Musky smell

Hold up: haven’t we often stressed that passive investors should have an understanding of what’s under the hood of their funds? Superficially, then, doesn’t it seem logical to be alarmed that a controversial and apparently bonkers-overvalued outfit like Tesla would garner a share of your retirement pennies? That a portion of your passively invested pension could be under the sway of Elon Musk, some people’s idea of a Marvel super-villain? Superficially logical, but in my view a misplaced concern. I don’t just say that because I’m a big fan of Tesla and Musk. Nor even because I first bought (a woeful few) Tesla shares around – cough – $30, or about $7 in today’s money. 1 No, worrying about Tesla as a passive investor isn’t warranted, in my view, because passive investors should just be passive investing. Why? Let me count the ways:It doesn’t matter – Ben Carlson has done the sort of deep dive some are probably looking for on Tesla’s inclusion in the S&P 500. Ben points out Tesla will likely make up about 1% of your S&P 500 holdings – and much less of your portfolio taking other regions into account.

You can’t put a price on Tesla – Why should a passive investor feel at all confident saying Tesla is overvalued? The theory behind passive investing is the market’s best guess – on average – is the one to go with. Your edge is you think Tesla shouldn’t be worth multiples of veteran car companies who make multiples more cars? Or that Elon Musk is a blowhard? People have been saying that for 10 years. Incidentally, you’re in good company – it’s nothing personal. I hope Ben doesn’t mind me mentioning that he and his sidekick Michael Batnick were laughing about the supposedly absurd valuation of Tesla since they began their Animal Spirits podcast. They’ve been wildly wrong.

Maybe Tesla is overvalued, but what are you going to do about it? – My faith in Tesla could be misplaced. I’ve been wrong about plenty else before and it is harder to be confident of decent returns from this high market cap. Maybe it is in a bubble. But what action will you take if it is? Short the stock? Abandon passive investing for active stockpicking? Even if you’re right about this one stock, are you going to be one of the few who is right about enough other stocks to beat the market? Have you got the time, passion, and energy to find out? No, no, no. Stick to index funds and enjoy a new series on Netflix.

You probably only care about Tesla because it’s famous – Maybe you’re a passive investor who has dug into hundreds of boring companies despite only buying index funds. But it’s likely you know about Tesla because it makes fancy cars and its founder is always in the news. You should understand there’s all kinds of shenanigans, crazy-seeming overvaluations and under-valuations, and things you wouldn’t think you’d want to touch with a bargepole whirling around the indices all the time. You just don’t know about them. For instance infamous hedge fund manager Bill Ackman has a closed-end trust that owns billions of dollars worth of his hedge fund alongside a ten-figure investment in a ‘blank cheque’ SPAC vehicle that is going to go and buy a totally undisclosed target. This trust is knocking on the door of FTSE 100 inclusion. Most passive investors would run for the hills if they looked at it, but they’ll never know about it. (Disclosure: I own a few shares in it.)

We’ve seen this before with Facebook – Same deal! Although it’s mostly forgotten now. Facebook’s valuation was said to be ludicrous. The profits were generated out of the thin air of the Internet economy. The CEO was a kid. The shares were in a bubble. Only they’re up about five-fold since it floated. Oops! (The Accumulator wrote a great post on the fears around Facebook joining the market at the time.)

If you really want to fret, worry about why you didn’t own Tesla when it was 50-times cheaper – It’s very easy to fear what you own going down. But how many passive investors fretted about whether their index fund owned Tesla all the way up, and if not what gains did they miss out on? To their credit one of our querying readers noted they already owned Tesla via their choice of a very broad index fund, and rightly saw this as a demonstration of the value of wide diversification.

Again, I’m glad we are considered a resource worth directing such questions to. And I mean everything above in the spirit of tough love. Sure I could go into the mechanics of Tesla’s inclusion (and hitherto exclusion) from the S&P 500, the free float impact on its weighting, or even the risk of hedge funds front-running this well-signposted index addition. But I really don’t think any of that matters for 99% of readers.The winner takes all

Nobody denies that some duds get into the indices. High-flyers that prove to be too expensive, too faddish, too crooked – who knows? But passive investing isn’t the most successful way for most people to invest because it is a strategy that somehow sidesteps landmines in the market. Passive investing is not, in other words, great at active investing. Passive investing works because after fees, on average, the typical active fund won’t be great enough either to do better than a warts-and-all passive fund 2. The passive fund will probably beat the active fund alternative, and even if it doesn’t it’ll deliver very near the market return. Passive investors do better than most active investors not by being cleverer in their stock selection, but by being clever enough to know their limitations. The crazy thing is it’s a ton less work and stress than active investing, too. Why spoil a good thing by worrying about micro-details? Have a great weekend all!From Monevator

