Note: What follows contains lots of speculation and fantasy finance. It is not a prediction. It is a reminder to keep our eyes on the horizon.

I had a dream which was not all a dream.

– Lord Byron

So here we are in April 2020. It’s a strange date to type out – it reminds me of when I was both a kid and a bookworm, and so I dreaded the arrival of 1984. For the first two or three months of that year I felt like someone was watching over my shoulder as I wrote the infamous date into my schoolbook each morning.

Now it’s 2020, and I can’t help looking back with 2020 vision.

Bear necessities of an investor’s life

As a Monevator reader, you don’t need me to tell you it’s been another good year for the stock market.

Strange to think that when I started writing this blog back in 2007, the memory of the Dotcom crash and the slump that followed had barely been expunged by a timid march towards the pre-crash highs, before we ran into the sub-prime crisis and another plunge in stock markets around the world.

I used to believe that investors of my generation would one day be grateful for a chance to get into equities at reasonable levels, but I don’t think many of them actually did. Going on Monevator traffic, it wasn’t until 2015 or 2016 that people really started taking an interest in shares in a big way again.

As a still-anonymous blogger – barely – the long years in the wilderness with just a loyal band of readers suited me fine. Having the Daily Mail camped outside my front door in 2018 after Time Warner tried to buy Monevator was infinitely scarier than seeing shares plunge in 2008.

And in case you’re still wondering, no I’m not Richard Branson, King William, Toby Young, Lady Gaga, or that Australian from the old show, Dragon’s Den.

Things could only get better

Anyway, I’m rambling – an increasing foible as you age, they say, but long-suffering readers will know it’s always been my vice!

Back to today’s stock market, and it seems fitting that the FTSE 100 finally broke through the 14,000-barrier this month. Round numbers don’t mean anything to computers, but thanks to behavioural economics we know they have an impact on us sentimental investors.

I’d love to have a time machine to go back to 2009, when other bloggers ridiculed me for writing about the potential for a great decade to come for equities.

Not because I would like to take them an iPad 11 to show them a screenshot of the FTSE 100 at 14,000 – if they ignored the evidence of historical asset class returns in favour of Doomsday scenarios, then I don’t see why they’d listen to a salt-and-pepper haired blogger from the future in a blue jumpsuit.

No, I’d simply use my time machine to go back and invest more money.

Short of borrowing to invest, I threw most of my disposable income towards snapping up equities between 2008 and 2011. Yet who wouldn’t have invested even more knowing what we now know?

Then again, as I say the decent run for shares wasn’t entirely unpredictable.

Short-term returns from equities are fiendishly volatile, as any investors who lived through that grim first decade of the 21st Century will attest. But over the longer-term, it tends to even out.

Indeed, by April 2011, the FTSE 100 had already soared like a phoenix from the flames (or like a bonfire of discarded share certificates heaped and set alight in a dumpster) to break back above 6,000.

14,000 and rising

Now, we know the long run nominal return from UK shares has been about 10%.

As well as inflation, that 10% return includes dividend income. Excluding the latter but not the former, we might have guessed the FTSE 100 would grow at about 7% for the nine years to 2020.

This would have taken the index to 11,000. But remember too that the decade from 2000 to 2010 was one of the worst on record for shares. Things were likely to do better than average, in turn.

True, much of the near-20% returns per annum that optimists predicted for the decade that followed were delivered in the early years of the recovery, as the market roared back from the March 2009 lows.

Yet valuations and sentiment had both become so thoroughly depressed by 2009 that equities have had a decent push beyond their long-run average for most of the past 11 years.

As it turned out, an investor who put £10,000 into the cheapest FTSE 100 index tracker in April 2011 and reinvested all her dividends should now have a nest egg worth approximately £30,000. And if she’d been even braver, and invested in the nadir of 2009, she’d have over £50,000.

Who says optimism never pays?

