What caught my eye this week.

Not one but two must-read articles for you this week. Less than ideal now the sun is finally showing its face, I know.

The first comes from the ever-reliable Portfolio Charts.

Inspired by the many criticisms that ‘safe’ withdrawal rate (SWR) research has overwhelmingly focused on US returns, Portfolio Charts conducted an incredibly deep dive into the SWRs of other countries – and also the myriad different asset allocation mixes you could have chosen to achieve them.

It’s a valuable read. Not because I think anybody should load up on any particular asset allocation that proved successful in the past – we do not know the future – but for the illustration of:

- How a lot of different assets can work together to deliver a decent SWR

- How, nevertheless, the resultant SWRs still varied quite widely

Today everybody should really have at least a somewhat globally diversified retirement portfolio. So to that extent, individual country returns are moot.

The point rather is to see again why global diversification is so valuable in the first place.

Unless you do have a perfect crystal ball, of course. In which case buy the best and forget the rest!

(Spoiler: you don’t have a crystal ball).

It was different in their day

Secondly, a powerful article from John Burn-Murdoch on the growing wealth inequality that’s caused by wildly different outcomes when it comes to inheritance and property.

For more than 15 years I’ve been arguing on Monevator that inheritance taxes should be far higher to curb us from inching back into a feudal state. While many childless people get the point, those with biologically-activated selfish genes tend to say “maybe, but not my kids”.

I understand people love their children and want to do whatever they can for them. Also that preventing that can seem draconian and punitive.

But where do we want to end up as a society?

Well, here’s where we’re going:

As you can see, boomer parents – who rage indignantly about being ‘taxed twice’ when they die and their children get something for nothing – grew up in a different world.

Not only had many started building property wealth by their 30s, but the gap between the average boomer and those who were really making progress with property was also far narrower.

Burn-Murdoch notes:

The average millennial still has zero housing wealth at a point where the average boomer had been building equity in their first home for several years.

But the top 10% of thirtysomethings have £300,000 of property wealth to their names, almost triple where the wealthiest boomers were at the same age.

These differentials are the result of wealth becoming increasingly hereditary:

Bee Boileau and David Sturrock at the Institute for Fiscal Studies found that more than a third of young UK homeowners received help from family.

Even among those getting assistance there are huge disparities, with the most fortunate 10th each receiving £170,000, compared with the average gift of £25,000.

I suppose it’s possible this is a one-time enrichment caused by the spectacularly lucky lives of the Boomer generation in the US, UK, and Europe. There’s signs that the generational wealth escalator has flatlined.

So perhaps the feudalisation is a one-off event? Bad, in my view, but maybe it won’t get worse.

The robber barons next door

But what if it does get worse?

Do we really want to be in a situation in 30 years where it almost doesn’t matter where you study, what job you get, or how hard you work – for the average person whether you can buy a nice home is not a reflection of your efforts and talent but how well your grandparents did with property in the 1980s?

I’d tax the recipients of inheritances at their highest rate of income – so 45% for those enjoying large windfalls in a particular year – perhaps after a modest allowance of £20,000 or so, as a sop to the atavistic realities.

No it’s not a perfect solution but what is?

Have a great weekend.

From Monevator

Early Retirement Extreme – Monevator

Decumulation strategy: First withdrawal, tax-free cash, and drawdown antics – Monevator [Members]

From the archive-ator: Making big savings – Monevator

News

Note: Some links are Google search results – in PC/desktop view click through to read the article. Try privacy/incognito mode to avoid cookies. Consider subscribing to sites you visit a lot.

Latest elevated US inflation figures make sticky reading – Axios

UK property market to bounce back later this year, says RICS – This Is Money

Spain axes ‘Golden Visa’ popular with British expats – Evening Standard

Services trade sees UK become fourth-largest exporter – City AM

British farmers demand Universal Basic Income to prevent post-Brexit bankruptcy – Farming Today

Briton and French wife face £11,000 bill to return home to UK – Guardian

Royal Mint to stop making overseas coins, will focus on gold recycling – This Is Money

Vietnamese billionaire sentenced to death for $44bn fraud – BBC

The top 50 restaurants in London – Time Out

It’s official: stock market crashes make you miserable [Research] – Alpha Architect

Products and services

eBay scraps fees for selling pre-owned clothing – Which

Quidco Vs TopCashback: comparing the best cashback sites – Be Clever With Your Cash

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

American Express changes terms on its BA Avios cards – Be Clever With Your Cash

Chase Bank’s 5.1% savings account is a Best Buy, with big catches – This Is Money

Get up to £3,000 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link – Interactive Investor

Should UK investors have easier access to crypto? [Search result] – FT

Is this credit card with a 704.6% APR for real? Yes and no – This Is Money

Get £100 worth of free trades when you open an ISA or trading account with Interactive Investor. Terms apply – Interactive Investor

Cost of UK passport to rise for second time in 14 months – Guardian

Mansions for sale for less than £1m, in pictures – Guardian

More LSE woes mini-special

Even Shell ‘looking at all options’ on ‘undervalued’ London listing – City AM

How Brexit wrecked the stock market – Wealth of Nations

Will investment trusts flee the UK over cost disclosure rules? – City AM

CEO of AIM-listed stock explains why it is delisting from troubled LSE [Thread] – via X

Will UK stocks finally catch a break? [Search result] – FT

Comment and opinion

Vanguard’s cautionary tale hidden in plain sight – Simple Living in Somerset

How to lie with charts – A Wealth of Common Sense

Ineffective savings accounts [Boo! Hiss!] – Resolution Foundation

Should you use equity release to pay off your mortgage? – Which

Salary sacrifice can boost your pension and your take home pay – Guardian

There’s nothing special about dividends – Morningstar

What can commodities do for you? – Morningstar

Victor Haghani: Lessons From The Missing Billionaires [Podcast, transcript] – Morningstar

Naughty corner: Active antics

Active investors need to think about the odds – Behavioural Investment

FAO Moguls! Great interview with Bill Ackman [Podcast, few weeks old] – Lex Fridman

Market share and profitability – Verdad

Top 40 quality UK dividend stocks – UK Dividend Investor

More long-term Bitcoin hodlers are selling out – CoinDesk

Hedge fund jobs versus private equity jobs – eFinancial Careers

Magnificent alternatives mini-special

Baskets of UK/European stocks to rival the Magnificent Seven – II

UK investment trusts look more attractive – Proactive Investors

Kindle book bargains

How to Read Numbers by Tom Chivers – £0.99 on Kindle

The Dip: Knowing When to Quit by Seth Godin – £0.99 on Kindle

The Pathless Life by Paul Millerd – £0.99 on Kindle

The Deficit Myth by Stephanie Kelton – £0.99 on Kindle

Environmental factors

New scheme to enable you to see a local heat pump working – Visit A Heat Pump

Future oil demand is wildly uncertain – Semafor

The coffee apocalypse – Slate

England could produce 13x more renewable energy using just 3% of land – Guardian

Saving a sea monkey hatchery – Hakai

Robot overlord roundup

Time is running out to avoid a super-deepfake future – Guardian

Where is artificial general intelligence? My grandfather’s guess is as good as yours [Search result] – FT

Gemini 1.5 and Google’s nature – Stratechery

Off our beat

Lucky versus repeatable – Morgan Housel

Where did all the Little Chefs go? – BBC

Carer convicted over benefit error with 30p a week fights to clear his name – Guardian

Canada’s NORCs: an alternative to nursing homes – The Walrus

Why it could be harder to find love in the age of Tinder – BBC

It’s slow-going in the 3D printed house revolution – Construction Physics

Why are so many young people getting cancer? – Vox

Life lessons from old people at the beach [Short videos] – via X

Crying to sleep on the biggest cruise ship ever – The Atlantic [h/t Abnormal Returns]

Eat, sleep, move – Humble Dollar

Peter Higgs: the shy man who changed our understanding of the universe – BBC

And finally…

“Every profession is a conspiracy against the laity, and every profession’s jargon is meant to confuse and exclude those who aren’t part of the guild.”

