Investing as complete guides for would-be passive investors. Both books have their problems (I find the latter a slog, personally, though my co-blogger adores it) but for UK readers they’re still hard to beat. If you can put up with stuff about American taxes, you could try The Bogleheads Guide to Investing instead.

Why they helped in 2021: I had a stellar 2020 as an active investor but despite a lot of effort I’ve badly lagged my benchmarks this year. If you’re not doing this because you love it, pick up the market’s return in the time it takes to do a lateral flow test and then head out to do something else instead.

What book to get for The Accumulator

Easy, I bought him Robin Wrigglesworth’s new history of the index fund, Trillions, after he suggested he had better things to do than to read it. The freedom to chase cows wasn’t gifted to us without a fight, The Accumulator!

Why read it in 2021? Index funds continue to take a greater share of the world’s assets, thanks to their low cost and consistent results. Yet they generate few headlines, due to them being crushingly boring. This book helps a bit, by revealing the personalities behind the fund fact sheets.

What to give if you want to give like The Accumulator

Also easy, because The Accumulator kindly sent me two books by financial historian Adam Tooze – The Deluge and Crashed. They cover two economic maelstroms nearly 100 years apart. I haven’t read them yet, but Christmas gift etiquette demands I have to say they’re amazing anyway.

Why they helped in 2021: Those who fail to learn from history are doomed to repeat it, as George Santayana possibly said. Only now with emojis.

Books off our beat

A lovely thing that happened to me this year is I finally got back into reading for pleasure. Here are five of my recent random reads I’d recommend:

- Analogia – Pattern-matching earlier innovation to our doom from AI.

- Project Hail Mary – Feel-good sci-fi thriller from the The Martian man.

- Titan – Not a moon, but the life of John D. Rockefeller by Ron Chernow. Rockefeller makes today’s 0.0001%-ers look like strivers, but it turns out he was just as eccentric. Also I cracked up every time the narrator intoned about his ‘powerful side-whiskers’, like he’s describing an alpha hamster.

- The House of Morgan – Another by Chernow (it’s a phase) and at more than 34 hours on Audible a great value history of banking.

- Piranesi – Reading and writing can take you anywhere.

In praise of Audible

While we’re talking books, a quick plug for listening to them.

These days I’d be consuming books like a Neanderthal if I wasn’t able to ‘read’ half of them on the move via the Audible app.

We all know it’s hard to get through a book with our Internet-addled attention spans.

But personally I also find it ever-harder to sit around when I could be on my feet and doing something.

A sedentary life is a shorter, unhealthier one. Time is running out, and if I’m going to reduce my lifespan, I’d prefer it was by doing something racier or tastier than reading Tim Hale.

Happily, I’ve found Amazon’s Audible membership service an easy way to keep my book digestion regular.

I’m too stingy to forego the monthly credit that my membership buys – and I’m too tight not to get my money’s worth from anything I’ve bought.

Are you that kind of crazy? Try Audible with a free trial.

Freedom

Lastly on books, I might as well come clean and admit it now looks like the Monevator book may never see the light of day.

We’ve had it 95% written for a couple of years. But both The Accumulator and I have repeatedly failed to get it finished and out there. Self-publishing it properly involves an ordeal that Reset author David Sawyer has warned me could be a multi-month full-time job in itself.

We both fear such inordinate effort for an uncertain return. We’d truly love to ship 200 copies to our most faithful readers. But what if that was it?

Perhaps we’re being pessimistic – blame the short winter days.

More likely I’ve read too much about sunk cost fallacy to continue.

We’ll certainly publish the text someday, if only chopped up into articles, so do subscribe to our emails. We may turn some of it into PDF downloads, too.

Wake me up before you go-go

On that rather anti-climactic note I’ll slap on a smile and thank you for reading in 2021. We hope you stick around for 2022!

Despite the book debacle the experiments continue at Monevator Towers, so watch this space.

The crazy market isn’t going anywhere, after all.

Stay safe, have a great break, and enjoy the bumper link-fest below. See you in January!

