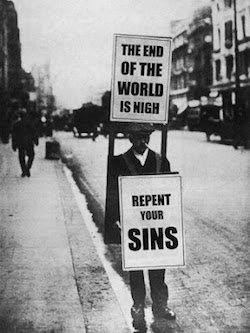

There’s nothing like a bear market to bring out the doomsters and hindsight heroes. Throw in a global pandemic, and it seems half the population is walking around with a sandwich board proclaiming the end of the world is nigh.

Actually, that does a disservice to the bloke on the High Street reading Revelations aloud.

At least your standard apocalyptic visionary stays in their lane. Many who claim stocks are toxic or that FIRE is finished were bull market cheerleaders a few short months ago. Some who argue airlines will be forever mothballed were warning ever more flying would cook the planet when this year began.

Don’t get me wrong. The pandemic is a threat to life and to share prices. The consequent economic shutdown is even worse for markets – and it’s not good for our long-term health, either – although with the data we’ve got you can see why Governments felt they had no choice but to try to curb the virus’s spread.

Time will tell. History must remember we were all groping in the dark.

The same is true of share prices.

It is easy to see why markets tanked at speed given we’ve driven the economy into the buffers. Massive monetary and fiscal support will not stop disruption or prevent profits turning to losses like the slumping A-Level grades of a nerd who discovers the dubious joys of a spliff while their school is shutdown.

But the pandemic will not last forever.

Holding back the years

Remember share prices reflect the best estimate of the value of a firm’s future earnings into perpetuity – discounted for uncertainty the further out you look.

Risks to the downside abound today. That ramps up the uncertainty discount.

At the same time we can be pretty sure that cash we thought would hit company bank accounts in March, April, and May will be much depleted.

Some firms will go bust. You can’t earn future returns if you’re bankrupt!

But for all we don’t know about it, we do know this coronavirus looks like a fairly typical upper respiratory tract infection that will run its course. Maybe we’ll get a vaccine, maybe it’ll burn itself out, or maybe it’ll become endemic and most of us will eventually get some resistance.

That’s hardly the end of the world.

In a couple of year’s time – maybe sooner – we’ll still be recovering from the economic impact, but we’re unlikely to still be glued to the virus statistics.

So what’s really changed – and what is just a reminder of what was always true?

Markets fluctuate

There’s nothing new about a bear market. You can see that crashes happen quite often if you stand back and take a wider view.

But shares still deliver good returns over the long-term.

The recent crash was extraordinarily speedy, but even that’s not novel.

As David Gardner, the co-founder of The Motley Fool, puts it:

“Stocks go down much faster than they go up, but they go up much more than they go down.”

Your mate in the office is not George Soros

There are always people who claim they sold out entirely three months ago because it was ‘obvious’ prices were too high, or that this or that would happen, or because they had a funny feeling.

I know because people message to tell me how sad they are not to have done the same.

I happen to believe investing edge exists. But it’s vanishingly rare, and it’s never manifested in huge market timing bets that repeatedly pay off.

The fact your nimble friend is not calling you from their private island is a big clue!

Independent financial advisors are not market timing geniuses

A worried friend forwarded an email from their financial advisor. It was sent at what was (to-date) the height of this sell-off in mid-March, and it strongly urged him to sell half of his equities and wait to reinvest when “things were clearer”.

This isn’t necessarily awful advice, depending on the client. That it was blanket guidance was the first red flag. Worse was the IFA claiming that normally they could read the runes of falling markets and get out before major damage – but this one had been too speedy.

It all smacked of self-preservation to me. Your IFA should have set you up with a sensible balanced portfolio, ideally passive, ahead of times like this. Because they happen!

If for some reason you both believe they’re great market timers, the evidence should already be apparent. They’re almost certainly not, and if you hear this kind of thing you might consider getting a new advisor.

Active investing is still a zero sum game

A golden oldie, we’re hearing this crash is a chance for active funds to shine. But the mathematics of investing shows it is impossible for active funds on average to beat the market through stock picking, regardless of whether share prices are up or down.

The average active pound invested will deliver market returns minus higher costs. Active funds’ only advantage over passives – as a group – is actives tend to hold cash to meet investor redemptions. This cash can cushion falls in a bear market. The same cash balance will have held them back in the prior bull market.

Individual funds and managers can do far better than passives of course, whether in rallies or bear markets.

But most will fail to consistently beat the indices, and the snag is always finding the winners in advance. Nothing has changed.

Passive funds have been on a ‘rollercoaster’

I’ve heard several fund management insiders conceding passive funds had a great ten years, but claiming the downside was being on a ‘rollercoaster’.

Firstly, active funds are, with passives, the market. They’re on the same ride.

Second, active investing is a zero sum game so there are no gains to be had for the typical investing pound, just higher costs – rollercoaster or log flume.

Finally most of the last decade was pretty placid in the markets – more like an escalator. Some active managers even bemoaned this as driven by ‘passive mania’ and ‘the Fed propping up the markets’. They blamed it for hurting their returns!

You’re not hearing advice from most fund managers. You’re hearing marketing.

It’s never the time to go all-in on anything

Some now say the crash has proven we’re headed for a depression, and it’s time to go all-in on government bonds.

Some say even government bonds are too risky due to high prices and ballooning government debt. Go all cash!

A few say it’s time to go all-in on equities, because this isn’t the end of the world, shares are cheap, and cash and bonds will deliver lousy returns.

Most of us should never go all-in on anything. The future is uncertain, and a good portfolio reflects that. Sure, have an asset allocation that accounts for your age, your time horizon, your earnings and liabilities – and tilts towards your gut feel if you must.

But don’t bet everything on anything. You could be wrong.

High-quality government bonds bolster your portfolio

For nearly a decade we heard high-quality government bonds were in a bubble that was about to burst. In recent years this turned into the widespread claim that bonds were ‘riskier’ than equities.

This is and was always nonsense. Shares just fell 30%+ in a few short weeks. Bonds held up, as we’d hope they would.

Over the long-term bond returns will probably be lousy. You own some bonds to cushion your portfolio when crashes happen and to sleep at night, not to get rich.

Equities will deliver superior returns in the long run

Don’t mistake that last point for me having any great enthusiasm for government bonds as an asset class right now.

I’m not excited about my house insurance or my smoke alarm, either. That’s not why you have them.

Stock markets will almost certainly deliver far higher long-term returns than government bonds from here. Even long-term bonds are now priced to deliver seemingly derisory returns – barely one per cent per annum in the longest-dated UK issues.

It’s one thing to expect a depression. It’s another to think it will last for 50 years.

Buying shares is hard in a market like today’s, but if you’re a long-term investor you’ll almost certainly be rewarded.

A week or so ago I pointed out that the panic had already been extreme, and it was best now to stick to your plan.

It’s rarely a good time to panic, but too late is never the moment.

Cash is always king

The dash for cash that saw almost everything sell-off in the first weeks of the crisis revived the motto that ‘cash is king’.

Well, cash is always king. It’s predictable like no other asset class. You can buy things with it. It feels good to have a fat wodge.

If I could achieve my aims with cash then I wouldn’t invest in anything else.

Sadly, I can’t. Even the richest person has to guard against inflation, which eats away the real value of a bank account balance like whispered court intrigue whittles away the power of a prince.

Ordinary inflation means 99% of us can’t even consider going all-in on cash, assuming we want to retire some day. The risk of hyperinflation means nobody can.

Despite this, cash is king. Never forget it.

Markets lurch about when they fluctuate

As I said, markets fluctuate. Sometimes they do so wildly, as recently. Because it’s 2020, many blame this on algorithmic trading – particularly those active managers who are forever casting around for a scapegoat.

