What caught my eye this week.

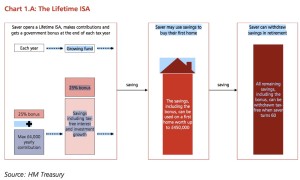

One of my least favourite articles on Monevator is the stab I had at explaining Lifetime ISAs.

In fact it was my second stab. I’d updated an even flimsier first effort just a couple of years later.

But I’d left a 2,500 word version 3.0 unpublished. Mostly because I felt it needed another 2,000 words to be comprehensive. And did anyone want to read that?

My published take is not a terrible article. But it doesn’t do a truly great job at explaining why the Lifetime ISA is a terribly confused addition to the ISA lineup.

And there are now better articles out there explaining exactly who might want to use a Lifetime ISA. Complete with the couple of dozen or more caveats and complications that such an article requires.

Fleas on fleas

My Lifetime ISA excursions triggered a bit of a crisis of confidence at Monevator Towers.

How comprehensive could or should we try to be?

We have perhaps the best reader comments on any financial site in the UK. And I knew that regulars would (constructively and rightly) point out the gaps in my explanation.

I didn’t mind that – indeed I welcomed it – but I also knew I’d be a bit miffed by some of them. That’s because it’s hard to explain how one-size-fits-nobody once you get beyond the basics of personal finance and investing to someone who hasn’t tried giving the complete picture themselves.

You need to write about something – whether ISAs or particle physics – to see that very often, the one thing you believe is of most importance is very often somebody else’s superfluous detail.

The Lifetime ISA experience ultimately nudged us towards doing fewer and deeper articles – especially for my co-blogger – and I feel we lost some of the breezy accessibility of an earlier Monevator in the transition.

But that’s the trouble with knowledge. The more you know about something, the more you’re aware of all the edge cases, contradictions – and everything you don’t know.

It was easier to write Monevator 15 years ago when we had less to share but didn’t really appreciate that. Knowledge is labyrinthine.

For whom the bell tolls

Anyway this isn’t all just me getting the tiny violins out about the hard lot of being a blogger.

It’s more a rambling Bank Holiday prelude to say I have sympathy with Andy Bell’s views on ISAs, which he’s been floating in the media recently.

Bell – the founder of the SIPP platform that carries his name – told the Financial Times this week that his company proposed:

…scrapping separate cash and stocks and shares Isas to create a single new offering.

It also wants to reform the Help to Buy and Lifetime Isas, which offer a tax-free bonus to people aged under 40 saving for a home. The platform is also urging the abolition of the Innovative Finance Isa, a type of peer-to-peer loan.

Bell said plans had been presented to chancellor Jeremy Hunt and reflected an ambition to simplify Isas to motivate savings and investment.

While he acknowledged the plans could narrow consumer choice, he insisted that the range of products currently on offer were too complicated.

“The proliferation of Isa products worries me. If you’ve got six Isa products to choose from, you almost give up,” said Bell. “If you were starting with a blank sheet of paper you wouldn’t design what we’ve got today.”

As somebody who did my time in the trenches on the ins and outs of various ISA products, I agree.

It’s true that a Monevator maven – someone who reads every article and pulls us up on our errors and omissions – no doubt enjoys nothing more than shifting from optimal savings product to tax-efficient vehicle to tax defusing like a freestyle skateboarder doing tricks.

I’m one of those too.

But in the profusion of ISA types, the average person just sees more jargon layered on top of the already murky world of saving and investing. And they have a point.

Ideally we’d have just one kind of savings account. Flat tax relief at 30%. With some curbs or outright restrictions on withdrawing and replacing all the money, to incentivize saving for old age. But those guardrails as clear as possible too.

The complexity we have today in ISAs and pensions 1 is more a result of politicians looking for rabbits to whip out of hats – or sneaky opportunities to take back what they gave us before – rather than joined-up thinking.

True, simplified ISAs would do Monevator out of a few opportunities for articles. But after my experience with the myriad (don’t-) use cases for the Lifetime ISA, I’ll live with that.

Have a great long weekend!

