Knowing how much you need to live on is key to achieving financial independence (FI). But a common mistake is not accounting for the depreciation of big-ticket items, and for irregular but direct hits to your bank balance.

We’re talking about expenses that don’t happen very often, but bust the budget when they do.

For example, replacing the roof is a peril that hangs over my head like an Independence Day UFO, or a menacing killer asteroid patrolling the edge of the solar system.

You know something’s lurking out there. It just hasn’t arrived to blow apart your financial life yet.

One option is to bury your bonce in a convenient bucket of sand. But if your FIRE 1 annual income is to withstand reality, it needs to include these dark star expenses – lest a cluster of them materialise and put a black hole in your budget.

Identify the cost-bombs

First, you need to list the shock expenses that individually show up once in a blue moon – and yet one or another occurs all the time.

For example: new car, boiler, windows, roof, white goods, tech, replacing kitchens, bathrooms, and private jets (I can dream).

Bucket list items might go on here, too. For example, trips of a lifetime, dream house move, and your next wedding or divorce. (I jest but personal tastes vary).

Next, you need to estimate these costs, and then average them out across the years. This way you can add a single figure to your annual FIRE income.

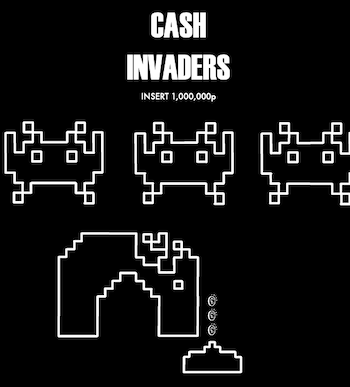

We’re not attempting to predict the exact cost or timing of these events. The idea is to create enough wiggle room in our budgets so that we can deal with the bills when they land like Space Invaders.

In lucky years, you’ll underspend. Any spare cash can then be dropped into your piggy bank! (Of course it will).

In years where you crossed a black cat or similar, you’ll need to raid that piggy bank for extra cash. But that’s okay because your overall FI number was built to withstand these expenses over a lifetime.

Straight line depreciation

The Internet runneth over with advice of varying quality on these matters. But I find straight line depreciation is a simple yet useful accounting technique.

Straight line depreciation helps smooth out the cratering effect of each expense into more of a boulder field on my spreadsheet.

Each item is rendered as a depreciating asset using this formula:

(Cost of asset – resale value of asset) / asset’s useful life

= cost per year

For example, if the replacement cost of my car is £11,000 and I can subtract £1,000 for resale value, then if I expect the car to last for 10 years… I need to budget £1,000 for a new car every year in my annual income figure. (Plus a dollop for inflation as the days go by.)

Theoretically, I’ll underspend by £1,000 every year and £10,000 will be ready to purchase the car when it finally kicks the rust-bucket in ten years.

Real life doesn’t work as neatly as that. But, in principle, this is how to build a FIRE budget that can bend with the bills that come blowing in.

Run through this exercise for every item you put on your whopper-expenses list. You’ll then have the extra amount you need to budget for, on top of your day-to-day living costs that are easier to track.

Of course, this model comes with more qualifiers than the Champions League 2.

For a start, you’ve probably already noticed it’s a massive guesstimate.

That’s because straight line depreciation requires some kind of grip, however infirm, on:

- Cost of replacement (very approximate)

- Lifespan (more approx still)

- Resale value (super approxy)

Despite notching fairly impressive numbers for neuroticism on the Big Five Personality Trait tests, I’m comfortable that this is a lot of guesswork.

The priority is to add a number to your budget that will enable it to flex to cope. This way you avoid sticking your head in the sand – or worse, actually leaving employment without having accounted for these future expenses at all.

Personally, I aim to make this task relatively easy to do and to update annually. As opposed to modelling every eventuality like I’m a supercomputer, but then never being able to face doing it ever again.

Make it doable

The first thing I did was drop the resale value part of the depreciation equation. That makes my numbers more conservative and saves me a sack of work.

What about the cost of replacement and plausible lifespan elements?

Well, there are websites that publish lists of costs for a mind-boggling array of home items, along with their lifespan.

Gawd knows how useful that is.