You can read lots of articles explaining how robot traders have shunted about this or that asset class – let alone individual shares. I don’t doubt they’re a factor.

But markets have always become unmoored in times of panic. These big moves are nothing fundamentally new.

Besides, the programs were written or trained by humans. We’re the same as we were in the 1920s, when we also boomed and bust.

Market falls enable market gains

Stock price falls are what set up your future gains. Without volatility, the returns from shares would be much lower because everyone would own them and bid away future profits.

Lower prices improve expected returns. All those markets everyone fretted were too expensive look a lot cheaper now. For example, Vanguard says the expected return from US shares over the next decade has improved by more than 50%, from 4.4% to 6.8% a year:

If you’re an active investor who successfully picks stocks, it’s even truer. You make your best buys in bear markets, but you don’t know it at the time.

There is no magic money tree

Plenty of leftwing columnists have asked how the Chancellor has suddenly found hundreds of billions of pounds to support the economy, when there was no money available for their pet projects in the past.

Governments can always create money to pay for spending by issuing debt. But there’s always a range of consequences, from (potentially) higher rates and (often) a weaker currency to (likely) higher inflation or (perhaps) the misallocation of capital and (consequently) lower productivity.

The reason this is less risky right now is because at the same time we’re ‘creating money out of thin air’, the economic shock is effectively ‘destroying money out of thin air’.

The aim is for these to roughly net out.

Do nothing and we risk deflation, or perhaps even a depression. Do something and we’ll hopefully get to worry about inflation sooner than we otherwise would.

Some day we’ll need to deal with these massive borrowings, whether through taxes or by shafting the holders of government debt by inflating away its value. A combination seems most likely. Our economy will be stronger than if we’d done nothing, however, making dealing with the debt more feasible.

Economies need to grow

On the flipside, we shouldn’t think throwing the economic switch into power-saving mode is a trivial undertaking. We will see a monumental short-term hit to growth. The big question is how long the downturn will last, and how easily we’ll be able to pull out of it.

Economic growth isn’t just a boon for billionaires and Davos attendees. Lower growth means fewer goods and services produced for us all to enjoy, plunging tax revenues, and ultimately less money to spend on great things like education, carbon capture, and mammograms.

We are paying to save lives now at the cost of future prosperity, and even some future lives. It will be decades before we have any idea how this equation balances out.

We probably do not face a Great Depression

This is an opt-in recession. Economic growth was recovering before the virus hit. There were not huge structural imbalances in the economy as we went into global lockdown.

This is important. It implies there’s still the hope – though probably not the expectation – of a ‘V-shaped’ recovery when we exit these measures.

Who knows what will happen, but I don’t expect a depression. I believe if things look that dire, then neither the public nor governments will stomach it.

Before that we’d likely try a different tack, such as more aggressive/supportive isolating of the vulnerable and the misunderstood ‘herd immunity’ approach for the rest of us. By then we should have bought time to ramp up breathing equipment for the ill, protective clothing for medical workers, and testing for all of us.

Things can always get worse

I’m not blasé. I can imagine a wide range of dire developments, from repeated and virulent future waves of infection to China going back into lockdown to mass-deprivation in India to political upheavals. You could argue we have all the ingredients for a full-blown disaster.

Heck, maybe another entirely different virus is set to emerge from some swampy hinterland to play tag team with COVID-19 – there’s nothing in the rules that says because we have one we can’t get another.

The pandemic proved this can happen. We’re just more alert to it right now.

Things can also get better

The lockdown could work out better than expected. Spring sunshine could reduce infection rates. We could devise a brilliant treatment that turns infection into an annoyance for even the vulnerable. We might yet discover half of us have already had COVID-19. Eventually there’ll be a vaccine.

Maybe there’ll be an innovation dividend from the crisis. During wartime, hard-pressed societies can achieve in a few months what normally takes years.

Perhaps the miserable trend towards nationalism will be reversed as we’ve been reminded we’re truly all in it together.

FIRE is not finished

I’ve heard people opine the Financial Independence movement is over because the market has fallen 30%.

This is ridiculous on almost every level.

As I’ve said, market drops are not fun but they are normal. Young seekers of financial independence should be pleased at least that shares are cheaper. Good asset allocation for the rest of us takes into account a bit of chop. Those SWR models included periods of big market falls – they just look less scary seen in the past!

I doubt people who saved money and learned to live within their means will regret it as we head into a recession. The FIRE movement was ahead of the game.

We will eat out and go on holiday again

At the end of the day it’s overwhelmingly likely that very little will change from the COVID-19 pandemic – at least if we dodge a second Great Depression.

We will still go to offices. We will still use Tinder. We will still get on planes.

Some pundits have reminded us that people resumed flying after the September 11 attacks – despite worries to the contrary – so we shouldn’t assume airlines are permanently impaired.

This is true, but the recency bias went much deeper than that.

I remember one worthy writer explaining that Hollywood blockbusters were done for, because nobody would want to sit through a reminder of what had unfolded in real-life.

A few lunatics predicted the end of comedy. How could we laugh after such horror?

In reality within a few years Hollywood was making disaster movies about September 11 and everyone flew everywhere.

There will be consequences at the margin when we get through this. I’m sure people will Zoom a bit more, fly a bit less, and working from home will be less frowned upon.

But millions of us have been Skype-ing and working from home for years. If everyone wanted to do it before now they could have. Many people can’t wait to get to back to the office.

We may save a little more money if we can. We will be taxed more. Governments should be better prepared for the next pandemic.

But otherwise life will go on almost exactly as it did in the past.

Comments on this entry are closed.

“FIRE is not finished”

Amen… it’s actually more relevant than ever. Those who make enough to save but have lived paycheck to paycheck might now be forced to reevaluate their relationship with money, stuff, and their values.

I think when this is all over our ranks will grow, but it will take time.

Well today is FIRE day, so despite the lack of leaving parties (darn, was at least hoping for a cheap drink or two!) there will certainly be a few things changing for me in the coming days/months/years.

I’m lifting a sincere glass to Monevator here and now: without you I don’t think I would have had the courage or wisdom to do it 🙂

Well done MJCross! Celebrating with you….

On a more mundane note, I have a practical question for the more experienced people out there.

It’s the end of the tax year, which is when I rebalance, switch to ISA etc.

I’ve never had to deal with this, though, in such turbulent times. And there’s the Easter break, too.

If I actually put an order in on a fund platform, before the end of the tax year, will it be counted towards that tax year (for CGT etc.), even if the transaction takes days to implement? I think there was something called “taxable date”? I’m just worried that websites may be a bit busy…but if I act too soon, shifts in the market might spoil my sums. How do other people deal with this?

@Haphazard, if you have the cash why not pay it into your ISA now? You could always leave it as cash while you work out where to invest it, or drip feed it in over a few months if that makes you feel happier.

@Naeclue – I don’t have more cash to add! I’m just switching investments from taxable (out at the end of this tax year) into ISA (in at the end of the next tax year). And rebalancing at the same time. It’s just about not wanting to be out of the market for a wild fluctuation and/or miss the deadline.

Hello there, Mr Investor

Long term reader but not usually keen on commenting. However I must make an exception because I feel a debt of gratitude to you for giving me the courage to keep on my investing plans for this year, even in the middle of all this turmoil. Best wishes and stay safe.

The claim that we are better off in active funds when markets fall has been proven wrong in every bear market I have invested through, but lets see how they have done so far this time.