From Monevator

How to think about Junior SIPP asset allocation – Monevator

The Warren Buffett hedge fund that wasn’t – Monevator

From the archive-ator: Holiday strategies to refresh a frugal soul – Monevator

News

Note: Some links are Google search results – in PC/desktop view click through to read the article. Try privacy/incognito mode to avoid cookies. Consider subscribing to sites you visit a lot.

Average monthly rent hits £2,500 in London and £1,190 in rest of UK – Guardian

73% surge in current account switching in 2023 – Independent

Just 800 of 4,000 laws to be scrapped in ‘Brexit bonfire’ – Sky News

SIPP operator Gaudi is in administration; no impact on clients – FCA

Thousands missing out on heat pump subsidies worth up to £6,000 – This Is Money

Plans approved for UK’s first women-only tower block – Guardian

‘Brushing’ scam: Amazon sellers sending stuff to random addresses – Which

Only 4% of 2m UK voters without Voter ID apply for ID through scheme – BBC

The UK faces a steep climb out of a deep hole – Spiegel International

Products and services

40-year mortgages on the rise, but what are the risks? – Which

Nearly 5%… Al-Rayan touts 4.9% three-year fixed rate savings – This Is Money

A shed office adds £22,000 to your home’s value – This Is Money

Open a SIPP with Interactive Investor and pay no SIPP fee for six months. Terms apply – Interactive Investor

Should you share TV streaming accounts? – Be Clever With Your Cash

The UK’s best and worst seaside towns – Which

Will Apple take a big bite out of the banks? [Search result] – FT

Homes to tempt British buyers this spring, in pictures – Guardian

Comment and opinion

The mortgage dilemma: to fix or not to fix [Search result] – FT

Why the pensions Triple Lock has to go – Tom Jones via Twitter

Frugal man buys $52,000 car – Mr Money Mustache

You’re neither as smart – nor as dumb – as you think – Humble Dollar

How much of your salary is punitive damages? – Klement on Investing

You have to own – Dror Poleg

Discombobulated – Indeedably

Beware ETFs with a ‘new edge’ – Citywire RIA

Get ready for Retirement 3.0 – A Teachable Moment

Market cycles mini-special

Understanding the basics of market cycles – Darius Foroux

When market volatility creates opportunity – Janus Henderson

After a bad year in the market – A Wealth of Common Sense

When, where, and for how long? – The Big Picture

Naughty corner: Active antics

Buy Sweden – Verdad

Returns from the oldest investment trusts – IT Investor

Larry Swedroe: expenses matter with active funds – Advisor Perspectives

Is the Bitcoin comeback for real? – Institutional Investor

Downside betas vs downside correlations – Finominal

The sell-side is harder than the buy-side… – Behind the Balance Sheet

…or is the buy-side harder than the sell-side? – Klement on Investing

Kindle book bargains

Influence Empire: Tencent and China’s Tech Ambition by Lulu Yilun Chen – £0.99 on Kindle

The Missing Cryptoqueen by Jamie Bartlett – £0.99 on Kindle

The Nowhere Office: Reinventing Work and the Workplace by Julie Hobsbawm – £0.99 on Kindle

Cooking on a Bootstrap by Jack Monroe – £0.99 on Kindle

Environmental factors

‘Endless record heat’ in Asia – Guardian

Cities are reclaiming land at risk of extreme sea level rise – Hakai

How South East Asia is fighting back to save corals – Guardian

The flawed logic of extreme climate solutions – MIT Tech Review

Why cutting your personal carbon footprint matters – Semafor

Robot overlord roundup

Inside ‘the mind’ of ChatGPT, with Cal Newport – Range Widely

There’s a new AI unicorn that will make coders faster – Semafor

Welcome to the age of AI-assisted dating – Washington Post

Microsoft nearing a $1bn-a-year run-rate AI business – Tom Tunguz

AI is taking work from Kenyans who write essays for US students – RoW

Off our beat

Some things I think – Morgan Housel

How shady companies guess your religion, sexual orientation, and mental health – Slate

Pour one out for the notion of healthy alcoholic drinking – Slate

The underground city found in a man’s basement – Atlas Obscura

Magnus Carlsen: the winner’s edge – Farnam Street

Kevin Kelly on excellent advice for living, universal AI assistants, time machines, and the power of fully becoming yourself [Podcast] – Tim Ferris via Apple

And finally…

“Three things ruin people: drugs, liquor, and leverage.”

