It’s no secret mortgage rates have crashed. But unless you’ve been following the housing market with – oh, let’s say the morbid curiousity of a renter who was waiting for a London house price crash and got another boom instead – you may not realise just how low rates have gone.

First Direct has a five-year mortgage with a fixed rate of 2.69%. Even with an arrangement fee of £1,999 and the need for a 35% deposit, that is remarkably cheap – and while it’s the best I could find, there are other lengthy fixes around.

In fact, what I find most remarkable about these low rates is just how little remarking is actually being done.

Why are these puny rates not raved about like soaring Dotcom stocks or National Lottery winnings in the 1990s? They’re more lucrative for most people.

Are the UK’s homeowning gentry just so smug and comfy in their castles that they don’t realize interest rates are at a level not seen since Dr Johnson and Boswell were out flat hunting? 1 And that rates were slashed mainly to keep them – and their creditors – in clover?

Or do some secretly appreciate that they’ve been handed a once-in-several-generations bailout, so they’re keeping schtum in case they spark a middle-class riot?

Whatever, I think if you’re solvent, earning, and you haven’t got a mortgage – and that includes me – then it’s looking like you need one.

Mortgages are not like other debts

A mortgage is the only good debt. The term mortgage comes from the French for “death contract”, but for decades mortgages have enabled people to enhance their lives by buying their own home without saving a six-figure sum beforehand. Over the long-term, that house can be expected to increase in value.

Some old wolf will come along and tell us that mortgages are terrible if there’s a big recession and you lose your job and interest rates rise, and you can’t keep up the repayments. Wise and true.

Fact is though, nearly everyone reading this article will at some point have a mortgage. Better to get them when they’re cheap, and around here we’re smart people who only take on mortgages we can easily afford.

Don’t think that because mortgages are okay, you can feel fine about a five-figure credit card bill. No way. All other debts are toxic and poisonous – with the arguable exception of student loans – and must be purged before you take another holiday, eat at another restaurant, or buy another Superdry windcheater.

I was challenged the other day by a commentator who thought my view that debt is a form of protection against high inflation was reckless. Fair enough, he or she was not a regular, and may not know I have a Berserker attitude towards all debt other than mortgages.

But anyone who thinks a mortgage is bad news when inflation is running high is wrong.

An affordable mortgage secured on a real asset – a house – is an excellent thing to have at times of high inflation.

Times, as it happens, like now.

How inflation is paying off your cheap mortgage

Mark it in your diaries: Wednesday 13 February was the day Mervyn King, the Governor of the Bank of England, said he would pay off your mortgage for you.

Of course, Mr King is not going to dole out cash for you to wheelbarrow down to your nearest branch of Lloyds.

But King did admit inflation was likely to stay above target for at least a couple of years, and that he was going to do diddlysquat about it.

So same difference.

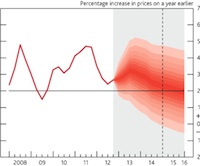

Look at this chart, which shows the Bank of England’s famous fan projection of the likely rate of inflation:

Inflation: The gift the BoE forecasts will keep giving.

The dark red line is the Bank’s central projection for inflation.

You’ll notice inflation is headed to 3%. You’ll remember the cheapest fix is only charging you 2.69%. That’s one heck of a deal.

Sure, you’ll have to make debt repayments every month. But for the next couple of years, it’s likely that inflation will be eroding a First Direct mortgage as fast as the bank can bill you for it.

Result! At least for anyone with a cheap mortgage, and for a nation sliding into financial repression to pay off its debts.

If you’re a prudent and debt-less saver like me, it’s time to wake up and smell the coffee. The authorities have other priorities. We can moan about it, or we can get in the game and protect ourselves against inflation.

Re-mortgage and save a fortune in interest

If you’re already a homeowner and you are not on a super-cheap mortgage, it’s got to be worth seeing how much you could save on mortgage repayments.

When remortgaging, remember to account for arrangement fees and any early repayment penalties (there’s no stamp duty, since you’re not buying a new house) to make sure it really is cheaper overall.

Should you go for a discount, tracker, or fixed rate mortgage?

That’s an article in itself, but I’d be tempted to lock-in a cheap five-year deal here. Rates have fallen again because of the Funding for Lending scheme that’s designed to get banks pumping out cheap loans. It won’t be around forever.

I know the best rates require decent deposits, and that while I limp on in high house price hell here in London, prices have been falling elsewhere. So it’s possible the equity in your home has shrunk, making it harder to get the top deals.

But are there other sources of funding you could throw into the pot to increase your equity and so bring down the rate you can apply for?

Given the paltry interest on cash, it’s likely to be worth using savings to increase your deposit if it gets you a lower mortgage rate. Do the maths and see.

Indeed, given where rates are, I think it’s almost a “sell your possessions” moment for remortgages, like shares were in March 2009.

Do you need two cars? Do you need that conservatory or loft extension, or can it wait a year? Can granny advance you your inheritance?

£10,000 might be the difference between a super-cheap 2.69% rate and a still cheap but not quite so bargain bucket 3.39% rate.

