Note: This article on pensions and inheritance tax aims to provoke ideas and discussion. It is very obviously not personal tax advice, which neither the author nor this website are qualified to give. Speak to professionals about your circumstances, if required. Also we’re not getting into politics here. (Indeed Monevator owner The Investor would scrap all this malarkey and whack inheritance tax up to 90%, above a modest allowance for recipients!) As always we’re mostly about making you aware of the tools, not telling you exactly how you must use them.

The Lifetime Allowance for Pensions (LTA) is to be abolished. Subsequently there’s been much gnashing of teeth about how big pension pots are a sop to ‘wealthy families’ who can use them to avoid inheritance tax.

Will your pension now save you a plane trip to Panama?

How much can you legitimately pass on to your heirs via your pension pot while mitigating inheritance tax (IHT)?

We run some numbers.

Setting the scene: pensions and inheritance tax

A quick (partial) recap of how pension rules work (as of now):

- You get (income) tax relief at your marginal rate when contributing to your pension.

- There’s a limit to what you can put in per year (the ‘Annual Allowance’).

- This limit is currently £40,000 (gross), rising to £60,000 in April 2023.

- You can employ ‘carry back’ to use unused allowances from the prior three tax years.

- You can withdraw a ‘tax-free’ lump sum of 25% of your pot. (Now capped at £268,275).

- You pay regular income tax on your withdrawals / income from the pension in retirement.

- You can’t touch the pension until you’re 55. (Rising to 57 in 2028.)

- Your pension falls outside your estate. There’s no IHT to pay.

- You have to tell the trustees (the pension administrator, essentially) who you want the beneficiaries to be in the event of your death.

- If you die before age 75 your beneficiaries get the pot tax-free. (Alternatively they can leave it in the pot tax-free and pass it onto their descendants).

- If you die after age 75, your beneficiaries have to pay income tax on withdrawals / income. However, there’s no ‘minimum income drawdown’ requirement. They can just leave they money in the pot if they don’t need it. (And can pass it on to their descendants tax-free, ad-infinitum).

- The LTA was a limit on the value of your pot of about £1m. You could have a bigger pension pot, but above £1m you had to pay 55% to withdraw the money – as opposed to 20%, 40%, or whatever your income tax rate was.

- The LTA was NOT a cap on total contributions, despite mainstream press reporting it as such.

- This 55% charge over the LTA limit also applied in all sorts of other situations. For example you dying, getting to 75, and so forth.

- Labour has already said it will re-introduce the LTA for everyone who isn’t a doctor, a judge, or presumably, an MP.

Here’s a ridiculously brief summary of Inheritance Tax (IHT):

- When you die, the value of your estate over the allowance of £325,000 is subject to IHT at 40%.

- If you give assets away and then live for seven years, there’s no IHT to pay on the gift.

- There’s no IHT between married couples.

- Reminder: pensions fall outside IHT.

- There are lots of other boring and complex rules I won’t go into. Read up and get professional advice as needed.

Sarah and Stephen

Let’s meet a hypothetical middle-class couple, Sarah and Stephen, both in their late 40s.

The couple live in a £2.5 million north London townhouse of which Sarah is immensely proud. They have two kids, Amelia and Jack, and a Labrador, Max.

Jack is 17 and still at public school (that is, a private school). Jack is smart, but he doesn’t work very hard, except at rugby, beer, and girls. Amelia is 19 and is nearly halfway through her first year ‘studying’ psychology at a mid-ranking university on the South Coast.

Stephen reckons they spent more than half a million quid on Amelia’s education, once you throw in the field trips to Norway (geography), and Italy (classics). But Amelia still didn’t do well in her A-levels. Worse, she suffered some fairly acute mental health problems during sixth form. She’s hopefully over that now, but nonetheless they do worry about her.

Stephen has had a few health problems himself and Sarah is into cycling – we’ll see how this is relevant in a minute.

Financially, they are doing okay. They both – conveniently for our maths – earn exactly £160,000 per year. Sarah is in marketing and Stephen works in the back office of a large global bank.

Their net (after-tax) household income is about £200,000. They still have a £800,000 mortgage outstanding on the house. Inconveniently, their super-low fixed-rate deal rolled off shortly after the ‘kamikaze’ Mini Budget and they’re now paying 5% on the loan.

Stephen and Sarah are great savers. They each have about £500,000 in their ISAs. Stephen has £900,000 in his SIPP, and Sarah has £700,000 in hers. (Sarah took a few years off work when they had Amelia and Jack).

Because of the LTA, they stopped contributing to their pensions a couple of years ago.

They have a few other assets, but most are fairly illiquid: a couple of private equity investments that Stephen made, some VCTs from when they still thought those were a good idea, and some ESOP shares in Stephen’s employer.

Now the LTA is abolished, they’d quite like to do what everyone else does and pay the slab of their income above £100,000 into their pension. That’s because the £60,000 above £100,000 is taxed at an effective marginal tax rate of about 50% (thanks to the withdrawal of the personal allowance).

Cash management

Our couple is clearly well-to-do, with masses of assets and great incomes even for London. They have options. However they have a bit of a cash-flow problem.

Let’s look at their budget. (I’m assuming Jack has turned 18 and with Amelia has a £20,000 annual ISA allowance).

Sarah and Stephen both feel strongly that they should fill up both their and the children’s annual ISA allowances. This may seem like an indulgence, but ISAs are use-it-or-lose it allowances and they have the cash to do so.

The couple worries that neither Amelia nor Jack will have the financial fortune they had. The political mood music for the treatment of income and assets outside of tax wrappers does not sound good, either.

(Unfortunately, the couple doesn’t read Monevator. They don’t know about this one weird ISA trick to preserve your allowance even if you don’t have the money.)

Stephen and Sarah acknowledge they could do better on the general expenses front. They swapped the bi-weekly hand delivery of fresh organic bread from the local artisan bakers for Waitrose. And a frank conversation was had about how much money was spent – and on what, exactly – when Stephen went for a weekend snowboarding with ‘the boys’ in Val-des-Aire. That’s one of three annual foreign holidays now substituted with a week at a friend’s holiday-let in Norfolk.

Still, it’s not plain sailing. Maintenance on the house seems to be a bottomless money pit, there are payments on the car that they only use at weekends, Max (the Labrador) is getting on a bit, and the vet’s bills are ridiculous.

Were interest rates lower, they might be tempted to borrow more on the house. But they’re not.

Indeed as things stand they are running a £40,000 deficit every year, when you take into account their ISA contribution ambitions. They can’t currently afford to make any pension contributions.

Enter Mike and Mary

Now let’s meet Sarah’s parents, Mike and Mary.

In their late 70s, Mike and Mary are classic wealthy boomers. They live in a mortgage-free multi-million pound pile in the Home Counties and have oodles of assets and cash. Their estate would be worth close to £7m if they died tomorrow.

In very good health, the couple can reasonably expect to live for more than seven years. (Mike’s dad only just died, aged 102).

But the family is still aware that there’s a looming inheritance tax problem, and now is the time to be planning.

However Mike and Mary don’t really consider the IHT their problem. They can’t really be bothered with any complicated arrangements.

Mike and Mary also feel, given the general state of the NHS and the possibility that they will need expensive care, that the £7m is money worth holding onto.

For that matter they can’t imagine, given Stephen works for a big bank in the City, why their daughter Sarah would need any help?

Sarah is a bit annoyed about this. In her opinion, the Brexit that mum and dad seemed to think, inexplicably, was such a grand idea, is causing half her problems. Brexit has them paying higher taxes. It also impacted Stephen’s promotion prospects at work. The bank has moved functions to Dublin.

(Naturally, they never discuss any of this at family get-togethers…)

Obvious inheritance options

Why don’t Mike and Mary just give some money to Sarah now, in the reasonable expectation that she’d pay for their care or medical bills if it came to it later? Even if it’s just for the younger couple to put in their ISAs?

If Mike and Mary live for seven years, that’s £40 of IHT saved for every £100 given.

