What caught my eye this week.

I don’t know about you, but I really miss that six-month spell last year when we all fretted about what was going to happen to pension allowances, inheritance tax, AIM shares, and all the rest of it.

Everyone knows financial planning is dull as dishwater. So why not living things up by throwing all the rules up into the air every few years?

That way we won’t get too complacent.

Instead: all the fun of the power-ups and banana skins in Mario Kart. Anyone might win – or lose!

Well rejoice because according to the Financial Times and This Is Money, financial firms have been lobbying the government to do away with – or at least severely do-in – the humble cash ISA.

The Financial Times reports that:

During a meeting last month, City firms lobbied chancellor Rachel Reeves to scale back incentives for cash Isas, arguing that the money would be put to better use if it were invested in the stock market.

Le sigh.

Cash cachet

Happily – though not exactly surprisingly, given it should be blindingly obvious to anyone – both articles found experts to defend the virtues of cash ISAs.

After all, here’s a rare popular financial product that anyone can understand.

Rates are now reasonable again. And the ISA shielding means there’s no returns lost to tax or time lost to paperwork.

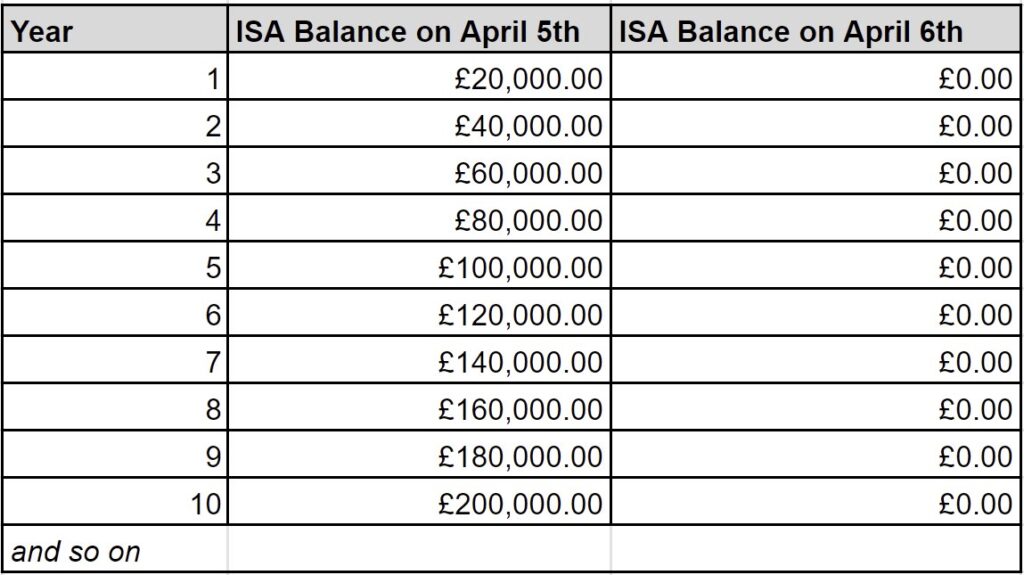

This is what success looks like, and you can see why it turns the City green with envy:

Source: HMRC

Of course I know returns from equities and even bonds will very likely trounce cash over longer timeframes.

And ever since 2007 Monevator has been trying to help people understand how to invest more productively.

I also agree that boosting the flow of capital going into the London Stock Exchange would be helpful for Great Britain PLC.

But getting rid of one of the very few financial products that the average person is comfortable with – and upsetting the applecart yet again – is not a good way to encourage more investment.

How about instead educating people from school age about regular saving and compound interest, and what it might mean for their futures?

Or how about just not changing the rules on the whim of every other Chancellor, and instead letting us properly plan for the long-term?

Heck, how about politicians not inflict years of political chaos and ultimately economically damaging policies on the British public?

That way instead of flirting with recession every few quarters (see the links below) maybe we’d have enjoyed years of proper GDP growth and even some of the full-throated animal spirits that the Americans have seen.

And by the same token, maybe don’t bang on about ‘going for growth’ and then immediately inflict an employment-penalising kick in the arse for business as soon as your first budget comes around?

(Okay, and it’d be nice if we could re-roll the cosmic dice so we don’t have a pandemic and a war in quick succession next time.)

Honestly, for the average financially-confused person out there, just hoarding cash in the face of all this uncertainty seems very understandable to me.

Cash is not trash

If something must be done about this ‘unproductive’ cash – and to re-iterate, I’d prefer they just left well alone for a few decades – then I’d vote for carrots rather than sticks.

Let’s get rid of the ridiculous stamp duty on UK traded shares for starters. And scrap that pernickety £1.50 PTM levy on trades over £10,000 while we’re at it.

But something as fundamental as the cash ISA shouldn’t be up for debate.

Politicians who look forward to generous defined benefit retirement schemes need to understand that normal people in the brave new-ish world of defined contribution pensions face what’s notoriously the hardest problem in finance.

Given that is already a lot to cope with, some lasting stability might go a long way to encourage more learning about investing – and eventually coax more money out of cash and into other assets.

Get a real job

To be fair to her, Rachel Reeves doesn’t appear to be the instigator of any of this cash ISA dissing – though This Is Money does note ominously that:

The Chancellor did not dismiss the idea, according to a senior banker.

Really? Okay, then I’ll make the decision for her.