From Monevator

Inflation is right up your street – Monevator

What happened to 2021’s biggest thrill rides for investors? – Monevator

From the archive-ator: Investment trusts discounts and premiums – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot!1

Bank of England raises interest rates for the first time in three years – BBC

Rail fares to increase by 3.8% in March – Guardian

Mortgage affordability stress test may be scrapped – ThisIsMoney

The increase in UK state pension age could come eight years early – Which

‘Buy now, pay later’ stocks plunge after US regulator launches probe – CNBC

Survey: public has no appetite for a post-Brexit perma-war with the EU – Guardian

Log4J security flaw is prompting 100 hacks a minute globally – BBC

Three secret ingredients of the most efficient portfolios – Portfolio Charts

Three secret ingredients of the most efficient portfolios – Portfolio Charts

Products and services

What the rate rise means for your mortgage, debt, and savings – Guardian

Beware the Lifetime ISA trap ensnaring young buyers [Search result] – FT

Major UK banks to roll out shared banking hubs – Finextra

Promo / free money Join the 400,000 people saving with a FSCS-protected Chip account, and we’ll both get a free £10. Download the Chip app here then head to the ‘Promos & Referrals’ section on your profile and enter the code CHIP-EBZ267

Masks are back in vogue, so which one should you buy? – Wired

Reasons why lenders may refuse a mortgage on a flat – ThisIsMoney

Tiny houses for sale, in pictures – Guardian

Comment and opinion

William Bengen: is it now the 3.3% rule? – Advisor Perspectives

“I lost $400,000, almost everything I had, on a single Robinhood bet” – Vice

Has Vanguard lost its way? – Morningstar

Charles Ellis: looking long-term – Humble Dollar

Gamestop et al: the revolution that wasn’t – The Rational Walk

Is index investing still relevant in 2022? – Banker on FIRE

The movement to abolish work as we know it [Podcast] – Bloomberg

What you’re worried about when you’re worried about money – The Atlantic

The Escape Artist and The Mad Fientist: FIRE in the UK [Podcast] – The Mad Fientist

The age of financial misinformation – Of Dollars and Data

Do portfolios have UFO or UAP risk? [Week old, search result] – FT

Billionaires aren’t better looking than other successful people – Klement on Investing

The urgency – Josh Brown

Lessons from a year of semi-retirement at 34 – Humble Dollar

Crypt o’ crypto

What do you buy when you buy an NFT? – Protocol

The Bored Yacht Ape Club is more than an NFT joke [Search result] – FT

Bitcoin could become “worthless”, Bank of England warns – Guardian

Melania Trump has launched her own NFT – via Twitter

Naughty corner: Active antics

Does the market efficiently price the value of brands? – Alpha Architect

The value/growth spread is currently, in short, massive [Graphic] – AQR

A case study in the return gap: Cathie Wood’s ARK fund – Morningstar

Is Ferrexpo a good dividend investment? – UK Dividend Stocks

Retail investors add stability and liquidity to markets – Columbia Law School [Research; h/t Abnormal Returns]

Covid corner

Action needed to limit hospital admission, says Sage – BBC

The maths that explains why Omicron is suddenly everywhere – Slate

Londoners with cold symptoms are more likely to have Omicron – Guardian

Pfizer’s antiviral Paxlovid is nearly 90% effective at preventing severe disease – Guardian

Kindle book bargains

Lab Rats: Why Modern Work Makes People Miserable by Dan Lyons – £0.99 on Kindle

Flash Crash: A Trading Savant, a Global Manhunt and the Most Mysterious Market Crash in History by Liam Vaughan – £0.99 on Kindle

Anthro-vision: How Anthropology Can Explain Business and Life by Gillian Tett – £0.99 on Kindle

Alchemy: The Surprising History of Ideas That Don’t Make Sense by Rory Sutherland – £0.99 on Kindle

Environmental factors

Government slashes electric car grant by 40%, tightens applicability – ThisIsMoney

Giant cracks push imperiled Antarctic glacier closer to collapse – Nature

A close encounter with a flame-bright Egyptian vulture – Nautilus

Off our beat

Even the reindeer were unhappy: Britain’s worst Winter Wonderlands – Guardian

Tim Harford: how to give the perfect present… [Search result] – FT

…although maybe it’s time to stop giving presents to adults – Slate

The office is an efficiency trap – Wired

Viral Tik Tok recipes are causing food shortages – Eater

Appraised – Indeedably

And finally…

“’Bah,’ said Scrooge, ‘Humbug.’”

– Charles Dickens, A Christmas Carol

Like these links? Subscribe to get them every Friday! Note this article includes affiliate links, such as from Amazon. We may be compensated if you pursue these offers, but that will not affect the price you pay.