Alas Mike and Mary worry about Sarah dying before them, leaving them in a sticky situation. And the grandchildren certainly can’t be relied upon to do the right thing. (Sarah’s mum has provided a running commentary on how they’re not being brought up properly their entire lives.)

They aren’t even entirely sure about Stephen.

Sadly, there’s a very good reason behind these worries. Sarah’s only sibling, James, died in a motorcycle accident in his late 20s. Untimely tragedy is not an abstract risk for this family.

A way out of the inheritance tax trap

Sarah’s family then are in a classic wealthy middle-class income tax / inheritance tax trap.

But all the chatter about the injustice of the LTA removal when it comes to inheritance tax has motivated Sarah to do a bit of digging.

And now she has a plan.

Sarah’s plan for Mike and Mary

Sarah thinks there’s an opportunity to reduce the IHT burden on her parents estate, boost the family’s wealth, and at the same time, actually increase her post-tax income.

A triple-whammy!

For now, Sarah’s not going to worry about Labour’s threat to bring the LTA back. (Besides, some kind of protection would probably need to be put in place to make any such move politically palatable.)

Let’s first consider what happens if Sarah doesn’t bother doing anything – and everyone just ignores the eventual IHT problem.

£100 in Mike and Mary’s estate would be taxed at 40%, becoming £60 in Sarah & Stephen’s hands. When they die it would get taxed at 40% again as part of their estate, and ultimately becomes £36 in Amelia and Jack’s hands.

Ahoy there, pension shenanigans

Enter Sarah’s alternative plan. She reckons it will enable her to restart contributing to her pension, reduce future inheritance tax, and, according to her sums, not leave the family out of pocket at all.

- She sets up a new SIPP, separate from her existing pension.

- Her mum and dad give her £48,000. (Unconditionally, without reservation, accompanied with a letter saying as such).

- She makes a £48,000 (net) contribution into the SIPP.

- She names her parents Mike and Mary as the beneficiaries of the SIPP.

- In the expression of wishes, she allocates the benefits to Mike (50%), Mary (50%), Stephen (0%), Amelia (0%) and Jack (0%) in the event of her death.

- She then instructs the pension trustees to allow Mike and Mary the option of forgoing the benefits in favour of other beneficiaries, if they wish. This covers the situation where they decide they don’t need the money when it comes to it.

Sarah has solved her parents’ biggest concern – that she dies before them. If Sarah gets left-hooked by a HGV cycling to work, they get their money back, tax-free. (Indeed with a 25% uplift, because it got grossed up in the pension).

Sarah knows she should be able to do this for three tax years (including this one) before the next election potentially changes the rules again.

The Annual Allowance goes up to £60,000 next tax year, and she has ‘carry-back’ available from previous years to use before the 5 April 2023.

Sarah runs the numbers. She’s got £60,000, grossed up, in her SIPP, and it has cost the family £30,000 directly. But they will also save the IHT on Mike and Mary’s estate.

So net of both income tax and inheritance tax this move cost them only £10,800!

Not bad. But there’s another benefit. The SIPP is outside Sarah’s estate as well.

The gift that keeps on giving

Ultimately, Sarah and Stephen’s estate will have an IHT problem, too.

In 30 years they are going to look very much like Mary and Mike (different politics, perhaps) and face the same challenges.

What if she included that latter IHT tax benefit of shrinking her estate via the pension move?

That’s another £11,520 saving.

Through this lens, getting £60,000 into the pension has come at a net cost of minus £720.

Sarah has created a £60,000 pot for the family, for basically nothing. That pot grows tax-free. Whereas Mike and Mary were paying income tax on the interest they earned on that cash they gave her, so another win.

Sarah ponders for a moment why she’s the one coming up with this stuff, given Stephen works in ‘banking’.

Actually, perhaps she can persuade mum and dad to do the same with Stephen, if she gives them Limited Power of Attorney to manage the investments in the separate SIPP she sets up for him?

This would double the annual pension pot gain for the couple to £120,000. With three tax years before Labour gets in, that’s £360,000 in the bag.

Best of all, every year, £36,000 of that is going to drop straight into their bank account after they’ve filed their tax returns. This is going to really help with the stretched household finances!

And for an extra kicker – if they can make these contributions as salary sacrifice they can reduce National Insurance (NI) as well.

They will save 2% employee NI, and their employers will save 13.8% employer NI.

Sarah works for a small, founder-run firm. It is perfectly happy to have her divert as much of her salary as she wants into her SIPP, and kick back half the saved employer NI in there as well.

That’s an extra £1,200 in her NI and £4,100 from her boss. Another £5,000, almost.

It’s the final countdown

Sarah’s aware she’ll need to be careful she doesn’t go over the Annual Allowance. (She can use her carry back to do this).

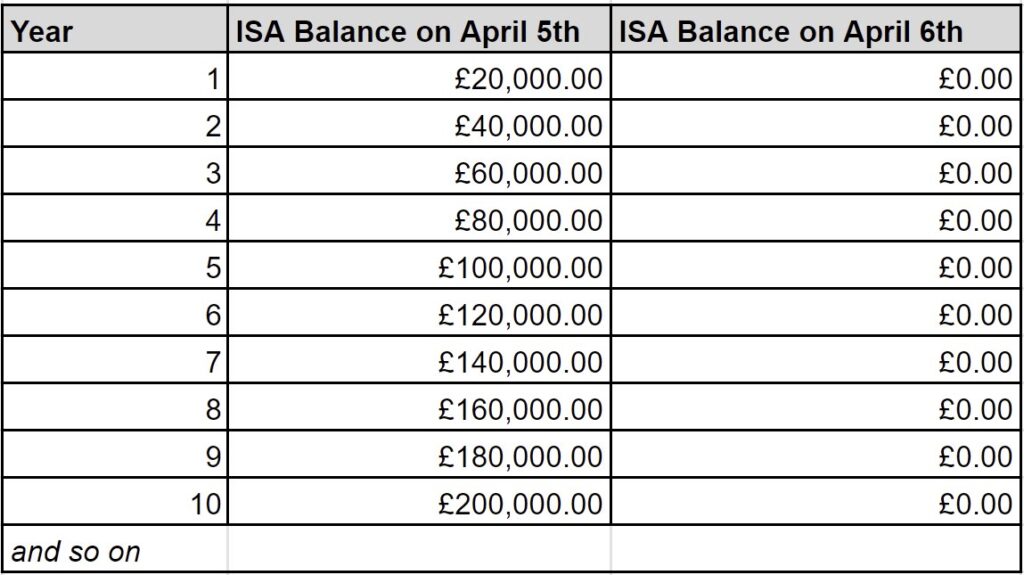

Her table is now completed as follows:

Alas Stephen’s employer is a lot less co-operative on the NI front. He can only use salary sacrifice to a maximum of 15% of his salary, only into the company sponsored scheme, and there’s no employer NI kickback. But he’ll still do the max – and then transfer the cash from the employer scheme into the specially segregated SIPP, which he’ll do once a year by submitting a partial transfer form. The rest he’ll do with a direct net contribution into the SIPP.

Sarah is feeling so pleased about this wheeze, she’s thinking of treating herself to a new handbag.

How will they get the money out of the pension?

As their daughter Amelia would say, spending the pension pot is a ‘future me’ problem.

The couple have no idea what marginal tax rate they or their beneficiaries will suffer on extracting funds from the SIPP. It very much depends on the circumstances under which they are doing it, and the rules at the time. Even their tax residency.

Their marginal tax rate could be anything from 0% to nearly 85% (the latter with the old LTA charge, inheritance tax, and income tax all compounded).

To Sarah, the manoeuvre still seems worth the risk, particularly as it’s not actually impacting her income at all.

Quite the reverse, it’s actually boosting it.

Back to the real world

In case you’re wondering, I’m neither Sarah nor Stephen. Yes there are some echos. But our situation is quite different to theirs.

