You’ve probably noticed your portfolio soaring these past few months.

The Slow & Steady portfolio is up more than 5% since last quarter. That’s despite it being 40% bonds.

Property’s 10% quarterly rebound is especially heady. Mind you, I’d estimate my REIT fund is still down around 5% since the eve of the coronavirus crash.

As the world learns to live with Covid, confidence is shooting through equity markets like bubbles in champagne.

What could go wrong?

It’s at moments such as this – with the Slow & Steady’s returns just shy of 10% annualised – that I like to think about how it could all end in tears.

(I’m giving up FIRE, by the way, for a new gig as a professional party-pooper.)

There’s a drumbeat of concern about ‘overheating’ out there. And it’s always better to burst your own bubble than to have someone do it for you.

So let’s scare ourselves silly with some frothy (over-)valuation porn.

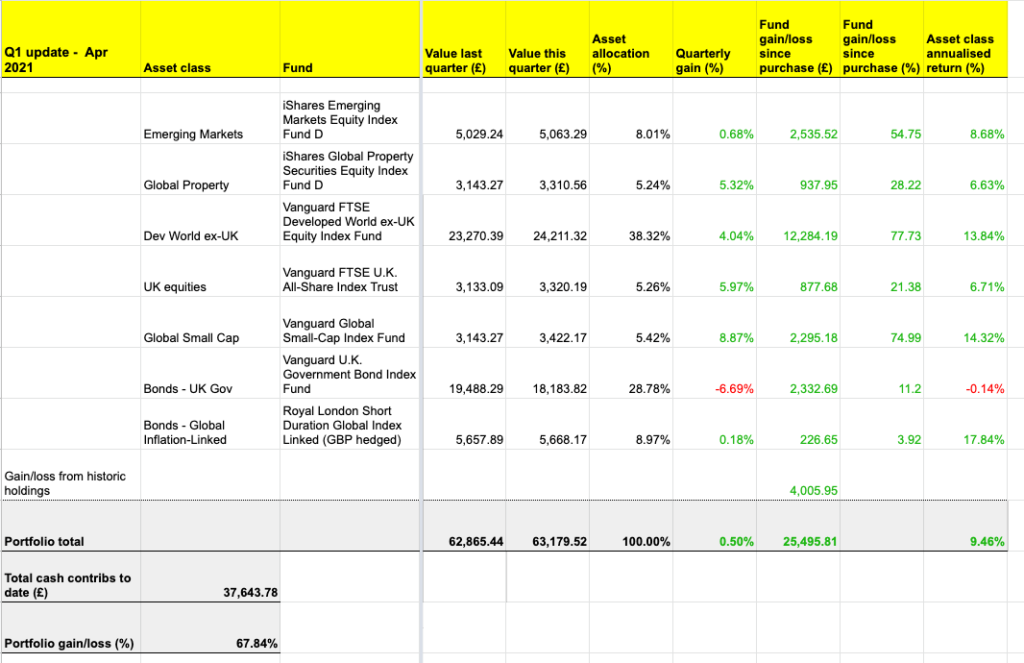

But first, let’s bask in this quarter’s lovely numbers. Just for a moment!

Returns brought to you by Don’t-Worry-Be-Happy-O-Vision:

The Slow & Steady portfolio is Monevator’s model passive investing portfolio. It was set up at the start of 2011 with £3,000. An extra £985 is invested every quarter into a diversified set of index funds, tilted towards equities. You can read the origin story and find all the previous passive portfolio posts tucked away in the Monevator vaults.

Valuations of doom

Okay, that’s enough basking. If our returns can’t deliver negativity then we’ll just have to do it ourselves.

Dialling up today’s market valuations and miserly expected returns is a quick way to pee on our fireworks.

One of the few equity valuation indicators thought to have some predictive power is the cyclically-adjusted P/E ratio (aka CAPE, aka P/E10, aka Shiller P/E…).

The Investor has written an excellent piece explaining how CAPE works. He also looked at its limitations and pitfalls.

