The standard story is that when equities collapse we should be saved by our bonds. Like a financial Clark Kent, this hitherto unassuming asset class takes off its glasses, reveals its cape, and soars above the chaos, lancing losses with laser beam glances.

The so-called flight to quality – when capital deserts risky equities to take refuge in high-grade government bonds – worked during the meteor strikes of 2008-09 and 2000-02.

But – oh big surgery-enhanced buts – it doesn’t always work.

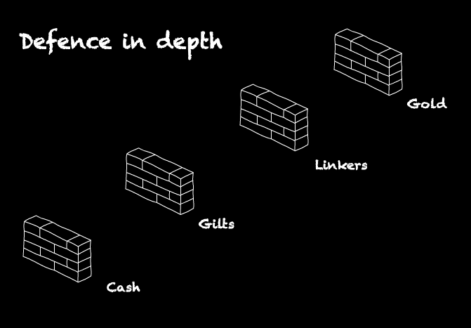

UK equity and gilt returns since 1899 reveal that bonds are not always enough. Our portfolio defences need to be multi-layered like a castle, with walls, moat, archers on the ramparts, and pots of boiling oil ready to meet the potential threats.

How often do bonds rise to the occasion?

UK equities have ended the calendar year with a loss 43 times between 1899 and 2018 according to the Barclays Equity Gilt study, the go-to source for UK returns data.

That’s a timely reminder that you can expect to see an annual loss on your allocation to UK shares around one year out of every three.

So how often have UK government bonds (or gilts) proved an effective remedy for that portfolio pain?

For each year that ended with a loss for UK equities, gilts:

- Rose 28% of the time.

- Fell by less than equities 37% of the time.

- Lost more than equities 35% of the time.

Two-thirds of the time you’d have been better off holding some gilts versus 100% equities during a down year – but even our safe haven bonds would have made things worse a third of the time.

Not ideal.

Do gilts save their best for darker days?

When equities lost 10% or more in a single year, 1 gilts:

- Rose 25% of the time.

- Fell by less than equities 65% of the time.

- Lost more than equities 10% of the time.

This is more like it! Gilts made a bad situation worse in only 10% of major market corrections. Nine times out of ten owning gilts cushioned the blow.

When equities lost 20% or more in a single year, gilts:

- Rose 40% of the time.

- Fell by less than equities 60% of the time.

- Gilts have never underperformed equities in this scenario.

UK equities have lost more than 20% in a year on five occasions. Gilts didn’t do worse in these years but the airbag left you in a body cast three times. Double-digit inflation was running amok in each case – 1920, 1973, and 1974. Gilts got trampled like a traffic cop trying to halt King Kong.

To put some gory numbers on the UK’s biggest horror show:

- UK equities lost -71% between 1973 and 1974.

- UK gilts fell by 50% between 1972 and 1974.

You’d struggle to live on those crumbs of comfort.

As mentioned, gilts did register gains during the Dotcom Bust (2000 – 2002) and the Global Financial Crisis (2008 – 2009). Not by enough to fully cancel your losses if you held a 50:50 equity/bond portfolio, but enough to help you pay the bills and buy equities during the fire sale.

Just add cash

The problem is our memories are short and the textbook performance of quality government bonds during the last two meltdowns can easily blind us to the fact that gilts haven’t worked one third of the time.

Can we solve the problem if we diversify into other defensive assets as well as gilts?

Cash has lost value in real terms every single year since 2008. That dismal record might easily stop us digging deeper to learn that cash scored better annual returns than UK equities and gilts in 27 of the 43 drawdowns – or 63% of the time.

Note: The Barclays Equity Gilt study uses UK Treasury bills 2 as a proxy for cash.

Cash looks worth holding because:

- Gilts and equities were both down 72% of the time in a losing year. But adding cash meant that you’d have at least one asset in positive territory 51% of the time.

- Cash outperformed bonds 65% of the time when equities lost more than 10% over the year.

- Cash outperformed bonds 80% of the time when equities lost more than 20% over the year.

- Cash beat bonds during all three of the supply shock years – 1920, 1973, and 1974. Cash was still down in real terms, but by much less than equities or gilts.

