We might as well be upfront: the passive vs active investing debate isn’t much of an argument. On one side is a mountain of evidence in favour of passive investing. While on the active investing side is a mountain of marketing money attempting to keep a very profitable show on the road.

It’s a story not unlike that of the tobacco or oil industries facing down their own inconvenient truths. Where the corporate incumbents deploy cash like nails under the wheels of progress. Slowing down change for as long as possible by befuddling consumers in a fog of doubt and alternative facts.

That said, what is the case for passive investing?

In a nutshell:

Active investing returns aren’t consistently good enough to overcome their higher costs. Over a lifetime, this means that passive investors will earn higher investing returns than active investors, on average.

Below we’ll walk through the key passive vs active investing evidence that justifies this conclusion.

What is passive vs active investing?

Passive investors hold entire markets, such as global equities or UK government bonds. The evidence suggests this low-cost, low-turnover diversification across key asset classes is a winning investment strategy for most people.

Each such market is defined by a benchmark index such as the MSCI World, S&P 500, or FTSE All-Share.

Passive investments such as ETFs or index funds replicate those indexes very efficiently. In doing so they enable investors to hold a whole market like UK equities in a single vehicle.

This makes index trackers the ideal way to implement a passive investing strategy.

Active investors, by contrast, hold a particular subset of each market they care about. They (or their fund managers) pick the mix of funds, individual shares, or other securities that they believe will do better than the rest. (“Outperform,” or “beat the market,” in the jargon.)

Active investors may also time their trades – trying to stay ahead of current events like surfers riding a powerful wave.

But active investors can be dragged down by their efforts to beat the market. They may misread events, choose the wrong securities, or incur such high costs that they earn worse returns than if they’d just taken the market average.

Passive investors, meanwhile, accept they do not have the skill to beat the market. They therefore choose low cost index trackers that reliably deliver the average market return, minus the wafer-thin fees necessary to run these funds.

By investing enough money, into the right combination of assets, for enough time, passive investors aim to achieve their financial objectives by earning the market return.

Thus active vs passive investing is the financial version of the tortoise vs the hare. Slow and steady wins the race.

Passive vs active investing evidence

The reason why passive investing is better than active investing largely boils down to costs.

Nobel Prize winner William Sharpe laid out the mathematical reasons why passive funds prevail.

When you look at the total population of investors:

- Passive investing delivers average returns minus low costs

- Active investing delivers average returns minus higher costs

The lower your costs, the more of your money you keep. The higher your costs, the more your money is diverted to some Ferrari-driving fund manager.

Passive investors beat active investors as a group because both earn the same returns on average – but passive investing costs are lower. (See the Financial Conduct Authority evidence on the damage wrought by fees below.)

Sharpe showed that the total market return is the sum of all investors’ returns. By definition, the market must encompass all investors who outperform and those who underperform:

That sum of outperforming and underperforming active investors is the reason why active investing is a zero-sum game.

The winning investors earn their gains at the expense of the losers.

But passive funds stand aside from this ferocious competition. Index funds and ETFs are designed to capture the return of their market. They do this reliably because they own that entire market. They don’t seek to profit from owning a particular slice in the hope of outperforming.

As a passive fund investor this means you can count on achieving the average market return – less the slim costs needed to run the fund.

Active investors as a group are similarly left with the same average market return. But crucially they must then deduct higher costs.

Hence the passive v active investing debate ends in a win – on average – for passive investors.

Passive vs active investing as explained by Warren Buffett

Investing legend Warren Buffett explains the logic of passive v active investing similarly:

A lot of very smart people set out to do better than average in securities markets. Call them active investors.

Their opposites, passive investors, will by definition do about average. In aggregate their positions will more or less approximate those of an index fund.

Therefore, the balance of the universe – the active investors – must do about average as well.

However, these investors will incur far greater costs. So, on balance, their aggregate results after these costs will be worse than those of the passive investors.

Active investors are betting that they can find a combination of securities that enable them to consistently beat the market.

They believe they will rank in the set of winners who achieve higher than average returns.

They do not believe they will fall into the set of losers who inevitably weigh down the results of active investors overall.

If they thought they were doomed to underperform then they’d buy passive funds and accept average returns.

Some people are fooling themselves. All active investors must believe they’re above average. But we know it’s impossible for everyone to be above average.

In fact the evidence shows the majority of active investors overestimate their chances of beating the market.

Active vs passive investing: why amateurs get fleeced

The competition between professional active investors is fierce. The stakes are sky-high: if you can consistently beat the market then you’ll rake in fabulous wealth.