Dismiss it: we don’t need any more unforced errors.

Get on with sorting out planning or transport or a proper energy policy or anything big and bold that could actually improve our future writ large, rather than more fiddling with how we move this or that pile of the dwindling coins we’ve already got.

Cash ISAs are a solution to a problem – not the other way around.

Lord make my readers frugal, but not yet

On a totally unrelated note, ten years after I first sketched out a couple of ideas for ‘quirky’ investing-related T-shirts, we’ve finally got some Monevator merch coming your way!

Yes, you’ll soon be able to wear your love affair with investing on your sleeve – and in any colour too, so long as it’s Monevator-style black and white.

Got too much cash hoarded in your ISA? Then why not live large and spend a few tenners from it before Rachel comes a-calling…

This Shopify – um – shop of ours will also feature pointers to our favourite investing books on Amazon. Because you’ve got to eat your greens too, you know.

Anyway I’m going to rollout access to the shop in stages, so we don’t get overwhelmed* like in those Black Friday stampede videos that used to go viral a few years ago.

(What happened to those? I guess it’s all just standard behaviour nowadays?)

Moguls first – please watch your inboxes over the next few days for your teaser discount code!

And have a great weekend.

* I wish!

From Monevator

InvestEngine LifePlan portfolio review – Monevator

The benefits of living mortgage free – Monevator

From the archive-ator: Portfolio (basket) case study – Monevator

News

Note: Some links are Google search results – in PC/desktop view click through to read the article. Try privacy/incognito mode to avoid cookies. Consider subscribing to sites you visit a lot.

Bank of England cuts rates to 4.5%, halves economic growth forecast – Sky

House prices hit record high in January ahead of stamp duty hike – BBC

ONS chief ‘very confident’ about rising health-related inactivity data – CityAM

Urgent action needed to ensure UK food security, report warns – Guardian

Musk effect? Tesla sales slump in five European countries – Reuters via Y.F.

New Zealand has launched a new long-term digital nomad visa – Forbes

‘Magical’ efficient market theory rebuked in passive era – Bloomberg via Y.F.

Man claims it was cheaper to fly 1,400 miles to Spain to buy olive oil – M.E.N.

Five years on, and Brexit is more unpopular than ever – Semafor

Products and services

What is the energy price cap and how is it changing? – BBC

How to save at the cinema every day of the week – Be Clever With Your Cash

Get up to £3,000 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link – Interactive Investor

Mortgage rates came down ahead of Bank Rate cut – This Is Money

Vanguard US just did its biggest-ever round of fund fee cuts – Vanguard

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply, affiliate link. Capital at risk) – InvestEngine

What’s happening to car insurance prices? – Which

Two leading lenders cut buy-to-let mortgage rates… – Property 118

…but should landlords fix or risk a tracker mortgage? – This Is Money

Homes for sale for first-time buyers, in pictures – Guardian

Comment and opinion

Embrace boredom – A Teachable Moment

Tilting the odds in your favour – Novel Investor

Paying off your landlord’s mortgage can’t be right – The Big Issue

Meet the woman who lives without money – Guardian

Put in the hard work – Financial Samurai

The mortgage payment trick that can clear debts five years early – T.I.M.

The perfect level of wealth – A Wealth of Common Sense

On my own time – Humble Dollar

How to retire and not run out of money [Search result] – FT

Make decisions like an options trader – MoonTower

Buying things is usually stupid [Podcast] – 50 Fires via Apple

Naughty corner: Active antics

Investment trusts could return 13% p.a. for five years [Says trade body] – Trustnet

How investors can harness Trump-induced volatility – FT

Portfolio exits: a post-mortem – FIRE v London

Tonight we’re gong to stonk-punt like it’s 2021 [Search result] – FT

Trading our dark triad overlords – Paul Podolsky

Has Michael Saylor’s ‘infinite money glitch’ run into a hitch? [Search result] – FT

Going beyond Buffett – The Leading Edge

Kindle book bargains

Fooled by Randomness by Nassim Taleb – £0.99 on Kindle

The Price of Time by Edward Chancellor – £0.99 on Kindle

Edible Economics by Ha-Joon Chang – £0.99 on Kindle

Taxtopia by The Rebel Accountant – £0.99 on Kindle

Environmental factors

How climate change could upend the case for home ownership – ProPublica

Record January warmth puzzles climate scientists – BBC

In pristine parts of the Amazon, birds are still dying – Guardian

Scenic loch becomes magnet for Scotland’s plastic waste – BBC

What are small modular nuclear reactors and why do we want them? – Guardian

Robot overlord roundup

No longer hiring junior or mid-level coders [Tweet] – Savil Navingia via X

Why employees are smuggling AI into work – BBC

How to invest for a post-AGI world – Of Dollars and Data

Companion asks interesting questions about our relationship with AI – The Conversation

DeepSeek might not be so competitive; reports finds $1.6bn spend – Tom’s Hardware

ChatGPT’s Deep Research creates reports from hundreds of sources – Engadget

We’re already at risk of ceding our humanity to AI – Lit Hub

Leading AI company warns applicants not to use AI – FT

US off-the-deep-end mini-special

Explaining to a child why tariffs hurt everyone – Roger Lowenstein

Garbage information is killing democracy – Garden of Forking Paths

How chaos became American’s economic strategy – Kyla Scanlon

What happened the last time a president purged the bureaucracy – Politico

Can anyone stop President Musk? – The Verge

Off our beat

Who owns London? – The Standard

The books that ruin your life – The New Republic

Drone-on-drone warfare in Ukraine – Ars Technica

What we can learn from a dog’s way of looking at the world – Lit Hub

The mystery of why Covid-19 seems to be becoming milder – BBC

What if you never come down? Postcards from 1990s nightlife [Photos] – Guardian

Scientists crack the perfect way to boil an egg – Guardian

And finally…

“To my relief, most of the attending senators seemed to appreciate that promoting global financial stability was in the interest of the United States.”