To cut to the chase, there appears to be some correlation between a stock market’s CAPE measure and future stock returns. How much? You can find material arguing the case either way. But – especially in the US – there’s evidence that a historically high CAPE signals poor market returns ahead.

Right now the US CAPE measure looks lofty.

Brace! Brace! Brace!

CAPE ought to be relevant in other countries, too. But good data is hard to find.

Thankfully, help is at hand from fund manager Research Affiliates.

Donning the cape of data superheroes – look, I’m having fun even if you’re not – Research Affiliates has calculated CAPE ratios for every major world market.

That data is packaged up with Research Affiliates’ 10-year expected returns in a superb CAPE Ratio tool. Thus armed, we can look to see where pockets of opportunity and danger may lie.

++Caveat warning++ This only matters if you lend any credence to CAPE as a metric, you concur with Research Affiliates’ methodology, and you believe passive investors have any business reading such tea leaves. ++Caveat warning ends++

Credit to reader Stephen James for sharing Research Affiliates’s tool. (No sniggering at the back.)

UK stock market valuation

Here’s the CAPE ratio, expected returns, and fair value reading for UK equities according to Research Affiliates:

Squint at the UK’s candlestick (bottom-centre of pic) and you can see that our home CAPE is 13.5. That’s a touch lower than the historical median of 14.3. (Research Affiliates’ UK CAPE time series dates back to 1980).

The black ‘X’ on the red column shows a fair value estimate. It’s bang on the 14.3 median CAPE score, and so just above today’s actual valuation.

(Note: Research Affiliates’ fair value isn’t always the market’s historic CAPE median).

Looming larger than any of that is the 10-year average expected return of 4.9% for UK equities. That’s a real (after-inflation) annualised return.

The green cumulative probability bar (bottom-right) gives only a 50-50 chance of us hitting those heights. There’s a 75% chance of scoring at least 3.4%. There’s only a 25% chance of topping 6.4%.

Still, based on historic data you wouldn’t expect to squeeze more than 5% average return out of UK equities anyway.

The UK looks okay then. But the US does not…

US stock market valuation

After the heroics of the last 12 years, US large cap expected returns are predicted to deliver a median of -0.9%. That’s as bad as today’s negative-yielding bonds!

Research Affiliates believes there’s only a 5% chance of scraping a measly 2.7% annualised over the next decade.

Many Monevator readers will maintain a large allocation to the US. Not least in their global tracker fund.

The Slow & Steady’s allocation to the US is 26%.

(The portfolio is 39.6% allocated to the Vanguard FTSE Developed World ex-UK fund. That fund holds 67% in US equities. 39.6% x 67% = 26.5%.)

Research Affiliate’s median forecast would hurt us if it came to pass.

The US candlestick notches a CAPE of 37. (See the white circle shinnying up to the 98th percentile of the historic range.)

That’s way beyond the CAPE ratio of 30, hit on the eve of the 1929 Wall Street Crash according to this calculation:

The S&P 500’s peak CAPE was 44, just before the dotcom bubble burst.

Look out below

In the US we’re back into nose-bleed territory. Then again, we have been for a long time.

The Investor cited the same US CAPE source back in 2012. It showed CAPE at 23. That seems tepid now, but the US market was considered to be overvalued even then.

Many knowledgeable-sounding commentators warned that US equities were frothy and there was trouble ahead. They’ve been wrong (or just early) for nine years.

I have often doubted the wisdom of sticking to my passive guns when I’ve read about US valuations. But if I’d cut back I’d have missed the main driver of global equity returns for the past decade.

Still, a US CAPE of 38 is scary.

But if you want to see something truly gaga then check out Japan’s CAPE history.

Japan stock market valuation

It’s the historical range of Japan’s P/E10 that makes my eyes bulge.

Beyond the red column, Japan’s slender grey upper shadow extends to an all-time high north of 90.

I’ve read that the Japanese Nikkei index’s P/E ratio reached 70 just before its bubble burst in 1989. 1

As super-heated as US valuations are now, Japan’s experience suggests they can keep gathering steam.