- On a 20-year repayment schedule, a £200,000 remortgage at 3.79% will cost you £85,586.60 in interest.

- A £200,000 remortgage at 3.39% still racks up an interest bill of £75,675.15.

- After chucking an extra £10,000 into the pot to get a cheaper rate, £190,000 at 2.69% costs you just £55,878.73 in interest.

Wealth warning: Mortgage rates will surely be higher some day. These numbers are just to illustrate the savings between two relatively low rates. Make sure you can cope if rates double, at least.

Of course the time value of money means £10,000 pumped into your mortgage now is worth more than £10,000 saved in the years to come.

But what else will you do with it? Low rates mean cheap mortgages, but they also mean cash saving rates – even inside an ISA – are pitiful.

If I were a super-cautious saver, I’d not muck about with cash on deposit outside of an ISA (beyond my emergency fund) if by redeploying it to build up my deposit I could slash my mortgage rate.

Remortgage and invest?

Of course, I’m not a super-cautious saver. I’m a childless 30-something who is happy to have lots of my money in shares.

So I lust over these mortgage rates for a different reason.

I’ve written before about the dangers of borrowing to invest. However I said the one exception may be if you can:

- Borrow via a mortgage (it’s cheap, long-term, and not marked-to-market)

- Invest to earn an after-tax return above your mortgage rate

- Invest the money inside a tax shelter – an ISA or a SIPP – in order to do so

- Be certain you can meet the repayments from your salary. (i.e. Do not rely on your investment to repay the debt).

Hedge funds would kill for long-term funding at 2.69%, such as we can get from the cheapest fixed rate mortgage deals today. Over a couple of decades shares should deliver far higher returns than that.

So that’s a big reason why I’d love a mortgage – alongside its usefulness as a hedge against inflation. (I’m not wild about having to use one to buy an over-priced house, but I’m coming around to throwing in the towel on that).

This is not for everyone. Borrowing to invest, even via a mortgage, greatly increases the risks. Also, these low mortgage rates won’t last forever, so you shouldn’t overstretch.

I’m thinking here of a 40-year old withdrawing say 5-10% of equity for prudent long-term investment, not a 60-year old pulling out 20% to punt on penny shares.

Incidentally, I have no idea how closely a bank will look at what you plan to do with any money you raise on remortgaging. I suspect it varies.

Banks were happy enough in the boom times to allow the withdraw of mountains of cash for cars, kitchen extensions, and summer holidays – in the last quarter of 2006 mortgage equity withdrawal accounted for over 7% of disposable income!

But no doubt in their new chastened form some won’t go for using their cheap funding for sensible long-term investment.

(Here is the benefit of an offset mortgage, where you can shift cash at will).

Remortgaging to fund a pension

I’ve written a lot more about borrowing via a mortgage to invest, so I won’t repeat myself further. I’d just add that if you’re a higher-rate taxpayer and you’re not currently funding a pension, it could be even more worth you doing the sums.

Let’s say you want to put £30,000 into your SIPP, to invest in a cheap FTSE 100 tracker fund for the long-term. After tax relief, that’d cost you only £18,000 taxed income. (I’m assuming for the sake of argument you pay sufficient tax to qualify for full higher rate tax relief).

If you’re getting 40% tax relief and your investment gains are tax-sheltered, you’re borrowing at 2.69%, inflation is running near 3%, and the FTSE 100 is yielding well over 3%, then a lot of things are working in your direction.

You don’t even have to invest in shares – at these low hurdle rates and inside a tax shelter other assets could work.

One cunning strategy might be to buy some of the floating rate bonds I mentioned the other week. When I did they were paying 4%, so well in profit versus a 2.69% mortgage rate, provided you’re invested within a tax wrapper. If and when interest rates rise – so increasing your mortgage rate – the coupon they pay will rise too, ensuring the trade stays profitable.

Like this you could hedge out interest rate risk, and eventually see a nice capital gain. (Remember you’ll face credit risk, so keep diversified overall).

Remortgage your way

I’ll repeat myself because some people always argue against things I don’t actually write. (Hey, it keeps me on my toes!)

I am not saying this last idea of remortgaging to invest is something we should all do. I’m definitely not suggesting anybody should withdraw £100,000 of arguably over-valued housing equity to punt on tinpot oil explorers.

I’m thinking more like a limited withdrawal to fund an ISA or a SIPP for a year, while equities still look fair value. Many people have too much wealth tied up in their house and not enough in shares. They could be more diversified.

Super cheap mortgage rates are an unprecedented opportunity and inflation is a growing risk, and so more financially creative readers might want to think about how to best respond.

As always though, please remember I’m just a humble scribbler, not a financial adviser, so do your own research and make your own decisions.

- That was the 1700s, TOWIE fans.[↩]

Comments on this entry are closed.

Back in the mid 90s, I extended our mortgage with the Leeds Perm by £50k and gave the reason as “investment”. They didn’t bat an eyelid.

I then put this money into an existing Bonus Gold account with them for two weeks, hit the second window for carpetbagging, and got £12k of free shares from them.

