What caught my eye this week.

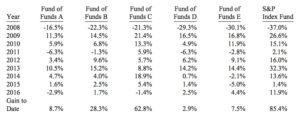

The cheque has been in the mail for several years now. But in his latest annual letter, Warren Buffett officially declared victory in his $1 million bet that an S&P 500 tracker fund would beat a bevvy of hedge funds over 10 years.

Not that the fund managers will mind – they’ve mostly gotten rich over the decade, too.

As Buffett notes:

Both the fund-of-funds managers and the hedge-fund managers they selected significantly shared in gains, even those achieved simply because the market generally moves upwards. (In 100% of the 43 ten-year periods since we took control of Berkshire, years with gains by the S&P 500 exceeded loss years.)

Those performance incentives, it should be emphasized, were frosting on a huge and tasty cake: Even if the funds lost money for their investors during the decade, their managers could grow very rich.

That would occur because fixed fees averaging a staggering 2.5% of assets or so were paid every year by the fund-of-funds’ investors, with part of these fees going to the managers at the five funds-of-funds and the balance going to the 200-plus managers of the underlying hedge funds.

Buffett concludes with a pithy new saying we could hang on the wall:

Performance comes, performance goes. Fees never falter.

Amen.

p.s. For an alternative take that I don’t quite agree with but that makes some interesting points, see this note by Albert Bridge Capital.

p.p.s. Unrelated, my thoughts on Theresa May’s vacuous ‘big Brexit speech’ – Twitter.

From Monevator

From the archive-ator: Another good reason to open an ISA – Monevator

News

Note: Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber. 1

Low volatility ETFs failed to protect investors during recent falls [Search result] – FT

A would-be £100,000 pension squandered down to £3,000 on fees – ThisIsMoney

Beat an interest rate rise by locking into a new mortgage now – Guardian

Experts warn of buy-to-let crunch – ThisIsMoney

Harvard fund blew $1 billion in bet on tomatoes, sugar, and eucalyptus – Bloomberg

Cumulative house price growth from 2009 to 2017 [Paywall] – FT

Products and services

Nationwide launches market-leading ISA savings rate – ThisIsMoney

Target Accuracy calculator to backtest model portfolios – Portfolio Charts

Innovative finance ISAs hit stumbling blocks [Search result] – FT

Sky and Netflix to join forces in single subscription package – ThisIsMoney

Comment and opinion

Modern finance must kick its addiction to indices [Search result] – FT

The importance of buying with a margin of safety – Of Dollars and Data

Will active stock funds save your bacon in a downturn? – Morningstar

Forget market timing. Think ‘expectations driven investing’ – Elm Funds

The morality of suing financial advisors – The Evidence-based Investor

Millennials can chill about not having massive savings – Simple Living in Somerset

Property is a ‘good investment’ mostly because you live in it – ThisIsMoney

A history of the Trump Slump [Speculative!] – The Economist

The case for a diverse portfolio – DIY Investor (UK)

Target date funds are underrated [Note: Tax tidbit is US] – The Finance Buff

Community care – SexHealthMoneyDeath

Crypto corner

Can Bitcoin threaten the stability of financial markets? – Institutional Investor

Bitcoin is falling out of favour on the Dark Web – The Atlantic

BOE governor Mark Carney says it’s time to hold cryptos to account – ThisIsMoney

‘It Just Felt Like a Miracle’: A bitcoin donor’s $56 million giving spree – TCOP

Nearly half of 2017’s Initial Coin Offerings have already failed – Fortune

Off our beat

A week inside WeLive, a utopian apartment complex – GQ

Six charts that show how the world is improving – Visual Capitalist

How a small town reclaimed its energy grid and sparked a community revolution – Guardian

David Lynch teaches typing [Free downloadable game] – Rhino Stew

And finally…

“No breath of wind,

No gleam of sun

Still the white snow

Whirls softly down”

– Walter de La Mare, Snow

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

Collateral’s P2P demise is worth a look too.

https://www.ft.com/content/5568a87a-1d36-11e8-956a-43db76e69936

Berkshire is one of the few stocks I own outside of trackers. I always find Mr Buffet’s letter to shareholders provides food for thought. I’m glad he won the bet though hardly game changing for me – my switch to trackers over active funds predates the bet by over 5 years..

Yes the Collateral P2P saga is moderately interesting because it shows how what looks like an administrative error can lead to Administration. The full story is fairly clear on http://p2pindependentforum.com/board/93/collateral Under the post “Administration”.

Essentially (as I understand it) Collateral had temporary FCA authority. And it was allowed to lapse in the last few weeks. Quite how that happened is not clear, but there is no suspicion at this time of fraud, scammery or insolvency.

So an administrator was appointed because Collateral were operating without FCA approval. Clients funds that were not loaned out (ie cash) are ringfenced. Loaned out funds are expected to be dealt with as normal, depending on the performance of the loans. Many will be secured against assets.

As one poster put it, this was the least worst outcome.

Possible Collateral will arise phoenix like for its own ashes. Not good news for borrowers who were almost set up for loans. they will have to seek finance elsewhere at some inconvenience.

Rhino Stew? Sounds delicious..

You learning to type properly?

You should try Colemak? Your fingers will thank you (eventually)

But its a challenge for sure.. You don’t realise what a deeply embedded motor skill QWERTY is until you try and unlearn it.

It took me about 3 years.

“A would-be £100,000 pension squandered down to £3,000 on fees” > one has to be sympathetic to this person of course, but who in their right mind doesn’t check in on a £50,000 investment over the course of 18years of their life. It is beyond belief, doubly so when it appears from the article to be his sole pension investment!

Just read the about section of that rhino stew site. Priceless. Think Nathan Barley but without the profanity.