We’re a lot more frugal for a start, and we don’t have a dog. (All that hair and barking!)

That the tax system is structured such that it incentivises this sort of thing seems to me nuts. All the same, I wish them the best of luck.

Quite a few people are asking me what I’m doing about my pension contributions – because I’m way over the (old) LTA.

You will not be surprised at all, if you’ve read any of my other stuff, that I’m setting my risk dial to 11.

I will max out pension contributions over the next three tax years and hope for a bull market. I’ll then hopefully take protection (if there is any) should the LTA be reintroduced.

My income is (un)fortunately below the annual allowance taper, and I have carry back I can use.

Mrs Finumus’s pension, on the other hand, is way below the old LTA. We were maxing out her contributions anyway.

The complexities of the LTA are such that I’d guess it’s not a slam dunk that Labour will just revert to the old regime (ex-doctors) once in power. Nor do I think it’s likely they bring pensions into peoples’ estates. Pensions are trusts, and this would require the overhaul of quite a bit of trust law. It’s more likely they remove the pre-75 tax-free status, which has the optics of achieving the same thing, but is a lot less effort.

Nonetheless I’ll be voting for them. I’m in a Conservative/Labour marginal constituency, so there’s literally no other choice for me.

I’m near the fag end of my career anyway. Is it too late to become a doctor?

If you enjoyed this, follow Finumus on Twitter or read his other articles for Monevator.

Great article Finumus. I am all for legal tax avoidance. Seems like a good plan for this fictional family. Personally I plan to give it all away to my kids 7+ years before I die and hope they and their families will be sensible (and not get divorced). If I do die within 7 years then it is someone else’s problem.

It’s an elegant solution. In the real world however (as an adviser) I have come across people like Mike and Mary, and they have a cash hoarding mentality. Getting them to part with cash is like getting blood out of a stone. And I don’t think their real problem is that their daughter will die too soon either. It goes deeper. They would rather die with their riches like Tutankhamun, than see their children enjoy while they are alive. (Boomers unfortunately)

I agree that Labour may decide not to bring LTA back ( as too complicated after two or three years without it.)

However I think they may well look very closely at the very generous tax treatment of pensions after death .

The IFS have highlighted all the issues with IHT, beneficiary pensions etc and Labour could use their findings as a blueprint for legislation, and quite rightly, as most can be described as tax loopholes that need closing.

A pension should be for retirement , not for avoiding IHT.

Impressive thinking and very clear. Problem for me is the pesky earned income problem. I can see how my mum putting in £60k into my SIPP is efficient for passing money to her grandkids, but I’m planning on using that now for shelter while working and then post work won’t have the earned income.

Labour may well not bring back LTA as it would be complicated.

However the abolishing of LTA, has put the spotlight more on the exemption of pensions from IHT. Especially as the respected IFS have been making a lot of noise recently about the over generous tax treatment of pensions after death.

So removing the LTA may well in the end prove to have negative consequences for many with large pots.

Brilliant post! (Vets bills only outdone by the pet insurance ‘scam’).

Could you explain the 18k tax return a little further please? (I must me a little tired today ;))

“Nonetheless I’ll be voting for them. I’m in a Conservative/Labour marginal constituency, so there’s literally no other choice for me.”

Did you mean “I won’t be voting for them”?

@Anonymous — As he’s a sensible Brexit-loather, I believe @Finumus has said exactly what he means.

@Anonymous – Yes, I’ll be voting Labour. Money is one thing, but the Tories have stripped me and my family of rights and are engaged in an all out culture war with people with my social values.

@Nearlyrich. Sure, I can explain Sarah’s £18k from the tax return. When you make a pension contribution, the govt ‘grosses-up’ the bit in the pension to 20% tax relief (which is a 25% uplift). £80 becomes £100. If you’re more than a basic rate tax payer, you claim the ‘rest’ of the tax relief on your tax return. Sarah’s marginal rate (on the bit £100k->£160k) is 50%. She makes a £48k pension contribution, which is £60k gross. So is grossed up to £60k in the SIPP. She now needs to get the ‘rest’ of her £30k tax relief back (£12k in the SIPP), the rest back on her tax return -> £18k. The £60k in her SIPP has cost her £48k – £18k = £30k. Which is what you’d expect as her tax rate on the £60k is 50%. OK?

Assuming Mike and Mary are already pensioners, can they make £10k contributions into their own SIPPs as well which potentially distributable outside IHT? Is there an age limit?

Typical middle class family making £300k+ per year.

@TI (#8):

Sorry but I must have missed Labour stating they will re-join the EU. I understand the sentiment you express, but …………. leopards, spots, etc, etc.

Looks likely to be a tough call IMO with no good options; how did we end up here?

I’m afraid I haven’t read the detail of the above, but it did occur to me that the ‘pension as IHT avoidance’ isn’t such a giveaway, given that if the beneficiaries want to spend the money they have to pay income tax on it (assuming the donor lives past 75). I have long supported tax on recipients rather than donors as the solution to IHT, after all. Just need to extend the principle to other assets…

“middle-class couple, Sarah and Stephen, both in their late 40s […] The couple live in a £2.5 million north London townhouse of which Sarah is immensely proud. […] Financially, they are doing okay. […] Their net (after-tax) household income is about £200,000”

The author reveals a lot about his own prejudices with labelling this a “typical middle class” family. Just ignoring the £2.5m house and the £7m grandparental estate a £200,000 after tax household income makes you a fully paid up member of the one per cent.

Source: https://ifs.org.uk/tools_and_resources/where_do_you_fit_in

@kewtips tax relief on pension contributions ends at 75. Also non earners can only contribute £3600 gross – that hasn’t changed for quite some time.

Thank you @vanguardfan and that makes sense. Even without the tax relief, it is still a way of avoiding IHT for those above the threshold but with the pensioner maintaining control of the asset? That might be attractive to some.

Point of information: Finumus managed to make £1m speculating on bitcoin IIRC. All power to him and longtime admirer but this is relevant context IMHO.

https://www.finumus.com/blog/thanks-a-million-bank-compliance-department-causes-1m-crypto-accident

@Mike N @Neverland — Except the author never wrote they are a “typical” middle class family (do a Search on the page…), though attacking straw men is not unusual for at least one regular commenter (unfortunately as ever, given he’s clearly got a lot of actual interesting insights to offer).

I’ve already discussed with @Finumus the fact that this couple is clearly in a privileged position, FWIW, and the article isn’t about whether this is right, wrong, moral, or otherwise.

As I’ve said before when this sort of thing comes up, it’s about *what’s possible* and what some people might be doing.

Investing in shares was once the preserve of privileged insiders. Perhaps some readers would prefer to shout down anything that offends their own sense of status and leave the 1% to discuss all this stuff among themselves?

I don’t.

I want anyone who is interested to know the tricks, and to understand the mindset.

The article is about how the pension system interacts with inheritance taxes, not about whether Marx was right.

@Badger101 – You don’t know how much I’ve lost in the meantime though, do you?

@Neverland – I don’t think I’m remotely trying to hide my prejudices, am I? I’m 100% with the @theinvestor on this – would you rather people didn’t know about this stuff?

I’m sorry, I’ve got nothing against you giving tax advice for the rich and wealthy, but I do think you should call it what it is, this family are not ‘middle’ class in any sense of the word. A house with £1.7m equity, 500k in ISAs, £1.6m in pensions, £320k income, both kids went through private school, grandparents worth £7m. That’s just not middle class! The title should be something like ‘Pensions, the LTA, and IHT: how a wealthy high income couple with rich relatives can bag £360,000 for free’.

@Wephway — Obviously I understand why you’d say that, but take the grandparents out and it’s not so clear cut IMHO.

I actually had the word “wealthy” before “middle-class” into the title in my edit of an earlier draft as you suggest — and sure, I think it could have stayed there — but it piqued my interest and I Googled around.

Things are really not so clear-cut with the good old British class system, and middle-class doesn’t mean “middle income” or anything like it.