I then payed down the mortgage by £55k and used the rest to resurface the drive.

Happy days!

I was fortunate to choose a tracker mortgage pre-credit crunch which has been tracking along quite nicely at 2.5% for the past 4 years or so. As I’m outside the initial period I can make overpayments easily and there’s no break clause.

However I’m starting to wonder if it would be worth getting a 5 year fix at a slightly higher rate, as you say these rates are unlikely to be this low forever.

Re-mortgaging to take some of my downpayments out and invest them in shares sounds a bit extreme to me, but then I’ll probably be looking to move in the next 3 years or so to buy a bigger place so the equity will be useful then.

Interesting post. I created two polls on the Motley Fool recently, asking whether it was worth paying off first a residential and then a buy to let mortgage, both at very low rates, or investing the money in an ISA instead. A third option was to put the money in an ISA for as long as the ISA was growing faster than the mortgage rate.

The results were interesting and quite evenly balanced, so I elected to pay half the total capital payment into the ISA and half against the residential mortgage (paying off the B2L would result in more tax) and see how I’m doing a year later.

An advantage the 60 something will have today is that he/she would have been a 20 something during the giddy heights of the double digit inflation in the seventies, thus lapping up your advice once he/she gets a handle on paying £640k for something costing less than £10k back when they wore shorts/skirts.

TBH I’m seriously hoping that the 70’s don’t turn out to be the best times of our lives. but as some wise old owl once said, hope for the best plan for the worst.

Another interesting read. I’m in constant debate with myself as to whether to overpay on the mortgage or invest. My head says invest (and overpay with the gains), though the security of a paid off house seems to constantly pull me the other way!

Completely off topic, but is anyone still carpet bagging these days?

Monevation (and life for that matter), is all but a virtual see-saw, where working smart, saving hard, investing sensibly; should result in earthly equilibrium.

Paying off a mortgage is a life balancing state of mind that money can’t buy nor rational mathematics explain. Remortgage? Not likely!

Great article – and i wish you the best of fortune in your property hunt.

Investing with borrowed money is a topic close to my heart. Because I have done it for around 10 years – during which time I have learned a lot about shares/debt and my psychology. In case anyone is interested I jotted down my thoughts below. Please excuse grammar and spelling. Questions and comments are most welcome.

Cards on the table: I have mortgage debt of around 40% of the value of my house in the South East, and that “equity” is currently invested in a portfolio of high yielding shares. The HYP currently yields 4.6%. My floating rate mortgage currently costs 2.8%. Just under half of the debt is an interest only variable rate deal costing base rate + 1% (remember those?). The balance is a repayment mortgage at a floating rate at 4.0%. I can offset against the 4.0% bit if I want. At present I have every penny (and the withdrawn equity) invested in shares. The last few months have been kind from a capital gain perspective, but the yields now look a little stretched so I may well begin to overpay the mortgage.

Some tips:

1. If you have a non-earning partner you trust – put the shares in his/her name. No tax to pay on the first 36K of dividend income.

2. As the INVESTOR says – be cautious about “margin” trading e.g. traded options or a trading loan from e.g. Interactive Brokers. I wrote a number of traded option “calls” and I was “shaken out” in 2009. It’s depressing selling shares in British American Tobacco at £15.00 in order to take assignment of battered shares in e.g. Land Securities at around £5:00. It may be tempting to borrow on margin at around 1.89% from Interactive Brokers but don’t do it if you face the risk of having to sell to cover your losses. For the record – I don’t have any relationship with Interactive Brokers. But they seem like a decent outfit to me.

3. It is wise not to rely on the investment income to pay the interest on the debt. I do from time to time because I have become very comfortable with the security of the HYP income. However, as a sailor once told me: when you throw the inflatable lifeboat into the water during a safety exercise there is an 80% chance that it will inflate the correct side up. However, if it’s the middle of the night and your ship is sinking you can be sure that it will inflate the wrong way up. When one thing goes wrong, everything goes wrong.

4. Finally, for those fairly new to investment, I would like to highlight the real risks, which I have personally experienced. Since I started investing in around 2001 the market has experienced some major falls. When you buy most of your shares at around FTSE 6000, and it drops to sub 4000 you are going to experience real concern. Some of your shares (Dixons, Lloyds TSB, Royal Bank of Scotland) will drop by >90% and remain there. I recall that my worst overall loss (had I crystallised it) would have been around 50% on cost. So if you are 50% leveraged on the way in you have “lost” all your money. Don’t underestimate how bad this feels. Naturally some people don’t want to lose more than their original investment so this is the point at which they sell. If you are going to gear up in shares you MUST be confident that you can handle “losing” (on paper) that kind of money and resist the urge to sell. When you look at the screen and feel physically sick – that’s probably close to the bottom. Repeat the phrase “never sell” several times and have several strong drinks.

That said, when prices and dividends rise you do see dramatic increases in your net worth. Which is nice.

Just felt the need to say the above. Hope it helps someone.

