The UK tax year ends on 5 April. For many people, the weeks before are a rush to put money into an ISA before the year’s annual allowance is lost.

This rush is despite them (maybe YOU?) having already had 11 months to open or add to an ISA in order to enjoy – forever – tax-free interest, dividends, and capital gains on shares.

Tsk. People, eh?

But what about those of us who do dutifully max out our ISAs every tax year? Those lucky enough to have cash leftover – even after making our pension contributions?

Or what about those who inherit a fat wodge, say, and haven’t been able to ISA-size it all yet?

And what about those people (*whistles* *looks at feet*) who years ago were dumb enough to buy shares outside of an ISA for literally no good reason? 1

After a few years and a strong stock market, even modest-sized investments made outside of tax wrappers can be carrying significant capital gains.

High-rollers / reformed muppets with this high-class problem – unsheltered assets with gains – should consider using up their annual capital gains tax allowance 2 every year – by end of day 5 April.

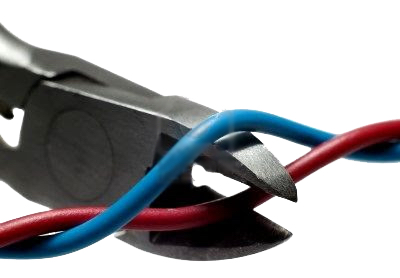

I call the process defusing capital gains because it helps to nullify a future tax time-bomb.

Keep on top of growing capital gains

In the 2021/2022 tax year, you have a £12,300 capital gains tax (CGT) allowance.

This means you can enjoy £12,300 in gains CGT-free, across all your CGT-chargeable investments.

Remember, CGT is only liable when you realize the capital gain. This happens (in most cases) when you sell sufficient assets to generate more than £12,300 worth of gains (aka profits).

Until you sell, you can let your gains roll up – unmolested by tax.

Deferring gains like this is better for your finances than paying taxes every year.

But it’s even better for your long-term returns to pay little to no taxes on gains at all.

The trick? Sell just enough assets to use your CGT allowance in order to trim back the long-term tax liabilities you’re building up – but not enough to trigger a tax charge.

You may also want to realise some capital losses, to defuse even more gains.

That, in a nutshell, is defusing capital gains.

Remember, taxes can significantly reduce your returns over the long-term.

Yet paying capital gains taxes is also a bit optional, like high investment fees. Similar to high fees, by being vigilant over a lifetime most people can dampen or even sidestep their potential impact.

Let’s consider an example.

Defusing capital gains

We’ve written before about how to manage capital gains by using your CGT allowance to curb the growth of your CGT liabilities. Read that before this article.

Let’s now see an example of how you go about defusing a gain.

Don’t make it harder for yourself! Your broker, software, or a record-keeping spreadsheet can help you track the ongoing capital gains on each of your holdings. I’m showing the underlying calculations below for clarity. Make sure you keep great records if you invest outside of tax shelters! The paperwork can be painful. But it is necessary.

A worked example of defusing capital gains

Let’s say you invest £100,000 in Monevator Ltd – a small cap share that pays no dividend, but whose share price proceeds to compound at a very rapid 30% a year for three years.

(I wish!)

After this period you decide to sell up. You plan to use the money to buy an ice cream van and become a self-made mogul like Duncan Bannatyne.

The question: is it a good idea to defuse or not to defuse capital gains along the way?

Here are two scenarios to help us decide. I’ve rounded numbers to the nearest pound throughout for simplicity’s sake.

Scenario #1: You don’t sell any shares for three years

What if you don’t defuse? In this case your initial £100,000 of shares in Monevator Ltd compounds at 30% a year for three years.

At the end of the third year / beginning of the fourth year your shareholding is worth £219,700. You sell the lot. You have thus realized a potentially taxable gain of £119,700. (That is: £219,700 minus your initial £100,000).

Assuming the annual capital gains tax-free allowance is still £12,300 in four years time – and assuming this is the only chargeable asset you sell that year, so there are no other gains or losses to complicate things – you will be taxed on a gain of £107,400. (That is, £119,700-£12,300.)

The tax rate you’ll pay depends on your income tax bracket.

At the basic rate, you are taxed on capital gains on shares at 10% (18% for residential property). Higher-rate taxpayers pay 20% on their gains (28% on property).

From our previous article, you’ll know that the taxable capital gain itself is added to your taxable income to determine your tax bracket.

The current income tax bands from HMRC:

(Wales has the same bands. Scotland is different – see HMRC.)

In other words, you’ll pay a 10% CGT rate on your gains on shares if your overall annual income is below the £50,270 higher-rate threshold.

You’ll pay 20% on your gains if your total annual income is above £50,270.

Clearly, in our example most or all of the £107,400 in gains is going be taxed at a rate of 20%. So to keep things simple, let’s presume you’re already a higher-rate tax payer from your job.

At your CGT rate of 20% then, that £107,400 taxable gain will result in a CGT tax bill of £21,480.

You pay your tax. You are left with £198,220 after the sale. 3

Remember: to keep things simple I’m presuming you don’t have any capital losses that you can offset against this gain to further reduce your liability.

Scenario #2: You defuse your gains over the years

What if instead you sold enough assets every year to use up your capital gains tax allowance?

In the first year your holding in Monevator Ltd grows 30% to £130,000 for a capital gain of £30,000.

Remember: you are not charged taxes on your gains until you actually sell the shares.

You can make £12,300 a year in taxable capital gains before capital gains tax becomes liable.

So what we need to do is to sell enough shares to realize a £12,300 taxable gain, which we are allowed to take tax-free. (i.e. We cannot just sell £12,300 worth of shares).

First we need to work out what value of shares produced a £12,300 gain.

A quick bit of algebra:

x*1.3 = x+12,300

1.3x-x=12,300

0.3x=12,300

x=41,000

So £41,000 growing at 30% results in an £12,300 gain, which we can take tax-free under our CGT allowance.

We need to sell £41,000+£12,300 = £53,300 of our £130,000 shareholding.

You could reinvest this money into the same asset after 30 days have passed, according to the Capital Gains Tax rules. Or you could invest it into a different asset altogether.

In the second year, we start with an ongoing holding of £76,700. (That is, £130,000-£53,300.) Again it grows by 30%, so we end the year with £99,710.

But remember, this ongoing shareholding had already grown 30% in the previous year!