Not a thorough analysis, but looking at the 1 year performance of Global ITs compared with the iShares global tracker ETF SWDA, shows 4 ITs beat SWDA on total return, 1 matched it and 11 underperformed. Of those that underperformed, 9 were serious dogs with returns between -16.3% and -33.5%, compared to -5.5% for SWDA.

ITs can suffer badly in bear markets due to widening discounts and being caught out through gearing, so probably fairer to look at OEICs instead. From Hargreaves Lansdown’s web site, filtering Global funds, accumulator versions and “unbundled” charges, gives 205 funds, with 3 month returns ranging from -0.80% to -42.6%. The global index funds are all in the middle of the pack, with 3 month returns between -17% and -18%. The worst performing fund is called Quilter Global “Best Ideas” 😉 I would love to see their worst ideas.

So at first sight it looks like the “Active beats passive in bear markets” yarn is as wrong as it has always been.

@Haphazard, not sure how to handle that. I always bed and ISA at the beginning of the tax year and do it by adding cash then trading out of something and back into the same thing. With OEICs, I always get the same trade price for the switch as it is set once per day, but if I buy and sell an ETF there is usually a small difference in price due to the spread and market movements in the few seconds between the trades.

I think you would need to ask your broker how they handle “Bed and ISA” deals of the sort you want to do as I can easily see it going wrong.

I’ve invested (actively, slap my hand!) in some companies that were selling part of their businesses. That sale then provides them with liquidity. The fact those businesses are

a) not able to be sold today

b) will almost certainly be worth less coming out of the L, W or U or whatever we find ourselves in may mean reappraisal of selling as the reappraised sale price may mean not worth it.

However, in the meantime those businesses who can’t sell divisions may have a liquidity trap, when (referring to @TI’s Cash is King) for a business having decent liquidity is king (you don’t want your bonds going to junk status do you!). Do you know, for businesses greater than £45M, if the government’s stimuli will loan money and keep those businesses running? From what I’m reading there is reluctance to grease those skids.

In the meantime I call BS on the Chancellor’s £330Bn stimulus package. Hardly any of it will probably be used as there are lots of people and businesses that fall through the cracks (mine included, despite not being able to do anything!). The bits used by furloughed salaried employees or contractors are small enough if it’s a 3/4 month lockdown (and I suspect testing kits available for home by then) – probably in the realm of £60Bn of the package and even then some of it gets paid back with National Insurance and Tax!!!

Stay safe everyone.

What about the smart-arse strategic bond funds that can nimbly move you out of harms way when the SHTF? Well of the 51 available on the HL web site, 50 have lost money over the last 3 months, the worst (Artemis) losing nearly 16%. The only one that did not lose money (AXA Sterling Strategic Bond, up 4.7%) did about the same as the iShares gilts ETF IGLT, with a gain of 4.8%.

I haven’t bought or sold anything yet.

Preference shares were temptingly cheap – almost 10% yield at one point.

But i didn’t have meaningful money available.

Ratesetter money is due to mature in July/August, but I’ve asked for it back earlier (if possible) – fingers crossed.

I promised myself I’d buy oil if it got close to $20 a barrel – it seems so cheap.

Any oil fans with insights to help keep me inactive?

B

Let’s see, let’s say you have a market with 1,000,000 index investors and 1,000,000 active investors. and the 1,000,000 active investors all own only one stock, say Apple. And maybe Apple has record high earnings so 1,000,000 new investors enter the market, they sell their rental real estate and decide to all be active traders and only buy Apple stock. The other active traders refuse to sell their shares, they hold every one of their Apple shares tightly. So the new investors buy all the shares from the index investors. Due to the demand for the shares Apple goes from $250 to $500. The original active investors make $250 per share, the new active investors all make money too because only the last share was purchased at $500. Every other share was bought for less so in fact all 2,000,000 of the active investors made money. How is that a negative sum game? I think you would be right if the pool of investors and the amount of money in the market was fixed, but the truth is active traders are in and out of the market all the time so the pie can get much larger very quickly as new money floods in. Active profits do not have to come from the losses of other active traders, they can come from new money. I’m not saying I’m right but it seems much more complicated than a zero sum game would explain.

@steveark — Hi. Your initial premise is wrong. Anyone who is selling their Apple shares is an active investor. Index funds wouldn’t sell their shares. Please read the original articles and comments, this isn’t controversial at this level. 🙂 (There’s some minor debates to be had around certain technical stuff such as stock buybacks/issuance, etc).

@Boltt — There is talk of the oil price going negative! The idea of being paid for buying oil really appeals to me I must admit. Sadly I lack the storage capacity… you can’t spare an oil tanker or two? Regarding preference shares I managed to grab a few when they were down near par, which I liked because it got rid of some of the redemption risk that arrived with the Aviva kerfuffle a couple of years ago. They’ve bounced now though. 🙂

@Naeclue — To be fair to those strategic bond fund managers, the entire asset class has been in tumult — even Treasury ETFs were at a notable discount at one stage! Maybe they ducked and dived and will come out smelling of profits when things calm down. Okay, I wouldn’t hold my breathe either. 😉 But probably not quite fair to judge them in the midst of such a storm.

Great article. Thank you!

My question is: how has Vanguard Lifestrategy 60% performed in this crash?

It came out in 2011, in the bull market. And ever since then a debate has taken place as to whether it was only doing well as it was only ever in a bull market, but it would fall down in a bear market…

How do you think it’s actually done compared to other funds? Have the bonds actually done their job and cushioned the enquity fall? Is VLS60 well positioned to make the most of the next rises in the market?

I believe it’s gone down by 12.5% as of today?

Thank you.

@MJCROSS @devinco — Thanks for the kind feedback, and you’re both more than welcome. Congratulations on making it over the finish line MJCROSS! Not the best time to do it I suppose, but on a bright note you’ll have plenty of time to soak up the freedom when everyone does eventually return to the Groundhog Day Grind. 😉

Just a minor technical point

This virus seems to be targeting the lower respiratory tract-coughs and breathlessness

Lungs seem to be a target

xxd09

Between 27th Feb and 3rd Mar, I sold my holdings in the Vanguard Lifestrategy fund (20/80, £140k) and my HSBC Global Balanced fund (40/60, £100k) as I could see their value falling rapidly, in line with the drops in the global markets. I took a hit but it was not as severe as it would have been if I had sold today. It was a decision I made in haste in an effort to preserve the capital in my SIPP and ISA as I am planning to retire in approx. 15 months time when I aim to go into draw-down. I think my decision was rational as I am 64 and do not have the long time needed for the current bear markets to recover. The problem now is that alongside a few loss making stocks, I now have a load of cash sitting in the SIPP and ISA accounts, earning nothing! Cash is king, but its earning nothing and the platform I use does not pay any interest. So, I am now waiting for the Covid-19 to disappear before re-investing in a 20/80 fund. There may be many others who have done what I did and have the same problem – any thoughts or suggestions will be welcomed. Maybe I should talk to a IFA

I read them before I commented, very well presented. They shed no light on this as far as I could see, but I might not be seeing clearly . Zero sum games are what thermodynamics and physical chemistry are all about. I’m a licensed chemical engineer, we do energy balances and mass balances for a living. In minus out equals accumulation, that’s our definition of the world, the ultimate zero sum game. Because the market grows and shrinks with the economy I do not see a way to apply a steady state concept like zero sum to it. You’ve got an interesting concept but I’m not sure you can have zero sum anything in an expanding or contracting economy. I was trying to show that by an example but didn’t pick a very good one. Another try, what if my new active investors want Apple but my old active investors won’t sell at any price, and as you say the index investors can’t sell. What happens to Apple stock price? It heads toward infinity, right? Now what does one million dollars per one Apple share price force the index to do to rebalance? Does that not force the index to either buy or sell Apple? Heck if I know. I’m not trying to argue, I loved your post, it’s just that I’ve made many millions in my career by recognizing problematic designs even if I could not pinpoint the flaw immediately. And this feels incongruent, but it maybe me that’s off. I prefer to think its semantics and we are both right.

