With my brain struggling to admit that it’s 2026, now seems like an ideal time to dive back under the duvet of 2025. (Still warm from the glow of double-digit equity returns or the world being on fire – I’m not sure which!)

Somehow it never appears to be a good time to invest. And yet Monevator’s Slow & Steady model portfolio earned 9.4% in 2025.

That’s the third year in a row the portfolio has advanced more than 9%. Not bad for a 60/40 portfolio run with a passive investing strategy.

Overall, our model portfolio has notched up a 7.3% annualised return over 15 years from the start of 2011 to the end of 2025:

The Slow & Steady is Monevator’s model passive investing portfolio. It was set up at the start of 2011 with £3,000. An extra £1,360 is invested every quarter into a diversified set of index funds, tilted towards equities. You can read the origin story and find all the previous passive portfolio posts in the Monevator vaults. Last quarter’s instalment can be found here.

All returns in this post are nominal GBP total returns unless otherwise stated. Subtract about 3% from the portfolio’s annualised performance figure to estimate the real return after inflation.

The journey so far

The last 15 years has proved to be a benign era for investing. The portfolio has only suffered one major setback – the bond crash of 2022:

Inflation is UK CPI. Data from the ONS.

Squint at this chart and you’ll notice the inflation-adjusted return line (light green) has yet to recover the heights it reached in December 2021. The portfolio is still down in real terms.

Nominal returns are deceptive!

Many happy annual returns

The divergence between nominal and real returns is clearer still when we look at annual results:

2025 inflation is an estimate based on November’s CPI annual rate.

2022 was a bear market retrenchment for our model portfolio in real terms. 2023’s annual return was cut in half by inflation too, and 2025’s return reduced by a third.

Nominal returns may leave you feeling warm and fuzzy. But remember it’s real returns that will ultimately pay your electricity bills.

Anyway that’s the negative take. More positively, the same chart shows we’ve only seen three down years out of 15, and only one otherwise sub-average year – the forgettable 2015.

Apart from those damp squibs, the S&S’s returns reflect a mostly exceptional period for investors.

Asset class annual returns

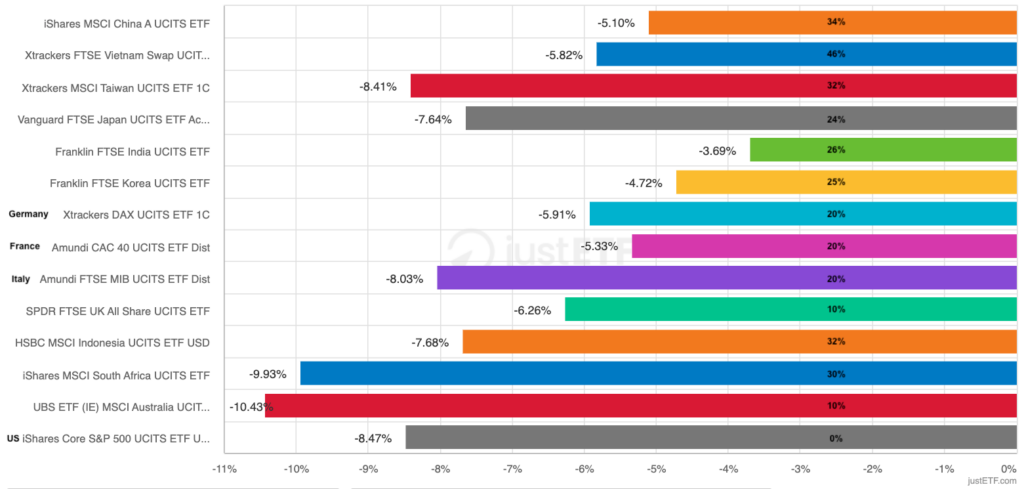

Here’s how the portfolio’s component funds fared in 2025:

Any fund return lower than the black CPI bar is negative after inflation.

For once, UK equities were the star of the show! In an event as rare as a Brit winning Wimbledon, the unloved FTSE All-Share did us home investors proud.

If you’re worried about overexposure to US big tech then a tilt to the cheapo, value-oriented UK is one way to solve the problem.

I wonder if the trading apps will now start pushing Greggs shares instead of Nvidia?

(Yes, Greggs is down of late. What can I say? I’m long sausage rolls.)