So the maths now is:

x*1.3*1.3 = x+12,300

1.69x-x=12,300

0.69x=12,300

x=17,826

So £17,826 has grown by 30% per year for two years to produce the £12,300 tax-free gain we want to use up our allowance.

We need to sell £17,826+£12,300=£30,126 of the £99,710 shareholding.

In the third / final year, we are down to a shareholding of £69,584, which grows by 30% once more to £90,459.

x*1.3*1.3*1.3 = x+12,300

2.197x-x=12,300

1.197x=12,300

x=10,276

Over the three years, £10,276 has grown by 30% every year to produce an £12,300 gain. (You can check this with a compound interest calculator).

We must sell £10,276+£12,300 to realize this gain and use up our CGT tax-free allowance.

That is, we need to sell £22,576.

This leaves us carrying a holding of £67,883.

In total over the three years we have sold £106,002 worth of shares, and realized £33,900 in capital gains 4 entirely free of tax.

Let’s once again assume we still need all our money as cash for the ice cream van at the start of year four, as in Scenario #1.

The fourth year is a new year, so we’ve a new £12,300 capital gains allowance.

But now we are going to pay some capital gains tax.

The £67,883 holding we are still carrying was originally worth £30,898, before it grew at 30% every year for three years. 5

We pay tax on the gain only, which is:

£67,883-30,898 = £36,985

We have that personal allowance of £12,300:

£36,985-12,300 = £24,685

Our final (and only) tax bill on selling up the remaining £67,883 stake is therefore:

(£24,685) x 0.2

= £4,937

Compared to Scenario #1, we’ve saved £16,543 in taxes.

After paying capital gains tax we have £62,946 from our final share sale, plus the £106,002 we sold along the way. That gives us total proceeds of £168,948.

Before you start to type something in response to that number being less than the end total in Scenario #1, please read on!

Is it worth defusing capital gains?

I can think of plenty of things I’d rather do with £16,543 than give it to the Government, so I vote ‘yes’. Defusing is worthwhile.

Your mileage may vary.

But note that I’ve worked through a simplified example.

A 30% a year gain for three years in a row is very unlikely, even with winning shares. In reality, even with the best-performing companies or funds you’ll get up years and down years, likely spread over many more than three years.

If you invest a lot outside ISAs and SIPPs you’ll probably also have more than one investment that sees capital gains. So you’ll need to consider your gains and losses across your portfolio to best defuse gains.

Are you a millionaire who invests outside of tax wrappers? Then capital gains issues are a reason to avoid an all-in-one fund, if you want to be as tax-efficient as possible. If you instead buy and manage a basket of separate shares or funds, you may be able to defuse any growing CGT liability by offsetting gains against losses, as well as by using your personal allowance every year.

I’ve also completely ignored the issue of what you’d do with the money you liberate each year if you do defuse your gains along the way.

In fact, I’ve ignored overall returns altogether. I just wanted to show the tax consequences.

As I hinted at the end of the worked example, the eagle-eyed may have spotted that Scenario #1 leaves you with more money than Scenario #2 – despite Scenario #1’s higher tax bill.

This is simply a consequence of ever-more money being left idle in Scenario #2 after annual defusing.

In contrast, in the ‘pay all the tax at the end’ strategy, all the money grows at 30% for three years – clearly a great return – before you pay any tax.

In practice, cash released from defusing capital gains can of course be reinvested (though I wouldn’t bank on getting 30% returns each time if I were you!)

Reinvesting your gains

- £20,000 a year of the proceeds could be put into an ISA and thus be free of all future CGT. You can immediately re-buy exactly the same share you defused if you do so within an ISA (or in a SIPP). The 30-day rule doesn’t apply here.

- You could also sit on the money for more than 30 days before re-buying the same asset outside of an ISA or SIPP.

- Or you could immediately buy something different. Or just keep the proceeds in a cash savings account.

In Scenario #2, the cash released could have been reinvested in the same share in an ISA and/or a SIPP at the end of years one and two for further gains.

So just to complete the circle, if we again over-simplify and assume the proceeds of defusing in my example were reinvested at the same 30% rate, then you’d be left with £214,763 in total 6, which is £16,543 more than you were left with in Scenario #1.

Which is: exactly what we saved in taxes!

Fair’s fair?

You might argue I didn’t give the non-defusing strategy the very best shake.

For instance, we could have sold one chunk on the last day of the third tax year, and then the rest on the first day of fourth year, to use up two lots of tax-free allowance.

This would have slightly reduced the tax bill. But selling over two years like that counts as defusing capital gains!

So my example is good enough I think.

The last word

As I say, this was all just a fanciful illustration.

I chose a sky-high annual return number because the alternative was to illustrate a much more realistic 30-year defusing schedule. That’s fine in a spreadsheet, but even duller to work through.

We’re talking taxes here. I don’t want to try your patience.

Incidentally, a few people typically complain whenever I talk about mitigating taxes on investments.

We’re not fat cats here. We’re just ordinary people trying to achieve financial freedom on our own terms in an expensive and uncaring world.

And the reality is it’s pretty challenging to get rich by investing on a middle-class income. You can’t afford to leak money away by paying taxes you don’t have to.

Indeed I’ve been investing for two decades and I can confirm it’s at least as hard as sitting in your million pound house in London that you bought in the late 1990s with a 95% mortgage – at a price that has quintupled since, multiplying your initial deposit 80-fold, entirely tax-free to you – while you occasionally look up from the Guardian to moan about tax-dodging share ‘speculators’.

Tax mitigation is legal and sensible. People can use the money they save however they see fit.

And we admire those who eventually give it to good causes or invest in noble pursuits.

But handing over more than your share to the State just because you weren’t paying attention hardly seems like intentional living.

The bottom line is taxes will reduce your returns, but there are things you can do to reduce them.

Talking of which, reinvesting the money via your new annual ISA allowance from 6 April is one of the very best. Check out our broker table for some options.

- Here’s short list of NOT good reasons. Laziness. Trying to save a few pennies in charges. Thinking “taxes won’t affect me” because you only look at one or two years expected returns. Not doing your research on the impact of taxes on returns.[↩]

- Also known as your ‘Annual Exempt Amount’, if only by HMRC.[↩]

- £219,700 – £21,480.[↩]

- £12,300×3.[↩]

- x*2.197=£67,883, so x=£30,898.[↩]

- £90,077+£39,164+£22,576+£62,946.[↩]

Comments on this entry are closed.

