People get muddled when they think about their own home in financial terms. This extends to a repayment mortgage used to buy a property.

Mental accounting – also known as ‘bucketing’ – is what causes this discombobulation.

Fact is we tend to think about the value of money differently, depending on where it comes from and where it ends up.

Mental accounting involves putting money into different mental accounts – or buckets – as a crutch in our financial thinking.

Bucket or bouquet?

For example, a 40-something friend tells you they have “no savings”.

Worried, you make plans to run the London Marathon dressed as a muppet on their behalf.

But then you discover they’ve been paying into a pension for 20 years.

Your friend discounts this substantial pension asset, probably because it can’t be accessed for another couple of decades.

Ignoring a pension like this is a mental shortcut. And to be fair it’s true that your friend can’t get cash from their pension if the boiler blows up.

It might also be easier for them to mentally treat pension contributions from their salary as more like a tax than savings. Filing such payments under the same ‘Inevitable’ label as taxes may help them stay committed.

Perhaps the thought that they have no savings could motivate them to build an emergency fund, too.

But still, the statement dramatically misrepresents their true financial position.

If they genuinely had no savings they’d be on-course to rely solely on a state pension in retirement. They’d be well-advised to take action – yesterday.

Or maybe someone decides to work out how to split their saving between their ISAs and pension – perhaps with an eye on early retirement.

When they do their sums their pension assets will suddenly appear in a ‘Live and Very Real’ bucket in all their glory. Previously they were clouded in a mental fog of their own creation.

The property puzzle

My favourite example of dodgy mental accounting is how even financially literate people think the home they own is somehow not an asset or an investment.

You can strive for hours to illustrate with logic and counterfactuals that their home is most definitely an asset AND an investment.

But this is a mental wall that Fred Dibnah would struggle to blast through.

Again, such self-delusion can be helpful.

Maybe because they don’t think of it as an asset, most people don’t trade their property or fret about small price moves. That helps their own home become the best single investment the typical person ever makes.

That’s the case even though their thinking is wrong! Oh the irony.

Admittedly the situation with a repayment mortgage is a bit more subtle.

Save your repayment mortgage

I was reminded of the confusion about repayment mortgages by comments on The Treasurer’s recent article on the savings rate.

Many – perhaps most – people tend to think of a repayment mortgage as a monthly expense.

They know they will own their home outright at the end of the mortgage term. (Weirdly even then most won’t consider it an asset. Harrumph!)

But along the way they see mortgage repayments as an expense that they mentally bucket just as they would rent.

They therefore don’t consider their repayment mortgage to contribute to their savings rate.

However repaying a mortgage is a very different proposition to paying rent, at least from the perspective of the person living in the house (as opposed to any landlord in the mix).

That’s because your monthly repayment mortgage direct debit consists of two parts.

- One part sees you pay interest you owe to the bank for lending you the money (via your repayment mortgage) to buy a home in the first place.

- The other part involves paying off some of the outstanding loan. These are the payments that will eventually reduce your mortgage debt to zero, and see you own the property outright.

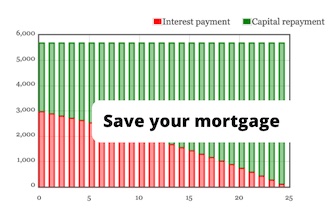

The following graphic from our repayment calculator breaks down these two parts of a repayment mortgage:

This shows a £100,000 repayment mortgage charging 3% paid down over 25 years.

You can see how in the early years you’re paying off more interest than capital. Towards the end though, capital repayment – effectively savings – makes up most of the payment to your bank.

Cutting the expense account

Strip out the mental accounting, and the two components of your monthly mortgage payment are two different kinds of money transfer:

- The interest payments are an expense. They are the cost of having a mortgage.

- The capital repayments that reduce your outstanding mortgage are savings. They reduce your debt and increase your net worth.

Incidentally, to nip another bit of mental accounting in the bud, the market value of your house as prices fluctuate has nothing to do with any of this.

Your house is an asset and an investment that is worth whatever someone will pay for it.