They are not upper-class and they are not working class. By some definitions they are not even “upper middle-class” (because they are not from a prescribed tribe of professionals). They are clearly wealthy but they are, as best I can tell “wealthy middle-class“.

As an aside, as I was researching around, I discovered that at least 1 in 10 properties in London are now worth £1m or more, and 16% of households in London (8% in UK) have a household income of over £100,000.

The numbers in the article are far higher, but still I was a little surprised even by these numbers. Time and inflation rolls on. Don’t want to become an old pensioner who thinks £2 is an outrageous rip-off for a pint of milk in 2035… 😉

We sidestepped a Brexit thread but ended up in a Two Ronnies sketch!

Interesting thought experiment, and I always love these kinds of articles that take a concept and stretch it to the breaking point. As I’ve said before simplicity is best. Many have enriched themselves through unnecessary complexity both in the tax and pensions systems, it’s only fair that these things are made visible to plebs like me.

Would I use this wheeze when I’m back in the UK? Hell no, pensions are simply tax deferred income and that slope looks especially slippery right now. In 10 years how many raids will be made in the national interest on my now unfettered pension pot?

Interesting article, but perhaps the biggest takeaway for me is that it highlights the huge disparity between London and the rest of the country, even allowing that this couple are described as well off. Here in the north, my daughter – 2 degrees and 10 years as an OT for the local authority – has just breached the £34k barrier.

Relevant when you remember the policy decisions all emanate from London too.

I had a similar talk with my parents recently who were talking about whether it was possible to avoid or minimise IHT (nowhere near the sums above btw!). Hadn’t actually thought of using SIPP so very helpful but I referred back to @Philip Dragoumis thoughts and just advised them to enjoy their retirement and spend their money as both siblings and families are all set financially and will be fine (because I read Monevator) 😉

An absolute belter of a post. Eye-opening with the figures involved, and thought provoking in highlighting how those of us on PAYE still have options we can take advantage of, with serious financial benefits further down the line.

Coming from a solid working class background in the midlands, these posts are the only kind of window I have into how the other half live, and the lessons we can learn from them. Thank you Finumus!

@TI

It’s an interesting question, what are the boundaries of class in the UK, to me ‘upper’ class would signify some sort of generational wealth, which arguably the couple above do have but I appreciate it’s not black and white. I would say if this couple aren’t upper class then they’re definitely knocking on the door.

I suppose in London you could have a 2.5m townhouse and not feel all that rich. I think it’s worth bearing in mind though, you can literally buy a castle in other parts of the country for that money. And to me, a castle = upper class!

As a doctor reading this, I’ve got to wonder why the hell would you consider being a doctor?

This sort of financial planning/problem is rarely going to be faced by a doctor.

@TheInvestor, what were the definitions of middle class you found?

I live in the North and these figures are totally alien to me, so pardon my ignorance but why, when they both have £500,000 in ISA’s, do they have a mortgage of £800,000? Surely they would have paid that off before the rate rise?

Thanks for a really good eye opening article. The difference between ‘wealth/assets you dont actually need’ and ‘assets you are either using (house) or depending on for income or unseen future risk (care home)’ seems to be the main difference between truly wealthy people and just the well off. As soon as you can put the ‘assets you dont actually need’ beyond the immediate risk of tax hits, like IHT – then you have something which has the potential to endure across generations relatively unharmed. Trusts have been one way to do this, but its expensive and complicated and only worth doing if there is a serious lump to put there (and Dickens wrote books about the conflicts of interest that creates!) The approach outlined feels a bit like an ad-hoc intergenerational trust that leverages some tax benefits of pensions without the serious hassle of a real trust.

The challenge as others have pointed out, is determining what is the boundary between the two asset types, needed and not-needed which is very much in the eye of the assetholder -I manage one of my parent’s finances – I wouldn’t want to be involved in that decision – whenever I think about it something goes a bit funny inside.

Top marks for pre-empting the visceral reaction in the comments, and LOL that they still happened despite the meme.

£4.3M net worth on £320k household income mid-40s does seem a bit of a stretch though. We’re 43/38, both in IT in banking, no kids, relatively modest (£950k value, £350k mortgage) London flat.

Our household income is around £380k pre-tax, and we’re nowhere near that level of NW. Around £2.5M. Perhaps that’s the difference wealthy parents make. Both our families require our support rather than vice versa. Our inheritance is likely to be negative.

I felt compelled to comment if only to applaud the clarity and succinctness of the post. Easy to follow from the perspective of someone not in this hypothetical families league so to speak.

You, perhaps, could do with a reminder of the 50% effective marginal tax rate when stating the pension contribution cost them only £30k. It’s not a natural thought process to those unfamiliar with the withdrawal of the personal allowance.

I can’t quite decide if you used “middle class” instead of “high income” to agitate (I don’t mean this aggressively but thought you may have been having fun with this comments section!). I very much hope we’ll see an end to categorisations by class in my lifetime.

@johnny – use it or lose it. Where do they stash their post-tax incomes when the mortgage is paid off?

@Jonny #28

Likely average return on an equities ISA exceeds typical mortgage rates, especially if they were in a favourable position in a 5 year fix cycle.

Keeping it in the ISA keeps your options open – you can transfer ISA to mortgage at any time. Rather harder to go back the other way.

@Finimus

As ever I loved your article, and the way you articulate it. I just wish you could have wrote it 6 years ago 🙂 as my wife’s family just by living frugally (and clearing off to India and Middle East to run some infrastructure projects so had some tax free living whilst renting their stock broker belt house out before it was fashionable) have amassed a small fortune. Sadly her father has Vascular dementia which is obviously terminal, and they’ve not planned at all. I did explain at the time there is no point being the richest person in the graveyard, but sadly as comment #1 said they like to hoard their cash. I suspect it’s because they’re self made and were born in the war years when times were tough.

They do contribute to their grandkids JISA’s though 🙂 That’s another story – how do you educate a clueless 15 year old on not blowing the lot at age 18? That would be a good article to write 🙂

Thank You

@Philip Dragoumis

“Getting them to part with cash is like getting blood out of a stone. And I don’t think their real problem is that their daughter will die too soon either. It goes deeper. They would rather die with their riches like Tutankhamun, than see their children enjoy while they are alive. (Boomers unfortunately)”

Indeed this is all too often the reality and stumbling block for the kind of game that Finumus describes. Perhaps it is a generational thing but still puzzles me why wealthy people would rather be generous when dead than while they are alive – the latter can be more tax efficient plus you get the pleasure of seeing the fruits of your generosity which is impossible when you are six feet under!

@Wephway

Agree with you this is a very London-centric view of wealth. It is not so much the vast assets that this couple hold (although the latest ONS Wealth and Assets survey would put this couple well within the top 1% of richest UK households), but to have accumulated such sums by their late 40s would probably put them in the top 0.1% of their age group and implies colossal incomes from quite a young age. I understand the thought experiment but the numbers chosen are so far removed from even most Monevator readers’ experience this has something of the taste of a rich people’s problem.

Monevator is superb and I have learnt a huge amount from you guys and Finumus is a contributor who I really enjoy reading and have also learnt a huge amount from, thank you all.

The post is clearly well researched and written.

However… once I started seeing the figures involved I just switched off (which is disappointing as I look forward to any and all Monevator posts)

I have never cared about class titles, so scrub that, I am not remotely bothered about whatever class band you gave them.

For me its about being realistic and the relevancy (to me and the majority) – I don’t have stats and please correct me if I am wrong but IMHO the majority do not live in London or have a joint household income of £320k. But maybe the majority of Monevator readers do?, if that’s the case I’ll apologise and keep quiet.

The scenario set out is so far removed from my experience, I do know anyone who gets near to fitting their situation.

It would have be nice to see another couple added (call them their poorer cousins from the sticks) with a joint income of £60k – one is self employed tradesperson, the other in the public sector (take your pick). With boomer parents who are asset rich but cash poor i.e. big house no savings. What could they do?

