Bad news: Our Slow & Steady portfolio is down for the first quarter in nearly two years.

AAAAARGH! MAYDAY! MAYDAY! Run for the exits! Shred the evidence! Hang a scapegoat!

Wait a sec. We’re only down 0.34%. Or £118, largely due to a minor dip in our bond positions. Emerging markets and global property have waned a bit, too.

Over the last year? Only gilts are flashing red at -1.27%. No asset class is down over three or five years. Year-to-date we’ve put on 3.74%.

Okay, sorry everybody. False alarm. Just a drill. Remember it’s important to stay on your toes people.

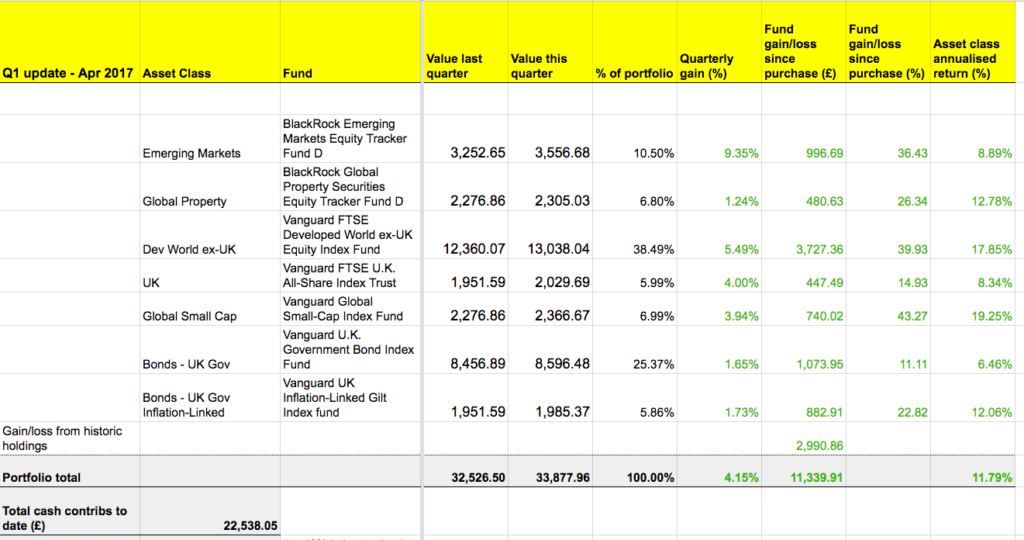

Here’s the portfolio latest in spreadsheet Dazzle-o-vision™:

In the last Slow & Steady episode (we’re in negotiations with Netflix) we talked about the futility of tactical asset allocation – why trying to position your portfolio for supposedly ‘inevitable’ outcomes like a bond massacre or a US blow-up is liable to boomerang back in your face.

It’s easy to doubt or to be blown off course, but nothing dooms an investor like portfolio management by media headline.

I sometimes think I need to invent a sticky substance to hold myself on track. This would be an actual stick. It would end in a boxing glove and I’d beat myself over the head with it every time I’m tempted to mess with the plan. Written on the knuckles of the glove – like LOVE and HATE on the fists of a gentleman with mummy issues – would be the word CALM. This would remind me not to do nuthin’ stupid.

Similar results may be achieved with an Investor Policy Statement. Such a statement is simply a quick-reference gameplan written by a cooler you for reference by hot-under-the-collar you in times of doubt: “Oh yeah, I’ve got 30% bonds to stop myself panic-selling when the market’s in free-fall.”

Another source of timely wisdom without violence would be having the words of the investing greats flash up before your eyes (perhaps via augmented reality specs) every time your brain goes AWOL – or when you log into your broker’s account.

The financial writer Jason Zweig recently republished an interview with the late Peter Bernstein, one of the most revered figures in US finance. When after 50 years at the sharp end someone like Bernstein says he is still figuring things out, you know that reacting to stray headlines or negative numbers is no way to proceed.

