The Permanent Portfolio is a strategy for diversifying your wealth. It’s an asset allocation that looks like it was lifted from the Old Testament:

- 25% in cash

- 25% in gold

- 25% in shares

- 25% in long-term government bonds

Okay, so you’re not shipping corn in a Phoenician galley or laying down shekels at the local moneylender. You’re investing in stock market listed companies and government debt.

Nevertheless, for an asset allocation the Permanent Portfolio is about as back-to-basics as diversified gets – the 25% slug of gold giving it an especially Old World tang.

The portfolio’s roots lie in the high inflation era of the 1970s, when investing was simpler. Forget robot advisors or quant funds 1 – the only thing most people used computers for was playing Pong or Pac-Man.

Back then people still held active funds and shares for decades. They phoned up their stockbroker to do trades – or visited them in-person!

A gloomy minority even buried gold coins in their garden or stashed them under floorboards, before hunkering down to wait for the inevitable nuclear conflict.

Plus c’est change

Nearly 50 years on – it’s a different world. (Well, sort of…)

You might well wonder then what the rather presumptuously named Permanent Portfolio offers us 21st Century investors.

Surely we’ve nothing to learn from an approach you could write on a fag packet? (If we still smoked…)

Well, I believe it’s worth pondering the Permanent Portfolio, and its deceptive simplicity. While it’s too straightforward for an investing stamp collector like myself, I recognise it as a thing of investing beauty.

The Permanent Portfolio’s returns have historically been pretty special, too.

Not the highest returns, granted. But that’s not the only way to judge how well a portfolio performs.

The history of the Permanent Portfolio

The Permanent Portfolio was the brainchild of Harry Browne, a US writer and politician.

Browne’s life was quite a journey – he wrote a classic of the US libertarian movement and ran for president – but it’s his evolution as an investor that’s relevant to us.

Beginning his investing career as a gold bug and newsletter writer, Browne morphed into a proto-passive investor. He came to believe nobody knew much about the direction of markets or the economy.

Expansions and recessions were inevitable but impossible to time. Investors should be fearful of inflation as well as deflation, and also of government interventions.

Cheap index trackers were the investments of choice. Why pay a fund manager when nobody knows anything?

This all resulted in the Permanent Portfolio – the pioneering all-weather asset allocation I outlined above.

The science bit

The Permanent Portfolio is extremely simple, but designed to preserve an investor’s wealth whatever fortune throws at it:

- In good times, the equities should do well.

- In retrenchments, long-term government bonds should shine.

- Gold protects you from calamities – as well as, hopefully, the sort of stagflation that prevailed in the 1970s.

- And cash, well it never hurts to have a supply of the folding stuff to call upon.

Rebalance annually and you might benefit from automatically selling high and buying low. More importantly, you keep your ship on an even keel.

Historical returns from the Permanent Portfolio

Here’s how a Permanent Portfolio, denominated in GBP, would have performed from 1970 against World equities and the 60/40 portfolio:

Permanent Portfolio = World equities, long gilts, UK money market, and gold priced in GBP. 60/40 portfolio = 60% World equities GBP / 40% medium gilts – up to 10-year maturities. Portfolios are annually rebalanced. Fees are not included. Data from Alan Stocker 2, British Government Securities Database, A Millennium of Macroeconomic Data for the UK, The London Bullion Market Association, FTSE Russell, and MSCI. November 2025

Note: All returns in this post are inflation-adjusted GBP total returns.

Here’s the trend lines in the graph broken down into their risk and reward elements:

| Portfolio | Annualised return (%) | Volatility (%) | Sharpe ratio |

| Permanent | 4.2 | 6.8 | 0.62 |

| 60/40 | 4.1 | 9.3 | 0.44 |

| 100% equities | 5 | 14.7 | 0.34 |

What’s most noteworthy about the Permanent Portfolio is its very low volatility:

- The average 4.2% return from the Permanent Portfolio came with a standard deviation of just 6.8%. That’s calm.

- By contrast, a 60/40 portfolio (World equities / medium gilts) delivered a 4.1% return and it ladled on more volatility – a standard deviation of 9.3%.

- 100% equities offered the best returns of all but upped the risk quotient yet again, subjecting owners to 14.7% annualised volatility.