TBF the post is about actions they are unlikely to ever be able to take, so that’s why they are not there.

I have sat on this comment for an hour before posting it as I am not comfortable about being critical of Monevator, but for some reason this post just hit a nerve.

No offense is meant to anyone involved.

Families, money, inter-generational transfers, power, control….what could possibly go wrong?

I personally think it’s more important to respect independence and autonomy in family relationships than to tie things up in knots for objectives that might not be shared or aligned between family members.

Love these Finumus wheezes.

I think they’re supposed to be a bit of fun rather than some serious class debate, but understand numbers can be ‘triggering’ to use the buzzword?

It is clear, but I still had to read a few times before the penny dropped. Thats probably more to do with my C19 riddled mind.

One thing I thought very interesting which I hadn’t clocked before hand is the fact that the rebate for lower rate income tax falls within the pension wrapper, but the rebate for higher rate income tax appears outside the pension wrapper. That little nugget in itself worth the article. Its not very consistent is it?

The other slight issue is that even gifting 48 or 96k a year isn’t going to touch the sides of the grandparents IHT problem at their age. The 48k is just so they get back what they put in in case of death of daughter right (with a little basic rate uplift), but really they should just gift far more and get on with it..

The JISA debate is unanswerable, i.e. tax efficiency vs danger of 18 yr old minds – but the pragmatic solution is if you see danger signs in the run up, you keep very quiet about their existence. Legal & ethical no, sensible, very much so..

@FI firefighter- that’s why I didn’t read it, I knew it would be an edge case with no relevance to me or most.

For me it’s getting into ‘knowing the cost of everything but the value of nothing’ territory. Like most IHT discussions it’s really about loss of control. I suppose death is the ultimate loss of control so I guess we shouldn’t be surprised that it evokes some strange responses.

What exactly is the grandparents IHT ‘problem’? They have tons of money, they just have to decide what to do with it. They should spend more time on that than on reducing tax. If they want to give it to their family, do that. If they don’t, give it to charity. They are trying to answer the wrong question (how can I get a bit more of what I already have too much of?)

I strongly disagree re JISAs. Illegal and unethical can never be sensible. Also, it doesn’t work. When your child becomes 18 you can no longer access the account. Obviously if the child doesn’t know about it then it will remain in limbo – I guess the provider would write to them and you repeatedly. But I’d suggest it’s not going to improve the child’s ability to handle money wisely.

Either do it and work through the consequences, or don’t. Whatever you choose you aren’t going to be able to control your adult children’s financial decisions.

Also, would I be right in saying that if they went down the salary sacrifice route, i.e. paying into SIPP direct from gross pay, they wouldn’t see that 36k kick back into their spending money? That only happens because of the wrinkle in claiming back higher rate tax for pension contributions via your tax return as mentioned in my prev comment?

Really enjoying the discussion of how privileged Sarah and Stephen are, the story is told form their perspective – I make no judgment on the matter.

In their defense though – look at their environment. At Stephen’s work, in the front office – graduates a couple of years in are making the same money as him, and some of their bosses, his age, are making £1m+. Someone Stephen joined the graduate program with, 25 odd years ago, is a partner at Goldman. Sarah’s boss draws about £500k of dividends every year (it’s all on Companies House). Some of their cohort form Durham (where they met) have already retired, in one case, to the south of France. Another donated £10m to their college, only 13 years after graduating, having sold his start-up. Their immediate neighbor is a partner at Deloitte, and probably pulls in £600k in a good year.

These are the people they compare themselves to.

Yes, the vast majority of people in the UK are much worse off than Sarah and Stephen, but they don’t know any of those people, so

Just as people in on minimum wage in the north of England, with working class parents that have no assets – are vastly better off than then most people on earth – rural peasants in India, for example. Does that make them feel any better, when they read this and see how entitled Sarah and Stephen are? I doubt it.

Sorry, last and final comment, is Val-des-Aire a typo or a joke that has gone over

my head?

@rhino higher rate relief only needs to be claimed back if it’s contributions into a personal pension, or a workplace pension which uses ‘relief at source’ (where contributions are made from taxed income).

Workplace pensions using salary sacrifice or net pay methods of contribution mean that all tax relief is applied up front. Similarly if employers contributions from a contractors limited company.

very interesting article as ever. hadn’t quite thought of it like that.

I guess the obvious downsides are (a) negative changes to the pension rules (b) you can’t get the money back if you need it albeit in the scenario in question the parents don’t appear to need it.

What are the other downsides that I’m missing here though?

Vanguard also highlights some family issues so you really do need to make sure it is truly a gift without reservation 🙂

The tapering rules will limit the ability of some people to do this but I agree that if you are in a position to contribute the full 60k even if you are converting assets then go for it.

I had also picked up the sic on val and wondered if it was a typo or not :).

For some select families they’ll be able to contribute just shy of £178k into tax free wrappers next year. £60k x 2 pension, £20k x2 ISA, £9k x2 JISA. Boom Boom.

Found it amusing to read how this triggered people – Kensington pays more income tax than Northern Ireland now as per the ES article yesterday. Get over it – rest of the UK has been left far behind due to decades of economic mismanagement and in many places now looks poorer than eastern european countries- just remember you get the the politicians you deserve in developed economies. That’s the simple reason in the disparity of earnings. Just imagine where these places would be without Kensington….

@all — I am deleting @neverland’s relentless trolling on this thread now as I’m bored of it. For the sake of newcomers, this individual poster has written several hundred comments on this blog, which he inexplicably continues to read despite, conservatively, 90%+ of those comments being whatever negative thing he can find. (The worse / most relentless I deleted.)

Like all good trolls he shapeshifts and says tangentially reasonably things (albeit often strawmen) to maintain plausible deniability / credibility.

Those who who find this deletion draconian despite that track record are welcome to go and read @Neverland’s own blog where he regular puts his neck on the line by giving his own (infallibly correct and always reasonable from every angle) perspective on a wide range of issues, and invites sensible discussion, feedback, and comment there.

Oh wait, you can’t.

p.s. Of course we can reasonably say this couple are in the top 1% and are wealthy. I don’t think anyone has claimed otherwise. Again, for me, knowledge is power, and there are lessons here that many — though certainly not all, or anything like it — can learn from. If you can find a more socially and to some extent economically liberal (in the US) sense financial and investing blog than Monevator than please do go and read it if it’s more to your taste because from what I’ve seen (and what we discovered after Brexit) the vast majority are the bastion of all-tax-is-theft extremists, or worse. Cheers!

I enjoyed the article as I said in my earlier comment, but the comments have led me down a middle class rabbit hole – “are Sarah and Stephen middle class and am I middle class?”

Having a university degree and being a Chartered Accountant, I am definitely middle class according to the internet. No surprise there.

Upper class is generally viewed as hereditary landowners and other uber wealthy folk. Sarah and Stephen have middle class jobs and are wealthy, but they are definitely middle class according to what I have read.

It just confirms (to me at least) that Britain has a lot of hang ups about money.

@Jonny — I can’t speak for Stephen and Sarah (and nor can they!) but I run a mortgage that I could pay off with ISA investments, but don’t. This was a no-brainer (for me, with my proclivities) when rates were very low. I agree it’s a much harder call now, and if ISA’s weren’t a use-it-or-lose it shelter I probably would pay off more of the mortgage.

I’m gambling (for want of a less provocative word) that over the long-term a combination of higher returns AND CRUCIALLY having a large amount of assets outside of the tax system will make it worth the extra risk versus paying down the mortgage today.

@Faustus #33

> Perhaps it is a generational thing but still puzzles me why wealthy people would rather be generous when dead than while they are alive – the latter can be more tax efficient plus you get the pleasure of seeing the fruits of your generosity which is impossible when you are six feet under!

