Warning: This is a ludicrously long post that collects together some stuff that has been knocking around my head for a while. Think of it like one of those World War 2 black and white movies they used to show on lazy afternoons when we only had three channels. In other words, if you’re in the mood then I hope you enjoy it, but I won’t be offended if life is too short! 🙂

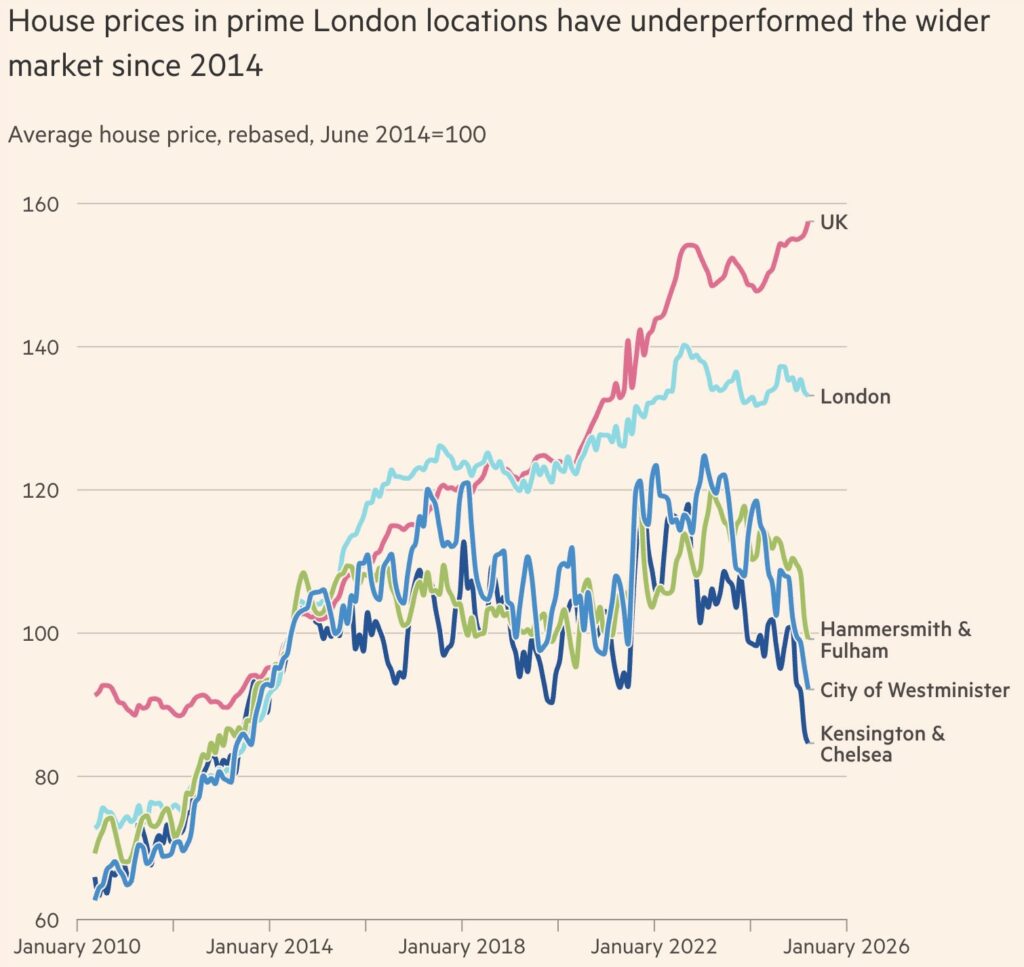

Many people agree that residential property prices in the South East of England are an accident waiting to happen.

I’ve even heard buy-to-let moguls concede the market is out of whack, at least when it comes to London.

On the basis of present yields – and assuming an interest-only mortgage of just 3% – my landlord is actually paying me to live in my rented terraced house in London, with no money leftover for, you know, when the roof caves in.

But it was almost as bad six or seven years ago. And he’s made perhaps £250,000 in capital gains in the meantime.

This is the greater sucker method of investing.

The investment stacks up so long as you believe someone will come along to pay even more for it in the future, regardless of the underlying economics.

My landlord has played it like a pro.

House price graph or blood pressure graph?

We’ve been here for years:

- House prices have never been so high relative to incomes, but interest rates at 300-year lows make them just about affordable – presuming you can get a mortgage, and probably also help from the Bank of Mum and Dad.

- Many pundits say the market will correct when rates rise – but putting it off is just storing up a bigger catastrophe.

- Most agree there’s a supply and demand imbalance – yet few are happy to see new houses in their own back yard.

- Some blame the banks for making borrowing too difficult – but who really thinks they should be lending more, with house price to income ratios at all-time highs in London and the South East?

This graph from the excellent Economics Help blog shows the mountain faced by first-time buyers in London:

So far, the government’s answer has been a sort of lightweight boom-and-likely-bust.

George Osborne hasn’t quite poured kerosine on the fire, as his predecessors might have in the 1980s.

But actions like Help to Buy and the recent stamp duty changes seem aimed more at shoring up prices, rather than tackling the root of the problem, not to mention its wider consequences.

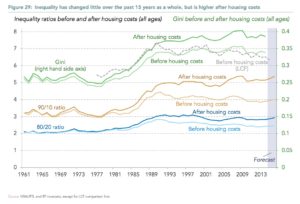

It is growing inter-generational inequality that is my biggest concern. 1

People say, “High house prices are not a long-term problem, because the kids will just inherit the wealth from their parents”.

This is awful thinking, in my view.

Firstly, it entrenches inequality. Fine if you were born to parents with property, and tough tomatoes if not.

That’s hardly fair, when most of us aspire to own a home. It’s feudal.

Secondly, a system based around waiting for your parents to cop it doesn’t exactly reward hard work and entrepreneurial flair, which is exactly what we need more of.

Many friends lament that they should have just bought the biggest London property they could manage after we left university in the mid-90s, rather than trying to set up businesses, or even just busting their guts out at a day job.

Of course some did buy – more than not, in fact – but even then they still wish they’d bought still more.

Who can blame them? The gains have been frankly obscene.

The first flat I nearly bought in Clapham in South London would have cost me £70,000 in 1996. Today it would cost more like £700,000. Assuming I’d put down say £10,000 as a deposit, that’d be a nice 70-bagger. (Yes I’d have had to pay off the mortgage along the way, but I was paying rent anyway).

I didn’t buy, and it’s a long story.

The bottom line is I was an idiot – let’s get that out of the way!

But leaving aside the biggest mistake of my financial life, it’s hardly good for the economy when society rewards sitting in London in a house bought with a bank loan over innovation and productivity to this crazy degree.

As for the average professional 20-something getting on the ladder in London today under his or her own steam? Forget about it.

The bourgeoisie of suburbia

In the run up to the General Election politicians will bandy around the usual platitudes about addressing this housing issue, but the fact is while the UK population continues to grow – and people keep divorcing, and living longer, too – we will need more homes and fewer empty promises.

That is not to say the solution is easy.

I just had a big argument on Facebook (not unusual) with friends who think the UK housing market shows that capitalism doesn’t work.

But I think capitalism is giving us what we’re asking from it.

Housebuilders are unable to build as many homes as they want because of a shortage of land with planning permission, particularly in the South East.

Some can’t get even their advanced plots through the final stages of planning without vast delays. Read their reports to the stock market if you don’t believe me.

Restrictions on building on the Green Belt and elsewhere, slow-footed planning procedures, and the power of NIMBY-ism from entrenched homeowners has stifled housebuilding.

And it’d do the same if we had the mass council building that so many seem to yearn for, incidentally.

I happen to love the countryside, and to some extent even the Green Belt.

But I can also see it has a massive impact on the supply of new homes.

Squeezed until the UKIPs squeak

I’m no UKIP voter, but it’s still plain to see that we’ve cheerily ramped up demand with unconstrained immigration from the EU and elsewhere.

This is not a political point, let alone a cultural one. It’s maths.

I live in London because all the world is here, and I can’t imagine anything worse than London frozen as it was in the 1970s.