– Jason Zweig, The Devil’s Financial Dictionary

Like these links? Subscribe to get them every Friday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Great articles and agree as always about inheritance tax being one of the most equitable and socially just taxes of all. Never can understand all the whining about it either. If you want to be generous and gift money to those you love surely better to do so while you are alive and can see the fruits of that generosity rather when you are six feet under?

The bloated English housing market could also be solved with some fiscal remedies – such as reducing stamp duty and instead putting CGT on all properties, to be paid by the seller not the buyer. That would instantly remove a powerful incentive to inflate asking prices and help to make property more affordable for first time buyers (more so than anything the Government has done previously).

Currently raising a child costs over £200000 so those couples that opt out of this fundamental act are really already well ahead in the game with a great financial boost to their financial situation

I had 3 kids, of my 3 kids 2 have 3 and one has 2 so they are £600000 and £400000 down

Inheritance Tax would seem to be relatively small potatoes in this situation

Of course the implications to a society /culture that doesn’t intend to breed is blindingly obvious

Finance is relatively unimportant in the face of oblivion

xxd09

@xxd09 — It’s not just about parents/non-parents. I don’t particularly care about that, in fact, because I don’t see IHT as being applied to the parents at all. Sorry guys, at that point you are DEAD whatever your genes are urging you otherwise. 😉

What I care about is a kid with relatively poor parents with little assets doing all the right things and never realistically (short of The City / Entrepreneur / Only Fans outlier success) being able to keep up at all with their lucky peers, whose (grand)parents happened to buy a two-bed flat for 3x average salaries in 1985.

We’ll never have a pure meritocracy of course. Maybe we shouldn’t. But entrenched feudalism is going too far.

Don’t be surprised if the consequences of inequality of opportunities as well as outcomes return to bite everyone, either. (Brexit was a taste of that).

Unlike in the old feudal times the landed gentry can’t (yet) put the peasants to death for being too poor and envious. 😉

Hi @TI.

I find it difficult to comprehend why you think the State can ever be more efficient at distributing (other peoples) wealth than a free market of individuals. More socialism / communism has never worked better for society than the free market. Why do you think it ever could ?

If you look forward, say, 30 years there will be a housing ‘pool’ , the boomers will be dead and buried , the houses don’t go away, in fact with about 200,000 new house built each year , there will be millions more houses.

As a general rule someone lives in each house. The price is largely a question of supply and demand….

No objection to inheritance tax, but it won’t solve the underlying problem. There is a shortfall in the number of homes available.

I was fortunate to get on the housing market on a whim with the help of a 105% mortgage., but if that was possible now , it would push prices up further by qualifying more potential buyers.

Disincentives to second homes , investment purchases from overseas would help.

@algernond — I don’t think that.

But the fact is we have a state and we have taxes.

It’s question of *how* we raise the money via how we tax, and what the knock on consequences / incentives are.

I’d rather tax productive working people less and dead people and their randomly fortunate heirs more.

Presumably you’d rather tax productive people / companies more?

Given it’s the choice here.

Love the Portfolio Charts SWR article. The #1 SWR portfolio (30% Gold + 10% Commodities !) really interesting. I wonder if Tyler would ever consider adding Trend Following into the mix on his site….

It’s almost as if adding a whopping 10 million people to the population of the country over a period of 16 years wouldn’t affect house prices.

But shhh…..we don’t like to talk about that round here.

And I do have a wry smile. People always prefer taxes that others have to pay. No kids? I’d like inheritance tax please… Funny that.

Hi @TI.

“Presumably you’d rather tax productive people / companies more?” – No. I think the State does way to much. Needs to be drastically cut down in size.

I do hope that in the (near) future, States will be competing more for citizens. A bit like as predicted in the Sovereign Individual.

Inequality needs to exist – it’s a fundamental social driver. Gross inequality not so. Attempts at apparent equality just end in corruption and inequality by different means ( Bolsheviks please stand up).

IHT as a bastion against feudalism ? You are not talking about multimillionaires here, just a middle class couple with some savings and a house.

In terms of giving to your children when you are alive, perhaps revisit TA’s piece on SWR etc and the uncertainty of backend care and medical charges. Are you advocating giving it away and relying on the state if you live long enough to need care? So if you spend cautiously and end up not needing the contingency savings it is ‘fair’ that the state takes a share ?

Still if that averts a return to feudalism fair enough. That hadn’t registered on my risk register so my bad.

As you say, you recognise opinions differ but you do keep raising the subject. House prices might be a better focus for concern perhaps?

IHT is pretty easy to enforce, because it’s triggered by an event which affects everyone (eventually!), and, except in very limited circumstances, financial institutions won’t release funds until Grant of Probate is obtained, which is where the opportunity to tax arises.

It’s also very easy for the super rich to minimise thanks to the multiple loopholes, and the fact that one could still live comfortably even if one gave away 80% of £10M. Most moderately well off pensioners err on the side of caution in holding enough back to avoid poverty, not knowing when ‘eventually’ will be!

It would be a lot harder to track, and tax, the £50k deposit ‘loaned’ during a parent’s lifetime, which somewhere along the line becomes a gift, and I suspect this sort of ‘bank of mum and dad’ support contributes significantly to the different outcomes noted in the article.

Personally, I could probably afford to stop working now (aged 55); one of the main reasons I keep going is to be in a position to help my (step) daughter and her partner get on the housing ladder.

Inheritance tax should be 90%+. If you don’t want to give assets up before you pass away, you don’t really care about the other people you’re giving it to and should be treated as such.

Also fully agree on the points about fairness, it’s anti meritocratic to have large inheritances.

@TI

You have commended me in the past for always “playing the ball not the man”, and I bear you no ill will when I do so again now.

As far as I’m aware you have no children of your own, since I’ve never read you referring to any. For me, that disqualifies you from saying anything of importance about IHT, no matter how you seek to justify your opinion.

Pax vobis.

My problem with IHT is that the burden largely falls on the middle class while the rich are able to avoid it. For example the Duke of Westminster inherited £9bn in 2015 (or thereabouts) and paid no tax. I would happily see IHT reduced to 20%, so long as everyone actually paid it. If you just increase IHT without some kind of reform then I fear the feudal system would be back even quicker.

Keeping wealth in the hands of the wealthy, rather than the state, should increase supply in the economy more, whereas tax would be used to add to demand, and therefore inflation, without increasing supply

I agree with the above posters that housing wealth is largely a function of extreme mass immigration.

If there is a recognition that we need to take large sums off the wealthy to redistribute to the less well off then it supports the argument that the only immigrants that should be allowed in should be wealthy or high earners, say £50k minimum salary or £80k with a family.

Otherwise you are increasing the number of people to redistribute to, without increasing the number producing the money to take then given out.

@Factor

Since when were estates liable for IHT limited to those with sprogs? For me, your comment disqualifies you from saying anything of importance about financial matters, no matter how you seek to justify your opinion.

@TI. As much as I agree we are sliding toward neo-feudalism, IHT is just another sticking plaster on the wound. IHT is another wealth tax and they tend to be unfair. Those with genuine wealth will gift it to their children well before they die. They will avoid paying a penny. Those with marginal wealth won’t be able to. So the marginal only get taxed. Plus inevitably the public will want loads to exemptions: a cash amount, the family home, farmer’s land etc etc. We’ll be back where we started very quickly.

We need to tax more logically. Basically just tax income and gains. No annual allowances, no exemptions. What is left is yours. The state has no more to say. CGT on primary residences as an example. Person kicks the bucket, house has to be transferred or sold. So estate has to pay the CGT before the greedy kids spaff it all over the wall.

I really don’t see the point of taxing the estates of rich dead boomers, if the money collected is just spent on hip operations for rich living boomers. Just cut the middleman out: make rich boomers pay for their operations. We need to put a cap on the cost of the state right now and that means getting rid of what is really costing too much: the NHS, pensions etc. In aggregate, the boomers never paid in anything like enough versus what they take out. So make them pay now. Not when they die!