Index-linked gilts for anti-inflation

Might we improve our portfolio’s resilience with index-linked gilts?

These inflation-resistant government bonds (called ‘linkers’ by their fans) have only been around since 1983, which is a pity because they would have been more popular than flares in the 1970s.

- UK equities have had ten down years since ’83.

- Linkers only outperformed conventional gilts twice. And linkers were still in the red both years, just marginally less so than gilts.

- Linkers ended down when equities lost over 10% in 1990, 2001, 2008, and 2018.

Index-linked gilts did register a small gain in 2002, when equities lost 24.5%. But all told they’re no replacement for conventional gilts as a safe haven.

With all that said, linkers are the only asset class regularly cited as offering useful protection against high and unexpected inflation.

Don’t expect equities, property, or most commodities to help when inflation is off-the-hook. Gold might assist, but not reliably so.

Talking of gold…

Gold for chaos insurance

Gold is famously uncorrelated with equities or bonds. It sometimes works when nothing else does.

We can take a look at whether gold improved a portfolio’s return during every UK equity market drawdown since 1970, thanks to the amazing Portfolio Charts.

There were 15 down years between then and now. Gold, equities, gilts, and cash all sunk together only twice – just 13% of the time.

Gold improved the portfolio return two-thirds of the time.

It did a spectacular job in the stagflationary 1970s. But it’s impossible to know how connected that performance was to the ending of US political controls on the yellow metal in 1971.

Gold also put in a good shift at the height of the Global Financial Crisis. It returned 90% between November 2007 and February 2009.

What’s less well remembered is that gold fell 30% in October 2008, swirling in the same toilet bowl as everything else. Year-end returns can only tell us so much about what it’s like to be a forced seller in the midst of a crisis.

There are many reasons to be wary of gold. It’s not a good inflation hedge for small investors and it has a long-term track record of low returns and high volatility – the opposite of what we want in an asset class.

But gold’s reputation as a safe haven holds up, on balance. Passive investing champion Larry Swedroe sums up the evidence:

As for gold serving as a safe haven, meaning that it is stable during bear markets in stocks, Erb and Harvey found gold wasn’t quite the excellent hedge some might think. It turns out 17% of monthly stock returns fall into the category where gold is dropping at the same time stocks post negative returns.

If gold acts as a true safe haven, then we would expect very few, if any, such observations.

Still, 83% of the time on the right side isn’t a bad record.

An asset that counterbalances falling equities 83% of the time is pretty remarkable in my view.

Gold may help you avoid being a forced seller of shares

Cash and gold do not feature in my personal accumulation portfolio because the evidence shows they’re a long-term drag on returns.

Instead, I’ve backed myself to ride out any crisis and to not panic sell if my portfolio heads south for a few years.

Living off your portfolio in retirement is a different ballgame, however.

A deaccumulator must sell to live. 3 If a bear market lasts several years then ideally I’d have at least one asset class in my portfolio that’s above water when I need money. At worst, I’d want an asset that I can sell for a marginal loss.

The nightmare is selling equities at a loss over a protracted period and torpedoing the long term sustainability of your portfolio.

Retirement researchers have found that the dreaded sequence of returns risk hurts us most during the period that starts five years before you start living off your investments until about 10 to 15 years into your retirement. 4

That period is the red zone for any retiree. Avoiding too much damage to your portfolio during that time is mission critical.

Which leads me to think that cash and gold should join my deaccumulation portfolio alongside conventional gilts and linkers to provide defence in depth when I’m most vulnerable.

Since 1970 there have only been two out of 15 total losing years for equities where all these asset classes ended the year down together.

I doubt I’ll hold more than 6% of my asset allocation in gold. In the deaccumulation red zone I could probably squeeze two years of living expenses out of that. The ever-excellent Early Retirement Now has also mentioned a couple of times that small allocations to gold (5-10%) can mitigate sequence of return risk.

Gold would be a one-shot weapon for me – fired off to protect my other assets from a worse loss. I’d be unlikely to replace it once used because I’ve only got to make it through that first decade or so. I remain firm in my belief that gold is an expensive insurance policy over the long term.