This is true however you financed it – with cash, an interest-only mortgage, a repayment mortgage, or by blackmailing the previous owner with saucy photos extracted in a sting operation involving a sex worker with a knack for hidden cameras.

Your repayment mortgage in contrast is a debt that you are paying off over time. Nothing more and nothing less.

Same difference

Still not convinced? Let’s illustrate further by thinking about someone like me who has an interest-only mortgage, rather than a repayment job.

As the name indicates, every month with my interest-only I pay interest (only…) to the bank.

I am not repaying any of the outstanding loan.

Don’t worry, my bank is well aware of this! The deal is I’ll repay all the debt I owe in a couple of decades time. Until then, I simply pay the interest.

For the sake of argument, let’s simplify and imagine I have a £100,000 interest-only mortgage as well as £10,000 in a cash savings account.

My situation:

- Cash savings: £10,000

- Interest-only mortgage: -£100,000

- Balance: -£90,000

Now let’s imagine Monevator wins a prize for Most Waffley But Charming Financial Blog of the Year. Along with the bronze gong that I ship to my co-blogger because I hate clutter, I get £10,000 sent to my current account.

Let’s say I have just two choices as to what to do with this £10,000. (I’m too boring sensible to spend it on bubbly and financially loose playmates).

I could put the £10,000 into my savings account.

Alternatively, I could make a one-off payment to my bank to reduce my outstanding mortgage.

In the first scenario, I add £10,000 to savings:

- Cash savings: £20,000

- Interest-only mortgage: -£100,000

- Balance: -£80,000

In the second scenario, I make a £10,000 payment to reduce my mortgage:

- Cash savings: £10,000

- Interest-only mortgage: -£90,000

- Balance: -£80,000

As you can see can see, in both instances I end up with a negative balance of £80,000.

Indeed you can think of an outstanding mortgage as a savings account that starts deeply in a hole. As you save money by repaying your mortgage, you move this ‘negative savings account’ towards breakeven.

Save as you go with a repayment mortgage

How you think about a repayment mortgage is not just pedantry. It can sway the financial decisions you make.

For example, if you think of a repayment mortgage balance as another form of savings account, then you can compare the interest rates between it and your conventional cash savings accounts.

Say your mortgage charges 2.5% and your cash savings pay 0.5%.

You don’t need a calculator to see that on those numbers you’re better off paying down your mortgage with any spare cash allocated towards savings.

On the other hand, a mortgage repayment locks your money away. (Unless you have an accessible offset mortgage, which makes explicit the link between savings and mortgage repayments).

Remembering this you might not make a mortgage repayment with that cash windfall, because you want to bolster your emergency fund instead.

Of course, this being Monevator many of you will be thinking you’d invest any spare cash into the stock market.

And of course that’s an option – but it’s a different kind of saving.

Like your own property (and as opposed to your mortgage), an index fund, say, is an asset and investment. Treat it accordingly.

Happy saving!

Comments on this entry are closed.

This reminds me of an item I saw on a TV programme (must have been almost 20 years ago!) the programme encouraged you to see an imaginary line drawn on your property indicating what proportion you owned vs. the mortgage company. The idea just sort of stuck with me and I regularly remortgaged reducing my term each time, overpaying and having an offset mortgage. Certainly think it helped me pay my mortgage of early.

I always considered my home an asset, but have been guilty of another mental accounting block. I have always very much considered this as our home and mentally ‘separated’ its value from our investment assets. In fact have never had current home valued (lived here for 20+ years).

As start to more seriously plan for stopping work and taking an income from portfolio. Need to consider this more, as likely to move, so home valuation and the costs of the home move, all need to be considered before I ‘push the button’.

Wow!

Never thought I would see Fred Dibnah mentioned on Monevator. Mind you, never thought I would see numerous references to Public Enemy tracks either.

I doff the great man’s flat cap to your excellent site.

Also, part answers the question I posed on the site at the weekend regarding paying my mortgage down.

I confess I am one who struggles with the mental accounting of my home too.

