Do you like simplicity? How about convenience? What about spending nearly none of your time on investing but getting on with your life instead?

Then multi-asset funds are made for you.

In this post, we’ll help you choose the best multi-asset fund for your situation. You’ll learn how they work, and we’ll offer some thoughts on what features matter.

What are multi-asset funds?

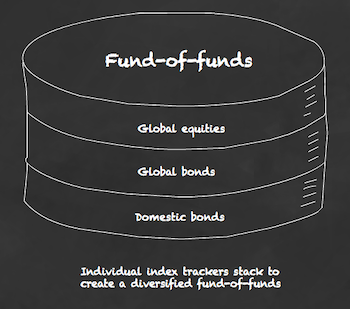

A multi-asset fund (also known as a fund-of-funds) offers you an instant portfolio with a single investing purchase. Instead of painstakingly choosing your own equities, bonds, and other assets, you accept the fund manager’s selection.

The manager will diversify you across the major asset classes. They’ll also handle rebalancing and swallow the complexity of portfolio management.

A fund-of-funds is so-called because it wraps several specialised funds into one neat investing package.

Each individual fund gives you exposure to a different sub-asset class. For example, one fund will invest in US stocks. Another in the UK. Yet another in the Emerging Markets.

A multi-asset fund is essentially a meal deal. You may get a heartier helping of corporate bonds, say, than you’d otherwise have chosen, but that’s the trade-off.

You relinquish control on the grounds that the manager’s choice will provide a positive experience, minus the hassle of making all the decisions yourself.

How do fund-of-funds work?

Fund-of-funds invite you to focus on the most fundamental decision in investing: how much risk do you want to take?

Each multi-asset fund in a given range corresponds to a different risk level. You pick the fund that best fits your risk appetite. You then simply choose how much to invest and leave management to get on with it.

The risk levels are typically labelled something like:

- Cautious

- Moderate

- Balanced

- Growth

- Adventurous

The higher your risk level, the more equities and fewer bonds your chosen fund-of-funds contains.

An adventurous fund may be 100% equities. A cautious fund can be as high as 80% bonds.

Risky business

Risk levels are predicated on the risk-reward trade-off.

This investing theory holds that higher rewards accrue over time to investors who bear more risk.

The empirical upshot is that equities have typically been the best asset for growing wealth over the long term. That’s because investors have demanded a premium for putting up with their volatility and periodic crashes.

The downside of taking risk? Your investments can be underwater until the market recovers.

That’s where bonds come in. High-quality government bonds can moderate stock market losses. But their crash protection doesn’t always work. And it usually curtails growth somewhat.

A risk-averse investor – perhaps one who’s older and more interested in wealth preservation – should choose a multi-asset fund towards the more cautious end of the spectrum.

On the other hand an investor who’s gung-ho for growth is liable to have a large risk appetite. Perhaps because they’re confident they’ll ride out temporary setbacks without panicking about paper losses.

Going back to the meal deal analogy, picking the riskiest multi-asset funds is like telling the chef you’re up for his extra hot spicy curry. Despite knowing it’s almost certain to give you a squeaky-bum-time at some point.

If you’ve no idea how to even begin to choose your level, see our piece on risk tolerance.

The middle fund-of-funds in each range usually approximates the 60/40 portfolio.

Best multi-asset funds

Here’s my pick of the best multi-asset funds available:

| Multi-asset funds range | Passive or Active? | OCF (%) | Watch out for | We like |

| Vanguard LifeStrategy | Passive | 0.22 | Home bias | High proportion of government bonds |

| Fidelity Multi Asset Allocator | Passive | 0.2 | – | No home bias Small cap equities Property |

| HSBC Global Strategy Portfolio | Active | 0.19-0.22 | – | No home bias Property |

| Abrdn MyFolio Index | Active | 0.2 | Home bias Junk bonds Low government bonds |

Property |

| VT AJ Bell Funds | Active | 0.31 | Home bias Junk bonds Low government bonds |

– |

| Legal & General Multi-Index Funds | Active | 0.31 | Home bias Junk bonds Low government bonds |

Property Index-linked bonds |

| BlackRock Consensus Funds | Active | 0.22 | Home bias Very low US Very low emerging markets |

– |

| BlackRock MyMap Funds | Active | 0.17 | Junk bonds | No home bias Commodities |

| Schroders Global Multi-Asset Portfolios | Active | 0.21 | Home bias Low government bonds |

Commodities |

Source: Monevator research

The table lists the multi-asset fund ranges I think merit further investigation.