@TimePasses. So far you have been lucky. You sold your shares and the market has fallen further. But your luck will change when the market rises and you are still in cash full of regret that you missed out on gains. If you ‘wait for the Covid-19 to disappear’ what do you think will have happened to markets in the meantime? I think you need to have a quick think about your risk tolerance (from the way you write understandably low at 64), decide how much further loss you can tolerate, remember that even at 64 you should probably invest to a 20 year time horizon and then get back into the market without delay. The figures you give suggest that your equity:bond ratio is 72:28 which is quite high. You could consider something more like 50:50, for further downside risk-mitigation you could get back into the market over a few weeks / months and if you are really nervous about losses you could go down the annuity route for some of your savings (you definitely should have professional advice before doing this though).

Technical quibble: COVID-19 is the disease, the virus is SARS-CoV-2

Further quibble @TI * know this coronavirus looks like a fairly typical upper respiratory tract infection that will run its course*. Covid-19 is an extremely ATYPICAL respiratory viral clinical picture in its natural history, the pattern of lung injury, its effect on blood coagulation, the immunological response etc etc. That’s one of the reasons healthcare professionals are scared as it is unsettling to deal with a strange pattern of disease that kills quite a high percentage of hospital admissions (though low percentage of the population overall) None of this changes the investing insights and wisdom in a brilliant article though. Thank you.

My ex-husband was an engineer. We’re much happier now.

@Steveark (fellow insomniac / early riser ). But that isn’t how Tracker Funds work. In your scenario where Apple shares are going through the roof because of high demand the Passive Investors who hold the (Market Cap) Tracker Fund don’t do anything and the custodians of the TF don’t do anything either. They just enjoy the fact that the fund units are worth more because one of the equities held in the TF (ie Apple) is worth more. @TI, Vanguard, Jack Bogle are all certainly right.

The zero sum is because for every buyer of a share there must be a seller. The market is simply the aggregate of all these transactions. For every genius investor who beats the market there must be ‘bad’ investors who in aggregate lose to the market to the same extent. I am sure @TI can explain it better but you may want to look at the beginning of The Little Book if Commonsense Investing by John Bogle. He lays it out the zero sum argument with beautiful simplicity and concision.

Transactions (buying and selling stocks) are zero sum. However market capitalisation can and does change over time which is perhaps what you are referring to Steveark?

Hmm, I’m not an IFA, but if I were, I’d be much more inclined to send out an email saying:

“When we met we discussed your risk preferences. We discussed the bad times as well as the good. We built your portfolio with this in mind.

Do not give in to short termism. Stay calm.

Remember: You are in this for the long haul.

Stay calm. Stay protected. Stay home.”

Here’s the link from the original article above again, as well as a second link which explains why investing (/markets) itself isn’t a zero sum game, as has been said it’s the trading (trying to beat the market) that’s to all intents and purposes zero sum.

Is investing a zero sum game?

https://monevator.com/is-investing-a-zero-sum-game/

Is active investing a zero sum game?

https://monevator.com/is-active-investing-a-zero-sum-game/

The latter (long!) article links/references a couple of other more esteemed sources than your humble blogger if anyone wants a second/third opinion. 😉

TimePasses

You have got yourself in a really tough situation

You cannot survive on cash alone

Equities give you growth and are risky

Bonds give you stability and low growth

Obviously you did not have an acceptable written down Investment Plan

Your Asset Allocation was not right for you-too risky-too many equities

Some rough guides

Your age in Bonds ie % of bonds in your portfolio should be nearing 60%

You should have at least 2 years living expenses in your cash account (at least you can get that right now!)

In an ideal world you would immediately reset your Investment Plan and Asset Allocation to one you can live with( downturns of various magnitudes occur regularly-every few years-2000,2008 and now 2020)

You will be in this situation again before you die!

Then put your money back in the market at once at these current low prices so that your portfolio does not lose out on the inevitable stock market upturn whenever it comes

Upturns can occur over a few days(like downturns)!

I am 73 retired 17 years with a 30/65/5 portfolio ie 30% equities/65% bonds and 5% cash

and can ride out the present storm doing nothing-portfolio down 8%- I can live with that

Even sleep at night

Something to aim for?

Good luck

xxd09

@xxd09 – would it be possible for you to share the funds/ETFs/ITs that constitute your portfolio?

@TP when you say VGLS 20/80 do you mean 20% equities? (Usually the 1st no. refers to the equities portion).

You’ve taken a big punt and called it right – so far so good. I think xxd09 advice is good. section off an accessible emergency fund in cash, prob a years worth of expenses or thereabouts and then monthly drip-feed the rest back in to an asset allocation that fits better with your newly acquired experience of your risk tolerance.

@TP – sorry meant to add the drip-feeding should be complete, i.e. all available cash re-invested, over a period of say, 6 to 12 months. I would prob say that would be easier to deal with psychologically than piling back in a lump-sum given current volatility and the consideration that in many ways this pandemic is still early days

Rhino

26% Vanguard Developed World ex UK(VVDVWE)

4%. Vanguard FTSE U.K. AllShare Index(VVFUSI)

65% Vanguard Global Bond Index Fund hedged to the Pound (VIGBBD)

5% Cash Tesco Internet Saver -1.4% Interest Rate

Had this Asset Allocation for many years

xxd09

@xxd09 — Excellent comment and insight, thank you for sharing. In a five year’s time no doubt we’ll have people again scoffing* about why anyone needs to be in anything other than 100% equities, because in the long-term that should usually deliver the highest return if you wait long enough.

At least when that happens there will be more of us around to tell the other side of the story! 🙂

*I have no problem with someone being 100% in equities (not counting an emergency fund and if they’re in their 20s or even 30s with good earning prospects and a tough investing constitution). I do have a problem with people in their 50s and 60s who have been investing for five years telling me that bonds are useless and far more risky than shares because the returns are so low and they *need* higher returns to meet their retirement aspirations but no they’ve never lived through a bear market, but sure they’ll feel fine because they looked at a share price chart of the last one. 😉

Rebalancing with new ISA money?

(Possibly not the right post for this question): Inspired by Hale & Monevator I’ve built a ‘slow & steady’-style diversified portfolio (7 funds/shares) in an ISA and simply rebalanced every April with new money. I hold ASL as the ‘UK value/small’ part, and so am faced with having to buy (for me) quite a significant amount to keep the ratios the same this time around. I notice Ermine is shorting half his ASL! Since starting investing (around 2010) I’ve always been an evangelical passive investor, but this is the first time the required automatic behaviour feels wrong.

Any general words of wisdom? There must be a lot of people in a similar boat…?

I guess the answer is ignore the feeling and do it anyway, or perhaps split the new money across the next few months if really worried…

@Steveark, there is a brilliant video by Warren Buffett that explains why active investing is a zero sum game. Unfortunately I cannot find the link, but here is the gist of it.

Imagine half of all shares are held by do nothing passive investors. They don’t trade, they just sit on the shares collecting dividends. The other half is actively traded, with investors buying, selling, borrowing and shorting, or simply holding a subset of the market, but not by market cap. So some might hold only apple shares and not trade them. For the definition of passive here, anyone who just holds apple shares is an active investor even if they don’t actively trade them. (This is where passive/active differ from normal dictionary definitions).

