Whisper it, but it does seem like the long shadow of Covid may at last be retreating in the UK.

That’s not the case for the whole world. Countries like India are feeling the full force of what some in Britain still march and vote to deny. Average global cases recently sustained a new peak of 800,000 a day.

But thanks to our long (and, yes, damaging) lockdown, high vaccination rates, and the immunological protection granted by previous infection, the UK appears to be leaving the tunnel we entered back in February 2020.

Now, as we blink back into a world of hugging and hubbub, we’ll finally find out what has changed and what has not.

Just like starting over

At the start of Corona-crisis, there was talk that Covid would kill off the quest for financial independence.

Even some esteemed contributors to Monevator’s comment section rushed to dance on the grave of the FIRE1 movement.

That was crazily premature, and proved that no matter how often you show someone a graph of the stock market going down and then going up again, they’ll struggle in a crash to grok it.

Fourteen months on, and it seems more middle-aged people in US than ever are pushing to retire earlier after their Covid experiences.

Booming US stock markets have to be part of that story. But as Bloomberg (via MSN) reported this week, life re-evaluation is also in the mix:

About 2.7 million Americans age 55 or older are contemplating retirement years earlier than they’d imagined because of the pandemic, government data show. […]

Financial advisers say they’re seeing a new “life-is-short” attitude among clients with enough money socked away to carry them through retirement.

The prospect of going back to the daily grind is going to be “a really tough pill for a lot of people to swallow,” said Kenneth Van Leeuwen, founder of financial services firm Van Leeuwen & Co. in Princeton, New Jersey.

One of Van Leeuwen’s clients, an executive whose portfolio has soared, is retiring at 48. After the past year, the prospect of going back to traveling 10-12 nights a month just isn’t appealing anymore.

Many people have had a hard reset. Now we’ll see how we reboot.

Back to life, back to reality

Anyone wavering about whether to retire or not could do worse than read Debt-Free Doctor’s summary this week of Bill Perkin’s Die With Zero.

I’ve been around this block more than few times. The concept of doing more, spending mindfully, and working less is hardly novel.

But I was still struck by the force of Debt-Free Doctor’s recap:

…if you spend hours of your life acquiring money and then die without spending all of it, then you’ve needlessly wasted too many precious hours of your life. There’s no way to get those hours back.

If you die with $1 million left, that’s $1 million of experiences you did NOT have.

I’ve added Die with Zero to my reading list. If anyone has read it let us know your thoughts below.

Turn! Turn! Turn!

As you get older, these decisions take on a less theoretical hue.

Indeed I was also struck this week by a blog post by one of the team at Bunker Riley about a teenage skateboarding hero of mine.

It seems veteran skater Tony Hawk has done his last ‘ollie 540’ – a signature trick with a very high wipeout-to-glory ratio.

Hawk explained:

“They’ve gotten scarier in recent years, as the landing commitment can be risky if your feet aren’t in the right places. And my willingness to slam unexpectedly into the flat bottom has waned greatly over the last decade.

So today I decided to do it one more time… and never again.”

When age – and risk versus reward – starts catching up with your childhood idols, these questions no longer feel quite so academic.

I can see clearly now

What will you do in the months and years following the great reopening?

Will you retire early? Move to the countryside?

Or move back, because rural life proved to be a Covid fad with all the staying power of a Tamagotchi?

Of course if you’re younger – or poorer – some of these choices remain theoretical.

You might have decided the pandemic has shown you the rat race is a total kabuki show, but you’re 25 and £20,000 in debt. FIRE isn’t for you for a long time yet.

But at the risk of sounding too happy-clappy, that doesn’t mean there isn’t a spiritual Covid dividend for you, too.

It takes most people several decades – and a few funerals or a health scare – to really understand that life is precious and nothing is given to us.

If Covid has taught you how precarious normality can be in your 20s, then you’re ahead of the game. Even if you’re behind in your bank account.

Personally I’d suggest looking for a more fulfilling career than going full-tilt on extreme frugality for an early and potentially under-funded retirement. But my co-blogger The Accumulator might disagree, so there’s definitely two sides.