Let’s now draft in the Sharpe ratio to help us make sense of that risk versus reward trade-off.

Risk rewarded

The higher your Sharpe ratio, the better your risk-adjusted returns. In other words, the more return you get per unit of risk, as measured by volatility.

On that score, the Permanent Portfolio’s 4.2% average return is achieved with far less grief than the other two portfolios dished out.

An allocation of 100% equities may offer the prospect of higher returns. But they’ll likely come with much more drama attached.

Meanwhile, you can see the Permanent Portfolio’s steady approach at work in the growth chart above. Its green line waggles, for sure. But it doesn’t feature the sickening cliff-drops that punctuate the 100% equities’ blue line or even the concave wilderness years that afflict the 60/40 portfolio (orange line).

Downside protection

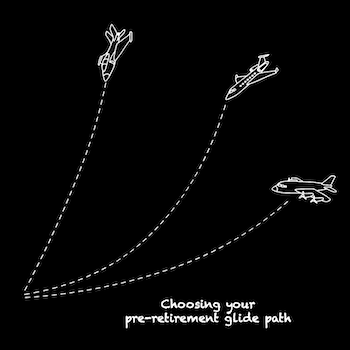

The Permanent Portfolio’s relative chill makes it particularly well-suited to retirees and those derisking their portfolios before retirement.

Investors focused on wealth preservation need to avoid devastating losses. That’s exactly what Browne’s asset mix is designed to avoid:

The Permanent Portfolio has only suffered one bear market drawdown greater than 20% in the past 55 years. Compare that with the free falls experienced by more conventional load-outs:

The Permanent Portfolio’s extremely low 25% equities holding reduces the severity of dips when the stock market crashes.

Nicer nightmares

Even the nightmare scenarios tend to be less terrifying:

| Portfolio | Deepest drawdown (%) | Longest drawdown |

| Permanent | -21.5 | 6 years, 6 months |

| 60/40 | -45.8 | 11 years, 11 months |

| 100% equities | -56.1 | 13 years, 9 months |

In inflation-adjusted terms, a 60/40 portfolio lost nearly half its value during its most abysmal run. 60/40 investors also had to endure almost 12 years underwater in the worst case before their portfolio reclaimed its old highs. 3

In contrast, at worst the Permanent Portfolio declined less than halve the amount of the 60/40. And its longest bear market recovery time was 45% quicker.

As the table shows, running with 100% equities was hairier still when the brown stuff hit the fan.

Take a walk on the mild side

One of the dilemmas facing investors – whether we recognise it or not – is that long-term average returns conceal some colossal landmines. Monumental blow-ups that can wreak havoc with your plans.

This is known as ‘tail risk’ and you can assess a portfolio’s susceptibility to such extreme unpleasantness by checking its annual return distribution.

The more often a portfolio deep-dives into negative territory, the riskier it is:

A portfolio comprising 100% World equities has lost nearly 40% of its value – in a single year – twice in the last 50 years. And drawdowns of between 15% and 30% in a single year are standard.

On the other hand, double-digit advances are common, too.

In short, a 100% equities portfolio is an Oblivion-grade rollercoaster.

Contrast that with the more regular 60/40 portfolio:

Eye-watering losses are fewer and shallower. But by the same token, blistering gains are also less frequent. Annual returns are more likely to land in a middling comfort zone.

If you like the sound of that then you’ll love the Permanent Portfolio’s track record:

The Permanent Portfolio hardly ever racks up a double digit loss. In the vast majority of years it makes steady progress and conserves what you have.

Why the Permanent Portfolio works

The key to the Permanent Portfolio’s stabler returns is its diversification, especially its out-sized allocation to gold:

Asset class correlation matrix: monthly real total returns 1970-2025

| Gold | World equities | Long gilts | Money market | |

| Gold | 1 | 0.01 | -0.02 | 0.04 |

| World equities | 0.01 | 1 | 0.14 | 0.1 |

| Long gilts | -0.02 | 0.14 | 1 | 0.39 |

| Money market | 0.04 | 0.1 | 0.39 | 1 |

Quick correlation recap:

- 1 = Perfect positive correlation: when one asset goes up so does the other

- 0 = Zero correlation: the two assets being measured have no influence upon each other

- -1 = Perfect negative correlation: when one asset goes up, the other goes down

These are extremely good numbers. Low and near-zero figures indicate the portfolio’s assets are exceptionally diversified.

