The government has revealed a new plan to get more houses built – and to enable more of us to buy them.

But I think it’s better news for shares in house builders than for the young, would-be home-owning masses.

Theoretically, first-time buyers will benefit from the new scheme to get the market for 95% mortgages going again.

The plan will see the government acting as guarantor of high loan-to-value mortgages, in conjunction with house builders, as The Independent reports:

The Government will underwrite a small percentage of each loan on newly built property. Banks are typically demanding a deposit of 20 per cent on loans to first-time buyers and, by guaranteeing a portion of the loan, the Government will in effect be shifting that “loan-to-value” ratio so that the borrower needs a smaller deposit – possibly as little as 5 per cent.

That, it hopes, will lead to more demand and provide a boost to the construction industry in terms of sales and employment.

As I understand it, the government is proposing that in order to achieve a 95% loan-to-value mortgage, a house builder would contribute say 3.5% of the property price and the government another 5.5%.

Together they’d be putting up 9% of the purchase price. Therefore to grant a buyer with a 5% deposit a mortgage, the lender would only need to put up 86% of the purchase price (100-9-5 = 86%).

With banks still hoarding all the cash they can, that’s a much more attractive deal for them than having 95% of their capital at risk.

High loan-to-value mortgages mean big risks

As a potential home buyer, however, the first thing to note is it’s you – not the government – who is first in line for losses should you sell your house for less than you paid for it.

I think that’s only right – a scheme protecting buyers 5% deposits would be untenable, giving a free option on house price rises.

Still, it’s likely to be misunderstood by some people. I remember that when so-called Mortgage Indemnity Guarantees (MIG) were in vogue in the 1990s – before reckless banks stopped bothering to account for the extra risks of high loans – there was little clarification in the mortgage documentation that the MIG protected the lender, not the person paying it.

But a more important question is whether new home owners should actually be risking taking out a 95% mortgage on a new build property, even as prices stagnate across much of the UK.

New build houses generally have a premium price, which lasts about as long as the leathery smell of a new car before they start depreciating.

Banks therefore don’t like lending 95% against the value of a new build property, for the very sound reason that any particular aggregation of laminate flooring and beech kitchen units is unlikely to be worth quite as much again until house price appreciation papers over that lost premium.

And outside of prime London, house price appreciation is notable by its absence.

While I understand the frustration many feel at not being able to buy a home, taking out a 95% mortgage on a new build property that the government is effectively bribing banks to lend on seems a risky way to go about it.

Buying the shortage of houses

Given the new climate of financial responsibility, it seems strange that the government wants to encourage high loan-to-value mortgages just a few years after the collapse of Northern Rock.

A cynic might say it amounts to State-sponsored negative equity!

A few years ago I would have suspected it was all part of a ruse to prop up high house prices. But having been repeatedly humbled by the strength of the London housing market – easily my most costly financial misjudgement – I’m nowadays less cocksure about the path of house prices.

Specifically, I now accept that there’s a structural shortage of homes for people to buy.

Note that’s subtly different from saying there’s a lack of places to live in. While rents have increased in the past couple of years as up to one million people have had to rent a home who would previously have bought a house, I’m not convinced there’s not enough rooms with beds in them for the UK population.

I now agree though that there’s probably a lack of properties that people want to buy, in the places that people want to live.

And while you might argue market forces should be the best way to fix this, I’ve come to the view that there are structural reasons why this isn’t happening.

Some evidence for this is the difference between the path of prices in the US and the UK.

Both countries experienced booms – indeed ours was much bigger – and both have seen new housing ‘starts’ derailed in the recession. In both countries mortgage holders have benefited from cheap money, too (at the expense of prudent savers, but that’s another issue).

Yet whereas US prices have fallen back to more sustainable levels in most areas, in the UK prices still seem stuck above both historical price-to-earnings ratios, and also higher than many pundits would have predicted given the low turnover of property.

The rise in the cost of renting – while clearly egged on by an influx of thwarted first-time buyers – also indicates that at the least there’s not a surplus of houses sitting empty.

All this was pretty much outlined in the much-cited Barker review of 2004, but I have to admit I was an avowed housing bear in the mid-2000s when it was released, and I thought Barker had under-estimated the impact of easy credit on house prices.

While I haven’t exactly done a U-turn, the housing market hasn’t crashed as I’d predicted it would once the taps were turned off, especially here in London.

When the facts change, you have to consider changing your mind.

The case for investing in house builders

Perhaps easier to predict than the path of house prices though is the fortunes of UK house builders.