@ Algernond..

Must admit, I was under the impression that the ‘efficiency of markets’ theory was long , and widely discredited. For example, an incoming government sees a publically owned water industry. This does not suit the new government. So it strangles that water industry by preventing it from borrowing funds for water quality improvements from, lets call it, the Public Works Loan Board. A few years down the way, the government accuses the water industry of being grossly inefficient, and must be privatised. So it was. Into regional monopolies. Captive customers. An ‘anything goes’ so called regulator. Sovereign wealth funds, and all the barracudas of unrestrained finance moved in, loaded the water companies down with debt, stripped them out with huge dividends.

And here we are now, with Thames Water at the front of the busted crew.

I don’t see free market efficiency. Just ideology, and greed.

I enter this debate nervously, as I am on record in my ‘Fireside Chat’ that I need to provide a lifetime income for my autistic son. But the reason I need to supply a lifetime income is that the state is not interested in supporting the unfortunate (not just my son but millions of others with disabilities, mental health issues, or just plain bad luck). Were the state to offer him the support he needs (and enable him to be a positive contributor), I would be much less concerned about inheritance.

In my observation the feckless and truly indolent are fairly rare, most are unlucky. In fact, I think the proportion of feckless and indolent is higher amongst the offspring of the wealthy. And yet we see inequality growing rapidly in the UK. That is not evidence of a meritocratic system working. The market is not solving the problems we face as societies, and any move towards the mad idea of the ‘sovereign individual’ would make things much worse, since it essentially denies the value of society altogether.

Again, I would be in favour of strict meritocracy providing there is a proper safety net (and no one could argue we have one of those). What used to be called equality of opportunity. I have no problem with people being insanely successful and rich by the value of what they do. I do have a problem when these same people prevent others having the same opportunities. And that is what they do by favouring their offspring and vociferously resenting any attempt to help those with potential get a leg up, or being charged to provide a safety net for those who, for whatever reason, can’t make it on their own.

There are so many people out there in media, fashion, property development and other fields who have no discernible skills except having the right parents. What my parents used to call ‘a waste of space’. Few of them could bootstrap themselves to wealth, but they make bloody sure no one without familial wealth gets the chance to try.

The tax system is a mess, and I have no idea how you could get anywhere sensible from here, but we need action. What evidence we have is that growing inequality is society is bad news. Eventually it spills out in poor health, shorter lifespans, and often violence. Eventually, those who can leave that society taking their skills and wealth with them (cf Russia). A government that sets out to do that is one that has no sense of its responsibility to its polity (and we have plenty of dictatorship that demonstrate that in history – mostly it ends in collapse, revolution and a large number of deaths).

I don’t have a solution, but I fear for the younger generations. They have it massively harder than I did. We have a strain of political thinking in the UK that considers poverty to be a moral failing and that is both wrong and counterproductive.

And to those raising immigration as an issue – just look at the demographics, and then explain to me how we are going to support an ageing population who are “entitled to my state pension – I’ve paid in all these years – it’s my money that the government is stealing from me”. Evidence if it is needed of the terminal self-interest and stupidity of so many people. People unfortunately more likely to vote than the average.

Find it somewhat hilarious that some commentators are trying to nullify TI’s opinion on the basis that he has no children. Some of us may not have any children, but we are all offspring ourselves and most of us will, at some point, be the beneficiary of some kind of inheritance. I guess it’s a question of perspective, as TI himself pointed out.

Great reading- I’ve had the chance to ponder this growing inequality between millennials and how it makes an unfair life even more unfair.

I come from a family of 6 kids of teacher parents from a non prosperous background and never expected to get an inheritance (and thus didn’t rest on my family laurels).

I’m for higher inheritance and wealth tax from a bitter point of view – my views chime with old_eyes.

although now I’m in a position of being a rich parent of 2 kids and try not to spoil them.

One big problem with the graph is that if the top 10% of millennials have £300k in housing equity by 37, where does that leave people like me where I can’t have £300k in equity because my house isn’t worth that much and a casual glance at houses for sale around my way, only maybe the top 10% of houses are worth £300k.

The only balm for this burning injustice is that the low house prices (and overall LCOL in Scotland) is that our mortgage is affordable, generally our friends are not hard up, there’s less inequality and whilst house prices can make you wealthy – the truly rich have their money in stocks, shares, ETFs.

That’s where our money is and my belief is that high house prices will only make you feel rich but never deliver because you can’t eat equity.

I think I need a new dictionary, I need help understanding feudalism (let alone neo-feudalism) in a tax scenario. Odd that in a blog specialising in FIRE you bemoan boomers who have wealth I gather you think they haven’t earned. However a FIRE aspirant tries to invest money to gain from the markets growth in wealth that he/she didn’t earn by their own effort (compare and contrast with house price growth). If they are lucky they will succeed so that then they can live like rentiers.

I think the source of the inequality problem is actually called capitalism.

Heaven knows what you think about the continuing accruals in public sector dB pensions.

I can think of the following policies that would help lower house prices (and hence address the problem that this article is trying to fix with inheritance tax).

1. Lower immigration to reduce demand.

2. Build more homes to increase supply.

3. Outlaw/restrict/tax property ownership for non-doms.

4. Penalise holiday home ownership for properties vacant for >x weeks per years.

5. Spread the economy around the country.

Number 5 in particular would be massive. The fact is the country is littered with cheap properties but few people want them because they aren’t where the jobs are. I don’t pretend to know exactly how this policy should be carried out but it must be possible as most other advanced economies suffer less for concentration in one city.

In my opinion all 5 would contribute to alleviating the problem and most importantly they would be POPULAR which means they’d work much better than inheritance tax which would be extremely UNPOPULAR.

ZX 4 PM

Again

It’s like watching the envious dream up the best way to repress fellow travellers who dared to improve their lot, and leave their life of shite.

Perhaps you should look to the unelected House of Lords, all seven hundred plus, who continue to frustrate the electorate at every opportunity, contribute nothing of value, but maintain their own and their beneficiaries’ lifestyles, whilst you debate the best way to suppress your cohorts.

While the portfoliocharts article on international SWR is interesting it does have some limitations, e.g. ‘only’ data from 1970 onwards are included (yes, that is over 50 years of data, but it does miss out some interesting things that went on prior to that). I also worry (as a holder of a small amount of a gold ETC in my portfolio) that the subsequent strong performance of the yellow metal was related to Nixon taking the US off the gold standard in 1971 (just in time to offset subsequent inflation effects on both bonds and stocks) and that this has resulted in its presence in ‘optimal’ portfolios. Still it has done well over the last couple of years!

In my view, Tyler’s improved projections of SWR, https://portfoliocharts.com/2024/03/15/how-to-harness-the-flowing-nature-of-withdrawal-rate-math/, is also a fascinating bit of work. There is a lot of good stuff on that site.

I found the article on ISA being Ineffective Savings Accounts and the broader conversation about Inheritance Tax (IHT) very demotivating. I am sensitive to the struggles faced by millions, but at the same time, I feel that this rhetoric tends to push people like me, who are striving to break the ceiling with hard work, further back in line. I didn’t inherit wealth; I’ve worked diligently to earn and save money in my ISA, resisting the temptation to spend it frivolously on things beyond my means. I’ve made prudent decisions to save and invest my money, all while consistently paying the top tax rate.

In my view, I’ve fulfilled my obligations by paying income tax and National Insurance contributions, and I believe I should have the freedom to determine how to use my assets. The government shouldn’t penalise individuals like me for being financially responsible and sensible, while offering support to those who borrow recklessly to sustain a debt-driven lifestyle. This is another aspect of meritocracy worth considering in the arguement above.