After a year, let’s say the market has risen by 10%. The passive investors, holding half the shares, have seen their shares rise by an aggregate of 10%. What about the other half of the shares, traded all year by active investors? Well this half has gone up by 10% as well. Despite(*) all the frenetic activity, the active half of shares in the market has gone up by exactly the same amount as the passive half. Every passive investor will have made 10% (plus dividends). There are of course a variety of outcomes on the active side. Some will have made more than 10% from shares, but for that to happen some will have had to have made less than 10%. This is where the zero sum game come in. Zero sum does not mean that active investors make zero (they made 10% before costs).

A share held by an active investor will rise or fall in value by the same amount as the same share held by a passive investor. This simple fact leads to the zero sum game being a mathematical certainty.

* Not really true. It is because of the frenetic activity of active investors that the market has risen 10%! Passive investors need to be grateful to active investors for creating the market.

@JDW, 3 month returns on Vanguard LifeStrategy funds, according to Hargreaves Lansdown:

100% Equity -18.0%

80% Equity -14.3%

60% Equity -10.4%

40% Equity -6.5%

20% Equity -2.6%

So on the whole, they have worked as expected. 10% down for the 60% equity is I think similar to my own 60/40 portfolio. The LS funds overweight the UK, so have suffered a little more on the equity side than a global cap weighted portfolio. There must have been a lot of trading going on in the LS funds as they rebalance daily. In contrast I rebalance annually at the beginning of January and have neither bought nor sold anything, so my portfolio is no longer 60/40!

@PassiveNoob, ASL is not something I would invest in and have little knowledge of, but I would suggest that the damage has already been done. It appears to be on a very large discount to NAV, so some might say you are getting a good deal over the long term by being able to buy into those small cap shares at a high discount to market price. Malkiel in A Random Walk down Wall Street says that buying closed ended funds on big discounts can be a market anomaly worth exploiting.

As for shorting ASL, that must be very expensive. Only reasons I can see for doing that are 1) Lack of liquidity makes them hard to sell at market prices or 2) to avoid taking a CGT hit.

Now is not the time to start questioning your strategy. Stick with it would be my advice and embrace the low prices, assuming that is you are unlikely to need the cash for 10+ years. If you are at risk, say from losing your job, then it may be worth hanging on to your cash.

When this all blows over is the time to consider changes to asset allocation.

We still have the toddler on loan from my daughter and son-in-law both of whom have the plague, feel awful but as far as we can tell are not expiring. Latter is good news for many reasons, including that Mrs Hospitaller and I are having huge trouble keeping pace with the toddler. But she is very, very, sweet.

Investing-wise, I would say that I was an active investor and also use mostly active funds. which as far as I can tell have been doing a good job picking up equities which are in relative terms well-priced after an indiscriminate sell-off.

I agree with the main thesis that the world is likely to keep turning. And so I have been dropping money in at levels of market decline which I defined a long time ago. And I will continue to do that if the last bounces take us beyond the recent depths. After all, if the world stops turning or I get plague, I will have other concerns.

@PassiveNoob — I can’t give personal advice and don’t know your total situation anyway, but I would offer the following general thoughts on this to you and similar passive investors:

You are correct. 🙂 In general, unless someone’s situation has changed markedly (e.g. you’ve lost your job) you should keep on with the plan.

This isn’t just for some kind of masochistic reasons, or because it’s a good time to make a quick buck or anything like that.

It’s because all the studies that convince us that long-term investing works (e.g. the SWR studies etc) assume that the INVESTOR KEEPS INVESTING.

The models do not assume that the investor gets cold feet whenever there is a downturn, stops contributing for a year, or god forbid sells then buys back.

It’s up to every investor what they do. They can of course sell or stop contributing if they choose. Perhaps if it’s the only way you can sleep at night that is what someone should do. There are NO guarantees the market will recover, certainly not anytime soon.

However if you do deviate from the regular investing / reinvesting that the plan was based around, then you have to accept you’re also deviating from the returns you’d expect from long-term studies.

You may do better for it. You’ll more likely do worse.

Either way, differing actions due to variable emotions et cetera aren’t in the passive investing backtesting. 🙂

@PassiveNoob in a couple of days, just before the start of the new Tax Year, I will quit shorting ASL, I have wound down the short from half already. I will then take the amount of money they were worth before all this kicked off, and buy half that much to add to the stock probably about a week before the end of this month. In another month’s time if they are cheaper I will buy another quarter of the cash value, hopefully I will get more shares. In another couple of months I will repeat the exercise. I will end up with twice as many ASL shares as I started with, though the market value will probably be lower 😉 ASL is a particularly sick puppy because it is an investment trust so discounts widen, and of course small caps are roadkill in the coming months.

FWIW I regarded shares as about 20% overvalued before this kicked off, I cannot understand or have any feel for why the suckout isn’t a LOT worse because economic activity will be hammered and a lot of companies will go to the wall. I expect this got a lot worse before it gets better.

But you have to buy into bear markets. I kick myself for having bought into the bull last year, though at least I had a decent amount in cash and premium bonds, because I couldn’t bear to buy too much into such an overvalued market. But the corollary of that is that I must be prepared to buy into lower valued markets, even where every instinct is that they are nowhere near undervalued enough. I have cash, the new tax year is coming, I have an income that meets my basic needs. Why would I not buy? I will start with ITs though, because the discounts mean I get more for my money. Monevator’s seen this movie before. After next year I will no longer be a net buyer. I was going to eke out the cash over the next few years to supplement my income, but a bear market presented itself and it would be rude not to but into it. I may not survive the virus, in which case it’s not my problem, but if I do get to look back in five years time my older self will probably appreciate the income top-up.

No, I don’t believe in passive investing. Valuation matters. Bear markets are when stocks are returned to their rightful owners. I want to get some of that 😉

Well it looks like I’m mustering up some courage after all!. Perhaps the fact that my employer is hiring rather than firing has helped. So I just moved a small stash of cash into my ISA. Don’t want to lose that bit of my allowance. As to allocations, well, if I cannot bring myself to buy the funds at -18% then I wouldn’t be doint it right, would I?

@ermine, I am a passive investor and believe that valuations matter. This is not in the least bit a contradictory position to take.

What I don’t believe is that valuations, which are widely known to the market, give any investor an edge over the market.

@TI, you make a very good point about the returns from long term investing through thick and thin. There are a number of studies showing that private investors fail to achieve the returns of the funds they invest in by getting cold feet, market timing, buying high, selling low, etc.

@Naeclue we are probably in general agreement even in your second paragraph. But given that I am old, and do not have a 30-year accumulating horizon but at best two ISA-worths of buying to do, valuations informed me when to hit it and when not, Most people on here hopefully have long accumulating periods in front of them, in which case they are looking at an open goal this year if they don’t have higher priorities on their liquidity.

Thanks for this, TI – I’ve always enjoyed reading your posts and amid all the doom and gloom and antics of the Covidiots, appreciate them now more than ever.

Well it was just pure good luck that I decided last summer to up my bond allocation (from 10% to 30%). Although I’ve been sleeping soundly at night despite the bottom falling out of the markets, I think I will start edging this towards 40% over the next couple of years.

@ermine, out of curiosity, why do you consider valuations to be low now, given the reasonable expectation that C19 will be damaging to company earnings?

Sure, share prices have gone down, but I haven’t a clue at present whether current market valuations are high or low.

Hollywood did indeed return to making disaster movies, however it stopped making comedies of any value many years ago.

With such indiscriminate selling down, looks like a global equity index tracker will be a solid way back in when the time comes. Wonder what the US weighting will be then.