The trouble is though that “all the world is here” is becoming less of a phrase and more like reality.

There are 8.6 million people in London today – the highest on record – and the forecast is for London to grow to 11 million by 2050.

Millions of additional would-be homeowners have arrived in London or are on their way. We can’t stop them, except by making housing unaffordable. (We’re nearly there!)

Yet while demand has surged, there’s been no increase in supply – quite the opposite. So we should not be surprised at the result, nor argue that capitalism isn’t working when it’s actually following the core principles of supply and demand.

Market forces will eventually see the more affluent incomers buy up more of London, and the poorer would-be residents moved out to the provinces – or even overseas.

Perhaps that’s no bad thing if Europe and the UK really are joined at the hip.

But it’s bound to cause frustration and radical change – if not worse – along the way, especially as most UK voters over 25 still wonder when they signed up to it.

The buy-to-let fret

It’s not just new homeowners who want a piece of our restricted stock of property.

For the past 20 years, buy-to-let landlords have been building their own portfolios, too.

In my street in London these days, a Sold sign is almost always replaced by a To Let sign shortly afterwards. And this is a street in classic suburbia, not a gritty inner-city hub.

Is this really a good thing, when we know most UK citizens want to eventually own their home rather than rent one?

Again, policy makers, media columnists, the bulk of the voters, and pretty much anyone who had a decent job 10-15 years ago is in the “I’m alright Jack” camp.

In contrast, my 20-something friends – almost all earning well above the average wage for their age, although not City wages – literally despair of buying their own home in the South East, which is where the jobs are.

So even as house prices have soared out of reach for the young, we have presided over a vast increase in buy-to-let landlords and others who own two, three, four or more properties.

Now, I don’t believe this is a cause for moral outrage, let alone insults.

Buy-to-let investors are just like most Monevator readers (indeed some are Monevator readers!) and most are simply trying to improve their lot, or gather assets to fund an uncertain future.

I also believe that buy-to-let has actually improved the quality of rental stock overall, at least in London. That was partly the aim of the policy in the first place.

Nevertheless, all cycles overshoot.

Perhaps it was too hard to be a landlord 20 years ago. Now it’s far too hard to buy a home if you’re young.

If the market isn’t free – which it’s not – and if policy partly got us here – which it has – then government should intervene again.

Taking a guillotine to high house prices

For basic reasons of democratic fairness, I think such policy should favour the aspiration of the many to own their own home, certainly at the expense of further expansion of the buy-to-let sector.

And if that also means house prices need to fall, so be it.

Of course, most people won’t like it.

As Martin Wolf recently put it in the FT:

“The wealth accumulated by property owners is fundamentally unproductive. Defenders of the system tend to refer to this wealth as the product of savings. It is not. I understand this myself, since I own a house whose nominal value is perhaps 25 times as great as it was when I bought it 30 years ago, almost nine times higher after adjusting for inflation.

This vast increase in wealth is not due to my endeavours. It is overwhelmingly the product of a rise in the value of land, which is the fruit of other people’s efforts, not mine.

Change will come only once people recognise how unjust this situation has become. This is not just about obstacles to becoming an owner occupier. High house prices will also raise rents. They will ultimately force people to live in more cramped conditions than would occur without limits on supply.

What is to be done? If a solution were politically easy, it would already have happened. It is not.

I cannot think of a better example of the way in which controls tend to create a vested interest in their perpetuation.“

(My bold).

In London we have a property market that serves overseas investors, buy-to-let moguls, high-end property developers – and anyone over 40 who is sitting pretty (but perhaps also stuck) in a house that’s soared in value beyond their wildest dreams.

Should policy really be designed to preserve that status quo?

Maybe we need some sort of grand coalition, so that politicians can all take the blame for doing the right thing together.

9 ways to help fix the housing market, especially in London

Having set out my stall, here are a few ideas to address supply, demand, and the basic fairness issue.

Obviously some will rile some of you, which is fine – it’s a debate.

I welcome any comments, but please keep them civil or I’ll just delete them.

Also I’m not saying these are all great ideas. Probably they each have flaws!

Read mine, then let’s hear yours in the comments below.

1. New savings tax breaks for would-be first-time buyers

First-time buyers need more help to compete for properties with landlords who can buy with an interest-only mortgage and set their rental income against it.

Sure, if landlords over-stretch they may face a day of reckoning in the future, but it could be years if not decades until that happens. In the meantime a couple of generations miss out on the surest way most people know of building up some assets, and we’ll all have to deal with the future bursting of the bubble anyway.

For starters I’d look at rewarding young savers. I’d create new First-Time Buyer Bonds that pay say 4% interest, tax-free, to enable first-time buyers to more easily build up a deposit for their first home.

A bit like the pensioner bonds, but better, and aimed at the generation that actually needs helping.

There’s probably even more that can be done here. The fact that residential property is free of capital gains tax is a huge bonus that makes it even harder for a non-owner to keep up with owners – made far worse by the fact their tax-free gains are geared up with borrowed mortgages.

(Believe me, I’ve tried – and I’m someone who is so capable with money and investing that I’ve ended up writing a blog about it. The average non-owner has no chance).

Any ideas you have are welcome below.

2. Buy-to-let rental income no longer allowed to be offset against mortgage interest

At a stroke this move would render much buy-to-let landlording unprofitable at current prices. It would probably cause a house price crash at the lower end of the market in the South East.

Would that really be such a bad thing?

Landlords would eventually re-enter the market once it had corrected, but it’d be easier for would-be homeowners to compete with them for the same properties.

Since most people would agree it’s fairer that more people get to own their own home than that a smaller number of people get to own 5 or 6, given that we live in a country with very limited housing supply, then to me that seems a fair trade-off.

3. Tax breaks for investment in new property developments

Of course, encouraging supply would help too. I happen to believe the problem lies more with planning and regulation than with a lack of appetite among builders, but nevertheless if house building was made more attractive then perhaps more smart people would find ways to get around the problems.

A good example of a problem solver is Tony Pidgley at Berkeley Group (disclosure: I own the shares). He has been finding his way around the brownfield/regeneration landscape for years, to the boon of shareholders.

Berkeley recently did a deal with National Grid for instance to turn lots of its old unwanted land into property. That’ll bring 7,000 new homes online.

How many more might be built if there were more tax breaks to encourage a housebuilding boom? (As opposed to tax breaks to create yet another a house price boom…)

4. Incentivise local communities to find and approve new in-fill and brownfield sites

Note I said communities – i.e. real people – not local authorities.

If local people got cash payments when new homes went up in their area, I think local opposition would plummet.

Such payments could be linked to average house prices, say, which presumably reflect demand. The money could be repaid to government by a special levy on the first sale of the property after its new build buyers move on.

Please note that I’m not talking here about knocking over ancient woodland to build another identikit estate.

There’s plenty of surplus old industrial land, unwanted pubs, builders yards, and that kind of thing that get turned down for new housing.

I don’t think in the South East that it can get turned down any longer.

5. A wealth tax on second homes

People will say “why a wealth tax on homes and not on shares or sports cars?”

The answer is that there are plenty of shares to go around, and sports cars are not a concern of government. Enabling people to buy and live in their own homes is (or should be) and there are too few homes to be careless with them.

I don’t mind so much holiday homes that are let out for say 50% of the year. That’s just a hotel by another name.

I mean little cottages in beautiful villages that are used for 6 weekends and a fortnight a year.

Tax them hard.

6. Make London taller…

All this moaning about skyscrapers in London is ridiculous. London is too flat as it is, with a sprawl to rival Los Angeles (albeit with better back gardens!)

Anyone who has lived in Paris or Barcelona knows that dense housing does not need to mean bad neighborhoods. Quite the opposite.

Heck, anyone who has visited Bath or South Kensington knows the same.

The key is to plan it right from the start, to make higher-rise living aspirational, and to build in features like green roofs and central courtyards and the like.

Builders are already doing this to some extent, and crazily some chastise them for it. These sorts of developments are the future.

London’s true villages are fabulous, and I’m all for protecting the good stuff.