“inching back into a feudal state”: so much pessimism in the comments above. How we fight over a shrinking pie. Ever thought that maybe we can/will ‘grow the pie’, maybe even ‘bigly’:

https://www.ft.com/content/d8112360-81e6-468e-a1dc-584b7d4797d8

https://ark-invest.com/newsletters/issue-404

https://ark-invest.com/big-ideas-

Apols, now with correct third link:

https://ark-invest.com/big-ideas-2024

@Delta Hedge

Are you for real? Cathie Wood? Returning a massive 2% pa over the last 5 years (-38%pa for the last three).

No one is getting fat on that pie! Please tell us you’re not invested? It’s not much of a hedge!

Thanks for the great comments, including those I disagree with which are mostly well-articulated. But as usual on IHT from my perspective some of you are missing the elephant in the room:

Again, I have no problem with people working hard, saving, investing, setting up companies and getting rich.

Their children did none of these things! They just happened to get born to them.

The graph shows this is driving huge levels of inequality. Not hard work, not striving. Neo-feudalism, as ZX put it.

Parents are not being taxed. Their kids are. Why is it so hard to grasp?

Do people really believe somehow they will literally ‘live on’ in their kids?

You are dead when you’re dead. Maybe you go to heaven, maybe there’s nothing, we all have our views on that. But I assure you that you’re not being taxed. You’re dead.

@Algernond — Of course I knew that would be your response. Any state, even a small one, needs funding. It’s no kind of answer really. Given the crossover of those on this thread against taxes / redistribution with those particularly worried about maintaining a strong border (which I’m all for too, incidentally) we can presumably all agree some taxes are needed for some kind of state. Even a small state that’s 10-20% of the size of the current one. It needs to be funded. And I’d prefer to tax people who did nothing to earn their wealth (i.e. heirs) than productive ones working hard / making decisions / breathing to better themselves and grow the economy.

@ZXSpectrum48K — Yes, you and others over the years have at the very least persuaded me that higher IHT is going to be hard to implement equitably. I still believe it’s one of the fairer / more social useful taxes, however. Even if only a big part of any ‘solution’ in a perfect world.

@Factor — Well naturally I see your point, and it’s not unreasonable. You’re arguing there is something ineffable about having children that I can’t really relate to. However I might equally turn it around and say that this is why I can see with clear eyes that inheritance tax is a much fairer tax, given we have to tax, than say taxing income.

Why is it morally better that someone who did nothing AT ALL to earn it gets given £150,000 unmolested by tax (the FT’s second graph) and that 30 low-earners get taxed £5,000 each on their very modest incomes? Because that’s what it boils down to.

Also, as others have said, I have parents etc. My mother, who by the standards of most older readers of this blog has very little, is insistent about thinking about preserving her housing equity partly because she wants to hand something on to her children / grandchildren. My grandmother, who we thought had literally nothing, gave us various young relatives a thousand pounds each when I was a teenager and it was more money than I could make on my paper round in 3-5 years. She wore the same cardigans for years, and used tea bags twice. I see the motivation and I understand it exists.

We mostly haven’t let the victims of injustice — murder, say — decide on the punishment for at least 1,000 years in this country. We recognise that emotions cloud rationality.

TLDR: right back atchya 😉

@Vic Mackey (#30): ha ha 😉 Not actually in Ark but….if you’d invested in QQQ3 (3x Nasdaq LETF) in 2012 and just held, then you’d be up 6,000% now, despite it falling ~75% in 2022. Pessimists may sound smart, but it’s the optimists (eventually) who make the money.

BTW, love the pseudonym. It rang a bell somewhere, and I just realised ‘Detective Vic Mackey from The Shield’. What a criminally underrated series that was. Absolutely gripping.

I have been living in the same house in the South East for almost two decades now. My subjective impression is that downpours of torrential rain and strong gails are getting much more frequent than when I moved in the house. I wonder sometimes how much longer will it take for the gails to get so strong that the current roof and perhaps even the walls will crumble?

Global warming is a force much stronger than our class system and politics. It could bring house prices down faster than most people imagine. This article from the Economist makes a better case for it than my two-decade subjective impressions of my neighbourhood:

https://stocks.apple.com/AwoBYuQbdTpWzUybY5VZ_eQ

@TI > Do people really believe somehow they will literally ‘live on’ in their kids?

I believe that many do. Some of the more self-aware have articulated this to me 😉 It’s not a totally irrational position.

Always puzzled me why people who claim to love their kids so much don’t want to watch their eyes light up by giving them some of the putatively taxed inheritance to. One of your previous commentators opined thusly on it, he was an IFA and saw the train wreck happen. Over and over…

It’s a double win, you get to see some problems fixed for the fruit of your loins while you are still alive, and make it another seven years and IHT is not an issue. What’s not to like? Presumably you have confidence in the integrity and character of your offspring that they won’t leave you in the dreck?

Surprised there have not been more reflections on Simon Nixon’s alarming article about the collapse of the London stock market after Brexit. Of course, it is not surprising that global investors now see Britain as a basket case, borne out in the parade of dismal Tory Prime Minsters we’ve suffered since 2016, but this problem matters for the economic and financial futures of UK readers.

@TomBaker

I wouldn’t panic about your walls collapsing. True this winter has been unusually stormy, but most scientists think the longer-term trend is actually one of lower windspeeds as a result of climate change:

https://theweek.com/news/environment/958900/global-stilling-where-has-all-the-wind-gone

@TI. Thank you for your tolerance. My point re FIRE was aimed at any baby boomers don’t deserve it sub-text, not IHT. However, on IHT, having your children better off seems a legitimate aspiration to me, no less worthy then investing with the goal of putting your feet up and watching as others have to continue to strive. Sounds a bit off the equality message.

Nb, my comment recently on ‘far right’ but never ‘far left’ was aimed at pointing out that the bit that matters is ‘far’ so why not left and right in an ambidextrous lexicon.

I have had a go at reading that tremendous Portfolio Chart piece. It aims to identify the optimum safe portfolio and withdrawal rate but by optimum it focuses on the worst scenario. Not surprising that gold, commodities and bonds shine as a bad scenario must be bad for stocks and the worst scenario would be when stocks and bonds correlate.

In all other circumstances other allocations would be better and generate a higher swr.

What I dont think it addresses is a probability approach to the surplus you would leave if you invested in this bomb shelter approach if the scenario you you live through is better than the historic worst case.

The surplus represents the difference between the model swr and the rate you could actually have enjoyed.

Mind you a surplus would leave money that you could bequest to your children, or to the charity of your choice.

A difficult and complex topic.

Meritocracies don’t really exist, and shouldn’t be strived for as we don’t all start off as equal or have equal access to the best education system, socioeconomic backgrounds, networking opportunities, health, nutrition, appropriate mindsets etc. Nor do we all have the same levels of intelligence, the same developmental pathway which means we can take advantage of the opportunities as they typically arise in the education system. All of which risks baking in a different intergenerational inequality.

I was reminded of this in a small way recently by a middle class parent of my acquaintance bemoaning the fact that a school trip for their offspring was costing as much as a mortgage payment, and that it was unfair on those who couldn’t afford it. As someone who grew up as part of the underclass, it landed as something like a cross between a humble brag and hand wringing. I never went on any school trips if they cost any money – and they pretty much all did so I’d usually find myself left behind with the children who were similarly poor and/or often had behavioural problems. A drip drip of similar missed opportunities meant that even though I was lucky (I went to university), there was already an estimated (by me) 10 year gap across a bundle of measures including wealth, self-confidence, health etc.

Through a mixture of luck, kind mentors, extremely long hours spent on self education, careful goal selection, management and timing of a chronic disease progression etc, I’ve managed to claw back some of that ever widening difference. Compared to my direct peers I grew up with, I have unimaginable wealth as I have my own house, will never go hungry again, never struggle to pay the bills and work as much or as little as I like. But I will never catch up with my middle class colleagues in terms of aspirations and ability to meet them as I’ve run out of sufficient energy due to a chronic health condition combined with getting older.