I feel they are. I don’t know that.

They are lower valued by a good handful than this time last month. That’s a damn good start, and I am looking to buy, spread over months. Much of what I retained I bought in the runout from 2009. Which is why

Premium bonds and drawing down cash made sense for me last year. Markets have gotten cheaper since then, so that makes less sense. I may be able to get some of that income and keep a bit of the capital. Or it may go all titsup. That’s the chance I take.

@ermine, OK I thought you might have mentioned CAPE, book value or something.

There is a reasonable correlation with low CAPE leading to above average future returns and high CAPE leading to below average returns. CAPE is definitely lower now than at the start of the year, before anyone knew anything about C19. Average historic earnings will be little changed, but the price certainly has. Yet how realistic is it to assume that the historic CAPE/future returns correlation applies when something as disruptive to business as C19 comes along? I have no idea what the answer to this is and it would be interesting to read an analysis of what has happened following similar disruptions.

Some, maybe a lot, of company earnings will go to zero and stay there permanently. Some companies are going to require new capital. If the private sector and/or bondholders are providing the new capital I would expect the price to be very high in a lot of cases, significantly diluting existing shareholders. So even for those companies that quickly recover their earnings, existing shareholders will not see the full benefits if heavily diluted with new capital. I would like to think that government/taxpayer provided capital came at a high price as well, but this may not be the case.

It seems to me we are in unchartered territory, hence the exceptionally high and ongoing volatility.

I usually rebalance my portfolio with new contributions every August. However, with the market crash I have kept calm and bought more! All my gains from when I started in October 2015 have been literally wiped out. Rathar than panic I have topped up my Emerging Market Fund (ishares) which has been languishing at the same value from July 2018. And I have invested in Global Small Caps (Vanguard) who have reduced a number of OCF fees for their funds. Even when I have not had a job since February! As one of my friends exclaimed I must have “Balls of Steel”.

I have still got a healthy Emergency Fund. And I still believe what John Templeton said about buying when there’s blood (or in this case COVID-19) on the streets. I haven’t a need to sell out and hopefully I can ride out this storm. But there doesn’t seem to be any sign that the storm has passed. I will keep adding to my monthly holdings carefully getting closer to my ideal portfolio allocation and try to think of this is mere blip on my journey to financial independence (and stop watching so much of the news!)

Portfolio allocation (ideal)

Global, exc. UK = 30.05% (40%)

UK = 33.22% (20%)

Emerging Markets = 8.27% (10%)

Global Small Cap = 4.31% (5%)

Global Property = 3.97% (5%)

Gilts = 9.68% (10%)

Index Gilts = 9.42% (10%)

Cash = 1.08% (>1%)

@Asperger’s guy

I’m pretty sure that was Nathan Rothschild who said that first and not John Templeton not least because Rothschild died not long after the battle of Waterloo

Also the whole quote I always liked;

“Buy when there is blood on the streets, even if that blood is your own”

@Naeclue

“Some, maybe a lot, of company earnings will go to zero and stay there permanently.”

Exactly that happened in 2008, 2001, 1991, 1987 and every market crash before that.

Some time later (I think it was 5-6 years last time) markets passed their previous peaks.*

I would be interested to see the statistics on companies passing on their dividends this time if anyone has them?

This seems to me to be a cashflow crisis and not a solvency crisis currently

*I am ignoring the Chinese and Russian stock markets after they went communist of course because they don’t fit the comforting narrative I’m peddling.

I posted a few weeks ago, but am still not ready to pull the trigger!

It’s strange because my plan (in January when, in hindsight, everything was really expensive ) was to make a lump sum investment into my ISA just before the end of the tax year, with a 5 ish year view on wanting (not needing) this particular amount. Now everything’s loads cheaper, I still have the same time horizon, but it feels like an awfully daft time to be putting a lump sum in (even if I had planned to).

It’s all very strange, but I’m putting it down to recent events giving me a better idea of my risk tolerance. On the other hand as for my existing investments (not insubstantial to me) I’m not really sweating that they’ve dropped. Its just this lump sum, that I no longer want to be wasting away in cash.

I AM keeping up my monthly contributions, and in fact am also throwing in an extra £50 a week to cover the fuel I’m saving on not commuting! So worst case I’ll be able to claim buying at most 3-4 days from the bottom!

@Neverland, your comments are very true and it is good to keep remembering what happened in previous crises. At this point in the banking crisis I have to admit that things felt far worse than they do now, from an investment perspective. In a years time we can be reasonably confident that C-19 will be gone and life will be back to normal. Those that survive can all take holidays again and buy what they want when they want. So it would seem reasonable to assume a more rapid bounce back this time round. The markets are currently signalling this to be the case, with lower falls than before.

I hope this turns out to be true. Yet, whenever we are in a crisis, there is always a nagging doubt that it really will be different this time…

@Passive Investor – April 1, 2020, 4:57 am

You said;

“If you ‘wait for the Covid-19 to disappear’ what do you think will have happened to markets in the meantime?”

I do not have a crystal ball but IMO, the markets would fall further.

You also said;

” I think you need to have a quick think about your risk tolerance (from the way you write understandably low at 64), decide how much further loss you can tolerate ………… remember that even at 64 you should probably invest to a 20 year time horizon and then get back into the market without delay”

My risk tolerance has been tested, yet again. In the past, I have experienced downturns since the 80’s but this time, and aging to 64, I have learnt some lessons! Getting back into the market will be slow and steady, but only after the current CV19 pandemic is over which will be some time and there is a chance that it may get me cause being a type 1 diabetic since 1999, my immune system has been severely compromised and I am at risk! However, I do not lose any sleep over that.

@xxd09 – April 1, 2020, 9:55 am

You said;

“Obviously you did not have an acceptable written down Investment Plan”

As I write, a plan is being implemented and your portfolio split of 30/65/5 is one that I am likely to adopt. A mixture of a Vanguard Lifestrategy 20/80 fund (core), an iShares Physical Gold ETF (a hedge?) plus a min. 5% cash reserve may be one I will pursue.

You also said;

“You will be in this situation again before you die!”

Well, I hope not but I aim to be better prepared if another situation arises again, I am only planning for a 20 year retirement period till death arrives . With regard to spending, I am quite frugal and with the state pension that kicks-in in June 2022, the mortgage already paid off, no dependant kids (apart from a recent grand daughter o/seas) and adding the wife’s state pension, I think we should be OK.

@The Rhino

You said;

“when you say VGLS 20/80 do you mean 20% equities?

Yes the Vanguard Lifestrategy fund I sold was 20% equities & 80% securities (government/corporate bonds etc). On 19/02, I sold this for £166.72 – today they are £158.01 so they have so far gone down approx. 5.22%

You also said;

“………monthly drip-feed the rest back in to an asset allocation that fits better with your newly acquired experience of your risk tolerance”

“………drip-feeding should be complete, i.e. all available cash re-invested, over a period of say, 6 to 12 months. I would prob say that would be easier to deal with psychologically than piling back in a lump-sum given current volatility and the consideration that in many ways this pandemic is still early days”

That’s exactly what I am going to do – the drip feed will only commence after the CV19 pandemic is over and oil prices have recovered which are the two main issues at present that are causing affecting markets. In this time of non-activity as a passive investor, I am also now looking into setting up another two SIPPs (one with Vanguard) as I am now greatly concerned about the large amount of my cash which is well over double the min. £85k FSCS secured amount that is currently left sitting in a SIPP and ISA with my current provider (doing nothing …..). The problem at Vanguard is that they do not yet have a draw-down facility in the UK and I was told today that in the current market turmoil, this is unlikely to be in place this year.