You’ll be first up against the wall when the revolution comes.

Power to the people!

Sadly I don’t have this problem. Just investing porn for me.

Very timely post

I’m struggling to think of a use-case where you’d wait 30 days before buying back the same thing, i.e. you’re probably going to lose out in terms of time out of market

So what you need is a few products to cycle through which are sort of equivalent so you can sell and buy as quickly as possible.

Anyone have such a strategy in place?

Is anyone doing this with VLS products?

Say you wanted a 60:40 split you could buy 50% VLS40 and 50% VLS80 and just flip flop between the 2 every late March mitigating CGT as you go?

Does that sound sensible? Have I got that right..

@The Rhino – that’s exactly why the 30 day rule is there – to make, what used to be called, ‘bed and breakfasting’ less desirable.

Great post TI although it’s made me come over in cold sweats thinking about calculating the s104 pool (both recalling my ACA exams and, god forbid, if I ever have to do it on my investments).

“Anyone have such a strategy in place?”

There was a time when one might have sold shares in Alliance Trust and bought shares in Second Alliance Trust. Then the bloody things merged. But maybe it would be close enough to trade between two investment trusts in the same categories and with similar investment policies. Or how about trading between two ETFs tracking the same market? I sell Vanguard and buy L & G; that sort of thing.

@rhino – A nice problem to have. Sounds like a good idea though, sell 50 of VLS40 and and 50 of VLS80, buy 100 of VLS60. I recon outside of the VLS funds, anything that tracks the same index should be a reasonable substitute.

@TI – is there a resource out there that groups ETFs by the index they track? I thought I had seen something like that on the Morningstar page, but I can’t find it now. Must’ve imagined it.

Interesting article! I have been trying to wrap my head around things like this lately as I luckily bought some Bitcoins when they were quite cheap and now plan to start trying to cash out sensibly.

I’ve slightly exceeded my CGT allowance for this year so will need to do a self assessment tax return.

I’d never heard of this 30 day Bed and Breakfast rule before, reading up on it a bit more I don’t think I’ve accidentally broken the rule as I sold Bitcoin and put the cash into my S&S ISA into a Vanguard Lifestrategy fund, as they are completely different asset classes I don’t think that’s an issue?

As you mentioned in the article, paying taxes isn’t an issue to me, I just want to be smart about what I do pay. I’m already in the higher tax bracket anyway so CGT charged at the higher rate unfortunately 🙁

Just a few weeks of home ownership has obviously been enough to turn you into the Daily Telegraph Money section made flesh

Actually the best way to not pay CGT is simply to be married; no CGT on transfers; and two annual CGT allowances

GBP 22,600 of tax free capital gains each year is going to be enough for most people

Whether its enough depends on what you need to do with it

My thinking revolves around the possibility of having to cash everything in all of a sudden to fund a house purchase. In which case judicious defusing over the preceding years could be very valuable.

But if you’re just selling to fund living costs then I would agree that the allowances are plenty

Its dawning on me that maybe my record keeping may be sub-optimal as I haven’t recorded the dividends paid within each accumulation type fund and I don’t want to be calculating CGT on dividends that I’ve already paid income tax on. I’m thinking going forward – acc units only in tax-free wrappers, inc. everywhere else just for ease of accounting?

I’m hoping the info is there but I’m going to have to do a bit of digging..

Just to clarify, if you sell in a taxable account but then buy back in an ISA/SIPP, does that mean you can buy the same asset but without waiting 30 days?

@YFG — Been there, done that. A major motivation for why I have got quite so vociferous over the years when people have turned up here saying they don’t bother with an ISA because of this or that spurious short term reason.

@Neverland — I’ve been writing articles on tax mitigation as you know on this site for a decade, so your comment is wildly inaccurate. As for my preventative rant, needless to say I wrote it partly with you in mind. All that said you have made me give a sort of amused snort despite myself, so fair enough. 😉 Further off-topic stuff about what *should* be enough (politically speaking, not from an asset management point of view which is fine) will likely be deleted.

I’m about to do this.

I’d like to sell non-sheltered funds on the final day of current tax year, and then buy within my new tax year ISA allowance the next day, to minimise time out of the market. Just not sure on what date I need to submit the sell instruction to ensure it is carried out within current tax year.

I’m with Halifax Share Dealing – anyone know their time lag for selling funds, or if it’s based on the date the instruction is submitted?

@The Rhino – yes, it’s fine to immediately buy back within an ISA. Some brokers, e.g. ii, even offer a bed-and-ISA service (for individual shares, not funds, in their case).

@Scott – good question, I’ve found with funds the actual transaction takes at least a few days to get executed, but whether you can use the instruction submission date for tax purposes I would also very much like to know..

@Scott – cheers on the bed-and-isa question. I remember now that iweb also offer that service, but on the same terms, i.e. shares, ITs but not funds

@rhino (I’m not stalking you, honest). I mitigate CGT in this way every year. I’ve used the strategy you flag, changing LS80 for LS100 plus a bond fund. I’ve also tried to find alternatives to LS to swap into, but nothing is quite the same 😉 You do end up with a rather more messy portfolio, and it gets complex quite quickly.

I do hope you haven’t been holding acc units in a taxable account – I discovered the pain of that the hard way. Inc in taxable always. There are also nuances to do with equalisation payments on some funds (including lifestrategy) even with the inc units. I confess that gets delegated to the accountant.

Yes, you can buy back straight away in an ISA since that is invisible in tax terms.

The other strategy I’ve used is to sell a security in my account, and buy it back in spouses account, and vice versa. I have since read that this might be considered dodgy by HMRC. And you need to be married, of course.

Overall, it’s a pain. Between spouse and me we hold 6 different securities in taxable accounts, and that is more than enough to keep track of. No idea how people deal with portfolios of 20, 30 individual shares….This article also doesn’t mention the scenario where your holding has been bought in tranches over time, and you need to calculate average cost per unit…

First world problems though, clearly.

@VF – where was the other blog I was talking to you about this? I’ve completely lost track!

Yes – I re-read the MV articles that have attempted to find VLS alternatives but concluded there aren’t any, at least not on such good terms. I think a move into inc. ETFs is on the cards for me in taxable accounts.

