A million doesn’t go half as far as it did, but making a million is still the first goal of almost any new entrepreneur I meet.

It’s also a target for many savers.

For example, a million pounds can buy you a (hopefully) steady and inflation-proofed income stream from equity income investment trusts that’s well above the average household income – provided you’re prepared to ride out the volatility of equities. With luck you wouldn’t even need to touch your capital.

Alternatively, if you’re a passive investor and a fan of the 4% rule you might use your million to model a £40,000 a year income in retirement. (But be aware of the many caveats! 1)

But what if you’re still 20 years from hitting the magic number? In that case, inflation strips away the buying power of your hoard. You’ll need much more than a million to buy the equivalent income or assets that you could today.

This was why we created the millionaire calculator, one of Monevator’s small but shiny collection of personal finance tools.

The millionaire calculator enables you to work out:

- When you’ll make your million, based on your current savings and returns.

- How much you need to save to make a million by a particular age.

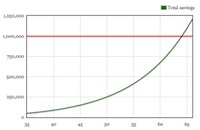

The rate your savings grow is shown in a pretty graph, which demonstrates the power of compound interest.

There are also three currency options, because we’re internationalists around here.

Understand the effect of inflation

Unlike with some calculators I’ve included an inflation setting in this tool.

Look below the graph and you’ll see what your eventual million is worth in today’s money. The tool also tells you how much you’ll need to save to reach the equivalent of a million today by that target age.

The bad news is you’ll need to save a lot more than you think, but at least the millionaire calculator gives it to you straight.

Play around with the interest rate setting. This is the rate of return. To get a flavor for what’s reasonable, look at my articles on UK historical rates of return, or US rates of return if you’re from over the pond.

If you’re 25 and 100% invested in equities, a 7% return with 2% inflation seems reasonable to me in the current climate. Use a 5% return if you’re more skeptical about future returns, and 3% inflation if you’re skeptical about central banks. Dial down further if you’re older and have more low-yielding fixed income in your portfolio.

Two final points:

- Real life is much more volatile than the smooth graphs from such tools suggests. It’s best to over-save, and be left with the problem of how to spend the excess.

- While having a target sum like a million can be very motivating, you may need to grow your income to get there in a reasonable time.

I hope you enjoy the millionaire calculator. Send us a postcard when you make it!

Also check out our mortgage repayment calculator and compound interest calculator.

- This so-called rule is not a rule, 4% may be far too high a withdrawal rate in the current environment, and it assumes you eventually spend all your capital. A deeper discussion is for another day![↩]

Comments on this entry are closed.

Okay, Monevator… Inflation is totally killing my wanna be a millionaire buzz. 😉

I really do enjoy this calculator. It’s very handy and efficient! Thank you for adding it to your personal tools!

@MoneyFunk – Glad you like it. Got to tell it like it is — too many people forget about inflation.

Thanks for the feedback. 🙂

Like the calculator too.

I take away inflation, b/c there frankly is none… well there is, but not really. In a time of people losing double digits a year easily, inflation is not even part of my registry.

If I have $3 million in 10 years, that’s all I care about!

We currently live in a dreadfully inflationary environment. Stagflation has been extremely prominent here in the Western world.

I don’t use the benchmark of a million dollars any more. I now have the benchmark of several thousand Silver ounces and a cash flow pattern that exceeds my monthly expenses. Rather, one should focus on “what can this buy me?” Instead of thinking in dollars. Especially US dollars.

Ha! A person has to make over 23 million 2013 dollars to be like a millionaire in 1913. A person who had 42,500 dollars in 1913 is a millionaire in 2013 dollars. Yup inflation sucks and it’s easier to become a millionaire in the inflationary economy.

If You want to be sure not outliving Your wealth than use fix 4% withdrawal instead of inflation adjusted. Charles D. Ellis suggests it too.

The calculator does demonstrate that we need to be high risk as long as possible

90% global small cap, 10% EM – for 30+ years 😉

(Will need to make safe later on, may need to be flexible about retirement year)

May I add I have the emotional capacity of a sith lord

I won’t panic in a crash, I expect crashes

No graph on the mobile site 🙁 Any hope for a fix pretty please?

@hosimpson — Sadly not, it’d be a big spend in terms of redevelopment money and effort that I haven’t got right now. 🙁 You should be seeing a notice saying you need to switch to Desktop view I think though, is that showing?

Mobile is the bane of this blogger’s life. Readers love it but it monetizes at less than 5% the rate of desktop currently (you can also see this in Google’s results, incidentally — unless you’re a trashy content farm doing billions of page views it has pretty much blown up advert-supported free web. Certainly for a long form of few articles and savvy readers site like Monevator).

Obviously it’s the future so no use complaining, rather re-calibrating eventually, but harrumph.

That’s fair enough, I doubt anyone here would be overjoyed if you decided to begin publishing celebrity money listicles (10 Celebrities Who Blew Their Fortune in Under 10 Years) and self help What’s Your Money IQ tests.

I can’t see the notice about having to switch to the desktop view though. I’m using Safari on an iphone.

“inflation strips away the buying power of your horde”: then lead your horde on a new campaign of pillage.

This is really helpful! Is it possible to add a field to adjust Amount Added to Savings Each Year?

@Matthew – how many crashes have you been through?

I like the calculator but it just goes how difficult it is to achieve it in the current climate or even any climate. Inflation is like a woman who teases you and make you work more and more and then still feel you haven’t done enough.

I think it is better to focus on investing mentality and the idea that maybe good enough is good enough rather than chasing numbers that perhaps will not result in difference in happiness.

-FIREplanter

Socialists often use “he/she is a millionaire” as part of their jargon of envy to recommend thieving from other people’s money. Good to see some acknowledgement here that that benchmark is outdated; a million really does not get you very far these days.

I’d imagine a million would get the vast majority of people in this country an awful long way.

Do you adjust the yearly savings for inflation as well?

Your privacy policy could use an update on how long you keep data entered into a calculator and what you do with it.

@ABV — Cheers for thoughts. We don’t keep the data at all, and hence do nothing with it. (Probably another poor monetization decision on my part but there you go). In fact, if I recall correctly the calculations are all done locally.

As to your other point, I won’t publish that comment for understandable reasons, but note the heads up and will take a look.

Why do some readers feel the need to bring their political sensibilities to the party every time?

@Simon – a million buys you a comfortable middle class lifestyle (house in a nice area, car, multiple holidays a year) in most of the UK bar the SE and a few ‘hot’ cities

Oh, the irony of it.

I am 52. Reached my million in Feb this year. A high savings rate and 30 years of grafting work. No smart investment choices. In fact the early ones were all dumb and retarded reaching that goal by about 8 years. But, it’s not quite enough to retire on it seems to me, what with the multiple uncertainties of the future, hence One More Year or maybe two. Perhaps the work habit has become somewhat ingrained. It does however make working seem a lot more optional and thus tolerable, and means I will be able to help my kids. Definitely took sacrifice.