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

So stocks did well in 2021, crypto did great (I think), my side hustle was amazing and everyone is complaining about how my mortgage debt is shrinking in real terms by 4.5%.

Inflation aside, it seems like those who holds assets are making a killing – and long may it continue because you all know that when this is over the HMRC will be after us all and those who have money and are not over the pension age will be first against the (hole in the) wall.

Merry Christmas everyone!

Bad news about the book. I was looking forward to buying it for my wife.

A very Merry Christmas and a Happy New Year to all at Monevator Towers!

Wishing you a very good Christmas & New Year, and many thanks for all the writings & links this year.

Too right about the short-term confounding machine! I don’t know if John Authers still does his ‘Hindsight Capital’ articles – they were always quite fun.

Cheers for the book links. I think I’m a lone voice about the Morgan Housel book. I LOVE his online writing that you link to. But I didn’t think the structure of the book worked. I find often shorter-form writers can struggle to make the transition to long-form.

A definite vote for Susanna Clarke’s Piranesi – a fabulous book. [Winking emoji here.]

One of the good things to come out of the pandemic is that I discovered audiobooks, completely free via membership of my local library, and playable through my laptop speakers. So I didn’t even have to dig out a long spoon to connect with Amazon.

Merry Christmas TI and TA and other contributors, and all the best to all of us for 2022.

Thank you for another year of writing from the Monevator team. I hope that you manage to take a break over Xmas.

Another good set of links. I may be in a minority but the reduction in electric car grants chimes with me. We need fewer, not newer, cars on our streets. The money would be better spent on subsidising electric bikes given how many single occupant cars I pass on my commute.

Happy Christmas to all at Monevator. Here’s to Covid 19 “varianting” itself into just another 99.9% non lethal respiratory virus (we have to have hope).

I happily follow The Accumulator in tracker funds and done very well, thank you in 2021. But I’d give it all back for Covid 19 to have never existed 🙁

Oh well.

“Project Hail Mary” was a lot of fun but I found “Piranesi” a bit puzzling.

I listen to a lot of audiobooks too – both free through my local public library app and via an Audible subscription. So much easier than the old days of fighting with multiple CDs or (showing my age) multiple cassettes!

Thanks for another year of links, articles and advice. I think the message must finally have gone in… I haven’t touched my ISA or SIPP all year (although crypto is another story!)

Also sad to hear about the book… had it earmarked to give to a few people

For those who love Audible, consider the annual Subscription. 24 books for just over £100, a significant saving.

Thanks to Monevator for some great reading over the last year.

Seasons Greetings and best wishes for the New Year to all @ Monevator.

Also disappointed about the book, but understand your reasons.

Lets see what 2022 throws at us 🙂

Firstly thanks for the years stimulating and educational weekly dose of opinion and links. Takes me the whole weekend to get though sometimes I click though so many of them. Hope all MV writers and readers have a great Christmas.

Have to pass comment on that Vice Robin Hood article though. Was SMH (As the kids say) at the incredible arrogance of someone who can lose $400k on an incredibley leveraged coin toss and yet still be sure they know better than Warren Buffett and the whole index investing ecosystem.

Rather than being sympathetic I ended up paraphrasing H. L Mencken and thinking they got what they deserved nice and hard!

@GFF

I have a bit of a mental block with the “mortgage being 4.5% lower in real terms” I get the logic but being 50+ and semi retired I no longer receive the annual inflationary salary increases.

I hold some pref shares, large cash buffer since P2P went bad, DB pension in 8 years (but fixed amount payable in 2030) + equities + properties (fixed ish rentals)

So my perceived growth in income/growth feels very much at risk from higher inflation. Hopefully I’m overly concerned. But am considering a temp role for a few months…

Strange times

@all — Thanks so much guys, and for showing up to read our stuff each week!

@Hariseldon — Eek, I didn’t know about that! Cheers, investigating.

Many thanks to all of you at Monevator for providing us with such excellent content.

Merry Christmas and best wishes for the New Year everyone. Live long and prosper! And may the FIRE be with with you!

PS: For people looking for a fun book to take their minds off their investments a bit during the holiday season, I strongly recommend ‘The Hundred-year-old Man Who Climbed Out of the Window and Disappeared’ by Jonas Jonasson.

@ Steve B: I’m completely with you on that RobinHood piece. The bit that had my jaw dropping was his response to his mother’s repeated warnings not to be a numbskull – “But I felt like, because she told me not to do it so many times, I actually had to.” I mean Jeez, is he 13 years old? Nope: 26.