I feel similarly about cash. Again, I can see myself holding a couple of years supply to get through the height of sequence of returns risk.

One of the odd advantages of being a small investor is that I can probably do better than the Treasury bills rate by keeping cash squirrelled in the UK’s best buy bank accounts – refusing to let it rot when bonus interest rates evaporate. I’ve certainly done alright with cash in the last decade using that strategy.

The critical takeaway is that we need to diversify our defences so that the high watermark of a crisis does not flood our equity growth engines. History tells us not to rely purely on equities and conventional bonds to protect our portfolios.

Take it steady,

The Accumulator

- There are 20 instances between 1899 and 2018. Okay, okay, I admit I rounded a -9.6% and a -9.8% to -10%.[↩]

- Short-term government debt with maturity dates of 12-months or less.[↩]

- Editor’s note: Ahem. Presuming they’re not following a ‘living off the income’ strategy, which requires a larger starting pot of capital.[↩]

- Peak vulnerability to sequence of returns risk can even last up to 20 years in the deaccumulation stage if you’re a precocious FIRE type looking forward to 60 years in retirement.[↩]

Comments on this entry are closed.

Great article.

Once thing I may have missed, is, how long were bonds down for during the times that equities went down more than 20%?

There have been times that equities have been down for very long periods, so I’m wondering if bonds may have always come back within a couple of years or not in those occasions?

A very apposite article for me as I am retiring early next year at age 53 and will need to live off my portfolio. A sharp market downturn in equities early in my retirement is a scary prospect that could induce sleepless nights. Over the past few months I have been selling enough ISA equities to have 2 years worth of spending in cash and 1 years spending in a physical Gold ETC. It has felt quite liberating selling equities at what feels like good prices and buying a comfort blanket.

Well, I am recently retired and now have a dangerous amount of time to sit around thinking. I am in the process of consolidating a few pensions and will have to start drawdown sometime in the not too distant future. At the moment I have a wodge of cash waiting in a sipp and my approach to investing this is to delay and obfuscate: this is working well so far as I am good at it.

With UBS threatening to charge a fee to hold your cash, and investors ( who are these investors?) prepared to buy bonds at negative yields, people must be treating these as insurance, happy to take a small but certain loss to avoid the possibility of a big loss. With inflation low, I think the zero nominal loss on cash ( this could change especially with a money hungry future government – yes I mean you JC and fellow travellers ) is a reasonable proposition for us small guys, maybe with a parallel holding in a medium duration IL gilt ( directly held).

For those pursuing growth, perhaps be a bit selective and overweight Asia and Japan whilst strictly avoiding the S&P 500 ? Any crash will hammer financials, as will continued low interest rates, and anything labelled tech is at a premium (and generally priced in those expensive dollars). Wonder if there is anything left? I have no more idea than anyone else but I sound plausible to my own ears 🙂

So, thanks for the article even if it was a bit devoid of the easy answers I seek.

Or just buy Personal Assets Trust (pnl) for a ready made mix of cash, gold, linkers and tips, bonds and boring value shares. Even it’s small yield of 1.3% is starting to look good in a world of negative interest rates!

I’m 5 years away from retiring, and ponder this dilemma quite often. I’ve come to the conclusion that if I spend all of my time fretting about such things, my retirement will turn into a brain-aching nightmare. Logically,I can’t possibly worry about all of the potential problems and permutations that could befall my investments, so I have taken the simple approach ; it may be right, it may be wrong,who really knows. I am basically 45% in a global equity tracker 25% in a Gilt index Fund, 5% in an index-linked fund and 25% in cash. Touch wood,it has given me a ‘reasonable’ return thus far.I think my main priority for this year (as I’m sure it is for many investors) is to get to the other side of brexit it one piece !