Asset class 15-year returns

Over the lifetime of the Slow & Steady portfolio, any allocation away from world equities has been punished by relative disappointment:

15-year returns comparison for the existing fund line-up. Note, the actual portfolio has only held global property, small cap stocks, and index-linked bonds 1 for the past ten years.

Diversification outside of the S&P 500 (the main driver of World equity returns) hasn’t paid off (yet):

- Riskier emerging markets and small caps didn’t deliver additional rewards.

- Commercial property acted like a weak equities fund.

- Government bonds lost money in real-terms.

But the moral of the story isn’t that diversification is dead:

- The US can trail the rest of the world for years.

- It can take a decade or more for equities to recover from a bear market.

- Diversification very definitely works during darker periods than the last decade and a half.

- Ten-year expected return forecasts look bad for US equities and good for bonds. That would be a reverse of the past decade. (No guarantees, mind.)

With five years remaining of the portfolio’s 20-year mission, I’m not moved to do anything drastic now.

Portfolio maintenance

We rebalance every year to ensure the Slow & Steady doesn’t drift too far from its preset asset allocation.

Our equity/bond wedges are fixed at 60/40 so there’s no change there.

All that remains is to shift our 40% bond asset allocation by 2% per year until our defensive elements are split 50/50 between nominal gilts and short-term index-linked bonds.

Which means that this time:

- The Vanguard UK Government Bond index fund decreases to a 21% target allocation

- The Royal London Short Duration Global Index Linked (GBP hedged) fund increases to a 19% target allocation

The reason for this is that we believe short-term index-linked bonds help defend the purchasing power of a portfolio once you’re ready to spend it.

(See our No Cat Food decumulation portfolio for more on this thinking.)

Inflation adjustments

We increase our regular cash injections by RPI every year to maintain our inflation-adjusted contribution level.

This year’s RPI inflation figure is 3.8%, and so we’ll invest £1,360 per quarter in 2026.

That’s an increase from £750 back in 2011. We’ve upped the amount we put in by 81% over the past 15 years, simply to keep up with inflation.

New transactions

This quarter’s trades play out as follows:

Emerging market equities

iShares Emerging Markets Equity Index Fund D – OCF 0.2%

Fund identifier: GB00B84DY642

Rebalancing sale: £587.19

Sell 237.785 units @ £2.47

Target allocation: 8%

Global property

iShares Environment & Low Carbon Tilt Real Estate Index Fund – OCF 0.18%

Fund identifier: GB00B5BFJG71

New purchase: £483.11

Buy 204.172 units @ £2.37

Target allocation: 5%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Equity Index Fund – OCF 0.14%

Fund identifier: GB00B59G4Q73

Rebalancing sale: £289.27

Sell 0.359 units @ £805.10

Target allocation: 37%

UK equity

Vanguard FTSE UK All-Share Index Trust – OCF 0.06%

Fund identifier: GB00B3X7QG63

Rebalancing sale: £590.02

Sell 1.721 units @ £342.86

Target allocation: 5%

Global small cap equities

Vanguard Global Small-Cap Index Fund – OCF 0.29%

Fund identifier: IE00B3X1NT05

New purchase: £26.01

Buy 0.052 units @ £502.48

Target allocation: 5%

Nominal gilts (conventional government bonds)

Vanguard UK Government Bond Index – OCF 0.12%

Fund identifier: IE00B1S75374

Rebalancing sale: £746.85

Sell 5.466 units @ £136.63

Target allocation: 21%

Royal London Short Duration Global Index-Linked Fund – OCF 0.27%

Fund identifier: GB00BD050F05

New purchase: £3333.50 (includes £269.29 reinvested dividends)

Buy 3075.184 units @ £1.084

Target allocation: 19%

New investment contribution = £1,360

Trading cost = £0

Average portfolio OCF = 0.17%

User manual

Take a look at our broker comparison table for your best investment account options.

InvestEngine is currently cheapest if you’re happy to invest only in ETFs. Or learn more about choosing the cheapest stocks and shares ISA for your situation.

If this seems too complicated, check out our best multi-asset fund picks. These include all-in-one diversified portfolios such as the Vanguard LifeStrategy funds.

Interested in monitoring your own portfolio or using the Slow & Steady spreadsheet for yourself? Our piece on portfolio tracking shows you how.

You might also enjoy a refresher on why we think most people are best choosing passive vs active investing.