But London is also full of ‘meh’ suburbs and housing stock that could and should be replaced with better.

7. And make London bigger…

I’m sorry, but we need to let a couple of notches out of the Green Belt. London has just grown too bloated.

Much of the Green Belt is arid industrial farmland, anyway. The UK’s savannah it ain’t.

Many times I’ve sailed through these empty millions of acres on a train, only to arrive at a friend living on the other side who asks without irony how I can stand to live in over-crowded, overpriced London?

Anyone who knows the formula for the area of a circle (Pi times (the radius squared)) will appreciate that the radius doesn’t need to be made much bigger in order to bolt a lot of new homes on to London.

Actually, I bet a few tactical incursions here and there could unlock the value of lots of currently rubbish brownfield/urban areas on the fringes, too.

Again, seizing the nettle and planning the roll-out rather than whistling and looking the other way could mean we end up improving the South Easy, rather than impoverishing it.

8. If not inheritance tax or capital gains tax, then a Rebatable Property Transfer Tax on all home sales

Regular readers will know that I’m the only person left in the UK who supports very high inheritance tax.

Lower tax rates on the productive workers and the old living on their slender savings, and more tax on the dead, that’s what I say.

Let Tarquin and Tabitha make their own way in the world.

This is a debate I regularly have with friends. I’d say I bludgeon win one in five around, for an evening. (They usually revert).

However I’m often told – not least here on Monevator – that inheritance tax is unenforceable.

So I thought perhaps there should be capital gains tax on residential property – currently it’s the biggest tax-free perk going, as already discussed above – but sadly I agree with those who say this would just gum up mobility, and make the market worse.

So then I thought, why not combine these two astronomically unpopular taxes into one even more logical tax?

Ladies, gentlemen, I have just invented and give you the Rebatable Property Transfer Tax.

Here’s how it would work.

When you sell any house, you would pay tax on the gain – say at your current rate of capital gains tax.

However you get also get a Rebatable Property Transfer Tax Certificate!

This is transferable when you buy a new property in your own name. It is effectively an IOU from the government.

This IOU means the government pays off an equivalent amount of the purchase price of your new home, perhaps working through the bank as an intermediary.

Example. You sell a house for £400,000. You pay £112,000 as capital gains tax, and get a Rebatable Property Transfer Tax Certificate in return.

You then buy a house for £500,000, of which £112,000 is paid off by applying your Certificate.

So no extra tax has been paid by you in the end.

Now you may be thinking: Huh? What’s the point?

The point is you can only apply it when you buy a house in your name (or together with your partner, in their name too, if applicable).

And you cannot buy a house in your name when you’re dead.

So the tax only impacts you when you’re dead and a property is sold. Which means it doesn’t impact you at all – it impacts your heirs.

Until then you can move freely to your heart’s content without being tithed by capital gains tax, just like you can today.

But when you’re dead, the Certificate has teeth.

And the heirs can’t dodge the tax, because it’s paid when the property is sold. (Or transferred. Or moved into trust. Or whatever. Look, it’s a first pass. It came to me in the bath. Eureka!)

Note: You probably don’t actually get a certificate. It’s all done on computers, which makes it easier to apply in chains and so forth. (And maybe we could sort out the ludicrous system of tardy solicitors at the same time).

9. Revamp the North. REALLY revamp it.

For all I’ve spoken about London, the fact is we need a true second city. Not a pretend one like Birmingham.

Human bodies have two of most things for a reason, and a sort of similar principle should hold true for countries.

One of the best ideas I’ve heard in a long while is to join Liverpool, Leeds and Manchester together via fast trains to make a new megacity in the North.

I don’t think centralized planning really works, but there are some things free markets can’t do on their own – at least not now the days of the railroad barons are long gone.

If Government really wants to revitalize the North then it should stop measly attempts here and there, and do something truly big.

Nobody in Seattle or Los Angeles frets that their city is not as important as Washington or New York.

Heck, nobody in Munich minds too much about Berlin.

You may be happy with Hull, but the world is not.

We need another London.

Ideas, comments, and so on are very welcome below. From experience though I know that house posts can generate nastiness from all quarters (landlords, frustrated young people, capitalists, communists…) so please play the ball, not the man or woman. And be aware I will delete nastiness on my whim.

- Yes, really. Before anyone tries to kick me in the metaphorical man-parts, I can buy a property in London due to rampant saving for 15 years and excellent investment returns. I’m unusual though. And I’m still currently a refusenik![↩]

Comments on this entry are closed.

“And he’s made perhaps £250,000 in capital gains in the meantime.” Wrong tense, I think.

P.S. Have you told him that unless he times his death adroitly, he’ll have lots of CGT to pay?

Your suggestions seem to me to be a tangle of (i) Letting the market work its magic (“There’s plenty of surplus old industrial land, unwanted pubs, builders yards, and that kind of thing that get turned down for new housing”), (ii) More interference with the market (a poor idea, given who will be doing the interfering, and their motives), and (iii) Altering the tax system. I vote for (i) and (iii). Even the CGT-on-owner-occupied idea could be made tolerable by re-introducing inflation-linking for capital gain calculations, and imposing a starting date for the sums (e.g. the value, demonstrated or estimated, of your house on 06/04/2016 or some other date a year or two after the announcement of the tax). Or you could really grasp the nettle and go for a Land Value Tax. Or even re-introduce Schedule A Income Tax on the imputed rent on owner-occupied property. (I have a fondness for that tax because it was the subject of the first discussion I ever had with my father about economics – a budget had just scrapped the tax. I must, I suppose, have grown out of Meccano.)

> I’m the only person left in the UK who supports very high inheritance tax.

I’m the second out of that one. But I fear among the PF community it is mainly the child free who will be of that view.

Leaving ancestral wealth to featherbed your kids sounds great. particularly in a time when power is shifting away from labour. But those children will have to live in the societies of desperate others long after I am long gone. The best of British luck to them… Desperate people with no hope and nothing to lose tend to seek desperate solutions.

On housing I think 2 and 5 would do the heavy lifting.

I also support high inheritance tax, despite the fact that I have kids and they both have an inherited disease (polycystic kidneys) that may not be treated under the NHS in the future – they may well need every penny we can leave them.

Please don’t despair of true fellow-feeling – it does thrive 🙂 (Although it may question what you mean when you say that “capitalism is giving us what we asked of it”.)

If Leeds, Liverpool and Manchester were all joined by uber-high speed trains, I’d move there in a second. I’ve spent a lot of time in all three, and they’re all fantastic places.

Question: why the angst against housing if you can afford one and have done well in your investments?

Is it because you feel you should have done well in both housing and equity investments?

Rates are going lower in the US. I’d buy here if I were you. San Francisco especially. Cheapest international city in the world that is most beautiful too!

Sam

I feel like this is the first time I’ve heard someone advocate development of the north as a solution to the housing crisis. It’s strange to me that it isn’t mentioned all the time, as it seems like such an obvious solution to a number of problems. The north needs more jobs and industry and the south needs fewer people–surely something could be worked out? I write from the perspective of an American who has been living in Newcastle for just over 5 years–in the US, it wouldn’t be unusual to provide tax incentives and whatnot to companies interested in opening offices in less developed areas. Sometimes that seems a bit ridiculous, but in this case I think there’s a lot to be said for the solution, or something similar. I’m not really sure what purpose the superfast train between the cities would serve–I love trains, but it isn’t clear how exactly that would lead to massive development? At any rate, I do appreciate you putting it on the table.

@dearieme — True, it is a mix of free market thinking and big government thinking. As I said in the piece, this is because I believe that (a) that’s how it is today and (b) it’s likely always going to be that way in a small island with a lot of heritage and history that you can’t bulldoze over, a love of the countryside and gardens and green space, (c) a growing population, and (d) enough wealth to mean that plenty of people want to live alone (or can live alone) by choice.

A genuine free market would buy up tracts of farmland from farmers in Berkshire, Buckinghamshire, and so on, and build multiple Milton Keynes’ tomorrow. Agricultural land is dirt cheap (because it won’t get planning) and at least for a while demand and profits would be off the charts. But it isn’t going to happen. (Rightly, in most cases, but that’s why we need to do other big things).