Like many, I’m generally of a dim opinion of governments as often it’s a place where the most venal or least smart middle class offspring end up – but I cannot see how intergenerational and intragenerational inequality can be tackled without some form of wealth and opportunity redistribution coupled with a sense that by doing so the cake gets bigger for everyone. Some will need more help because they’ve been handed a bad lot in life due to pure accident of birth – and even then it may not be enough. Some elements of structural inequality are so egregious, eg the Royal Family and associated but far less visible aristocracy, they simply need dismantling. There is a lot of work to do.

Cheers for the Which piece on equity release aka reverse mortgages. We all know that a home is the largest asset (and investment) most people ever have, yet releasing that equity to live on in retirement is regarded as unwise or déclassé and rarely discussed openly. Quite relevant to the inheritance chat too.

Surely the issue as to the level of IHT is separate from lack of housing ? I have absolutely no doubt the scales will tip and a future government will go on a massive house building programme- that’s why I invest in the real economy and not property. When today’s 20 years olds are 40, perhaps younger, they will be in the driving seat and they, like we all did, want a place to live !

Assuming that is sorted , I don’t see an argument for a high level of IHT. Why should my accumulated wealth be spent on benefits or hotel rooms any more or less than my heirs ? How is one recipient any more deserving than the other ?

Faustus thinking the LSE collapsing due to Brexit is a perfect example of what I was commenting last week about if not mattering what people think on the internet about global (or western) trends being the result of Brexit or Liz Truss

In 1996 the US had 7,000 publicly traded companies, now it has 4,000.

https://amp.cnn.com/cnn/2024/04/09/investing/premarket-stocks-trading

I remember in 2017 a new iPhone had bad sales worldwide, this was explained in all the other countries as not tolerating the higher price, not enough upgrade over previous model etc etc, and in the U.K. as being a consequence of Brexit. And you’ve all had years of burying your head in the bbc, guardian, monevator echo chamber since then. It’s good to take a deep breath and look at what is happening in other countries sometime (and try to remember when doing so there are countries outside of Europe)

Firstly, this argument “you don’t have kids so you are ineligible to speak on it” is a poor one.

I don’t have kids, but I also live entirely from capital and personally think that capital is taxed too lightly compared to labour in the UK. How is that possible? The answer is that one doesn’t have to be entirely selfish in their outlook.

Re: the Murdoch article, I totally agree with the premise though I felt the representation of it was a little strange

Defining a millennial is one issue. I’m 40, technically a millennial apparently, yet my cohort’s average lot is way better than those who are 30 (also millennials) because we had a chance to buy houses at low interest rates, and houses were cheaper in 2012. Still hard, but nothing compared to young millennials woes.

Second, using the median rather than mean shows a strange result where apparently the ‘average’ 37 year old has £0 property wealth, whilst really all that shows us is that the middle person doesn’t have a house. Which is not *necessarily* an issue, and it could also hide that the 52nd percentile does have much more equity because they *do* have a house.

Notwithstanding that, I’m glad he’s raising the issue. My wife and I have often talked about the impossibility of buying the property we did if we were born just 5 years later, and we were DINKs with decent jobs.

@far_wide

It’s a very interesting thought experiment to consider how your path and outcomes would have varied had you been born -0, -5,0, +5, +10 years.

ZX mentioned a few months ago along the lines of his boss was 5x wealthier than him and his DR was 20% of his (for about 5 years age diff).

On a non monetary note, my old Underwriting Director said he’d never have got past the Graduate interview process nowadays (that was 15 years ago when he was early 40’s)

There’s probably a good chunk of fire types who would have missed university if it meant taking out student loans. I can’t see myself borrowing tens of thousands for an unknown world/outcome – my dad wasn’t keen as it was and only cost him about £300 contribution pa the rest (85%) being a grant (1988)

@TI

I’m not an anarchist (yet?), and so am not advocating for zero taxes. If there is a government, then some taxes will be required (preferable over money printing/debauching).

However, we had a ‘State’ before WWI, and as far as I am aware, gross taxation was well under 10% which was plenty to fulfil the governments basic requirement of protecting individual & property rights.

From the comments, it still seems to be coming down to the State vs the Free Market (not incl. Crony Capitalism) at being better for overall wealth creation. I’m not sure what this discrediting of ‘efficiency of markets’ that @trufflehunt alludes to is or what it has to do with it.

For relatively recent takes on the State & Taxes, I’ve been enjoying Dominic Frisby’s books ‘Life After the State: Why We Don’t Need Government’ & ‘Daylight Robbery: How Tax Shaped Our Past and Will Change Our Future’…. And his song ‘Show Me the Way to Ancapistan!’ is most entertaining:

https://www.youtube.com/watch?v=wPQdCaxuNNc

@Boltt I was in the £1k a year for fees cohort, at the time I remember feeling it was a bit harsh as my Dad was paid to go (!) Now of course I’m very grateful, and it’s yet another millstone that those in their early 30’s and below have around their neck.

I agree with you that University now looks pretty darn marginal. That said, I’m not sure personally I’d have had the presence of mind at 18 to not go, and despite the huge cost now there are still many (vast majority?) of employers who will disregard you entirely without one unfortunately.

Gen Z, though, should be in the streets at this point with their lot. Houses drastically more expensive than the high prices millennials faced, high interest rates and an effective graduate tax too. All whilst also experiencing the limitations to economic growth and personal freedoms that Brexit has brought.

When I saw a poll recently of Tory support at something like 9% for under-35’s, I could only think ‘why so high?’

The essay on the decline of the UK stock exchange was interminable and utterly fatuous. It’s argument for the current state of affairs was of course Brexit without offering any rationale beyond a hand wavey “foreign investors are deterred because of political uncertainty” type nonsense. This argument has similarly been mirrored in these columns without any evidential offering. The truth of course is that the UK remains the second most popular market in Europe for FDI and a cursory look at the data in the ONS( which is a treasure trove btw and rarely quoted) states:

At the end of 2022, shares in quoted UK-domiciled companies listed on the London Stock Exchange (LSE) were worth a total of £2.42 trillion.

The proportion of UK shares held by overseas investors (rest of the world) increased again to a record high of 57.7% of the value of the UK stock market.

The proportion of UK shares held by UK-resident individuals fell to 10.8%, down by 1.2 percentage points from 2020.

The proportion of quoted shares held by banks continued to rise and stood at 3.4%, an increase of 0.3% from 2020.

As mentioned by others above, increasingly ALL stock markets are shrinking as the ladder to accessing assets is being pulled up upwards and away from the retail sector.

Further, the UK pension sector, unlike many in Europe in the past, heavily financed domestic equities, so much so that over 60% of their assets were invested in UK equities as recently as 20 years ago. For many different reasons not least regulation around permitted asset/ liability strategies that figure now sits at sub 5%. Despite the many legitimate complaints about Brexit, the current plight of the quoted UK equity sector is just another lazy canard to leave at its door.

I’ve got no idea who the author is of that piece but it was uninformed drivel…. That does sadly have a more than willing audience.

It is interesting how this week’s topics have made commentators (including me) much more angry than we usually see. Clearly strikes close to home for many of us.

Haha yes old eyes, that is a fair observation. We need a super technical moguls article to bring the heat back down. It’s all naval gazing anyway so no point getting too hot under the collar

Less politics and more finance ?

It is the Investors blog however and he sets the tone and content

xxd09

I sincerely hope Monevator maintains its opinionated forays into politics and other “non-financial” realms. It’s delusional to think that you can understand investing without considering its broader societal context.

SWRs are a fascinating topic – it would seem a great shame to take a real 4pc from a mixture of assets producing real 6pc after costs. Some people think you can take a higher rate if you ‘annuitise’ your necessary spending and take less during the bears. But not making withdrawals during a six year bear seems a miserable end to a lifetime of saving.

I suppose we will all be subject to different sequence of returns when we get to decummulation – what will work for some not for others. Interesting indeed.

I agree with @TI, that wealth/inheritance article was an eye opener. And I also agree that it should be taxed more effectively than now – though I disagree about taxing the recipient. The beauty of the current system is it doesn’t double tax the individual as some claim (because the individual is by definition no longer alive to be taxed) and it doesn’t tax the recipients because the wealth isn’t legally theirs until tax is paid and probate granted. It would get a lot more messy if the recipients, who are quite likely on PAYE and have never filled in a tax return, start getting chased by HMRC.