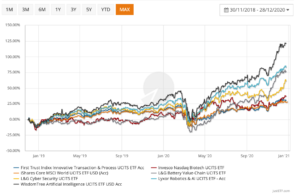

Ordinary investors try their luck, too. Picking stocks on trading apps. Perhaps investing in an industry of the future like AI, robotics, or healthcare.

But remember active investing is a zero-sum game. Winners pick the pockets of losers.

And ordinary investors don’t realise that most of the time they’re competing against huge financial players. They’re kitted out like Mr Blobby on a battlefield stalked by giant terminator droids who use amateurs for target practice.

Civvie active investors pit their stock tips and hunches against smart-money war machines deploying ranks of quantum physics PhD.s, advanced AI, data connections powered by lasers, terabytes of industry intelligence, and a relentless 24/7 work ethic.

Some active firms have literally dug through mountains for an extra millisecond trading advantage.

David Swensen, the famed manager of Yale University’s endowment fund, candidly assessed the chances of ordinary investors in his book Unconventional Success:

Individuals who attempt to compete with resource-rich money management organizations simply provide fodder for large institutional cannon.

There’s a reason the finance industry calls regular folk ‘dumb money’.

- Learn what to do if you’re an ordinary investor with no reason to believe you can beat the smart money.

Active vs passive funds: why picking a professional is a losing game

An alternative active approach is to outsource your strategy to someone who promises to smash the market for you.

Intuitively it seems obvious. Find someone with a good track record, and let them spin your mini-bucks into megabucks.

Sadly, this doesn’t work either. The long-running SPIVA study shows even most investment industry professionals can’t outperform for long.

A whopping 62% of active fund managers investing in UK equities failed to beat the market over the ten years prior to the end of 2021.

It gets worse.

- 90% actively investing in global equities failed to beat the market across the same decade.

- 95% of actively managed equities funds investing in the US failed too.

Some managers do buck the trend for a while. And a few maintain their winning streak for years. They’re hyped like the Second Coming by a finance industry eager for miracle workers.

But like aging prize fighters, most are brought down eventually. Neil Woodford being the most spectacular crash and burn in recent UK investing history.

The evidence against persistent active manager outperformance led the FCA to conclude:

It is widely accepted that past performance is not a good guide to future performance. We find that it is difficult for investors to identify outperforming funds. This is in part because it is often difficult for investors to interpret and compare past performance information.

Even if investors are able to identify funds that have performed well in the past, this past performance is not likely to be a good indicator of future performance.

Picking an active fund on the basis of dazzling recent results is like handing your money to someone who just hit the jackpot on a fruit machine. There’s no guarantee they can repeat the performance. There’s many reasons to think they won’t.

They don’t make their money by beating the market

Failure isn’t worth the risk when your financial future is on the line and that’s why we recommend using a passive investing strategy.

This is difficult to credit in the face of active investing propaganda – and even common sense.

So let’s turn again to Warren Buffett, the Sage of Omaha, for a dose of his condensed wisdom:

Huge institutional investors, viewed as a group, have long underperformed the unsophisticated index-fund investor who simply sits tight for decades.

A major reason has been fees: Many institutions pay substantial sums to consultants who, in turn, recommend high-fee managers. And that is a fool’s game.

There are a few investment managers, of course, who are very good – though in the short-run, it’s difficult to determine whether a great record is due to luck or talent.

Most advisors, however, are far better at generating high fees than they are at generating high returns. In truth, their core competence is salesmanship.

The problem simply is that the great majority of managers who attempt to over-perform will fail. The probability is also very high that the person soliciting your funds will not be the exception who does well.

Remember we’re not saying that active investors can’t beat the market full-stop. Some do.

But active investing is like a sea seething with mosasaurs and megalodons. People get eaten for lunch all the time. And it’s rare for even the biggest of beasts to stay on top for long because this is an ultra-Darwinian competition, red in tooth and claw.

Knowing this, the finance industry long ago realised it’s easier to profit from high fees and the human desire to believe we deserve better than average.

A UK academic study by Blake et al points to the true beneficiaries of active management:

Although a small group of ‘star’ fund managers appear to have sufficient skills to generate superior gross performance (in excess of operating and trading costs), they extract the whole of this superior performance for themselves via their fees, leaving nothing for investors.

Passive vs active investments: the importance of costs

An FCA report on the UK asset management industry confirmed the passive vs active fund findings of academics like Sharpe and investing insiders like Buffett:

Active funds for sale in the UK, on average, outperformed benchmarks before charges were deducted, but underperformed benchmarks after charges on an annualised basis by around 60 basis points.

Now, that cost gap doesn’t sound so bad. Which helps explain why many people risk taking the active side of the passive vs active investment bet.