Yes – I have done exactly that and I now understand it will be painful. I think I can do it though. On the plus side I did have to extract the dividend income for prev tax returns so that may be half the battle.

Good to get a 2nd vote that ISA buyback inside 30 days is fine

Good to hear of someone implementing the VLS flip-flop approach. I think theres a nugget of a good idea in there.

My gut feeling is that spouse thing would be OK, and if so then its a great idea. But happy for someone to tell me otherwise..

I’ve got less than 6 holdings in taxable accounts so fully agree how anyone (without an accountant?) manages on anything more complex is a bit of a mystery

On a related note, I have the spectre of a house sale CGT bill hanging over me (but on the wifes tax side). Now that is also fully complicated, when its somewhere you’ve also lived in for several years.

I think I have worked it out, but can’t know for sure until I submit the tax return in december to see if HMRC agree.

I *believe* there is no taxable capital gain on it – so do I risk using up the wifes CGT allowance for this year on a bed and ISA?

But what if I’ve got the calculation wrong and I effectively shoot myself in the foot?

Ahh – more 1st world problems..

I should probably hire a tax accountant (but wheres the fun in that)?

Sorry to multi-post, but I’ve just found something interesting (in the loosest sense of the word)

In the case of the wife, I have three tranches of VLS60 purchased over time, with the current gains on those purchases varying between +30% to -3%. Now if I make a sale, I can’t tell iweb which tranche I want them to sell from. So, effectively I can choose which tranche I notionally sold from at the point in time I submit my tax-return – giving me the option of posting a nice gain or a small loss. This is very attractive! Have I got it wrong? I think it makes the Bed and ISA option a no-brainer..

I’m only vanguardfan on Monevator.

Spouse swaps can also be complicated if very different % gains. ETFs are good in taxable accounts.

Accountants – I do the end of year CGT calcs myself, to inform trades, but delegate the actual tax submission. Sometimes I get it wrong (usually due to something like equalisation that I don’t properly understand) and I like to have a check on what I’ve done, not least because some of what I look after is not my money.

@rhino, sorry, you can’t do it like that. You have to calculate the average purchase price per unit for the entire holding, and then the gain per unit, and hence the number of units that can be sold.

@VF – haha yes I remembered that it was on the last article here! My memory is shot 😉

when you say you get it wrong – who is spotting that? the accountant or HMRC?

unless the accountants checking everything (I can see the value in that) then surely your doing the graft and delegating the easy bit?

I keep a running spreadsheet for each holding tracking sales and purchases, and average purchase price, to help calculate the current gain per unit.

@VF – ah brilliant – I had totally the wrong end of the stick there then..

I use a free piece of software called GNUcash for tracking all my spending and my investments, then I use their lots feature for tracking my gains/losses. I think it uses a basic FIFO (first in first out) system for calculating these values.

Saves a lot of faffing with manual calculations.

@Rhino

Bed and ISA (as well as Bed and SIPP) are offered by most brokers. It’s fine as you aren’t trying to dodge capital gains, only making use of tax sheltered investment wrappers. Most brokers offer the service at a discount to regular trading, usually you pay only one lot of trading fees. Its what I’ll be doing on 6th April.

On the spousal asset front – it’s a grey area. As long as there is no ‘strings attached’ it should be OK. But generally speaking you need to be married and living together. Hmrc take a dim view if you gift the assets but really you are still the beneficial owner and that you are doing all this purely for you to avoid cgt. There are a set of principles called the Ramsey Principles on this subject.

@Vanguardfan is right – Acc funds outside of a tax wrapper are an absolute nightmare. If you are going to hold funds that are non tax sheltered I would strongly advise Inc funds.

That said accountancy firms have fancy pants software that does most of the CGT calculations for them, so for them calculating the s104 pool isn’t too onerous.

@Scott date of disposal for cgt purposes is the date of contract – i.e. when the transaction is not legally reversible – you’ll get the contract note from the broker shortly/immediately after you’ve hit execute on the transaction. The settlement date, when you actually get the money, doesn’t matter.

@hosimpson – there is a great website called just etf.com which does exactly that. Actually, I think TI has written an article about it in the past.

@YoungFIGuy what are the implications of holding ACC funds outside of an ISA? I had a life insurance policy that paid out a couple years ago and I filled up my ISA and put the rest in a Vanguard Lifestategy ACC fund as my lazy passive investment.

I wasn’t aware I had to do anything fancy for this other than just measure how much profit I’d made like any other fund / share? How do you even find out how much was from dividends getting reinvested?

I’d assumed the whole point of those types of funds was to avoid all the hassle?

@Kris — Alas! See these two articles:

http://monevator.com/income-tax-on-accumulation-unit/

http://monevator.com/accumulation-funds-dividends/

I’m dithering over this. I put a 6 figure sum into vanguard ftse global all cap find in October, and it has sunk by 5.4% since then. I’m considering selling the lot and switching into a similar product, as someone suggested doing with the LS funds, however there is only one directly comparable fund I can find (Halifax Fund of Investment Trusts A, which has the same morningstar category and similar performance, but quite a different composition e.g. about 45% UK vs 5% with the Vanguard fund – so not really what I want). The few others in the category are inaccessible as they are from dimensional fund advisors (institutional or via certain IFAs only I think). My aim in selling would be to crystallize the loss (about 7k) to carry forward on my tax return and offset against future gains. I think that this can provide a £700 (10% X 7k) tax saving at some time in the future. The downside is the risk of missing out on market moves while I’m doing the trades, that can take as much as a week in my experience, plus the increased product fee ( 0.5% vs. 0.25%), and having to invest in a fund I don’t like the look of. Alternatively I could buy units in a different category, such as vanguard global small cap fund (0.38%) – that seems more attractive. But changing the investment category seems to add extra risk again – for example I’d have to compare the performance of the two funds over the relevant period to make sure I wasn’t losing too much value. So on the one hand I’ve the feeling taking this course is too much unnecessary tinkering for a relatively small potential gain after a relatively short period in the market, but on the other hand maybe it would be a sensible course of action despite the effort and additional risks. I’d be interested to learn how others have weighed up these kind of issues.

@Kris Wragg – the issue with Accumulation funds is that it’s a pain to work out the cost of acquisition.

Without rambling on for too long, to calculate the capital gain: Sales proceeds mins purchase cost.

In respect of purchase costs, this is the average purchase price per unit of the investment sold multiplied by the number of units sold.