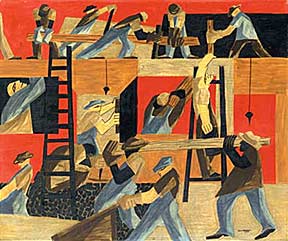

House building volumes have collapsed from pre-crisis levels, which were themselves too low for all the new household formation going on in Britain:

With divorce and single living still in the ascendant and net inward migration hitting a new high of 252,000 in 2010, the need for extra homes just keeps on rising.

I therefore think house builders will enjoy plenty of demand for new houses to keep them in business for the next few years, even without a return to go-go price rises.

The share prices of house builders collapsed by 90% or more in 2008 and 2009. While they have recovered a bit, they still look cheap given that most now have far stronger balance sheets thanks to big rights issues and asset sales.

All the main builders have now returned to making profits, with their margins being helped along by the cheaper land they bought in the downturn. Margins are also up because today’s lower levels of activity enables them to haggle with their suppliers, and with the various tradesmen.

Yet the price-to-book values of house builders – a measure of how much you pay for a company’s assets – are still well below 0.5 in the case of the volume players like Taylor Wimpey and Barratt Developments.

Theoretically that means you get £2 of assets (such as land and properties in development) for every £1 of shares you buy.

True, these volume builders still carry a fair bit of debt. If you’re more risk averse you might want to investigate shares in the likes of Bellway and Redrow. They are more lightly-geared, and should better withstand the impact of a renewed recession.

Alternatively, you could wait for a dip and consider buying my favourite company in the sector, Berkeley Group. You’ve already missed a nice rise though, and the company doesn’t look half so cheap as its rivals. I continue to hold its shares for the long-term, and consider management in a different league to the competition.

Investing in property mad Britain

Interestingly, share prices in the builders actually fell on the news of the government’s plans.

Perhaps the market expected more of a bail out from Cameron and Co, or perhaps investors are concerned about the money that builders will need to invest as their part of the guarantee scheme.

It’s worth noting, however, that most house builders are already on the hook should house prices fall with renewed vigour.

Not only will their land holdings be written down in value again, but many have been undertaking shared equity and part-exchange business, which has seen them retain housing assets on their books. You should definitely dig deeper into the accounts if this makes you nervous and you’re considering investing; my point is the few percentage points of extra risk they’d retain with the new scheme isn’t wildly different to what some are already doing.

Whatever the stock market thought this week, though, I think the outlook for shares in house builders in the medium term from today’s depressed levels is pretty bright.

The government clearly wants more houses to be built – if only for the economic activity it generates – and most of us seem happy to keep paying an awful lot for those houses. Planning changes should also play into the house builders’ hands.

No guarantees, but I think their share prices will likely be much more upwardly mobile than general house price inflation over the next few years.

Comments on this entry are closed.

I’m not necessarily opposed to the thrust of this article and may well follow the principles in the coming Euro-geddon. However, there is a serious business-as-usual assumption behind it, and I’m not sure it’s entirely justifiable:

You yourself pointed out some things we could learn from recent immigrants. One of the key things they do is they share houses in the way we used to. When my Dad bought his first house in the 1960s we shared with two uncles who were also working, which helped him pay the mortgage. As a student in the 1980s I shared rented rooms, and then houses, with other people. As a young worker in London, I shared a rented house with four other guys to keep costs down.

Britain is going to become a much poorer place for most people in the coming decade. We are going to have to collectively wind our necks in about our desire for our own front door, and start to double up more. I don’t know where the myth has arisen that people buy their first homes in their twenties. My Dad was over thirty-five when he started, and I don’t think he was unusual then. You had to have a decent deposit then, too.

Also look at the houses that house builders build in the UK. Very few fall into the category of starter homes, because there’s no money in that. It is either cheap as chips apartments, though that market seems to have gone flat in ’07, and ‘desirable executive homes’ that I would struggle to buy even as an old git earning more than the average wage and mortgage free. There just isn’t enough money in building homes for the average Brit on the average wage, and it isn’t hard to see why. With the average wage at £25k and falling in real terms, and the time-honoured multiple of affordability being 3.5x one wage or 4x if there are two earners, we’re looking at a house price of £100k tops to generate any volume. Yes, house prices may fall, but so will wages and employment.

Another anomaly in Britian is the excessive level of home ownership compared with other European countries. Even those that are in the same ballpark, like Spain ISTR, have closer family ties which probably assist new buyers financially. The Bank of England has seen the light, even if the Government hasn’t.

House builders may do okay in future, but they won’t get there by making the houses that Britain needs to achieve its current aspirations of home ownership. They’ll be targeting the second or third rungs of the ladder, perhaps elderly-friendly homes or the like. If they have any brains, they’ll follow the money, and first-time buyers isn’t where the money is.