Our updated guide to help you find the best online broker – Monevator A coda to my mini-bond confession – Monevator From the archive-ator: Investing for beginners: Time value of money – MonevatorNews

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 3 Sunak faces backlash over public sector pay freeze – BBC Government announces 10-point plan for a ‘Green Industrial Revolution’ – UK Gov Rents in British cities fall by 15% in Covid exodus – Guardian Lump sum pension withdrawals leap 94% as households suffer income shocks from Covid-19 – ThisIsMoney

Products and services

Nutmeg joins with JPMorgan to offer smart ethical tracker fund range – ThisIsMoney What the Government’s ‘Green Revolution’ means for our homes and cars – Guardian Fintech start-up Lanistar’s secure debit card promotion attracts the attention of the FCA – ThisIsMoney Do you need a good credit score to get a COVID-19 home test? – Which Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade Virgin Money offers 15 bottles of wine and 2% interest on balances up to £1,000 – ThisIsMoney Corporate landlords are muscling into the residential lettings sector – ThisIsMoney There are now 24 crypto assets with a market cap of over $1bn – AVC Homes for sale in former vicarages, in pictures – GuardianComment and opinion

Inkblots – Klement on Investing Early retirement: Boring – Finumus Wealth tax risks worsening defective CGT system [Search result] – FT Getting comfortable with your ‘enough’ – The Evidence-based Investor Menopause: another reason to become financially independent – Quietly Saving The biggest stock market reversal in history – A Wealth of Common Sense Can active bond funds keep repelling the indexers? – Morningstar The lifecycle of investing factors – ValidideaNaughty corner: Active antics

Merryn Somerset Webb: the coming commodities surge [Search result] – FT The case against using CAPE for relative valuation across markets – EconomPic Bitcoin is gunning for a record and nobody is talking about it – Bloomberg via MSN Four things Warren Buffett does that most investors couldn’t or shouldn’t – Valididea US small caps experienced maximum pain in 2020 – The Irrelevant InvestorBright side to the virus mini-special

We have no idea what happens next – Morgan Housel Is the vaccine our One Giant Leap? – A Wealth of Common Sense COVID-19 pandemic and its positive impacts on environment: an updated review [Research] – SpringerCovid and politics

Note: Any comments on Covid should only go on our special thread, please. Mass coronavirus testing in the UK: An unevaluated, under-designed, and costly mess – BMJ Oxford study: Covid reinfection highly unlikely for at least six months – CNBC Moderna’s vaccine looks extremely effective, reducing infection by 94.5% in trials – Stat New York is closing schools again, despite most evidence showing schools don’t drive infection spread – The Atlantic More from a US epidemiologist on reopening schools safely – Vox Spending splurge before lockdown reveals our true feelings [Or, a Guardian veteran finally understands people] – Guardian Can daters trust an ‘antibody positive’ claim? – Scientific American Danish Covid mink variant very likely extinct – Guardian Pay people $1,000 each [!] to get vaccinated to achieve herd immunity, argues economist – Yahoo A fully reopened economy will require digital health passes – Abnormal Returns Mock Covid-proof cruise trials attract thousands of volunteers… – CNN …but elsewhere the first cruiseliner to return to the Carribbean just returned to port due to, ahem, Covid – Guardian Donald Trump’s potential criminal liability is the key to understanding his presidency – New York TimesKindle book bargains

You don’t have a Kindle? Get one – they’re great and save a ton of space. The Everything Store: Jeff Bezos and the Age of Amazon by Brad Stone – £0.99 on Kindle Putin’s People: How the KGB Took Back Russia and then Took on the West by Catherine Belton – £1.99 on Kindle Happy Money: The Japanese Art of Making Peace with Your Money by Ken Honda – £0.99 on Kindle The Finance Book: Understand the numbers by Stuart Warner – £4.19 on KindleOff our beat

How to design the perfect day… – Rad Reads …versus the omnipresence of work – More To ThatAnd finally…

“Things that have never happened before happen all the time.” – Morgan Housel, The Psychology of Money Like these links? Subscribe to get them every Friday!- Don’t worry, I botched my trading as I got jittery and dithered a few crucial months when defusing the gains and moving it from outside to inside an ISA, so I didn’t enjoy all those crazy returns![↩]

- Really the average pound invested, but that’s niggly for this post[↩]

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

I think we should just all be grateful that we own Tesla. It’s been such a great ride over these past several years that I think we should just give things to Elon for helping us make money and outperform the market.

