Fair warning: Feel free to skip this LONG post. I have tried to focus on the investing ramifications of the general election. However I do make statements that will strike some as political, if not excessive. That is the nature of politics currently, which I really would love to fade from this website.

Today I’ll explore what stance investors should take post-election, given where we are and where we seem to be going.

I won’t be rehashing (much) how I believe the country should have voted in the Referendum or in last week’s election, though inevitably I’ll reference both.

Remain is lost. The Tories have won a big majority.

If you applaud this outcome then I’m not going to change your mind. And if you’re a Remainer who has watched the rise of Leave, Boris Johnson, and what it represents with dread, it’s still time to take stock and be prepared.

Hard Labour risk off the table

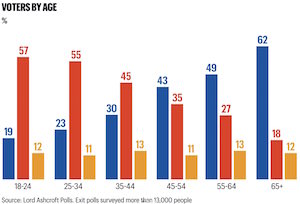

It’s already clear from the data that Brexit was the biggest of several swing factors that won it for Johnson.

However from the market’s perspective, taking a Jeremy Corbyn Labour win off the board is by far the bigger win.

That’s true from the perspective of the individual personal finances, too, for anyone with chunky assets and/or a good-to-high income.

Catastrophic defeat for Labour and Corbyn means no outright nationalisation issues, no State-forced dilution of shareholder assets via 10% share giveaways, far less regulatory threat, probably a stronger pound, probably stronger gilts (and thus cheaper government borrowing), and no windfall or wealth taxes or outright Tobin-style taxes on financial transactions, or anything similar that Corbyn and McDonnell might have come up with.

UK shares warrant higher multiples

All of that is very good for UK markets. Britain looks set to remain an Anglo-Saxon style capitalist country. Shareholders will enjoy strong property rights, and other ongoing regulatory and legal protections.

The immediate beneficiaries are obviously those companies that were directly in Corbyn’s sights – utilities, travel firms, and telecoms for instance.

But all UK shares should be marked higher on this risk going away, to whatever extent a potential Labour win had previously weighed them down. A multinational that earns only 5% of its revenue in the UK and was thus fairly immune to the UK economy, say, still faced outright threats from some Corbyn proposals. That risk is now gone.

With that said, the bounciest companies in the immediate post-election rally were UK domestics, such as housebuilders and UK banks.

This is also logical, but only so far.

On the one hand it makes sense if you feel that Corbyn’s domestic agenda threatened such company’s profits as well as potentially hitting their assets directly through, say, mandatory share distributions.

Higher unionism and government regulation loomed larger under Corbyn, for example.

Many will feel too that UK economic activity will be stronger under a Tory government than under Corbyn’s version of Labour. I’d say that’s true, leaving aside thorny longer-term issues about generational inequality or wealth distribution.

Remember though that any State stimulus-driven boom that happens under the Tories would have been equally enjoyed under Labour.

Moreover the Conservatives come with far higher Hard Brexit risks baked-in. That to my mind remains a big danger to the UK economy. (See below).

On balance I’m minded to continue to hold slightly more UK assets than before the likely result of the election had become clear, but fewer than if Hard/no-deal Brexit was finally ruled out.

Remember a UK home is a UK investment and an asset. If you’re a homeowner with an average-sized investment portfolio, you’re already very exposed to the UK economy. Even more so if you have a job here.

Tax shelters, personal allowances, and pensions – as you were

There is little reason to believe the UK’s very generous tax sheltering regime is going away under this Tory government.

ISA allowances, higher-rate relief for pensions, and the ability to put large amounts of money into those pensions will almost certainly all remain intact, if not improve.

Capital gains tax allowance shouldn’t change, either.

In the election run-up the Tories talked about revisiting the annual allowance taper. This problem is most acute from a societal perspective in the NHS. However it would be more coherent for a Conservative government to ‘fix’ this problem universally. So if anything, the potential of pensions as wealth-amassing vehicles could get even better.

I can see inheritance taxes being simplified, too. The main residence nil-rate band is confusing. Illogically to my mind, most people hate inheritance tax (IHT) even if they don’t pay it. But anyway, the number who do pay has been rising. Perhaps Johnson will use his majority to scrap the current system and instead aim for the £1m IHT-free threshold the Tories mooted a few years ago.