– Ben Bernanke, The Courage to Act

Like these links? Subscribe to get them every Friday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Meh. Half my stocks and shares isa and half my sipp is currently in royal London short term money market acc.

I know this is monevator but I’m happy following Buffett’s recent behaviour. Even if I don’t like the guy. We appear to have a similar view of the market.

So take that Rachel reeves et al. Cash proxies can be held, so I’ll take close to risk free interest one way or another right now before Bailey and Powell crash it all back down to bail out the debtors once again.

Then it’s back to stocks.

Envy from the US where there is no shelter for accessible cash! I filed last week and saw the amounts. Decided to increase my emergency fund to 12 months (6 isn’t nearly enough in the AI era) so it was on my mind.

@TI.

Merch! Wow. Good luck with it ( I sincerely mean that, not a hint of sarcasm) I was not expecting that one.

… While you are at it, the one line that struck me hard in your article leading to articles was… “How about instead educating people from school age about regular saving and compound interest, and what it might mean for their futures?”

Well that seems worthwhile and necessary, argued for from many corners of sensible finance, and achievable! You always promised a book so it seems you are the man to do it. Team up with CGP (www.cgpbooks.co.uk), they have sold more books than J.K herself. You may not fatten your coffers greatly from your efforts but it might just be the thing for future growth of the U.K.

Thanks for all the work you do. It has more than educated me over the years, it has entertained. Keep it up.

I will dwell upon the T-shirt, I have eschewed brands for decades, but I fear my disheveled appearance might detract from yours.

JimJim

Looking forward to my ‘Index quick, get rich slowly’ hat!

Apologies for the admin message, but…please can you remind me how I get the emails. I have signed in and out before and signed up for them a few times but they never come through. You also said something about eating biscuits which I tried but didn’t seem to work. I just don’t want to miss out on my discount on a Squirrel themed T-shirt or TA turn your heating off thermals. Thanks

@learner – If you’re really eager to tax-shelter cash from the IRS, a money market fund in a Roth IRA is a decent workaround. You can always withdraw contributions (not gains) tax-free. Clunkier than ISAs (or Premium Bonds), but an option.

@JB — Thanks for being a Mogul and for the interest! 🙂

It seems that a couple of years ago you marked an email of ours as spam (perhaps by accident, or perhaps in frustration at one too many puns haha 😉 )

Unfortunately the email people take this very seriously and marking anything as ‘spam’ puts your email address out of reach to my emails.

I’ve personally sent you a new email at the address you’re using here, so please reply to that email and we can go from there.

If you don’t get that email or you don’t hear back from me within 24 hours then we have other issues to unravel, so please do come back and tell me here. 🙂

Thanks!

@all — Ha ha, thanks for the fun reception to the incoming shop. It’s just a bit of a laugh really, I don’t think Paul Smith or even Zara will be quaking in their boots.

However I have been wearing them out and about for a while and actually had a couple of people ask what they are.

Who knows? Maybe such conversations with friends or fellow gym goers or whatnot could convert a couple of people to sensible investing and/or the path to FIRE. 😉

None of the shirts feature the ideas here, but I’ll note for future seasonal updates! 😉

2 timely articles this week! Certainly don’t hope cash ISAs bite the dust. Ended up in the fortunate position of fixing for 5 years (against brokers advice ) in 2022 at 2%, while taking a lump of equity out for an extension. We then also had a small inheritance. Due to health issues and resultant job loss the extension hasn’t happened, but the opportunity to clear the mortgage has. We are fully utilising both our ISA allowances and by the end of the fix should be square to clear the mortgage. Similar to the article in the week I recognise the mathematical benefits of the market, but given the health situation the risk is not acceptable. If situations change before the remortgage in 2 years I’ll reevaluate and maybe move some into S&S, but at the moment cash ISAs are a godsend. The loss of health was also a wake up call that all the best laid plans are subject to change! A paid off mortgage is ultimate security for the unexpected.

@JimJim

February 8, 2025, 6:37 am

@TI.

… While you are at it, the one line that struck me hard in your article leading to articles was… “How about instead educating people from school age about regular saving and compound interest, and what it might mean for their futures?”

I know this has been mentioned before, but I can attribute my life-long savings habit/interest in money to primary school TSB savings books. Seeing my pocket money deposited weekly, adding up, then interest added….

Vitally important in my view.

“I also agree that boosting the flow of capital going into the London Stock Exchange would be helpful for Great Britain PLC.”

Would it? You seem to be saying that the market is not efficient enough to price UK stocks sensibly. In reality, I am sure that other investors would sell if they thought that the LSE was getting over priced. Sensible investors would likely buy global trackers anyway, and the LSE would get about 3% of their investment. I believe that the firms lobbying the government are motivated by their own self interest, not that of the country. They want to boost their AUM and make more money.