Great post as always, and some interesting follow-ups. What I would say I have learnt in the past couple of years, principally from this exceptional blog, is that a balanced approach is the best/safest, albeit with occasional rebalancing/reprioritising of your money to reflect short-term market conditions (inflation, interest rates on savings vs. mortgages, the impact of income on the PAYE tax grab) and longer-term forecasts (when will rates rise? changes to the tax system re: adjusted net income and will higher rate pension tax relief be abolished? and so on).

At the moment, I am concentrating on building up a diversified pot of pension and ISA money (mainly equity but with a dash of cash), taking advantage of the reasonable conditions for generating a return after inflation and the relief on pension contributions. But I am also making regular overpyaments to the mortgage because of the psychological good that it brings, rather than there being a compelling case to do so on a 2.50% rate.

Thanks for another bang on the money post. The best 5 year fixes may carry big fees, but for all but the smallest mortgages they should pay for themselves as long as you know you can stay put for 5 years.

I wouldn’t consciously leverage to invest, I would rather make big overpayments regardless of the low interest rate, thus paying off the capital at a greatly accelerated rate. I agree inflation will ultimately erode the debt, but wages are barely keeping up atm so it won’t be a golden bullet like in the 70s.

You could use the leverage to “arbitrage” against predicted investment returns, but I value being mortgage free before I’m 50 and set it as a major goal. That said I’m paying into a SIPP as well.

Offset mortgages are great for several reasons, I have one myself, although there is a small premium in interest rates for that flexibility.

> Some old wolf will come along

Somebody called? The devil is in the detail –

> Be certain you can meet the repayments from your salary.

A nice steady, full-time job for the duration would be nice….

and

> arguably over-valued housing equity/I’m not wild about having to use one to buy an over-priced house, but I’m coming around to throwing in the towel on that

I think I hear straws of a potential change of domestic circumstances pushing in this direction, so at least you get enhanced quality of life for the overvalued asset 😉

There’s another way of looking at this. Britons have bid up the price of houses to a level that is unsustainable, because first-time buyers can’t get a start before they’re 45. So the value of the pound is going to be destroyed enough that they aren’t so overexposed. Whether any of them are going to have the brains to realise the gift rather than yet again treating their houses as ATMs to turn into consumer goods I very much doubt, but you can hope some of them recognize the big yellow eject handle and use it correctly.

It’s the second asset class bailout after the financial sector. Perhaps the third will be of the personal pension holders whose pensions are being destroyed by the paltry annuity rates. And the fourth is…well God Knows

I know that Mervyn King is going to destroy 10% of my total lifetime financial net worth in the next five years. He’ll take a slice out of yours too, maybe less if you grab a hold of that overpriced asset now 😉

Thanks for another informative post. There’s no doubt an offset mortgage can be extremely useful for a store of cash. It could almost considered tax efficient, in the sense that the interest saved (rather than interest earned) is not taxed. But at the slightly higher rate of 3.9% I don’t think there would be any advantage borrowing to invest, unless there is a sizeable drop in the equity market.

The IRR on investing in tax advantaged savings products like Personal Pensions and VCTs is pretty compelling when you can borrow at 3-4% through a mortgage and immediately get 43%-66% of your initial investment grossed up a few months later (note: this is how much 30-40% income tax relief is worth on your investment out of post-tax income)

If you are one of the tiny number of people paying additional rate income tax at 40%, then your initial gross up on a pension investment is over 80%

However you have to weight against this the Lifetime Allowance in the case of the personal pensions, plus the fact IMHO that it will fall further from the planned £1.25m level

“If you are one of the tiny number of people paying additional rate income tax”

Do you mean higher rate? If so, I think you need to check your numbers as close on 4M people are caught by this now and many more will be snared each and every year as the threshold is heading downwards.

But I would love to get a mortgage but alas, it is not a deposit problem but salary multiplier’s problem. Just have to keep saving to get bigger deposit I suppose. 🙁

>I’m thinking here of a 40-year old withdrawing say 5-10% of equity for prudent long-term investment, not a 60-year old pulling out 20% to punt on penny shares.

I’m nearer the latter in age, but it is true that with an outstanding mortgage of 5% LTV and 2.5% rate I am not being financially efficient. You make a good case for the right person, and it is tempting to remortgage and buy more shares in defensive stocks, but I am rather attached to the idea of seeing my tiny mortgage vanish into nothing in a few more years.

The huge equity release figures pre crash are probably driven more by people buying houses than holidays or cars. Likewise the repayment of mortgage debt since is more a result of a dirth of housebuilding than prudence.

1.Agree–mortgage rates are great if you have decent deposit

Another cost is council tax—-it’s the first thing that goes up when local council is struggling

@Ermine

I think there is a flaw in your logic

You seem to be saying that inflation will erode the real value of mortgage debt

This only works if pay rises equal or are more than inflation

It is after all actual net pay, not RPI, that pays interest and principal on a mortgage

This was the case for the last 20 years up to about 2009, however it hasn’t been the case for the last three years

Also IMHO significant tax rises are inevitable for at least the next five years given the government’s finances

This could lead to a scenario where there is a severe squeeze in post tax-income for UK tax payers that lasts a decade in total

I think you have an tendancy to expect the future to look like the immediate past of your experience and that isn’t necessarily the case

So basically this only works if you’re a higher rate tax payer and have high equity to remortgage/a massive deposit?