Personal tax allowances should rise a little, but I wouldn’t hold your breath for big income tax cuts. Not given the likely scale of State spending. Possibly the additional rate band could be scrapped as a simplification measure. That would make some sense.

Bottom line is if you have assets and you’re an average-to-high earner, you’re alright Jack.

Wealth preservation should be straightforward (ignoring currency fluctuations!)

What if you’re just starting out?

If you don’t have assets or a decent income, you need to try to fix that if you can. Pronto.

State spending increases will be directed towards infrastructure and investment, rather than welfare payments or even in-work benefits. I see little respite for the bottom rungs hit by austerity over the past ten years. So get off those rungs if you can.

Talented individuals of any age and class should do better financially in a looser and probably more vibrant Tory-run economy than under a Corbyn Statist equivalent. But the aggregate wins will continue to be skewed towards the haves, rather than the have-nots – continuing what we’ve seen post-Gordon Brown.

Run this forward ten to 15 years, and there’s a case for Monevator readers making even more self-provision.

For instance I don’t believe Johnson intends to dismantle the NHS – I’d argue there’s even more of a consensus around it being a public good than in the 1980s – but I could see nips and tucks. If you are concerned about NHS waiting lists today, I don’t see the situation improving. It might be worth thinking about private healthcare, or at least self-insurance in the form of a far higher-than-otherwise emergency fund.

Ditto education, vocational training, your kids’ university courses, and similar state provisions. I’m not hysterically claiming state support for such is going away tomorrow. However there’s no reason to think it’ll be improved much, beyond some catch-up anti-austerity spending.

What about housing? Well, if you’re young, you’re not already a home owner, and you’re not likely to be a high-earner, you’re probably screwed re: housing. At least in the more prosperous areas of the country where most of the best jobs tend to be.

The Conservatives say they’ll build more homes, but I don’t expect them to build in their core voters’ prosperous backyards. Also, it won’t be social housing, it will be new homes for the next generation of young professionals. So anything the Conservatives do to deliver their million home pledge will likely be done through relaxing planning or further boosting incentives and support for builders and buyers. We can probably also expect some sort of new Help to Buy type scheme eventually.

This means house prices will go up – assuming no hard Brexit.

Again great for those of us who own a home already, not so much if you don’t.

Honestly, if you’re a 20-something Remainer – especially if you’re in a non-high-paying field (say teaching, nursing, general admin) – then it might be worth moving somewhere like Lisbon or Valencia or maybe non-mega-city Canada or Australia and building a new life there. It could be a big quality of life arbitrage.

Brexit isn’t done yet

Okay, let’s dial up the controversy a tad. I’m still trying to look at this from a practical perspective, but clearly it will reflect my views.

We are going to leave the European Union. However I believe this becoming a certainty with Johnson’s elevation didn’t have much to do with the immediate rise in the pound or the relief rally in UK assets, despite the spin. I think that’s nearly all about Labour being out of the picture.

With that said, the size of the Conservative majority is important. We now have a government that can get through its legislative agenda without fear of internal revolt or external coalitions.

For investors, the multi-dimensional problem of Brexit politics has become easier. It’s now ‘only’ about what the Conservative party and the EU each want and will accept. Other hitherto important players (opposition MPs, soft Brexit Tories, Remainers at large) have at a stroke become irrelevant to the calculus.

This should make it easier to assess the trajectory of Brexit than before – but note that easier does not mean easy!

For instance, just last week I was opining in the Monevator comments that Johnson’s ego would encourage him to sidestep a very hard or no-deal Brexit, if he wants a strong economy for the next five years.

Even if you’re a Leaver who believes in national economic benefits from Brexit – superior trade deals, reduced regulation improving competitiveness – such alleged benefits won’t be front-loaded. (I am setting aside any ‘pent-up demand’ business or foreign investment we might see over the next few months, which would have happened with-knobs-on if we’d instead had the certainty of Remain.)

So avoiding a no-deal Brexit remains short-term important, from an economic perspective, even you’d think for Johnson. But already it’s been cast back into doubt.

Johnson is apparently looking to impose a new ‘cliff edge’ at the end of the current transition period. While this will give the UK some negotiating leverage, it does the same for the EU, who can now test the UK’s tolerance to go through with a no-deal Brexit by dragging their feet.

The result is the stakes have been raised again.