– Charlie Munger, Charlie Munger: The Complete Investor

Like these links? Subscribe to get them every Friday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

- Especially with the recently abolished Lifetime Allowance.[↩]

So Bell is basically asking for everything he doesn’t offer (peer to peer ISAs for instance) be scrapped. I am shocked. Shocked!

If he Bell wants to scrap Cash ISAs for instance then can he get off his arse and make his S&S ISA flexible please?

As far as I can tell the only broker worth a damn offering ISA flexibility is Vanguard.

@Andrew — Agree with you about flexibility, but I’d also add that the fact that this is down to the whims of platforms is yet another ridiculous layer of complexity for anyone approaching the topic who doesn’t want to make it their hobby.

If Hunt really wants to reform ISAs how about making transfers work properly like current account transfers do?

I waited *5 months* for a cash to cash ISA transfer starting the end of last year, and I’m 5 weeks and counting on Cash transfer in to iWeb now.

It’s not just ISA’s, the whole tax system is far too complicated.

Couple of points

I am very suspicious of business and government types closing down our freedoms to choose our own paths to perdition or heaven or what is more likely knowing the human condition-a mixture of both

Business types like Andy Bell want a monopoly-get rid of those pesky competitors-what businessman wouldn’t-it’s the ideal state for a business!

The government then thinks it knows best -telling us all what to do or more likely in the current climate what not to do!

I have more faith in peoples judgment and common sense that than either of the two previous groups ie business and government !

I am rather enjoying watching real life currently administering lessons to our business leaders and governing classes who constantly need “kicks up the……!” to leave us well alone

The market place (capitalism?) does the job best of all ie arrives at the best solution by competition -all you have to do then is protect the more vulnerable and tax the most successful

A system that seems to work

Andy Bell could also start a trend by paying a decent interest rate on cash held in his stocks and share ISAs -at least as good as the current crop of Instant Access Cash ISAs-ie 3%+

xxd09

I don’t see the point in simplifying ISAs.

First of all, a typical personal on the street of your average town probably don’t even know that IFISA’s or S&S ISA’s are a thing. In fact they likely only know LISA’s exist because it’s literally “free money” that can help them buy a house. In the main, the retirement aspect means exactly nothing to anyone.

This is not really a bug in the design that needs to be fixed. Most people simply don’t have the spare income to put anywhere except a cash savings account or a Cash ISA.

In fact, I’d be brutal and say S&S ISA’s are inherently a niche product. If you’re buying shares outside of a pension in Britain you’re either genuinely wealthy, trading (gambling) hoping to Get Rich Quick, persuing FIRE, or you’re simply uneducated financially and don’t trust pensions (and you probably should). I earn a very high percentile income and still can’t justify filling a S&S ISA after hefty pension contributions.

We all know “simplification” will just be a cost cutting exercise for the government. They’ll roll out some bullshit “British Innovation ISA” offering crazy tax relief with a pathetic cap, on the condition that you invest in British companies and don’t cash out for about 300 years.

Whatever they do will be much worse for people who can afford to save, ever so slightly advantageous to the people who can’t (but not enough to make sod all difference to their lives) and save the government a fortune on average.

Just to present my niche use-case for the Lifetime ISA… As director of a one man Ltd Company, my minimal salary only allows basic rate tax relief on pension contributions, and without the bonus of employed matched contributions.

So for me, contributing to a LISA as well as a SIPP (with the same tax-relief / bonus for each) spreads the risk of future govt meddling and potentially lowers my tax liability as a future pensioner.

@Andrew, It’s very nice of you to put your investments where you can’t touch them until the government gives you permission. My choice (under different rules about taking the pension) was to keep most of my money where I could access it whenever I needed or wanted to, i.e. S&S ISA.

And if the ISA choices were simpler, more people would know about them, instead of being put off by attitudes that S&S are not for the likes of them.

> If you’re buying shares outside of a pension in Britain you’re either genuinely wealthy, trading (gambling) hoping to Get Rich Quick, persuing FIRE, or you’re simply uneducated financially and don’t trust pensions (and you probably should).

Well, that’ll learn me. I have a modest SIPP that I will get rid of before SPA and a much bigger ISA doing the rest of the work. I don’t think I am in the taxonomy of listed morons, but y’know, Dunning-Kruger and all that 😉

I salute the top rant, however, bravo!