Now, every index investor gets to own a little bit of Tesla too. More winning!

I’m excited about all the IPOs that are coming out of San Francisco soon, like Airbnb, Wish, and Affirm. Things are heating up!

Sam

Great article.

Fortunately I have been with Tesla for a while and have seen all the shorting and bad PR being done by fund managers and other competitor car manufacturers against Musk. The share price possibly will drop from its heady heights but not before it has seen off Ford and General Motors. If I had shares in these I would be more concerned. Fords new F150 could be a side note in history once the Cybertruck arrives and they know it.

The way to look at Musk is to see him as the Isambard Kingdom Brunel of the 21st century. Rockets, tunnels, cars, trucks and suvs. However the real game changer is that Tesla are developing battery power storage for either the grid or for domestic use. This alone has significant share holder value in its own right. Power stations can charge these during the night for the morning and during the day solar panels can charge them for the evening. Net result is a serious reduction of power stations needed. One only needs to see what Tesla are doing with the Australian grid to see where this is going.

So at this stage the jury is out but we are seeing some fascinating developments from Musk which will change our lives forever.

I admire some of what Musk has achieved with Tesla, particularly the overarching desire to accelerate the adoption of EVs globally.

That doesn’t mean I can’t think that it’s also one of the great price Bubbles in history (and I won’t get into some of the governance). Not that I’d short it either.

But then if it’s 1% in an index, it’s not really a problem for a Passive investor i.e. TI’s commentary is bang-on as usual.

I recently dipped into Fintwit, and it didn’t take long to find a worrying amount of people who sound like daytraders in 1999. Or Gerry Tsai fanboys in the late 60s. We’ve been here before…

Sure, Ackman has his issues, but if you offer me Tesla or a basket of US blue-chips at a 25% discount, I know which is more appealing to me. I suppose it’s the Active equivalent of ‘slow and steady’.

Arguably investors’ greatest fear when it come to companies they invest in, should be bored management. There are so many examples, and it’s always the same story. They have a good thing going, they get bored of winning, they do something stupid, the company takes a hit and the share price takes a beating.

My worry is not Tesla, my worry is Elon Musk and the fine line he often appears to tread between utter brilliance and complete idiocy. Historically genius/madman pioneers and inventors have rarely made money in the long term – they opened the frontiers which others monetised.

It’s not a question of whether Elon is going to fall off his rocker, it’s a question of when. What I’m not certain about is whether Tesla’s board are strong enough to stand up to Elon and boot him out when that happens, and if they are, will the company be able to sustain even half of its current trajectory without Elon.

I’ve called the Telsa bubble too early and it is now sitting at around $500 up from a recent trough of $350.

I don’t need the thrill of shorting stocks but my personal view of Tesla is that it is the best known stock and considering that there are supposedly millions of first time investors buying stocks through Robinhood in the US or Freetrade in the UK, it is this new money that is pumping the price up.

Has the smart money already left the table?

On a tech level, talking to people that I know who know about these things and they say that whilst Telsa has first mover advantage they are not immune from competition.

Speaking to Tesla enthusiasts and they believe that the company has almost patented alchemy.

Can’t comment on Telsa. I actively invest in equities but only through index products. I never touch single stocks so it’s not something I’d ever have in my portfolio.

Regarding the article “The Sharpe ratio is much misused and misunderstood, and its successors don’t add much value”. I wonder why people write these articles. Are they just filling space? It’s obvious why the Sharpe ratio is a key metric. It’s not misunderstood or misused.

I think most investors would agree that the return on utilized capital over the risk-free rate is an important metric. Now for leveraged investors, utilized capital is just a function of portfolio VaR + stress loss adjustments i.e. the portfolio volatility or risk. It then follows that return on utilized capital = return per unit risk … which is the Sharpe ratio. So Sharpe ratio is functionally return on capital for leveraged investors. So it’s clearly a very important metric by which to measure a portfolio manager. But it’s not complicated or misunderstood.

They have a legitimate corner (luxury) of a legitimate market (ev) and that has a legitimate future, they meet the criteria for the s&p, so they should be in our portfolios, that said now that the cat is out the bag I can’t predict them now surprising the market with anything new, but you never know how much you don’t know, so I eat humble crumble and stay passive. I do think that most of what previously we called “technology” no longer should be called that – Tesla is an automobile company, Facebook is a media company, Netflix is entertainment/media, etc, Google is a marketing company/ library. I’d also say that there has always been a lot of josseling in newer markets so diversification is important and with an index you kind of ride the momentum of winners while they’re winning.