^ +1 on that. I don’t have kids, but it surprises me how little wealthy folk seem to trust their kids to use their wealth right. Either they have the rags to riches to clogs in three generations writ large, or they missed something in the handbook of being a good parent 😉

Either way, fixing some of the problems for the people you love and/or the situations you feel strongly about are some of the best bangs for the buck you can get out of your investment gains/hard earned. And look on the upside, if you get to enjoy watching that for seven years then you get the buzz for a tenth of your three score years and ten and there’s no IHT on it either 😉 JFDI.

Entertaining yarn, but yeah, I took a double take to middle class in the title after getting through the intro, WTF? Even in firevlondon’s taxonomy of London salaries and rescaling these guys down to £130k to account for inflation since then qualified by the Bank of England inflation calculator, they’re above the globalising elite and closer to the one percenters. Either that or I have an unrealistic understanding of the term middle class in British English 😉

@SF (#44):

Re: “For some select families …”

And you could add to that two times three years of pensions carry forward (@£40k per person per year) if they have been sitting out at least the last three years due to, say, LTA concerns.

I’m curious if anyone has any holes to pick in the actual meat/point of the post, rather than their personal view on what particular demographic we should be targeting or discussing with each and every post on Monevator? 😉

Have to admit I thought there’d be at least a couple of articulate criticisms of the strategy or unforeseen snags. (Or maybe “hoped there’d be”, given my notorious antipathy towards IHT avoidance… 🙂 )

As for the middle-class question, as @Kerry has kindly pointed out from his research — and as I found in my edit — middle-class does not mean, at least historically, “doing pretty well for themselves but not loaded”. It has deeper class/family/professional and social hierarchy implications.

I’m not endorsing any of that, which could well be seen as some snobbish vestige that was tackled way back in the 1960s, including famously by this sketch…

https://www.youtube.com/watch?v=UDIHrX-Jp2E

We’ve clearly come a long way since then, but I don’t think we’re (superficially) the US where money maps on to social status (which, of course, it doesn’t, with old Bostonian money, Irish roots, Ivy League schools, where you ski, and all the rest of it.)

There’s an interesting post on ‘status games’ in Weekend Reading coming up tomorrow, incidentally.

Don’t quite understand the flood of comments around the suitability of the posts examples. I think its healthy that a certain proportion of the articles aren’t directly related to people in my income bracket with NW equivalent to my own. How else would we expect to stretch our thinking and take lessons from those taking smarter approaches? Innovation surely stems from adaptation of idea’s rather than invention of them?

@The Investor

The article is sufficiently well researched, detailed & comprehensive that no criticisms are possible.

The only thing left to discuss is our collective longing to be as fortunate as this (semi-)ficticious couple 🙂

I thought my comment, about the issues of power and control and family relationships, was substantive, but you may disagree. I don’t dispute the technical details but the premise that this is a financial problem with a technical solution.

Or rather ‘to which this is an appropriate technical solution’.

I agree with ermine that it’s kind of weird how folk are desperate to save inheritance tax (that they won’t even be alive to pay) but yet have an aversion to simply giving the money to their family.

@Vanguardfan — Yes, fair. I should have written “a few *more* articulate criticisms of the strategy…” Thanks for your thoughts!

I guess this situation only applies to quite a small number of people, but some of the components are more widely applicable. I was interested in two components. (1) Sarah gets a gift from her parents and then invests that in a SIPP. She then claims money back in her tax return to get to her marginal rate of income tax. That’s an interesting idea for anyone with cash lying around outside of their normal income. You don’t need to involve your employer (unless you want to get some of the employer’s NI back in which case salary sacrifice and the fungibility of money is the way to go). (2) Is the LTA charge always 55% if you are over the limit? I thought you pay 25% on crystallisation and then normal income tax when you drawdown (and don’t take a PCLS). So if you drawdown £50,270 then the income tax is £7,540 or 15%. So that’s 40% overall not 55%. I am happy to be corrected!

Building on Vanguardfan’s comment about ‘what could possibly go wrong’ –

With any loophole or wheeze, I wonder how many families would get into difficulty because they rely heavily on one family member for most of their finance knowledge. I guess there might be some families out there where everyone is a finance/tax nerd and things like this, or much more moderate versions, would work. Or maybe they trust the family financial advisor 100%. But surely most families need to keep things simple, so the attempt to be clever doesn’t come back to bite them when one individual is no longer around.

Good comments by faustus and ermine too – they remind me of the recent ‘die with zero’ podcast TA/TI linked us to. I was a bit wary of some of the ‘self help’ vibes it gave off but have to admit the key points rang true (decide what really matters to you; use your funds for that sooner rather than later).

The article is, of course, hilarious.

One of the “boring” IHT rules which Finumus doesn’t go into is “gifts out of surplus income”. If Mike and Mary turned part of their £7m capital into an income generating asset then they could pass all of the income onto Stephen and Sarah tax free (after paying any income tax on it themselves of course). They could continue to do this on an ongoing basis for as long as they wished. As they would own the assets themselves, it avoids the risks around Sarah dying before them or that they need more capital than they expected in old age.

That might be a simpler option than an elaborate tax avoidance scheme that involves setting up new pensions with variable beneficiaries.

@Investor A question I’ve had for a while is _why_ are pensions outside the estate for IHT? Someone alluded to it briefly earlier, mentioning that they’re trusts, and unwinding that would be complex, but I’d find it interesting to try and unpick why anyone thought it was a good idea to design them like that in the first place.

As with others my only objection to the article was the use of middle class. Personally I include what I guess some folks would consider nouveau riche in the upper class, which would arguably include this couple/family…

@FireIT- pensions were always outside IHT because that’s the rule for trusts.

Before 2015 there was a 55% tax on lump sum death benefits. Plus hardly anyone was in drawdown so most pensions in payment would have been annuities anyway. With the 2015 reforms the lump sum tax was abolished. It’s worth remembering though that if beneficiaries choose to take an inherited pension as a lump sum, they will likely be paying 40% tax on most of it. So the saving with respect to IHT is only if the donor dies before 75 or the pension is taken as income via drawdown.

(One important point that everyone should check, is that not all DC pensions allow beneficiary drawdown)

Creative article with some interesting points to consider, the figures highly accentuate the possible and stimulate thought in a way smaller ones might be easily dismissed

Personal finance is obviously personal and we dont know what has formed peoples money foundations nor how this impacts their actions, I rarely appreciate my own.

I am fortunate i can discuss finance with my “kids” 27 & 28, (i try to be an open book including my many mistakes). I pass on Monevator gleaned wisdom – assume this is a key point of the site – improve knowledge then share, with caveats and due credit to the originating team!

Family, friends and colleagues benefit…. it is extremely shocking how little financial knowledge most people have, how infrequently considered let alone openly discussed.

Financial assistance i have given my kids is appreciated and respected (i think) as they have seen how hard i have worked to generate as income. They have (Passive) LISA’s, ISA’s, Pensions, cash savings with Raisin and low / no credit card debt.

Thanks @investor and @accumulator !

I had considered JISA’s if/when Grand kids come along and have covered the additional pension contribution to max out employers as initially this isnt a consideration for a newly employed young thing but i hadnt thought about SIPP contributions for the offspring, one is higher rate taxpayer but only just, the other not yet – so thank you for that nugget. Nudge works for me, tell them, show them, see it steadily grow = realisation and hopefully adoption.

Not this thread sorry but LTA was an issue for me, i was stopping work in a week but Jeremy’s “remain in work budget” has me doing another year maybe two (i’m 57), salary sacrificing 50% into the companies DC and stuffing anything else i can into my SIPP. Plenty of allowance room as last year was minimal due to LTA, I hit the LTA due to significant saving into the SIPP over the last 9 years. i also had a pension freedom eventually completed when yields were really low. IFA’s wouldnt initially let me freedom because i had a SIPP and they said would likely manage the pension myself (sort of true but i lied) its actually in the same place as my work DC but more diversified than the default lifestyle which would have crucified me with rising rates

I guess my point for mentioning LTA is that the income at 57 isnt “rich” on £1M with a SWR although the life it affords me will hopefully be.