- The best fund-of-funds for you is a personal decision.

- Your choice from any particular range should be guided by your risk tolerance.

But how would I choose the best multi-asset fund for me?

Fund-of-funds fundamentals

Above all, I believe most investors benefit from a passive investing strategy.

Hence the top spots go to the two multi-asset fund ranges that adhere reasonably well to a passive approach.

This means their asset allocations aren’t likely to change much while you’re not looking. Moreover their portfolios consist mostly of index trackers.

The other multi-asset funds in the table also hold lots of index trackers. But the difference is they employ active management.

An active mandate gives the managers licence to change your asset allocation.

Some operate within wide risk bands, too – some fund-of-funds can contain anywhere from 40% to 85% equities.

This flexibility sounds like a strength. But it’s often counterproductive in practice, because even the experts’ powers of prediction are weak.

The ‘sell’ is that a skilled manager has the potential to deliver great performance while protecting their investors from downside risk. That claim is mostly a vain hope, as we’ll see in a moment.

Overall, active management is likely to be a less effective strategy for most people.

Of the passive multi-asset funds, the Vanguard LifeStrategy range is the clear leader. Its balance of sensible asset allocation, consistency, reasonable cost, and long-term returns make it a great choice.

Every other contender on the list must really be viewed as an alternative to Vanguard LifeStrategy.

That said, you may want to consider putting some money into a Vanguard LifeStrategy alternative once your portfolio has grown large enough that it makes sense to diversify your fund manager risk.

You don’t want all your eggs in one basket, in short. Our investor compensation scheme piece explains more.

A couple of additional notes on the table:

- OCFs listed are based on the best available fund share class that’s accessible via UK brokers on a non-exclusive basis.

- Add your fund’s transaction costs to gain a full picture of its total charges.

Multi-asset funds: what to watch out for

There are many ways to rank funds.

Counterintuitively, recent results aren’t foremost among them. Primarily because as all the fund literature baldly states: “Past returns are no guarantee of future performance.”

For that reason it’s better to pick an option that best suits your circumstances and is geared towards investing best practice.

All things being equal:

- Passive is better than active

- Low cost is better than high cost

- Property, small cap equities, index-linked bonds, commodities, and gold are good diversifiers

- Junk bonds and thematic investments are highly questionable diversifiers

Home bias1 has resulted in many of the fund-of-funds holding more UK equities than investing theory suggests is optimal.

Multi-asset funds that overweight the UK are usually underweight US equities, too. This posture may work for or against you, depending on the whims of the market gods. But as a deliberate choice it makes most sense for retirees with bills to pay in the UK, or if you believe the US market is dangerously overvalued.

Note that fund-of-funds typically carry only small payloads of index-linked bonds. The funds rely on equities as a long-run inflation hedge instead.

Inflation is a big concern for retirees. If that’s you, then consider target-date funds with stronger anti-inflation defences.

Beware trivial asset allocations. Holding 2-3% of something won’t make much difference to your return. However it may help the fund look more sophisticated!

Fund-of-funds and corporate bonds

A fund’s allocation to corporate bonds is worth investigating if you’re choosing an alternative to Vanguard LifeStrategy.

Many multi-asset fund ranges include a large percentage of corporate bonds in their asset mix.

And while bonds are generally assumed to reduce risk, whether they do so depends on the type of bond:

- High-quality government bonds are reasonable hedges against a stock market crash. (High quality means a credit rating of AA- and above)

- Corporate bonds – even when dubbed ‘investment grade’ – are less useful in a crisis

- High-yield (or junk) corporate bonds typically heighten risk – much like equities

So pick a fund-of-funds with a strong government bond asset allocation and credit rating if you want to keep a tight rein on risk.