Many thanks for all the responses received and GLA

“Buy to the sound of the cannons and sell to the sound of the trumpets”- Nathan Rothschild

xxd09

Great article.

I second Passive Investor’s comment here that we should use the correct scientific name for this virus – SARS-CoV-2.

It matters because the name is a subtle reminder how similar it is to the original SARS virus, and indeed how predictable such a pandemic has been. A white swan and not a black one, in Talebs words.

In 2012 the German government did a detailed risk analysis of a “modified SARS” pandemic (publicly available, google “Deutscher Bundestag Drucksache 17/12051”). It reads eerily familiar down to the details of what’s happening now, except that the death rate is thankfully lower than in the 2012 scenario that assumed 10% based on the original SARS.

Just checked my assumption that the market has not fallen as much as it did in the previous financial crisis. Peak to trough in 2008 saw the MSCI World Index drop by about 35% in pound terms. So far we have only seen a fall of about 25%, although intra-day it has probably gone lower. A 35% fall would see the iShares ETF SWDA trading at about 3250p. That is another is 17% down on the current closing price of 3892p.

Hi Investor!

Just a heads up from a doctor here – this isn’t ‘a fairly typical upper respiratory tract infection’ at all, unfortunately. It’s very much a /lower/ respiratory tract infection (i.e. the lungs) and it’s important to make the distinction. No other respiratory tract virus I am aware of has this high a death rate. This is serious business!

@Tom — Thanks for your comment. As a layperson it’s hard to parse the conflicting accounts of the severity of this virus, especially given the inconsistent testing / statistics. Just before writing this post I’d been reading an interview with a Cambridge virologist which is where I got that phrase from I believe.

Hang about… *searches history*

The scientist (interview below) uses the phrase “upper respiratory tract” twice, though looking at it again not sure if she’s actually talking about an earlier stage of the infection. Also she’s not a doctor haha.

Anyway, I’m happy to be corrected — thanks!

https://www.cambridgeindependent.co.uk/news/cambridge-virologist-explains-what-we-know-and-dont-know-about-covid-19-9104220/

@Sparschwein — It’s worse than that. 🙁 A friend forwarded me a couple of scientific research papers from 5-10 years ago detailing the risk of new coronaviruses emerging from ‘reservoirs’ in live animals, and specifically talked about those Chinese animal markets as a risk. I believe the phrase “time bomb” was used. So on some level we’d had a warning this would happen, although I guess that’s always the way with every crisis and it’s easy to underestimate how many such time bombs never explode?

China is going to get a lot of stick for this, and perhaps rightly.

They’ve also just officially approved bear bile and goat horn as the treatment of choice for Covid…

ffs

@jonny why do you lump sum at the end of the tax year and not the beginning? (I fill ISAs and pensions at the start of the tax year, thus benefiting from longer in the tax shelter).

I am buying back, in weekly tranches, the stuff I sold for CGT realisation. I am sure there will be a short term hit due to bad luck in timing, but I hope that in 5 years time it will seem insignificant.

@Vanguardfan

It’s not that I “lump sum at the end of the tax year” so to speak. I have some fixed rate savings due to mature very soon, so was going to ‘borrow’ from one of my other savings accounts to get it in this tax year – in case I’m luck enough to be in a position to max my allowance next tax year (unlikely, but a nice problem to have!)

I’m currently leaning towards putting it into the investment account as cash, and investing it (into VG LS 60/40) monthly over the next 6 months (reviewing how I feel each month just before doing so*).

* Though if the market continues to tank, I may feel worse each month, putting me off investing even more, when I should be feeling better about getting it even cheaper. It’s all so counter intuitive!

I have listened to Monevator and I hope learned something from it.

Just did my monthly ‘where do we stand’ check. Down 10% on the month. What am I going to do about it? Nothing.

Reasons – a) much more important health and safeguarding issues to worry about, b) unitised value of investments is still 20% above this time 5 years ago – comfortably ahead of CPI inflation for the same period, c) I would have no idea which way to jump anyway.

Stay safe all.

@ Neverland #49 “….. companies passing their dividends …..”

Very early days, and only a couple of cases, but the dividends due on 1/4/20 from two of the ITs in my portfolio were both paid on time and in full.

Thanks for the article. A few thoughts:

One thing that is different from any bear market I’ve seen (3 before this one). Is the extent but more specifically the speed to which dividends have been cancelled. I am expecting >50% drop and possibly more. This has somewhat damaged the narrative that dividends are more resilient than capital values. Investment trusts will be no protection here given they will no doubt pay dividends out of reserves but that will come at the cost of greater leverage or selling positions so the net position is not different

I’m of course part of the crew that believes stocks go up but there can be very long periods when they don’t. The FTSE 100 a great point in question – >20 years now! There have been 40 year periods when bonds outperform stocks. I doubt that will happen from here but who knows

– (apart from the dividend cuts) this has been a shallow bear market and I agree the lack of decline is somewhat puzzling. My best answer is that bond yields are so low / money printing is just pushing up asset prices. Money has to flow somewhere. Even if once this is over dividends recover to say 50% of where they were as corporates de-lever well that’s a lot better than you can get from bond yields. I’m still investing on a monthly basis from here

– On bonds though, whilst the two decade trade (which I completely missed) has been benefitting from lower rates, which must surely be nearer the end than the beginning, bonds could still generate some pretty nice returns. rates can go more negative, cash can be penalised. the high convexity in long duration bonds means you can make (and lose!) a lot of money if rates go either way a little. I believe western governments will continue to print and lower rates where they can

On Fire, this has implications, mostly psychological. If you are FIRED and get through this you are mentally probably well set. Indeed, if you’ve based it on the Trinity Study well there have been >60% drops in the modelling period so you have nothing to worry about right? For others thinking about it, you need to think ok can I manage with the volatility of a >75% portfolio of equities. If not your SWR needs to come right down, or you retire later, or save more or spend less. Investing in dividend stocks is now been show to be no panacea. Personally I think the future SWR is well below 4% given interest rates but what do I know

I continue to like the idea of having (a) sterling (b) physical gold coins (c) $ TIPS as a decent cash reserve (5 years is right for me) and then some long duration bonds (recognising these can be v v volatile)

Ermine, I can see why you are looking at ASL. Just to say I think there are a few pretty sub standard companies in there, I’ve worked with them in my career in financial services. They look classic value traps to me. But hey I’m terrible at picking stocks.

– Time passes / passive investor. Personally I think if you are 64 your investment horizon to model is 40 years (not 20). If you are married (m & f) and both in good health and live in an average part of the country for longevity (not Glasgow) then there is a 1:10 chance of one of you living to 100. It something like a 1:4 chance of one of you living to 90. The fact you are reading this blog probably means you will live longer than the average. If you are single, male, overweight and smoke like a chimney then by all means go nuts and push up the spending rates

Off direct personal finance topics but related

I feel this will accelerate the transfer of power from west to east. I’ve seen one IB forecasting -13% GDP growth for 2020 in UK & Eurozone in a worst case scenario. China 0%. The hegemony of the West is over and our children will have to get used to it. US will be down but definitely not out. Europe down and out. State spending goes up, wealth taxes up, living standards stagnate

Main downside risk here is the possible geo-political fallout between US and China in some shape or form. I’m not saying there are any parallels between 9:11 but I can see neo-con republicans drawing some when there are a few hundred thousand dead americans, which is a worry.