@Boltt

My own dB pension increases by inflation each year up to 7% – so any inflation up to 7% I can live with.

Likewise, I’m maybe over invested in renewable energy projects but these have inflation resistant long term cashflows. (All you need is for the wind to blow!)

Those most concerned with inflation are the feather bedded classes – those that have been killed by Zirp / 0.5% returns on their cash ISAs for the last decade but saved by rampant house price inflation (the good type of inflation).

Inflation is not something to worry about for most people is my opinion.

Old and long retired but still learning

Monevator each Saturday keeps me in the game and tuned up!

Terrific work and much appreciated

Great Christmas and a Happy New Year to all at Monevator

xxd09

Thanks for another great year of posts – and shame about the book.

@Boltt (#11):

Re: “… DB pension in 8 years (but fixed amount payable in 2030) …”

Could you clarify please, e.g. do you mean the DB value (in nominal £’s) that will be paid in 2030 is already set and will never change – ie no ‘revaluation’ until DB comes on stream [aka ‘deferral’] and no increases (aka ‘indexation’) after it commences, or did you mean something else?

@GFF (#15):

7% seems generous – and does this apply to both revaluation and indexation?

A happy holiday and a thanks for your efforts this year in producing this site to all at Monevator.

I will admit to being a bit gutted about the book being kicked into the long grass (for now?) Lets hope that you build upon the obvious success and utility of this site as it is such a precious resource to us all and potentially to many more in future.

The “three secret ingredients” article was an eye opener and food for thought this weekend. I will chew it over for a while.

We are in the peak time of year for financial crystal ball gazing and I enjoy the articles on this, especially the reviews of the last years predictions. A round up special of the reviews in the new year??? After this year they may make some hilarious reading.

This year has been one of huge change for me and the book that perhaps in my circumstances that has been helpful, if not the most accessible and easily translated into U.K. portfolio has been McClung’s Living off your money. Still some work to do after reading that one.

JimJim

I’d buy the book. No discussion no debate. Merry Xmas.

> But personally I also find it ever-harder to sit around when I could be on my feet and doing something.

I have never understood audiobooks. Is there some special mental trick to taking them in? The data rate of speech is about a fifth of my normal reading speed, but worse still for me is I don’t take it in, it is like reading a newspaper with a microscope – no capacity to micro-skip back and read bits expanded by the following sentences, and so goddamn s-l-o-o-o-w bu the end of a paragraph I can hardly remember the beginning 😉

This was highlighted to me when I read a biography, obviously ghost-written read by the protagonist, whose voice I have loved for decades. This was not high-minded material or non-fiction, and I listened to it first.

When I read the book afterwards, I actually took it in and can remember it as a whole. Of the audiobook, I remember small vignettes but had no overview.

It is many decades since I learned to read visually, and I could read before starting school. Somewhere I need a guide to taking in written material read aloud. I don’t have any problems parsing normal speech, but audiobooks, bah. There must be a trick to this I am missing.

Similarly podcasts, I can burn through a transcript much faster and remember more of it than the slow exposition in audio. And these things are more designed as a monologue or dialogue than written books.

@ermine

I also struggle to understand the preference for audiobooks. I suspect it’s because people feel it allows them to do other things at the same time. But humans cannot multitask so you have to sacrifice attention away from the content. But maybe that is no bad thing if the alternative is people not engaging with the content at all.

I do prefer audio for discussions between people (podcasts/YouTube) where I feel part of the content is the way in which the interaction unfolds which you can’t get from a transcript. But I nearly always listen at 2x speed.

@all — Again, thanks for the good wishes and comments! 🙂

@ermine @platformer — I agree with your points. I am definitely a visual learner, and don’t take in as much with audiobooks or podcasts, though I fancy I am getting a little better. (You really have to force concentration).

One big clue I have that audio isn’t ideal for me is that when I think back to a particular book or podcast, I sometimes struggle to remember what I want from it, but I can *often* remember where I was walking around when I was reading it! And I don’t mean anywhere particularly exotic. It might be “okay, I know he talked about the sack of Carthage when I was in Waitrose checking out.” So that’s interesting, to me.

As I said though, reading means more sitting around. That’s fine for an hour a night and I’m sure I could cut back a bit more on random YouTube or Netflix series, which I never used to watch at all and now do eat hours. But overall I’d be ‘reading’ maybe two books a year if I had to read them (I have a stack next to my bed from January! 🙁 ) whereas I can easily get through one a week on the move.