Clearly it is an asset, it has a monetary worth. But is it an investment? It certainly wasn’t bought with the intention of generating value, that will just be a bonus if and whenever it is sold. Its value to us now is exactly the same as it was when we bought it eighteen years ago – a place to live that we liked. At the same time we took the view you propose here of overpaying our (repayment) mortgage rather than paying into cash accounts at a lower rate of interest, though the benefit has been something like a virtual annuity, investing in our retirement by reducing outgoings (the house still needs repairs and maintenance).

And I don’t know what to do with it in our finance reviews. It ends up having a line as an asset – but at an arbitrary sum, Zoopla now declines to estimate its value – while being ignored when we consider how our investments are balanced to achieve our aims. In fact if you were considering our finances strategically it would look very high risk to tie up over half our assets in a single illiquid investment!

I did this with our Mortgage.

I actually did the psychological trick of trying to pay off some of it every day, even if it was £1.99. I kept it up for 10 years and paid off our mortgage at 40.Every night I would do, it became a ritual. Obviously you need a mortgage where this is penalty free.

The bank thought I was crazy. The statement would have things like £1.99, £10.53, £2.80, £5.10,£1.50 etc etc

Robert Kiyosaki has always taught that the home you live in should go in the liabilities column rather than the assets.

Argument being , why you are living there it is taking money out your pocket.

Of course, if you sell it it and downsize it has the potential to be an asset, however if you roll it over into a bigger, more expensive one then it really can be a liability.

@Erico1875 #5: Eh? you have to live somewhere. That makes no sense.

Our house goes into the assets column at the (2017) valuation the mortgage was taken on, and the mortgage balance goes into the liabilities column. That way the net value of the property is part of my total balance sheet. The disposal or liquidation value would be lower but with other assets to draw on we’d never plan to sell but may remortgage up instead.

Yes Im almost at the point where it becomes an asset i.e. paid off 🙂

HOWEVER

7 years ago, just changed jobs, fixed rate coming to an end, I did my back in. No employer sick pay, just SSP (£388 per month)

Phoned Santander, no help and tbh they were horrible They then put me back on the variable rate and harrased me constantly when I couldnt make payments.

I had recently put all my savings in to 2 BTL flats. One tenant bumped me 3 months rent and painted the place black. Left 20 bag of rubbish and lots of damage.

I spent the last of my money, £1500 on a private MRI scan to jump a 12 week NHS

queue.

6 months later, finally sble to work again. Finaly able to resume payments and overpay to reduce arears but they wouldnt let me come off the variable rate until arrears cleared which took a year.

Thats what I call a liability

A timely post as I’m about to take on the biggest debt of my life (on my own) at an age when most are closer to being mortgage-free.

However, my mind is riddled with buckets so I think I might have to say ‘repayment mortgage is a form of saving’ out loud like some sort of mantra, in the hope that it will change my way of thinking.

@Erico, property is both an asset and an investment, but very few investments are risk free and some investments are bad investments. Property is also most definitely an asset. In everyday speech a liability is not the same as the precise accounting term. Liabilities are things you have to pay someone to take off your hands. Your mortgage is a liability, not your property. If you are in one of those flats blighted by cladding problems the flat may feel like a liability, but from an accounting perspective it isn’t.

I have never had your experience, but our second house was not a good investment as in real terms we sold for less than we paid and that was after putting in central heating, a new kitchen and numerous repairs and refurbishments. It was still an investment, just not a very good one. We saved on rent, but for the period we held (85-92) the capital would have done a lot better invested in the stock market.

Don’t forget, your home is a tax advantaged investment as well. Over extended periods the tax advantage is significant.

Owning your own home should not just be seen as an asset or investment though. For most people it provides more security than renting. It is also a space that you are able to shape how you choose. Don’t like the colour of the walls, or even where the walls are? You can change them. Want to let a room, or the entire property if you go off on a sabbatical? Not a problem.

Your own home is an investment, an asset and a luxury item.

@weenie — I feel your pain, I also found buying my place pretty stressful. Not least the taking a wheelbarrow of money out the back and setting it on fire… sorry, I mean paying chunky five-figures of stamp duty. 🙁

All those little savings and budgeting decisions I’d made over the years, up in flames in an instant!