The problem with Acc funds is twofold:

1. You need to account for ‘notional dividends’ that you get. These are reflected by the value of the units going up, not receiving more units. But remember, each of these dividends was subject to income tax. So before summing them up, you can deduct the total income tax you paid on those dividends. The aggregate amount of these dividends is called the ‘net dividend’ and you subtract it from the sales proceeds.

2. You also need to account for what’s called ‘equalisation’ this is the amount of accrued dividends, but not yet “released” before you bought into the fund when you make a purchase. This is equalisation is added to your first dividend, but is not subject to income tax (it’s treated as capital). Therefore, when you buy into the fund the purchase cost includes this equalisation amount, so to avoid double counting it is subtracted from the purchase cost.

So the modified formula for capital gains on an Acc fund is: (sales proceeds – net dividends) – (purchase cost – equalisation).

[You might realise that the net dividends includes the equalisation amount, so really, the equalisation on both sides cancels out.]

This is why Acc funds are more of a pain outside a tax wrapper because you have to adjust for the ‘notional dividend’ and the tax you have paid.

@YFIG – many thanks for detail. super useful. I fully concur that acc units in a taxable account are non too pleasant and I intend to correct the oversight of having naively gone down that road several years back.

I think there is a case (which hopefully applies to me) where you don’t have to be super-accurate when trying to compute CGT. Thats when you have a good margin of safety that you are under the threshold. I.e. you make some assumptions that you know mean your overestimating your CG (like not correcting for dividends) and your still a few k under 11,300. On top of that if the amount sold is https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/505151/sa108-notes_2016.pdf

Did you mention you may start freelancing ‘wealthy accountant’ style (https://wealthyaccountant.com/)? I am on the lookout for a good tax accountant..

To be clear, the sale transaction of Bed&ISA is liable to CGT.

See “The Disadvantages” section of

https://www.charles-stanley-direct.co.uk/News_Features_Research/how-tax-changes-have-increased-appeal-%E2%80%9Cbed-isa%E2%80%9D/

@TI I think use of a less than sign trashed that last post

meant to be:

On top of that if the amount sold is less than 44.4k then I think you don’t have to declare anything to HMRC.

I based this thought process partially on this document:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/505151/sa108-notes_2016.pdf

I echo the point about Acc funds outside of ISA being a PITA. I thought I might manage two birds with one stone by selling the Acc units and buying Inc ones… intending to diffuse the CGT and simplify the accounting. However the HMRC said that Acc and Inc probably don’t look enough like different funds (more like ways of interacting with the same underlying fund) and so would not be enough to trigger CGT calculations. I say ‘probably’ as nobody was willing to commit to giving legally-binding advice, even the HMRC.

I think it’s fair enough that during life we should have as little tax as possible because of the risks we’re taking, and also more practically I think it’s better for the global economy if investment builds tax free and remains in trust after death, better than charity I suspect, since handouts aren’t sustainable and get impeded by conflict, etc.

@Rhino: re your property sale, there’s a CGT calculator on the HMRC site which may be helpful. Whether it can cope with anything unusually complex I don’t know, but I found it quite easy to use when trying to work out what CGT would be due on my BTL if I sold now-ish.

I try to utilise our CGT allowances by rotating between ETFs outside our ISAs and SIPPs, with ETFs/tracker funds inside ISAs/SIPPs. I look at this twice per year, once at the beginning of January when I rebalance and raise cash in our SIPPs for drawdown and once at the start of the tax year when I transfer assets in to our ISAs. The last few years this has been sufficient to use up the allowances.

Always a bit of a balancing act as I also try to keep higher amounts of lower yielding ETFs (US and Japan) outside tax shelters to mitigate dividend income tax.

Another perfectly legal tactic is to sell part of a ETF/index fund position and buy into a very similar ETF/fund from another fund manager, but I have not had to do that for a few years.

Hopefully at some point we should end up with all investments tax sheltered and no longer have to concern ourselves with this faff, but I would not be surprised if the ISA tax relief was watered down in some way before it happened!

@bekoo HMRC CGT manual confirms what you have been told on transfer from acc to inc units:

“Many unit trusts offer accumulation units and income units. These should be treated as different classes of unit. Any switch from one class to another within the same unit trust should be treated as a share reorganisation, see CG51700+”, ie it is treated as though no disposal takes place.

@YoungFi Guy. Can you clarify what you meant when you said that in calculating CGT on acc units “you can deduct the total income tax you paid on those units” Do you not just add the dividends before tax to the purchase cost? Am not sure where income tax comes in to it.

Another thing I am trying to work out how to handle is the best way to help our children buy property. I am happy to give/lend them the money for this, but I would likely need to sell some investments to do that. If I just did that with investments outside our ISAs, that would likely land us with a CGT bill. Instead we could sell some investments inside our ISAs and withdraw the cash, but that seems very counterproductive.

A stock market crash would be helpful, hopefully coinciding though with a property crash ;).

Another great way to avoid CGT (and IHT if transferred to a spouse) is to die before you get around to selling your shares, at which point they also get revalued at the current market value (CGT uplift). Reminds me of Hotblack Desiato in the Hitchhiker’s Guide who spent a year dead for tax reasons… But seriously, a diversified portfolio of higher yielding FTSE 100 ‘defensives’ bought and held forever, with only the natural yield taken when you need it, is not a bad way to go if you’ve got enough cash (and the stomach to ride out the volatility).

@Kris Wragg, #26

GnuCash may well be misleading you here with FIFO. Perhaps badly.

The US allows FIFO, LIFO and average cost methods of computing capital gains. The UK only permits average (section 104 holding). Computing the average resembles blockchain(!), with each transaction dependent entirely on the result of the previous one. Somewhat more painful than specific share identification, but no choice in the UK.

With funds and OEICs, you might also have to deal with the effects of dividend equalisations. These are things that the US tax regime doesn’t have, and so GnuCash almost certainly won’t support.

My suspicion is that you might want to look closely at what GnuCash is doing here, to see how far off it is from UK capital gains tax reality.

@ianh Your world tracker has dropped 5% and you are dithering over new strategies and whether to sell and crystallise your loss?!

You are a disgrace to the Monevator readership!

Revisit this Lars Kroijer article (http://monevator.com/why-a-total-world-equity-index-tracker-is-the-only-index-fund-you-need/)

Then sit back, relax, and find something better to do with your time.