One thing working in your favour if you’re young: companies may be desperate for talent as the economy takes off.

The venture capitalist Hunter Walk believes we’re on the cusp of a ‘Great Talent Reshuffling’ as the psychological after-effects of Covid ripple through society, with younger workers looking for more meaning and older workers abandoning ship to find meaning elsewhere.

It could be the greatest economy-wide game of musical chairs we’ve ever seen, outside of the wartime.

Are you ready to dance?

From Monevator

Vanguard LifeStrategy funds review – Monevator

Never ever respond to a cold call – Monevator

From the archive-ator: My 10 rules to stay sexy and save money – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot!2

Buy-to-let landlords spread their bets away from London [Search result] – FT

HMRC pays back £716m in overpaid pension tax – Which

Woman loses nearly £113,000 in scam dating site romance – BBC

Gary Lineker’s political Tweets could help him avoid a £4.9m tax bill – Guardian

Warren Buffett names Berkshire Hathaway CEO successor – BBC

Also: Berkshire Hathaway broke Nasdaq’s 32-bit code with its monster share price – The Register

Yale’s legendary portfolio manager David Swensen has died at 67 – Yale

Ethereum price momentum could see it “flip Bitcoin” – Independent

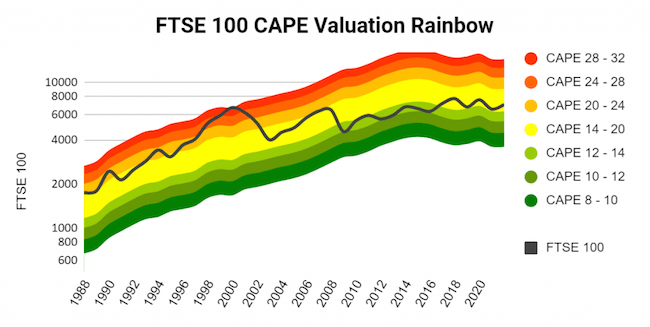

The FTSE 100 looks fairly-valued on the CAPE measure – UK Value Investor

Products and services

American Express halves cashback on its market-leading cards – ThisIsMoney

Comparing the monthly High Street coffee subscription deals [Search result] – FT

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade

Estate agents reveal the 10 biggest flaws that stop properties from selling – ThisIsMoney

The race to the first US Bitcoin ETF – ETF Trends

Homes for sale with a view, in pictures – Guardian

Comment and opinion

Buffett and Munger are no longer relevant – The Reformed Broker

Common mistakes that investors make – The Financial Bodyguard

The US market really should be in a bubble – A Wealth of Common Sense

ESG outperformance narrative ‘is flawed’, new research shows [Search result] – FT

A 147-year old warning against stock market speculation – Novel Investor

Why do smart people do dumb things, like investing actively? – TEBI

Adapting to a world bent on falsifying the past – Abnormal Returns

Resurrecting the value premium [Nerdy] – Alpha Architect

Naughty corner: Active antics

Margin loans in the UK – Fire V London

Bitcoin: we’re all HODLers now – Elm Funds

Stocks, bonds, and higher inflation – Compound Advisors

Data shows markets behave differently in the low-rate era – Klement On Investing

Half of all VCs beat the stock market [US] – AVC

How is Keystone Positive Change trust getting on under Baillie Gifford? – IT Investor

Buffett’s investments: the great, the good, and the gruesome – Think Advisor

Covid corner

Under-40s to be offered an alternative to the AstraZeneca vaccine – BBC

Early cancer diagnoses plummeted in England during pandemic – Guardian

The Covid lab escape theory is looking like the best fit – Nicholas Wade

Kindle book bargains

What It Takes: Lessons in the Pursuit of Excellence by Stephen Schwarzman – £0.99 on Kindle

Radical Candour by Kim Scott – £0.99 on Kindle

Hired: Six months undercover in low-wage Britain – £0.99 on Kindle

The Future Is Faster Than You Think by Peter Diamandis and Steven Kotler – £0.99 on Kindle