Some publish costs in dollars and they have to be putting their finger in the air like they just don’t care.

For certain things, it helps to consult, for example, a ‘New boiler cost’ article, if you don’t have prior experience of the job in question.

If you’re conservative or sense that you’re sitting on a cost timebomb (such as an old house with ancient pipework that should probably be condemned), then plump for the high-end of the price range.

My roof sits on the edge of oblivion, so it was sensible to ask a couple of roofers for a cost estimate. Next big storm, and one of them will get the work.

White goods – I’ve replaced most of them in my time, so I’ve got prices in my budget tracker. Otherwise, it’s easy enough to find the price of a fridge that looks the part.

Brand promiscuity – There are items that many of us don’t care that much about but know roughly how much we’re prepared to spend. The car falls into this category for me. I’ve set a price ceiling and I’ll operate within that next time.

Brand loyalty – Sad to say I’ve got this terrible affliction when it comes to my laptop. As long as I keep tabs on Apple’s latest price-gouging hijinks then I’m sorted. Though it might be cheaper to pay a psychoanalyst to fix my mind.

Past experience and years of budget tracking have given me a reasonable sense of how often I replace my big-ticket items. I’ll take an online estimate for everything else. You can also ask friends and family.

I don’t revisit the prices for everything on my list annually. I simply adjust upwards for inflation and update from my personal experience.

It’s probably a good idea to review the price for each item every five years. Costs can escalate drastically where materials, methods, or health and safety legislation have changed since you last looked. (I don’t actually do this but I should.)

Obviously it’s better to research in-depth any expenses that may be a very large and open-ended can of Lambton worms.

Yes, I’m thinking of my roof again.

What goes on the big expenses and depreciation list?

This really depends on personal preference, but here’s some ideas:

- Windows

- Gutters

- Roof (AIEEEE!)

- Boiler

- New kitchen and bathroom installation

- Redecorating every other room in the house

- Oven

- Fridge

- Washing machine / dryer

- Dishwasher

- Fencing

- Car

- Computer

- TV

- Bikes

Lifestyle counts for a lot here. I read a comment from someone talking about how they replace their couch every seven years. I’ve owned one couch ever, it’s near 30-years old, and I still love it.

You’ll also need to adjust your numbers for things nearing the end of their useful life.

For example, if the Internet says your windows need replacing every 25 years but yours are held together by paint, putty, and the power of prayer, then it’s better to set aside a lump sum than spread the cost across your annual budget.

Anytime I ask an expert to look at something in my house that leaks, creaks, or causes Mrs A. to freak, they generally say it could go anytime in the next five years.

Home maintenance rules of thumb

The expenses listed above are on top of basic home maintenance – that is the ongoing cost of patching things up, nailing stuff down, and stopping the place falling apart.

Various upkeep rules of thumb have colonised the Internet.

Here’s a common one:

Allocate 1% to 4% of your house price to your annual home maintenance budget.

You could go with 1% if your home is less than five-years old. Perhaps 4% if it’s past its 25th birthday. Maybe add a premium if you live in a Grade 1 listed medieval property in Lower Slaughter.

Obviously you can run a coach and horses through that range depending on the existing state of your home, construction type, location, size, and so on. And so some prefer this guideline:

£1 per square foot of property size = annual home maintenance budget

My guess is that these rules of thumb caught on because they’re simple, not because they’re accurate. I mention them because they’re a starting point if you don’t have much experience of home ownership or tracking your expenses.

These days I just average out my home maintenance costs tracked over the last decade.

Don’t over-optimise

Most of us can swap war stories of expensive gear that broke 24 hours after the warranty expired.

Equally, we all have a heart-warming tale of that one heirloom appliance that’s still going strong, even though spare parts can only be sourced from a museum.

All of which says to me: it’s better to be roughly right than waste a lot of time being precisely wrong. I’m not running one of the big four accountancy firms.

Because bad luck runs in threes, I maintain my emergency fund in decumulation. I will dip into this when replacement costs are sky high and replenish when my luck changes.

After minimum pension age, I’ll be able to access my entire stash and then it’ll be fine to spend more than my sustainable withdrawal rate to meet a big expense occasionally, on the assumption that I’ll spend less in the years when nothing breaks.