@Ermine — That’s true, you have stood up and been counted before. We’ll be first up against the wall etc! 😉

@Cerridwen — I mean what we ask of it in terms of our actions, not words from politicians etc. So they will say we need this, that and the other from the property market (more affordable housing, more regeneration, more flats targeted at younger people and so on) but they don’t do anything to meaningfully change the ‘rules’ of the game. Capitalism plays everywhere according to the rules you set it (give or take distortion, boom and bust, greed and so on). If we want a different outcome, we need to change the rules (/incentives).

@Andrew — Yes, the North has a lot going for it. 🙂 But there’s no denying those places are currently nowhere on a global stage, however much local pride they have or the odd business doing well. I think the UK needs at least one genuine second city, for all sorts of reasons not just property price related.

@Financial Samurai — Yes, I’d be deluding myself (and nobody else… 😉 ) if I said it literally didn’t bother me that I’m relatively poorer because property prices have gone up say 10x in many inner London hotspots where I’ve looked/lived since the mid-1990s, and yet average salaries have gone up maybe… 50%? Clearly it annoys me, and clearly I’d want my money to go further. Remember we haven’t had a mega-stock market here in the UK like you’ve had — the FTSE 100 is still below where it was in 1999 (although there are other markets, of course). It has been a hard and painful road to keep up with friends who just lied on their mortgage forms and funded deposits with a credit card 10-15 years ago, and now sit on property fortunes and look like geniuses because rates were slashed to 300-year lows.

However I have had a long time to get used to that story and my ineptitude with London property over the years, and it’s genuinely not what has motivated this post. I am honestly looking at it from a societal perspective. I think it’s hard to grasp living in America how London-centric the UK is, and how truly out of reach to most London prices (unless they are funded by others who have already done well from London prices — i.e. their parents!) The US has hotspots, but as a percentage of the population the prices in Manhattan or San Francisco or wherever impact a much smaller set of the population.

I love San Francisco and used to visit a lot in the late 1990s. Should have moved. 🙂

@Emily — Well, companies will open offices where the workers want to be and right now all the brightest people (generalizing and rounding up! 🙂 ) want to be in London. If you come into London via Kings Cross you’ll see massive development there which will house among other things a huge pharma research facility right in the Zone One London. I have known people who work in pharma, and it does not pay the average 25-40 year old well at all, so who knows where/how the young people it employs will make the maths work. And yet I see the logic, because these people want to be in energetic London, and around each other, however much people from other towns say there’s more to life than London.

So the ‘megacity’ would have to be jump-started right up to the level of attracting workers. The trains help by bringing the three cities together, in the same way that people who live in Uxbridge (West London) and people who live in Greenwhich (South East) all think of themselves as Londoners, even though these were once separate towns. You get a critical mass, is the theory, and then the world class companies can take a chance.

It’s definitely difficult for government’s to turn the tide on local geographies and trends, and I think you probably need to do it on a massive, Chinese-style scale to make a difference and have a chance, otherwise you just throw good money after bad with piecemeal funding of £100m here and £20m there. I think you’d also have to include in the cost-benefit the ‘social good’ of London having more affordable housing and the back-up of two major cities, even if on paper the whole exercise actually cost more than it appeared to generate for a decade or two…

I really enjoyed the long article to read. The main point I thought was in relation to “New savings tax breaks for would-be first-time buyers”.

Now I am no economist, but surely a tax break for first time buyers (if implemented with nothing else) will:

1) Give a lot of money to the Buy to Let brigade, who generally own the first time buyer houses as investments.

2) Push up the price of first time homes, making the savings scheme possibly have no impact in real terms (saved more, but house costs more).

3) Cause problems higher up the market. If people get help to make the first step, but none to make the second, how will people actually end up in family homes? If your earnings stay the same (or even go down after having children) then moving up to those second stepper homes can be a bigger problem than the initial foot on the ladder.

Moving into a 2 bedroom house/flat to have a child seems sensible, but if you can’t move on because you had help to get your first foot on the ladder, but can’t get help again, then we will have a generation of young children growing up in shoe-boxes.

Possibly a more viable option would be a savings account that can only be used to buy residential property that you are going to live in, no matter it’s size? (although in turn that has its own flaws…)

A lot of the others I agree with whole heartedly though. I would love to read more of this open ended thinking:)

on the subject of inter-generational equality i would ban all private education as well as all the inventive death taxes you suggest.

that would have an immense effect on the cultural landscape of the UK within a very short time-span

would definitely shake things up a bit

i’ll never forget being asked by some ginger toff in a hockey jersey at uni ‘where did you school?’ just before i broke his nose. I’ve been convinced private schools do more harm than good ever since..

I guess a few would just get sent overseas but you would have to *really* hate your kids to do that, in which case they’re are most likely all a lost cause anyway

@theRhino — As warned I am going to delete hard here, and “ginger toff” is on the edge. I’ll leave it here and anyone else who feels the need to throw something in that direction can consider it already covered.

The rest of your comment is good, thought provoking stuff, and I can see arguments in lots of different ways. On balance I dont agree but I know where you’re coming from. I’d bring back a mass State / charity funded grammar system myself.

What is astonishing about the current situation (and you allude to it in your comment) is the incredible level of demand for London housing. It seems however expensive, however painful the commute, however much more “you could buy in Leeds” – people, especially young ambitious people, want to be in London. You can understand why a global business person wants to be there – but the demand seems to come from almost everybody that is able to be mobile.

I don’t think that that demand can be easily diverted by building railways across the Pennines or inefficient regional development funds funding businesses that frankly shouldn’t be funded. London, like New York City, like Silicon Valley, has decoupled from the region around it and that density of people with skills, money, professional support, related networks has reached a critical mass that I don’t think can be replicated by mere governments.

IMO increasing supply by building more houses will simply pour fuel on the flames – the demand cannot be met and creating more supply will encourage more demand and that will be global demand.

I suppose my inclination as a libertarian market capitalist is to let demand find it’s natural acme. At some point, the pain of commuting (even though it’s probably the best public transport in the UK), the price, the lack of nurses and policeman, the sheer grind of London life can no longer be balanced by its advantages. If you also throw in some overt London-only taxes or slightly-covert, like the mansion tax or CGT on gains over a certain value like the US, that will temper demand further and fund continued fiscal transfer from the SE to the rest of the country.

Hmmm…us northeners might prefer it if there wasn’t an influx of cash rich southerners making our houses unafordable and replacing our mushy peas with guacamole. 🙂

But I generally agree that something should be done to spread the wealth (and thus property buying power) across the UK. I’m not keen on incentives to help first time (or any time) buyers as that simply further props up an unsustainable market.

I don’t see a realisitic solution. As long as people want to work in London and the world’s rich use London property as a safe way to store their wealth, it’s going to continue.

There will come a time when it’s not “very difficult” for young people to afford to live/work in London but “impossible”. They will then have to move…unless the benefits system continues to fill in the gap.

OTOH I suspect that our grandchildren will live in a very different world re life expectancy, jobs, salaries, own-vs-rent, etc. Just as our world is very different from our grandparents’. We shouldn’t just assume that the future will be just like now, but with ever more unaffordable (to some) houses…

Some comments from the USA:

1. Property owners in USA already have a “wealth tax”. It’s called property taxes. In my state, Indiana, non-owners (landlords) pay two to three times the taxes of owners. Property taxes are used to support schools, libraries, local governments. Do you see any logic to over taxing landlords? Be very, very careful asking for a wealth tax. As soon as greedy politicians decide all investors are wealthy (and have the backing of the spend it all crowd), CD’s, stocks, savings accounts, etc. will all pay extra taxes on principal, not just interest and growth.

2. Inheritance taxes are double taxation. The money was already taxed. It should not be taxed again.

3. If taxes must be raised, go to a national sales tax. (We do not have one in the USA). Punish those who spend and never save, and rebate the tax to the truly needy.

We need to reward savers, not punish them by taxing them extra . And that includes estates and rental home owners.

Good reading.