As a recent FTB, a rare article on Monevator that doesn’t offer me much cheer!

Neverland

I agree it’s unlikely that we will see a repeat of the 70s when inflating incomes reduced the real mortgage debt. It seems more likely that useful stuff like food and fuel will rise, and incomes will remain broadly similar. So perhaps house prices will fall due to the drop in disposable income among workers not entitled to inflation pay rises.

However, this does not detract from the case for leveraged investment in income producing shares. One hopes that the income will rise each year but the repayments will remain the same.

Its an approach i’d only seriously consider at the bottom end of a market crash .. i’d want extreme value not just fair value .. i’d want it so bad that people were puking in the streets at the loss to their portfolios .. then i’d feel safe to do it !

@Brodes

I agree with you only where there is an income tax relief offered like a VCT or SIPP investment and you are a higher or additional rate income tax payer

“One hopes that the income will rise each year but the repayments will remain the same.”

Dividends go up as well as down and so do interest payments, often dividends and capital values of shares go down when interest rates rise

Sure you can fix an interest rate, but only for five years max in the UK mortgage market

Another reason why house prices could fall depends on whether the interest keeps getting paid on four particular types of mortgage once rates start rising:

1. Self-cert, aka liars mortgages with owners whose income has either dried up or never existed in the first place

2. Interest only mortgages with no investment plan to pay off the capital

3. Buy-to-let mortgages secured on poor quality rental properties that don’t generate reliable rental income

4. Legacy mortgages tracked to the base rate where the owners have got used to paying virtually no interest

If we start seeing repossessions, or even just increased sales volumes, then desperate sellers could force prices down, particularly if wages don’t keep up with inflation (which they probably won’t).

By the way, for anyone who bought in the last few years, the current low rates for 60%-65% LTV mortgages are actually also a good reason to pay off MORE debt in order to get a better rate.

@Neverland – at the time of writing N&P are offering a 10 year fix at 3.99% for a fee of £295 – http://www.moneysupermarket.com/mortgages/

Hmmmm.. whilst I completely understand the arguments here, as an FSA-authorised IFA, I’m not so sure that the FSA would agree! In addition, many lenders are very wary of “capital raising” mortgage applications although it is by no means impossible. Since 2007, most of the lenders that still operate – and there have been lots of “casualties” – have become increasingly “risk averse”, preferring to deal in “certainties” such as capital & interest repayment mortgages, rather more severe affordability criteria, etc.

It is, however, an urban myth that mortgages are hard to obtain. As someone who remembers 15.20% mortgage interest rates, the so-called “Friday afternoon rate war” that we are seeing in the residential mortgage market is, frankly, astonishing.

Mind you, I’m stuck with my 3.49% variable rate from the wonderful Stafford Railway Building Society, as much of my (modest – really!) income is dividend (and yes we do pay our corporation tax bill); most lenders are decidely sniffy about that.

Really interesting comments, thanks everyone. Couple of quick replies:

@Mark Meldon — I appreciate an FSA regulated adviser couldn’t give this sort of suggestion. Perhaps that’s a good thing. However let’s look at what I’m proposing here. I’m saying that somebody who is solvent, has good and secure cashflow, and has a lot of equity in their home, might consider removing a modest 5-10% of that equity to make a very prudent long-term investment, very possibly picking up tax relief along the way to sweeten the deal. And that extraordinary low interest rates of <3% mean the returns required for a pay-off are pretty low.

In contrast, in the boom, the regulators/authorities/standard advice was that it was fine for young first-time buyers to get 110% mortgages -- completely above board, regulation wise -- to stretch to buy a house (at the top of the cycle, just ahead of recession) with interest rates at say 5-6%.

Which is really the risky option here?! 🙂

I'm extremely confident in saying my proposal is far less risky.

I am not a big fan of boilerplate wisdom, for exactly these sorts of reason. And I am not a big fan of waiting for the regulators to tell me what's risky.

Every week on Radio 4 I hear of people losing tens of thousands in greenfield land investment schemes or penny share pumpers or wot not. I'm sure individual staff at the appropriate agencies cringe every week, and know what should be shut down tomorrow, but the official wheels grind slowly.

Being smart and alert and responsible for your own fate -- and ready to take opportunities as they present themselves -- is IMHO going to best protect and grow your wealth.

@Luke -- Come on, don't be one of those homeowners I mentioned at the top. If you bought recently, you're already presumably benefiting from historically titchy interest rates. Good for you! 🙂

@Brodes -- Particular thanks for your extended comment and insights into your strategy.

@BeatTheSeasons -- If you have already bought a house, then you are already exposed to falling house prices, whether you overpay or not. This article/strategy is about your exposure to interest rate risk, and to other assets. And I stress again, I am talking about minor equity withdrawal for people with a lot of it, not wholesale plays on market X versus market Y.