Lumpy expenses can even be smoothed out by paying on a 0% credit card as long as you’re sure you can pay off in full, or that you will transfer the balance once the promotional period expires.

Others will dip into offset mortgage accounts or pawn the kids.

Let us know in the comments what techniques you use to account for irregular budget blowouts and depreciation.

Take it steady,

The Accumulator

Comments on this entry are closed.

Interesting. My parents were always worrying about the roof – I assumed it was a generational thing : a kind of latent fear of the ‘horrible financial outcomes that can come from owning your own home’ and one step short of ‘you come home from work and the whole thing has collapsed’, which I think even they would have admitted was fairly unlikely….

I’ve always had a “Reserves” line on my spreadsheet for big ticket items: house maintenance/refurb, cars, holidays etc. The various sub-lines always have a negative value, and the value decrements each month based on a formulae: £-1k/month for house, £-1k/month for holiday, £-500/month for car etc. So paid a plumber £1k for some work, the current account line decreases by £1k but the reserves line increases by £1k, so no net worth reduction.

I like that this means I’m always understating my net worth by £100k+. Feels conservative. When one of those big, unpredictable (but inevitable) house maintenance items comes along, I feel it’s already been paid for. Reduces the risk of being cheap resulting in ‘buy cheap, buy twice’ issue. It also means that when my better half wants a new kitchen that costs £50k (yet oddly looks exactly like the old kitchen), I can smile and just say ‘yes darling’!

Greate article. I recently adopted an almost identical process, even down to the point about ignoring resale cost. Run it ’til it dies is my motto.

A bit of a sobering exercise as it increased my monthly number by 50%!

Still in the process of digesting the implications of that. Interested in what percentage of planned monthly or annual spend others FIREes are allocating to major spend and depreciation?

Love it. Absolutely – ignoring these things is not a solution! But neither is it worth creating another huge s/sheet and trying to capture every possible angle. And that’s from someone who enjoys a good s/sheet

We did something pretty similar in coming up with how much makes sense. There’s a pot for house, car & holidays as well as ‘other’ in our cash holdings. We still pay a regular amount into them and then as/when needed it’s there.

One thing we’ve thought about is increasing the amount as we get older. We’re pretty hands on now but already my appetite for climbing up ladders to fix my roof is declining fast…

And it’s defn true it’s very lifestyle driven. The more you own – the more you have to think about. One of the best parts of travelling so much is staying in places, noticing some maintenance task and ignoring it . Until we get back home…

PS Apols if this is a duplicate, been having some issues posting comments lately. Maybe someone is trying to tell me something..

I’m abroad but thinking of moving k to the UK once I reach my number, hopefully next year, but this means that it’s been hard to budget based on my current situation.

I’ve been using the results of the most recent ONS household expenditure survey to plan what I might need. Although broken down onto shorter timeframes I was hoping these kind of costs were built in. I should probably check!!

@David (#4):

Geographical relocation is always a tricky one!

The OECD publish national level data – but it is always averages – and the cost of living varies enormously within some/most nations. I found this site a few years ago and IIRC it is populated with participants experiences/inputs. And, at least in principle, it does allow city to city comparison, see: https://www.numbeo.com/cost-of-living/comparison.jsp

Another source of helpful info re the UK might be the: https://www.retirementlivingstandards.org.uk/

Best of luck.

I really like your approach here. I took more of a lackadaisical thought process and baked in roughly 5% of my total expenses for these types of items. Something typically comes up every year so I figure that it’s already been baked into my historical budget that I worked off of, but I think there is more risk going forward because house is getting older and my cars are getting older. Basically everything including myself is just getting older!

I have a budget spreadsheet with columns of expenses that are weekly, monthly, quarterly and yearly. The totals are all multiplied by an inverse of the period before adding to an annual total. There’s a fractional replacement cost in the spreadsheet for each item I think is worth tracking.

I had a fridge last nearly 20 years.

That’s funny. I was thinking to myself the other day that Monevator must have covered this but I couldn’t find an article. It is a tricky one and I’m glad to see from your post today that I’m not a complete weirdo with how I’m addressing it. I have varied my approach over time as I’ve been a bit indecisive on what to do.