Another shout out to Portfolio Charts. Fantastic free resource! I am a recent early retiree and have been biting my nails trying to maintain my wealth in dodgy times. By playing with asset classes in the aforementioned modelling engine provided by Portfolio Charts, the top of the risk / reward league table goes to something called the Pinwheel Portfolio. It comprises:

15% Total Stock Market

10% Small Cap Value

15% International

10% Emerging Markets

15% Intermediate Bonds

10% Cash

15% REITs

10% Gold

Bearing in mind that this is US based, the top 4 items (50%) could probably be replaced by a world tracker with perhaps a small slice of emerging markets. After doing some tweaking I have followed this and the large slice of gold has been a godsend with a 22% return so far this year. The portfolio is up about 9% with a lot less volatility than the World Index that I compare it against. I have substituted the “Intermediate Bonds” with a couple of Strategic Bond funds (Janus Henderson and Baillie Gifford) which seem to be performing well too. Fingers crossed that it keeps doing what it has been doing!!

The only thing about using the UK’s best buy bank accounts is to watch out for tax. I believe a basic rate tax payer, pays no tax on the first £500 of interest, and a higher rate tax payer no tax on the first £1,000 of interest. If you were to use a few different bank accounts, even with the meager rates available today, it is possible to get caught out with tax to pay.

Apologies the other way around:

I believe a higher rate tax payer no tax on the first £500 of interest. Basic rate tax payer no tax on the first £1,000 of interest.

> long-term track record of low returns

Low returns? You’re in for a very long wait if you are looking for a return from gold. Gold is the ultimate layabout, it’s never done a day’s honest work in it’s multi-thousand year existence.

It’s not gold’s job to deliver you a return. Gold’s job is to give you balls of hardened steel, so you can hold you head when all around are losing theirs.

5% sounds about right. It’s to lift the animal spirits and buy you time, it’s not a hedge against the war of all against all. Harry Browne would push your further, but you have to be quite well off to carry the 50% deadweight drag on returns in his portfolio.

Very interesting. Im high in cash.10 years living expenses.i know ,quite a large amount. That’s because I’m(54) fi working part-time. Ready to live off portfolio at any given moment. As stocks have been booming for past 10 years, at any point it could turn the other way….just as I would need to start drawing down. So the cash is there to use instead. I’ll could then leave equities alone untill full recovery. Then state pension will start kicking in. But I have a rental property too. So I feel im belt and braces. Great article , thinking on the same lines as me. Which is reassuring. I think it’s a great help to everyone to share our plans and how we each prepare to weather the storms ahead.

Does anyone know if there’s an easy and cheap way to hold a bit of gold with Vanguard? I have a Vanguard account for their lifestrategy and was considering a bit of gold just in case (maybe a gold ETF), ideally with the same provider. I see references on the internet to a Vanguard precious metals and mining fund, but can’t seem to find it on UK Vanguard site, so perhaps it’s US only?

Thanks.

Ten years into (early) retirement and I still worry about this ‘sequence of returns’ thing. i.e. a downturn in the NEXT ten years would affect retirement funds disproportionately. When does that stop then?

I’m very dubious of Gold too. It has long, long periods of doing nothing, or worse losing, and doesn’t generate any yield. At least some combo of cash, linkers and very short term Gilts generate something and should stay abreast of inflation. According to Portfolio Charts, as a UK investor if you had bought in 1980, I don’t think you would have seen a positive real return until 2000 (I may well be reading this wrong.)

US equities? Again, seem overvalued so I’m a little light there and over in EM. Both will be hit in the downturn I’m sure.

Property? Very, very rich at the moment and falling (thank you Mr TI!), very illiquid and already being taxed as an asset class such that you’re not likely to make money on rentals. And in the very long term, returns are no better than equities without the liquidity preference.

Essentially, I think there’s so much funny money pumped into the system post-2008 that’s still there, all asset prices are sky-high and I think there will be a decade of low returns. Or maybe an almighty crash? Who knows.

@Mr Optimistic – you talk about Jeremy Corbyn stealing your money. Well, this Conservative Government has overseen policies during which the £ has devalued nearly 20% since 2016 to this month. And no-ones raises an eyebrow.

@Mr Optimistic (again!) – Btw, thanks for looking into my hedging question, you pretty much ended where I did. Does anyone know the answer?