It can’t be said to be anything other than taxation of unearned wealth.

However it does need a system where everyone pays the same, you can’t pay an accountant to rearrange your finances to minimise IHT. I am sympathetic to the flat rate idea, or to those suggesting that after death all assets including the principal residence are assessed for CGT. It would need legislation to address the taxation of trusts.

@Faustus (#36) – It’s interesting that the climate models predict a long term trend of calmer winds. They also predict increasing chance of extreme climate events.

Anyway, the point I was so poorly trying to make is that all this is going to cost loads of money and someone will have to pay the bill. The Economist suggests that none of this extra cost seems to be priced in the property market now and it might eventually force house prices down.

People are often against things like taxes on assets at death and as many posters above demonstrate, suggest ‘their’ wealth was earned by hard work, never good fortune or luck (at best, and more likely, a combination, involving good fortune), they think it is all their own greatness and efforts of course, so why shouldn’t they get to pass that on? Wait until you or your children have twins with special needs or lifelong disabilities, or something equivalent – you wont be calling the state too big then and *rightly*, at that point, you will be expecting the state to support.

Sadly, we need to be more militant about taking wealth to fund the state, the problem is that once you are reasonably wealthy and with good fortune, you can manipulate it more than anyone else. Case in point, the head of the unit I worked in – moved to England to pay lower taxes than Scotland. Fine you think, and he done it all legally, declared residence, comes into office contracted days etc. So what is the problem? He plans to move back to Scotland at the latest point possible so his kids can get free university tuition in Scotland. Again, all legal.

The above example might be a stretch from the points being made about where the tax comes from but the tax system is meant to support and protect those who need it most like the disabled, those who genuinely can’t work, etc, and to be paid to fund services that the country benefits from. Tax systems are not there to be optimised (read: abused) to suit your current circumstance. At the point where you are able to work in a low tax place, retire to somewhere more favourable to you, including your tax arrangements, then die somewhere optimal for passing on your wealth, is the point where you know your life and family has been blessed and you have been fortunate (infinite wealth to pass on does not greatly improve the life of severely disabled children etc, wherever they live, if this happens to you suddenly you will be less interested in optimising tax and less worried about death taxes). However, such an optimised approach to your tax affairs does not look after the genuinely ill and disabled, nor does it fund things we all take for granted. We can’t all operate like this and expect the sick and disabled to be looked after and the essential services to run. You just happen to be fortunate right now that such situations do not impact you.

The state might have problems, but I have worked in both public and private sector, and the only real two differences are the private sector can simply run away from anything that is a money sink and abandon it, and secondly, of course, the grossly higher salaries in the private sector. We see it right now with rail, water, and energy, things that can’t be abandoned, as soon as profits dry up and losses look inevitable, it basically gets handed back to the state (or costs lumbered on the state), no acceptance of failures, and we don’t hear the old chestnuts about needing to pay millions to CEO’s to get the ‘best’ people etc when such happen, despite those millions of pounds of pay to single individuals leading to the state needing to pick up the pieces.

I personally would be putting efforts in place to devise a system that was less open to any manipulation or somehow pro rata-d cost wise by time in the country or something. The sad thing about this is many of the costs we find ourselves dealing with (and what most reasonable, non-racist, peoples problem with migration is) are due to the systems being gamed or being perceived as being gamed eg the perceived abuse/drain of national services/benefits/resources by those who are perceived to have not contributed to, or be deserving of before long twrm residents. I do wonder sometimes if the anti-immigration sentiment would be quite so high if almost everyone who came here to work had to pay for services we take for granted and did not immediately become entitled to the same as the long term residents here. I am purposefully talking about economic migration here and not asylum and all the other variations that are more complicated – basically, the idea that a country should look after its people and provide basic services. These need to be paid for. The tax system simply needs to be better devised so it can’t be abused or trivially optimised by those who currently are fortunate enough not to need many of the expensive services. I say this, as someone who carefully organises my tax affairs and in general, has been lucky with family health etc, but I am honest enough to see many of the problems that need addressed.

If you think you pay too much tax already, and get too little back from the system – congratulations, you and your loved ones are *currently* probably blessed with good health and reasonable opportunities.

Random Coder #54

Well said hear hear, a round of applause to you a great comment.

Everybody never knows what hand luck/fate will deal you to your friends, yourself, family etc. or when …

Being a society is what taxes and state is about providing insurance for things most people realistically can’t insure on their own or the private sector won’t and as you say either runs away or dumps the problem on the state after they have taken all the money ( banks in 2008 included).

Your comment about legal immigration I also agree with and believe the reasons you gave and the large scale and speed of it causing “culture shock” had a lot to do with Brexit sadly and could have been avoided.

Along with utilities etc. as you point out, care homes are another area that are just gamed by the private sector for profit, the private sector claim they need need lots of immigration as they can’t get the staff, but until recently they could basically get a visa for someone who would be paid minimum wage and then also bring their family over with them who no way could be supported by a single minimum wage so would have to claim all kinds of benefits, school places heathcare etc.. So the state is effectively subsidising the profits of the private care home owner. If the care home can’t provide good enough wages and working conditions to attract workers then it it is not a viable business at all and should provided by the state or council and then it is at least openly subsidised by the state and not for anyones profit either….. this probably leads into the discussion about IHT … are care home fees ( in my view that should only be allowed to be not for profit ) paid for by wealth of the recipient simply a form of early IHT anyway , this potentially disincentives saving etc. but then this falls into the realm of TIs IHT or ZX CGT on wealth , that couldn’t be avoided with trusts etc. then fees could be paid after death rather than before out of the recipients wealth.

As with everything no simple answer… but for sure I think things are simply going in the wrong direction at the moment with growing inequality and lack of meritocracy.

The problem with IHT is that only the moderately wealthy pay it. Billionaires don’t. I think what is needed is a shift in focus so that capital and transfers of capital is more properly taxed.

I would base a capital tax on notional return. If the notional return on capital was say 5%, then a 40% taxpayer would pay 2% tax. This tax would be offset by income tax, so for example if an investment or property portfolio produced an income of 2.5% and 1% tax paid then the capital tax would be reduced to 1%.

I would replace IHT with a capital transfer tax, so if someone gave you money or assets you would pay tax on the value of the transfer as though it was income.

To get round evasion by people keeping money offshore we would require that beneficial ownership of assets and businesses are identified. Then a charge could be levied on the business or asset according to the amount of capital and transfers of capital value.

The safe withdrawal rate article is very interesting. I was surprised that the optimum portfolio has almost as much invested in gold as in stocks. Presumably a consequence of this is that you rule out unexpectedly good returns, so can no longer fantasize about the holiday home a stockmarket windfall might fund.

The above is a more concise way of saying what I was trying to get at – the point that taxes are to pay for what is needed, so it can’t be easily manipulated.

I also was trying to get to the other side of the equation about entitlement to services and at what cost. I’d be happier with a flat tax rate of X% and those who spent 100% of their lives here got services ‘free’ whereas those who just entered the country were effectively charged for the services in proportion to their proportion of life in the country. It’s a messy idea and not well thought out but it’s a bit like the new state pension where 35 years need accrued, 10 minimum, and you only get a proportion of state pension if between 10 and 35. These sorts of approaches only really work though if everyone agrees to do them.

It would need proper thought and be done sensibly, but there are two ways to make sure the state has enough money – collecting appropriate/more taxation and reducing entitlements sensibly and fairly. Interestingly, inheritence taxes become a problem under such an approach, and preventing capital flight late in life would have to be a thing, or else taxing it as suggested above.

I struggle to believe anyone can say honestly that it is ‘fair’ to work in a very low tax region but then retire to somewhere else and expect all the benefits and services paid for by taxes, at the point in your life that most people benefit from/need state services most.