Bonds a bust, gold got sold

It hasn’t all been plane sailing. While we’ve seen none of the truly horrendous turmoil that scared that earlier generation of investors so silly that for a crazy moment in late 2008 they accepted negative returns on US Treasuries, we have had the usual lurches in confidence – along with the usual background noise of geopolitical posturing.

And needless to say, while equities are the biggest daredevils of any portfolio, they aren’t the only asset class that can give investors the willies.

The great bond rally of 1980 to 2010 finally broke down, for example, to the dismay of those who’d gorged on those 30-year issues that Central Banks pumped out in 2009 and 2010. But at least with bonds you get your money back if you hang around long enough.

Not that anyone seems to want to hold bonds these days. Nor cash, for that matter, despite 7% interest rates. We would have killed for that a decade ago!

Of course, back in April 2011 it was all about gold, which had just hit $1,500 an ounce – roughly where it sits today. Gold bugs were right that the price of gold would go higher, but wrong that we’d all eventually trade in our American Express credit cards for Krugerrands and shotguns. Eventually, gold fell. The yellow metal is a valuable diversifier, but there’s no comparison between backing it or human industry.

The same might be said about oil and the other commodities. Yes, they provided the early juice to the recovery, as countries like China and India took the accelerated steps that turned them into the top-tier powers we know today. But oddly enough, just like the British Empire and the American one that followed, China and India still haven’t consumed every last lump of whatever the Australians can dig up. Our energy use has changed, and we’re also changing how we make things, which ultimately put a lid on price rises.

Just ask anyone who bought into that insane IPO of 2015, which simply proposed an open-ended mandate to begin an “undertaking of great advantage” through mining operations in the last unexplored realm within our reach.

Back to the future

The flotation of Moonshot Mining PLC aside, most of the past decade has been largely free of the bubbles that blighted the previous ten years.

So has humanity finally learned its lesson? Hardly. I’m sure we’ll see bubbles again in my lifetime.

It’s true that 2000 to 2010 did leave a painful memory. But frankly, those same events also left the average Man on the Clapham Hoverbus without much money to pump up a new bubble – especially given the competing need to service those horrendously huge mortgages taken out on UK property as a result of the last one. (Even higher interest rates from 2012 haven’t really dented London property prices. Long-time Monevator readers will know I’m STILL renting as a result!)

Having said all that, there are some signs that shares are now getting frothy.

The rally over the past decade has been broad, with miners eventually giving way to leadership by the global consumer companies that rule our world, and to the eventually rehabilitated banking and housebuilding sector.

But technology shares have arguably become very overvalued, 20 years after the last tech bubble burst.

Also, while I’m his biggest fan, I do wonder whether Warren Buffett can really keep running the very expensive-looking Berkshire Hathaway from a life support machine.

Bond vigilante

Overall the market isn’t expensive, claim my critics, who call me a grizzly old bear. “Britain is booming!” they cry, adding that we can hardly have a recession when so much of what we used to call the emerging world is now living the middle-class dream.

It’s funny how things turn on their head if you wait long enough.

Maybe I am an old fuddy-duddy. From 2008-11 I was happy to run 90% equity exposure: I knew it would hurt me in a dip, but the opportunity was there for the taking and the odds seemed fair. Plus I had a crucial long-term perspective.

Now I’m 50% in cash and bonds, which is much more conservative than my share crazy doctor tells me I need to be. (He’s also more bullish that I’ll eventually reach my centenary, too, but then I can remember when even a 70-year old was considered ancient. Buy more GlaxoSmithKline-Zeneca, I say).

So why the shift in my portfolio? Joking aside, it’s partly an age thing – I’ve ten years fewer left now to ride out the vicissitudes of the stock market.

But there’s also the thorny matter of valuation.

Back in 2011, the FTSE 100 was on a forecast price-to-earnings ratio of roughly 10. The P/E ratio fell to less than 9.5 for 2012. These numbers suggested investors didn’t expect much growth to come.