Take it steady,

The Accumulator

- Short index-linked bond returns are FTSE Actuaries UK Index-Linked Gilts up to 5 yrs index then Royal London Short Duration Global Index Linked Fund from 29 February 2016.[↩]

@TA:

Another good year indeed.

Re: “This year’s RPI inflation figure is 3.8%, …”

Could you please say just a little bit more about this phrase? For example, is it the 12 months RPI figure to November 2025, or something else? Also, do you use the same definition of a year for CPI too? Apologies for being picky, but what I understand by the term annual inflation figure for 2025 will only be available later in January when the ONS is scheduled to publish the inflation data for Dec 2025.

Happy new year

Was a bit shaken by index linked bonds undershooting CPI over 15 years till I saw it was a fund.

A bit tangential but I was surprised to see that Interactive Brokers claims retail users on their platform achieved 19.2% average returns in 2025, outperforming the S&P500 17.9% return.

The only footnote is that its aggregate returns on accounts holding >$50k.

https://www.businesswire.com/news/home/20260102281120/en/Interactive-Brokers-Individual-and-Hedge-Fund-Clients-Outperformed-the-SP-500-on-Average-in-2025

@Al Cam – You’re right, the RPI upweight is the change over the last 12 months of 3.8%:

https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/czbh/mm23

I update at the same time every year, so am always operating with the figures published in December which measure inflation until end of November.

The CPI estimate for 2025 in the annual returns chart is the same 12-month change currently 3.2%:

https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/d7g7/mm23

You are of course correct that the actual annual rate for 2025 won’t be known until later in Jan so I’ve flagged that the 2025 figure is an estimate.

CPI over 15 years is the annualised change in the CPI index Dec 2010 to Nov 2025 i.e. the latest data available.

@B. Lackdown – HNY! It’s the 0-5 years index linked gilt index until the fund launched in Feb 2016. Linkers were on negative yields for most of the period so losses were pretty much baked in. Now they’re on positive yields so should be fine as long as not sold at a big loss.

@TA:

Thanks for the clarification.

I think your point that “Nominal returns are deceptive!” is well made, but sometimes overlooked, as real returns are generally not to hand. I dare say we could spend a lot of time/energy debating the best deflator. FWIW, I think CPI/CPIH is as good as any – although people should probably bear in mind that their household consumption choices/idiosyncrasies are generally far more influential on their financial well-being than household inflation, howsoever measured.

Agreed, the money delusion is real and I’m still kinda shocked by how deceptive it can be. The portfolio earned returns north of 9% in 11 out of 15 years. Amazing! But in real-terms, it’s come in right around average. Dagnabbit.

Yup, the burst of high UK inflation Q3 2021 to Q4 2023 has a lot to answer for. And whilst I am still not personally convinced inflation woes are entirely behind us yet, it will take many years at 2%PA (the BoE CPI target) or less to smooth out the impact of that period – which incidentally was repeatedly and significantly under-estimated by the BoE (and others).

@TA

Probably a newbie question, but can you elaborate on this:

> All that remains is to shift our 40% bond asset allocation by 2% per year until our defensive elements are split 50/50 between nominal gilts and short-term index-linked bonds.

Specifically, why the gradual adjustment? Is it safer to do it this way rather than all at once?

Thanks @TA – another excellent update and useful links to past posts.

Your analysis certainly shows how inflation has eroded real returns.

I’m aware that the BoE has a dual mandate – not only the primary objective of price stability (the 2% CPI), but also the secondary objective of supporting the economic policy of the government of the day (growth, employment levels, etc). Personally, I think the Bank gives too much weight to that secondary objective, which undermines the priority of curtailing inflation.

It’s interesting how the central bank mandates differ. I see the ECB for example has a more hierarchical mandate, and will seldom act when inflation is on target, even if growth is weak.

It’s a pity there isn’t something like ‘mean reversion’ when it comes to inflation, or that the Bank can’t target an ‘average’ CPI of 2%. That said, having seen the problems associated with Japan’s deflationary years, I can understand why there’s a reluctance to risking deflation.

Until a few years ago my future cashflow model for retirement showed that Mrs Mack and I would be able to cover our annual expenses by each withdrawing only the Personal Allowance from our SIPPs, which I think would have given us a retirement at the bottom end of the ‘comfortable’ range. Unfortunately, sustained inflation and years of stealth taxes have materially changed that.