@Geoff — Hi! You write:

Yes, I am saying that to some extent. (Remember I come from the naughty side of the class at Team Monevator).

With that said we could argue about whether it’s not pricing efficiently, or if there’s something of Soros’ reflexivity concept going on that makes the pricing rational.

e.g. If market participants believe that the UK has been marked down / avoided by global investors for the best part of a decade (plenty of evidence for that from fund flows etc) then if they have reason to believe this will continue then they could continue to avoid putting money into it themselves, thus perpetuating the cycle.

Especially if they are operating on shorter time horizons, so are reluctant to wait for a mean reversion.

Moreover you could get very cute and say that this in turn leads to would-be UK listed companies either delisting, moving their domicile, agreeing to takeovers, or even never listing in the first place on the LSE as a rational response.

Again, plenty of evidence of that too.

It’s now a couple of years since I first said that the LSE was in trouble. Admittedly I did flavour my comments with a dash of the B-word, which is perhaps what provoked the dwindling band of defenders of the latter to come out and say I was talking rubbish. (Not saying you’re one or not, and of course you’re entitled to your views either way 🙂 )

Since then the de-equitisation of London has largely continued, although thankfully mostly at the smaller end of the size spectrum. But nobody could argue it’s the market of the 1980s or even the 1990s.

Of course there are plenty of other factors going on here than just local factors. I expect we will end up with either a couple of global main markets (New York/Asia) or else some very decentralised thing that nobody currently envisages (blockchain mediated or whatnot).

On the other hand in the medium-term I think it’s more likely London will have another spell in the sun, presuming the AI cycle doesn’t end with 10 companies owning the world etc. (i.e. the US market is not the only game in town, in such a world).

Incidentally I am currently extremely overweight the UK versus the c.3% global benchmark, so I’m (a) seeking value as you suggest and (b) am not just intrinsically hostile to the UK capital market!

I agree with all the rest of your comments — especially the incentives of the lobbying companies! 🙂

@Barm — I’ve actually seen it argued both ways, with some evidence suggesting ‘financial education classes’ in school don’t achieve much. As a massive skeptic of the education system in general, at least for the likes of me, I can believe that, but equally I find it pretty hard to believe that in 2025 we couldn’t create a two-hour video game that would teach kids pretty straightforwardly and in a fun way the difference between sensible financial management, versus YOLO-ing your way through life and ending up living on the state pension in a bedsit in Bolton.

@Carl — Sorry to hear about your ill-health. I am presuming that having a solid financial footing provides some comfort. All the best with your future decisions etc!

I have no idea why there’s a separation between cash and stocks ISAs in the first place. IMO they should be merged into one simple ISA to rule them all, and all the other variants should be ditched ASAP.

Scrap the cash ISA. In fact, scrap all the other ISAs. Yes, replace them with a new revolutionary product called … an ISA. Problem solved.

I don’t like this idea that our kids need to be educated about finance, at least anymore than they need to be educated about anything. They are already taught compounding and discounting in school, what inflation is. One you have those principles, the rest can be derived. It’s pointless to teach specifics, because the rules (pensions, ISA, tax etc) change so damn frequently, they become stale before they even got to the exam. So what else do you need to tell them? That “saving = good and consumption = bad”? That seems rather subjective.

@ZXSpectrum48k

I think you miss the point a little. It’s about planting that seed. One lesson demonstrating compounding, a worked example may be enough.

My father in law is 92. He remembers putting his pocket money into the Post office and watching it grow. Unfortunately he took it too far, and doesn’t spend enough on himself now.

Two Comments:

1. Can’t the same ends as a savings ISA be obtained by simply raising the tax relief band on interest to, say, £3,000.

2. The interesting thing is what the company borrowing the ISA money does with it. It is relatively long term money, does it all go into mortgage lending or is it invested in corporate lending, thus achieving what the Govt wants with shares ISAs.

Please make the t-shirts available in big baggy sizes. I̶’m̶ s̶t̶u̶c̶k̶ i̶n̶ t̶h̶e̶ e̶a̶r̶l̶y̶ 9̶0̶s̶.

Very comfortable when mooching around at home.

@FT as quoted: “money would be put to better use if it were invested in the stock market” and @TI #12: “perpetuating the cycle”: is this necessarily a ‘bad’ thing and, if so, then how would restricting cash ISAs ‘help’ here?

Some people don’t want to take equity risk. Doesn’t work for me personally but it does for them.

They’re not going to suddenly start investing in the shares of LSE listed firms just because they can’t pay into a cash ISA.

Why should my risk mindset be imposed onto theirs? Each to their own. Can’t lead other peoples’ lives, less still invest or save for them.

Yes it’s sad that the numbers of London listed firms has fallen so far. But that’s not a trend which HMG can/should meddle with. It’s not a job of government to run the stock market. Capital goes where it’s treated better. Maybe Mrs Reeves should concentrate on that bit. The electorate won’t thank Labour for removing the opportunity to pay in a little into a cash ISA.

And why should equity investors welcome this anyway?

We need cheap assets as an alternative to the 30+ PEs of US mega caps.

When the US ERP could be negative (the S&P 500 Earnings Yield is below the 10Y T-Bill) then what’s good for an investor about trying to raise the price of an alternative?