Dynastic wealth accrued through pension passing will be stopped if it gets too juicy a prize for any future government and the really rich will avoid it anyway. Funny how the rich or really rich is always someone else. Finally isnt the pot invested so generating taxes and returns rather than wasted by whichever government. My hope is that it is going to be diluted away by multiple offspring so is moot

i do get finance / wealth is relative.

@The Investor, well, I though the middle class part was a joke. Since apparently it was not, it’s just ridiculous. There absolutely nothing middle class about this family.

This has strong vibes of that tech lady on Twitter (whose company makes a $600/month Google Calendar) that said after the SVB bankruptcy that her husband worked in “manufacturing”. Said husband was a former McKinsey guy now in upper management of a manufacturing company.

I remember when we on this website made fun of that guy on the last (2nd to last?) election that thought his £80k was below average as being out of touch with reality…

While I’m not likely to trouble the income bracket of this couple (except for once very briefly around a decade ago, I managed to match one half of the couple), I agree they are middle class Londoners. Almost certainly, they don’t feel wealthy due to the circles they move in/high living costs. I always love reading about Finnimus’ wheezes, escapades and tales of how the 1+% think about wealth/tax management – in the same way, I would be about a polar adventurer ie not a life for me, but still interesting nevertheless.

Finimus, thanks, it was the 50% marginal rate that threw me.

As stated at @Vanguardfan, not all pension schemes allow for a drawdown option on death from both uncrystallised and crystallised funds. Also, from what I can gather, under the proposed changes going forward, a lump sum death benefit paid from uncrystallised funds before age 75 will be subject to tax at the beneficiary’s marginal rate if it exceeds the LTA (or whatever that limit will be called in future), so it won’t all necessarily be tax free? Happy to be corrected if I have misunderstood that!

Great article, thank you @Finumus. Your work here is a thing of beauty.

I’m sure the IFS would welcome you with open arms in the unlikely event you’d run counter to my recommendation and consider such a thing.

As for all the “middle class” digs here in the comments, I can only say:

“Don’t hate the player, hate the game.”

But I do wonder what HMRC’s GAAR lot would make of all this (in the unlikely event they got a sniff, somewhat conspiratorial as it is)?

It is fascinating to read about the how the very wealthy (by all normal standards) can exploit the tax system. And it makes one ask questions about why the opportunities for exploitation exist. Just as the different effects of the LTA on DB and DC pensions made one question the LTA itself (thank you Jeremy Hunt for addressing that) so the ability to bequeath drawdown pensions without paying IHT, but not other forms of savings or indeed DB pensions or annuities, makes one question why. I see that a SIPP may technically be a form of trust, but it would surely be possible to say that to qualify as a SIPP the trust can only extend benefit to a surviving spouse in the same way as other pensions.

The story also throws up the important issue of human nature. Financial plans have to be psychologically acceptable. Despite it being overwhelmingly the sensible thing to do, older people are reluctant to pass on wealth despite the fact they are doing nothing with it. I faced this with my mother, any realistic estimate of her personal financial needs after my father died when she was 84 meant she had excess savings at a point when her children had young families and would have had a big benefit from gifts – but psychologically she was unable to do that. I suspect that despite Sarah’s brilliant wheeze she will have a hard job persuading Mike and Mary to carry out her ideas.

And the discussion has brought up fascinating ideas about social classes. I spent a couple of years working in the States, and despite what everyone says I found it much more class-ridden than the UK. Within a couple of minutes of meeting anyone they were quizzing you to work out the relative social standing. It was clearer than here, the biggest determinant was clearly income or other wealth, but there was the social element too – my boss (likely well remunerated) once admitted that he was always outclassed by his wife who could trace her ancestry to Mayflower passengers.

In the UK the traditional designations of working class, middle class and upper class are clearly no longer fit for purpose. The traditional working class is very much smaller now, as is the upper class (limited to aristocracy and generational landowners) leaving middle class too broad a designation to be useful. But as a rule of thumb, upper middle class can be used to describe those who went to private school or sent their children to private school, lower middle class probably means those skilled workers who didn’t receive higher education but whose training makes them valued and reasonably paid. In between you could say there is a professional middle class of those with a university level professional qualification which can range from nurses and teachers to doctors and lawyers, and a technical middle class who have reached their valued and remunerated status from both university education and developing expertise through experience in things like IT and management.

(Lights blue touchpaper and retires immediately).

I love it. Excellently written personal finance pornography. Thanks Finimus.

I was nearly comment #1 but got sucked down a rabbit hole link of maximising the isa allowance (that I somehow missed before).

I got to enjoy the comments section just now as a brucey bonus.

As a slight deviation from the other comments, I felt a tinge of sorrow for Sarah and Stephen because of their priorities around maximising the stash and not passing on their badass financial skills directly to their kids.

I thoroughly enjoyed a peak into a different priveleged life perspective!

@TI I know this is your site but it looks to me that you seem to take things personally / emotionally and feel obliged to react defensively. This might be how you get your kicks but in case it’s not… Lots of virtual hugs from me with reassurance that Monevator is 100% spectacular.

@slg — I think my last comment was a bit histrionic, yes. So I’ve deleted it. Cheers for the generous words, have a great weekend!

@TI unless you’re deleting reams of abusive comments, I think you should congratulate yourself on the quality, maturity, and politeness of the debate you curate – in stark contrast to most online forums.

It’s hardly surprising that fairness should feature strongly in the comments. Hitherto, most people in this country have received at least some benefit from a slowly expanding pot. Now, for the first time, they find themselves arguing over who gets what share of a rapidly shrinking cake. For many the anger is visceral. But there are many far worse off than us, and we should, perhaps, take a moment to reflect on that.

@ finimus There’s a small typo. Typo as i think you mean ‘kamikWaze’. I don’t think it’s relevant to your example but readers should be aware that the tax free lump sum is still limited to £268,275. This means that once your pension is valid at more than 4 times this £1,073,000 give or take the tax break on pension contributions is more limited particularly in a scenario where Labour are likely to reintroduce the LTA (and who says they’ll allow protection?)

Still waiting to come to the bit where we find out why Sarah’s love of cycling is relevant? Did I miss it?

Oh, I seeee! She’s going to die cycling in London rather than live longer because of the health benefit obtained anywhere else! I get it. Yes, a very London centric article. 🙂

While the care system remains self-funding for all those with more than minimal levels of income or investments, I believe it is entirely understandable that the elderly (which at age 69 I should probably include myself) should want to hold on to their wealth rather than pass it on in their lifetime. Only on death can one be really sure that it will no longer be needed. Okay, perhaps £7M is easily more than enough to cover any possible future needs, but where do you draw the line?

I would also like to say as well that I really appreciate Monevator and it has really helped me in my financial journey, please keep it going!

It was just the use of the term ‘middle class’ that I found incongruous.

@Finumus, I think you need to stop hanging out with rich people and make some poor friends! Then you’ll feel much better. Seriously though, there is always someone richer out there, someone with a bigger yacht. By your argument 90% of the kids at Eton must be middle class because of the richer kids they hang out with. If you continue to move in ever richer circles then you’ll always feel middle class, even when you have £10m, £20m, £50m. I appreciate the goalposts are always moving with inflation but I do think if you are in the top 1% for both income and wealth then you’re not really ‘middle class’ anymore. Nothing wrong with that I should add, I hope to be in the same position myself eventually.

Regards the actual article, it does seem like a bit of a loophole to me that probably needs closing down. Being able to put gifted money into a SIPP and then claim tax relief seems very Jimmy Carr-esque to me, that is, technically legal but probably not moral.

We all want to organise our tax affairs to minimise what we pay but surely there must come a point where you think actually maybe it’s not a bad thing if I put a bit more in, it’s going towards schools, hospitals etc after all. (Veering dangerously towards politics here sorry.)

I thought the whole point of pension tax relief was to encourage people to save for their retirement so the state doesn’t have to do it for them. So to me some kind of LTA makes sense, because once you reach that point the state doesn’t need to encourage you anymore to save. Again probably an argument for a different thread.