Environmental factors

How much energy does Bitcoin really consume? – Harvard Business Review

Rare fish set to return to River Severn breeding grounds – BBC

How to regrow a wrecked coral reef – BBC

Pension funds urged to help UK meet net zero goals – Guardian

Why not turn airports into giant solar farms? – Wired

How ‘insanely cheap’ solar power continues to shock the world – Guardian

Off our beat

Take Ray Dalio’s free MBTI-style personality assessment – Principles You

You may not like the coffee guys, but you like the coffee, guys – FdB

Seeking stillness and sunlight: the art of fly-fishing – Lit Hub

Taking an idea from invention to the marketplace – BBC

How the Pentagon started taking UFOs seriously – The New Yorker

And finally…

“There is much more to life than what gets measured in accounts. Even economists know that.”

– Tim Harford, The Undercover Economist

Like these links? Subscribe to get them every Friday! Like these links? Note this article includes affiliate links, such as from Amazon, Unbiased, and Freetrade. We may be compensated if you pursue these offers – that will not affect the price you pay.

- Financial Independence Retire Early [↩]

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

Comments on this entry are closed.

Just finished Martin Lewis’s book “Premonition “ on the Covid outbreak

Rattling read as always from him

2 new insights for me

Asymptomatic kids were the probable super spreaders due to their normal social behaviours with all the problems that generates in formulating disease control

A yearly “flu”vaccine might be requirement for everyone not just oldies

No doubt the human race (and stockmarket) will bounce back as ever!

xxd09

@xxd09

Michael Lewis interviewed this morning on Radio 4 (from 50:30 for c. five minutes at: https://www.bbc.co.uk/sounds/play/m000vwr6)

@TI – Typo or a very funny millennial phrase? “One thing working in your favour if you’re young: companies may be desperate for talent as the econommy takes off.”

Yummy economy? Nom 🙂

JimJim

@JimJim — Oh dear, thanks, fixed it now. (And agree it could be a good foodie re-opening neologism).

Weekend Reading probably took 12-15 hours all-in this week, and I skimped on proofreading pre-posting because I was late.

Parkinson’s Law is in full effect at Monevator HQ! 😉

Having read the summary of Die with Zero, Perhaps the true test of your opinion of the book would be if you would then encourage your other half to read it.

Having already gathered a wealth of experiences along the way to F.I. , personally I don’t feel like I have missed out. Perhaps not a good read if you are in the later age brackets and have worked too hard.

The annual CAPE review is always one of my favorites and I see John (hope you are reading) is looking to do the numbers on the S+P500… Can’t wait 🙂

JimJim

“If you die with $1 million left, that’s $1 million of experiences you did NOT have.”

Totally disagree. It’s $1mm more that my children get. Which is $1mm more (plus compounding) that helps ensure they don’t have to shovel shit in any job ever. I far more pleasure from the idea my children will never need to do an “honest day’s work” in their whole life than from a losing a few “experiences”.

Van Leeuwen‘s client may be tired of the travel but I suspect that many more will be moving on for the opposite reason.

Pre-pandemic, compliance were already cracking down on corporate entertainment (no more sports tickets on the firm’s dime). Post-pandemic, you’ll have to prove that your meeting could not have been conducted equally well on Zoom, Teams or Meet, so say goodbye to those frequent flyer benefits.

Some people genuinely loath being away from home, missing the kids, not being there for their partners. But plenty of others love the fine dining, swanky hotels, turning left when boarding an aircraft and the ego massage that goes with it.

This article interested me courtesy of Investors’ Chronicle/ FT. Might need a search if you hit the paywall… https://www.investorschronicle.co.uk/news/2021/05/04/biden-goes-back-to-the-50s/

JimJim

Re CAPE ratio, does anyone know of a (ideally) free resource for the World Market CAPE. I found this https://www.starcapital.de/en/research/stock-market-valuation but it’s no longer being updated.

Last 3 jobs for me:

Sales – travel a lot, nights away ~10 per month. Lots of flights, feeling like always on call. Wfh 2 days a week Fun but hard work.

Engineering- leave house at 5am back at 6:30. M-F no wfh, easy enough work but knackered overall.