Starting yield is one of the strongest determinants of future returns, after all. I want to be able to buy my discounted UK REITs and specialist ITs with 20% to 30% off NAV and at yields of 6% to 9% p.a.

There’s nothing wrong with cheap assets, whether its commodities, gold miners (priced at record lows relative to the all time high metal price), PGMs or silver (likewise at hugh relative discounts to gold), the Chinese ex tech sector, Japanese micro caps, or the UK equity sector including particularly ITs.

> How about instead educating people from school age about regular saving and compound interest, and what it might mean for their futures?

Do these kids not have parents? School (in an industrial society) prepares you for work. Parents prepare you for life, from tying shoelaces, how to boil eggs and later on broadly how to make your way in life. Regular saving is demonstrated by praxis, the theory is easy enough but since you have to give up the MUST HAVE, NOW experience it’s not an easy theory to apply in practice unless there is a careful demonstration of the benefits in lived experience.

Schools have to get the national curriculum over to their pupils and that seems to take more than the time they have already. If they have spare time, sure, why not double up, but otherwise what part of the curriculum would you have them drop to fit this in?

As for Cash ISAs, leave ’em be. It always shocks me when I see these stats massively favouring cash ISAs, but at least it fails sort of safe, and perhaps it matches the risk profile of ordinary Britons individual circumstances better than say the typical Monevator reader.

I made enough of a mess with an ISA in the dotcom bust even given competent outline from my parents and a general understanding of the system, but their basic advice don’t borrow money (other than a house and if applicable the tools of your trade) meant it was a graceful fail, and there are some things you can only learn by experience.

I could do with a Slow & Steady t-shirt.

We should have T-shirt logo/slogan competition

> Man claims it was cheaper to fly 1,400 miles to Spain to buy olive oil – M.E.N.

Man paid £7.09 to fly to Spain for a 250ml bottle of olive oil.

Waitrose own brand is £3.50 for a 250ml bottle. Filippo Berio is £4.50 for a 250ml bottle.

It is not cheaper.

They seem to be comparing against the avg UK price of a 1 liter bottle. £7.00 in Tesco, which is still cheaper in total. Typical Reach “article” I guess.

@ermine — I think you have a very high estimation of the average financial competence of the average parent. 😉 I’d suggest we have mortgage mis-selling scandals, vast amounts of money hoarded in cash for decades, people retiring without pension savings, larcenous credit card debt and much much more because the grown-ups aren’t much better informed than the kids?

You ask:

Well yes, clearly we’d have to change the national curriculum. And again I speak as someone with no great affinity for traditional education.

But still, judging by my experience a good 40% would be a candidate for losing 1-2% to discuss various financial aspects of their future lives. Maybe they lose the lesson on lemurs, maybe the lesson on how sand dunes are formed, or maybe a couple fewer compulsory PE classes.

I appreciate that one can be very reductionist about this and everything sounds dispensable in isolation. I’m not saying biology, geography, or indeed PE are not worthwhile.

But I am saying they could lose a few hours if they had to without people coming a-cropper later in life.

Which isn’t the case with personal finance!

I’m not convinced that the average kid makes the connections from their more general education. Though I certainly agree it’s pointless teaching them about this week’s tax bands or interest rates or whatnot. 🙂

@Barm; a little earlier in time, but yes, the joy of sticking the sixpenny savings stamp into the book and watching the savings grow…..

Except at the time, I was a little cross that I couldn’t spend that sixpence on sweets. (Rather glad now though).

There’s definitely a place for a safe tax free place to store some cash. I agree the types of ISA’s could be merged or simplified. I have an element of liability matching to my pre-58 plan and a five year fixed cash ISA is helping me there.

I’m really looking forward to seeing some one out and about with a “Do not F***ing SELL!” T-shirt.

I’m still trying to decide which Steely Dan t-shirt design to go for, but if ‘never give up’ (26) gets his requested language into production you can put me down for one of those!

Can you put that Financial Samurai article on a t-shirt? Should be published as an open letter to some of the population.

To be fair, when I was younger I didn’t really understand what ‘hard work’ was, I thought there must be several levels of application. But now, at 40 years old, I know that you are either working or you aren’t. It’s binary. ‘Working hard’ can simply be thought of as ‘working more’.

Personally – if it were a choice – I’d rather pay more income tax than trash cash ISAs. And I both pay a lot of – and hate – income tax.

Lee Boyce has it right on TIM IMHO.

@Delta

> Why should my risk mindset be imposed onto theirs? Each to their own. Can’t lead other peoples’ lives, less still invest or save for them.

Hear, hear!

I don’t have any Cash ISA’s, but generally think they are a good idea. Straightforward, and easy to understand.

@Jonoooooo (28)

” To be fair, when I was younger I didn’t really understand what ‘hard work’ was…”

At 13 years old, I learned that to buy myself a watch, I would have to work and save for it. A paper round.

At 16 years old, a summer week’s worth of lifting potatoes on a Scottish farm under a boiling hot sun. ( Yes, there are some days like that in Scotland ). My Mum didn’t recognise me when I got home at the end of the first day.

At 17, general labouring for a summer in a Somerset paper mill.

At 18, more of the same.

At 19, builders labourer for a summer in Yorkshire.

At 21, post university, 18 months driving buses in Glasgow, while I worked out what I wanted to do. A 3 shift system, in a stressful urban environment, that entailed early morning starts, and trudging back to my bedsit just before midnight.