I split my expenses into five categories, of which two (4 & 5) form what you are talking about here:

1. Core Regular Bills e.g. Council Tax, electric, gas, food etc I.e. the essentials

2. Car Running Costs I.e. Tax, Insurance, Servicing, MOT & Fuel

3. Fun I.e. hobbies and holidays

4. Lumpy Expenditure (Short Term) I.e. Clothing, Gardening stuff, Electrical & Appliance replacement, home repairs and maintenance under £500.

5. Lumpy Expenditure (Long Term & Expensive) I.e. Car replacement, Windows, Roofing, Carpets, Boiler, Fencing, Kitchen/Bathroom replacement.

I suppose by short term I mean things that last less than ten years, while long term is over ten years.

Category 1 – I’m using this as the basis of understanding my personal inflation rate. These are the essentials so I want to understand how they vary year to year.

Category 2 – It’s beneficial I think to isolate car costs and understand what the environment/health destroyer is costing me. It helps me minimise its use. I have these costs logged for the last 13 years so I have good data here.

Category 3 – Easy to cut in times of trouble.

Category 4 – I suppose I’ve followed your straight depreciation method here. I feel this category is fairly easy to estimate for in terms of white goods and electricals. I base this on an 8 year lifespan for most items and that has normally meant I’m over-saving here. I own numerous electricals that are over 10 years old. I’m keeping this approach as a safeguard.

Category’s 1 -4 total my annual expenditure and therefore my FIRE number is derived from this.

Category 5 are so random as to when they may be needed and are very expensive when they do occur, that I’m budgeting for these with a separate pot invested in something like VGLS40. I cover this category from earnings right now so I haven’t yet built this. I deliberate over how much to have in it but have currently settled on £45k. By taking these out of my FIRE number it means I get less volatility in my overall annual expenditure. Category 4 is fairly consistent so my numbers don’t change much year on year and that is providing me with the confidence in my FIRE number. I just need to settle on a figure for this separate lumpy/expensive item pot.

Sorry that was a bit longer than I thought it would be. I hope I haven’t bored anyone! I could talk about this stuff for hours!

Ah, cost bombs in America are always:

Healthcare

Housing

College tuition!

If one can handle those, then FIRE becomes so much easier! Makes all other cost bombs like a boiler blowing feel like nothing much.

Sam

Hmmm, pawn the kids…. How much do you think their worth? Just kidding!!!

An interesting thread. I am still working through this, but see costs split into three: regular monthly/annual bills and expenditure, including for entertainment and holidays, which can be calculated fairly precisely, medium term expenditure (every 5 to 10 years), for which I make an annual provision, roughly calculated (this covers items such as car, white goods, technology, and general property maintenance), and a separate largish pot for one off big expenditure, such as new bathroom, boiler, etc (roof overhauled a couple of years ago, so not included as should last 20-25 years hopefully). Its not an exact science (especially the last one, which keeps changing!), and we will adjust as we go along, including for inflation.

@ never give up – your comment the other day made me write this! It was on my list for ages but I’d never actually gotten round to it. Looking at your approach, it seems to me that were already all over it 🙂

@ ZX – nice approach, I really like the idea of feeling like I’ve pre-paid the bills. “Buy cheap, pay twice” is an absolute killer. Tell your better half that the cost of your new kitchen wasn’t far off my annual salary 😉

@ Accidentally Retired – heehee. I know what you mean. Things that creak refers as much to me as bits of the house.

@ Sam – yes, same here, though most of us use the NHS for healthcare. You have lower taxes of course but I’d rather have the NHS.

@ Budget Life List – Probably less than they’d hope 😉

Ah excellent, a decumulation article – may there be many more of them.

Also on my capital list; seriously expensive (£20k) holiday every 2 years, in

addition to the regular trips. Dentist; in the first 2 years, I needed 2

implants (roof type expense).

Pre-FIRE, I had everything on a spreadsheet, from Air travel to Zoo trips.