Wfh engineering l- home office, no commute, great flexibility. Pay the same and saving on the commute. Much less stress and much happier. Flexible dress code is a bonus (will I ever wear a shirt again?)

We are FI so – I’m never going back to the office like I did before.

(Miss the business travels though)

@ZXSpectrum48k

Your grandkids maybe, but by the time you’re leaving us (assuming nothing untoward happens), your children will be approaching retirement age themselves (assuming average lifespans and child bearing ages).

Spend it on giving them experiences, or setting them up, earlier in life because it’ll be too late to have any meaningful effect when you shuffle off.

Not to mention that it’s a big assumption they need your help. Spending it on better education for them will likely serve them perfectly well to get a career that will mean they’re never hurting financially.

Wow I just looked up the vaccination stats for UK – impressive! Meanwhile it looks like the US is going to top out in the mid 50s % (beginning to plateau at mid 40s now, only 9% of unvaccinated adults surveyed intend to get it). I’ve been looking forward to a summer where everyone is vaccinated and we can finally drop the precautions – these dismal stats suggest a different course.

“If you die with $1 million left, that’s $1 million of experiences you did NOT have.”

Kinda assumes that a worthwhile life is one where you maximise your experiences if you can afford them. Someone with an experience-maximising mindset is unlikely to be left with that much money & has probably flipped over to spending beyond means. Conversely, someone not with that mindset may be unlikely to care about missing out, if the wealth is passed on.

I have not read Die With Zero, and not likely to, but I agree with most of the rules in the Debt-Free Doctor’s link. I worked for too long, mostly out of a misplaced sense of loyalty, but I also hadn’t counted on the superb sequence of returns we have had these last 10 years. It’s all very well telling people not to save, but it really is sensible to plan for comfortably living off a poor sequence of returns.

I have witnessed many people who worked for too long, had an inability to spend and died leaving money to thankless relatives. I have also seen the flipside where people have never properly saved enough for retirement nor spent their money wisely on experiences. A balance is needed, but it is not easy to achieve.

Dieing with zero is a good target, but how to do it? One way would be to sell up, rent, splurge it all and live off the state pension and benefits until we both die. That carries too high a risk of spending many miserable years on a low income. We could buy annuities to top up the state pension. That would work, but I begrudge buying annuities as they are such poor value for money. To make things even worse, annuities would not be tax efficient – something I really could not stomach.

I don’t much like the idea of living in rented accommodation either, although we could certainly downsize. Living in your own home is a luxury and an “Experience” well worth paying for IMHO.

There is a danger with this sort of advice in people interpreting it as advice that they need to be more hedonistic. Being hedonistic does not necessarily lead to fulfillment. Far from it in many cases.

Thanks for the environmental links – a bit off topic maybe but I enjoyed them a lot.

Dying as your portfolio ends is a perennial

How is it practical where two people are involved?

It is an ideal scenario but short of a planned suicide or suicides not a practical plan in the real world

We (wife and I) now both 75 -travelled a lot around the world

Might have done more without Covid

Will probably be too old once things open up again

So portfolio growing faster than planned

Intend our U.K. travel to be first class on trains and staying at boutique hotels!

Then there is always carehome fees!

xxd09

I’m re-retiring by the end of this year. i’ve spent enough hours working from home online that I no longer want to try to build passive income anymore. So exhausted, time to relax and enjoy life so much more.

Too much work as a stay at home parent!

Sam

Dying with 1m is dying with peace of mind, that 1m DID buy you -that- experience.

Or you could buy an annuity and have peace of mind with zero left behind

I was going to buy “Die with Zero” but wasn’t sure it would give me any idea of how to do it! I’m struggling with how best to taper my pension spending – how much should I take today versus tomorrow? It seems totally nuts to have almost the same income requirement at 80 as you would at 60 and a bit defeatist to assume that in the latter years any excess income will probably be required for a care home. So how much should I be spending of my pension fund on experiences today that I might not enjoy as much in later years when health and fitness are inevitably not as good? Answers on a postcard please.