High fever

Passive investors aren’t meant to respond to market signals. We avoid action because we know we have no edge.

Despite this I’ve often wondered how I’d react in a market delirium.

If I’d been investing in Japan in the 1980s, would I have scaled back as its CAPE climbed through the 40s and beyond?

I previously told myself: yes. But how easy would that have been? The Japanese economic model was lionised at the time. Some predicted Japan would soon eclipse America.

Now the US CAPE is approaching 40.

I am fully prepared for a decade of low returns. Equities have had a barn-storming run, after all.

But I don’t believe I can use CAPE to predict a bubble and nor should you.

Some like it hot

There’s an internet full of arguments for and against CAPE.

Vanguard research has previously put CAPE’s correlation with future equity returns at around 43%. So there are clearly a lot of other factors in play.

I think that CAPE is a useful indicator. At the very least it helps you gauge what others mean when they mysteriously refer to ‘valuations’.

But so far I haven’t acted on CAPE’s fuzzy signal.

If you want to do something, consider using a systematic technique called overbalancing. I wrote about how it works some years ago.

Even then Monevator’s mail bag was full of worries about markets overheating.

Like frogs in a pan, we just keep on boiling.

New transactions

Every quarter we throw £985 into the global market furnace. Our financial fuel is split between seven funds, as per our predetermined asset allocation.

We rebalance using Larry Swedroe’s 5/25 rule. That hasn’t been activated this quarter.

These are our trades:

UK equity

Vanguard FTSE UK All-Share Index Trust – OCF 0.06%

Fund identifier: GB00B3X7QG63

New purchase: £49.25

Buy 0.221 units @ £223.21

Target allocation: 5%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Equity Index Fund – OCF 0.14%

Fund identifier: GB00B59G4Q73

New purchase: £364.45

Buy 0.719 units @ £506.90

Target allocation: 37%

Global small cap equities

Vanguard Global Small-Cap Index Fund – OCF 0.29%

Fund identifier: IE00B3X1NT05

New purchase: £49.25

Buy 0.123 units @ £399.46

Target allocation: 5%

Emerging market equities

iShares Emerging Markets Equity Index Fund D – OCF 0.17%

Fund identifier: GB00B84DY642

New purchase: £78.80

Buy 38.875 units @ £2.03

Target allocation: 8%

Global property

iShares Global Property Securities Equity Index Fund D – OCF 0.17%

Fund identifier: GB00B5BFJG71

New purchase: £49.25

Buy 20.746 units @ £2.37

Target allocation: 5%

UK gilts

Vanguard UK Government Bond Index – OCF 0.12%

Fund identifier: IE00B1S75374

New purchase: £305.35

Buy 1.69 units @ £180.71

Target allocation: 31%

Royal London Short Duration Global Index-Linked Fund – OCF 0.27%

Fund identifier: GB00BD050F05

New purchase: £88.65

Buy 79.081 units @ £1.12

Target allocation: 9%

New investment = £985

Trading cost = £0

Platform fee = 0.35% per annum.

This model portfolio is notionally held with Fidelity. Take a look at our online broker table for cheaper platform options if you use a different mix of funds. Consider a flat-fee broker if your ISA portfolio is worth substantially more than £25,000. The Slow & Steady portfolio has long since passed that threshold. I’ll explore a move to a flat-fee platform in the next installment.

Average portfolio OCF = 0.15%

If all this seems too much like hard work then you can buy a diversified portfolio using an all-in-one fund such as Vanguard’s LifeStrategy series.

Interested in tracking your own portfolio or using the Slow & Steady investment tracking spreadsheet? This piece on portfolio tracking shows you how.

Take it steady,

The Accumulator

- I’ve also read that differing accounting standards explained some of Japan’s wild P/E ratio, though not all of it.[↩]

Comments on this entry are closed.