@JB – yes I recently discovered about CGT uplift on death, slightly bizarre but true..

@ianh. Not sure which fund you’ve bought, but you could sell and buy vanguard lifestrategy 100 as a close alternative (or the LS80, which should reduce volatility with very little reduction in return).

But also, what e17jack said. 🙂

@doctor. Yes, the sale of the ‘bed’ part of bed and ISA is CGT liable. Sorry if I gave wrong impression above. But the 30 day rule is irrelevant (ie buy back exactly the same holding immediately in the ISA and it does not nullify the disposal).

@Xyz Thanks, looks like I need to do more reading! Here I was thinking it wasn’t that difficult doing my own accounts, I’ve learnt a lot today and need to do more reading before I start on my tax return for the 2017-2018 tax year 🙁

@e17jack v. funny. To be fair I’m not planning to sell out during a downturn but do what the article and other commenters suggest and switch investments between funds to lock in some tax gains. The question I’m weighing up is whether the small potential gain is worth the additional risk. What TI suggests is that getting off the sofa once a year to optimize your CGT position is a good idea.

@vanguardfan the fund I have is vanguard ftse global all cap fund GB00BD3RZ475 and I am considering a swap to the vanguard global small-cap fund IE00B3X1NT05 (well, the income variety), some of which would go into a 2018-19 ISA.

@ianh – the small cap fund will have a very different risk profile and volatility to the all cap global fund, and can’t really be considered equivalent. You shouldn’t be changing your asset allocation in order to crystallise the losses – that really is the tax tail wagging the dog!

I suggest you clarify what your intended asset allocation is, and then, if you do decide to crystallised the loss for CGT management, choose something more similar (eg lifestrategy 100, or the VWRL ETF.) But remember that fund trades can take several days to clear, and you might lose more than the £700 while you are out of the market!

@John Nicholas –

I’ll try to explain by an example (it’s worth reading the links TI has posted at post 29):

Say you have a one unit of a fund worth £100. Over the year it accrues £5 of dividends from the underlying investments. At dividend date, for an income fund they give you £5 in dividends. So you still have investment: £100; and now cash £5. With an accumulation fund, that £5 is put back into the fund, so its investment: £105.

Say you then sold the fund for £110, if you did the “standard” CGT calculation: £110 – £100 = £10 you’d be including income as part of the gain (you’ve only actually gained £5, £5 was dividend income). So that’s why you have to subtract the aggregate notional dividends reinvested back into the fund. Then you’d have £110 – £100 – £5 = £5.

But depending on your fund you may (I’m not sure how the market place works since the 16/17 tax changes, as I haven’t had an Acc fund for some time) have had some tax taken off before it gets reinvested in the fund. If that’s the case, then it isn’t the gross figure that’s reinvested (£5) it’s the net (and lower) figure that has been reinvested into the fund. That’s where the interaction with income tax comes in.

For you Accumulation fund, each year you’ll get a tax voucher and it will show the net notional dividend figure. These are the ones you add up to calculate the total notional dividend to subtract from the sales proceeds.

@ The Rhino – The Wealthy Accountant does do rather well for himself. Alas, I’m not a tax accountant, so always take what I say with a large grain of scepticism. Quite frankly, tax rules in this country (and most other countries) are mindbogglingly complicated – and there are much more fun things to do!

@John Nicholas and TI – Sorry for the spam, I think: ” But remember, each of these dividends was subject to income tax. So before summing them up, you can deduct the total income tax you paid on those dividends.” Was a bit confusing. The key is, it’s the Net notional dividend that’s reinvested into the fund, not the gross figure. So when you are calculating the aggregate dividend, you sum the net figures. The principle is that these dividends are classes as income for tax purposes, not capital.

Teaches me for commenting on my phone.

@vanguardfan yes I agree – I mentioned in my first post the only directly comparable fund I found (Halifax Fund of Investment Trusts A) was not a good match, and VWRL may be better. I have a lot of that in my ISA and SIPP anyway though. Explicitly including small cap fund in my portfolio is based on my reading of Michael McCLung’s book Living off Your Money, whose recommended portfolio includes significant global small cap elements. I’m loathe to tinker too much TBH and am fairly happy with how I have things set up. But I have to sell for annual drawdown and to make an ISA transfer in the first few months of the new tax year anyway.

@The Rhino, I think iWeb automatically calculate a running average of any asset you’ve bought in multiple tranches, so that saves some work.

Yes it does. Very handy.

I took a punt and queued up two sales of 20k each to move into the ISAs

I did double check the BTL CGT situation

Ok, interesting comments. It seems I’m in the same boat as a few others who hold an Acc fund out with a tax shelter. I only hold one fund…Vanguard LS80. My account is with Charles Stanley & I’m looking at the 16/17 Tax Certificate they provide & trying to understand what figures I should be using for both CGT & Income Tax calculations.

There are two columns, ‘Dividend paid’ & ‘Equalisation’.

So for Income Tax… is it simply a case of using ‘Dividend paid’ for calculations? Anyhow, this is below the £5000 tax free allowance for dividends so I don’t think I owe HMRC in this respect unless I’m missing something?

And I think CGT = (Sales Proceeds-Dividend paid) – (Purchase costs- Equalisation) ?

From my own calculations using Trustnet dividend figures, simply multiplying the dividend (Trustnet figure) by Units Held on the dividend date results in a figure which equals (‘Dividend paid’ +‘Equalisation’) from the Charles Stanley Tax Certificate. I just feel this is a bit odd and perhaps my CGT formula above is wrong in respect of the ‘Dividend paid’ figure?

Anyway, I guess I’ve learned that Inc funds are the way ahead in future for non-tax sheltered holdings! But any light shed on the above would be appreciated.

So to further the discussion with @Xyz with regards to using GNUcash for my accounts, it seems I wasn’t using it correctly but it can do them in accordance with section 104 holdings.

The issue is by default it will create a new ‘lot’ for each purchase and do FIFO which is suitable for US tax rules, this yields incorrect CGT calculations for UK. But if you have a single lot and put all buys and sells in that then it seems to calculate the correct results based on some tests with this:

http://www.cgtcalculator.com/calculator.aspx

I think you’d need to do a bit more if you have purchases before 2008 though as slightly different rules? But that doesn’t effect me.