@Lee

This is true. Plus, there is the thought that the kids may want to make their own way, thanks very much. You have a sense of achievement in building up your money, and being in a position to help them: but would you be denying THEM that same sense of achievement?

If Dying with Zero is good, is not dying with less than zero better?

Financial Samurai

That was an intriguing last remark-“Too much work as a stay at home parent”

The girls have been doing that for years -polls show that most would rather stay at home than go out to work especially with preschool kids

I wouldn’t dare take it further than that!

xxd09

> I’d suggest looking for a more fulfilling career

The tragedy with that idea is that it’s easy to say but hard to do. Fulfilling tends to be qualified in the rear-view mirror, because it is an interaction of personal growth and character, an aspect of the process of individuation.

Sure, observation shows that it’s easy to fall out of love with being a lawyer even if the pay makes up for it a bit, but it is your younger self that sets the orientation for your older self to live. OK you can retrain at any time, but a career reset does often come with a pay reset.

I have no idea what the answer is, but I don’t think that it’s as easy a Joseph Campbell’s ‘follow your bliss’. Until you reach FI, in which case knock yourself out, but then career is a moot point anyway!

I thoroughly enjoyed both reading and summarizing Die With Zero.

It really opened my eyes to show me life from a 30,000 feet view.

The recommendations are NOT for everyone.

But it gives you different options instead of the way the masses live.

The bottom line, if you’re healthy enough to enjoy your life now (and afford it), then do so as you NEVER no what your health will be like next year.

‘Die with Zero’ is on my reading list. But if it concludes that the only experiences worth having are those that cost money, then I’m not sure it’s going to be my thing really. And you know, there are people (like my OH) who think they can best contribute to the world by continuing to work. I myself am enjoying some paid roles post FI. So in fact some worthwhile experiences actually cost negative money.

I assume that ‘dieing with zero’ also includes giving it away, but so far I’ve found that more effort and less rewarding than I anticipated.

There were a few posts on crypto this week, so this seems relevent.

I’m sure most people are aware of the risks involved in investing in Bitcoin or any of the alt coins but now they are offering a fixed annual return of around 7% to stake a coin.

Websites like Binance are now offering the chance to “Stake” your coin, effectivley loaning your coins to Binance in return for an annual savings rate.

The risk of doing this with something lile Etherium is quite clear to me, you lose the chance to trade out if the market drops in that time frame, in return for around 7% return, significant capital is at risk.

However, what I think might be worth looking into, is staking “stable coins”. These coins are pegged to GBP or the Dollar, for example TGBP. Binance is currently offering a 6.66% return. It seems like a good way to earn a bit of interest, but the return is high given what we know can be achieved elsewhere. This leads me to believe there is a significant risk herem but I can’t quite see what it is yet.

Apart from the interest rate on offer being the evil number, are there any other risks anyone can think of that would make this a “too good to be true” return? There is the risk of the platform going under, and your cash isn’t protected by the government, theres also transation fees and spreads to deal with. Other than that, it seems like it might be worth looking into?

Just been doing a bit more research, sounds like another risk is that the coin, “TGBP” could de-peg in the case of mass-selling and the coin you are buying goes bankrupt and the value falls to zero. Perhaps it is a bit too good to be true. Interested to hear if anyone else has looked into this as well.

@Owen – I’m no crypto person, but is there default risk if you’re lending the crypto? If nobody sits between you and the borrower, and we’re talking a borrower who is taking risk (what would happen in a margin call if that happens in crypto? or can this crypto be stolen either from the borrower or by the borrower?)

Also 7% isn’t a compelling return, you’d probably beat that and sleep better with vls80.

@Vanguardfan (#25):

Re: “I assume that ‘dieing with zero’ also includes giving it away, but so far I’ve found that more effort and less rewarding than I anticipated.”

I believe that it does – see e.g. Rule #5 in the Debt-Free Doctor’s link.

Your comment: “but …. more effort and less rewarding ….” caught my eye – is there anything more you can share?