🙂

My wife insists on holding gold and IL certs. Probably would agree with her sans the compulsion. We hold SGLN, iShares physical gold. The devaluing pound plus the rising price of gold has certainly boosted returns. I could sell a bit of the profit but what to buy? Everything is high.

Saw SPGP, gold producers. My, that’s a bit volatile and currently stands on a pe of 49. I would need to be sedated to hold that.

Good article by John Authers on Bloomberg ( his daily newsletters are free and good I reckon). He highlights the bond bubble (except Argentinian sovereigns which are north of 12% yield) but no immediate sign of the catalyst which will eventually burst it. His advice seems to be to hold a bit of IL just in case, otherwise hold steady.

I looked for, but couldn’t find, anything on the history of Japanese government bonds. Wouldn’t be surprised if they have been in bubble territory since 1989. The current economic scenario could last longer than me.

Back in the 1970s, who would have thought we would one day be desperate for inflation but couldn’t find a way to generate it.

Is anyone using the Permanent Portfolio? This seems to give reasonable performance but with very low volatility ideal for someone in drawdown and would appear to allow a higher drawdown rate than a traditional 60/40 portfolio. I found the article on https://ace-your-retirement.blogspot.com gave pretty compelling reasons to examine it further.

Like Coldstar I’ve used, and still do use, PNL and Capital Gearing Trust (CGT) for a buffer against what may come. As TA says though, in the long term on the way up you’re as well just to stick to equities and not worry too much about these things.

@Mr O: I’m a fan of Index-Linked Savings Certificates too. They are even proof against negative inflation, which ILGs are not. I expect we’ll hang on to ours indefinitely, or at least until index-linked annuities pay a decent return.

Since his blog no longer accepts my comments I’ll address a possible reader here. Oi, RIT, keep your ILSCs!!

This may be an unpopular opinion but I’m a fan of premium bonds. If you put 50k in and have bad to average luck you’ll get 0 – 1.5% but no tax annoyance. If you had good luck you could get a decent tax free return. They compare favourably to cash. Wish the limit was higher than 50k

I’ve been invested in equities for thirty-three years and I have had nine losing years. Only three were worse than 10%, i.e. 2001-2002 (-27%) and 2008 (-23%). These higher losses were recovered in the following two or three years and the smaller losses were normally recovered in the following year. I aim to stay invested in equities, hold my nerve, and let any crisis pass. I take the view that any losses will be recovered eventually.

@Marco.

Re Premium Bonds. Here’s a neat little calculator: https://www.moneysavingexpert.com/savings/premium-bonds-calculator/

Gold is an investment of choice in countries that have volatile governments and a cavalier attitude to private property

Those of us fortunate to live in a more stable area have little need of this illiquid non income generating investment

If it was ever needed here there would be a lot more serious problems to cope with than possessing some gold would help!

Plus would it be there when you needed it-would you store it at at home where it could be stolen-could you use bits of it to buy you groceries?

If Armageddon theories interest you then certainly have some in the bunker with the spam and the bottled water otherwise put your monies to more productive uses

xxd09

As an aside – Portfolio Charts didn’t work for me for months (the charts didn’t display)

Did some digging – found out it was a weird setting on the BT Home Hub router which is the default setting.

When I switched to 4G one the phone the charts appeared – weird

Mentioned it to the Portfolio Charts author – didn’t know if he did something but it now seems to work

I’m similar to dawn and Atlanticspan. Asset allocation is 50% equities, approx 25-30% cash and 20-25% bonds. I’ve been moving over to hedged global bonds in place of UK gilts, who knows if that is correct.

On the cash side I hold ILSCs (not very many, they withdrew them before I had much money to invest), premium bonds (they are my emergency fund really) and a ladder of 5 year fixed rate deposits.

Sometimes I think I am ridiculously cash heavy, and should ramp up equities. Other times I remember ‘if you’ve won the game, stop playing’ and realise that I don’t need to take more risk.

@gettingminted, are you actually drawing down from your equities? I can certainly see the argument for staying exposed through thick and thin during a long accumulation phase, but surely it’s a different matter if you need to live off your investments. How do you manage that? Do you have a cash buffer or an alternative income stream?

