by The Investor

on January 20, 2010

Everyone knows risky and excessive lending led to the credit crisis, with the collapse in US house prices sparking a global banking blow-up.

But what caused the risky and excessive lending?

Obviously the banks needed money to lend hand over fist without a care in the world. Where did they get it, and how were they able to sell on their toxic loans so easily?

Partly, they increased leverage – the amount they lent for every £1 in their reserves. But they were also aided by low interest rates, particularly in the US, which not only cheapened funding but also dramatically reduced the yield on risk-free government bonds, encouraging bankers and their clients to hunt for higher returns elsewhere.

The ultimate question then is what kept central bank interest rates so low? And on this point, Bank of England governor Mervyn King blames the Indians and the Chinese for not spending their money as fast as debt-happy Westerners.

[continue reading…]

Thanks for reading! Monevator is a spiffing blog about making, saving, and investing money. Please do sign-up to get our latest posts by email for free. Find us on Twitter and Facebook. Or peruse a few of our best articles.

{ }

by The Investor

on January 19, 2010

After months of public wrangling, Kraft has agreed terms with Cadbury’s directors for a takeover of the British chocolate company.

The news will be a relief to City managers who’d been ‘forced’ to sample Cadbury’s Caramel and Dairy Milk bars to assess the correct price for their shares.

“820p!” cried Mike ‘Tubster’ Smugbottom, who runs the Saturn Consumer Contrition fund, as he swallowed Curly Wurlys like a puffin guzzling sand eels.

“No” *gmmf* “way!”, gulped hedge fund manager John ‘Two Belts’ Bainbridge, who hadn’t eaten this many Roses since his father gave him five tins at Christmas for exhorting £200 from a weak boy across the street to whom he’d sold a broken bicycle. “This stuff is the shizzle!”

Such fun and games are over, for imaginative writers and investors alike – but there is a more serious ramification arising from the takeover of this 200-year old British legend.

[continue reading…]

{ }

by The Investor

on January 19, 2010

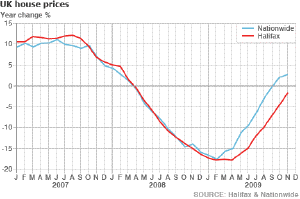

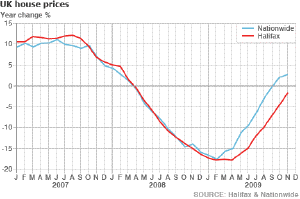

I have rounded up a bunch of house price predictions for 2010, to follow up my article on the likely fate of some first time buyers after the great UK house price crash stopped crashing (as shown in the BBC graph to the right).

These predictions aren’t wildly useful. It takes years for bearish sentiments to play out (Capital Economics was looking for a UK house price crash in 2004, as I recall), while the big banks are loathe to predict anything worse than stability (predicting losses implies more writedowns).

[continue reading…]

{ }

by The Investor

on January 16, 2010

A busy week on Monevator covered everything from banker bashing to, well, financial adviser bashing. But it wasn’t all wanton violence, with posts on how to start investing, UK home buying, and DIY hedge funds, too.

Still need to work on making one or two of those articles shorter, though!

My post of the week is from The Simple Dollar, the huge US blog, and it continues the ‘financial adviser – friend or foe?’ theme.

[continue reading…]

{ }