However leave aside taxes and transaction costs and (for a moment) volatile house prices and you can picture that all these components — cash, debt, and the equity in your property — are fungible, with plus or minus signs of course.

Buy your property and you create a new debt (liability) as a mortgage. That feels stressful! However you’ve also gained entry in the asset column – your house. This house has value, unless you’re one of the numpties who doesn’t count it as an asset… 😉

Net these two off against each other and you’re left with the equity in your home, which has currently been injected by you from cash with your deposit but in time will hopefully be added to with house price rises and repaying the mortgage.

So absent transaction costs/price moves (which as I acknowledge at the top can be chunky) and in a perfect world all you’ve done is rearranged your financial posture with different assets and liabilities. 🙂

As for the mortgage itself, as I state it has two components, as you know: interest and repayment. The interest is definitely an expense. Paying it every month supports your ability to add that house line to the asset side of your balance sheet, albeit by also adding a corresponding liability with the mortgage.

However paying the repayment component of the mortgage slowly increases your net assets by reducing debt and building equity in your home.

(A similar increase in net worth would happen if you were able to keep that repayment component of the monthly mortgage in a bank account at the appropriate interest rate, but unless you have an offset mortgage, you can’t.)

What really happens then when we buy our own home with a mortgage is that we swap one set of risks for another (again, ignoring the frictional costs).

We get new risks — such as not being able to keep up mortgage payments, more direct exposure to interest rates, risks to our property that we must bear or insure against, bigger calls on our cashflow as we have to maintain and repair our property. And of course we get an option on future house price growth in our area, with property prices now directly impacting our net worth as they rise and fall.

At the same time we shed some risks — we have more security as we can’t be evicted on a landlord’s whim, we won’t see rents suddenly shoot up (mortgage costs can increase, but these can be fixed for a period), and we no longer face the risk of not being exposed to rising house prices and potentially being unable to buy in the future.

There are more risks of both sorts, of course, and opportunity costs all over the place. 🙂

Financial management is typically down to converting one kind of risk to another like this.

https://monevator.com/the-first-law-of-thermodynamics-and-investing-risk/

Good luck with your new home!

A savings account with a not very good rate of interest at the moment

I’ve just paid a 13k early repayment charge to get out of 10 year fix with 5 years to go. Smart decision I thought when I did it. interest rates were ticking up and I wanted to invest instead and was ultra cautious about fixing the downside. Then. Covid.

Refixing with another 5 years saves me 20k over that period by going from a 2.59% fix to 0.99%. Bonkers . I had also changed to interest only last year literally just before the pandemic hit as I’m below 60% ltv so finally got my head round the fact I’m far better filling pensions and Isas than paying it off.

I’m now debating the pros and cons of borrowing a further hundred k to do btl or other investment with (I could even put part of it in wife’s pension and get a 20% boost-mines got enough I am better off using wife’s) . Borrowing would be less than 4 times salary and I’d still be around 70% ltv. Appreciate this is effectively using my house as a margin loan. Thoughts welcome?

I think the mortgage gets mentally tied up with the house because (a) your LTV percentage dictates how good an interest rate you can get, and (b) if you don’t pay your mortgage you lose your house. But I agree it should be considered separately – a mortgage is simply a big loan with a very low interest rate and so it’s better to invest in the stock market (which historically pays 7-8% after inflation) than to pay it down.

I would make 3 caveats though if you do get an interest-only mortgage – (1) make sure you are disciplined – do actually invest that money rather than frittering it away, (2) invest in a low-cost index tracker to spread the risk and make sure you do have enough money in 10-20 years to pay off the mortgage when you have to, rather than taking risks on say Bitcoin or Tesla, and (3) don’t lose your head when the stock market crashes, ie don’t sell when the market is down. All probably really obviously to us but for some it may be better to just get a repayment mortgage which after all is a good ‘pay yourself first’ strategy of saving and probably better than putting money in a savings account.