@IverPotter and others -- I wouldn't knock anyone for paying down their mortgage ASAP. It's an extremely credible and sensible strategy. My suggestion above is for those with a greater appetite for risk, it's certainly not for all. 🙂

Lots of interesting comments and of course it depends on your appetite for risk, the mortgage rate, price of cheese etc.

A lot of this applies also to buy to let property where there is a tax incentive to keep the LTV high and no risk of losing the roof over one’s head.

As a way of mitigating risk, what about running a notional DIY mortgage/ISA ‘fund’ similar to Vanguard’s LifeStrategy?

For example, 80% of a regular amount would be paid against the mortgage capital and the remaining 20% paid into an equities tracker (I’d suggest Vanguard LS 100% but you could use others) within an ISA.

You would then rebalance annually (or quarterly, or even constantly) by calculating the present day value of the mortgage capital payments (using Excel or a calculator) and comparing this with the value of the equity ISA. You then top up or adjust your payments to reset the proportions.

The starting ratio may drift a bit if the mortgage grows more slowly than the equities (a.k.a. ‘running your losers’), but this would at least be in the right (e.g. safer) direction and the overall process ought to smooth out some of the equity volatility over a long period.

‘MortgageStrategy’ anyone?

@The Investor

I wouldn’t say 4.99% was particularly wonderful 😉

@Luke — Hmm, no, perhaps not. Maybe try and get some extra savings together and re-mortgage when possible? (I’m sure that’s occurred to you of course!)

I talked to Nationwide about this (where I have my existing mortgage) and they won’t let you borrow to invest, it’s only if the extra borrowing is used for home improvements. Others may though. Pity because I reckon interest rates like these will be fond memory in 2-3 years and we’ll never see them again.

I’m sticking with NW though, I reckon my current life time tracker “much cheapness” mortgage can’t be beaten.

Very thought-provoking. My intuitive reaction is that you should never borrow in order to invest. However, this should logically imply that if you have an existing mortgage, you should always focus on paying it off and you should never make any investments until you have paid off the mortgage. (The two are economically equivalent.)

I don’t think I would say that if you have an existing mortgage you should not be making any investments and should instead be paying off the mortgage. This would be particularly true if the interest rate on your existing mortgage is only 2.69%. So, intellectually I agree with you, though my intuition still says it is a bad idea.

Great article, Monevator! Really enjoyed it. I think differences with UK/US investing terms, combined with my own lack of knowledge, caused some of your strategies to fly over my head. But overall I understood most of it. Are there options to lock in a mortgage rate for 30 years in the UK? I know talking to a few Canadian folks that they’re subject to new interest terms every 5 years or so.

For us, we hustled to buy our first condo by saving up a 25% down payment and locking in a 30 year, 3.25% interest rate. In a sense, we’re doing what you advised (sort of) now by maxing out our 401ks rather than pay down the mortgage early. It is may be bullish/risky, but with a decent emergency fund and low monthly mortgage payments, it makes the most sense to me.

We might eventually pay the mortgage down, but part of me would rather invest and then use gains to make the monthly payments (why not draw it out for the entire 30 year term, at a rate that low). Not to mention mortgage interest is (for now) a tax writeoff in the US. Anyways, very topical and interesting article, thanks for writing it.

Great article. As always.

Slightly off topic: I’ve been thinking about getting a mortgage for some time now. And since I regularly invest in funds and plan to keep doing so, this would essentially be borrowing to invest.

However, here’s the catch: I live in Paris and can’t possibly afford to buy my own flat here at current prices (sounds familiar, anyone…?) So I’ve been thinking about Buy-To-Let. Because I CAN afford to buy something where my parents live. Plus they would take care of the letting out etc, as they are retired and already take care of their own two rental properties. It’s also kind of a hobby for them.

Then again, I’m wondering whether this is a typical case of – I quote – ‘when you feel it’s safe to borrow to invest, it’s not actually safe to do so’. (http://monevator.com/good-or-bad-time-to-borrow-to-invest/)

Just curious, does anyone have any experience with Buy-To-Let vs. Investing and some invaluable knowledge to share?

@DonF — Just to clarify, what I’m driving at with my section you quoted is that in general people (and also funds, companies, private equity firms etc) take on lots of debt when money is cheap and everyone is doing it. At such times, it’s much harder to make good investments because all this borrowed money is driving up asset prices.

Psychologically feeling it’s a good time to borrow may therefore be a clue that it’s not.

However if you were doing buy-to-let in the provinces of the UK, I don’t see a lot of froth currently (though every time I try to make the maths work it doesn’t look super attractive to me, unless rates stay super low for a decade or so).

London is a different kettle of fish. I’ve been wrong about London so take this with a big wheelbarrow of salt, but certainly in prime and central London there’s lots of giddy looking activity going on, houses being sold in days, all-time high prices, and so forth.

@ The Investor – Thanks for the reply.