Need to digest the specific suggestions still but agree in principle with the sentiment.

Incentivising the North and indeed other places would help out London. Whether that’s a megacity I don’t know but a fast train to London doesn’t sound like the answer.

Get rid of Right to Buy as social housing stock gets depleted so quickly because of it. It is forcing people in to the private market unnecessarily.

I am the 20something graduate earning a good wage and I can’t afford something even after living rent free for a few years. Not that I would right now with low interest rates. That may sound like me moaning but more pertinent is that if that’s the case for me what hope do others have?

Fantastic reading and discussion for a Friday afternoon. I can see an argument for tackling “buy to leave” as well – who knows how many empty and/or never lived in flats there are in London.

My solution is to make voting compulsory, as is already the case in Australia, Singapore and a few South American countries. At the moment too many policies are designed for the benefit of the old and wealthy, who are far more likely to turn out to the polls. If all the young and disenfranchised had to vote then politicians might start embracing some of your ideas.

However, what I think will actually happen is that the pound will eventually collapse – the current account deficit and overall debt are totally unsustainable. This will lead to inflation and we’ll then see prices of everything rise except housing due to an inevitable resultant hike in interest rates. It’s simply inconceivable that the government will allow house prices to collapse in nominal terms, but clearly they do need to fall relative to incomes. In the meantime we’ll finally get some (council) housebuilding from a Labour government along with some 70s style socialist policies that send the UK into decline and cause lots of foreigners to leave. Or maybe more UKIP influence with the same result. Either way a perfect storm for the housing market.

I would like to see this blog refined and developed into a strategy that could be adopted and legislated. With that in mind and speaking as a brand new landlord (with two properties funded entirely through mortgaging the main residence), I approve of your second point. In order to take it from theory to practice could be facilitated by introducing it in stages to reduce the initial opposition.

In the South East I suspect that capital gain is the stronger incentive for new landlords to enter the market but at least your strategy would reduce the overall attraction and provide funds for your first time buyer incentive..

Immigrant here (born in Oz) with one home and one flat I rent out, both in what used to be el cheapo East London (no longer so but it has not gone up as astronomically as Clapham, that’s for sure). I have no bone to pick with any of your arguments per se but three cheers to the proposals to a) give tax breaks to investment in developments, b) offer incentives to communities to identify potential sites and c) tax second homes, and ten cheers to d) developing the North, which would kill several birds with the one stone (it seems to me). The North is beautiful and I would move there in a second if I wasn’t tied to my London job. I would happily retire there.

Ah yes, that is impressive if you traded stocks well enough to afford since the FTSE isn’t too hot.

I don’t understand how people in the UK can afford London either. Ridiculous prices!

I TRULY believe San Francisco is the cheapest international city in the world and buying in place like Golden Gate Heights, where you can get PANORAMIC ocean views is worth millions, but only costs $1.5 million USD 🙂

Pls read my post linked in my URL field! All foreigners should buy SF property. It is an absolute no brainer, especially before China’s capital account opens.

Best,

Sam

@Emily

The deliberate emptying of people and jobs London was government policy from about 1940 to 1980

I think from memory the population of London fell from just under 9m to about 6.5m during that period

30 years of (largely) free market economics has reversed that population in absolute if not relative terms

I feel like an outlier in these kind of discussions; I’m young(ish), in a new- build brownfield site house in the East Mids, having bought it with no parental (or governmental) help.

I’m helped by working in a profession that has good income potential, that doesn’t rely on living within 50 miles of the capital.

For as long as my generation (and those younger) refuse to partake in the political process, as broken as it is, radical change is unlikely to happen. This is not helped by idiots like Russell Brand speaking the right language but saying completely the wrong things.

The reason the odds are stacked against the young is effectively two-fold – we can’t be bothered to vote, and in aggregate we’re a pretty lazy bunch (largely due to the coddling we receive from our well-meaning parents).

As for your points, I think they’re generally quite sensible. I also think it’s hard to see the UK without the London lens – it’s really not so bad once you get about 50 miles out of The City.

@ Investor

The country is running an annual deficit of £75-100bn as far as I can figure, there is no justification to giving tax advantages to any well-off segment of the population who can afford houses (already owners of multiple homes or not) when poor people are going to see their welfare payments cut heavily whoever is in power after May

We just need

– a proper residential rates system that charges people based on the actual value of their properties, like the rates system abolished 25 years ago

– just build on a bunch of rape seed fields in zones 4-6

Its not a question of developing the North, just matching the huge infrastructure investment made around London in the past 20 years (Northern line extension, Crossrail, Olympic Park, London orbital rail line, Jubilee line) while the rest of the country was left to rot would be enough

@qpop

Being old enough to be your dad I find the people your age I meet to largely be better behaved, better educated and harder working than my generation

I can’t help noticing that their paths in life are largely dictated by who their parents are, much more so than mine was

The London property problem could be even worse if a number of large employers didn’t offer their staff free or heavily subsidised rail travel. I earn a decent wage with relatively regular overtime possibilities, but I could never afford to live in London. Instead, I’m subsidised to take my wage into the provinces and help ramp prices up out here.

I’m not sure what the answer is, but there is *something* about London that draws people there. On such a small island it’s difficult to justify a ‘second city’ like we see elsewhere, but I think that’s really what needs to happen.

Living in Manchester, I’m all for money being pumped up north, especially to create more jobs. However, as Richard says, we may want to keep our houses affordable (and they are, just see Zoopla) and plus, we wouldn’t want to have to moan at house prices as well as the grim weather up north! 🙂

Thing is for us folk who have never lived and unlikely to ever live in London, we just shrug our shoulders at the daft house prices – it’s like it’s happening in a different country.

The BBC has made a bit of a start on investing in the north, relocating some of their studios up to Media City and the whole area has had a lot of money thrown at it, with new prime properties springing up and other businesses wanting to be seen to have offices in the area. It looks really good.

However, I fear that it may well be some Northern people themselves who will be resistant to the making of a super Northern City, eg Mancs v Scousers v Yorkshire!

I consider Monevator thinking to be the finest there is in terms of investment philosophy and strategy, so I’m excited to read a foray into the area of public policy. But then I genuinely don’t get it.

What is the problem we’re trying to fix?

You open suggesting that London prices are over-inflated and about to crash. I also don’t know what to make of that: I’m frequently told similar things about the bond market and the S&P500, but I don my Monevator armour and invest according to my asset allocation regardless. There’s an asset class (that you missed out on) which has seen spectacular returns but you think has low yields and is highly volatile. The world seems to be working nicely so far. You admit that perhaps you colour your view by being under-exposed to this asset. I colour mine by being over-exposed. In the absence of a good mechanism for holding parts of property, they are so lumpy this is likely to often be the case. Try re-balancing a flat in Kensington.

Perhaps, then this asset class is in some way evil. It’s like investing in tobacco or guns or something and damaged the world so we have to reign it in. Ok. What’s going wrong? It seems that you hang your hat on the fact that British people want to own their house. It appears they can’t afford to. Young people can’t afford expensive things. Twas ever thus. They’ll have to rent. Or commute. You can live in Andover and work in the City: I have friends who do this. You can work from home or start a business in Bristol. This is exactly the kind of pressure that drives innovation and entrepreneurialism that you think is being strangled. If I can’t afford to play in the old world, then I’ll build a better one. And if I want to run a business in London then I’ll have to pay my staff more. Or move my business to Manchesterpool.

Let’s look at your solutions which are overwhelmingly tax levers. The thing is that this changes very little if you have no power in the value-chain. Take the BTL mortgage rates — almost universally they are 40% higher than residential mortgage rates to account for the tax break that the BTL landlord carries. The tax break is there, but the benefit flows to the financier, not the owner. Create a first-time buyer tax break and watch their mortgage rates go up, too. Empty properties are already taxed. Capital gains tax on properties is an odd anomaly, but one that would be politically impossible to remove and unworkably complex with certifications. Tax the dying harder and they will wriggle better.