Zweig’s interview reveals much about Bernstein’s strategic approach to dealing with uncertainty. Here are a few choice bits to succour any investor-nauts who find themselves drifting in space:

Understanding that we do not know the future is such a simple statement, but it’s so important.

Survival is the only road to riches. You should try to maximize return only if losses would not threaten your survival and if you have a compelling future need for the extra gains you might earn.

I view diversification not only as a survival strategy but as an aggressive strategy, because the next windfall might come from a surprising place. I want to make sure I’m exposed to it.

Somebody once said that if you’re comfortable with everything you own, you’re not diversified.

Wise words, more powerful than any boxing glove. (Just hope I can find them when I really need them.)

By the way, the Slow and Steady portfolio is Monevator’s model passive investing portfolio. It was set up at the start of 2011 with £3,000 and an extra £900 is invested every quarter into a diversified set of index funds, heavily tilted towards equities. You can read the origin story and catch up on all the previous passive portfolio posts here.

Fiddly stuff

In more prosaic matters, BlackRock has rebranded its index funds as iShares.

That’s why our emerging markets and global property funds have a new label. It’s just a name change, nothing more. We haven’t done anything rash.

I should also mention the Slow & Steady portfolio has technically passed the threshold where it’s cheapest boarding is with a percentage fee broker. We are now roaming in flat-fee territory, where a fixed cost platform and fund dealing fees could lower costs overall.

Lloyds Bank Share Dealing offers an ISA account for a flat £40 per year. Fund trades are £1.50 a pop. Buying seven funds would cost us £10.50 a quarter or £42 a year. That’s £82 plus an estimated four sales a year to cover rebalancing trades, for £88 brokerage costs all-in. It sets up a photo finish with our current Charles Stanley residence. Lodgings with Mr Stanley notionally cost us £88.90 at 0.25% of the portfolio’s present value.

There’s 90p in it! What does the great god Optimal have to say about this?

Okay, I know we’re meant to snuff costs like Jeff Bezos but I’m not filling in a form for 90p. Sure, the value of our portfolio will probably rise further but then Charles Stanley charges a £10 exit fee per holding. (We wouldn’t have this problem at Cavendish Online, incidentally). What’s more, Lloyds doesn’t list our Vanguard Small Cap or Gilt funds.

So like a koala clapped out after a eucalyptus leaf and a scratch, let’s put the action on ice.

New transactions

Every quarter we pin another £900 on to the market’s wheel of fortune. Our cash is divided between our seven funds according to our asset allocation strategy.

We use Larry Swedroe’s 5/25 rule to trigger rebalancing moves, but all’s quiet this quarter. We’re just topping up with new money as follows:

UK equity

Vanguard FTSE UK All-Share Index Trust – OCF 0.08%

Fund identifier: GB00B3X7QG63

New purchase: £54

Buy 0.284 units @ £190.27

Target allocation: 6%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Equity Index Fund – OCF 0.15%

Fund identifier: GB00B59G4Q73

New purchase: £342

Buy 1.105 units @ £309.42

Target allocation: 38%

Global small cap equities

Vanguard Global Small-Cap Index Fund – OCF 0.38%

Fund identifier: IE00B3X1NT05

New purchase: £63

Buy 0.240 units @ £262.78

Target allocation: 7%

Emerging market equities

iShares Emerging Markets Equity Index Fund D – OCF 0.24%

Fund identifier: GB00B84DY642

New purchase: £90

Buy 61.350 units @ £1.47

Target allocation: 10%

Global property

iShares Global Property Securities Equity Index Fund D – OCF 0.22%

Fund identifier: GB00B5BFJG71

New purchase: £63

Buy 32.291 units @ £1.95

Target allocation: 7%

UK gilts

Vanguard UK Government Bond Index – OCF 0.15%

Fund identifier: IE00B1S75374

New purchase: £234

Buy 1.461 units @ £160.21

Target allocation: 26%

UK index-linked gilts

Vanguard UK Inflation-Linked Gilt Index Fund – OCF 0.15%

Fund identifier: GB00B45Q9038

New purchase: £54

Buy 0.294 units @ £183.78

Target allocation: 6%

New investment = £900

Trading cost = £0

Platform fee = 0.25% per year.