@Mack,

Not sure when you last checked the RLS numbers – but it is worth remembering that these have increased by somewhat more than inflation since they were introduced IIRC in 2019. I think there are also separate figures for single/couple and also London/rest of UK.

Nevertheless, fully agree that a) fiscal drag is insidious, and b) deflation can be harmful too.

While I don’t replicate this portfolio I do like to do a rough comparison against it. Having just checked for 2025 I seem to have managed an 11.5% total return for my SIPP, although I started the year 70/30 equities/bonds and shifted to 55/45 by year end. And was very underweight the US/S&P500/US tech, and overweight UK equity for the whole of 2025. I think City Of London IT was my best performer.

The current bond allocation I have isn’t all in gilts, I have 25% of portfolio overall in nominal gilts and the rest a mix of other bond types.

My allocations are not purely age-based but very much influenced by some of the estimates and forecasts you mention in your Expected Returns article, as well as yield bias. So far from passive asset allocation, although it seems to have converged with what you might expect for my age and proximity to retirement.

I guess even with your portfolio you’ve made conscious decisions on fund choice.

@Trinity — The reason for the gradual shift is that the higher bond versus equity rating over time is meant to run parallel to the (model) investor getting older, and thus closer to retirement (/taking money from their portfolio) and to reduce so-called sequence of return risk.

Appreciate I’ve thrown a few terms at you there but clicking around the site should help. 🙂

A couple of starters:

https://monevator.com/sequence-of-returns-risk/

https://monevator.com/when-to-derisk-before-retirement/

@Trinity – There’s no right or wrong. Many passive investors on the Bogleheads site advocate splitting your bond allocation 50/50 between nominal govies (anti-recession) and linkers (anti-inflation).

But the yields on linkers were sharply negative for most of the lifetime of the Slow & Steady. So you were guaranteeing an annual loss in exchange for a measure of inflation protection.

Plus inflation protection wasn’t a priority when I first constructed the portfolio. A newbie investor can generally trust that long-term equity returns will safeguard purchasing power over time.

So I decided to gradually shift to a higher linker allocation over the portfolio’s lifespan – the assumption being that inflation hedging is more important when retirement looms large.

As it turned out, it would have been better to have more in linkers than nominal bonds in 2022. Though if the Covid crash had turned into a full-on recession / depression the reverse would most likely have been true.

In the end, it’s about weighing up your balance of risks; fortune decides the rest.

@Mack – I modelled the same thing for Mrs TA and I. The personal allowance plus 25% into ISAs would have covered us. It’s a salutary example of ‘No plan survives contact with the enemy.’ The enemy being reality in this case 🙂

@Trinity @TA — Oops, ignore my comment above, apols for the confusion. The perils of moderating on the phone on the tube, illustrated again! 😉

@TA, @Mack:

Totally agree that plans change and will hopefully continue to change too!

FWIW, I have been a fan of floor and upside for many years and when I pulled the plug almost exactly nine years ago my plan was to start my DB pension in approx. ten years. My DB plus SPs (in due course) would comprise our [partly] inflation protected flooring. In the gap from retiring to commencing my DB [and SP’s] I decided to build most of the required floor with nominal products and an assumed rate of inflation. I assumed 3.5%PA, which somewhat outpaced CPIH initially, and by about four years in our cumulative CPIH from retirement was <2%PA. However, we all know what then happened and by Q1 2023 cumulative CPIH was winning. To date, our cumulative CPIH (over the period since pulling the plug) is still above 3.5% PA, but seemingly on a slowly decreasing trajectory. I also commenced my DB some four years earlier than originally planned. So whilst my inflation assumption looks about OK, I bought too many years of flooring – which came with a non trivial opportunity cost, if you like to look at things that way. We are still to start our SP's, but it seems possible that not only did I buy too many years of flooring but too much flooring on average per annum too. This is far from the worst situation to be in, but is something that is rarely mentioned.

Plans definitely change, and often for reasons beyond your control or influence.

@Al Cam (15)

We have debated this many times at SLIS, but I continue to struggle with your concept of too much flooring. Are you saying that you underspent your floor? In which case, had the surplus been instead allocated to upside (the opportunity cost), what were/are your plans for the upside other than to watch it (hopefully) grow further? You have previously said you have no legacy motive and you have quoted studies that secure income is more likely to be spent to the benefit of retirement lifestyle.