But the FCA produced this chart to show how much wealth active management can leech during quite a short investing lifetime:

The graphic compares the ultimate returns (after costs) to an investor in typical UK funds:

- Passive investing returns (red line)

- Active investing returns (blue line)

The passive investor’s returns are 44% higher than the active investor’s.

It’s a tiny discrepancy at first. But the higher fees lever open that 44% gap that’s a trough of City riches.

For many people that could be the difference between enjoying a secure and comfortable retirement versus living in fear of running out of money.

The reality of being on the wrong side of the passive vs active investment cost gap is even worse than illustrated though.

Your investing horizon could easily last over 60 years when your wealth-building phase is added to your retirement years.

That’s a long time for high fees to negatively compound against you.

The upshot is that active vs passive fund costs make a critical difference over a lifetime. Do not underestimate them.

Don’t fall for it

If you still find it hard to believe that a multi-trillion dollar industry can largely be based on smoke and mirrors then let’s get a final sense check from Warren Buffett:

The bottom line: When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.

Both large and small investors should stick with low-cost index funds.

Enough said.

Take it steady,

The Accumulator

P.S. Many other investing luminaries have spoken in favour of passive investing vs active investing. The Investor has put together a small selection.

There is also much more research available from the academic community that finds overwhelmingly in favour of passive investing.

An interesting starting point is the literature reviewed by the FCA. You can find a list of sources on page 104 and 115 of the FCA’s Asset Management Market Study – Interim Report.

Great analogy: “smart-money war machines deploying ranks of quantum physics PhD.s, advanced AI, data connections powered by lasers, terabytes of industry intelligence, and a relentless 24/7 work ethic.”

… and dare one say it’s a very fine line between ‘industry intelligence’ and inside information.

To me as a naughty active investor, passive *can* be great. A simple effective long-term approach for friends starting pensions, drip-feeding kid’s ISAs etc. Scenario’s where you can go 100% equity and build compounded wealth over the years without having to worry about sequence of returns risk etc.

The biggest problems are where that isn’t the case, where you shouldn’t go 100% equity – because you’re approaching retirement or protecting a lump sum etc. The standard passive solution to this seems to be to buy ever larger chunks of bonds (Vanguard Target Date Funds etc). Fine in a 40 year bond bull market, financial suicide (& a brewing mis-selling scandal?) now that it’s over.

To me, in these “real world” scenarios you do have to at least consider the macro / big picture. Even more so at the market’s big turning points. From there, you need to at least question whether an automated passive system is still appropriate.

The solutions don’t have to be rocket science once you accept that they *can* be active in this case. e.g. at its simplest, if you want to preserve your wealth for a few years (and hopefully match or even beat inflation) you could do worse than the 3 wealth preservation funds with long term records (Ruffer/RICA, Capital Gearing/CGT, Troy Trojan/PNL)?

The essence of Monevator distilled down into a single article – brilliant!

I really want to invest right now, but diversifying it across the world in let’s say an all world ETF doesn’t seem like a good idea. The GBP is so weak right now, is it wrong to think to hold cash against the standard practice of cost average investing?!

@RS, the guys who do the analysis say that looking back over history people did better by investing as soon as they had the money than they would if they waited hoping for a more favourable exchange rate or stock market.

However it is even more crucial to have a strategy you feel happy with, and can stick to. Nothing wrong with phasing your investment, say 10% a quarter over the next 10 quarters, if it works for your psychology.

@R S – seems bizarre to buying dollars at 1.15 to the pound. But I am. As markets have always achieved fresh highs, presumably at some point in the future with history as a guide it will turn out to have been the right decision !

Let’s just hope it’s within my lifetime 😉

Oops – the world stock market as a whole has always gone on to achieve fresh highs ! Not all markets have achieved new highs, just for benefit of first time readers, some have gone to zero.

@TA – I’ve enjoyed reading this. Straight to the point, as always. Thanks TA!

I would just add my twopence. IMHO it is useful to think of passive/active investing as a spectrum with nuance rather than a digital thing. What I mean is that, for example, you can invest in passive index tracker funds/ETFs but still tweek the portfolio slightly according to an active view. So at a time when it’s very likely that interest rates are going up, you decrease the duration of your bond funds. When value lags too far behind growth for too long, you might increase the proportion of passive value funds a bit. When people are far too pessimistic about the UK, you can add a little bit more of UK trackers than a whole world tracker would contain.

I wholeheartedly agree with this well written article and the Monevator advice on passive investing. It just makes total sense and I can’t really understand why anybody would even try to bother to beat the market investing actively and then not on average doing as well as passive investors after fees (although when younger and knew even less than I do now, I did invest in actively managed Pensions & ISA’s as I didn’t know any better and was scammed with high/hidden charges and very poor performance but obviously changed these now I know better.)