Maybe common ownership in the s&p will reduce their appetite for competition though, since Teslas owners now also own Ford etc

Musk’s approach to life and work is outlined in this excellent series of lengthy articles

https://waitbutwhy.com/2017/03/elon-musk-post-series.html

He has a very unusual mind and I hope he pulls his interconnected endeavours off. The biggest concern is his physical or mental health. There are interviews where it seems it doesn’t seem like it’s a lot of fun to be Elon although he’s done as much as anyone to overcome fear and self-doubt.

I’m a very passive investor since my exposure to S&S is via my pension. Things go up, things go down (I’ve seen wild swings in its value this year). As long as it looks like I’ll have enough to live on, I’m not worried.

@TI, A couple of articles that are probably best read in order and would fit into the “News” or “comment” section that have had me thinking this weekend around the work of Peter Turchin. How entirely convinced I am of his predictions is not the issue, I think his method has validity and is moving what was an art towards a data driven science and I applaud him for that. https://www.theatlantic.com/magazine/archive/2020/12/can-history-predict-future/616993/

https://www.salon.com/2020/11/21/what-lies-ahead-after-the-damage-of-the-trump-era-can-america-avoid-disaster/

JimJim

I think Musk is a once in a hundred year figure. What he has achieved in his life is nothing short of astonishing. I bet you didnt know was a co-founder of PayPal.

The amazing thing is Tesla is only one of several companies he founded, and probably in potential is third. Second is Space X, which is now the default way of getting into space. The first with most long term potential is in the Boring company, which is developing ways of creating tunnels cheaply.

Whereas having learnt from my own investing ignorance and related financial losses and having read up here and Lars Krojer, I comfortably am only vaguely aware Tesla is a US share related to clean energy/electric cars which has sky rocketed in recent years like the Nasdaq. I have no edge and stay well away from individual shares. Albeit I appreciate the point in the question- not dissimilar to the “aren’t world trackers dominated by the US market”. Well yes, but you’re buying the market not gambling that you can identify in the future, which individual investments, sectors or geographies will outperform the market in the next 10-30 years….I am happy to accept I do not know what Tesla’s future holds. Another netflix box for me in the time saved. And hopefully with less gambling will come higher long term returns too.

I have no doubts that Elon is a highly skilled visionary

I also have no doubts he was very lucky – the right place at the right time (imagine if he was born in medieval times or caveman times!) – you have many very clever people out there and only a handful are the first to do something. I believe that scientific progress was so slow in the past because only the elites could write or publish or be taken seriously (imagine things like gravity, evolution or round earth were thought up many times)- it’s obviously a better situation now but you do still need the luck of being the first to do something at a time in history when it’s possible.

@Mathew (12). A very interesting point.

The late, great, Carl Sagan, in his book Cosmos, proposed that but for the various destructions of the libraries (there were several) at Alexandria (Julius Caesar is accredited with burning some 40,000 books by accident, for example), human knowledge would have been sufficiently advanced that we could have put a man on the moon in the 16th century!

This may be far fetched, but consider that it was the Arabs who took over what was left of the libraries, and it was on the basis of what they learned that, 1300 years later, Galileo was able to take Arabic scholars work and forward his theories.

1300 years lost?

@borderer – perhaps, definitely a lot earlier if we made an effort! When I see things like the pyramids or Stonehenge I wonder what we could be achieved if weeks something useful – I think what was really lacking was any vision of what science could do – they couldn’t have predicted electricity or medicine. There was also a much greater focus on arts although I wouldn’t say that was unproductive as generating a cultural identity glued together tenuous civilisation – and you could imagine people needing hope from something like the Sistine chapel to continue with their harsh, unrewarding peasentry, it might be even kept rebellions down and suppressed any wage demands.

I also think that societies have to become militarily stable before they can take off – what did happen through scientifically unproductive years was that society grew in size and perhaps refined trades and engineering that helped later on, ultimately refining the concept of industry, creating an education system, etc. Maybe if society had not grown beforehand we would not be knocking on the door of climate change and so wouldn’t be developing tech in the teeth of a crisis – likewise I have hopes that the vivid vaccine will spur on other RNA vaccines of other stuff

Of course Elon Musk doesn’t exist in a vacuum. His success like everyone’s is built on the back of those who gone before, as well as all those smart people who contribute around him.