The alternative that I can envisage is that you fully spent your floor plus some money drawn down from the upside. I suppose this is the scenario that most retirees would consider as normal. In this situation the only reason that comes to my mind why you would consider that you had too much flooring is as follows: you considered that your essential expenditure was more than covered by the floor, and as a result somehow regret that too little of your discretionary spending came from the uncertain upside. As there is always a psychological hurdle to cross to decide to spend some of the upside on discretionary spending, why would this be preferred over spending from the floor?

@DavidV,

In our experience (thus far) as I am starting to see it, there are a couple of obvious questions:

a) what is my upside actually for; and

b) why did I not retire earlier?

OTOH, nothing is certain and in the final reckoning it may turn out that I retired too early – ie we may still run out of money before we run out of life. Who can tell?

musing on all this “how are we doing against inflation” question :-

suppose you had started investing in 2023, and you were aiming to cope with 2023 inflated by 3% annually – level – prices, I think you’d be really happy with 2025 returning around 9.5%.

the problem might be that S&S has to adjust to inflation the wrong way round: we increase the contribs for the remaining future investment period by inflation, but there’s nothing we can do to auto adjust the existing savings to the price shock.

Also, the rule that we “just increase contribs by inflation” to make everything fine. How? in 2023 our pay maybe rose 5% while we had 15% inflation, where are we supposed to get the necessary?

You actually want to increase contribs to bring the existing pot up to the

needed level, so build in a level of how much of it was excess growth, and estimate what your gap to a minimum target is, type-of-thing. Then it’s all

a game of how much do I need to work vs how much of a leg up can I get from investment.

@Meany – “the rule that we “just increase contribs by inflation” to make everything fine. How? in 2023 our pay maybe rose 5% while we had 15% inflation, where are we supposed to get the necessary?”

CPI was 7% in 2023 although maybe you’re toting up 2021 and 2022? Anyway, your point stands.

It’s like any other spending pressure, surely? If it’s a priority then you’ll prioritise it.

Post-GFC, my company froze pay / increased it below the rate of inflation for about a decade. FIRE was one of my priorities. I got myself promoted, took on a side-hustle, cut everything else about as much as I could stand it, chucked money into SIPP over ISA for the tax relief.

As TI always says, the Monevator audience is generally a capable and resourceful bunch.

Auto-adjusting existing savings is similar. Save more, or wait longer and allow your assets’ positive long-term real returns to retake the lost ground.

@Al Cam (17)

I’ll start with (b) as this seems the easier to me. As I see it the possible reasons for holding off from retirement are:

i) moderately content with work and want to continue;

ii) uncertainty of how to occupy time in retirement; and/or

iii) uncertainty of adequacy of finances with uncertain future spending, investment growth and inflation.

I plead guilty to (i) and (ii), with (iii) much less of a consideration, even though it was a voluntary redundancy opportunity with fairly large payout that induced me to retire slightly earlier than the traditional age.

IMHO (a) is much more difficult to pin down. Ostensibly it’s easy – you cover your essential expenditure with the floor and then spend what is available from the upside on discretionary expenditure. First problem is setting the floor at the correct amount. Too little and you are at risk of struggling to cover essentials if there is a market downturn. Too much flooring does not seem as much of a problem to me, but clearly concerns you. Where too much flooring is definitely a problem is if it is in the form of taxable income and pushes you into higher tax bands, even though the income is higher than needed. This is potentially a problem for me in the next few years.

The next issue to consider is what exactly is essential and what is discretionary. After how many years of indulging in holidays, cars, entertainment, meals out, expensive hobbies or whatever from the fruits of your upside, do these outlays become essentials?

How up does the upside have to be to be confident to spend it? What if there is a downturn next year? Okay there are guidelines such as Guyton and Klinger, but these seem to me more geared to people living completely off their portfolio rather than just tapping the upside.

All this leads me to the conclusion that, tax considerations permitting, the most desirable solution is to cover all your reasonable desired expenditure, essential and discretionary, with secure income, if this can be afforded. Of course, it may not be affordable and it will be necessary to cover luxuries from portfolio growth.

If all reasonable expenditure is covered by secure income, what is the upside (portfolio) for? This is the fortunate position I find myself in. My DB and state pensions cover all my modest essential requirements plus holidays, entertainment, memberships, meals out etc.. So the portfolio remains untouched. For many people they would want to leave this to their children or grandchildren, but I have no dependants.