After a few years, I sorted the lot into about 6 categories and made some

generalisations on what got spent, suitable graphs and I have monthly/annual

numbers. After 6 years FIRE, I’m pretty much on track, with no wobbles from

collapsing roofs (new one next week if the roofer shows up) and have several

new Apple toys. Only if the wheels fall off, will I get back into

micro-managing, which is a tedious way to spend time, even in these locked

down, travel free, friend free, days.

BTW, if you know your roof is dodgy in spring, get a new one soon, before the

autumn gales make the matter urgent, roofers as rare as hen’s teeth, and the

cost rise stressing your numbers.

Further down the road than most posters her? Now 75

Running expenses in Quicken for many years pre retirement gave me a good handle on daily expenses so even big items like cars could be sort of allowed for.

Found it very difficult if not impossible to have a systematic approach because of regularity/irregularity of these large items appearances in the budget

Re roofs……

A surveyor friend of mine told me I needed to renew my roof 50 years ago- it now looks if it will see me out !

Live well within your means and be able to tighten your belt if required -we would have reduced holidays initially to release ready cash-never had to luckily

xxd09

@ The Accumulator – I can’t remember what comment that was but I’m very excited I helped the post along! It is a good subject to cover. The amount of times I see a FIRE budget that doesn’t allow for these infrequent but expensive maintenance items is quite surprisingly common.

I’m a bit indecisive over the separate pot approach but I’ve done my best to understand my expenses and plan accordingly.

Re Chiny’s “roofers as rare as hen’s teeth” – agreed! I’ve been getting roofing quotes this week and the ones that can be bothered to come out and quote all seem to be booked up for work until August. Pent-up demand, obviously.

Re the capital expenses – I notionally earmark 1% of my property’s value per year for maintenance and repairs, but started FIRE with a few years’ worth set aside in case I needed to call on it in year 1 or 2. I also budget £xk for travel and holidays, and in later life when I’m old(er) and decrepit and have lost my wanderlust that will be re-purposed into a fund to buy me gardeners, cleaners, taxis, and similar services.

We are getting quotes for those plastic fascia that gutters attach to (bargeboards?).

The guy we use who has done a patio for us before is booked up until January with large jobs and is just doing a few 1/2 day bits like we want in between.

Guess all that C19 savings are going in to house improvements.

Some of these building issues might be covered by insurance, I have had to organise some tradespeople recently at about 2k per room which should be good for a long time and what’s bothered me more than the money was the sheer inconvenience of having your house turned upside down, not feeling at home in your own home, having to chase up defects, dealing with attitude, them not wanting to take the job as far as we wanted, them trying to charge for the job on top of a labour charge for the same day, them not taking all the rubbish you paid them to, knowing who to trust and if they’ll turn up after paying a deposit, etc.

Anyway you could consider equity release for some of this stuff – taking money out the house to put back into the house. Equity release can square some of these bumps in the planning and we can outperform it with equities, although it might make it difficult to downsize.

Also I wouldn’t underestimate how long things can last – especially cars, thar be galvanised steel now. Also I did have a washing machine fault but it was fixable.

Buy an end of life car with 1 years mot – if it lasts more than a year you’re winning. Also not only do you avoid depreciation but also opportunity cost or worrying about fender benders, and it also lets you trick friends and family to conceal your wealth. Also old cars might become future classics – why shouldn’t this asset accumulate too? And if it does become a classic car you might be able to escape electrification if you have no driveway.

We have taken the approach of jar or pot saving since having a offset mortgage with IF back in the Nineties, it came with as many “jars” as you wanted to set up within it. We view savings as savings for big ticket spending, holiday jar, household jar, car repair/insurance jar and a treat jar each (naughty jar, sorry). I worry if the household jar drops below 10k, and in truth the times a jar has not been sufficient, the other jars step up to the job. Most get pleasently oversubscribed but work well as buffers. The rest of the savings we see as “deep savings” our initial jar for this was called “untouchable” and remained so, although the new roof nearly touched it.

The deep savings jar will be the only one we stop funding when we retire, the others will be funded from regular income. ATM we have been building a surplus in “holiday” pre retirement and hope to have enough to do it justice in year one.