The difficulty with your approach, Random Coder, is that children born in a country haven’t contributed anything by way of tax to the state either. I guess we hope that they will at some point. That must also be true of immigrants, and indeed that is why practically all governments regardless of their posturing encourage immigration – especially in light of shrinking birth rates and ageing populations. I also strongly suspect that a recently arrived immigrant is in a better position to contribute to the state’s coffers than a recently born baby.

BBlimp (#51).

Trying to get a fixed income out of a variable asset, like the SWR is approach is, IMO, not using the right tool for the job.

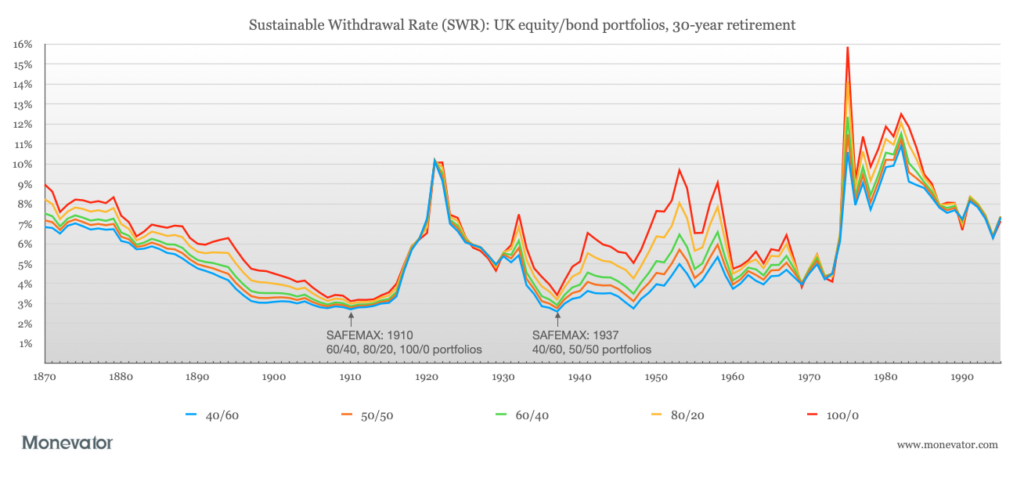

The historical 30 year SWR for the UK with an allocation of 50% to equities varies from something like 3% (retirements starting in around 1910 and 1937) to about 10% (retirements starting in 1920 and 1981). Of course, this varies with asset allocation, but the variation in time (i.e., good/lucky or bad/unlucky retirements) is far larger (e.g. using 100% equities instead of the 50% I quoted figures for above, the worst case SWR increases to 3.3%). In bad retirements, assuming an a priori knowledge of the worst case, you will scrape by your money running out after 30 years, while in ‘good’ retirements you will underspend by a large amount.

Providing a floor (e.g., state pension and a RPI annuity) means that you can accept some variability in portfolio withdrawals without having to worry about eating the proverbial cat food! In bad retirements, the mean amount drawn from the portfolio over 30 years is, in the worst cases, slightly less, but there is a bit left over, while in good retirements, the mean withdrawal can be much higher and there is less left on the table.

At the moment, RPI annuities are particularly attractive since they have an income rate slightly higher than (single life) or similar to (joint life) the UK SWR.

The “problem “ is the family unit.Parents will go the wall for their kids -that includes IHT! Add to that those parents who have got a good life deal with their genes etc will continually outperform the rest of us-ensuring their offspring get a head start

These are some of the reasons that totalitarian regimes target the family unit so vigorously – mostly unsuccessfully

Those who purposely opt out out of having children and continuing their own family unit will lose out competing with these fundamental building blocks of human nature

Substituting “caring” for the rest of society will always be a poor second best against such a powerful human drive

Reproduction is only beaten on the Darwinian scale of evolutionary forces by Survival

Western societies have coped relatively well with this fundamental unchangeable “unfair” scenario in that the wealthy concede that they must pay most of the tax that funds the rest of us -unlike all of the rest of the world where the lucky better off cling grimly to their wealth

Ignoring these major forces at play could lead to disillusionment and despair -far better to recognise reality and work with it

Our country seems to be quite good at doing this -certainly from what I have seen extensively travelling the countries of the world in my retirement

No where else I would want to be

xxd09

Algernond (#44)

“However, we had a ‘State’ before WWI, and as far as I am aware, gross taxation was well under 10% which was plenty to fulfil the governments basic requirement of protecting individual & property rights.”

There are some interesting difference between the UK now and before WWI, both economically and socially. As one example, the history of education is interesting (see https://researchbriefings.files.parliament.uk/documents/SN04252/SN04252.pdf)

Some headline numbers: School leaving age in 1910 was officially 12 (but many left at 10) and fewer than 10000 people obtained a degree.

A good question is then how well can you run a modern, technological economy with an undereducated population?

I don’t think I have ever seen a serious argument for defunding schools (even in the US) and besides, in a democracy, it would probably be hard to persuade many voters to vote for it (even those without children).

Another area of government expenditure is health. For example, the 1904 Fitzroy report (see https://history.port.ac.uk/?p=2264) prompted social change because defending the state requires healthy citizens.

The argument over IHT is very much a philosophical debate. On the one hand you’ve got those saying (a) it’s *my* money, and it’s *my* property, and I should be able to give it to whom I want, and (b) there needs to be incentives for people to work hard and innovate and so on. On the other hand there are those saying (a) those with money have invariably been lucky to some degree, ie it is undeserved, (b) capitalism tends towards inequality and without some degree of redistribution you’ll end up with a feudal system which is inherently unfair, (c) those with the broadest shoulders should help those in need.

John Rawls’ book ‘A Theory of Justice’ is probably helpful in this debate. He argues we should all imagine ourselves in a hypothetical pre-society state, as though we haven’t been born yet and we don’t know what we’ll be, what race, sex, class, ability/disability, and so on. And then we should come up with rules about how society (and by extension taxes) should be structured based on that premise. Obviously you’d have rules about non-discrimination as a starter, and about equality of opportunity. You’d like to think that there would be a system for helping those in need (because you don’t know whether you might be one of those people), especially when there is a great deal of wealth that could be redistributed. But you’d also want to allow incentives for people to work hard and innovate because we all benefit from that, and therefore allowing people to profit from those things and choose how they spend those profits seems sensible.

Anyway you could go into more detail on it, the main point is to try to be impartial which is difficult to do, and that’s why the above thought experiment works so well, because it forces you to consider all viewpoints and come up with a system that is fair and that everyone could (should) agree to.

@Alan S (#60):

I share your scepticism of so-called safe withdrawals* and also favour, and follow, the floor and upside (F&U) approach. I note from an earlier post that you may (in due course, I assume) benefit from a fully inflation protected DB pension. What, if anything, do you see as the key options for overcoming the drawbacks of limited price indexation of some DB pensions?

Also, do you currently have any plans to develop any further publications about the practical use of F&U in the UK? I ask as IMO this is a glaring hole in the available de-accumulation literature.

* essentially the SWR is unknown and unknowable in advance

@G

You are right, and my underthought out approach is miles away from being ready, so I am not claiming its in a state for use. But to your point, yes, a new born kid here has contributed zero and may contribute zero, but id be arguing theyd be in the pot of people that need and would be entitled to 100% ‘free’ state support regardless, whether that is lifetime care, or nothing and they become the next CEO millionaires paying lots of tax. This is not meant to be you pay in to take out what you have paid, more like everyone pays in tax to fund the *system* needs, but entitlement within that system is something that needs considered. The head of service example I made earlier is a good non-contentious example of the issues I am trying to address here – sorry, but if you bail 100 miles down the country to avoid higher taxes as a high earner, you should not be able to return 3 years (or whatever it is) before your kids are due to start university and enjoy free tuition funded by scottish taxpayers when you left to avoid paying those taxes.

My point was the tax system ‘pay in’ needs to be designed so everyone is funding the needs, which depend on the entitlement. If someone wants to come here they too will contribute to the *countries* needs but only be entitled to lesser benefits and entitlements etc.