@ermine — Thanks for your comments, little of which I disagree with except our long standing disagreement about an economic ice age… 😉

House builders are definitely following the money, especially away from the volume end. My favourite Berkeley abandoned volume a few years ago, and now does mainly high end urban brownfield development, to great acclaim (and profit). Others like Steve Morgan at Redrow are also following the money.

Equally, it doesn’t matter from my perspective as an investor whether first-time buyers — old or young — or investors buying to provide rental accommodation do the buying, although I would say you overlook pent up demand at your peril.

My main point is house builders are doing well on what’s already by any measure low volumes and lower prices for the UK. I therefore see the upside to downside ratio as looking favourable. The big picture speculation stuff I can park to one side, personally, for investments like this.

I’m definitely *not* saying the UK housing market is a happy state of affairs. I’ve thought for years it’s a bonkers market, and I fully subscribe to the view that it represents a big wealth grab by older generations from the young. I’m all for something different, if and when it comes about.

I’m investing to make money though, not to change the world. 🙂

What do you gentlemen think about the Economist magazine’s call that housing is still at least 20% overvalued on an income basis and 28% based on rents? http://www.economist.com/node/21540231?fsrc=nlw|hig|11-24-2011|editors_highlights

As someone in a country that enjoyed mass housing hysteria followed by 50% price cut on housing in the hotter areas, I’ve come to think that the other markets and their buyers seem awfully similar to the US in 2006. I especially like this quote from the Economist article:

“Another concern is that Australia, Britain, Canada, the Netherlands, New Zealand, Spain and Sweden all have even higher household-debt burdens in relation to income than America did at the peak of its bubble.”

On the other hand, it is nice to know that if prices do crash, life goes on just fine afterwards as it is here in the US, and those who didn’t buy into the boom, get to rake up some nice houses with pocket change in the years following.

Very interesting article anyway, Monevator.

@MMM — Thanks for stopping by! I think there are very strong arguments for suggesting that UK house prices are still overvalued. The trouble is that’s been true for many years – The Economist has been calling a UK house price crash since about 2004 (rather like me!), and it wouldn’t have paid off to follow them. Prices have fallen quite a bit in some places outside of London, but not back to 2004 levels. In London, in many areas they’re up above their 2007/8 peak.

But as I say above, my key point on the housebuilders is I think by making profits and getting on with business with today’s far lower volume of starts, they’re showing they can have a viable operation without a return to strength that will surely, eventually, follow. While we had a worse house price bubble here than you guys did, we didn’t have anything like the same degree of overbuilding, so I think that aspect of the cycle should be quicker.

Widespread price falls would at least knock down the cost of adding plots to their land bank, and they’re already showing how valuable that can be with improving margins today. Given how much more reasonably they’re priced than a few years ago, it’s quite an appealing prospect to buy now, and sit tight waiting for the upturn.

True, sustained price falls could be very bad news for the more highly levered builders, so anyone who thinks big falls are likely would be better off looking at the less heavily geared operators, or of course skipping the sector altogether.

Incidentally, I also like house builders because I suspect their substantial holdings of land could be a hedge against excess inflation, but that’s another article!

Excellent article. I agree with the general view of it and the other comments. In 2003 I sold a two bedroom semi detached starter home (it was tiny) for £130k, which was around six times average incomes at the time. This house was in a nice area in the north west.

The U.K government is trying to keep house prices up in order to help both the banks and the builders, but this will compund inflation and that is going to be our next big problem.

Recently I have being reading about the problems Germany had with inflation in the 20s and 30s, high inflation frightens the hell out of me. Most people fail to understand inflation and its effect, most just see prices rising rather than their money being worth less than it was. We are now all paying for the mistakes of the so called ‘boom’ years, it all has to balance in the end.

Have you considered Kier or Galliford Try as potential investments? I think they give an interesting way of gaining exposure to builders as they are relatively diversified within that industry.

>the housing market hasn’t crashed

No, but it has declined significantly over the past four years in real terms, 20% nationally, less so in London. I think inflation and, perhaps, rising interest rates will continue to help the market to adjust for a good while yet.

@Halkett — Thanks for your comments, glad you enjoyed the piece. Haven’t looked at those builders closely, but have been tempted many times by Morgan Sindall, another diversified builder / operator in infrastructure with (I believe) great entrepreneurial management.

If I didn’t want to buy housebuilders directly (and so far I have limited myself to Berkeley Group) I’d maybe consider Wolseley, the massive plumbing group. Should benefit from both an upturn in activity here and in the US, but also has defensive qualities in that people will keep living (and maintaining) the houses their in if they don’t move to new ones.

Man, why didn’t I buy UK housebuilders like you?! 🙂

So easy to kick ourselves in retrospect.

I’ve got 25% of my Net Worth sitting in 4% yielding no risk CDs forever. Shoulda levered up! But that’s what my property and stock portfolios are for.