It’s not so much multi-tasking for me, which I agree often just means doing two things badly. I’d read the words off a page if I could do it jogging! (If I had my own stationary bike I’d maybe give it a go on a Kindle on iPad zoomed up to 10, but not going to try at the gym…!)

Hi A1Cam,

12 years in DB, 25 years in deferment at 5% fixed – then once payable max 5% RPI/CPI. Inflation feels like the enemy for another 8 years.

B

@Boltt:

Thanks. Got it now I think.

Whilst I kind of understand why you say that “Inflation feels like the enemy for another 8 years” I suspect you are already well ahead with seventeen years revaluation at 5%PA fixed – although who know what the next eight years will bring. Furthermore, indexation capped at 5% is IMO rather good too.

> sometimes struggle to remember what I want from it, but I can *often* remember where I was walking around when I was reading it!

haha – that may be because using location is in fact a known method of improving recollection – also called the Memory Palace. It also works in reverse – if I am in the lab and want to go get something from the house, particularly if I am trying to solve the problem I will have forgotten what the hell I wanted to get. But going back usually brings it back to me.

> don’t take in as much with audiobooks or podcasts

I am glad it’s not just me that finds this effect then 😉 I was wondering if I had auditory dyslexia (dysphonia?) but I don’t struggle to follow the radio etc. Mrs Ermine absolutely swears by audiobooks, to the extent of being prepared to subscribe to Audible, where I am just left with a puzzled expression and WTF is the point. I am sort of with platformer that the radio and some podcasts where there is dialogue works better.

OTOH I am perhaps a wider acoustic narrative philistine – I never understood what the point of the theatre was once they invented movies and non-linear editing. About once every ten years I sample it to see if I have got mellower with age or like classical music appreciation improves with advancing years. So far 100% fail on stage performances being worth the candle IMO

Would Invest your way to financial freedom be a better pick for a total beginner than the usual Smarter Investing or Lars Kroijer recommendations.

Thinking of getting one for my student step son,give him a bit of an early blueprint that I wished id had

Ermine et al,

Try below VARK Learning Style quiz, it identifies how you learn best (that’s the theory anyway!).

VARK being Visual, Auditory, Reading/Writing and Kinesthetic.

Ermine- be interested to see if you are kinesthetic due to your previous occupation.

https://vark-learn.com

Merry Christmas,

Lee.

@finumus feel free to share any million pound profit ideas you’re working on ahead of this new year! a heads up prior to another argo blockbuster of a windfall would be much appreciated…..

Have a great christmas all, and thanks all at Monevator for this life changing website. I would buy the book if you get round to publishing it.

@Lee Briggs

The idea of different learning styles has been shown to be a myth over many studies now.

For example, it has been shown that people who come out as ‘visual’ learners on VARK do not actually use visual learning strategies in practice when studying. And those who do use their VARK learning style to study show no better performance than the rest.

https://digest.bps.org.uk/2021/02/04/the-learning-styles-myth-is-still-prevalent-among-educators-and-it-shows-no-sign-of-going-away/

Here’s an interesting recent study showing watching videos at 2x seems to have no negative impact on comprehension.

https://digest.bps.org.uk/2021/12/21/watching-a-lecture-twice-at-double-speed-can-benefit-learning-better-than-watching-it-once-at-normal-speed/

@ermine

With theatre, if you’ve got a good cast and see the performance several times, you can watch the nuances of each actor responding to the other in an evolving fashion, and the whole performance develops over time.

For me, theatre vs film is rather like in person meetings vs video calls. Generally video calls are fine, but confirming the other person has legs periodically makes them feel more real.

Thank you for a wealth of immensely helpful information over the year. Happy Christmas and all the best for 2022!

some good books to have a read up on there whilst we await your 🙂 thankyou.

an interesting comment by William Bengen in the article about “is it now the 3.3%rule?”

“Therefore, below-average returns might last longer than they have in the past. But 50 years of below-average returns? There is no precedent for such in the historical record.”

have a safe Christmas all and a prosperous new year

Regarding the AQR article/graph, will 2022 be the year global value and dividend stocks strike back against growth/tech and finally outperform the NASDAQ and mighty S&P500 even?

It’s anyones guess, but if the last couple of months and central bank interest rate signalling is any indication the tide may have just turned.