I mean if the vast majority of professional fund managers with all their resources/qualifications/ experience/training/inside knowledge and access to companies/up to the minute data – as well as teams of support staff with banks of computers still fail to beat the market/average passive investor consistently then how the hell is any other “average joe” going to be able to do it except by luck for the odd year or two. As an active investor you therefore must think you have a better chance than these fund managers who can’t.

To me it’s so implausible that you can “win” it’s not worth considering. You might as well go and throw away a load of money each week on lottery tickets. I can’t really see why I or many others, would want to spend lots of free time outside of work looking over data/company accounts and the like to try to beat the market with the high likelihood they fail miserably, well consistently anyway, and why go to all that time and trouble to learn about it only to still fail. It just seems to be gambling where you are bound to come unstuck whereas investing passively in index funds/ETF’s is always a journey of volatility (depending how much you wish to take) with a calculated risk that you could possibly get back less than invested in a bad period or if not invested for long enough.

I think the only reason I can think of for actively investing is for those who have a career in it/real interest above anything else such that they would class it as their main hobby as I imagine it would take up that much time that you wouldn’t have much left for many others (especially if working.) I can’t see how there would be that many though in this category (and if in a relationship how do their other halves suffer it with it taking up so much of their time as such a solitary pastime.) Its obviously fun to some somehow but I can’t fathom it myself but we are all different. Would rather be doing anything else really – holidays/travel, outdoor pursuits, keeping fit, meeting friends/family and can’t see how this would all fit in that well with actively investing. Prefer to put money in and forget about it largely while having to do as little as possible (even to look through your different accounts and rebalance once a year is a pain to me – why do you want to be working for nothing effectively – your time is valuable) so prefer mainly multi asset funds where possible (although to me there are not too many decent ones to spread investments around – except Vanguard/Fidelity/HSBC.) I’m happy with the boring average return as I know I would do worse otherwise and at the end of the day I’m not in it for the “thrill” of it (and don’t see any fun in it myself) but just for the goal of the best return possible on my investment (as I imagine the majority investing are.)

The only thing I wonder is if the majority went “passive” as seems to be more and more the case and it virtually killed off active investing or a large proportion of it – would this be a good or bad thing for the industry? – (and I don’t mean bad just for the active fund managers and their companies/associates and their high fees) as I do remember reading something on this some time ago that the amount of monies moving over from active to passive index funds was concerning to the industry but can’t really remember now why that was said about it. Obviously I think they were talking just about “funds.”

Just my thoughts on the subject.

So passive beats active – that I agree on.

But as much as sticking everything into VWRL (or similar) is there a case for diversification into bonds, REITS, growth, income, US, Emerging markets, cash, gold,. commodities.

I see this as you just being your own fund manager if you have to make the decisions and as investors we tend to back the wrong horses – picking yesterday’s winner.

@Vroom – so I thought I’d have a look at what Ruffer Investment Company Ltd holds for your 1% fee (plus dealing charges)…

1 Cash 17.70

2 Illiquid strategies and options 16.20

3 Short-dated bonds 15.80

4 UK equities 10.50

5 Index-linked gilts 10.40

6 Long-dated index-linked gilts 8.20

7 Non-UK index-linked 8.10

8 North America equities 3.80

9 Japan equities 3.70

10 Others 5.60

Which to me all looks very vanilla and replicable for, I dunno, 0.15%. The asset allocation is way of whack compared to the global market. 10% UK equities and less then 4% US equities, anyone?

And is Ruffer’s 50% or so fixed income also “Fine in a 40 year bond bull market, financial suicide (& a brewing mis-selling scandal?) now that it’s over.”

And you end up paying say 0.85% on 16% holding in Illiquid strategies and options, whatever that is. Effectively that’s 5%, which is daylight robbery and not likely to move the needle a great deal since it’s such a small percentage.

And CGT – Cash 4%, Bonds 50% Equities 25%, Other 20%. For an Ongoing Charge of 0.84% (plus dealing charges). Again, what is Other that you’re effectively pating 4% (plus dealing charges) for?

Not for me thanks!

@ RS – this is a trap that lots of people fall into. We second guess the market because of the crisis of the day. But the world always seems to be teetering on the brink of catastrophe. Yet take a look at stock market returns over the decades and the trajectory is up.

Jonathan B makes an excellent point about easing your way into the market. Here’s a couple of helpful pieces:

https://monevator.com/pound-cost-averaging-the-buy-low-superpower/

https://monevator.com/lump-sum-investing-versus-drip-feeding/

https://monevator.com/why-a-total-world-equity-index-tracker-is-the-only-index-fund-you-need/

@ GFF – absolutely. The piece isn’t meant to imply anyone should bung everything into 100% global equities. You can equally take a passive approach to your bond holdings, though the actual mix in the portfolio depends on objectives and risk tolerance which is an individual decision.