This model portfolio is notionally held with Charles Stanley Direct. You can use that company’s monthly investment option to invest from £50 per fund. Just cancel the option after you’ve traded if you don’t want to make the same investment next month.

Take a look at our online broker table for other good platform options. Look at flat fee brokers if your ISA portfolio is worth substantially more than £25,000.

Average portfolio OCF = 0.17%

If all this seems too much like hard work then you can buy a diversified portfolio using an all-in-one fund such as Vanguard’s LifeStrategy series.

Take it steady,

The Accumulator

Comments on this entry are closed.

Just a couple of points – you always end these updates with the option of Vanguard Lifestrategy and I was wondering if you have a comparison of the returns of Slow & Steady versus say VLS 60?

Secondly, as much of the portfolio is with Vanguard, there would be a small saving by now going with them direct for their own funds – 0.15% and still no dealing charges. Leave the property fund with CSD?

Anybody over there worried about the stock market? I’m a worried US investor here, but then again, I’ve been worried for the past couple of years.

Sam

Not really worried but as a middle aged investor I’ve just moved the first part of my portfolio from equities to bonds. My plan is to make a Kitces bond “tent”. That’s 125k of a total of 891k moved.

https://www.kitces.com/blog/managing-portfolio-size-effect-with-bond-tent-in-retirement-red-zone/

Hi

@The Accumulator. Appreciate the update and was intrigued by the use of the global small cap fund. Thought I’d look into it for my own portfolio, and my (admittedly cursory) scan suggests that its performance has been very similar to the Vanguard Developed World fund ( their global fund is too new for comparison ) and variants of the S&P500 – albeit with marginally higher volatility.

So I’d be curious to hear your thoughts on when & how you expect it to diversify sufficiently to justify the OCF of 0.38%. Not at dig, just interested to explore the idea further.

Cheers

I envy US passive investors, on bonds if not equities right now, where US 10 yr treasuries at least kick out over 2% to compensate for the interest rate and inflation risk.

And their TIPS (inflation linkers) seem better value than our index linked gilts which seem guaranteed to deliver a real loss of near 2%. Not to mention the very long duration of most linker funds.

Recently read the Gone Fishin Portfolio book and its an interesting take on bonds.

He has 30% in total bonds, split between 10% high yield, 10% in short-dated (up to 5 year) investment grade corporates and 10% in TIPS. So no conventional govt bonds at all.

Liked the book anyway, and wondered if any UK investors run a similar asset allocation.

Just wondering the reasoning behind splitting the equity exposure into UK, developed, emerging, and small cap, as opposed to a global equity fund? Also what are the benefits of holding a property fund. I use the advice by Lars Kroijer, which as you know is just world equity + bonds. Would be interesting to hear some of the reasoning behind the choices.

Thanks

@Sam — Hi. The portfolio is a model portfolio that will run for 20 years, designed to show how diversification across a range of asset classes produces good results for minimal effort. Holding a single global tracker (or LifeStrategy) would make this diversification less transparent. It would also be very boring to read four times a year! (Basically just a 60/40 LifeStrategy performance chart…) In addition it’s usually slightly cheaper to hold a range of funds, plus there are many successful passive portfolio models, and it’s nice to emphasize that. If you read back on comments on these posts @TA has been through this many times. 🙂 We’re all for using a single global tracker if you want to keep things simple.