Happy Christmas to all at Monevator Towers! I’m thinking more Fawlty than Trump?

For anyone interested I have just added collateral to a new Scandinavian based liquidity pool, the interest is paid in Santacoin, and airdropped late on the 24th. Best of luck to all!

Happy Christmas one and all!

Thank you for so many fun and informative threads on Monevator in 2021.

@ Jim Jim – I love Portfolio Charts but the starting point for his data circa 1971 overplays gold.

I do think there’s a role for gold but after reading ERN, McClung and others who’ve crunched the data, it’s not the no-brainer that it appears to be. McClung doesn’t think there’s any role for it. ERN was on the fence.

Moreover, GBP returns for gold in the same periods weren’t quite as good as the US – though the pattern remains true.

Small Cap Value – it’s just not available in the UK except through expensive DFA or active funds e.g. ASL investment trust. Even then you’d have to bear with it. It’s taken a comparative beating vs Growth for the last decade.

Long Bonds – They are a wonderful diversifier but it’s a brave investor who puts 20%+ into this asset class after a 40-year ‘bond bubble’. Again, UK returns aren’t as bright as those in the US – though the role in a diversified portfolio remains the same.

I don’t dispute the thrust of the article. But the UK experience is muddier and I’m less enamoured with gold – though it makes sense to me as a small slice of a decumulation portfolio.

I should add I do have long bond and small value holdings – but it’s not always easy to live with.

Merry Christmas to all. I’m with ermine, I can’t do audiobooks as my listening concentration is only a fraction of my reading concentration – I either drift off and end up missing chunks of audio or it’s in one ear, out the other and I don’t take any of it in (reminds me of uni lectures!)

I’ve gotten a little better with podcasts, though not much better – I just don’t have a good attention span for that kind of medium, although the idea of listening on the go has appeal, ie less sitting down.

@TA, 37 et 38… Food for thought only, McClung seems more actionable over this side of the pond, the bond allocation is skewed by my DB pension in my portfolio – so not too much of an issue – and, as I have mentioned before, gold is not a logical step for me to take ( I basically don’t get it and never have – the maxim never invest in something that is beyond your comprehension comes into effect here). I have more interest in small cap value and, as you say it seems not too accessible. I wonder what my exposure to it is already? That is the thing I need to look at. As I stand until next March I am cash overweight out of necessity. How I allocate this after then is my main focus now. Playing around with the portfolio tool on his site brought up some interesting results.

JimJim

Re small cap value: USSC and ZPRX etfs both available on HL, and others I think. I have USSC and attempting purchase of ZPRX currently. Perhaps these fit part of the small cap value universe. Thank you Accumulator and Investor for so many useful insights over the years. It really has made a great difference to my financial wellbeing.

@JimJim, @TA

Being somewhat averse to gold too, that Portfolio Charts article intrigued me when it mentioned that other portfolios have historically achieved good results without all (or any) of the “three secret ingredients.”

The one that caught my eye was the Svensen portfolio as it contains neither gold nor the hard-to-access small cap value. To my unsophisticated eye, this could be achieved by a global all cap fund (hello, Vanguard), a bog-standard bond fund, and REITs (I’d substitute an ETF like IWDP).

Re small cap value investments, I have asked iWeb to add SPDR MSCI USA Small Cap Value Weighted UCITS ETF

ISIN IE00BSPLC413, Ticker USSC, which looks like it might fit the bill.

@Onedrew.

Interesting to look at the sector allocation of USSC, and comparing it to our own MIDD (FTSE 250). The percentages of each sector except financials show similar weightings, with our markets already looking like value relative to many in the world, how much of our domestic “Small Cap Value” does it capture? – Just a thought experiment at this moment.

JimJim

@JimJim: Went for USSC as the Golden Butterfly seems to be based on US only. Would prefer a GBP-hedged version tho.

@ Onedrew – that’s a good point. I always think of trying to get small value exposure from a global p-o-v but of course you could just take US exposure.

I wonder how US small cap value would look when converted into £ returns. I haven’t seen anything on that.

I have seen work that shows UK / Global small cap value did do the job for UK investors historically and it makes sense to me to diversify across strategies rather than geography.

In the end, I plumped for a multi-factor ETF that blends small, value, momentum and quality factors. Historically the risk premiums were relatively good, and correlations were low to negative across this factor matrix too.