I have more problems (tax system wise) with the UK born national that lives and works in some lower tax economy elsewhere most of their working life and then retires or moves back for free NHS etc when they get ill, than the person who spends their life in the UK happily working on minimum wage, with benefits to supplement that. My only real point is the tax system shouldn’t be easily manipulated at both the pay in stage and pay out (benefits/collection) stage. The point of it is those with the most and in least need *should* be paying in the most to pay for services that are needed by others and expensive, as that is the point.

The ‘solution’ being presented is not developed properly, but those with the most should be paying the most for those who are in need via taxes. Tax should not be something that you weigh up your personal circumstances and optimise readily at various points in life to pay the least in to get the most out, especially because, often, only those healthy and wealthy enough have this luxury.

Just wanted to chime in to say that immigrants from many countries already have to pay a steep levy to access NHS services (the immigration health surcharge). I believe it can be extremely burdensome for a large family, since you pay per person (I gather it would run into many thousands of pounds), and might conceivably even deter foreign professionals such as academics from taking up posts in the UK.

@Wodger

Hmm, unlikely, the UK open access Soviet style rationed healthcare system is very much the exception. Most citizens of other countries are familiar with having to pay for their healthcare.

@Vic Mackey — you might be surprised. This Guardian article (https://www.theguardian.com/uk-news/2023/jul/16/borderline-racist-rishi-sunak-plan-to-fund-pay-rises-by-hiking-migrant-fees) cites a figure of £33,000 *upfront* for a family of four on a five-year visa. Plenty of highly talented overseas candidates for moderately-well-paid jobs in the UK (e.g., university lectureships) would look at that and say “No, thanks!”

@Al Cam (#64)

As an engineer/physicist I have a strong dislike of automated systems with no feedback – the basic SWR approach has no such feedback and, even historically, the outcomes are critically dependent on small changes to the initial withdrawal. As you say, the actual SWR at the beginning of any retirement is unknown and unknowable. Even with the SWR projections developed by Tyler at portfolicharts, the range of uncertainty is about plus/minus one percentage point and that is after 15 years of retirement. I also doubt that many people could happily continue to draw their inflation adjusted 3 or 4% if their portfolio had just dropped in value by 50%.

I actually retired early and took actuarial reduction on a DB pension (not an easy decision, but it has worked for us). I think there are several ways of thinking about DB pensions without inflation adjustments (2.5% and 5% caps are common for post-1998(?), while level were common before that) probably depending on how crucial they are to providing income

1) Use it to Provide extra income early on in the retirement when healthy enough to appreciate it (front loading), and to provide a diminishing baseline as time goes on.

2) Use it to support an income target replacing some of the portfolio withdrawals. In others words, the contribution to total income from the DB pension will gradually decrease while that of the portfolio will gradually increase. I did some historical backtesting (not peer reviewed, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4473040) that suggested that for both the UK and US, the “MSWR increased by approximately 0.6 (for a DB pension with no inflation protection), 0.7 (with 2.5% inflation cap), and 0.8 (with 5% inflation cap) percentage points for each percentage point of DB pension income.” But, of course, a period occurring close to the beginning of retirement that was worse than the 1970s and 1980s or anything approaching what Turkey is currently experiencing, would be a disaster.

3) Purchase some alternative RPI protection (this has been looked at in the form of a TIPS ladder, at the bogleheads forums, I think in relation to VPW, but I cannot find a link).

Yes, I’ve done some work that has looked at floor and upside – the partially completed report has sat in my ‘try to finish it’ list for a quite a while (I got distracted for six months by historical bond return calculations!) and will return to it at some point.

Here is who has to pay the healthcare surcharge:

https://www.gov.uk/healthcare-immigration-application/who-needs-pay

Not really something that is highlighted when these topics are discussed, so thanks for highlighting it Wodger

@Vic Mackey — The article isn’t drivel. Numerous studies have shown a statistical discount that emerged on UK share ratings in 2016 and persisted. Keep in mind that the UK currency also significantly devalued with Brexit, and that this actually boosted UK company earnings which are predominantly generated overseas. So on that particular (narrow) score the fundamentals actually improved in an accounting sense for UK shares. Yet the discount emerged and remains.

I could cite any number of banks and fund managers, here’s a source you presumably won’t think is a hotbed of Remainer-ism:

https://www.telegraph.co.uk/business/2024/03/14/london-stock-market-brexit-uk-economy/

There doesn’t need to be any causal link between the Brexit reality and company earnings for shares to decline, however, so neither I nor the author needs to cite one. That is not how markets work. The perception is enough. Over the past few years I’ve read many, many global fund managers say they can’t be arsed with the UK while in its immediate post/pro-Brexit state. It’s only 4-5% of the global market and making irrational self-harming decisions (by the standards of the elite, if you like, but guess who fund managers belong to).

Why get involved? The UK was at the bottom of fund flows for years (you’ll see that above in the Telegraph article, too).

I’ve been actively investing since the early 2000s. I can never remember a time of such pessimism, companies getting taking out every week by foreign predators, etc. I agree Brexit (/Brexit perception) isn’t the only reason for this, but it’s highly suggestive.

The best that can be said from a ‘forget about Brexit’ perspective is that if it’s just the perception that the UK is in a bad way then that can be reversed sooner or later.

Personally I think the outlook for UK listed companies under Brexit is a bit healthier than for UK PLC (as a nation) and that the UK market is a relative bargain, and I’ve been selectively and steadily increasing my overall UK exposure via certain companies and trusts for 1-2 years, mostly versus the US where I’m now pretty underweight.

It’s hardly worked out so far, obviously! Perhaps when Labour get in things might improve pretty rapidly though, particularly if accompanied by evidence that the Conservative Party is continuing to regather its sanity, albeit in opposition.

I purposely used UK examples as I didn’t want this to become an anti immigration type argument, as it is not, the problems I am talking about exist even if we only look at movement/legal tax avoidance of UK taxpayers. On the charges detailed above however in the official links, it looks like slightly over £1000 per year of visa, which is relatively nothing in my view. Yes, if your taking 4 other folk with you (all 4 of whom are not working) for 5 years it gets expensive overall, but the truth of the matter is, those other folk are likely to be more dependent on state services than the person jumping up and down about the cost (likely the main earner). As someone with a PhD I have some sympathy with the academic special case that always is brought up, as it is one of the few genuine areas where the person may be bringing truely unique skills and knowledge that we could not readily get in the UK, and most reasonable people would be sympathetic to trying to do what they could to encourage smart unique people being in the UK. Unfortunately it is otherwise a bad example as although universities have been encouraged to raise money via work and many have, the university sector receives vast sums of money from the state as well, so even the main earner salary is being subsidised by the tax payer, while that family likely will be sending kids to schools and using services etc that are already strained at almost no cost to them. This might actually be fine for a lot of people to accept (including me) but the truth of the matter is that the genuinely gifted academics coming to the country are the rarity – we know that sure from the failed super academic visa thing they tried to introduce years ago and an FOI request after it had been running for ages showed only a handful of folk had visas via that route.

We need to stop considering special cases and looking at this as what it is, a ‘system’. The tax system has the pay in side and the cost side. My only real points I reiterate is we can’t allow the pay in side to be so easily manipulated so people can readily pay in hardly anything, whilst the take side is also possible to be readily manipulated in such a way to get as most out as possible. Both sides need looked at – while all of the manipulation is going on, the genuine unlucky (sick, disabled, infirm etc) need looked after, and it needs paid for, and the private sector won’t touch it if its unprofitable.

@TI #71: “if accompanied by evidence that the Conservative Party is continuing to regather its sanity, albeit in opposition”.

Don’t count on this scenario eventuating when weighing up your discounted UK IT exposure.

[FWIW I’m tilting a little towards EM and Euro Small Cap Value to outperform US large growth, but what the hell do I know 😉 ]

The fewer seats which the Tories are left with, then the greater the influence of the residual Brexit Sparta and the wider ERG wing(nut) of the party.