The return correlation between government bonds and equities shows fairly obvious ‘regimes’ based on the dominant economic themes of those eras. Negative correlation from 1945 through early 70s in the Bretton-Woods era, positive correlation in the 70s-90s on the inflation shock and failed attempt at monetarism and back to negative in the last 25 years or so on globalization and monetary dominance. Worse, when bond returns have been positive in 18 of the last 20 years (and 26 of the last 30), that return correlation may be rendered less meaningful as a forward indicator.

I’d agree that in a crisis, gold will usually generate positive returns. The problem it isn’t the crisis that kills you. It’s the shape of the recovery. Something like 2008 ended up being rather easy to navigate since you got a nice, fast V-shaped recovery in asset prices. What kills you is the L-shaped recovery i.e. no recovery in asset prices at all. Or no crisis at all but just a stagnation in asset prices. Returns averaging a few percent up or down for a decade or two. Gold is of little use there. Reverse equity glide-paths fail. That’s the sequence of return risk that keeps me awake at night. It’s also exactly the scenario we may be facing after a decade of stellar returns in most major asset classes.

@ZXSpectrum48k – that’s the scenario that I think likely too. Or a nightmare decade like the ’70s. I’ll be happy with a real 2% CAGR over the next 10 years.

So I’m hedging by working till I’m 60 or so (6 years), staying married to my still working wife (no hardship), and then a small state and civil servant’s pension from when I’m 67.

But I don’t worry about it cos I can’t control it. I’ve made my plans and God can laugh.

I think you can lose a lot of sleep if you start to worry about regime change in the markets — perhaps rightly. :-/ There are certainly scenarios where very early retirement and a SWR based on the past 40 years of data could look pretty optimistic.

Very low / negative interest rates are at the heart of my own immediate concerns here, and AI/robots/climate at the far end. I’d have laughed this chap out of the room a decade ago but after 10 years of puny rates and clear growing inequalities in the system (wealth, markets, tech network effects, water scarcity) I’m not so sure now:

https://www.bloomberg.com/news/audio/2019-08-09/what-negative-interest-rates-mean-for-the-world-podcast

The more pertinent thing for us everyday investors is what are we going to do about it? The super wealthy can afford to invest in a way that anticipates several different economic pivots; they can perhaps afford to be wrong with a couple. Most of us don’t have that kind of leeway in our finances and are best off investing for various shimmies around the status quo by diversifying, and holding our nose with certain asset classes. Optimizing for (say) an expected real return of 5.5% based on historical data versus say 5% with hopefully more potential to hold up if history fails to do so seems to me unwise.

In that light, having a few per cent in gold is small beans. I’ve had 4-6% in gold since I bought my flat (i.e. got an asset-backed mortgage!) and de-emphasized total return over reducing my version of risk (i.e. having any difficulties with that mortgage). I don’t expect gold to do much but keep up with inflation. But it’s there in case…

@Kraggash:

Ideally (hopefully!) you get sufficiently old that cash (or an annuity) can take you over the finish line in almost any mainstream scenario. 🙂 An 85-year old has less reason to worry about sequences of returns than a 65-year old because they’ve fewer years left to have to balance their household books…

@MAX. Regarding the “Permanent Portfolio” (PP). Portfolio Charts is vulnerable to small sample bias since it only has data back to 1970. The failure of the Bretton-Woods system led to high inflation in the 70s/early 80s. As inflation fell back in the late 80s and early 90s, risk-free real yields were left at high levels. Gilt yields were above 10%, resulting in long-duration Gilts killing the FTSE in total return terms over the last 30 years. Cash generated an anomously high real yield through the 90s/00s.

So the PP with 25% cash and 25% in fixed income would have generated good returns with low return volatility. To replicate that return, however, now given the current negative real yield starting point for cash and Gilts would be very unlikely.

Using a longer term dataset, such as DMS back to 1900, the PP has a poorer SWR. Assuming 50p of fees, the SWRs for 30/40/50-year retirements are 2.83%/2.19%/1.88% with SAFEMAX starting in 1937/1937/1935.