I actually consider my house part of my net worth and part of my FI net worth goal, and I work on an ‘imputed rent’ for the house – that is, I am landlord and tenant, and I have passive income (from myself) and rental costs (to myself) to pay. The question is, how large a percentage of the FI net worth goal should your house be? If you own a £1m house and have no other investments then you probably aren’t going to be retiring anytime soon! But for someone with a £250k house and £750k in investments then they may already be ready to FIRE.

Although I agree with most of yet another brilliant article, I have read many times that I should not consider my own home as an investment. Second homes, apartments abroad, yes, but they can all be sold whenever we want in order to free up funds. Your own home is a different matter. You need somewhere to live. I will retire in a year or so and will require an income to continue our life in our house and garden. So the house is part of us and cannot be considered as an investment.

Well…maybe for our kids!

Steve, I understand the sentiment, but after a few years rattling around an empty house you may change your mind. We did and downsized a few years ago. One of the best decisions we ever made even though it was difficult at the time as it was the house our family grew up in.

Very good article by the way. Many people get muddled when thinking about their home.

I agree its a form of saving, and that it should be considered as part of ones net worth. The extent I’d consider it part of my FI number is interesting though. Personally I’d see the house as a “bond of last resort”.

My FI number factors in repaying the mortgage whilst it still exists as a debt, however I wouldn’t necessarily consider the house value part of my FI pot.

I’m of the opinion that an FI pot is different from net worth. Net worth should include house valuation (equity) however FI pot not so. FI pots really are a total of accessible assets – but then I suppose that then opens up the question of at which point a pension pot should be considered if inaccessible for a number of years. All very subjective when it comes to FI numbers but pretty straight forward when it comes to net worth. I think those arguing differently are often confusing net worth and FI pot.

I think of our property as being part of plan B, to be turned to if we run short of other liquid investments. Mental accounting? Probably, but it simplifies things.

I agree wholeheartedly about using your Mortgage as a savings account. In fact, I build out an entire spreadsheet to analyze paying down a portion of your mortgage early to help speed up the mortgage and maximize your net worth:

https://accidentallyretired.com/resources/mortgage-prepayment-analysis-calculator-spreadsheet/463

What I found was that on a 10 year time horizon, paying 50% of your mortgage is actually a better outcome for your net worth than investing a lump sum or paying monthly.

But whatever you do, looking at your mortgage as a partial savings account is THE way in my opinion. Glad you hit on this too!

Sometimes things have a value that isn’t calculable in pounds and pence.

I got my first offset mortgage about 18 months ago and knowing that I kill the interest on the amount offset (rather than getting a paltry 0.1% return in a standard savings account) makes it far more palatable to build up and hold a decent cash reserve.

…and having that cash reserve makes life far less stressful. Yes, I previously had access to reserves in the form of shares that could be sold, but you can’t always sell at the optimal moment. Cash in an offset is emotion-neutral, and that, it turns out, has tremendous value.

A friend of mine’s father is self-employed and claims that his family home as his ‘pension’, with a plan to downsize and ‘live off the difference’. He has no other pension provision except the State Pension.

I think there’s a problem generally that people don’t understand how much it takes to fund a decent retirement, so a lot of people like him are probably very lucky to have lived their prime through an era of falling interest rates and a property market, which they’re exposed to through leverage, that has almost kept up with stocks.

I had my house valued the other day and it’s only risen $50k over the last 10 years. And $50k is about the amount of interest I pay in just 2 years of my mortgage. Meanwhile it’s also costing me money in upkeep and land taxes and won’t generate me a single coin. So while at the end of the day it will have intrinsic value – but it will have ultimately cost me a lot more. And that makes it a liability.

But hey… it’s a nice house in a decent area with low crime and plenty of employment – and I need to live somewhere, so it’s a necessary evil.

@Nathan S, “but it will have ultimately cost me a lot more. And that makes it a liability.”

No, it is still an asset, but you might consider it a poor investment.

@Nathan – there’s also the opportunity cost of renting. If you rented for the term of your mortgage you may pay more (or less) and you’d have nothing to show for it. at least you’ll own a house. Plus the stability angle.