I shared the Dying with Zero summary with my wife, first FIRE article she actually read in great detail and agreed with… the trick is knowing what “zero” is. To me this includes investing in the kids NOW vs leaving them an inheritance they’re insufficiently prepared to handle. It means education and life experiences that make them into rounded adults not pampered trust fundamentalists. Etc.

One of my many mantras to the kids was there will be no money left-we intended to spend it all travelling etc

However their education would be fully funded including 5 years at Uni -(if they got there)-they all did

Seemed to work

Had to help one with £5000 deposit for a house-that’s it

Now 75 and we have 7 figure savings which they know about

No requests for cash-too much self respect?-carehome fees could still eat it all

Seen the devastating effect of inherited wealth,controlling grand parents on colleagues and their marriages-not been my problem thankfully

xxd09

Ok so now I’ve actually read the Die with Zero summary and I can report back that I was already fully signed up to the main thrust of the argument. For me, life has always been about experiences in the present. It’s mainly time and not money that limits the experiences I’ve been able to have. And this year, of course, the blasted pandemic. And it remains the case that some of my most treasured experiences and memories have come through work. As I’ve adjusted to FI (which for me was a sudden windfall experience) I’ve also gradually concluded that ‘work’ (or rather ‘purposeful activity which contributes to collective good’) is actually part of the tapestry of a fulfilling life, for me. The hard part is finding enjoyable work experiences while allowing enough non work spaces to remain. Getting there.

But I will buy the book and hope it has the same spouse converting effect as for mr jetlag! Not hopeful but I’ll keep chipping away. Empty nest next year should prompt some reflection on our lifestyle and future possibilities.

@Al Cam. Been working on gifting for a while with limited success. Recently a further windfall, definitely surplus to requirements, landed and I decided to pursue the goal of giving it away. Have so far distributed less than half. Lessons learned:

1. More effort than expected. Best description here is the ‘paradox of choice’ issue. How do I decide the best use of the funds? Spread small amounts thinly or large amounts to make impact? How to choose from an infinite number of worthy causes and needs? It can feel overwhelming and it certainly takes a lot of time to do the research. Also, you have to take care to match the amount to the organisation. And if you want to gift to people, just as a nice thing to do, then that takes care as well, and amounts need to be considered carefully. All in all, it’s not something I want to spend tons of time on. And yet surely it’s better to get it out somewhere than just sitting in the bank. So guilt too.

2. Less rewarding. I’m not sure what I expected here tbh. A warm glow of smugness? To be showered with praise and gratitude? A feeling of achievement? Possibly none, or all, of the above. But it has been interesting to observe the range of responses from recipients. Most (but not all) organisations will write a nice thank you letter. Fine. Some organisations are quite hard to give to. I’ve still got money waiting that I’ve promised to an organisation that seemed terribly grateful, but that hasn’t actually managed to organise the payment. I’ve given up trying to force it on them. Some organisations (not many but perhaps it would be more if I gave much larger amounts – I haven’t gone more than lowish 5 figures) will invite you to some nice donor event (but not too nice, these are cash strapped charities of course). That can be a bit awkward. Overall, the whole effort feels a bit transactional. I mean I know there are some people who make philanthropy a big part of their lives, who actually set up charities or trust funds and try to have a much bigger influence on their causes. That feels to me more like a second career, and also not quite the point (it’s a bit arrogant to feel that I can and should wade in on causes that I’m not expert in, and use my money as power to say – do this, but not that). Plus, in the areas I am more expert in, I’m giving my time more formally, in paid or unpaid roles. Being a donor as well would create a strange dynamic.

So, all in all, complicated. At the moment I’ve stepped back from spending much time on this. I’ve also decided that rather than stress about big high stakes donations, we’ll just increase our regular spending to allow more spontaneous gifting – ie we’ll just be more generous to things that come our way, and not worry too much about a grand plan or strategy. Perhaps at a later stage some opportunity will arise to get more involved with a worthwhile project which needs our money and our time. I don’t know.

@Vanguardfan (#32)

Thanks for the additional info – much to ponder therein – and as you say “complicated”. Thanks again.