Brexit uncertainty is certain to continue for at least the next year. You can see this in the pound, which has already slipped back to where it was before the election!

And this is not to even go into future Union-related issues concerning Scotland or Northern Ireland.

Most observers, including me, still believe it’s likeliest we’ll have an extended transition period and a long debate about a trade deal, which could go on for many years. This is economically perhaps the best outcome from here (leaving aside a soft ‘Brexit in name only’) but it will still be an indefinite economic friction, which will continue to see the UK economy trading below where it would otherwise.

Judging by the past few years, the electorate won’t care politically, but they will remain a bit more hesitant, and this will continue to dampen consumer spending, house prices, and so on.

The question will be how much the enthusiasm for Johnson and his new Tory government and also Remain being off the agenda – and the spending the Tories are likely to unleash to reverse their own austerity – can be translated into what we used to call a ‘feel good factor’ that will rev up animal spirits to counter that ongoing Brexit drag.

Active versus passive responses to ongoing Brexit gyrations

Personally as an active investor I’ll be nimble in the face of these Brexit shifts. The past week or so was great for me – I was up about 5% in a week as I’d tilted heavily towards the result I didn’t want but seemed inevitable – but even as the rally roared I started dialing back that tilt, selling some UK property assets to buy international earner Diageo, for example.

There is a cost to this. Not just trading costs, but also the opportunity cost of continually trimming winners, adding to losers, hedging against increased or decreased political risk and so on.

I have done fine in 2018 but I have lagged my benchmarks. I see this as the price I have paid for avoiding a No Deal calamity, if we’d seen it, while retaining the opportunity to benefit from other outcomes.

Passive investors are well-advised to stay clear of all this. Just owning global trackers and some bonds and letting Brexit shout itself out in the corner has been a boon since the EU Referendum.

True, you will be thwacked if we do see a deal reached and the pound truly rally. Your overwhelmingly overseas holdings will fall in value.

But remember two things:

First, they were previously juiced up by the collapse in the pound after the Referendum.

Second, it’s anyway extremely difficult to trade the existential politics of Brexit to post a net gain that’s worth your time.

It’s easy to look in a paper and say “I saw that coming!” But you probably didn’t, and even if you did you often won’t get the market reaction right. And even if you did see that, are you sure you know where you’d be all told if you’d steered clear of trading altogether?

For example the UK domestic shares that have rallied so much in the past few weeks were in the dumpster just a couple of months before that. That plunge was what set the stage for their recent sharp recovery.

What does Johnson’s government stand for?

Okay, from here it’s big picture navel-gazing – possibly the most important questions, but also the muddiest answers.

Like most of the developed world, Britain is going through convulsions.

As best I can tell it is being driven by technological change, the advent and polarization of social media, globalization, the financial crisis and its uncertain, austerity-dominated aftermath, a backlash against the overreach of identity politics, and decades of self-selecting regrouping around people who think like us and our particular friends – aided by moving (or not) to a few big cities, marrying our peers, and the waning of all sorts of mixed social spaces, from churches to old-style ‘you get all sorts in there’ local pubs.

However unlike most of the rest of the world, the UK hasn’t been the calm one carrying on, as we might have expected.

Instead it’s embraced Brexit – overturning its long-established political and trading relationships, and voluntary casting overboard various rights enjoyed by its citizens, in exchange for less ‘foreign’ oversight of those citizens.

And it’s now delivered a general election that’s smashed our preconceptions of class and the political geography of this country.

The best that can be said is that if the world is changing, we’re doing something about it rather than passively sitting back. (Albeit I think the wrong thing.)

One might also argue that the swing to the Tories in Leave-voting towns – and the evident disquiet if not disgust in many of those places for what Corbyn’s Labour represented – shows a final flowering of Thatcherism. After all, Thatcher – whom on balance I admired – wanted working class people to throw off preconceptions of where they came from and aspire to be middle-class types, just like traditional Tory voters.

Haven’t they done just that? Well that discussion is for another day, and another website.

From my perspective here, the issue for our net worth is the country is in flux and it’s not clear where we’re going. To me the UK is ‘in play’.

The new government will set the tone, of course. What can we say about its ideological convictions, beyond ‘getting Brexit done’?