On the subject of the roof. Our original roof had been on the property since 1860. I know this because the ones we took off were Kirkby round head slates, not produced at the quarry since early 1900’s. We put back the slate in new Kirkby blue, so I expect it to last me out with occasional small repairs. 12 years ago this cost 12k for a coverage of 100m squared. The old slate I used to roof the new garage and half of it was still sound after 140 years. I hear good things about Brazilian slate also. Work today is more expensive as we are not training enough tradespeople, the tradespeople we have are ageing and we just voted to stop importing them to work. Most tradespeople I know, and I interact professionally with them week on week are busy some have booked work for 18 months.

The pot method might not be for everyone but it has served us well in running the rest of the day to day budgets from what is left and I cannot see this changing. Our deep savings are seen as a separate entity.

JimJim

Are we not in danger of seeking perfection here?

Yes, absolutely, having an idea of what your main “lumpy” expenses are is a very good practice. But a fridge freezer is what £4-500? A laptop the same (maybe double for a Mac, but if that’s your thing…) Surely that’s a bit of saving out of the monthly budget or judicious use of credit cards?

And when we moved onto our house in 2012, we got the flat roof done. 150mm of insulation and EPM with a 15 year guarantee was £15k for 75m². It’ll see me out I expect.

Bearing in mind this is a one off, can’t this be just a large drawdown? The main danger of running out of money in retirement is not occasional large withdrawals, but an unsustainable SWR for decades.

Just my tuppenceworth.

@Brod — Hi. I think it’s a case of each to their own. 🙂

@TA knows that I’m much more in your camp. I’ve never done a budget in my life. I probably juggle figures roughly in my head more than I think I do (and I guess I can get antsy when various numbers fall below various mental thresholds) but the idea of me projecting forward the cost of replacing my dishwasher in 2029… well it’s a non-starter.

However I’ve met innumerable people who swear by budgets and forecasts — including, crucially, a preponderance of those who were spenders and are now savers. So I’m delighted we’re running these sorts of articles for that audience.

What’s more, I suspect that as much as the practical benefits of doing the budget and (if it’s part of your practice) setting any money aside, the mental exercise helps keep such people on the straight and narrow. Sort of like going to an AA meeting!

My ‘problems’ like elsewhere (https://monevator.com/buffetts-folly-compound-interest/)

But as ever, best to know oneself and act accordingly. 🙂

Don’t talk to me about the roof. The thatchers arrived at 7:30 to start work. That’s the best part of £20k on it’s way out. Don’t understand the worries about white goods. Fridges, washing machines, tvs cost about the same now as 40 years ago. Based on a 10 year life won’t £200 pa cover these ?

In our case the “emergency fund” is there to deal with irregular but essential (non discretionary) items. The annual discretionary budget flexes cope with home improvements tech upgrades new toys and the like, by reducing spend on overseas holidays (anybody remember them ?) Our fire number broadly supports an annual 50/50 split between essential/discretionary spend we just need to agree on our discretionary priorities be they kitchen refits or more holidays in nicer accommodation 😉

To @TA,s list of unforeseen expenses apartment dwellers should be braced for fallout from Grenfell ie the Cladding crisis, which in our case is a 75k addition to this years service charge, should we fail in getting that cost met by Gov remedial fund…… never saw that coming in our Fire plans……

@TA If your roof sits on the edge of oblivion, schedule its replacement ASAP rather than waiting for it to blow off. Less mess, less stress, less collateral damage.

I’ve had most of the replacements you mentioned (don’t have a car). Paid for from the emergency fund, and replaced that from income over the following year, instead of longer term savings or discretionary spending.

I sent a still working TV for recycling within the last five years that had been in the family since before Channel 4 was a thing. Could no longer get an input signal after Virgin Media’s set top box was replaced with one with no ‘aerial’ output.

By coincidence (or not?) Fritz of The Retirement Manifesto covered this very recently; see the 5th question (“Lumpy Spending”) to see how he budgets for the ‘expected unscheduled money spending events’: https://www.theretirementmanifesto.com/your-bucket-strategy-questions-answered/

Timely topic for me. Over the last couple of months it has dawned on me that a lot of the money I have saved and invested for retirement is in reality being stashed away into a big ticket items fund since every big ticket item is over ten years old except for my tech stuff and even that is on its last legs – phone and laptop are 5 years old and PC 8 years old, car 15 years old and kitchen dates from the 80s! I have had a good run out of all this gear but it will need to be replaced, some of it soon.