Hopefully these articles help re: diversification:

https://monevator.com/how-to-estimate-your-risk-tolerance/

https://monevator.com/defensive-asset-allocation/

https://monevator.com/how-to-protect-your-portfolio-in-a-crisis/

@ Tom-Baker Dr Who – I agree entirely. Lots of people find it difficult to avoid taking a view – including me! I’ve actively invested in risk factor ETFs, plus overweighted the UK and Emerging Markets because those markets looked cheap.

But looking at it dispassionately, I’d say none of those plays have worked out versus just holding a global tracker. So much as I think it’s OK for consenting adults to smoke and eat cream cakes every day, it’s important to know the risks we run too.

@ Steve – cheers! The joy of it is that your healthy take on getting on with life is likely to enhance rather than hinder your long term returns.

There are lots of theoretical musings on what would happen if the entire world turned passive. In reality it isn’t going to happen.

There will always be active competition among financial industry professionals in pursuit of outperformance.

That provides price discovery for the rest of the market while we let them knock seven bells out of each other. Makes about as much sense for me to compete with them as stepping into the ring with a heavyweight champ.

@ Brod – You pays your money and you takes your choice. To me what matters is net return, after fees. My core holding is CG Absolute Return which costs 0.69%/year, with a £1.50 dealing fee via Lloyds (and no stamp duty or other fees). You can show me millions of passive funds that beat that on a fees basis (I’m invested in some of the 100% equity ones). Can you show me any that will beat it on a net return last year, this year and that you’d stake a lump sum to beat it next year? (if you can they have a new investor right here!)

What you’re paying for with these funds is an evolving macro view looking to preserve your wealth, which is about as ‘active’ as it gets. This particular fund is ran by Peter Spiller who has been doing this for 40 years and has had one (I think?) down year. Ruffer I seem to recall made money through the credit crunch. Some of the things they’re using we can replicate at home, but lots of them in practice we can’t (inflation breakevens, credit default swaps, option structures etc). It can be interesting to look at their holdings, but for the full picture you often need to know what it’s ‘against’, or are the bonds collateral or etc.

My point isn’t that passive is bad, it’s great for the 100% equity examples the article focuses on. Where it gets tricky is when people try to extend that success into scenarios where 100% equity isn’t appropriate. There’s seems to be a growing recognition of this in the passive space (especially on sequence of returns), but as yet no solution I’ve seen as good as the 3 funds I suggested?

@Vroom

By dealing fees, I meant the dealing fees of the fund as it rotates its “strategic macro view” and changes holdings which, afaik, aren’t included in the Ongoing Charges calculation. Though happy to be corrected. Sometimes unflatteringly called “churn”, though I’m not accusing Ruffer of that.

I agree, prejudiced by my personal risk tolerance, 100% equities is probably not appropriate as you approach retirement (or usually never for some/most people). So as I thought I’d enough, in November ’19 I went from 100% equities to a portfolio including (now) 20% short global linkers (half hedged, half unhedged – my macro view of Sterling), 15% Gold, 20% Cash and 45% Global Equities with an overweighting in EM. and I’m paying about 0.15%.

Saving 0.6% p.a. over Ruffer. My point is that you can replicate 84% of it really cheaply and still take a Macro view (gold/linkers/hedged/unhedged/EM/etc), and probably be wrong!

Is the 5% p.a. or so you’re effectively paying for 16% Illiquid strategies and options going to move the needle enough?

The other point about illiquid investments is that they are illiquid. They are not marked to market. so what are they truly worth? Today? I think TI had a great article on that recently. They can keep them on their books at the original valuation, supporting the NAV, until forced to re-value them by events e.g. a new fund raising round, while using reserves and gearing to continue to pay out dividends, enhancing IT’s reputation for stability/capital protection/whatever.

If you’re happy with your ITs, great, no problem. But as I said, not for me!

There’s two situations I believe active investing competes with passive.

The first is for century old wealth management funds, like Foreign & Colonial. They’re from a time before robotic index funds, with overlapping goals. If you’re an older investor, sticking with what you know might not be the worst option.

The second is deep knowledge of at least one company. You probably could make better investment decisions. The problem is, you need deep knowledge of at least one other asset to trade with (do you really know how cash has value?) Two or three company experts, I’m very skeptical of; and anyone claiming deep knowledge at sector level or above is mistaking luck for skill.

@TA (#12) – So far, my unorthodox approach has been working well for me. I had a much smaller drawdown during the Covid crisis than the market and the recovery time was faster too. This year, my total portfolio has gone down much less than the market every single time both from a sterling point of view as from a USD point of view.