For those of us who despair at the ACC fund calculations… can we fairly assume that we can hand this lot over to a high street accountant? Lots of them round where I live advertise self-assessment, in general terms – is the general idea that they understand all this investment stuff? Or is it a more specialist thing?

Don’t want to hand over to someone who knows even less than I do.

Haphazard – hard to comment as everyone’s different, but in my experience, a lot of tax accountants, even at Top 10 firms, won’t know much about investments generally. If presented with a situation, a good accountant will look it up (or rather, get a junior to look it up), but this can rapidly create an expensive bill.

It’s up to you, but if you’re a regular Monevator read, have the right articles on Acc Funds, and have one or two free evenings, I’d say you’d probably be better off working it out yourself.

It is not fundamentally difficult, just extremely fiddly, and in my experience requires time and (sometimes a lot of) patience.

In summary: a high street accountant may well know less than you.

p.s. Thanks to TI for the Acc articles – they’re very much appreciated – it is quite scandalous really that you are the only person I can think of who has managed to explain what to do in ‘plain english’. Thanks for nothing Office of Tax Simplification!

My tax accountant, who I think is very good, seems to be pretty clued up on managing tax on investments, and definitely knows more than me.

Above mostly focuses on capital gains on shares.

Does anyone know if the following work re property? Let’s suppose you once bought a second property for say £100,000 and its now worth £200,000. Can you each year sell a chunk to a company owned by yourself and in that way gradually eliminate the capital gain, using your annual capital gains allowance? I know if you sell the lot to your own company, then that causes a capital gains taxable event. But is there some HMTC rule to stop you using the annual capital gains allowance in this way?

I too am whistling and looking down at my feet. You’re not the only one. To be fair there seemed no pressing reason in days of yore to ISA (or PEP) my all. There was no higher rate tax to pay on dividends in my case. The annual CGT allowance whispered that in retirement I would be able to stagger disposals to get at any ill gotten gains tax free. There may have also been an ISA/PEP platform charge? In my case the root cause was simply admin:- my savings scheme didn’t originally offer monthly direct debits into an ISA – I continued with my monthly direct debits into a non-tax favoured savings scheme for some 20 years. The wake up call for me was the dividend allowance coming down to £2,000 – I had no tax to pay when the allowance was £5,000. I’ve now spent hours researching the capital gains tax base cost of my shares to work out how many shares to sell to use the capital gains allowance and the first tranche is sold and the proceeds waiting on 6 April 2018 to put it into an ISA:- this will be the first of a few Bed and Isa-ing exercises. All completely avoidable I know but no crystal ball at the time that I knew of forecast the dividend allowance. On the issue of new legislation having adverse effects on perfectly reasonable planning/transactions done years ago, I now find that the AVCs I put in for most of my years into a DC pension scheme may create a lifetime allowance charge when I come to 65 or more likely 75. A nice problem to have I hear you say, but would I have paid AVCs in for all those years had I known that the lifetime allowance charge was on the horizon ? – almost certainly not. I wonder what’s next for the sitting ducks of retirement taxees? How about dividends in ISAs remaining tax free by virtue of a 0% tax rate but using up your basic rate band?

When doing CGT defusing disposals I try and keep the gain £500 below the limit to avoid being caught out by my mistakes, and normally below 4*allowance so I don’t need to show my working to HMRC. So glad I’v finally disposed of the M&G monthly savings plan that had quarterly reinvestment of dividends. 16 transactions per year!

Make sure your funds are UK reporting, even if Irish domiciled, as in some jurisdictions capital gains are counted as income for tax purposes by HMRC

@hospitaller

I have a few BTLs and also wondered if I could sell a % annually to a ltd company to manage Tax.

So far Ive not found any useful info, but if I do find some I will post.

My daughter lives in one of the properties and I also wondered if I could gift a percentage every year to manage IHT.

Nice problems to have!

@Boltt “I have a few BTLs and also wondered if I could sell a % annually to a ltd company to manage Tax. So far Ive not found any useful info, but if I do find some I will post.”

Indeed, a nice problem to have but also a bit of a pain to manage. Yes, please do let me know if you find anything on that as a way to manage capital gains tax.

Piecemeal disposal of assets/property to reduce CGT:-

These two websites seem to indicate partial sales of property is possible – the property will probably need to be mortgage free and some valuation fees will apply. But seems like a fine idea to me.

https://www.wealthprotectionreport.co.uk/public/Piecemeal_disposal_to_utilise_CGT_annual_exemption_.cfm

https://www.accountingweb.co.uk/any-answers/gift-my-btl-property-to-children-in-stages

In true monevator style DYOR, no warranties provided.

Great link here to explain your tax voucher.

https://www.google.co.uk/url?sa=t&source=web&rct=j&url=https://www.oldmutualwealth.co.uk/globalassets/documents/literature-library/platform/collective-retirement-account/omw_pdf6600_a_guide_to_your_tax_voucher.pdf&ved=2ahUKEwjH98TAqZvaAhXMBcAKHWY-DKsQFjACegQIAxAB&usg=AOvVaw0Csuxh3xEjy0NTJxGFPLoX

Thanks that’s a very helpful link on the tax voucher…

The local accountant in town charges £360+VAT for self-assessment – certainly makes me think again about doing my own.

I noticed last year that you can’t just stick “dividends” in a box, if I have understood rightly. Because if you have any funds domiciled elsewhere e.g. in Ireland, presumably that is “foreign” income, for the foreign pages?

There’s also a Monevator article in the archives on “excess reportable income”… so many things to potentially get wrong!

Note: I updated this article with the current figures on 4 April 2022, so comments above this one might refer to numbers which are out of date. 🙂

To keep it simple (and sometimes not completely optimal) I try to sell less than 49,200 in total. If you sell more than that you need to put it in your self assessment even if no tax is owed, which is a pain.

I know not quite in line with this theme but could a similar approach be used to minimise the tax on breaching the LTA?????

I’m just about to access my SIPP and I’m not sure whether to take the 25% tax free lump sum and pay the 55% tax on the excess or just leave everything in the SIPP for now and worry about it some time in the future?

Any thoughts?

@ Chris

I have DB and DC pensions – my plan is to take the 25% tax free lump sum (settle a mortgage) and take out the DC money between ages 55 and 60 – at 20% marginal rate. If I breach the LTA then I’ll just pay the 25% penalty and the pay 20% tax and count myself fortunate (So 40% tax (.75x.8) instead of 55%)

Is there a rationale for considering paying 55% tax?