Of course, I’m paying a higher OCF for this ETF, it’s probable that the index construction captures a fraction of the premiums, and it’s been totally smashed by the S&P 500 ever since I bought in. But then, what hasn’t?

@ JimJim – you’ve prompted a memory that US cap definitions are characteristically larger than our own! Although Morningstar does routinely peg FTSE 250 trackers as mid cap blend rather than small value in its style box:

https://www.morningstar.co.uk/uk/etf/snapshot/snapshot.aspx?id=0P00014D7O

ASL – the UK small cap value investment trust – holds some FTSE 250 companies and some AIM.

@ NewInvestor – another good shout. Think I’d want to add some index-linked bonds at some point but perhaps not if you’re starting out. BTW, David Swensen’s book, Unconventional Success, is well worth a read if you haven’t seen it.

He absolutely skewers his own industry for the way they exploit retail investors and explains why we have no business trying to swim with the sharks in opaque sectors like private equity.

Intrigued to know people’s thoughts on this FT article: https://www.ft.com/content/06317e0e-b6bf-4fdc-9255-cf664cb92062

I’m confused/dubious about the figures in the latter half that suddenly flip to describing how the majority of active funds outperform their benchmarks. The final 10 year figure of 85% was particularly unbelievable unless it’s good old survivorship bias on display?

@Steve B.

Without seeing how the statistics are calculated, and with no mention of the average level of over-performance, I would think this is just spin both ways in the article to justify a readers standpoint either way. Faced with the choice of a 15% chance over 10 years of not getting market returns or – getting market returns- I think I would choose the latter, even at 85% of funds showing outperformance of an unstated nature and without mentioning fees.

Perhaps the report on A. J. Bells website would shed more light but you need a log in to read it. https://www.youinvest.co.uk/sharesmagazine/2021-12-23/manager-versus-machine

JimJim

My annual “shout out” for the Investment Trusts Handbook 2022 (on this occasion). Plenty of general investing information, as well as about ITs.

If we are allowed a good film, “Don’t look up” on Netflix deservedly reached Number 1 yesterday

JimJim

@TA

You said…

As it happens, in the asset notes on that Swensen portfolio page, it says

Swensen specifically calls for 15% TIPS as part of the bond portion of the portfolio.

Great minds think alike, eh? 😉

Short term TIPS (TI5G), a slug of long term treasuries (IBTL) and a bit of cash suits me for my non-equity sllocation. Feel more comfortable with this combo than my previous VAGP (or AGBP) global bonds holding. Wish I could bring myself to hold gold, but I cannot.

Interesting reading the comments on house prices here, and then seeing the discussion in the rags about predictions for next year.

I personally don’t like house price inflation as I think it prices the young out of the market (sadly). I was very lucky to walk out of University and buy a house within 6 months (in the south east, at that), but I know I couldn’t do that now, and feel sorry for the young people that just can’t get on the ladder.

My current predictions for 2022 are that house prices will increase at least with RPI despite what seems a meteoric fuel cost rise in April and a few increases in the mortgage rate this year (which I actually think are banal – the reason for inflation is not because huge pay rises put money in the pocket but pure costs like fuels – although there is an argument for interest rates not being kept artificially this low). The reason I think house prices will still be a little frothy is lenders seem to be abandoning the responsible lending that was put upon them by the BOE in 2014. I read somewhere that one mortgage company is now prepared to lend up to 7 times a person’s salary…. Wow! I didn’t read the minutiae on it but if the brakes are off there you’ll find house prices increasing due to this.

Happy New Year everyone.

Kindle Unlimited: 3 months subscription for 99p @ Amazon, ebooks, magazines, audio books.

ive never tried audio books but will take out the above deal and see if my brain works that way 🙂

@Marked

The 7x salary mortgage offer from Habito seems like an express ticket to become house poor.

Let’s say you’re in one of the blessed professions, can put down a 20% deposit of £70K to buy a £350K home, and intend to borrow the remaining £280K, which is 7x your £40K salary.

On £40K you’re taking home £2,572/mo. The cheapest 80% LTV, 30 year, mortgage deal with Habito has a fixed rate of 3.74%, which means your £280K mortgage will cost you £1,295/mo, so around *50%* of your take home pay.

If you’re not in one of the blessed professions, but you qualify because your salary is greater than £75K, your monthly burden is going to be higher than 50% because of your higher tax bracket burden.

Rather alarming.