Personally I don’t think I’ll be asking my parents to consider gifting me money to avoid IHT, just seems a little cheeky, I’m not even sure how that conversation would go. ‘Hey by the way, you know you’re probably going to die soon, could you possibly give me your spare cash now so I can claim some tax back on it? Think of the grandkids! Oh and if you want it back you can’t have it because it’ll be locked up in my pension. But make sure you live for 7 years at least. What about my siblings? Don’t worry about them they dont make as much money as I do so wouldn’t benefit from it. Is this all above board? Yes of course it is, trust me…’

Great stuff.

It has some useful points to consider even for an individual high earner whether in a couple of not.

The new rules mean you can get up to 60k AA into a SIPP AND the appropriate reduction in a , probably large, tax bill by claiming back the higher rate rebate through self assessment….I think….. I’m a pensions amateur.

I think there’s good learning from this article in many lateral ways…. need to give it some more thought

A minor point is that if you want to pass on a perpetual FIRE fund (pension) that you have already inherited it has to be in flexi-access-drawdown when your die. Not sure what happens if it isn’t. But the implication is put it into drawdown as soon as you get it. Even if you never actually withdraw anything. https://www.gov.uk/tax-on-pension-death-benefits

My understanding is that generally speaking, you can get three choices as a chosen beneficiary under a DC scheme – (flexi-access) drawdown, lump sum or annuity. So if you choose flexi-access drawdown you can take funds out any time or leave all or some in there till death, and again the cycle can continue. BUT all of the above only applies provided the scheme and product caters for this (both uncrystallised and crystallised funds, the former especially if the person doing the planning is under minimum pension age so means they could die with only uncrystallised funds). Not all do. So seems to me whats vital in any long term planning is to ensure the scheme can actually do what you want it to do. That might mean the person doing the planning transferring to a scheme that does, while they can. I think it stresses the importance of getting the right advice may be, as its a complicated area, and Id say especially when it comes to IHT which is a complete minefield.

Thanks, A very interesting proposal. Not applicable at present, but may be at some point.

Unfortunately though I think the days of pensions being passed on free of IHT are likely to be numbered. I have often thought that a glaring hole in the LTA system is/was the lack of an LTA on death for crystallised funds. I don’t know what a future Labour or otherwise government will do, but a simple 40% charge on the pension fund at death would be much simpler than reintroducing the LTA.

Possibly with spouse/dependent relief and/or perhaps a charge free allowance if we are lucky.

@Barn Owl I can’t see that anyone has replied to your questions on LTA tax, but there are lots of answers here so I’m sorry if someone already has! There are currently (until the 5th of April!) two LTA tax charges when any excess above the LTA (standard £1,073,100 or personal if protected) is crystallised of either 25% or 55%. The 25% tax charge is if the funds are designated as income, i.e. purchase a lifetime annuity or leave in a drawdown pot to draw later. The 55% tax charge is if the funds are drawn out in one go as a lump sum. Hope that helps.

Side note – from the 6th of April LTA excess will still be taxed, but at 0%, and actually removed from next April. I assume because of providers not being able to change their computer systems fast enough between Budget day and the new tax year!

Isn’t the problem simply that these gifts may become liable for IHT or to pay for care and are now locked in to a SIPP? In the event that Mary loses or spends too much of her savings, presumably Sarah will have to stump up, which could be tricky given its in the SIPP and the tax rebates are spent?

The financials aside (but not really, given the intertwined nature of money in all aspects of life). Sarah is an absolutely entitled parasite and I don’t blame Mike and Mary for being concerned. The “Bank of Mum and Dad?” Never used it because I have something Sarah doesn’t: self-respect. What a disgrace!

@TI – My first time on here, but I already have a couple of thoughts/questions.

1) I think you are doing Sarah out of some tax relief unless my sums have always been wrong. For her to make a 48K contribution after tax, even at 40% she’d need to have earned 80K (i.e. 32K more) so her claim should get her another 20K back. As you say, in comment 9, if her marginal rate is more like 50% then that’s even more….and I couldn’t even start to calculate across all those tax bands!

Have I been doing it wrong all these years? 🙂

2) For those with smaller aspirations than your couple, here’s another moral dilemma, using the new MPAA.

Assuming my reading of “earned income” is correct, once you’ve decided to break into your DC pension you could withdraw £16,760 which nicely has £12570 as the 75% taxable element, giving you the whole sum tax free.

Paying 10K back into the SIPP gets topped up to £12500, leaving you with £6760 in hand for a real withdrawal of $4,160.

Obviously you could have done something smaller before with the old 4K limit and it’s what the government worked against with the lower limit, but £2,600 feels like a nice addition.

Martin

@Martin Percival – Thanks for your comment. You’ve now got me confused, but (having re-done it), I think I’m right. Here goes.

She’s making a £60k GROSS contribution into her SIPP. She does this by contributing a NET contribution of £48k (60k * 0.8), which is “Grossed-Up” to £60k (£48k / 0.8) in the SIPP. Now (assuming for simplicity, she paid a 50% tax rate on that (gross) 60k, she needs to get the ‘other’ 30% (OF 60k) back on her tax return. How much is that? 0.3*60 = 18k. She received £30k in her (net) pay, paid £48k into her SIPP, got £18k back on her tax return. The cash cost to her is £30k (+30-48+18). The amount in the SIPP is £60k. This is exactly what you’d expect, her tax rate on the £60k is 50%. It ‘cost’ her £30k of post tax money to get a SIPP worth £60k.

I think my maths is right. Happy to be corrected though.

I think I’ve finally got where your numbers are from. I think the problem comes in assuming that the “30%” is from the same 60K that has finally arrived in the SIPP.

In reality, to get a NET inbound of 48K you would need to earn 96K (no allowing for crossing tax bands) say, at 50% tax.

In the initial instance you get topped up to 60K GROSS in the SIPP as the provider just assumes you are a 20% tax payer, so they work it out as 25% of your input (ie 12K). When you go cap-in-hand back to HMRC, and they work it out on your real rate, they would actually owe you another 36K out of your 48K taxed.

It’s more about who is viewing your payment and how much they “assume” you earned to pay that original 48K in.

I think 🙂

Martin

The worried Mike and Mary should consider whether Stephen and Sarah could change the nomination on their SIPP the very next day without their knowledge…. or at any point in the future…..?

Something for those at the other end of the economic spectrum; I only learned this yesterday.

If your only income is the State Pension, you can add up to £2880 to a SIPP, wait for the tax top up, take out up to £3600.

This has got me thinking, as someone fortunate enough to be subject to tapered annual allowance.

Is it worth paying into my pension above my AA and paying the tax charge, in order to be sheltered from CGT and IHT? Rather than putting same post tax income into a general investment account?

Interesting reading, as someone who will never earn the sums in the example and coming from a working class family. It was interesting to see how you can manipulate the tax system to benefit now and in the future.

As per others, the English class system is based on family and profession. So upper class was royalty and titled families, middle was professions, such as medical, finance, legal and clergy. It also included factory owners/ business employers. The working class was manual (physical) professions and unskilled. It was not directly linked to wealth. There may have been more of a link 100yrs ago but the access to financial info has opened it up to more.

You can have a bankrupt Lord(upper class) as well as a millionaire plumber(working class). The latter being something that can occur more readily today.

The better your financial position, the more access to financial management and tools to aide in reducing tax and improving growth. I will just potter along and give up work when I feel I have ‘enough’… don’t get trapped in the ‘one more year’ syndrome. It will not be the sums quoted here but hopefully I can be happy with the net worth I can achieve.

Another great article Finumus. You and your crystal clear and original thought process are the gifts that keep on giving. Keep up the good work!

Great analysis! A few questions spring to mind:

Is it possible to carry over allowances from the last 3 years even if I had Fixed Protection in place for my LTA?

Can one withdraw 25% and pass on the rest to descendants or is accessing the pension preventing the remainder to be passed on?