Have an Asset Allocation you can live with through downturns-most investors should know their personal risk tolerance by now

Rebalance with new monies in Accumulation phase and with your withdrawals in Retirement

Then “stay the course “-“ enjoy the financial noise” and do nothing

Actually quite a difficult investment policy to maintain!

xxd09

Thank you (as always) for this @TA) and thank you Stephen for sharing the Research Affiliates’s tool, with you / us. I am thinking about my variable withdrawal, when it starts in a few years time and I’m leaning towards a CAPE based rule, as although not perfect, it makes sense to me to consider equity valuations within this.

Thanks again @TA. Always insightful and a good read.

Here’s what I plan to do: keep investing regularly, mainly into VG LS80%, plus a little (aiming for 5% in each of what is in the LS fund in total) in Property and global Small Cap, FTSE 250 indexes, commodities, plus then also build up a diverse mix of investment trusts in time for the ‘active’ income/growth. Taken a while but now sold all my individual shares now, other than Unilever. (Although as I’m with HL, the costs of this over the last year was a slightly eyewatering 2% of my ISA – ouch! But would rather do this now than down the line, plus plan on moving to ii in the next year to keep the costs down) Eased off my saving rate over the summer, partly due to lockdown easing, down from 65% during lockdown to around 25/30%. Personally found the extreme frugality too much, but suspect I will ramp it up again in winter when there is less to do. I’m also trying to moving away from open-ended funds but also probably a bit cash light too (probably only 0.5% held in cash overall, incl emergency fund and likely moving house in the next two years, so shifting towards cash a bit more for this reason, rather than any market overheating I can’t control.) In recent months I’ve taken out subscriptions to Investors Chronicle and Money Week, but found although it was interesting reading and learned a lot, it mainly wasn’t relevant for the most part for where I am in my FI journey and just added to the nouse. I keep going back to the simplicity of passive investing into a fund of funds (call it LS+, if you will). Still building up the core really so will wait for a while before tinkering with the active side of things. Is no cash held in the S&S portfolio?

Not tinkering is much easier said than done! Bumpy times ahead? Who knows. I don’t! Good luck everyone.

@Whettam #2. I have also been interested in a CAPE-based rule for when I enter my decumulation phase. It was sparked by this article (and the one preceding it) https://www.caniretireyet.com/the-best-retirement-withdrawal-strategies-digging-deeper/

My issue was that this article (like many) is US focused and I struggled to find up to date information for other markets, so a big thank you to Stephen James for the link to Research Affiliates that will likely help me in the future.

Thank you for that CAPE site. The UK isn’t so bad, really, in a relative way. Mind you, there are limits. Brazil, eh, good value, better prospects, I know you shouldn’t, but IBZL anyone 😉 Where’s Clint Eastwood when you need him, eh?

Great article, and the link to research assocs looks very useful.

43% is a lot of correlation. Food for thought. Or… maybe the US tech sector is going to eat everyone’s lunch, globally, and no one will stop them? IT… telecoms… Books… CDs and music… dvd and film… travel agency… TV… retailing… automotive… maybe everything, in time? And no govt or regulator will stop them?

Re portfolio – would be interested to understand how the indexed linked stuff has delivered such a high annual return when it isnt up much (final 2 columns look odd)

And yes JDW the magazines are quite noisy… worth a look from time to time but i find monevator is rather more educational, and way more useful!

I most certainly did notice the soaring markets this year. The run up in capital value of our equities portfolio in the first half of the year was over 10%, which triggered a rebalance event last week and I sold most of the gain.

I don’t use CAPE and just hold markets according to market weight (mostly). I think there is something in CAPE, but one thing that always concerns me about using it is that this information is widely known by the market and betting against the market rarely works out over the long term. One thing I do know is that if I had been using CAPE, I would have been underweight the US for years and would have underperformed the market as a result.

@MarkR Thank you I’d not seen those articles, interesting. I assume you have seen @TA’s articles on Dynamic Asset Allocation and variable withdrawal rates, earlier this year:

https://monevator.com/dynamic-asset-allocation-and-withdrawal-in-retirement/

When I referenced CAPE based rule, I was actually referring to the variable withdrawal element, rather than the dynamic asset allocation. It feels more logical to me to vary your withdrawal by considering market valuation e.g. CAPE, rather than which assets to sell, which seems a bit more like market timing to me. But it does show how many different variations there are on same problem.