B

@ Chris

I’m perhaps going to extract 25% TFLS in stages because of the annual ISA limit and not wanting all that much outside pension and ISA. But I do mean to start as soon as allowed so that LTA is not breached (or not much; depending on future returns).

@Boltt, @BeardyBillionareBloke,

Thanks for your response. I guess I’m in a slightly different position as I’m already over the LTA. Neither do I have any LTA protection as I was well below the LTA a few years ago and didn’t qualify at the time. However, the performance of my portfolio has been better than I expected and has now taken me over the LTA.

My understanding (and please correct me if I am wrong) is that I now have the following options:-

1- Take the TFLS and pay 55% on the amount that is over the max LTA TFLS limit. The remaining 45% of this amount would have to go back into my SIPP. I would then drawdown the rest of the SIPP at 20%.

2 – Take the SIPP as a monthly drawdown paying 25% tax on the excess (although I’m not sure how the monthly excess is calculated) and then 20% on the remaining monthly amount.

Is this your understanding or have I missed anything ( highly likely).

Thanks

@ Chris

I’m not an expert so may be worth reading and perhaps talking to an IFA or similar expert – free consultations are available for the over 50s to help with these decisions (via Pension Wise, I believe)

This is worth a read:

https://www.thepfs.org/news-insight/news/articles/drawdown-planning-and-the-lifetime-allowance-tests/94262

My loose understanding is that BCE (benefit crystallisation events) are when money is taken from your pot, and a final test at age 75, so at each “event” a percentage of your LTA is used up. Once this cumulative amount exceeds 100% all subsequent withdrawals have the extra 25% penalty applied.

Again, my understanding is that penalty is applied when the money taken from the Sipp exceeds the LTA – have a Sipp > LTA doesn’t automatically trigger a bill under the age of 75.

A couple of minor points:

– I took fixed fixed protection 2014 when below the £1.5m LTA, you can still apply for some historic protection if you didn’t add new funds to the pot beyond certain dates

– if your income is over ~£50k then 40% tax applies

@Boltt

Thanks for this. Good informative link. Still not 100% clear on a number of things so I guess I’ll seek out further advice to ensure I make the appropriate decision from a tax point of view.

“This rush is despite them (maybe YOU?) having already had 11 months to open or add to an ISA in order to enjoy – forever – tax-free interest, dividends, and capital gains on shares.”

Well, no. Capital gains taxation depends upon the tax regime that you’re subject to, when you realise that gain. Lots of people overlook this, and relocate from the UK to another country, becoming tax resident somewhere else, without thinking to realise their ISA-contained capital gains before acquiring the new tax residency.

The consequence of that is that capital-gain tax can become payable in the new tax jurisdiction using the original purchase date as the cost base — the UK ISA has provided no capital-gains tax protection at all.

@Jonathan — Sorry but that comment — or rather the way you begin it — doesn’t seem super-constructive.

“Well, no.” Because in some unusual circumstance where somebody emigrates to another country, and so moves outside the UK tax framework this whole article and this website for that matter, is talking about, then this doesn’t hold anymore?

Should we caveat our articles to say stuff like “unless you die before you can take the money out”?

Should I edit out “forever” because readers are not immortal?!

For the vast majority of readers the most important thing is to fill an ISA – to which there is no downside nowadays (no higher fees) — not to wonder if they’ll be one of a slim minority who permanently emigrate. (Just last night a friend bewailed to me on WhatsApp that for no reason at all he hadn’t filled his ISA — he has six-figures in cash languishing around for context, and he is familiar to investing and ISAs.)

This isn’t to say that your comment hasn’t got something to add to the discussion. It really does. It’s worth people knowing about and it is otherwise a helpful addition. But why this passive aggressive and pendantic posture — “well, no” and “the UK ISA has provided no capital gains tax protection at all”.

Not to mention our articles are already 2,000+ words long far too often — and riddled with enough caveats as it is.

We’ve only just finally shoo-ed away one house troll. Please don’t feel the need to fill the spot. 🙂

I don’t understand scenario “Scenario #2”. You say:

“So what we need to do is to sell enough shares to realize a £12,300 taxable gain, which we are allowed to take tax-free. (i.e. We cannot just sell £12,300 worth of shares).”

Why can you not just sell £12,000 worth of shares?

Isn’t this what the maths should look like?

— year 0

£100,000 worth of shares

— year 1

£130,000 (30% on £100,000)

sell £12,300 worth of shares

now have £117,700 shares

— year 2

£153,010 (30% on £117,700)

sell £12,300 worth of shares

now have £140,710 shares

— year 3

£182,923 (30% on £140,710)

sell £12,300 worth of shares

now have £170,623 shares

What am I missing here?

@Ad — As the article explains, we are trying to minimise the ongoing and growing tax liability on the growing value of our shareholding — while maximising the use of our valuable annual CGT allowance.

You could indeed sell £12,000 worth of shares (or any other amount, if you had some other aim in mind than the above).

And indeed if you did so you’d pay no CGT on it, as it’s under your annual allowance.

But in your scenario, you’d be under-utilising your CGT allowance in reality.

You’d only be using £12,000*30% worth of the potential £12,300 allowance in this example.

Given that CGT allowances are a use-it-or-lose it tax break, this is sub-optimal from an overall tax management /defusing perspective.

Note that annual CGT allowances are changing (coming down!) as of this writing, unfortunately.

(Which means, incidentally, that those who have not defused in the past have a bigger tax bill coming at some point in the future…)

From the worked examples above (which are very useful!), I’m trying to understand whether there are any additional subtleties to account for in purchases and sales that straddle tax years.

For example, if I purchased shares worth £100,000 in Sep 2023 (i.e. 2023/2024 tax year) that are now worth £115,000 in Sep 2024 (15% growth since inception) could I sell £20,000 of this investment ‘now’ (i.e. 2024/2025 tax year) to remain with the £3,000 CGT allowance (0.15*£20,000= £3,000) or would I need to factor in the value of the investment at the beginning of the 2023/2024 tax year (i.e. it may or may not have been £115,000 depending on market valuation)?

Thanks,

D_D

I think I made a mistake in my last post.

I should be able to sell £23,000 of my current holding without incurring CGT. This is because £20,000 of the initial investment at 15% growth now represents a gain of £3,000.