Am I allowed to consider the savings of mortgage over rent part of my Savings Rate to make me feel good? after all, we have to factor in maintenance, Council Tax and stuff too.

@TI

Only just seen your reply, thanks for the taking the time with such a detailed response. Ah yes, stamp duty, makes me want to weep but the alternative was battling it out with the other desperadoes during the summer, trying to complete before the end of the stamp duty holiday which would have surely tipped me over the mental edge!

Thanks for providing me with more ammunition to appease my brain – as you have said, all I will be doing is rearrange my financial position with different assets and liabilities, I just need to educate my brain into seeing that (without it getting stressed!) – mind over matter!

The repayment part of my mortgage is a pretty hefty chunk (in comparison to the interest) – I don’t think I will include it as part of my savings rate (to avoid messing up my consistent measuring, not that it’s wrong to include it), although I now do see, with the help of this article, that it is a form of saving.

I will feel better once I start seeing that debt being paid off!

I’m in the process of going down the IO mortgage and investing the capital instead route. I’ve taken the position that I wouldn’t invest in a 1% savings product so should avoid paying anything more into the mortgage than I need to.

Like Accidentally Retired, I’ve created a spreadsheet to model this but it’s based on ongoing monthly payments rather than lump sums.

I think the balance may well change back to a repayment mortgage if interest rates hit 4% again.

https://docs.google.com/spreadsheets/d/1Bx2b–bNqDgXZz9Eba16cHDYr5JcA9Gh-rlEcwwh29w/copy

@ArnoldRimmer — (Loved your work on that spaceship, btw 😉 ) I’m just exploring your spreadsheet now. Looks very neat. Would you object if I tweaked it around a bit / used it as a base for a future Monevator article? I’d link to your comment here, or a follow-up comment if you’ve a resource you’d like to point people towards. 🙂

When health reasons dictated that full time working was no longer viable our home mortgage repayments were definitely a burden/liability. The solution was to FIRE earlier than intended, sell up and move somewhere cheaper.

Our liability had also been an investment as, like all our other properties, it was a do-er upper and therefore an investment – a good one.

It became a fungible asset, which when liquidated provided sufficient capital for our retirement to the country and investment in another do-er upper.

You just need to get used to living on a building site for years.

@TI

No problem, please tweak or completely rework (and double check my workings!).

I created it for my own personal use so at least a couple of caveats/potential improvements:

– It doesn’t model the impact of supercharging the investment strategy by pumping the money into a SIPP.

– It assumes the investment is going into an ISA so need enough headroom available (or model on basis of investment sitting outside of tax free wrapper).

Looking forward to reading the article.

More reliable than a garden strimmer.

https://www.youtube.com/watch?v=r-ZiI3iVgpM

@ArnoldRimmer — Thanks! I particularly liked the way you showed where the strategies overtook each other, that’s what mostly inspired me.

It could get very detailed (and very personal situation related) once you start to put those extra factors in, so might just mention in the text.

I have a long list of To Dos so don’t hold your breath, mind. Cheers again! 😉

I think I’m being a bit dense… I’ve never managed to work out how to calculate the proportion of an individual month’s mortgage payment that’s repayment and the amount that’s interest.

The usual calculators tell you over a year or the life of the mortgage but any pointers on the month to month?

@Cleanshoes take the balance, say £100,000, and the interest rate, say 1.3%. Multiply together and divide by 12 gives you the interest on your mortgage, in this example about £108. If your monthly mortgage payment was £500, then £108 would be interest and the remaining £392 is repayment.

@Cleanshoes

On my mortgage (nationwide) balance/statement online there’s a bit that tells you how much interest has accrued, unfortunately this is just the total over the lifetime of the mortage.

To work out the proportion month to month take a look at this number on the day your repayment goes in.

Then take a look at the number in one months time (~30 days), this will have increased as the bank adds their interest.

Subtract the latter from the former and you’ll be able to see how much interest has been added on that month!

As an example

Repayment day: interest balance = £5000

after 30 days: interest balance = £5250

£5250 – £5000 = £250

Therefore that month £250 of interest is your expense.