With that said, I think if we’re going to move towards labeling or even dismissing the achievements of someone like him “very lucky” then we might as well give up on recognizing anyone’s special contribution.

As has been said, the guy has founded at least three major companies so far. He actually founded a mapping company pre-PayPal, which I used to use in the 1990s! He sold that for a many millions and rolled it into the start-up capital for what became PayPal (he actually launched a rival payments service, forget the name, and then later it merged with PayPal).

He has repeatedly risked masses of his own money and reinvested and risked it again.

And he’s done this in at least three different fields! (Fintech, engineering, space travel!) Most people are lauded if they achieve what he has in one field.

On top of all this, he had a pretty tough upbringing. No he wasn’t a caveman, but read his biography and there were family difficulties etc. He even had to emigrate to get going in the US.

He’s by no means a perfect individual. Clearly not. But he’s the closest to an Edison or even a Da Vinci type we have right now, and if his achievements don’t stand for themselves then nobody in business does (and maybe nobody outside of the greatest artists?)

I totally agree, TI – I don’t like Elon Musk as a person because of many of his comments (and tweets!) over the past few years, but it cannot be denied that he has achieved what many would argue was impossible not once but many times.

Interesting to see Nutmeg moving into ESG although with a significant uplift in fees compared to the underlying funds, it proves once again that a passive approach with a global, ESG fund via a low-cost broker would be the way to go! I have been considering allocating part of my monthly investments into an ESG fund but doing so feels like ‘greenwashing’ to me as opposed to continuing to reduce my personal carbon emissions (2.6 tCO2e for 2019/20). The billionaires and governments (ie. The Green Revolution) continue to push renewables, electric vehicles, etc. as the solution to our problem when in reality a 50+% reduction in energy consumption in the developed world is required. But what would that do to our investments…?

Just a note for your next low-cost broker table, Fidelity has bought Cavendish and is merging the two platforms. Fidelity are retaining the Cavendish fee structure for 12 months for existing customers before (presumably) charging the higher Fidelity fees.

I hold most of my exposure to US shares via the US listed Vanguard ETF VT (Total Stock Market). It currently holds shares in 3,590 US companies. Tesla is the 14th largest holding at 0.88%. For comparison, the 3 largest constituents are Apple (5.09%), Microsoft (4.65%), Amazon (3.93%). I could not swear to it, but Tesla should have been in the fund since shortly after it floated. So have S&P 500 tracker holders missed out by not having Tesla? Possibly, but overall the S&P has delivered better performance despite not having Tesla. The 10 year performance (in dollars) of VTI was 233.55% and the 10 year performance of VOO (the Vanguard S&P 500 ETF) was 238.70%.

ps, I hold a small amount of the Vanguard FTSE Developed World ETF (VEVE). That has Tesla in it in 15th place at 0.64%.

I wonder what the biggest company failures were? What percentage of the S&P or world index did companies peak at before eventually going bust? I must have held quite a few monumental failures while I have been invested (Enron comes to mind), but the market has still delivered overall.

@Naeclue — They may have recovered a little in recent weeks but I was looking at the destruction of value in energy stocks over the past decade or so earlier this year. Exxon for instance isn’t a failure, but this one-time biggest company on the US exchange has seen its value more than halve in a few years, and from a fairly un-exuberant rating at that. As you say hasn’t hurt the returns of the US market.

p.s. Sorry, that was a stupid comment as well as containing a bad (corrected) typo. Of course it HAS hurt the returns of the US market! 😉 I mean to say “it hasn’t stopped the US market delivering decent returns”, as you’ll appreciate. Cheers!

@TI, have you seen this paper by Hendrik Bessembinder?

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2900447

I find his work fascinating in illuminating how abysmal the long term returns are for most companies, yet how good the market as a whole has been in delivering long term returns. You might be surprised to learn that up to the end of 2016 Exxon contributed more to the returns of the US market between 1926 and 2016 than any other company. Even if it went out of business completely, it would still be amongst the best stocks to have held, just as GM was, which delisted in 2009 falling from a peak share price of $93 to $0.61. Tesla could well be overpriced and amongst the majority of companies which it would have been better not to have owned at all, but we cannot know that for sure and investors are better off being on board every company like Tesla that displays stellar price growth than not being on board and missing out if it does end up being one of the few lottery ticket companies that actually generate long term returns for investors.

Let the market decide. Over the long term it is much better at allocating capital than the vast majority of stock pickers.