@Lee. The inheritance is for their 20s. The whole point is that they can stick two fingers up to the nonsense that is society’s Protestant work ethic. Plus earning money is too easy. I don’t want my children wasting precious time on pointless jobs when they could be doing something more harder/more interesting.

As for education, I’m paying for their whole education (private school, uni, postgrad etc). Education is just too important to be about providing qualifications for a job. They might want to do Anglo-Saxon Studies or Theoretical Physics (like I did). I don’t care but I don’t want them bound by anything as trivial as employability. University should be about frontier research, original thinking, not learning accountancy or business management. It should be an ivory tower.

How about giving/encouraging a vocation?

I have a Teacher(Type 1 Diabetic) ,Prison Governor and GP as the kids jobs

They never left the frontline once -makes Dad very proud

There to serve pupils ,prisoners and the ill public

Dad was a vet and Mum a teacher so by imitation/example?

We do however need successful businesses to pay for the above who all cost money

I am pleased to say that one of them married a banker whose taxes pay for most of them

xxd09

Hi All,

As always great comments from all. I am failry youngish (in my late 30s) married man with 1 kid (early single digits). I have heard about this notion of dying with xyz amout of wealth as a waste of time/life etc. and I really dont like the central assumptions of such a view point. 1st and foremost, feels really selfish to even think about that, as I was not born alone (most arnt) and owe a debt of gratitude to my (financially) poor parents who put me in the position that I am in today. The only way I can repay (if at all) what they did for me is by passing it fwd. to my kids and (hopefully) grandkids.

Creating a huge corpus, to be left beyond our time on this planet, is the most useful way of ‘accounting’ for our life. I consider this my parents legacy, that I am carrying fwd and hope that will continue far beyond our or my parents time.

We are not born alone and we dont (in most cases) die alone. To say I will consume all our resources within our lifetimes almost feels like cheating future generations. I have learnt this lesson from my parents sacrifice to give me and my sister the life we have today.

In terms of giving my kids good education and paying for it etc. yes within reason, I would do that, but I would much rather than they get educated in a good public school and have half a million fund invested in ISA at age 18 than me spending on pvt education and leaving them with student debt at 21!. If you can pay for both, good on you!

When it comes to kids inheritance and them not being good with money or lack of sense of achievement etc. I think it is a very middle class way of thinking, that the only sense of achievement is when you start at 0 and make something of it. I would rather that every generation following me starts with an even bigger corpus, and their responsibility is to increase that corpus and leave more for the generation that follows them.

There are more than enough family trusts (Caledoni, RIT, PAT etc) that come to mind, that have survived for 100s of years. Unless, you think all of their decendents are delinquints who just lie on a couch, it is clear that generational wealth and planning can be done. The key is to make every generation realise that they have a duty to handover more than they received.

I for one am definitely not even remotly thinking of dying with 0. I am thinking about retireing when I am enough funds to generate more income than I would need in retirement as that way the fund/capital will keep growing. My back of the envelop calucation tells me escape velocity is around £1.5M. If it becomes big enough (£5M+) to convert into family investment trust, I would consider my life to be extremenly succesful in monetrary terms.

Regards,

Rishi

P.S.: I am ok with ppl not agreeing with my views. I am keen to read alternate points of view.

From some of the comments above, perhaps it’s about time for a “just a boy, giving it all away” special @TI?

JimJim

@Vanguardfan (#32) – thanks, I was as surprised as you 🙂

@Rishi (#36) – likewise I appreciate the different perspectives you bring. I do think there is some overlap in our views.

From my perspective what’s wasteful is hoarding wealth and not using the resources you’ve accumulated over a lifetime in the best way possible in the here and now – VF has mentioned charity / nonprofits for instance.

All of us I hope are aware of the corrosive effect of wealth inequality (usually generational) on society, perpetuating that in the hope that your descendants “get a leg up” seems to me more perverse than investing in changing the world around you while you can.

There’s also a form of survivorship bias in your comment that “some” wealth is passed on successfully (most billionaires are 1st or 2nd gen only) and a healthy disdain for middle class values. I know quite a few friends with “family office” level wealth despairing of how to instill “middle class values” in their rich offspring so I’m talking from direct experience.