Worth noting that late last year, even Shiller seemed to finally admit what hordes of other pundits had been saying for years: that interest rates DO matter and CAPE needs to take them into account. There’s a good article by him at https://www.project-syndicate.org/commentary/making-sense-of-soaring-stock-prices-by-robert-j-shiller-et-al-2020-11 on the topic. His new metric is called Shiller ECY (for “Excess CAPE Yield”). Not seen much more on it since, but apparently it makes the US look much better value. (I don’t know if that Research Affiliates tool has any support for it?)

Is Shiller just fudging the model to get the results people want to hear? Or will it actually have improved predictive power? It’ll probably take at least another decade or two to find out…

Great update as ever. Can i ask about the bonds you selected for your portfolio. I get the royal london bonds and why they would be there but the UK gov bonds have a risk number of 4 and are not really going to be that defensive. Can you share you rationale for this selection and whether this is simply diversification whilst your in the accumulation phase. My question would be would these be your bond choices in draw down?

@Tim, or has the market simply absorbed Shiller’s work?

@TA:

Thanks for a very interesting update.

Couple of thoughts/Q’s if I may:

a) the referenced Research Affiliates (RA) method doc dates from Jan 2014 and uses data to 2013. Their forecast for the next ten years (contained therein on page 13 – unlucky for some) of 1%PA real seems a tad pessimistic. What if anything does that tell us?

b) any news on whether you will be updating us on the progress of your deaccumulation portfolio?

CAPE seems more of a sector story than a national one. The US is “expensive” by CAPE because it contains a lot of large cap tech, whereas the UK is “cheaper” because it contains a lot of out of favour sectors like finance, mining and oil. I don’t really see CAPE as a useful metric to compare between countries, but perhaps it has use as a historical indicator within each country. The US will probably continue to have higher CAPE than the UK indefinitely, or at least most of the time.

Aren’t US valuations down to QE and high savings rates chasing a limited supply of liquid investments. S&P 500 is limited to only 500 companies (obvs), how many Americans are putting all their dime into Vanguard 500 et Al thanks to Mr Bogle? Law of supply driving prices surely applies to equities too?

The JPMorgan Long-term strategy team put out a piece on empirical models of US equity returns in March this year. They looked a number of simple valuation and positioning signals: Operating P/E, Nominal earnings yield, CAPE ratio, Excess CAPE yield over USTs, Dividend Yield, “Buffet” indicator (Total market cap to Nominal GDP), US household equity holdings to total assets, and Tobin Q.

The first thing they observe is that the signals that are good predictors in-sample are not necessarily good out-of-sample. The CAPE ratio is one of those, producing good in-sample results but large forecast errors out of sample.

The second thing they observe is that these valuation signals produce a very wide range of outcomes. The Buffett indicator would imply -10%/annum returns over the next decade for a cumulative 65% loss. In contrast, the excess CAPE over UST yield signal implies a 12% annual return over the next decade.

The best signal, both in and out of sample, over the data set was actually the ratio of household equity holdings to total assets. With equity holdings now back at late 90s levels, this signal projects negative returns over the next decade. It has to be said though that this signal performed really badly since 2008.

Combining the best signals to minimize the root mean forecast error, produced an expected return of 4%/annum nominal over the next decade (2% real), compared to nominal aggregate bond returns of <1.5%.

Shudder, very near my FIRE number, makes me want to offload my equity funds sit tight and wait for the 30% drop “guessed/predicted” then sow them back in then FIRE. Anyone got a crystal ball? Think I’ll prep for another year at work, just in case and keep on depositing each month. Must be a mental thing that I don’t want to FIRE if we are at a peak

Oh good, predictions 🙂

If I had to guess where we’ll be in 5 or 10 years time:

– Significant inflation won’t have materialized.