@SemiPassive — Well yields are higher in the US now but this time last year their 10-year was around 1.5% — and of course holders had to take some mild pain (of the type bond-phobics are always telling horror stories about) for those yields to climb up above above 2%. Agree re: their TIPS though. If you’re willing to go very off-piste for a passive investor (not something I’m recommending!) then you could look at currency hedged bond ETFs such as STHS and SBEG to give some overseas diversity to your bond allocation without currency risk (but higher OCFs).

@FS @P — Well the idea of this portfolio is not to worry, just to be happy and let the rules take care of things. A 20-30% correction for a couple of years say would be great with 15 years or so left to run on this portfolio’s intended life. More money into equities from rebalancing and new contributions. Volatility is good for returns over a long time horizon. 🙂

@NSB — I’ll wait for @TA to have time to comment. However I would say five years isn’t a super-long timeframe for these sorts of things to reveal themselves, especially in a raging bull market like we’ve seen in the US. I don’t know the fund, but a quick look at the fact sheet reveals it is at least holding pretty different companies to the larger index so the potential for diversification is there. (Some purported UK small cap funds hold a good chunk of mid caps from the FTSE 350, as you probably know. Though in the context of the UK market that still does diversify you from the 10 or so companies that make up 40%-ish percent of the index! 🙂 )

Thanks for the tickers (chunky yield on those emerging mkt bonds!), now looking at all the other UBS ETFs available. There is an up to 10 yr TIPS one hedged to GBP with a ticker of UBTP if anyone is interested. Early days on performance as its not even a year old. Perhaps an option if wanting to replicate the Gone Fishin portfolio.

Sorry to go off piste – be patriotic everyone and buy gilts instead!

I’m 54 and planning on retiring and entering drawdown next year. With a very long drawdown period (35+ years, hopefully!) I intend to retain a big chunk of equities but to also have sufficient cash (3 years of essentials) to allow me to ride out the dips. This is mostly held in NS&I linkers.

In pensions and ISAs, I’m at roughly 65% global equities, 15% bonds (65% corporate, 35% gilts), 15% property+infrastructure, 4% “themes” (currently RIT Capital and Scottish Oriental Smaller Companies), and a few percent cash.

I may well increase my bond exposure within pension post as we’ll want to keep drawing these down even during market drops to make use of lower income tax brackets, but I don’t intend to touch ISAs for maybe 15 years (in fact, will keep contributing) so these can retain a heavy bond exposure.

I know that maybe 30% bonds in pensions makes sense but … but …

@P – thanks for the link regards the “bond tent”. I’m considering increase my bond exposure in pensions and perhaps also reducing duration, which will calm my nerves regards “bond crash”, so I’m looking at ETFs like IGLS and IS15. Dunno what similar I can do in my group pension but I’ll start taking a look into it.

Is there any reason why UK bonds make the bulk of your portfolio as opposed to diversifying towards Euro/US or corporate bonds?

Alvaro

Thanks for the article and your usual honesty about human failings. Please keep reminding me as I am apt to stray.

I can confirm that Lloyds do indeed carry the Vanguard Global Small Cap fund (IE00B3X1NT05) as I’m invested in it.

They also (somewhat intermittently, it seems in my experience) carry some institution class funds which are available to private investors. Although when I asked about a couple I was interested in (HSBC Global Tech/Pharm Index Trackers) I was told that although these are available now, they will be withdrawn ‘at some point in the future, certainly by next year’.

Would it be possible to also see the performance history of the slow and steady portfolio using its unit value which I know you record?

@ Neil – at the time of writing it was 9.23% annualised. Now 11.87%. Woot!

@ Alvaro – It’s 100% UK bonds because we’re UK based and if we needed to withdraw from the portfolio in a crisis then bills would be due in pounds (if the portfolio really existed, which it doesn’t). In other words, we don’t want our defensive assets to be exposed to currency risk at the wrong moment. There’s evidence for a slim diversification benefit with global bonds but also evidence that hedging adds expense and doesn’t work perfectly. On balance I keep things simple and don’t try to work the bond section of the portfolio too hard. It’s for crisis management while equities are for growth and diversification.