@LCILondon – you would be surprised how casually reckless most people are about their finances in general, for a host of deeply entrenched & often unshiftable psychological reasons. FI/RE sites on the other hand are inevitably an echo chamber for those with above average interest in their finances …..also for a bevy of reasons.

That effect & the fact that culturally it’s a bit taboo in UK society to talk about money, means the likes of us tend to keep hold of the impression others think similarly. But, talking to those who actually will, about money, [probably means close friends & relatives] is the way to test this – they also are more likely to give honest answers vs in surveys. My experiences of this sort of curious inquiry revealed shocking levels of naivete, complacency & general neglect – even though the same people can often get really upset after finding out they’ve been shafted, but then still sort of refuse to see they were complicit in not watching out. They’ll rant against an insurance company that quietly raised their charges by a few % every year on noticing no push back, for example yet will resist reviewing their charges annually to prevent exactly this from repeating.

It’s too easy for those enamored of perfectly legal sharp corporate practices; shearers, fleecing…….

It depends on the hedge fund. Berkshire is really a hedge fund: they leverage insurance float to invest. Although it’s very hard to beat the index for a vanilla hedge fund that stock picks listed securities, market-beating results can be achieved where the public aren’t allowed – private equity partnerships, securitised infrastructure projects, even cat bonds. But that pond isn’t very deep, and those who swim in it aren’t usually called hedge funds.

Looking like business as usual, TI, thanks for pausing from unpacking boxes to get these links up, and note that — as the pause extends — the joy of buying a dwelling is that you know you don’t need to unpack those last few boxes until next year. Or possibly the one after. Soon you won’t even notice them.

Absolutely love the ABC shot back at the Church of St Warren of Buffet. Some lovely sideswipes in there (dealflow! leverage! cheap purchases!) reaching into the back catalogue of why he’s more the Adage from Omaha – but most damning is the graph of performance. Lovely stuff. Although more commentary on the extremely bad year would make for fairer reading and an interesting story (2015 stands out as an outlier in the decade the author picks). Of course it doesn’t stop the thrust of the bet, of course, and if the old man wants to nail his point home in his twilight years, I guess he should close BH and stick it in the index, pointing out that he’s the greatest investor who ever lived and even he can’t beat the market for the last decade.

Elsewhere in indices, the FT completely fumbled the ball on the index article. There are plenty of interesting things about indices (who decides them?!) etc and instead it launches off against people who try to understand whether they are expensive. I mean I like a good “we’re in a bubble” / “this time it’s different” article as much as the next guy, but I prefer it to be more entertaining and direct.

Loved the “world is better” charts. This needs to be published every week. We’ve never had it so good.

Finally the chap who “lost” 97% of his pension is a salutary lesson that if you aren’t the one looking after your wealth, then soon it will be someone else’s wealth.

In other reading, I’d also commend:-

https://www.ft.com/content/c2abde66-1b1a-11e8-a748-5da7d696ccab

Nicely written and covers some of the other stuff that can go wrong other than running out of money.

Notwithstanding the administrative errors leading to the administration of Collateral, a quick check suggests that the company balance sheet was not the strongest and the debt to assets trend wasn’t looking good:

https://www.checkfree.co.uk/Company/09314729/COLLATERAL-UK-LIMITED/Company-Details/

Underlines the importance of client funds being ringfenced from company assets.

@Mathmo (9) ….. the chap who “lost” 97% of his pension …..

Sadly, “….. a foole and his money is soone parted.” – Defence of the Government of the Church of England, 1587. So not just “my old Granny” who used to say it.

The Harvard investment managers presumably took the line that Harvard is a perpetual corporation and therefore well suited to realising the assumed extra returns of rather illiquid and exotic investments. To panic and sell up in the short term sounds pretty silly to me.

Put otherwise, if you can’t trust the investment manager to have a backbone don’t invest in anything that isn’t the standard stocks/bonds mix. Be a closet tracker.

@mathmo — Thank you — sincerely — for that ‘permission’. 😉 Have literally just taken your advice and put about four boxes of borderline ‘should they stay or should they go’ paperwork and records and lobbed them into a big cardboard banker’s box, labelled the top, and lobbed them in the corner of the storage vault where they take up little room and zero thought.

And it’s thawed in London. What a day! 😉

So we’ve now got death, taxes and fees as things we can never escape. Fees never falter does have a good soundbite to it, I can see this quote going far.

On crypto, have to say I’m waiting for it to die – I’m with Bill Gates who links it to crime and deaths. Do you really want to be the mafia and Al Qaeda’s money launderer? It’s not a socially acceptable investment in my view.

Speaking of socially acceptable, I went through my investments to check for sin stocks. We all know BATS is inherent in any FTSE holdings, which I dislike but have made my peace with. Alcohol is cool in my view, so Diego is good to hold. Guns are a bigger concern, especially since nutters in the US seem to be rather fond of them. I’m relieved to see that there is only a whiff of guns in the S&P500, in Walmart.

Like others, I’m not shocked at the dude who ignored his pension for decades and never read the small print or any statements and realised his cash was running out. Financial ignorance is real, and it’s not confined to those that have no money. High earners can be the worst. Money is still taboo to talk about here, and the move to the left and a Corbyn government may make it even worse.

@TheInvestor – hope you are settling in at the new place, waiting for your post on curtains.

On the subject of the pension pot that went from £50k to £3k. Yes the owner was reckless by most people’s standards, and possibly negligent when they didn’t update their contact details. However, I don’t think that excuses the outcome – if I understand the article correctly, the provider cashed in *all* investments to pay for one year’s worth of fees. That was clearly not in the customer’s best interests and the pension provider should have some minimal level of standard of care. Most people shouldn’t need to check (pension) investments regularly.