– Stock returns, globally, over period back to today will have been paltry or slightly negative. Retail investors will lose faith and fall away.

– Savings rates will remain zero but mortgage rates will have inexplicably gone up.

– Property prices in hot areas will be roughly they are now. People taking 80% LTV mortgages today will be paying the same per month, or perhaps even more, when it comes to remortgage at 70% LTV, thanks to higher interest rates.

– Wages will grow to bring down those housing P/E ratios, but it will still be a struggle for people to buy, but:

– … unemployment will not have risen but even more people will have side-hustles.

– … both personal and corporate taxes will be higher.

– … tax reliefs stripped away. The annual allowance for pensions will be pushed down to £20K, with the Lifetime ISA allowance pushed up by £16K to the encompass the full £20K ISA allowance.

– Ethereum will eclipse Bitcoin both in popularity and price.

– People will be trading and holding “mirrored stocks” on the blockchain with most financial media accepting it as normal and governments will still have no clue how to regulate something that is completely decentralized.

– Apple will have at least tried to buy or merge with Nvidia.

– Revolut will have issued their own stablecoin token and IPO’d at a $40bn valuation.

– Generation Alpha will look at bank notes and even plastic debit/credit cards like Millennials look at vinyl records. Facial recognition and automatic payments will be the norm. Checkout-less stores operated by AI and cameras (like Amazons) will become the norm, at least in the cities.

A bit of research would’ve shown that CAPE is based on trailing 4 quarters earnings while market prices are based on forward earnings.

So effectively we are comparing valuations for rapid economic recovery to historical earnings in probably the worst year of the past decade and find out valuation is high. Shocking!

@BuildBackBetter — You write:

A bit more research still would’ve shown that CAPE is not based on trailing 4 quarter earnings, but is actually based on the past ten years of earnings. 🙂

Read my article referenced by @TA or others around the web for more. Cheers!

My personal view is that any metric of valuation is useless on a standalone basis. It’s only by looking at a broad set of metrics that you can get a feeling for valuations.

CAPE though to me has a big weakness of not incorporating the discount curve. So I prefer the Excess CAPE yield (Shiller, Black and Jivraj, Oct 2020) to CAPE itself. This helps to address that criticism. Very low bonds yields are an important driver of multiples.

Anyway you cut it though, the classic 60:40 portfolio is in trouble here. Not because it’s somehow “broken” but just because both legs look overvalued and asset correlations have risen. Time diversification is more important and the classic Markowitz doesn’t place enough emphasis on that.

@ZX. I am not letting you get away with that . So can you elaborate on ‘ time diversification’ pls?

@MrO (#21):

Did you catch this post: https://the7circles.uk/rethinking-60-40-part-2/

@Al Cam — I don’t mind the odd link to other sites where useful to other readers — and I know you’re doing it in good faith — but your very frequent linking to that website in the comments is getting a bit much to be honest.

Let’s leave that site to have its own comments and our site to have ours, in the main. Cheers! 🙂

@MrOptimistic. Investors think about reducing risk by diversifying their holdings across different types of assets that are not highly correlated to each other.

Similarly, they can diversify portfolio risk over time by holding assets over longer periods if the periodic returns on these holdings are themselves negatively correlated over time. Time diversification requires negative serial correlation in asset returns. It manifests itself in the annualized volatility of holding-period returns falling as assets are held over longer periods.

Example: US equities. Annualized volatility of real returns over the last 150 years for a 2-year holding period is 18.3%, but over a 15-year holding period it’s 16.3%, 2% lower. Equity returns are generally positive serially correlated (displaying momentum) from quarter to quarter but tend to be negatively correlated (mean-revert) over longer periods.

By comparison, for US Treasuries, for a 2-year holding period, volatility is 9.1%, but over a 20-year period it’s 11.5%, 2.4% higher. Short term, UST returns exhibit mean-reversion, over the long-term they tend to trend.

