Further to my recent article about the gold possi-bubble, we can now add biting (and scratching) satire to the unfolding bull gold market story.

Cats for Gold is a spoof site promising to turn “glitter into litter”.

Further to my recent article about the gold possi-bubble, we can now add biting (and scratching) satire to the unfolding bull gold market story.

Cats for Gold is a spoof site promising to turn “glitter into litter”.

I previously shared my research into developing iPhone apps. The clear message was making money from iPhone apps is not easy.

Of course, before you can make money from your iPhone app, you need to develop the app in the first place.

It’s hard to get a feel for how difficult this would be in practice – the developers of the iPhone apps on the iStore range from one-man bands to multinational software companies.

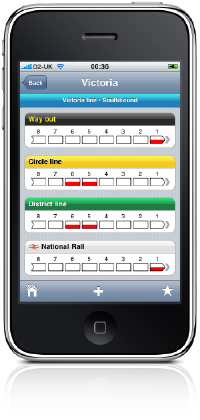

For some answers, I dropped a line to programmer Paul Dias, who created one of my favourite new iPhone apps, Tube Changer.

Paul’s simple-to-use app tells you where to get on a London Underground train so that you’re correctly placed for the exit at the other end of the journey.

It sounds pretty nerdy, but as a true Londoner I consider it my sworn duty to hurtle through the system as rapidly as a banker running towards a bonus. Tube Changer can save you valuable minutes being stuck behind mobs of Spanish students blocking the platform.

Tube Changer is also interesting because it was created by one man in his spare time – the sort of cheap development process I’d require to keep the risks down and to maximise rewards in the shape of a passive income stream.

To find out more, I batted a few questions back and forth to Paul on email. He was kind enough to reply with pretty extensive answers, as collated below.

With the markets up over 50% from the low point, my net worth has risen accordingly. Happy days!

Dangerous days, too, with the usual warning signs:

As a buyer during the bear market – and very positive on equities during the March market low – it’s tempting to permit myself a self-congratulatory moment.

Tempting, but experience tells me to resist. Gains lead to complacency, and as an only-halfway passive investor (the head is willing, the heart says not entirely) I need to stay alert. What the market giveth in six months, it can easily taketh away.

Worse, having gone ‘all in’ on equities during the bear market, I’ve not got a properly diversified portfolio.

In particular, I want to buy and hold some government bonds. I currently have none.

My regular Saturday comment followed by this week’s blog and financial site links.

I can’t decide whether I should feel frightened at no longer having any exposure to gold, or pleased I’m not taking part in a bubble.

Generally I subscribe to the Keynesian view that gold is a ‘barbarous relic’. I sold my holding in Blackrock’s Gold and General fund during the credit crisis to buy more cheap shares.

Like many modern investors I don’t like gold because it’s a near-useless lump of metal that’s only worth what someone will pay for it.

But equally, I can see that’s what gives it special status when diversifying a portfolio. Gold is uniquely useless, and that makes it a potentially pure bet on money supply, compared to say copper or silver which also have industrial uses.

This week saw the gold price fly past $1,100, and the usual justifications trotted out:

Most of these don’t stand up to scrutiny.