There is a story that I recall, recounted by one Gordon Sumner, aka Sting of the 1980’s band The Police, when, for a brief period he worked in a roadworks crew. Sumner described how he felt that he had little in common with his colleagues, and his demeanor was picked up by the others. One day the foreman said to him… ” What are you doing here ? I know why I’m here. It’s because I don’t know anything else. You’ve got an education. What the *uck are you doing here ? ”

All these years down the way, there are plenty of jobs out there that are hard work for poor pay. Anyone who can come out with a statement that there only exists work or no work has, in my opinion, never done any hard work, either in the direct physical sense or work of the mind.

( No offense, of course )

Don’t forget how much pension provision has changed in a relatively short space of time. The majority of parents of younger adults had DB pension provision provided by work with Osbornes pension freedoms relatively recently.

The investment, interest and inflation risk all now sits on the employee for the majority of private company employees. Unless you work on a civil servant contract people need to be aware of investing and providing for their own retirement. The state pension if it’s available in future only provides a basic income level according to most projections. This needs topping up with your own provision.

Most older parents are/were ill equipped to provide this level of education / support to their kids because they grew up in a different rules based environment. We will have a generation who are ill prepared for retirement in the UK. Hopefully newer parents will be better informed to educate their offspring. Monevator for the masses would better equip people for their future! The concepts of compound, inflation etc are taught in school in a theoretical, economic basis, they could easily be bought more to life with practical real world examples which would make them far more engaging for our youth. Perhaps then I might even feel more comfortable to put a state pension provision back into my excel projection!

Compound interest is covered in the national curriculum in mathematics at Key Stage 4 (i.e., GCSE).

Like a lot of maths this topic sits on a some rather deep foundations that not every child will have mastered for a variety of reasons*. For example, in this case, multiplication, percentages and ratios. While engaging examples are useful, without the foundations they are pointless. As a ‘craft’, maths teaching needs individual attention that is not often available – although this is an area where well targeted AI might be helpful.

* In case anyone thinks this is solely a problem with today’s youth, it ever was. Some of my schoolmates (in the 70s) would have struggled to count to 20 without taking their shoes and socks off.

Haha – a moguls early bird teaser and discount code. Makes us feel like VIPs. Very nice indeed!

On the chancellor tinkering, for sure, everything pension related and a lot of the rest should be made very difficult to change by any given government. Long term consistency should be paramount.

Ultimately, on pensions, defined benefit need to come back and become the default again. DC is too risky for majority of population, certainly with all the current freedom and complexity associated. The difference being DBs just have to be far less generous. The concept is great, it was just the value that was off.

FS article is confusing from someone who burnt out young and is up and down like a yoyo. Can you have a salt of the earth work ethic and also revel in publishing a book on engineering the perfect layoff? I don’t think so. I don’t think they know if they are a Catholic or a Calvinist to be honest. My suspicion is it’s an attempt to retro fit a positive narrative on to their life story for their own peace of mind rather than a genuine desire to impart words of wisdom on to the wider world?

The balance between work and play will forever be a bloody tight rope I imagine, no matter how many times we flip-flop between the Ermine and FS ( & Dix) ends of the spectrum..

Profoundly disagree that there is no distinction between hard work and easy work. (Jonoo 28)

I’ve done psychologically very taxing work (emergency clinical medicine), and also really rather pleasant work (discussing interesting ideas with colleagues), along with the usual share of tedium (dealing with bureaucracy and toxic bosses, shuffling emails). I’ve never done physically taxing or dangerous work (beyond the exhaustion of very long hours) but that certainly exists. I’ve also done my fair share of large quantities of work, which even if its joyous (it wasn’t) can lead to an unbalanced and unfulfilling life.

Work becomes a burden when there is too little interest/satisfaction and too much physical/emotional wear and tear.

Its really not all the same.

I have also spent some time teaching money matters in schools (a post retirement ‘fun work’ gig). While I do think that is a worthwhile endeavour, I think its too glib to say ‘if only this was taught in schools everyone would be money savvy’. You can only teach the concepts that are relevant at the age they are relevant. eg for 6th formers: how much is it going to cost to go to uni? What do these numbers on my payslip mean? What is the minimum wage and how do taxes work? (along with ‘what are my rights as a tenant…’)

For younger kids, some concept of budgeting and spending choices is the main thing, and just knowing in basic terms what a ‘mortgage’ and a ‘pension’ is.

Of course parents remain the most important influence, whether they like it or not and whether they are ‘good’ role models or not (most parents are simply human, and neither better nor worse at money management than their offspring).

But nothing is going to replace the need for ongoing curiosity and making it your business to take responsibility for your own money, as for the rest of your life.

@Maj – Not sure how common it was in other areas but at my school they used to have someone from the Post office come Once a week and set up in the assembly hall and sell the savings stamps to any child who wanted them rather then go to the PO (also got you out of class for 10 minutes or so!)

Might be my memory but pretty sure Once the book or page was complete you could pay into your PO savings book? Once i got older and working my dad then introduced to the heady world of Savings certificates.

In among the usual thought provoking and interesting items two links made me smile this week.

The women who lives without money would more normally be described as a freeloader or scrounger where I’m from. Nothing more, nothing less – but I enjoyed the euphemistic writing nevertheless.