Sometimes I’m glad I don’t know as much as some of the commentators on here 😉

I agree that in the long run, climate change and, possibly, AI are game changers.

But there is no practical response on the financial level, imho, other than to stay flexible, keep human capital as long as possible, don’t be proud, and have modest needs. I’m not going to waste my energy trying to hide gold coins in the garden or assets overseas. Better to put energy into building social capital and trying to leave the world a better place. We come from nothing, we return to nothing and all that.

@Marco

I wonder what will happen to premium bonds if we have negative interest rates?

– a random x% charge for all, or

– Different size charges depending how unlucky you are

Doesn’t sound much fun!

B

I hold a small amount of gold in my portfolio and it has done very well since I bought it by way of the “etfs physical swiss gold” etf.

At present my main worry about gold is that it might really soar in value due to geopolitical events. I suspect that if this happens governments including our own will decide to make it illegal to hold privately (like the USA did some time ago) . Holders of gold might have to exchange their gold holdings for some sort of government “gold bonds” maybe paying 0.5% interest with a 50 year maturity.

When you see people talking in “gold bug” forums about how gold might go to $5000 or $10000 an ounce they dont seem to consider how governments might react.

Am I just getting paranoid in my old age?

@Vanguardfan

Yes, I’m drawing down from my equities. I’m near enough fully invested with no alternative income. I aim to keep my expenditure below my portfolio income and have managed that for five and a half years so far. In 2018 my expenditure was 3.57% of my portfolio and dividend income was 4.38%. My current main investment objective is income growth rather than total return.

@coldstar – possibly getting paranoid.

More prosaically, why waste time and energy worrying about speculation or extreme outliers?

My central assumption is that I’ll work part-time to 60 or so, I’ll get 2% CAGR on my 80% equity portfolio which will bridge the gap to pension age, and at 67 I’ll be able to withdraw my state and civil service pensions (reasonably inflation adjusted still) which in today’s terms will be worth around about £17k p.a. That I can see a likely scenario, well within the middle 80% of outcomes.

I DO worry about my children, their education and prospects and the world we’ll bequeath them. This summer’s crazy weather may become the norm. Extreme heat waves and now seemingly days of rain (higher global temperatures equals more evaporation equals more rainfall somewhere.)

Great analysis of the correlation between defensive assets. I too am afraid of the L-shape vs V-shape recovery @ZXSpectrum48k is talking about.

Although defensive assets will probably hold their value, there will be low equity growth to fuel our portfolios. When you’re in the accumulation phase you can just get away by working more. But if you want to make work optional at some point, the optionality bit fades if you ‘have’ to go back because of poor returns.

Sure, transitory losses ala 2008 are shocking but at least you can protect against them by spending your defensive part. But permanent losses can be more terrifying. I can’t remember the exact figure but something around 25% of the recent US stock market gains were attributed to the Trump tax cuts.

An example of a permanent loss for investors could be the opposite – a corporate tax hike. Or just their portfolio companies going bust (although you can reduce the non-systematic risk by going index style).

I’m slowly moving towards a less aggressive, 60/40 portfolio as I’ve entered the 5-year pre-retirement window. And considering gold too. That’s to protect against sequence of returns risk by following the rising equity glidepath approach. So thanks for the timely post TA.

While I’m fairly dark in this comment, it’s far from certain things will turn out negative for investors. Maybe I should just keep calm and carry on! And also not let my human capital skills weaken in ‘retirement’!

Anyone got a view on the new ‘Vanguard Sterling Short-Term Money Market Fund’ as good place for defensive cash in an ISA or SIPP?

@ZXSpectrum48k – Interesting comments on the Permanent Portfolio. I always think that the Portfolio Charts data is more useful as a portfolio comparative rather than a guide to absolute performance. Whilst it would be interesting to backtest the Permanent Portfolio to 1900 the Permanent Portfolio could never have existed as a viable strategy due to gold price fixing up to 1974.