That may mean dropping down a risk level or two if you’re set on a fund that devotes the lion’s share of its bond allocation to corporate debt.

UK multi-asset funds results check

Source: Trustnet Chart tool

The results comparison above compares the UK fund-of-funds that are closest to a 60/40 equity/bond split in each range.

We already know that past performance does not predict the future. But it’s still worth checking the five-year and ten-year timeframes. Do any trends pop out?

For example, over ten-years the passive Vanguard LifeStrategy 60 has comfortably beaten its active management rivals, apart from HSBC Global Strategy Balanced.

This result is a microcosm of the entire passive vs active investing debate.

If you pick any broad market, you will likely find active funds at the top and the bottom of the league tables.

Most passive funds, meanwhile, usually loiter somewhere in the top half.

The problem is that the table-topping active funds regularly change. To benefit from the winners, you have to be able to choose them ahead of time. There lies the rub, and sadly picking the winners is much harder than plumping for whoever has done well of late.

That said, Global Strategy edged Vanguard LifeStrategy by 0.2% when we first began tracking multi-asset funds six years ago.

Three years ago, Global Strategy eked out a 0.4% lead over LifeStrategy while now the gap is 0.6%.

So Global Strategy has consistently delivered over that timeframe (which is still short in the scheme of things) and seems like a well-run fund.

Short termism

Five-year returns are the minimal viable comparison period in my view – a blink of an eye in investing terms – and not long enough to draw firm conclusions from.

Over the stubbier time-frames, short-term management decisions can pay off for a while.

For example, the Abrdn MyFolio Index III fund currently holds 75% equities – at the very top end of its range for risky assets.

That move has juiced its returns for now. The fund boasts the best one-year return in the table. But very few managers enjoy 10-year winning streaks. They tend to fall back into the pack over time.

That’s why the 10-year return is a much better test of prowess. Mistakes tend to cancel out temporary runs of good form.

The benchmark

I’ve added the IA Mixed Investment 40-85% returns to the table, inside the green dotted lozenge. These numbers show the average return for all funds belonging to this category, and are a reasonable yardstick for comparison.

(The Investment Association, or IA, is the trade body that represents the UK’s investment management industry.)

Because this category is dominated by active funds, you can see that many investment professionals aren’t adding value over ten-years, given that the passive Vanguard LifeStrategy 60 comfortably surpasses the 4.9% average.

But it’s actually worse than that.

The DIY passive alternative to holding multi-asset funds like these is to run a two-fund 60/40 portfolio.

For example, you could have:

- 60% in global equities

- 40% in global bonds hedged to GBP

Rebalance every year and you’d enjoy a portfolio that captures the bulk of the risk-reward trade-off offered by the funds-of-funds in the table.

Over 10-years, that 60/40 portfolio2 delivered a 6.3% annualised return.

You would think that the vast majority of skilled active managers could best such a simple portfolio. Yet they have not.

ESG multi-asset funds

Most multi-asset managers also now offer fund-of-funds with an ESG spin.

It’s extremely difficult to verify ESG credentials. Hence we’ll just offer a few leads for further research:

- BlackRock MyMap Select ESG

- Legal & General Future World Multi-Index

- Abrdn MyFolio Enhanced ESG

Vanguard’s candidate is its SustainableLife Fund range. But this fund’s holdings are too concentrated for my liking.

Also, all of the ESG options above are actively managed.

Multi-asset ETFs

A handful of multi-asset ETFs trade on the London Stock Exchange. JustETF maintains a good list.

iShares’ Portfolio ETF range is worth a look.

The rest are either too narrowly focused, expensive, or new to make the table for now. We’ll keep an eye on them though.

The Swiss army knife of investing

If managing your investments makes you want to stick pins in your eyes then rest easy – a multi-asset fund is a good way to get the job done.

Choose a fund loaded with equities to take more risk in pursuit of higher rewards. Or opt for a fund-of-funds with more bonds for a smoother ride.

Ultimately, it’s your topline equities/bond split that will count most towards your long-term result.

Go for the extra bells and whistles if you believe the evidence. But don’t be fooled into thinking that more always means better.

Take it steady,

The Accumulator