In the end, it’s only money… I’m much more interested in my effect on the world while I’m in it.

@mr jetlag – I can see why it looks that way, but unused invested wealth isn’t wasted – it supports higher share/bond prices, which means that when companies see fit to grow they can access that by issuing new shares/bonds. It’s indirect, the benefits to companies that produce things is highly diluted by the sheer size of the market, but it is real, and one if the reason why capitalism has left us richer despite encouraging these things. It is more productive than leaving cash in the bank – hence why quantitative easing was designed to push us towards riskier, more productive assets, for the benefit of the economy.

Sometimes unequal systems still uplift the poor by more than an equal system does – i.e. you could give everybody £1 in an inefficient but fair system, or you could give the poor £2, middle class £20 and rich £200 – so it becomes more about “how best do you help uplift the poor” than “how do you make everyone equal” – we see the fact that the western world has higher real wages for it’s poor and that people migrate here because of it as proof of the long term efficiency improvement of meritocracy, even if it comes at short term costs.

Further, I believe charities pretty much cover things that the taxman doesn’t see fit to fully fund, so you have to wonder why, and whether simply paying more tax is a more ethical use of money than giving to charity, considering the boring but vital things the taxman pays for.

Further to that, for profit companies make money because they supply things that people need, with the profit motive driving efficiency (with profits reinvested in the secondary markets) – so according to capitalist theory, these for profit businesses do more good in supplying what people need that even the taxman, so the most ethical course of action is to keep as much invested as long as possible, minimising tax, charity, and consumerism (minimise demand to assist supply).

I like the concept behind Die With Zero, although I’m not comfortable with aiming quite that low. My take away is that I should have a plan for spending just as I do with saving. I’m approaching the FI tipping point (if not past it) but switching from 100% saving to 100% spending is too much of a psychological hurdle and I hope that thinking differently about using my wealth will help me over the bump.

Regardless of what you want to do with your money, have an approach rather than be aimless. Also don’t forget that some people around these parts argue for 100% IHT, so your kids might not get it if you don’t use it 🙂

This quote from an annual reports shows why corporate remuneration policies are so unfair to shareholders:

Shareholder experience

Share price The Committee considered the reasons behind the

substantial fall in the share price during Q1 and determined

that this was as a result of the market and impact of Covid-19

and was not as a result of omissions or decisions made by

the executive directors. The share price has since moved

up over 60% since this low point.

The Committee determined that as the fall

in share price was a market-wide phenomena

and not driven by the actions or omissions

of the executive directors this would not be

considered in the final bonus determination.

@Vanguardfan, interesting to find someone else finds giving away money harder than expected. Having benefited from a bit of a windfall last year when my late mother’s house sold for much more than anticipated, I dreamt up a couple of projects to benefit local good causes. A year later I still haven’t written a cheque. Though a fair bit of the issue has been Covid lockdowns, it was still a surprise how slowly things moved.

@Robert – For the bigger companies at least we should ask Vanguard, Blackrock, etc to install their own low cost directors in companies to keep costs down. Ultimately if a board robbed it’s company in the long term it’d sink down the indexes, but there is still this uncomfortable compromise often for paying more for a director who you trust – but ultimately we do as a group have the power to install our own board, and the big fund managers are in the perfect position, although they might also judge that a CEO with a personality cult like Musk, Bezos, etc is worth paying for.

But ultimately there are limits anyway, an efficient company would rise.

One reason I’m wary of mutuals, government and charities is the lack of any real accountability for their boards, at least in PLCs they might get voted out if they go too far, it’s just that you see big £ salaries because they are big business, like football, but hopefully limited in % terms.

watched this little music video today about dogecoin and it made me laugh. Worth a couple of minutes for a little lighthearted fun

https://www.youtube.com/watch?v=cbI31x3FpS0

@ZXSpectrum48K: You write:

I don’t think you’ll agree with all of it, but this article made me think of you:

https://www.theatlantic.com/ideas/archive/2021/05/marriage-college-status-meritocracy/618795/