So what about building more? Great. London has boat-loads of commercial property that could be converted. Many industries that could only exist on high streets are internet-enabled out of local existence, leaving empty shops. You risk a change of character, but that’s progress. Why stop at the Green Belt? Leave a few big green woods and parks, and start on the far side:- Slough, Reading, Guildford, Bicester, Cambridge are all terrific commuter-range towns and there’s a huge amount of land out there to build on (look out of a plane window). Extending your pi-r-squared argument to a 80 miles radius gives you all the space you need.

Whatever the public policy actions — they should be done gradually so that investors are not spooked out of the class altogether. It also needs to be done so that it doesn’t look like a bunch of have-nots legislating to take back from those who have. (Imagine the Govt suddenly taxing pension funds). Noone wants to get involved in large illiquid assets if the tax and regulatory regimes are fast-changing — at least not without a significant speculatory premium.

* * *

Perhaps “something must be done” in a hand-wringing way, but I’d always consider doing nothing as a first step and try to understand exactly what goes wrong. From a Monevator point of view, isn’t the question how we as investors respond?

In my opinion the root cause lies in the loosening of lending standards, combined with the lowering of interest rates and fractional reserve banking (none of which is capitalism, it is centrally controlled cronyism). Previously a bank would lend based on you putting down sufficient deposit (quite reasonable, if you cannot afford to save for deposit, you cannot afford to save for ongoing repairs and maintenance. Plus you have skin in the game so to speak, lowers bank’s risk). They also lent based on sensible standards, say 4 x an individuals income, this was loosened and now it’s joint incomes etc, essentially stealing much of the economic gains of a two person working household. If they weren’t able to lend the money in the first place, they would not have increased in price so much as where would the supply of funds come from to fuel the demand? Sure there are pockets of undersupply, but that is only long demographic driven temporary factor, who exactly will all the baby boomers sell their properties to when they need to go into care homes? (maybe the govt can simultaneously fund long term care homes and buy properties for the unemployed youth to live in? All paid for by shrinking percentage of people actually working, innovating and adding to the pot?). Solution, admittedly painful, would be to return to sensible standards and make them set in stone, i.e. 10% deposit minimum, max lending 4 x highest earning individual in household, 2 x joint income. BTL mortgages, enforce them to be repayment based like vast majority of owner occupiers. Raise interest rates. Just watch the house prices collapse! This will ruin nearly every borrower of last decade, which is why no politician would pursue it, yet talk of extra taxes and subsidies is unhelpful, we have more than enough taxes and government involvement in the economy, the government needs to get out of the way. Excellent point about London and brownfield development. Boris Johnson has good and ambitious ideas for developing London and talk of developing the north Manchester to Liverpool high speed train network and supercity would be great for UK in general. Many political housing ‘solutions’ actually favour people who already own property, i.e. they all try and maintain the prevailing prices through subsidy, despite the rhetoric of helping first time buyers etc. If we lowered the supply of credit and increased it’s costs, the price of property would reduce to a level that people could afford in a sensible manner. Yes lots of estate agents etc would go bankrupt and the market would dry up for a bit, yet only until many BTL and imprudent borrowers became enforced sellers.

Interesting ideas but I fundamentally believe only 2 of them would work (And even then have a good chance of failing). The inheritance and the second homes tax. Fundamentally why are homes expensive, partially it is down to supply/demand but fundamentally there are a few very rich people hoarding money that grows faster than wages. This means they can gradually purchase more an more investments (in this case houses) bidding the prices out of reach for the rest of us.

In effect the only way to stop this continual cyclical is to prevent wealth hoarding cross generations (inheritance tax, easy to dodge) or stop investors using residential property as investment – tax second homes/rents heavily.

I recommend reading Thomas Piketty’s capital for the full details…Personally I think his conclusions are a global wealth tax are the solution, but unlikely to happen in our lifetime!

@Mathmo — Just briefly as on the move, thanks for your challenging comments (and to everyone else who has chimed in, this is a great discussion!)

Just wanted to clarify that I don’t think prices are about to crash, and I’m not sure where I said that. If I believed that then the problem would indeed be solved. 🙂 (At the expense of a massive new one).

What I think is that prices are unsustainable — in our current world order — so either (a) they’ll likely crash some day, with poor consequences for the economy and so forth or (b) they won’t crash because our society has fundamentally changed, to the degree that, say, anyone under 30 who doesn’t have well-off parents and doesn’t work in the City will never own even a modest place in our capital city. And that this entrenched wealth problem rolls out across the South East.

But I agree with you and anyone who says my thoughts may be muddled on all this. I think it’s a hard problem.

As for how to respond as investors, here’s one I did earlier — well in 2011 — that would have led to gains of 100-300% with a basket of main market housebuilders.

http://monevator.com/buy-shares-in-house-builders-not-a-new-build-house/

However this isn’t a blog about touting past successes (I wish I got anything like everything so right!)

But anyway, I hope it shows I’ve been thinking about this from various angles for a while, too, including the pragmatic one. (i.e. I am not a perma-doomster housing bear…)

Interesting ideas for an area I agree is a huge problem for UK society. I think increasing the supply of flats/houses is really the only solution but I honestly don’t think the UK is capable of building enough.

I would suggest that taxes on property should be more related to the value. I don’t think it really makes much sense to divide things up in “normal house” and “mansion” since they are a continuous distribution. I suggest 0.5% of the property value as an annual tax to replace council tax bands. It would be one thing that would provide some downward pressure on prices and would provide needed tax revenue.

1. The private tenant end up paying unnecessary rent as home owners compare rent amount with council tenants.If government reduces the rent support by 30 percent then rents will definitely go down.

2.The tax need to be charged on rental income .

3.Second home mortgage interest rate- The housing support tax must be charged on the the second house.This tax can be used to give financial support(interest free loan for 2 years) to people who are buying their first house.

4.Council tax- No rebate in council tax when second home is empty.

Great food for thought, however I had to throw my penny worth in.

You wrote…”Some blame the banks for making borrowing too difficult…”

The problem was EXACTLY the opposite, A few decades of endless easy credit drove the housing market up. Ninja morgates, liars loans, self certifying mortgages. Free money = rising house prides.

Still is really. The same problem.

Sure rising population is a factor but if you look a charts of population, money supply, and housing, the way the banks work fueled this with money. Banks create +95% of all money in circulation.

As for taxes… Sure we all use services, however, if you gave 100% of everything you earned to the government! they would spend it all And still borrow more and add it to your future tax bill. If we start raising taxes, let’s start with the royal family actually, ayng some and set an example. I think the last time the royal family “paid inheritance tax, we were writing on a piece of parchment made from goat.

There is no real way to unravel this housing crisis without losing voters, so the gov will not do anything substantial.

Inflation is the stealth tax solution. Most people wil never see it coming, just slowly become more skint, and through QE, the housing market and the stock market will continue to rise. Right up until they all crash big time.

Your post is verging on communist ” fairer that more people owning homes than pole own 5/6…” That is not a solution. Life isn’t fair, you either sit back an expect handouts or go out and find a income.

Anyhow a rant over…. Love the blog and the discussions…..

Sorry for the grammar…. Damn mobile technology…

As for tinkering with the solutions above. May I suggest the following.

If your constantly doing autopsies on fish who are dying in a lake. At what point do you step back and think, hang on maybe there is nothing wrong with the fish. Maybe the lake is the problem?

All prices of all assets are determined by the supply of money. Until we sort out who controls the money creation system, boom and bust will be a fact of life. We have to get used to it 🙂

“on the subject of inter-generational equality i would ban all private education.” It might be better to give everyone vouchers so they can buy a private education, and ban state schools.

I must declare an interest: I had a private education in music, in dancing, in swimming, and once even a golf lesson. And my parent taught me a huge amount and you can’t get more private than that. Do you really plan to ban such things? You must be a monster.

Some good points. I like the rebateable property tax idea.

I grew up in one of the South East’s most expensive towns and now own a flat in zone two London. Theoretically the property boom has made me and my family rich – richer than work ever would.

But it is hideously corrosive. I have watched it change my home town into a City commuters’ enclave, destroying its character, and I have also seen the people pushed out of my gentrifying part of North London.