@ Sam and NakedStockBroker – Small cap and property for added diversification. Property is meant to be a halfway house between bonds and equities. Non-correlated assets are the essence of diversification so we ‘ave ’em. In reality, we’re buying into REITS, which tack reasonably closely to the equities market, so I’m not expecting miracles. Small cap – plenty of evidence that small cap outperforms large cap over the long term in exchange for greater volatility. We live in hope but also realise that the extra growth may not happen, or take many, many years to show up, or be small beer when it does. In sum, I guess the approach is to play in all the right spaces and hope something pays off.

@ DIY – I have looked at it versus LifeStrategy in the past and there wasn’t much in it. Over 20 years, you’d expect the Slow & Steady portfolio to do better as it’s riskier and cheaper.

Re: Vanguard, there would be a small saving for the sake of extra complication. It’s a trade-off. Longer term the future of the portfolio is flat-rate fee.

@ Tax Avoider – thanks for the tip-off. I wonder why brokers don’t list all the funds they offer? Now, why did you pick that name 😉

If I was to follow this investment plan for my own portfolio could I effectively rebalance every time I deposited, which would be monthly. So each month I could work out the percentage each fund is currently running at and then just split my monthly £1000 deposit into each fund so that it closely resembles the initial allocatin % for the portolio?

Out of interest, how long would this monthly rebalance take? I read a lot about Life Strategy saving hassle of rebalancing, but if its just 10 mins of depositing and working out %’s of each allocation per month that doesn;t put me off doing it manually.

Also, as I’m likely to be using Self Trade, would each deposit and allocation be free of charge – the way I’m reading it in your broker table, that does appear to be the case.

Cheers!

@ B80 – yes you can do it exactly as you outline. Let’s say 20 mins depending on how quick you are with a calculator. There are rebalancing spreadsheets out there that will make it quicker still. There is some evidence – though far from conclusive – that monthly rebalancing curtails your winners and that you are better off rebalancing infrequently – as in once per year.

This technique is a good compromise: http://monevator.com/threshold-rebalancing/

Yep, buying funds is £0 with Self Trade, though obviously there’s a charge to sell.

Hi B80 . I’m fairly new to this investing malarkey but have based my portfolio on Slow & Steady since I started 18 months ago. Reason being that it is the only portfolio ever described that I could actually understand the logic behind. Why Financial Advisors, Corporate Pension providers etc can’t achieve this when they are being paid to look after their customer’s best interests financially I don’t know. And I think Monevator need to be applauded for that ( sound of clapping).

Anyway, I invest with Charles Stanley Direct : Rebalancing small imbalances can be tricky as they have a minimum purchase price of £500 of a fund for an initial immediate purchase , £100 for subsequent immediate purchases and £50 for monthly investing. Rebealancing only takes me 5 minutes or so over and above the 10 minutes it takes me to purchase the funds.

I have stayed with CSD as their telephone support is absolutely superb and fund buying and selling is free. And the platform charge is ok for me.

I only do funds.

All the Best.

Is it possible to get the excel spreadsheet template that you use to track the performance of your portfolio of index funds? Thanks in advance.

@ flacko – I appreciate the comment. Cheers!

@ Ja’u – I need to spend some time cleaning up the spreadsheet so that others can use it. It’s on the to do list. In the mean time, this excellent article helped me build it:

http://whitecoatinvestor.com/how-to-calculate-your-return-the-excel-xirr-function/

These are helpful too:

https://onedrive.live.com/view.aspx?cid=826E19AB9B5B8CE9&resid=826e19ab9b5b8ce9%21137&wacqt=sharedby&app=Excel

http://www.experiglot.com/2006/10/17/how-to-use-xirr-in-excel-to-calculate-annualized-returns/

Or, there are some links to ready-built portfolio tracking software and spreadsheets in the portfolio tracking section of this piece:http://monevator.com/financial-calculators-and-tools/

@The Accumulator – many thanks for your response and supplying the wealth of information on this site – really has been useful to say the least! No doubt you’ve considered a forum in the past, is something you envisage creating in the future?