Sorry, I probably should have been clearer about this: the plan is to lock in a 2.x% to 3.5% rate for 15 to 20 years. And it wouldn’t be in the provinces of the UK but in the provinces of southern Germany, an the area known for their abundance of ‘hidden champions’ ie. there will hopefully be enough people looking for a place to rent for the foreseeable future. (Renting is far more common in Germany than it is in the UK. Many people happily rent their whole life. And there exists according protection for renters including a planned cap on rent increases.)

Don’t get me wrong, I think all this protection and moderation is actually a good thing and has spared Germany the odd bubble in the past. But it might also be the reason why, when I do the maths, BTL doesn’t look super attractive to me either. Or am I missing something here? Plus house prices in Germany have risen EXTREMELY moderately over the last 30(?) years or so (except for the last two).

‘At such times, it’s much harder to make good investments because all this borrowed money is driving up asset prices.’

That’s exactly my point: It feels like a good time to borrow. AND house prices in Germany have increased dramatically(?) during the last two years. (Germans are notoriously careful when it comes to investing. I’ve got the feeling everybody buys ‘concrete gold’. It probably doesn’t help that the domestic stock market is small relative to the size of the economy.) But then again, they might just be catching up while in the rest of the EU they are still / should be falling.

Oh the uncertainty of investing…

@DonF– Hmm, tricky. I don’t know much about German property, but I do know it’s historical backdrop, especially re: Berlin. And there have definitely been signs that things have turned around there; one company I follow has seen its Berlin properties rise sharply in value, as has a friend who lives there. Berlin is sort of a special case, but prices are rising elsewhere in Germany, too, partly I’m told because of Eurozone fears (so Germans are putting excess capital into property).

Be careful doing straight comparisons with German BTL and the UK though. As I’m sure you are aware, the German rental sector is *very* different to ours, and a tenant can effectively stay on indefinitely, remodel the property, and in at least some cities be insulated from rising rents to a great extent, etc.

Hi,

This has been great reading about property and your perspective on things. Great comprehensive thinking.

I made a very lucky property decision a few years (8 years I think) ago with mortgages, I thought that arrangement fees were going up a lot (at the time 250 pounds seemed a lot, now they are easily 5 times that), and I saw a good deal with Abbey (now Santander) with a off-set mortgage (one that links with your current account), I liked the option of paying off early with no penalties (although I never ended up utilizing that). It was a life-time tracker at +0.49% above the base rate. At the time there was a slightly better rate I could have got with a tracker but it only lasted 3 or 5 years, and there were okay fixed rates too. But I thought with arrangement fees rising this would be a great deal. For the first couple of years we would have lost out, as rates rose slightly, but it has been a winner since.

As I said, it was a very lucky decision, and good timing. I technically could push up this mortgage to a slightly higher amount, or at least it seems to give me that option online, but I like to have the buffer, and although I do invest quite a bit in funds, I don’t really like the idea of borrowing to invest. I also realise I could probably get a bank account with a higher savings rate, but I am not sure that the hassle would be worth the return in that case. Also, I wouldn’t really want to flag anything up at Santander to make them look more closely at my mortgage, and see if they could move me onto something else, as I am although a good customer, dragging down their profits.

Mr ‘Monkey with a Pin’ has a new book on inflation http://www.inflationtaxbook.com/ and what to do about it

My partner and I have just been offered a 2.7% fix for 3 years on a 90% LTV. Hoping you’re right Monevator 😉 although we do share the same view on the matter. The journey of home-buying is a frustrating one it has to be said. We were outbid on the one we truly wanted a few weeks back. 3 days ago the buyer pulled out and we have re-offered on the property as the owner is desperate to sell as is nearing exchange on their new purchase.

Waiting for the phone call today as nothing could be done over the weekend!

Tense times Lee! Nice rate though. Good luck!

Thanks buddy. The estate agent called just now and said the “old buyer” has until midday to respond otherwise its down to our bid instead. Not sure I can take much more of this lol

Investor, you have fallen into the trap of thinking there’s such a thing as “good debt” in the shape of a cheap rate mortgage. This is preserve of those who are smart and lucky—and those who are seriously inexperienced.

During economic prosperity, with low interest rates, many people talk about debt (on “appreciating assets”) as something good. It isn’t. When interest rates rise (and they always, eventually do) those leveraging to buy investment assets get hammered harder than a vintage Mike Tyson haymaker to the chin.

Most people, like yourself, would be shaking their heads. “No way,” they’d say, “leverage is good.”

I disagree, all debt is bad. When inflation does rear its ugly head (don’t suggest that high inflation will never come again) people who owe money on assets and liabilities will see those payments soar. If they can’t service those payments, they’ll be forced to sell. We all know what that will do to the economy.

@Andrew — Far, far more people — several tens of millions in the UK alone — have been enriched over their lifetimes by having a mortgage that has enabled to buy and eventually to own a house over the past 60-70 years then have been made poorer for it.

In fact, it’s been the main driver of wealth for the masses. Those who haven’t been able to get a mortgage have largely been unable to gather assets.

I am no fan of debt, obviously, but there’s a danger of throwing the baby out of the bathwater.