The issue with the classic 60/40 type analysis is that it assumes a single horizon period over which you calculate the “efficient frontier”. You look at it as just a start and end point; the analysis is path independent. The reality is that most of us are path dependent. We’d prefer the path not to involve the stock market dumping 50% the day after we retired!

The path dependence is also a benefit due to time diversification. Volatility and mean reversion are good because it allows us to buy low, sell high etc. Now passive fanatics see trading as blasphemy so they give it nice name – “rebalancing” – so they can do it and not feel like the sinners they really are.

In the last 30-40 years, if you bought your 60/40 portfolio, you earned 10%/annum and also got a nice negative correlation between bonds and stocks, so it was all happy days. Going forward that looks harder. “Safe govt bonds” yield nothing and look less “safe”. Stocks incorporate that low yield and look overvalued. The negative correlation looks vulnerable to switching back to positive if (big if) inflation comes back hard.

You need every bit of help you can get. In world of 10% returns, rebalancing adding an extra 0.5-1% is a rounding error. In a 3-4% world, you want that extra return. You want as much time diversification as you can find.

Personally, I’ve often taken positions in my portfolio that are just there to add that component. I just want to capture their tendency to mean-revert. Not because I necessarily see their long-term returns as attractive. Take HY corporate bonds or EM sovereign bonds. The annual volatility of HY bonds over a 2-year holding period is 10.7%. Over a 15-yar period it’s just 5.6%. Massively mean-reverting. So every time they get clobbered (like Mar-20) I buy some. I never intend to hold them. I buy only to sell, just to capture that tendency to mean-revert. If I could short them easily, I’d do that aswell.

“Bless me Father Bogle for I have sinned…”

@ ZX – I’ve read arguments in favour of precious metal equities on mean-reversion grounds. Have you ever looked into that?

@ All – Re: wider market indicators and where to find the data. ERN’s take:

https://earlyretirementnow.com/2018/02/21/market-timing-and-risk-management-part-1-macroeconomics/

(US centric but isn’t everything?)

@ Lesley – check out this piece for more bond rationale:

https://monevator.com/are-bonds-a-good-investment/

Yes, those are my bond choices in decumulation. Though I hold cash too.

@ Tim – thank you for that link.

@ Naeclue – Worth a look for how CAPE is holding up more recently: https://www.morningstar.com/articles/993648/maybe-theres-something-to-the-shiller-cape-ratio-after-all

@ Al Cam – It tells me that there are no easy answers. I’m only human so I can’t help looking at market indicators from time-to-time but I don’t expect to profit from it.

Re: Decumulation portfolio – I’m thinking on the lines of an annual update.

@TA. I only ever hold significant amounts of precious metals or currencies to trade their mean reversion (sorry ‘rebalance’). There is no value in being short GBP/USD if you are not taking profit when it gets to a 30 year low as it did post Brexit. There is no value holding gold if you don’t take profit when the markets rout on Covid etc. If you never take profit on them, they just turn in uncompensated volatility.

With equity and bond valuations at these stretched levels its good to ask, what are the alternatives? The fed has indicated a more relaxed attitude to inflation, so cash probably not a good option although better than bonds with negative interest rates possibly. Taking money out of equities could give you the chance to get back in at lower prices if equities fall but we are told not to try to time/beat the market. I look at equities today in the context of share buy backs, interest rates, the fed put and the absence of alternatives. The long term trend in interest rates is down and there is no reason why we can’t have negative interest rates in the future which would be positive for equities. Vanguard wrote a piece three years ago discussing the benign outlook for equities and look how wrong they were. However tempting it might be to cash in my equities, I will resist and do nothing, as a true passive investor is meant to do.

Favourite pastime on a Saturday morning: catching up on Monevator articles!

Looking at the iShares Global Property, I wonder how to get exposure to property in my portfolio in a tax-efficient way? I intend to rent for many more moons. And have my ISA with Vanguard where I haven’t found a property fund yet… Any suggestions welcome! (haven’t yet put any money into an ISA this tax year)

I’m very cash-heavy at the moment as I’m also struggling with the ‘passive’ in the passive investment strategy! 😉

I was lucky in that I sat on lots of cash early last year that I managed to funnel into my ISA with Vanguard over February to May 2020 so am up by ridiculous amounts. Now it physically hurts me to hit ‘send’ every time I decide to shift cash into the market… Is there a bigger first world problem?!