Can I clarify on rebalancing and costs please. If I was to deposit 1k a month into the isa, how would I split the 1k between the 7 funds listed in this portfolio? Would I not analyse the %’s of each funds weighting in the portfolio and split the 1k accordingly? How else would you allocate the 1k without carrying out a form of re-balancing?

Also, with Selftrade, what would my monthly costs be if I wasn’t selling any funds? The regular investment cost is 1.50. If I was deposit my 1k monthly and then allocate portions of it to different funds, would the charge 1.50×1 or 1.50xthe amount of funds I top up with my deposit?

Part of me is wondering with to go with Alliance Savings Trust from the off as it appears that if I invest 20k into an isa each year, after 2 years I’ll be paying the same platform fee as selftrade, plus I’d have to pay £15 per holding to transfer out. Is the transferring process fairly painless? If its as big a job as it has been moving my work pensions I think I’d rather pay a bit more by going with Alliance from the offset!

@flacko thanks for response mate. Yes, CSD do seem to offer a decent platform at a competative rate, it’s a shame my hands are tied through being an employee of an investment bank so I can’t use them!

You can split your £1K by your rebalanced asset allocation percentages every month. Alternatively, you could buy in line with your asset allocation percentages and leave the rebalancing aspect until 12-months time or any other review period you decide upon.

Your dealing costs for fund purchases on Selftrade are £0. Your platform costs 0.3%. You’d pay £1.50 x no of transactions if you were buying ETFs, ITs or shares with Selftrade.

Alliance Trust aren’t competitive. Not sure why you would pick them.

I can’t promise you a painless transfer process. It should be but isn’t always. Companies screw up.

@The Accumulator. The reason I mention Alliance is that they’re my only option for flat fee platforms due to me working for investment bank. My maths indicate that after 40k’s worth of investments self trade would cost me 120 a year in platform fees – same as alliance. If I was to follow the slow and steady portfolio It would cost 15×7 to transfer out of self trade after 2-3 years. By the time I factor in potential hassle of transferring, I was wondering if it may be ‘easier to simply start with Alliance despite the higher costs for first year or so.

With Alliance you get one free trade per quarter, so am I right in saying I would have to spend another 9.99 for the other 2 months when depositing my 1k – in which case it does appear alliance aren’t going to be competitive for a few more years!!

The 1.50 for regular investments, would I have to pay this if I opted for a life strategy fund that contains etfs?… this could bump the cost up if it does?

Hi Accumulator,

I’ve got the Lifestrategy 80 fund with Vangaurd but quite like the sound of emulating this portfolio of yours going back to 2011 and copy it.

Thoughts?

Hi Accumulator – sorry if you’ve already covered this somewhere, but I was looking into the Vanguard global small cap fund and it didn’t seem particularly small cap to me – for instance, the UK portion seems to be effectively a FTSE250 tracker, whilst the overall median market cap size is over £2bn. Given that, do you think it really adds anything extra to your portfolio?

Tom, it’s a good question and the answer is necessarily a murky one. There is no single definition of small cap. Moreover, US definitions tend to be a lot larger than UK ones – more like the market caps you’d expect in the FTSE 250.

You’ll notice there is no genuine UK small cap tracker fund available. Presumably because the costs of dealing in such small, illiquid companies are prohibitive. The iShares UK small cap tracker really is more like a mid cap beast.

Now, evidence is that the power of the size premium intensifies at the lower end of the scale. You can buy micro-cap funds in the US. But the premium exists higher up the scale too – it’s just you have to lower your expectations accordingly.

So the way I look at is, I’m happy to diversify into a different range of firms and if I can achieve a sliver of size premium on top then so much the better.

But I wouldn’t argue with anyone who decided that they’d rather stick with a single, simple, low cost broad market fund instead.