Investor,

I can’t imagine someone buying a house without a mortgage. But I would rather pay it off as quickly as possible, rather than have it linger. With low interest rates, much more of an aggressive payment schedule can go towards paying down the principle.

I’ve listened to Dave Ramsey’s “pay cash for houses” with fascination, because I think he gives poor advice on that front. I’m not sure if you know this, but he advocates people save up cash until they have enough money to buy a house outright. So many of the Americans following this advice (and he has a huge following) are never going to end up with a home. As home prices increase, they’ll be chasing something they never catch up to. U.S. home prices are still cheap. And mortgage rates down there are set for the duration of a loan. In Canada, there are five year terms. Down there, you can get a mortgage for 30 years at 4%. That, in itself, baffles me. When interest rates rise (and at some point, they will) it’s going to be a perfect storm for American banks, receiving a pittance in payments when global rates everywhere rise.

@Andrew — The US is a an incredibly generous place to buy a house with a mortgage. You can fix your mortgage rate at any time at the prevailing low rate, and then if rates fall lower you can re-finance without penalty. (In the UK you pay a “redemption fee” which can be several whole percentage points of your outstanding balance!)

And as if that wasn’t enough, in many US States you can still walk away from a house and leave the bank with the debt and property without penalty. Here in the UK, you remain liable until the debt is paid off or until some very long period (at least a decade from memory) has passed.

To cap it all there are modest tax benefits.

In such circumstances Ramsey’s advice seems to me as you say especially questionable. There’s basically no downside to buying with a mortgage with those criteria unless house prices are definitely too high and so very uncompetitive with paying rent. (Remember, you can walk away from your debt if prices simply fall!)

I agree with Andrew. A very irresponsible article.

I disagree – the article is very balanced. You need to do your research, understand the risks and rewards and make your own conclusions.

Well, since I wrote that post in mid Feb 2014 the market has gone up and down and all around. Tesco has slashed the dividend, Legal and General and IGG have surprised with large increases. But the most important thing is that I have continued to receive generous dividends from my shares which more than cover the interest payments on the loan. If you understand the risks and you have the stomach to not sell when things look bad I expect that a leveraged strategy will work wonders over the long term.

This is truly bizarre! I have been sittimg here for the past few weeks thinking about my problem (which I appreciate is not truly a problem in the grand scheme of things so apologise for that….but like monevator, the financial mind is always ticking). It is that I have a largish pension pot (at 51) and my house is fully bought up. I have a small ISA (16K) and a small SIPP for wife (7K). However, I have only a few thousand cash in the bank so missed maxing out my ISA in 2016/17. If I drift into retirement, taking pension contribtions I will be taxed, especully with hardly anything to use wife’s personal allowance. So I was thinking how I could get more dunds into tax free wrappers that should grow at normal market rates… what about if I took out a 5 year fixed rate mortgage at 1.69% with HSBC (say 130K against 800K property) and then the next three years ISA allowances for both of us are sorted, as well as LISAs for my 18 year old. I then do a google search to see if anyone has done this and bingo! ….. I see Monevator’s post……..and it seems I’m not insane. I’m still earning so mortgage payments will be very small in comparison and I’ll fully pay it down at the end of 5 years fixed rate with 25% tax free pension take. If there is a flaw in this plan please shout. I’m definitely not a financial expert but strangely arrived at Moveator’s position after a lot of thinking. He has certainly made my mind up…. it’s a visit to HSBC later this week.

This has been very much on my mind too recently. If I had come to this subject 4 years ago when I first mortgaged my new home (to repay the bank of mum and dad) I would have taken a far higher loan and invested it then. It seems to me that a large offset mortgage can act like an overdraft in waiting. This is what I intend to get when my current deal expires in October. I will use it as a backstop to my rather lumpy and irregular (but more or less sufficient) income to ensure that my whole family’s ISA and SIPP allowances are filled with absolute regularity for the next few years. Basically I am taking a punt that the stock market will deliver a better return for my family than my mortgage will for my bank, over 25 years. With rates as low as 1.19% for an offset mortgage, this seems like a good bet to me.

Does anyone have any up to date thoughts on this. Paul, I’d be interested to hear from you. Yorkshire BS told me this week that they will not finance this approach for me.

Hi Alex,

I’m not sure what the rules are by lender and mortgage type specifically, but as I have genuinely considered major home improvements in the past (including an annexe for ageing dad) I’m not sure I’d even tell them what the money was for – in fact one company I spoke too said I would be treated as a first time buyer as I haven’t had a mortgage for years ….not sure they all see it like that. When I went through the application process on HSBC it became apparent that you need to be on a basic salary of £100K in order to get an interest only 5 year deal @ 1.69%. I’m a little shy of that so won’t qualify for that particular deal (although working on it!). For me, it’s as much about being able to utlisise the allowances as it is about making a return …… I know over a 5 year period I could lose out if markets tank, but equally I’m risking 130K @ 1.69% so really can’t see a reason why you wouldn’t. At least when I hit 55 I”ll have a few years ISAs in place whcih means I can combine drawdown from pension and ISAs to maximise tax efficiency.