So this leaves large unplanned expenditures. Private medical treatment is the most obvious example, while the other possible need is long-term care. The latter especially makes me uneasy when people talk about lifetime giving rather than bequests.

As we have concluded many times before, all this seems much simpler in theory during accumulation that to actually manage in retirement. Still it is much better to have to manage the problem of too much secure income or upside portfolio than the opposite.

@DavidV (#20)

Re: Too much flooring

I’d agree that while too little flooring is easy enough to envisage, ‘too much flooring’ is probably harder to define. I suppose that a working definition might be if the retiree consistently underspends their flooring, then they probably have too much flooring (or are unable to break the frugal habits of a lifetime!). On the other hand, where flooring is inadequate to cover emergency ad-hoc (unplanned) spending then maybe there is also too much flooring (i.e., too little upside). Whether there is an opportunity cost to too much flooring will depend. For a retiree with a legacy motive, this is likely to lead to a larger legacy (which may or may not be considered a ‘good thing’). For someone who really wanted to retiree earlier but didn’t, then this represents lost time.

RE: What is essential and what discretionary?

IMV, this probably represents the most personal and most qualitative part of ‘personal finance’. Outside of shelter, heating, food, clothing, etc. (and even with those there can be huge variations in spending), deciding what cannot be lived without (i.e., is essential) is an interesting question.

Re: Spending upside

Personally we use amortization based withdrawals (of which the bogleheads variable percentage withdrawal, VPW may be the best known?), i.e. a percentage of the current portfolio value – if the portfolio has shrunk, the income shrinks too. However, like you, we have flooring that covers all of our essential spending and most of our discretionary so are able to deal with highly variable portfolio income. Also like you, once our SPs kick in portfolio withdrawals will become unnecessary.

Getting a bit OT. So, I’ll leave it there.

@David V, Alan S,

All good stuff guys.

One of the main reasons I bang on about excess flooring is because it is rarely talked about. I do not recall even thinking about it prior to pulling the plug – as my attention was focused on trying to ensure we did not fall into the too little flooring trap.

However, my real life experience is nine years down the line our total spending is some tens of percentage points less than I estimated prior to pulling the plug – perhaps this is unusual, but so be it! And this is in spite of a period of runaway inflation, fiscal drag, etc, etc. This experience, in part, explains why I started my DB earlier than originally planned. It is also seemingly the case that our core spending has ticked upwards since I took my DB. Might this happen again with the SP’s – who knows? In our case, there is a lot going-on thereabouts (including scope changes) and I have not really got to the bottom of it and am beginning to think I might just never get there either!

FWIW, I will be a HR tax payer once my SP starts – which was something

I wanted to avoid on retirement – but fiscal drag is insidious.

My purchased flooring was reversible – ie not a lifetime annuity. I think this is a key point, because locking yourself into an Annuity from the outset could turn out to be expensive, or at least reduce your spending flexibility/choices.

IMO, flexibility/optionality is very important once retired, but OTOH so is regular income too (especially if you were salaried for most of your working life). Yup, it is a bit of a conundrum wrapped up in a riddle, to mangle a Churchill phrase!

In summary, I did a pretty poor job of estimating our retired spending ahead of being retired. But at least I was wrong in the right direction.

FWIW, I have not drawn from my upside since pulling the plug.

I have long struggled with essentials vs discretionary and still tend to think regular vs 1-off spending is a more useful categorisation. There is no agreed split for essentials and discretionary spends and this paper gives IMO a pretty good summary of the issues (as well as copious references to other papers), see: https://www.tandfonline.com/doi/full/10.1080/00036846.2024.2337812#d1e143

Most lifecycle economists support the floor & upside approach, in theory at least. However, IMO they all fall well short on providing real nuts and bolts details, and tend to gloss over the real practicalities of implementation.

@TA – absolutely, re all of your angle on this.

Yeah, I ballparked numbers to make the general point, not

making any kind of specific real life complaint.

Oh, I perhaps should say, on the idea we touched on around

using Kelly to size a SCV position and whether I could offer an

article or input around that, I did start to think about it a bit but

no I don’t think I can put out anything I would be happy with.

(for one thing, my confidence in that factor is much lower than

yours, which gives a much smaller allocation than optimal (“quarter-Kelly”)).