I will go away now and repeat ‘market timing doesn’t work’ three times.

The mad run that global equities have had does worry me (as does inflation as I get “taxed on inflation” when I hit 75 due to BCE 5a !) so I’m tweaking allocations a little by using “global dividend aristocrat” ETFs to get more of a value/income tilt. Of course, I then watch VWRL soaring away with GBDV less so, but while the former is hitting new highs, the latter is still well of its peak, and things have got to revert to mean, right? 🙂

There are similar ETFs to GBDV and don’t ask me why I chose that one as for once I don’t have notes.

It’s a good job the portfolio is only notionally held on Fidelity, because (unless I’m missing something) Fidelity only offer the “H class” units of those iShares funds, and they appear to have a 5% bid-offer spread, which I find a bit painful in this day and age. (Weirdly, for the iShares Emerging Market fund, they offer “D class” for the income units and “H class” for the accumulation units, but if I’m reading the ISINs correctly, your portfolio contains the acc units.) I’ve just found out the hard way by shifting my Fidelity-platformed UK equity allocation to iShares without reading the KIID properly. My own silly fault. I think the issue may also affect some of the funds on your https://monevator.com/low-cost-index-trackers/ page, but I haven’t had time to look them all up.

@David C — I think you are missing something. Every time this has ever come up before, it’s been a case of readers looking at institutional classes that don’t apply to retail funds. I grant the platforms clearly don’t make it easy to see this.

I’m not an expert though, so will await @TA’s comments. Obviously no reader should be paying a 5% bid/offer spread, and it’s very hard to with retail funds these days, if not impossible! 🙂

@ David – you make a great point about the outrageous spread on the H class iShares EM fund. Is choosing the D class inc fund not an option for you? I periodically reinvest dividends along with new money. That’s especially easy when you invest monthly. Or how about a different EM tracker such as Vanguard’s?

Charles Stanley or Close Brothers are alternatives to Fidelity if you want funds only. I mention Fidelity so that new investors have a starting point for research. Previously the portfolio was held at Cavendish which had the D class, but they merged with Fidelity.

I don’t think this issue affects other recommendations on the low cost index trackers page. I always choose D Class for iShares funds and steer clear of platform exclusives like the H Class.

Thanks for raising this though, it’s always worth checking that a fund that seems competitive based on OCF hasn’t got a sting in the tail like that H Class one.

@TA: Cheers. It’s not the end of the world. New ISA money is going into a fixed-fee platform (Halifax) which offers the D class for iShares, so I’m less worried about that, but I have a big chunk on Fidelity, and I was looking for alternative providers to my HSBC and Fidelity index funds, where I’m bumping up against the FSCS limit, and alternatives to Vanguard for bond/gilt trackers, as I want to go more defensive. Especially as I’m using Vanguard for my modest SIPP. Annoyingly, the iShares bond/gilt _funds_ on your low-cost list are all in H-class on Fidelity too (apart from the Over 15 Years Gilt D acc, for some reason). I guess I’ll just have to look at the ETFs. When I was starting out the £9.50 dealing fee for ETFs put me off – but that now looks like an absolute bargain in comparison! I could/should transfer to a different platform, but Fidelity doesn’t allow partial transfers out (another bit of small-print I wish I’d noticed earlier), and I’m too scared to transfer the whole lot in one go.

@TI: Yes, I too thought massive spreads and initial charges were a thing I didn’t have to worry about in the 21st century. Apparently not. Fidelity definitely don’t offer a choice of classes. I can’t imagine why Fidelity and/or iShares do it. Surely nobody who actually reads the small print is going to take a 5% hit on a bog-standard product. As TA has pointed out, there are alternatives. Fidelity or iShares must just not want the business.