Give me a Delorean and I would gladly go back, change things, wipe hundreds of thousands of pounds off my family’s wealth and reset house prices in the UK to rise only steadily with wages.

One point I would add is that London and the South East’s current problem is exacerbated by the rest of the country and Europe wanting to live there. Eventually, if the market does its work, that will end. Heaven knows how bad things will get before it does though.

I’ve thought more, and think there’s more light to be shone on this argument by comparing housing to other asset classes to dial out some of the emotional language that floats around housing. It’s also illuminating to consider how we would fix an analagous problem in those other asset classes.

I can’t agree with Martin Wolf and other comments above that housing is unproductive. It provides shelter and commands a rent. It has a capital value which is presumably anchored on the NPV of future rents. It’s a bit like owning a company, buying a house, and just as voluntary. The problem isn’t the price of housing but the rents – after all you don’t have to own a house, but you do have to live somewhere. (Lord knows what these people think about owning gold)

Are rents too high? Is the price of a bottle of Coca Cola too high? Of the new iPhone? There are people on both sides of that. What do I do if the iPhone is too expensive? Buy a competitor’s phone, substitute the need for a phone or go without. Can I live other than in London and still get by in life? Unimaginable though it may seem, many people do exactly this. Does this stunt my opportunities to earn? Possibly – if there is no transportation of people or data. Are there enough competitors to choose from? Possibly supply is tight: building more homes near transport links will keep the lid on rents. Indeed, increasing supply is the only non-distorting option for constraining prices in a rising demand environment.

So how come rents increase? How can the iPhone keep getting more expensive? Is Apple a monopoly and abusing its position? Are the people of London smothering development opportunities? I think they might try, but whilst there are trains cars and the internet, there’s too much space to occupy nearby. You can’t make more land, but you can increase occupancy and we have a long way to go in that regard. There’s a tradeoff with character and greenspace but more people means addressing that head-on.

So if that’s not it, why are rents increasing? The simple fact is that cities are networks of commerce on many levels. Network strength is determined by the square of the participants so big cities are much better than medium sized cities. Indeed – the strategy for medium cities is to become accessible to the big city. Should Birmingham interact with London or Manchesterpool? The choice is obvious. The bigger a city – provided it remains connected and cohesive – the more attractive it is to be part of, the higher the rent that can be charged for living there.

If you don’t want London prices to keep going up then you either have to subvert some of the increase into a tax (although this doesn’t necessarily suppress rents) or add supply faster than demand (which will in turn increase the attractiveness of the city) or max-out the network effect.

Good hunting.

Love the blog! Keep up the good work!

Without in any way wanting to seem rude, it looks to me like there is just the faintest whiff of “first world problem” to this article with a bit of “politically left leaning whilst guilty for having plenty of dosh”! 🙂

As someone said above, the proposed measures seem to involve a mix of (1) “leave it to the market”, (2) “meddle” and (3) “tinker with tax system”.

Your article seems to be saying 1 either isn’t working, or is working too well, either or both of which is a problem, in which case I’m confused as to your overall message.

On 2, the real problem in this country is meddling by politicians with vested interests who always seem to vote themselves exemptions to the laws they impose on others. That to my mind is the real problem – only when politicians are forced to live in the same world as the rest of us will things improve. This to my mind is the real root cause of the country’s problems. The expenses scandal being simply the most visible manifestation. If people have an issue with buy to let, they might want to check out this article in today’s Telegraph. OK, it’s a bit pop-sci like the Telegraph mostly is these days, but the core message is the same – many labour MPs are also doing quite nicely out of BTL, thank you very much, and would (a) prefer you didn’t know this (rather ruins the “one of the people” image old chap, and (b) would like the status quo to continue thank you very much. See here: http://www.telegraph.co.uk/finance/personalfinance/investing/buy-to-let/11394847/Why-Labour-wont-stop-the-stampede-into-buy-to-let.html

Which leaves 3. I found myself oddly surprised when I think it was Mylene Klaas who said to Ed Miliband recently “why do you think more tax is the solution to every problem”. Wow, a “sleb” speaking common sense.

For a lot of the voters, a new tax might seem evidence that the government is “doing something”. Unfortunately, it is the response of lazy government, and most people don’t really want more taxes for themselves. They want more taxes on *other people*. And more taxes just encourages governmental waste, profligacy and unwillingness to ensure value for money. Why bother when you can just “raise taxes”.

I’m not going to rehash the inheritance tax argument we’ve all had before, other than to say that making it more punitive is only going to end up counter-productive. And for all the childless who die, what are those who still have significant assets at their death going to do. Leave to charity maybe, but in which case, why not ensure that those charities are clobbered for tax on the “windfall” gift, just like children of people with kids are. After all, many (of the larger) charities now seem to effectively be arms of or lobbyists for government in one way or another and seem to be doing quite well out of the public purse, so it’s not like they need more. I guess whay I am trying to say is – more or newer taxes is not the answer. It encourages lazy, spendthrift government and simply stokes tensions between segments of the population, depending on who is benefitting or not.

That said, I do think the tax regime might be (part of) the answer here.

Why do people flock to London? OK, capital city. But what does that mean? In London’s case, it means (mostly) excellent transport and communications links (if you ignore the crowding problems on the tube etc), seat of government, seat of royals, large numbers of (mostly) free to enter museums etc and a vibrant (if expensive) cultural life.

The main thing through will be the transport and comms links and convenient location.

Much of the problem with the rest of the country I think comes down to creaking infrastructure – old, potholed roads, pool or non-existant rail links, outdated water and sewerage infrastructure and a broadband system which, despite what the adverts have you believe, it still very much hit and miss outside large urban areas. Couple that with NIMBYism and you see the problem. If the area is served by rubbish transport and comms links, who wants to relocate there?

So, how could the tax system help? I don’t know how the specifics would work, but there must be some whay whereby rather than clobbering people and companies with more taxes, you could e.g. “bribe” the nimbys in ways like “new railway nearby? OK, we’ll give reduce your tax level this year to allo you to e.g. install new double glazed windows or other soundproofing measures, but you must evidence that this is what you spent your dosh on otherwise we’ll simply collect double next year”. You might also encourage infrastructure companies with tax concessions to build in areas needing regeneration and allow them to issue tax advantaged bonds to help fund the work.

Or (radical idea), since all parties do (seem to) agree that we need new/better infrastructure, why not get buy-in from across the political spectrum that “we all agree this is needed, we all agree it’s a “good thing”(tm) and we all agree that we’ll support the measures and not change things if the party actually in government when the project is halfway through changes that the incoming one won’t change their mind”.

How you might make that binding on them all though is another matter!!!

Comes back to tax and stability though. People and companies don’t invest or hold off investing when they think things are about to change and/or taxes are going to be raised or new ones introduced. You see it all the time with pre-anounced changes to stamp duty, higher rate tax, etc. Rush to get things through under the older (more benign) system, with big fall off after that, or else decisions delayed until a new (more benign) system comes in (with drought before then).

OK, coffee wearing off and I can feel myself rambling, but I guess what I’m trying to say is, if you’re going to use the tax system, why not make it the carrot rather than the stick?

I can’t prove this, but I have a hunch that a material proportion of “casual” landlords are not paying tax on their property income. Clamping down on this area would and fining the perpetrators may force owners to sell as post-tax yields become unsustainable.

I’ve casually a number of colleagues how profitable their rental properties are after paying 40% tax on the income, only to be met with blank looks and ignorance.

Maybe these fines could go towards developing brown-field sites, or compensating NIMBY’s..

@LadsDad: enforcing the law would be a good idea, even if it happened to result in rents going up (as it well might).

TI, your Rebatable Property Transfer Tax is definitely practical!

Why?

Because it is pretty similar to something companies already have: Roll-over relief! Why should there be no CGT on homes but on offices? I think it is an excellent idea (I also support inheritance taxes. Remember, you can always gift your money before it has to be snatched from your cold dead hands!)

One other comment, not touched on by many here: FIX COUNCIL TAX! (sorry for the caps, but needs must)

How the bands are calculated is:

1. completely arbitrary (mainly based on hypothetical values);

2. not reflective of services received; and

3. not reflective of current property values.