And the TIM mortgage trick was a classic of the genre – TLDR: Overpay your mortgage by more than 8%/year and as if by magic it will be paid off early! Truly a reminder of the crucial service some elements of the free press provide I’m sure.

Sorry I couldn’t resist…

Martin Lewis has been campaigning for financial education in schools for the last 10 years or so. I don’t think previous governments have taken the issue seriously though.

https://www.moneysavingexpert.com/family/financial-education/

Surprised no one has suggested that we should have a secondary market in ISA allowances. Then the basic rate taxpayer can maximise their allowance by selling it to higher / additional rate taxpayers who are also more likely to use it for stocks & shares. The proceeds received can be sheltered with a separate ISA squared allowance.

I’m really looking forward to seeing the bright red ‘MIGA’ baseball caps in the Monevator shop……..

Make Investing Great Again

Having read extensively on trackers and personal finance the penny dropped for me 12 years ago that saving most of my money in cash (fortunately putting alot in pensions as well), gambling a bit with the stock market buying individual shares and still overpaying my mortgage at 60% LTV , I was (for me ) doing it wrong

I have been 90 odd % invested ever since with enough to cover 6 months emergency fund in cash and ad hoc lump sums to spend on larger purchases taken out a year or 2 ahead as required . Otherwise left to grow

I know very very few people who have their finances set up like this . My step mother commented that all her (undoubtedly wealthy) friends were almost all illiquid in houses with high income lifestyles and thsy she doesn’t know anyone with the liquidity I have

To me this is how those on relatively normal salaries gain wealth by (sensibly) exposing as much as possible to investment returns

So yes I’d agree education is paramount.

I’ve been thinking for sometime there must be a way of offering this service through employers at a High level with follow up 121’s with staff . I wonder if there would be sufficient demand for it ? A boon for employers would be reduced ni charges for high level salary exchange into pensions If people embrace it

Playing Devil’s advocate, would it not be bad for returns if everyone who was in a position to save and invest in equities did so with the enthusiasm of the average Monevator reader? And channeling income into savings and investments reduces consumption, which would surely lower corporate profits?

I guess my point is that capitalism needs lots of chumps with consumption addictions and poor savings/investing habits to thrive. Or am I wrong?

@wodger there’s been a few good articles about this (please delete if not allowed ) https://www.mrmoneymustache.com/2012/04/09/what-if-everyone-became-frugal/

@Wodger #42. Indeed.

Supply and demand moderated through market (in)elasticity directly determines prices and indirectly largely sets the future returns.

Fundamentals (margins and sales) and macro (interest rates, and derived from these, discounted cash flows) of course heavily inputs into the supply/demand curves, but so too does sentiment and government actions.

If everyone is forced into equities it will likely end badly. The price signal will become mangled.

QE distorted ‘natural’ background levels of demand for sovereign debt setting up the unprecedented 2022 bond crash. I can’t say I’d welcome the same happening for UK equities.

So if things are cheap (in some sense) for a reason, then respect that reason.

Natwest isn’t JPM. BP isn’t ExxonMobil. Arm Holdings (when it was still in the UK market pre-2016) isn’t Nvidia.

And they never will be up to the quality and scale of their American ‘cousins’.

Reeves can’t turn wool into silk, or make water run uphill.

So no point pretending HMG can magic up success for UK plc by trying to force people to buy its shares.

And yeah the frugal investor does capitalise on the consumerist spender or risk averse saver who respectively have no money left and(/or) no inclination to buy shares.

@Fatbritabroad #41 > I’ve been thinking for sometime there must be a way of offering this service through employers at a High level with follow up 121’s with staff .

there is. When I was still working the company engaged a firm called Wealth@Work to try and chivvy along their old gits to retire early. That was before the GFC, when they decided to try and use other methods pour encourager les autres to get off the payroll. It was useful in highlighting the value of salary sacrifice, even though they didn’t share or split their NI win with employees.

You had the option to get x amount individual free follow up, typically being pointed into W@W managed FA. The presentation was worth going to, with specifics of The Firm’s pension scheme, sharesave, share option scheme and sal sac options

@DH — nice explanation!

pm

@Fatbritabroad #43 — thanks for the link. I’d read MMM’s article previously and wasn’t wholly convinced. I’d be interested to hear the opinion of a more qualified economist.

Re: who pays for the financial education of the next generation?: Richard Murphy today has an interesting proposal (suggest playing 2x speed as he paces his delivery):

https://youtu.be/xT0L168BGzY?feature=shared

I have previously downloaded the material from MSE and have been using it as part of Monday night finance lessons with my eldest. Tonight we went over credit cards vs debit cards and what to think about if spending overseas as he’s off on a school trip in a bit. Other stuff we did was build compound interest models in a Google sheet. I’m half thinking of tying it in with philosophy and psychology as/when we run thin on further subject matter. He does genuinely seem to find it quite interesting. At least he says he does?

@Rhino #49 I am glad to hear there’s at least one parent who takes the trouble to do the job my working-class parents did all those years ago. The way people talk about financial education it would seem kids are raised by wolves 😉

There wasn’t great depth to it – essentially never borrow money unless it’s a house or the tools for your trade. They did take the time to point out when the repo-men came to take back a neighbour’s TV why you shouldn’t do that on hire purchase. You lose the payments and the TV, and even if you get to the end you still paid over the odds for your TV, while acknowledging there was value in that the HP firm had to repair it until paid off. Don’t borrow money for the nice-to-haves, son.