Post the 2008 crash all the stars aligned for the Permanent Portfolio with stock market recovery, gold price increasing and government bond yields reducing with a consequent rise in their price – cash as almost always delivered below inflation returns – 3 out of 4 performing asset groups was pretty good going. What AceYourRetirement argued was that the Permanent Portfolio had a strong rationale that wasn´t based upon backtesting an infinite number of portfolio configurations to find the perfect match for the historic data but a portfolio of uncorrelated assets would ride out any economic environment. This has indeed proved to be the case.

From a personal point of view I am reluctant to invest in low yielding bonds, depreciating cash and a non productive asset such as gold. For a long term investor participating in global growth via shares makes infinitely more sense – providing one can tolerate the thrills and spills of the market. However, for someone risk averse or needs capital preservation maybe the low volatility of the Permanent Portfolio is a good option.

@TI – ah, the fear of the mortgage. I wish I was more risk tolerant, many people have made tons of money through leveraging while I sit on the sidelines worrying about losing my job etc. Out of interest, why gold and not cash? I know if you have a lot of cash keeping up with inflation is harder, but as cash and the mortgage will move together (inflation erodes the cash and the mortgage and vice versa) and gold could move independently either way doesn’t it add more risk / volatility? If the main aim is to protect against mortgage payment risk.

@Algernond 34.

Too early to tell for this particular fund, of course, but according to Monevator, as at March 2019 the GB Money Market – short term asset class has, on average, delivered a 5 year annualised return of 0.26% with a stdev of 0.05.

After paying fund holding charges to your provider I doubt it’s worth it. Maybe better to have some cash to keep your powder dry?

According to Morningstar UK

Thanks @ The Borderer.

And I don’t like the sound of this bit from the KIID:

‘*The Directors may at their discretion apply a redemption charge of up to 1% in exceptional market conditions.’

@Richard — Cash *and* gold (and various flavours of UK/US government bonds and a *lot* of other diversification). As I always say, it’s very rarely either/or. 🙂

My 4-6% of gold isn’t there to precisely match the liability of anything as such. It’s more, as the gold bugs say, that it’s nobody’s liability. That gives it potentially attractive qualities in unforeseen circumstances. But I expect (hope?) it to prove to have been a drag in the long run.

Well, TI calls the top of the property market and now with this article TA has called the top of the equity market – Nikkei down 1.2%, S&P down 2.93%.

You guys are dangerous!

I started a Permanent Portfolio (small but not insignificant % of SIPP assets) a couple of years ago (with a plan to drip-feed-and-rebalance annually for around a decade). Basically I saw it as a useful framework for holding some gold and long-dated bonds… things I could see the value of as diversifiers, but would struggle to buy in isolation as “standalone” holdings. The annual rebalance at least puts you in a situation where you’re automatically putting more of the added top-up cash into whatever asset class has gotten relatively cheaper. Some more detail on the implementation in this comment on Monevator’s article on the PP: https://monevator.com/the-permanent-portfolio/#comment-850378 . Last rebalance to 4 x 25% was mid-October 2018… it’s since 20% up (in the context of a ~9% GBP-vs-USD depreciation of course, but making up for a bad first year ~3% down) and the allocations have drifted off to 27%/23%/22%/28% gold/stocks/cash/long-bonds since then (gratifying, when the whole point was to get into those better performing asset classes) but who knows where they’ll actually be when the October 2019 rebalance comes round.

I’ve got a small 2-3%ish allocation to Gold which I’ve been ramping up over the past year (I’m in the Red Retirement Date Risk zone). The psychological benefit of seeing even a small holding proudly lit green when the rest of your portfolio is flashing red cannot be overstated. I’ve been reading for years that Gold is dead, first the taper tantrum then the cryptomania-bubble would be the death of Gold as an asset class. But I was glad to hold it on B* day in 2016 (I sold out to invest in UK equities) and I’m equally glad to have held it over this Summer as the Gold fashion has gone full circle as bond yields all turn negative.

“What’s less well remembered is that gold fell 30% in October 2008”

I’m not sure that it did? Eyeballing goldprice charts in gbp * looks like a ~13% drop in October, recovering a month later, before heading up sharply for 6 months. It’s a different sort of toilet bowl than that which my stocks and corporate bonds were swirling in 🙂

*data resolution of a week, no idea what it looked like day to day