Change it. Make it reflective of services or property value. The current system does neither and is a farce.

It’s amazing and amusing how many posts you get as soon as the h-word is mentioned and not surprising how political the debate soon becomes and how TI gets attacked for being a lefty!

Here’s another thought. As some point there will be a run on sterling. I’m not predicting what will cause it or when it will occur but there have been sharp falls many times over the last fifty or sixty years and when both the Conservative and Labour parties have been in government. If inflation is relatively low when this happens, it will initially be welcomed by the government of the day but when inflation shows signs of getting out of hand, emergency measures will be introduced such as a sharp rise in interest rates and possibly the ‘grand coalition’ which TI mentions. Once that happens, things get very interesting because policies which would spell electoral disaster for an individual party become feasible. I think you’d then get a very interesting mix of spending cuts (involving areas currently ring-fenced) and tax rises to restore confidence and reduce the deficit more quickly than at present.

@Grumpy Old Paul

The reason the H word gets mentioned so much is that for most people, especially those without public sector final salary pensions, it is their main asset. So they are understandably … protective of it.

On this board, people are (or want to become), relatively savvy about financial assets like shares and bonds. For a large percentage of the population though, they have far less understanding of such things and in many cases are quite happy with that state of affairs.

Once you start imposing more taxes on the the primary residence, whether by (raising) inheritance taxes, imposing land value taxes or wealth taxes, it’s but a short step towards confiscatory taxes on pension pots, ISAs and share dealing accounts. I mean, after all, if you’re rich enough to have stocks and bonds, you must be a “capitalist pig/thieving 0.01%er/insert favourite pejorative for those with more that you here” and should pay “your fair share” (meaning, a *punitive* rate of tax).

At which point, why bother? Remember the old axiom – “The power to tax, once granted, will continue until it destroys”.

@L – agreed that Council tax is broken.

But what exactly is your preferred alternative?

Remember, for those on average wage, in most parts of the country, Council tax is like another 10% on income tax. Which means a “basic” rate tax payer is paying 20% income tax, (effectively) 11% NI and then 10% Council tax – so over 40% of a “basic rate” salary already gone before you start adding VAT, VAT on fuel, etc etc etc. Except Council tax has an added sting in the tail – it comes off *net* rather than *gross* pay!!

You could replace with a local income tax, except that for most people, that will I think in practice mean an increase in what they are paying, ameliorated slightly by the fact it might have to come out of gross pay. But how do you administer it. Via HMRC? Can’t see Council’s going for that. Or is the Council now to get the right to dip into your salary as well?

You could try rebanding, but how do you choose the value? At the top of the property boom, or when prices fall? Guess which politicians will go for?! But then you might get an electoral outcry! With politicians of all parties having BTL empires and/or pads in nice parts of London, courtesy of us the plebs, I can’t see them voting for higher property taxes unless of course they get their usual exemptions and/or get to expense the lot of it (and what useful idiots “Hacked Off” are in helping to keep politician’s dirty dealings private)

You could try a Land Value Tax, but everyone’s argument for that is that it is supposed to encourage development. But most people’s houses are already there on their land. And again, how to you set values to tax.

Remember, the rise in the “value” of people’s primary residence is entirely notional/paper until they sell. Just like shares. And are we really proposing yet more taxes on “notional” gains which haven’t crystallised yet? English law is meant to be based on notions of equity, but being taxed on something you haven’t had the benefit of in terms of cold, hard cash doesn’t strike me as particularly equitable.

If you look at the nice breakdowns the Council gives you with your Council tax bill (or at least, mine does), you’ll see they trumpt that “Education” is at or near the top of the expenditure list. Except that, once you dig into those figures, you’ll mind that the main part of “Education” is the pension provision for the teachers.

Leaving aside the whole argument about public sector pensions, the issue here is your comment about tying the cost of Council Tax (or it’s replacement) to services. OK, well, what if (like many of those on this board it seems) you don’t have kids? Much of that “Education” cost of Council tax is of benefit to those with kids (or, if you’re more cynical, free daycare for “breeders”). If you don’t have kids, you’re paying for a service you don’t use. Or what about bin collections? They moved from weekly to fortnightly most places. The reality is, many Councils are doing like whilst still collecting the same.

Any attempt to replace Council tax with anything else, especially something tied to services provided, is just going to provoke an almighty argument about “I don’t use / benefit from this, so why should I pay?”. And then once you’ve put in place the usual exemptions for the poor, the elderly and the disabled, I bet you’d end up somewhere broadly similar to where we are now, except with the added vast expense of having had to put in place a whole new system to take you largely back to where you were before.

If you want a proper local tax , what you’re really saying is that you want the Poll Tax back, because that actually ticked all the “fairness” boxes – which was precisely why it got shot down in flames. Those used to getting something for nothing were outraged when they suddenly had to contribute. And that is exactly where we’d end up if we tried to replace Council tax with something “fairer” – more riots and more arrears.

Which is why politicians leave Council tax as is. 🙂

@GOP — Yes, it’s funny isn’t it? On Monevator I am fairly often accused of being either leftwing or (as on this thread) veering into communism. In real life my friends all think I’m a wannabee Gorden Gecko with a crush on Lady Thatcher (RIP).

I went to some length in my article to explain why I think housing is a special case. Principally that everyone wants and needs to live in a house, and if you made a list of people’s life ambitions, then with having a life partner and having children and perhaps a satisfying career, owning their own home would make the running. Yet we have a limited stock. It is a finite good. So yes, I am prepared to say I would rather tilt policy in favour of people seeing that outcome then a BTL landlord owning 6-7 properties, if that’s the choice.

We set the rules for capitalism and the markets all the time — employment laws, monopoly laws, tax laws, environmental laws, trade laws, etc etc etc. Just because you suggest that some of the existing laws migh be changed for the betterment (from my line of thinking) of society, that doesn’t make you a communist. 🙂

Also, I’m not saying the state should appropriate houses and give them to drunks at the end of the pier. I’m just suggesting tweaking the settings to nudge things in a more useful direction.

Similarly, I didn’t suggest taxing notional gains (though others have on this thread I know). My idea is specifically to tax realized gains, when someone is dead. Until then, no tax. You can not like it because you don’t like inheritance tax, but that’s another issue.

The mention of roll-up relief was pertinent — good spot.

Thanks for all the comments on here, whether you agreed with me about anything or not it’s been a good thought provoking discussion and in good spirit. (Even the communist bit was softly delivered! 🙂 ).

Make me number 3 on IHT; in fact I’d increase the rate to 50% of the estate. I’m an IFA and I spend a great deal of time discussing IHT with an ever-increasing number of our clients, even here in sleepy Somerset.

I do not like hiding cash in offshore investment bonds set up in complex trusts (for example) but do recommend AIM stock ISAs (they qualify for business property relief) from time-to-time.

However, I think that the tax should be paid and tell my clients so. They then have the choice of a) doing nothing (“I never inherited a farthing, myself” is a typical comment), b) indulging in some philanthropy (I’m entirely serious – I have one client who financially supported a promising, but penniless, pianist through her studies until such time she could turn professional, which she still is (and still penniless, mind you)) or c) pre-funding the likely tax by using a specialist life insurance policy.

Die broke is what I say and let your children make their own way; there will, in reality, nearly always be money left over ‘cos of the house!

The only real long-term solutions here are supply side ones. Any scheme to reduce demand will fail as the gains to be made will outweigh the tax/restriction. If you can make 100 grand a year in capital gains then a few thousand in tax won’t make a noticeable difference.

Building enough new houses and infrastructure to meet demand on unzoned agricultural land will cause prices to stabilise. This is how the great affordable cities of the US operate – Chicago, Houston, Atlanta and many more. Restrictions on land supply are the main cause of overinflated prices. Have a read of the Demographia survey if you want more proof of this http://www.demographia.com/dhi.pdf

re…Mark Meldon

Hi Mark, sorry got to disagree completely.

IHT affects only the middle “classes”. Poorer people dont pay it, the very rich dont pay it.