I’m in the process of moving a company pension to a SIPP now. It’s my chance to go from a very limited choice of funds in the company pension to a much larger choice of passive funds with much lower fees! I have been designing the new asset allocation for subportfolio. When I compare my current idea (60% equities) to a simple entirely passive 60/40 portfolio, I find the historical data suggests my portfolio idea suppots a SWR of about 4.5% whereas the 60/40 SWR is much lower. The worst historical drawdowns for a UK 60/40 is almost 60% with a recovery time of 12 years. For my portfolio idea, I get a worst drawdown of about 30% with a recovery time of 12 years.

I used various online tools to check this portfolio. If you would like to have a look, I’ve got a PortfolioCharts bookmark that makes it easy to check on that site. Here it goes:

ZGBRXAA20AC03AI03AJ05BA07EC05EI05EJ03AL14AM08AO03GB09QC08FA07Z

@Tom-Baker Dr Who — I have more sympathy for this kind of portfolio construction provided (a) you know what you’re doing and (b) you’re properly accounting for the trade-offs. (E.g. Likely doing worse over a full cycle, even if you outperform during downturns. But that’s true of most/(all if long enough time horizon, to-date) portfolios that aren’t 100% equities one way or another.

However similarly to the discussion with @ZXSpectrum48K on the recent SPIVA thread, I don’t think it’s actionable mass-market advice. Most people do not meet (a) and won’t understand (b).

I have an active post half-finished about this (it’s called ‘strange diversifiers’ or similar) and it’s basically about how you can add anything to a standard 60/40 passive portfolio and get a different profile (for good or ill!)

As that implies I think it’s more in the realms of active investing. I don’t believe this kind of thing is a mark against passive investing; more as Morgan Housel would say it’s playing a different kind of game. (Certainly different scoring!)

More of this when we get our active investing paywall up where we can all happily chat about naughty active investing without legitimately being concerned we’ll turn the heads of the 95-99% of people who would do better investing purely passively and not listening to siren calls. 😉

Interesting debate, which will go on and on.

Investing in active funds also encourages switching, which is a recipe for significant under performance and the evidence indicates this is even more harmful for investor returns.

For ex – A fund manager underperforms. Has the PM lost their marbles, is the style just out of favour. Very hard to know. So you switch into another fund, that fund starts underperforming post a few years of outperformance etc etc.

With a passive portfolio you know you are getting the index returns. As others have highlighted for liquid equity and bond markets, passive allocation is demonstrably the way forward.

The other factor is obvious asset allocation. How many people have invested in high yield index funds, or overweight emerging market, or the FTSE 100 etc etc and think they’re passively allocated without realising they are making a substantial active asset allocation decision. That’s likely to have a much greater impact on returns either +ve or -ve than fees.

Be ruthless on fees but don’t forget asset allocation – hence the global tracker being best for most people – is key.

RE the likes of personal asset trust etc – I agree it’s seems fairly easily replicable. I suppose some people are happy to pay up for someone else to do the work. Otherwise it would seem quite s/f to largely copy PAT for <0.2% TER. A global index, physical gold, a $TIPS ILG, Cash and some ST dated Gilts / US treasuries and you are done.

If nominal returns are going to be lower g/f – 1% fees seems a high price to pay.

@Brod

I looked a bit more at what Ruffer do after some comments on an earlier post here. Those “illiuid strategies and options” they hold are 2 things:

(1) They FX hedge any foreign shares where they are worried that FX movements will cause the cap value in sterling to fall even though the underlying share value might rise. (those “active bets” are probably losing a bit just at the moment!)

(2) They buy “swaptions” to protect linkers and other bonds from capital losses when the interest rate changes. So while your linker fund cap values are falling (but you are getting a little + from the coupon and any unexpected inflation), they are getting all of the +, no cap value fall, minus the cost of the swaption. Done passively over very long time frames that would be a losing strategy, but at a time when interest rates rise it is very sensible prudence and allows them to make a little money. I don’t know if the amount they make from that move covers their fee! But I’m pretty sure that if you were just holding their linkers (without the swaptions) you would be losing more than their fee!

@All – fascinating discussion this week.

@Tom-Baker Dr Who — Wow, that’s a complicated portfolio! Fourteen funds? I too play with the wonderful Portfolio Charts (and am hoping the future is somewhat like the past 🙂 ). I’ve taken it one step further and have a spreadsheet pulling out the ranking of each attribute I’m interested in (all bar Standard Deviation and Baseline ST Returns really) And then colour coding (green 7 <= 12, red 12+) and averaging across returns, drawdowns, S/PWR, etc. I am Mr. Over Optimise!