I’ve also felt there is a strong chance the next generation will be debating whether democracy is necessarily the best form of government. We have all been indoctrinated in this for decades. But those countries where government is strongest are coping with the crisis better. The largest economy will soon be non democratic. I’m still for democracy but I can see the q being asked.

the fact that China is not getting a lot of stick from countries (apart from the US) demonstrates they are comfortably the second most powerful country in the world. That’s life. I cannot see Europe doing anything about it. Although we should (diplomatically of course) – personally I think we have been nuts in selling assets to (sorry attracting investment from) the chinese when we can issue debt at negative real interest rates. The west is going to realise in the coming decades the mistake it has made. It’s not that they are Chinese (to be clear) – it’s the fact that the form of govt and outlook on life is totally different to ours and the west has mis-understood this.

I do worry about the outlook for the UK. We are locked in psychological turmoil between remnants of the glorious past and the challenging future – unable to make the sweeping structural changes needed to generate wealth in the future. US in the same position but coming from a much stronger base

– the weather looks like it’s going be nice this weekend – enjoy a barbecue if you can everyone!

Oops forgot to tick notify of comments…

@Seeking Fire

If you are married (m & f) and both in good health and live in an average part of the country for longevity (not Glasgow) then there is a 1:10 chance of one of you living to 100. It something like a 1:4 chance of one of you living to 90

The Glasgow reference made me chuckle ( it is fair comment though). On a couple’s collective longevity, I calculated that a 65 and 60 year old m&f had a 50% chance one or both being alive on the males 90th birthday so thought your 1:4 seemed a bit low ( not quite the same scenario). Present circumstances excepted of course.

The issue I have in staring into the glowing embers is timescales. The reverberating consequences of governments throwing their planes around the sky will persist much much longer than the little RNA package doing the rounds. A medical crisis may become a fiscal and monetary marathon.

@ Seeking Fire

Re the Chinese “it’s the fact that the form of govt and outlook on life is totally different to ours and the west has mis-understood this.”

Very true. Unlike the West it’s said that when the Chinese make a decision they always consider both the short-term and long-term long-term consequence.

So they ask themselves, what will be the result over the next 100 years. And then they also consider the long-term.

I’m just ROFL at this talk about the infallibility of the Chinese communist party

The virus got to where it is due to the deep flaws in the Chinese government

@Neverland.

Got to agree here. I think the Chinese state is fundamentally fragile in the way that all top-down states are. The USSR looked strong until it didn’t.

Like all strongmen, President Xi primarily does a good job of looking strong. The reality is plenty of internal rivalries in the CPC, which may not survive his departure (assuming he doesn’t fall suddenly from grace for some other reason). The cult of personality is exactly what even quite recent Chinese governments have tried to get away from. They have failed in this case (“Xi Jinping Thought” in the constitution. lol!)

Yes, it is so nice to see all these comments.

People often say its impossible to predict the stockmarket next week. Seems a bit defeatist to me. But here we have people that helpfully predict what geo-politics is going to look like in 50 years time. How lovely!

Jonny. It is good that you have realised your risk tolerance is much lower than you thought but you should still probably lump sum.

Just choose something like VLS 60:40

It pains me to advise such low allocations because I always run at close to 100% equities, but have a good DB pension which I can draw from in 15 years

I am 30 years old, own my house outright, and have an apparently very secure job. Am I being crazy to consider taking out a £50k mortgage to drip feed into the markets over the next 12-24 months, or is that a very smart long term move?

@Factor

I disagree. This is a liquidity crisis in the real world in Europe and the US. 2008/2009 was a solvency crisis in the banking system

The easiest way to deal with a liquidity crisis is not to pay money out. Dividends are one of the easiest cash outflows to cut.

Evidence will be in soon enough.

Quincel

Why convert your good position into a £100000 debt?

You should have written Investment Plan

An Asset Allocation you can live with

Then live frugally and save as much money from your job as you can and invest it now in a good fund -a Global Equities Index Fund for instance

Having said if you are a gambler-go for it -opportunities like this only come rarely -no tears if it comes unstuck and the recession lasts for some years!

xxd09

“Perhaps the miserable trend towards nationalism will be reversed as we’ve been reminded we’re truly all in it together”

Not too sure about this – I think there’s a lot of anger that a *single public health/food hygiene failure* in a Chinese city has had such a huge effect on the whole world. The downside of Globalisation? Highly mobile populations moving between ‘megacities’ are ideal disease vectors. Many (including me) are also concerned about long fragile supply chains, and would welcome a more self-sufficient approach. Hopefully international cooperation and sharing of ideas will continue, and expand. We just need to question mass movements of people around the globe. Do people REALLY need to fly around the world ‘on business’ ? What about the Instagram generation ticking off ‘experiences’ and getting photos from exotic locations as a form of one-upmanship?

xxdo9

For the same reason anyone leverages money when investing, it might improve my returns. Let’s say I have £1k surplus to invest each month. If I put that into the markets for 4 years and 2 months it will buy certain funds which will rise or fall a certain amount. If instead I take out a £50k mortgage with £1k monthly payments it will take about 4 years and 7 months to close, with £55k cost in total, but I could triple my monthly investment for 17 months instead.

Put another way, given prices now are lower and may fall more but a recovery at some point will come is £5k a good price for bringing forward the investments from month 18-50? It may be a very good price if the market bottoms after 12 months and recovers over another 12, in that case I’ll regret not spending £5k when, in 3 years time, I’m spending £1k a month on shares at higher prices than I had to instead of repaying a mortgage I invested at much lower prices.

I’m very uncertain about whether to do it, but it would essentially be investing on margin. Let’s say my house is worth £200k, that would be investing 25% margin because I think the next year or two might be more lucrative than the two or three years after.

I don’t know much about equities, but I struggle to view them as “on sale” as a few comments here imply. The S&P total return index (SPXT) at 5150 is still 10% above the Dec 2018 low (4665). So we haven’t even taken back the return of 2019. The peak was 6900 in mid Feb, the 2008 low 1100. I suppose I feel I want at least to see 4665 or really 4000 (50% retracement) before feeling the equities are “on sale”. I suppose I’m looking to see a unwind in both level and time. It’s sort of odd: since 2009, the SPXT has still delivered over 14%/annum; yet since 2000, a paltry 4.5%. Long-duration bonds have been a much easier ride.

I’m 3.8% down from my personal peak NAV in Feb but still marginally up on the year. I still have about 25% of my fund portfolio to report March returns. I expect them to be up but it’s always a bit of a lottery on these type of events. I haven’t marked down my physical residential property, direct loan or private equity holdings since fairly hard to quantify any of those this early. Have to think though that these don’t take a decent hit. I usually consider taking a stop-loss on a 5% high to low drawdown, so only got 1% or so to play with. I’m 30% in cash and zero interest to add risk here until have more visibility. Preference to preserve capital.

ZXSpectrum

I broadly agree, shares probably have much further to fall (albeit who knows, the market is a weird beast). My view is simply that they are likely to be better value either now or during the next year or so than normal. But you’re not wrong.

@Quincel. Sounds good to me, the best bit is the actual debt of 50k , in my opinion we are going to get higher inflation and inflation works wonders on debt and you can make out like a bandit if the debt is fixed. Best of luck.

@W

Who said it? Some CCP mouthpiece? Did they consider the long term impact when they decided to silence whistleblowers, shutdown labs and destroy samples then deny human to human transmission for months and now publish absurd statistics to pretend the problem is solved?

Does that sound like a long term vision from a clairvoyant and benevolent government or desperation by a regime obsessed by its own survival?

I do like Ben Carlson’s comment in one of the links: “waiting until the dust settles” is a strategy that has never worked in the history of the markets

I am also wondering how @Hospitaller is doing. Would be good to hear.

Amazing to read this two years later – so cognisant