I believe Boris Johnson’s only absolute conviction is Boris Johnson. Before you shake your fist, consider that we knew him first as the globalist, liberal-ish London mayor. He then went on to recast himself as the leader of a nationalistic and subsequently populist project, and latterly he’s been trying on the robes of a one nation ‘King of the North’.

If you find these shifts consistent, you’ll reach your own conclusions. I don’t and so I’m inclined to discount anything he says. I’d rather look at what he seeks to gain, which is re-election, in assessing his motives.

Dominic Cummings has been cast as the closest this Conservative government has to an intellectual wing. What does he stand for, and how should we prepare?

The short answer is read his blog. You’ll find long screeds against government and paeans in favour of technology, science, cleverness, and the markets. If you’ve less time on your hands, this New Statesman article is reasonably non-partisan.

My take is that Cummings is more an arsonist than a firefighter. He seems angry, he’s against a lot of things, and so far we’ve seen how effectively he can take things down but not what he can build. I think he believes the market, science, and data can do a better job of coming up with solutions than government anyway, and he has expressed a deep antipathy towards establishment politics.

In more normal times I’d actually expect to sit more on his side of the room. But we’d be on the fringes, where radicals belong, gestating ideas to be cautiously cherry-picked, not at the heart of government, swinging an axe.

So there’s the potential here for disconcerting levels of change – as if Brexit wasn’t change enough for a generation.

You might say bring it on, after all you wanted Brexit. But what if the next institution the axe targets is your legal protections through the courts, or mandatory vaccinations, or the BBC, or national service, or food standards, or the House of Lords, or the armed forces, or the benefits system, or the promise of a state pension?

I’m just throwing out examples, not making predictions. The point is revolutionaries are by definition agents of change. You might not get the change you wished for.

Incidentally, the defeated Labour party manifesto shows traces of the same trends. In place of the pragmatic social democracy of Blair and Brown, we had a Hard Left manifesto from the early 1980s, albeit stripped of the guff about state control of car makers and so on.

Remember, something like half of people under 45 voted for Corbyn’s Labour manifesto.

Tory voters are dying, Labour voters are still being born.

So again, be careful what you wish for. Who is to say the next lurch won’t be back from a harder right-wing government to a harder left one?

As someone who believes this election was hugely influenced by Leave/Remain, I certainly don’t write off Corbynism. Nor will Johnson, so we can expect to see some efforts to shore up his new base in the formerly Labour-voting regions.

A tinfoil hat bit to conclude: Have a ‘bug out’ plan

The point for me is that you need a Plan B. I believe there’s a non-trivial chance you may want to get out of the UK in the next five to 20 years.

Before I get screamed at – or this post referenced in ten years as ludicrous – I’m only talking perhaps a 5-10% chance as things stand. So it’s a small chance, but it might happen. That’s the way probability works.

Probably we won’t spiral down into some hard-right / hard-left Dystopian nightmare. Perhaps having these modest populist convulsions today will see off deeper problems that other countries will need to face in the years to come? That was one argument made by some Leave voters, who felt we’d be more flexible outside of the EU.

The point is this prospect of national calamity was effectively non-existent 20 years ago. The UK was one of the most politically stable countries on the planet. This is no longer the case.

So get your F-off fund. In a worse-case scenario you may need to deploy it against more than just an unpleasant boss. Consider using some of that fund to explore and if needed secure the potential for a life in an alternative jurisdiction.

I made sure my Plan B was solid in the weeks after the Referendum. I suggest you do, too.

Think I’m being hysterical? As I said, I’d guess it’s only a 5-10% chance I’ll need it, gut feel. But it’s the sort of thing that if you need it, you really need it.

While I don’t claim to be a fortune teller, I’ve long warned there’d be societal consequences from the financial crisis, such as in this post back in 2012.

We are certainly not yet off that train. I’m not even sure we’ve left the station.

——–

Note: If you’d like to comment please try to focus as much as possible on money and investing consequences. I understand I’ve strayed a bit above, but that’s my prerogative as this blog’s owner and waffler-in-chief! 🙂 For the sake of a good conversation, if you like the Johnson agenda it’d be better to focus on what tax and spending benefits you see. If not so much better to focus on what practical steps you’re taking to mitigate any downsides.

Please stay polite. I didn’t delete a single comment on the post-election Weekend Reading, and it’d be great to avoid doing so again today.

[Source and larger version of voting poll in top-right: Paul Lewis via Twitter.]