Fast-forward to 2020, and I’m assured a P/E of 22 reflects the new reality of a world population that’s topped 8 billion hungry souls.

The next bear market

A new reality, eh? Now where have I heard that before?

Personally, I suspect a new bear may finally be preparing to emerge from the history books. Don’t ask me when it will strike – nobody ever knows, and markets can stay irrational far longer than you will want to wait. (Did I mention I’m STILL renting?)

I tell you this though: I am more fearful today given how everyone seems so gung-ho about equities, compared to when none of my friend’s cared less.

What should you do? Some will say stock up on gold and cans of tuna, but of course there’s no tuna left.

Instead I suggest you rebalance your portfolio a shade more conservatively, consider a few alternative assets, and don’t be afraid to hold cash.

I know, I know: you tripled your money by investing in shares over the last decade. But take it from an old codger – the good times won’t last forever.

Comments on this entry are closed.

(Regular readers: my HYP update is still to come — an exciting development has postponed it, but only for a week or two).

Bravo – I really enjoyed reading this, made my morning!

Excellent.

However, if you’re not Lady Gaga, who are you? I reckon this was a clue that you and the Accumulator’s real identities point to you being….

Jedward!

Am I close?

Like ermine,

I have to first compliment your change in writing style. Very nice. I liked it ver much. Did you spend too much time in the Sun 😉 Yes, I know which doomers you are talking about and I would be happy to be called wrong in such matters. 😀 Really!

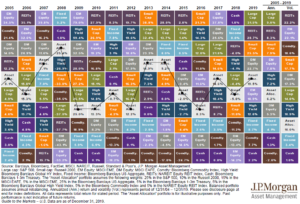

But next, I have to point you to this graph (see 70s until Internet stock crash) and a small write-up by our fav. astrophysicist.

I’m invested in stocks (and would like them to grow, like everyone else), and I do follow the markets as much as you do (and agree that they are a very savvy means of investment, if made in an informed way), but I am very /heavily/ ironic about it as well.

Sorry if I am being drippy.

—

You’ve missed something. How did the ETF/ETC/ETN story pan out then? Did they wreak havoc?

This is all going to be true, isn’t it? You haven’t just made it up, have you? Please say you haven’t.

Nice one 🙂

Cheers all!

@Tony – Hm, having literally had to Google them, I can confirm that Jedwad are a bit mainstream for this particular duo!

@Surio – Jacob has his views, I have mine! 🙂

@Alex – Tune in next decade…

@Salis – Of course it’s all going to come true. I have the equations and the Klondike-ian mega-wave trend graph reversions to prove it. (Er, not really. But I did spend a happy half hour doing compound interest calculations. No guarantees, of course!)

Jedwad? Get with the programme Grandad.

I’m glad you confirmed my suspicions about the gold price. Back in 2012 it was being touted as the only safe haven by most of the financial press. Even the otherwise astute Terry Smith was keen on it. Didn’t make sense to me.

By the way, you forgot to mention the euro. Just when did it finally collapse? And what is the Sterling-DMark rate now?

@Grinning Chris — Sadly the Euro crisis is still in the news every 3-4 weeks in 2012. But now one country a year is voted to be the whipping boy, in a cruel twist to the old song contest called the Euro Pong Contest…

I love this story , maybe because I love Sci Fi. I’ve read it three times over the past few years and when I set my course in 2009, putting all my money into the market ( I took one look at Gordon Brown in 2007 and moved the lot into USD then switched it back into Sterling at a handsome profit) and it it has gone pretty much to plan ever since. I am now aged 58 looking at a horizon. I think 2020 is a good one. And then I plan to become cautious , or at least a bit more cautious. If it all works out I can tell my children, but no one else

I seem to recall things were a bit hairy in April 2020!

And the last comment was before the B-Vote, never mind the rest of it we’ve had this year.

The DO NOT SELL post must be one of the best ever.