As someone that hit FI before they were 30, I have the vast majority of my equities/wealth in ISAs and taxable accounts. I was never keen on locking my wealth into a pension as I knew/suspected I would need access to it.

LISA has a place for those worried about govt tinkering with pension rules. Ok the same could be said of isa’s but atm at least funds can be accessed, rather than dangled like a carrot

@ermine – being long out of the rat race and happy to tinker is probably another exception. Salary sacrifice/employer contribution matching probably does make focussing on pension contributions the best option for most in terms of S&S as well as avoiding the temptation to raid it/fall prey to various cognitive weaknesses eg selling when there’s blood in the streets etc.

@e17Jack. As far as i am aware you can make company contributions directly to your pension thus saving company tax and employer Nics etc.

@ermine @Ecomiser

You seem to feel I’m saying investing in a S&S ISA is a bad idea… I’m not. But I think you both fit in to one of the non-normie categories I mentioned, or an adjacent one…. and so do I. It’s definitely something I will do when my pension balance is high enough, but paying 47% tax now in order to save 20% later on money I will need post-60 anyway isn’t very appealing.

You can see some recent ISA statistics here:

https://www.gov.uk/government/statistics/annual-savings-statistics-2022/commentary-for-annual-savings-statistics-june-2022#individual-savings-accounts-isas

First of all, only a third of all ISAs are S&S ISA’s, but they account for ~60% of all ISA value. In other words, they are concentrated amongst the wealthy.

More than half of people in the £30-50K/yr income bracket have ISA valuations of less than £5,000. And it’s not because of age… The 55-64 age group has an average ISA balance of only £30K.

Let’s be clear hete. Mr Bell wants the system simplified because he wants to draw in the 2/3rds of ISA clients that are only in cash, hook them on buying shares on his platform, and make some money on their trades and with holding fees.

There an important caveat with Investengine that the extended settlement times mean you maybe waiting a long time to withdraw your money, auto-rebalance etc – please see my more detailed comments on the invest engine review

@Andrew:

Tax arbitrage is generally a long term game whose ultimate performance can only be calculated after the event. Given most folks cannot wait decades for the results to be confirmed they generally make some critical assumptions at the outset. Typically, such assumptions have relied on the relative stability of the tax regime. Please note that the current trend of stealth taxation (e.g. freezing bands) can play havoc with this approach for some [edge] cases.

LISAs are really useful for retirement savings if you are self-employed/with limited UK earnings. For basic rate taxpayers, pension tax relief is not that attractive in any case.

The problem is that AJ Bell, among others, don’t allow transfers once you hit 40. So the few LISA providers there are “trap” their clients for 60 years. This is what needs to be addressed urgently. I’ve never seen a financial product where you are forced to stay with one provider for 20 years.

The “neither fish nor fowl” aspect of LISAs could also be remedied a bit by making it clear that for people who have bought a first property (and are not using a LISA to save for a house), they will be exempt from means-testing, as a pension would be. I also think people who move abroad should be allowed to withdraw in full, without penalty.

Re Guardain article on “Britain’s first women’s-only tower block”, Glasgow built an eight-storey block 1950-52 for single women: https://www.scottish-places.info/features/featurefirst94586.html

@ Investor ,opened an account via your link with investengine. Free dealing sounds good and the app is easy to use.

@TRS80 I had a look at your previous comment. It seems that the cut off for ETF choices is £300m in size, anything smaller could be a problem in dealing time.

LISAs seem to be an idea in search of a real practical purpose. Maybe I’m just bitter because I was too old to ever benefit but the govt subsidy locked into a long term investment vehicle that would probably fail to meet house price inflation for the stated purpose of facilitating a deposit on a first home always seemed odd. Thereafter the lock in til old age (rather than say 10+ years) seemed a deterrent to younger savers (perhaps not extreme FIRE types) rather than an opportunity.

Immediately signed up.

Then logged out as I wanted to comment under my usual nom de plume and not the name I was logged in under with the membership.

Very pleased about you launching the membership. I wasn’t sure you’d actually do it. Long live TI/TA/MrsTA!

Wrong post! Don’t know what happened there.