Not sure how I will account for these items once I retire but I like the simplicity of the put aside pot@never give up. Save the money and then leave it alone knowing you are going to be covered.

Having gone into FIRE 14 years ago I initially just tracked what I spent but soon refined the system into an average of all costs, eg Cars spread over 8 years, computers over 5 years, iPhones over 2.5 years etc for a monthly spend.

My final twist is to divide all such expenses into ‘immediate’ eg Council tax, Electric, Gas etc go out every month, but cars, computers, holidays can be ‘deferred’

The big thing is that investment returns are never a smooth (say) 6% a year, year in year out, but very lumpy. After the initial shock of 2008/2009 investment returns quickly made up the deficit and subsequently have exceeded the expected by some margin.

The last two weeks have provided gains well in excess of my anticipated annual expenditure, it seems hard to worry too much, however the opposite is also possible. I find having £100k+ in near cash makes life far more enjoyable, if the belt needs to be tightened this would keep us going for some time…

Yes there is an opportunity cost but peace of mind is priceless and I am in no doubt from that position of strength you can relax through the market downs and stick to your portfolio.

Rather than account for roof repairs, boiler repairs, I have a category “Sh*t Happens” for the unexpected..

Agreed, there’s a lot of expenses I don’t worry about here. Insurance for castrophe and a fighting fund for a few tens of K for the rest.

White goods? If you very stuck, chances are you’ll find someone locally giving one away for free or near enough to it. Computers, ditto. I like my Macs too, but always buy secondhand and sell on before they get too old. The actual per year cost is very cheap – especially given how much time I spend on it. If push comes to shove I can do without most appliances for a while/indefinitely.

Cars. Don’t have one, probably never will.

Roofs last a very long time. Some of our roof is 100+ years old and storms are what insurance is for. If it ever needs serious work that I have to pay for, chances are that it won’t need doing again in my life time.

Developing skills in some stuff will help keep costs down – as well as having quality friendships with competent mates and tradespeople (as well as useful skills you can trade).

I often think of life/maintenance costs as a bit like eating out in London. No matter how rich or poor you are – there is a version you can afford. I see cottages around here with the chimney stack wrapped in plastic until better financial weather visits the occupant. Sometimes it takes years.

Some useful ideas and comments – think I’ll rename one of my spreadsheet categories “Sh*t Happens” – thanks @HariSeldon 🙂

One of the reasons I went through this exercise is because my FIRE is pretty lean. I have budget flexibility but it could be wiped out in any given year by a bad run of luck.

And sure, any given item may be relatively affordable but a swarm of small expenses mount up. The depreciation exercise added an extra 10% a year onto my income requirement. I was glad I did it.

@ G – good tips, cheers.

@ Cigano99 – I’m sorry to hear you’re caught up in the Grenfell fallout. It’s a tragedy and a national disgrace – makes me despair every time I read about it. Yet another system that failed those it was designed to protect courtesy of greed, incompetence and indifference.

Looks like I’d better saving for a new roof by the looks of this article before sending the resignation email

@TA – this article is handy for whole life I think, not just decumulation

The housing maintenance rules of thumb made me laugh – even with the caveats – the figure at 4pc is 30x the sq ft figure ! Although in fairness I guess people with small square feet and high house prices probably pay service charges

@ BBlimp – yes agreed on the house maintenance rule of thumb – I think it’s just a starting point. I didn’t have a clue about home maintenance so something like this would have at least got me thinking when I first bought.

As it was, the whole escapade was a stretch in the first place: relying on an interest only mortgage, a promotional rate, and reaching for the next rung at work. I remember a friend saying if interest rates ratchet up then you’re screwed. He didn’t see the GFC and ZIRP coming did he? Ha.

My thinking is when I retire I will I have a chunk of cash stashed say £50k, this should cover cars, the roof flying off, surgery that you have 2 wait two years on NHS for etc. So, I set this up once and don’t worry about it again.