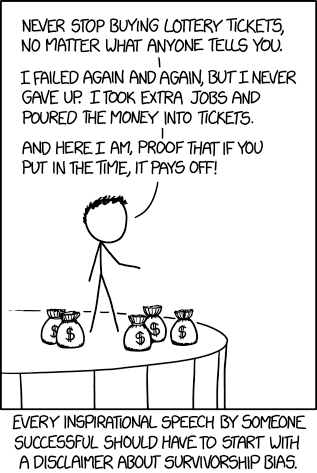

@TI – I suppose recognising an individual’s contribution is exactly what the markets (are supposed to) do – he made the money he has because of a combination of any edge he has as well as his risks happening to pay off – I’m just saying that if you have a lot of high risk takers then survivorship bias will quash a lot on the way, and of the many useful things that have been invented we might forget many because they don’t pull off a string of things or that they were in the past, and taking lots of risk can make someone look like a genius/great contributer. If you think of the number of inventions/scientific achievements there have been recently you can see that there are many speculative opportunities to put your name to something

If someone does have an edge you have to wonder what that is/why (beyond ego flattering in articles that allude to something mysterious)- I believe the human brain has always been capable of far more that we use it for before or now (given the right circumstances), so it doesn’t take a particularly special one to push the limits – think that every single modern physics student must learn more than Newton or Einstein came up with. People do need motivation though so if you wonder why someone would dedicate their life for the betterment of mankind at undue personal cost then to me it looks like they undervalue their own life and are trying to prove themselves to themselves by virtue and ego.

My personal favourate apparent genius is John B Goodenough – he was on the team that invented RAM for computers (1 nobel prize? not Goodenough!), then won another nobel prize helping invent the lithium ion battery (still not Goodenough!) so he’s working (at 98!) on solid state batteries to help overcome capacity, charging and price problems. Whether he was able to actually capitalise on this I don’t know – he might not have a capitalist mentality, he certainly isn’t part of the FIRE community! Also how much of the actual generation of ideas was actually him I don’t know either – because I know how places work – your ideas/hard work are owned by your boss, who is the one who goes in front of the cameras for the credit (but maybe in this case it really was him)

I have no problem with folk a la Financial Samurai lauding the massive appreciation in share price on their holdings – as long as they don’t subsequently moan and cry foul when it plummets and if they are still holding, they try suing all and sundry for them being ‘ill-advised’.

I was one of the contactees and my simple point was that its inclusion in the narrow index of the 500 means a company trading on a trailing p/e of 900 and a forward one of 112 is not necessarily a good thing for passive investors.

This happened with yahoo and was one of the reasons they introduced the four quarters of profits test – which is arguably still not satisfactory for a $400bn market cap from zero to hero in no time.

However the points made about this being of no concern to passive investors are valid; however it simply makes me realise that vast numbers of simple investors are pushing up the price without any fundamental rationale. The fact it would take c.120 years to recoup the investment made today even if nothing goes wrong and Tesla’s competitors don’t catch up should be pause for thought.

The fact that it also rose (what 14%?…) on the day it split shares to $100 with literally no other change should really make people holding it as a single stock raise eyebrows.

And as of today Musk is now the world’s second richest man on paper.

Bubble, what bubble???…

No idea why it came out at $100, LOL it was meant to be 5-1 or $400, but the point stands LOL.

@DBF — Thanks so much for coming back and commenting, and glad you took my post in the spirit in which it was intended.

You may well be right about Tesla, there are certainly multiple grounds for concern. But as I think we agree (re: my points in the post) the bigger picture is for a passive investor it’s best to let the market get on with it. Good luck!

I don’t know how Ark always manage to be quite so optimistic, but here’s their latest 5 year forecast for TSLA:

https://www.ark-invest.com/articles/valuation-models/arks-tesla-price-target-2029

It’s either bonkers or inspired. You can judge.

Basically their 1 mn simulations Monte Carlo inter quartile range shows a $7 tn to $10.9 tn market cap for 2029.

And if FSD robo taxis don’t show up, then by my rough arithmetic, they’re guessing about $1.2 tn (@ $350 per share).

Currently TSLA market cap is $545 bn.

Not so much glass half full as get me a bigger glass.

For some balance, here’s the view from a TSLA short seller in 2024 targeting $25/share (for an ~$80 bn market cap), versus Ark’s $2,000/share through to $3,100/share estimate for it’s inter-quartile range:

https://open.substack.com/pub/bradmunchen/p/teslas-q1-results-were-appalling