(for a bigger thing, it’s not my expertise – or my own pitiful investment

process, I would like to use it in a more confident way, but I really

take it more at the level of “more volatile => hold less”, “higher return =>

hold more” etc type thinking).

getting back to today’s thoughts around how long will the s&s investments

count as being “behind” and does the buyer need to add catchup cash:

if it is 7% annualized and we hoped for 4% real all along, it is on track – but

that means on this timeline that what looked like some bigger investment

gains around 2020ish have disappeared and we now label them froth.

So we only get the retirement pot originally hoped for, not bigger.

on

>allow your assets’ positive long-term real returns to retake the lost ground

(bringing “all that” up again)…

s&s was putting new money and reallocating shares into – basically, VGVA –

in 2020-22; it cost £29/unit then. It’s like £20-21 now. Made a nice 7%

last year. So it needs a 40% gain by 2030 for a nominal recovery by the end date, but with 50%-odd inflation this decade the buyer would probably want

to see a unit price more like £44+ to call it “recovered”. So, recovery by, um, well inflation will roll on, so 2040?

But, another 1% rate hike on longer bonds in that fund, and a bit more inflation could easily push it towards the 2050’s.

@Meany – I think you make an excellent point about the froth. I remember ZX saying something similar around 2021 – that essentially we were booking returns in advance and would pay for it later. That’s exactly what happened. It probably can’t be stated enough that the market progresses in fits and starts and not in a smooth line.

I’m as guilty as anyone of constantly benchmarking against *average* historical returns but they’re not something you earn like a monthly pay cheque.

Re: your point about bonds – they could be an ongoing car crash for sure. And in retrospect, we can say we’d all have been better off if we hadn’t touched them. But I don’t think we learn much of anything from that.

Owning more bonds is the right move when you need to derisk a stock heavy portfolio. The main threat to a portfolio full of stocks is a stock market crash. Fortunately that didn’t happen but a bond crash did.

Bonds are a risk asset, the risk materialised. That doesn’t nullify them as a useful portfolio tool and today’s higher yield means bonds are well positioned for the future relative to frothy stocks.

The point of a diversified passive portfolio is to think about the overall result and not lament that one part or other lagged. That’s the nature of spreading your bets.

For me, the real weakness of the portfolio is the lack of a gold / commodities allocation. It’d be better diversified against the full range of threats with those two assets rounding out the defensive side.

Cheers for your thoughts on SCV too 🙂

Kelly? SCV? Google doesn’t provide any likely meanings.

@DavidV — Kelly will be a reference to the Kelly Criterion:

https://en.wikipedia.org/wiki/Kelly_criterion

I’m guessing SCV is small cap value, but I’m not sure.

While we all drop into jargon sometimes (and one person’s standard term is another’s jargon — I frequently get asked what ‘FIRE’ means!) it is thoughtful to think of other readers and to at least use the full terms not acronyms for the first mention in a thread if possible. Cheers! 🙂

@TI (26)

Thanks. I should have guessed small cap value, but the Kelly Criterion is completely new to me.

@DavidV

sorry, blog etiquette crime there was putting my aside to @TA on the wrong

thread.

Anyone out there interested in factor tilts to escape the mega tech

dominance issue, it’s this thread:

https://monevator.com/do-the-risk-factors-beat-the-market/

Delta H’s idea (written in October when nobody will have read it there!

after my grumbling near the end) – looks like quite a good approach.

(I think TA’s basic sizing proposal for the portfolio was circa:

30% cap weight; 15% momentum; 15% small value; 40% defence).

As ever, so interesting and useful, albeit sometimes over my head. Cannot say what a difference your website has meant to me. Constantly recommending it to others!

Just a plea: please could you include tickers when you make a table? Just makes it so much easier for troglodytes like me, and always so many ways of misunderstanding…

thank you 🙂

Was the 2022 bond crash not foreseeable?

Well the exact timing clearly wasn’t but surely it was obvious that with rates where they were since the GFC, bonds were a bit of a one way bet – rates really couldn’t go down much but they could go up significantly?

Various institutional investors were effectively forced to own bonds by regulators (partly explaining how expensive they got) but private investors were not. This was our edge.

I had almost no allocation to bonds in the decade running in to 2022 (I did have some through one occupational pension that was running an unusual absolute return strategy which involved bonds). I bought a more conventional allocation to bonds after interest rates (and bond prices) had moved back to more normal levels.

None of this required skillful timing or deep insight, just an allergy to expensive valuations and capped upside.