Outside of this surely smaller ticket items, holidays etc should come out of your pension when they occur (or just spread the cost over a couple of months the way we do when we have a salary) if not then maybe the fire is too lean/or the purchases too extravagant?

I get that some just like budgeting (me too) and I love a good spreadsheet but for me this level of micro managing would be stressful and start me worrying about every penny

@TA

Thanks for following up promptly on your comment in the Monevator article of 13 April.

It’s helpful to see a list of big-ticket items – a new roof wasn’t previously on my radar. Like others, I don’t concern myself so much with the lower value things (e.g. white goods) as I would hope to be able to absorb those as they arise but I can foresee that during a long-ish retirement, an updated bathroom or kitchen may become necessary. never give up‘s five categories approach is a useful model for prioritisation too.

I imagine there are lots of retirees like me who are incapable of running complex budgets like some suggested above. Reasons include sloth, ineptitude, gagadom, the need to pass a very simple baton to a disinterested widow, etc.

All our income goes into a cash account and the balance keeps rising modestly. This account is meant to cover new cars, sharp dividend drops, etc. A monthly spending allowance, based on years of spending accounts, is then transferred to a second account and is rarely totally spent building up another healthy balance.

This second account covers expenses such as car maintenance, insurances, holidays, new white goods and recently a new boiler. We chose to live in a newish house to minimise major repairs.

When the time comes for nursing homes, or a one-way ticket to Switzerland, we will sell preselected shares.

So far so good but nobody really knows what the future may bring.

TP2.

I’d pay for most of these, certainly white goods failures, boiler kaput, minor house/property repairs out of the emergency cash fund, and then top up said fund afterwards.

A complete re-roof including rotten timbers is maybe outside that scope and you’d have a separate budget if you own a much older house likely to be hit by that in the foreseeable future.

I think fixed monthly saving in advance works best for things like cars, where you aim to sock away at least enough to cover the likely depreciation.

In recent years I’ve aimed to buy used cars that are fairly popular and depreciate by no more than £1000-1500 per year. Not full on bangernomics exactly, but perhaps tidy low mileage examples that are 5-7 years old at time of purchase, and keep for a few years before changing to minimise the hit of ‘dealer spread’.

@ New Investor – my apologies! It was you who inspired me this time. Thank you for clearing that up.

@ SemiPassive – what info sources do you use to identify your quarry?

@ TP2 – sounds like you have such a firm grasp on your finances that you can manage by intuition and experience. Thanks for the wry grin about tickets to Switzerland. I’m a sucker for black humour.

@TP2 (#36)

Re: gagadom

I had to pause for a bit before I worked out that you did not mean Lady Gaga on Champagne! This might just be a sign of early onset!

TA, I don’t have any particular source but keep an eye on the market on the main classified websites (good old Autotrader among them) in anything I might possibly be interested in the future, combined with geek-like research into any models known to suffer from ruinous mechanical problems.

But some strange things have happened in the used car market in the last 12 months. Quite a few models have actually gone up in value, especially sporty cars or otherwise desirable stuff. A combination of lack of supply, lockdown-trapped buyers able to save more disposable income, and maybe even a smattering of YOLO in the face of Covid.

You could even play the “guess the next future classic” game on the basis of what has happened to certain 70s and 80s cars, and bag an appreciating asset. More viable if you don’t need something too modern for a daily commute and don’t cover large mileages.

@semipassive – I’ve heard that 2nd hand cars abroad (left hand drive) were historically more expensive than ours, so much so that foreigners have been surprised by the cheapness – maybe we’re less of a supplier of cars nowadays and our demand has matured more?

Also many cars live far longer now, maybe that makes it easier for suppliers to avoid oversupplying us.

Perhaps also the scrappage schemes we’ve had. Perhaps also people feel less easy handing over cash in a private purchase and so are going to dealerships instead.

Maybe also low rates have bouyed cars value and cars are also a good currency for money laundering when other options have closed – perhaps criminal money has had to go that way a bit.

There could also be anxiety about electric cars and so people buying guzzlers now to avoid being pushed later. – We might have a lot more classics when petrol becomes a (convenient) novelty.