In earlier times they showed how to add stuff up, all 240 pennies in a pound, a whole ashtray full of the blighters. It was kids’ magazines that they paid for that explained how stocks and shares worked, along with other pieces of general knowledge like how a vented central heating system worked. That was World of Wonder ISTR, so historically they did expect kids to learn about money at home rather than at school. My mother explained how a mortgage worked including how you paid mainly interest in the beginning, then more of the capital as time passed.

So I really don’t know why in a world that has far more connectivity and resources, this basic part of fitting the fruit of your loins ready to take on the world seems to be considered in the far too bloody hard department. It goes with teaching kids how to tie shoelaces, crossing roads and climbing stairs, all part of the parent job description of teaching little hairless apes the ways of the world.

You don’t need the complexities of compounding etc. Most of the financial gotchas early in life are in what to avoid doing, rather than what to do. Rolling credit, Klarna, indeed consumption on credit all round. A healthy distrust of advertisers who are trying to get richer at your expense, son is also a good grounding.

You aren’t going to forestall all the errors of a young pup, I got an endowment mortgage because of the expectation of a doubling of the capital, despite having a reasonable theoretical understanding of inflation, a doubling of nominal was pedestrian for a 25 year term as well as being a false promise 😉 But knowing the principles helps you spot the mistake and reverse gear quicker.

@ermine #50 — I suspect parents’ own lack of financial knowledge is more to blame than it being “too bloody hard” to educate kids about these matters in the home. Once this knowledge is instilled it will likely be perpetuated.

My own parents taught me to avoid going into debt, how to be frugal (or at least not to waste money), and how to save up for expensive things. But they had no clue how to invest, or that saving habits could lead to financial independence. I suspect they think that only greedy business-minded conservative types care about such things.

@Wodger – your parents served you well. Investing is a different level of the art of financial nous. They gave you the platform. What you choose to do with your mix of talents and abilities is yours to determine – as Nietzsche said “No one can build you the bridge on which you, and only you, must cross the river of life.”

@ermine

You can’t teach what you don’t know. Not knowing does not make you a bad parent.

@Wodger — My parents were very similar. I tried to get my financially unimpeachable working-class made good dad to lend me £10K to get started on the London property market in the 1990s, promising to pay him back with interest or a share of the capital gain to suit. He felt it was just too risky (partly because to be fair he’d possibly have had to remortgage to do it) and I didn’t end up buying until 2018 in the end (the rest of the story is my own blundering).

The flat I was looking at, a two-bed that would have been paid for by a friend in the second bedroom on a mate’s rate, was worth north of £800K when I last saw very similar in the same location a few years ago. More than a ten-bagger.

I should also add I have siblings and he felt he wouldn’t be able to offer the same to them, partly because I was the money whiz but we all have different talents, and partly because unless I recycled the cash out to him pronto (which from memory I reckoned I could do in 2-3 years due to effectively not paying rent) he wouldn’t have had the money to.

The details are hazy but that’s the gist. A similar conversation happened when I encouraged him to look into shares in the early 2000s. Given that the financial crisis and massive bear market of 2008 and 2009 was just around the corner, I am glad he wasn’t interested in that.

After he passed I was able to more than double a chunk of my mum’s money with a low-hassle portfolio of investment trusts in about five years. So she thinks her son is Warren Buffet on a good day, though more often she thinks I’m Boyce from Only Fools and Horses or maybe Albert Steptoe. 😉

Having just read Vassal State by Angus Hanton which provides an interesting if depressing overview of our economic relationship with Uncle Sam (as well as an explanation for our bloated tracker returns) I came here to be cheered up with a little light reading. Suffice to say it didn’t work so I’ll resort to my winter woollies and our amazing countryside for sustenance until the sunshine returns..

Well I thought I had posted a comment but maybe I got deleted. Simply to say thanks for the weekend reading (as it’s been a while since I last posted but am lurking and reading).

Also to make the mathematical point about averages. TI posts that “we all think we’re above average drivers”. Indeed it’s likely that we are. There’s a long left tail to driving performance, I observe. This means that the mode is higher than the mean. Same with legs. Most of us have an above average number of legs.

With SEND, I wish all who are dealing with these issues the very best of luck. I have seen it up close with relatives and friends and it is a painful mix of councils with little money meeting parents who desperately want to do the best for their kids. Some heroes and some villains, and a lot of heartache, I observe.

@Mathmo — Hi, you posted it on this thread 🙂 :

https://monevator.com/weekend-reading-no-spring-in-my-step/comment-page-1/#comment-1861949

Cheers, glad you’re still enjoying the links!

FLIC has been going for several years now. It’s by the Financial Times.

It’s doing the things everyone here is talking about. Financial education, with a specific emphasis on under 18s and schools.

ftflic dot com

I was in there from the beginning and a bit surprised that it hasn’t already been mentioned since its work is in the FT at least a few times a month, especially the FT Money personal finance supplement at the weekend.

@all — Rachel Reeves confirmed they’re looking at changing the Cash ISA allowances in the small print to yesterday’s Spring Statement:

https://www.morningstar.co.uk/uk/news/262611/rachel-reeves-pledges-cash-isa-reform-in-spring-statement.aspx