Permanently at odds

Even well-differentiated equity sub-asset classes typically have correlations ranging from 0.8 to 0.9+. The highest here is 0.39 betwixt long gilts and money market (which stands in for cash in the mix).

Even 0.39% is a moderately low correlation as it goes, while the other – still better – numbers go a long way to explaining the low-volatility nature of the Permanent Portfolio. Basically when one of its asset is face-planting then the others usually trot on, relatively unbothered.

Of course, by the same token if World equities are on a tear, then it’s also likely that others among the assets will be dragging their heels.

Hence, during bullish times it’s important to focus on the Permanent Portfolio’s goal of balance. Otherwise you’ll be forever grousing about how some laggard or another is cramping your style.

Diversification and gold

Here’s an illustration of how gold in particular has historically proved a diversifier for UK equity investors:

The chart shows how well gold counteracted falls in World equities. Exactly when you’d most want to see a non-stock asset go up – to offset the pain of plunging share prices!

It’s especially notable because in a crash correlations increase. That is, most assets tend to fall together. So if you can own something that doesn’t, you’ll someday probably be glad of it.

Bottom line: the big allocation to gold is the oddest but perhaps also the most important aspect to the Permanent Portfolio.

What have you done for me lately?

The Permanent Portfolio regained popularity between the stock market crash of 2008 and the peak of the gold market bull run in 2011. Scarred by memories of the still-recent global equity rout and attracted by the allure of gold, new adherents flocked to its defensive asset allocation.

With hindsight that was poor timing. This particular golden age didn’t last long – the yellow metal nose-dived 40% from late 2011 until the end of 2015.

Gold has since bounced back with a vengeance, however. And stock markets have soared too.

Yet Permanent Portfolio investors had to cope with their worst ever drawdown of -21.5% in 2023, as all four assets struggled with the post-Covid inflation and interest rate double-whammy.

Survivor’s gilt

No asset was more of a liability in 2022 and 2023 than long gilts. They suffered a dreadful 61% decline from their peak at the outbreak of Covid.

Despite that shock, I’d say the Permanent Portfolio coped reasonably well. Its 21.5% loss in 2023 is no more than a bad cold in comparison to the worst maladies that can befall a stock-heavy asset allocation.

And since then the Permanent Portfolio has recovered its losses and resumed its forward march.

Do recent events mean that long gilts are broken? No. They’re no more broken than equities or gold right after they crash. Those assets are just as capable, if not more so, of delivering an appalling performance.

The real learning point is that although the Permanent Portfolio looks outwardly dull, it actually invests in three highly unpredictable assets. Each one can punch the lights out or punch you in the face.

The genius of Harry Browne is that he chose these volatile assets because they can cover for each other.

One of them is usually charging forward, while another is heading for the field hospital.

Meanwhile cash plods along keeping up the rear.

It’s hard to credit, but highly-volatile individuals can create a surprisingly harmonious environment even though all appears to be churn and chaos.

Think The Expendables, but with Sharper ratios.

Investing in the Permanent Portfolio

The Permanent Portfolio is a self-reliant DIY investors’ dream.

Not as simple as the very simplest global shares and bond mix, admittedly. But a Permanent Portfolio shouldn’t take more than half an hour to set up, and the same again once a year to rebalance.

My co-blogger The Accumulator gave an example setup in his review of model portfolios for DIY investors.

Needless to say you should be investing in ISAs and SIPPs to avoid your portfolio being ravaged by tax.

Permanently a place for the Permanent Portfolio

Active investing is my passion. At times I’ve approached 100 holdings. I’ll also accept higher volatility for hopefully higher returns.

So the Permanent Portfolio is too simple for me. And realistically, I can’t imagine putting 25% in gold.

All that said, compared to when I first learned about the strategy a couple of decades ago – back when I was happily all-in on equities – my need to diversify has increased. The absolute amount I have invested has grown a lot, and my time horizon has shrunk.

The Permanent Portfolio – and its history of decent returns with minimal volatility – is a useful reminder that well-considered diversification need not be a recipe for stagnation.

Those looking to reduce volatility in their portfolios – especially around retirement D-Day – could do worse than spend a few minutes thinking about what it has to teach us.