What I have noticed, though, is that it doesn't make a lot of difference. Adding 10% or even 20% LCV instead of adding it to LCB does improve a little (or rather has) but they're pretty much rounding errors. For example I go from Baseline LT Return/SWR/DD 4.5/4.9/29.9 to 4.6/5.1/30. Not sure it's worth the bother (for me!) for a 20% allocation. Have you looked into how much difference your 3%'s here and there will have?

(If you like, next week, I can go through my car spreadsheet I made before confirming my gut feel… I mean making an evidence based rational decision.)

@Meany – thank you for that. I'm sure I've read somewhere that you should hedge your FI (cos of stability?) but let your Equity portion ride? Anyway, seems you're paying a lot for that stability. If that's what someone wants, fair do's.

@Brod @TBDW — Despite featuring it in Weekend Reading when it launched, I can’t find where to put the bookmark @TBDW shared into Portfolio Charts to take a gander. Do you have a URL please?

@ Tom-Baker Dr Who – I checked out your portfolio and it looks very sensible and well diversified to me. Cheers for sharing. Do you have linkers too? Do you hedge your US bonds?

Just for clarity sake, I don’t think of a 60:40 portfolio as the one, true, pure passive portfolio from which any deviation is unorthodox. For example, we could argue that it’d make sense for a passive investor to own 100% index-linked government bonds if that enabled them to meet their goals. It doesn’t reflect the global market, nor use index trackers, but it is a portfolio that can be 100% passively managed to pay that person’s bills for the rest of their life.

In reality, very few of us could achieve financial independence if we relied on linkers, nor would I want to bank my entire future on the full faith and credit of the British Government.

The way I think of it is that a global tracker is the passive position on the equity side. But the defensive side of the portfolio is about diversification and risk management. And that’s where asset allocation becomes incredibly personalised:

Conventional bonds to deal with recession.

Linkers for inflation.

Cash for liquidity.

Gold for when nothing else works.

My allocation to those asset classes is not active – assuming I stick to my own asset allocation rules (e.g. I don’t suddenly start buying gold because it’s done well recently) and that I’m not buying in because a fund manager promised to make a killing in that market for me.

I actually think our positions are relatively close on this – I’m just trying to clarify where I’m coming from.

@ TI – this post explains how to use the Portfolio Charts bookmark: https://portfoliocharts.com/2021/03/11/bookmark-your-portfolio-and-share-it-with-a-friend/

I did mean to say that if you tinker with any tool (oo-er) long enough you can bork it.

For example, I get the best SWR on Timeline if I go 100% UK small cap value.

That historical quirk is not something I would ever bet on paying off in my lifetime.

@TA – Thanks for answering TI’s question about bookmarks, I got up rather late today and have only just read this now.

Thanks also for the feedback on the portfolio idea. To clarify, this is not a real portfolio yet, just an idea for what I would invest what was in my company DC pension.

I think PortfolioCharts assumes all the US Treasuries in a UK portfolio are hedged to sterling (this a very important point to clarify by the way and I’ll try to find out). I intend to have most of them hedged except for the longest duration ones I have added. The reason for having the long duration ones unhedged is that they are there mainly to cushion equity drawdowns and deflation. As you know, king Dollar is the top safe heaven currency the world and his wife usually desperately want whenever there is a crisis. So by keeping the long duration bonds unhedged, I am betting on a double cushion effect from those unhedged Treasuries in a crisis. I don’t think PortfolioCharts is modelling this, as I guess all treasuries are hedged to sterling there. Another thing I couldn’t model was that my original idea was to have some 5y TIPs as well for inflation and I think I couldn’t add them on PortfolioCharts.

@TI – Thanks for the feedback. The new post you are writing seems very interesting. I’m looking forward to it!

Yes, I’m not expecting to make as much as a simple world tracker in an up cycle with this portfolio. I’m focusing on Warren Buffett’s two rules of investing that you are very familiar with:

Rule 1 – Never loose money.

Rule 2 – Never forget rule 1.

I think of this in the context of someone withdrawing from the portfolio and the need to reduce volatility and paper drawdowns to mitigate SoR. So having 30% drawdowns rather than 60% is a pluss as well as having higher SWRs and permanent withdrawal rates.

@Brod (#20)- Thanks for the feedback. I’ve built a few spreadsheets for analysis over the years too but nothing using PortfolioCharts yet. Would be great to know what you find out if you run this on your spreadsheet. Thanks for the offer 🙂

@TA (#24)- I agree. I always try never to go 100% on anything and always think of any analysis with a pinch of salt. One very important thing is to test for robustness. You can, for example, test the same portfolio idea in different international markets and check what features remain similar and what changes a lot.

I also try to diversify across funds too. It can help mitigating the counterparty risk of the fund provider, tracking errors, as well as unknown unknowns 🙂

Interesting thread. Monevator’s ‘Slow and Steady’ passive portfolio has obviously done very well over the last few years. Will it beat CG this year and next (with a 0.6% headstart on fees), that’s the intriguing question?

We all love low fees. As the post points out the case for them in long-term 100% equity investing is pretty compelling. My point/question I guess is are there scenarios when you would consider going active, where an expert is actually worth paying for? For me approaching retirement or protecting a lump sum in this market (the first real inflation in 30 years, the end of a 40 year bull market in bonds, a shifting world order etc) is one of them.

The wealth preservation funds can and do use a huge range of derivatives, to hedge and to position. Inflation breakevens are particularly useful for them, but they can and do use all kinds of share and commodity futures and options, swaps, credit default swaps etc. Not only can we not access a lot of that, we don’t really know what they’re doing with it in real time: their Holdings reports typically cover their physical holdings but not their derivative positions which can be substantially larger and potentially ‘the other way’. A Black Box and you pay higher fees for it – I’m not surprised there’s a lot of resistance to it in these parts.

The counter is to look at their track record, particularly through the tricky times (dotcom bust, credit crunch, even the other flare-ups since). Peter Spiller has been right 39 out of the last 40 years and has made 15%/year (after fees) compounded over that time, with a ridiculous Sharpe Ratio to boot. If I give my passive portfolio the 0.6% headstart, do I back it to beat him with his experience and track record in this particularly tricky environment. When he can access and has proven he can gainfully use all the derivative markets and I can’t?

To me, that’s a very different question to “is passive better for long-term 100% equity investing”?

Our equities portfolio is mostly weighted according to the FTSE World index, albeit scattered across various geographic index funds and ETFs to save on fees and diversify across fund management groups. I have strayed a little into active areas, but on the whole these active bets have not worked out. We hold a US REITs ETF, a US low volatility ETF and US plus non-US small cap ETFs in our SIPPs. All low charging US listed ETFs and we save on the US dividend withholding tax, but none have kept up with basic cap weighted US trackers for the period we have held them. The low vol ETF has been good this year, but so far the outperformance has not made up many years underperformance.

We used to invest in VCTs, but have not done that since the rules changed making VCTs more risky. The VCTs we used to invest in were of the limited life sort, so you are guaranteed an exit near NAV, and included asset backed loans to further reduce risk. Not allowed any more. Returns on these were mixed but all beat 5 year cash returns after tax.

On the low risk side, we are mostly in cash, having moved out of gilts when yields dropped very low at the start of the Covid crisis. We moved from 60/40 equity/gilts to 90/10 equities/cash. One of my few active decisions that has, so far, worked well, despite recent falls in global equities.

Personally I am very happy with our asset allocation and drawdown strategy. We hold up to 6 years spending in cash, or near cash such as short dated gilts held to maturity. Everything else in global equities. We top up the cash from dividends and from disposals when equities show real capital increases, capping the equities portfolio at 60 years spending. The fact that the equities show a lot of volatility and will likely have significant drawdowns is bearable because we invest for the long term and don’t need to sell when markets are down.

Personally I cannot see the point of betting on actively managed low volatility funds/ITs. FSCS protected cash deposits does the job well enough, with zero risk of nominal loss. I don’t care what the track record of any fund looks like. History is littered with instances of long term good returns that eventually become mediocre, or worse still falls off a cliff.

@ Tom-Baker – I’m tempted by the US treasuries idea too but have ultimately opted against it. Recent history is certainly on your side. For anyone else who’s interested in the idea:

https://monevator.com/do-us-treasury-bonds-protect-uk-investors-better-than-gilts/

I think Portfolio Charts would struggle to tell you anything meaningful about TIPs. They weren’t launched until 1997 (index-linked gilts were first issued in 1981) and this is the first serious bout of inflation we’ve experienced since.

@TI I think your original conclusion, that buying US Treasuries was mainly a currency play, was correct – and nothing wrong with that. Although the usual, eg Vanguard, advice is to hedge overseas bonds to the £, the link between weakening US equity market and weakening £ to $ seems to be remarkably consistent – we’re on our third round since Brexit. Underscoring this, the two iShares short-term inflation-protected TIPS ETFs have turned in a remarkable performance: the £-hedged TI5G has fallen just 2.5% this year while the identical except unhedged TP05 has risen a tidy 14.64%.

Sorry, that should have been addressed @TA

I believe what you said and is a passive investor myself. However, I think Buffet himself is an active investor, e.g. he buy shares. I think what is means if you’re good professional investor you could do better with active investing.

Thanks,

Mei