I sometimes fantasize that people in power read Monevator, and that our humble blog makes a bigger impact in the world.

Note: I said fantasize.

Like all fantasies, my mooning is sustained by the odd sigh here and lingering moment there… The policies I’ve mooted on Monevator that later make it into law… The emphasis on some new idea or meme that soon after gets discussed by regulators or raised by a politician.

I know it’s silly. In fact, I’m sure it must be an affliction that’s common to all egomaniacs writers.

After all, if you’re doing your job properly as a writer then you’re aware of the zeitgeist and of its consequences for your readers.

And presuming you’re not ranting in the comment section of the Telegraph or Guardian, you might even have the odd half-decent idea or two that occurs to – oh – several thousand other people at the same time.

Tens of thousands, maybe!

But still… I must admit I swooned like a Jane Austen heroine at the lido when I heard George Osborne announce the new Help to Buy: ISA in his Budget.

A tax-free savings perk that would directly aid first-time buyers who were building up a deposit to buy their first home?

Time slowed down, and it seemed like Osborne was looking directly at me.

“My aides found this great idea on a website called MoneyMotivator,” he said, inevitably getting the name wrong and smudging my moment of triumph.

“Check it out for loads of other good guff.”

Except he didn’t really say that. It was only a daydream.

Just as well, because my idea was better than his.

Say hello to the Help To Buy: ISA

You may just remember my 9 ideas to fix the housing market kicked off with:

#1. New Savings Tax Breaks to Help First-Time Buyers.

My own idea was 4%-paying first-time buyer bonds, like Pensioner Bonds but paid tax-free, to help this stricken end of the market with climbing the mountain that is buying their first home.

The Chancellor’s answer – the only one that matters, since his is law and mine just idle musing – is different.

We are to get Help To Buy: ISAs. 1

The Help To Buy: ISA is a new ‘one-shot’ special ISA allowance, where the government will boost the savings you put into it by 25%.

So if you save £200, the government will boost that £200 with a bonus of £50.

Actually, according to the official factsheet you can only save “up to £200” a month into a Help to Buy: ISA.

In other words, there’s no scope for high-rollers (/cash-rich house-buying refuseniks) to just dump some spare money into a Help to Buy: ISA for an immediate bung from the government.

(Not that the idea crossed my mind. *Cough*)

Also, the maximum Help to Buy: ISA bonus you can achieve will be £3,000.

Getting that bonus will require saving up £12,000.

At £200 a month it would take around five years of regular saving hit that target 2.

Are you thinking “hmm” yet?

Standby then, because it gets, well, not exactly worse, but certainly less attractive.

How the Help To Buy: ISA boosts your deposit

You see I’m using the PR spin-sounding words “bonus” and “boost” quite deliberately – because the government doesn’t actually give you any extra money.

Instead, the bonus you have earned from all that Government boosting is only paid when you buy your first home.

That’s sensible from a targeting point-of-view, but still a bit finickity.

Here’s more fine print, lifted verbatim from the Help to Buy: ISA factsheet:

- New accounts will be available for 4 years, but once you have opened an account there’s no limit on how long you can save for

- Accounts will be available through banks and building societies from Autumn 2015

- You can make an initial deposit of £1,000 when you open the account – in addition to normal monthly savings

- There is no minimum monthly deposit – but you can save up to £200 a month

- Accounts are limited to one per person rather than one per home – so those buying together can both receive a bonus

- Only available to individuals who are 16 and over

- The bonus is available to first time buyers purchasing UK properties

- Minimum bonus size of £400 per person

- Maximum bonus size of £3,000 per person

- The bonus will be available on home purchases of up to £450,000 in London and up to £250,000 outside London

I’m glad they didn’t put an age limit on eligibility, given how varied first-time buyers are these days. I do wonder if and how they will police the clause that the money must be for your first home though.

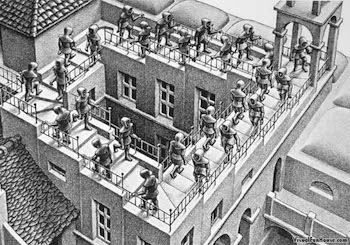

Here’s a handy summary diagram of what it all means, hewn from the burgundy Budget document itself:

How many ISAs can you take?

One thing I’m not sure about is whether you can open a stocks and shares ISA as well as your single Help to Buy: ISA in the same year.

According to the official details on how the scheme will work:

As is currently the case, it will only be possible for a saver to subscribe to one cash ISA per year.

It will therefore not be possible for an account holder to subscribe to a Help to Buy: ISA with one provider, and another cash ISA with a different provider.

So on the face of it you are okay to open a share ISA and get that ISA allowance for the year in the bag, as well as the Help to Buy: ISA. Just not a cash ISA.

But I’m confused because I thought ISAs (or NISAs as we were supposed to call them after the revamp, and did for about 5 minutes) were now transferable back and forth between stocks and cash versions?

I’ve never done the conversion, however, so perhaps I’m not appreciating some nuance here?

If you can shed any light in the comments below, please do so!

Whether it matters depends on where you buy

At the end of the day, a potential first-time buyer like me has a new savings option that it would seem foolish not to take advantage of.

True, that £3,000 bonus won’t amount to much for those of us who’ve amassed six-figure sums and a few grey hairs trying to keep up with London housing over the years.

But it could be a very useful perk in areas that are more “realistically-priced” (to use the Estate Agent lingo), where salaries are also lower and most Banks of Mum and Dad are probably less able to write huge no-doc loans to children on their whim.

The average deposit size outside of London is now about £28,000, as shown in this new chart from the Treasury:

Source: Help To Buy: ISA scheme details.

On these figures then, the Help to Buy: ISA bonus could be worth around 10% of the median deposit size for typical first time buyers – although median deposit sizes will surely grow far larger in the several years it takes to save up a deposit via this scheme.

If you can take advantage of the Help to Buy: ISA scheme and you think you’ll one day buy a home, then – in the absence of any information yet on interest rates and so on – it seems it would be smart to do so.

It’s free almost-money from the saver’s perspective.

It seems churlish to complain.

Still: Hmm.

Help To Stop A Property Slump

Some critics will argue that the Help To Buy: ISA is just the latest way for the Government to prop up the housing market with taxpayer’s money.

Also, one might suspect that house prices will be higher in a few years by an amount equivalent to where they would have been had this extra Government money not arrived, which would leave first-time buyers no better off than they were before it.

These may prove to be valid points, but I’m not sure.

I suspect that as it will take years of saving to achieve the maximum government bonus, a Help to Buy: ISA may prove too weedy and diffuse to impact the property market much at all.

The spending commitments start trivial, which reinforces that point. In the first year the government expects the scheme to cost it a mere £45m, though this does rise to a heftier £835m by the years 2019-2020. 3

Remember, aggregate UK property wealth is well over £5 trillion!

Too little, too late

While we’ll have to see if Help To Buy: ISAs do have any impact on property prices, they might not do much for first-time buyers prospects, anyway, especially in the more expensive regions.

As The Guardian reported in its summary of the Help to Buy: ISA’s pros and cons:

Lucian Cook of property firm Savills says the £12,000 limit on savings should prevent a surge in house prices and means the scheme is “more likely to help get buyers over the deposit hurdle in the lower-value, lower-growth markets of the Midlands and the north than say London and the south-east, where significant constraints remain”.

Seems a sensible view. The long timescale required to build up funds does work against both the bubble-stoking potential and the scheme’s usefulness, especially in and around London.

Presuming no house price crash, even modest first-time buyer property price appreciation is likely to far outstrip that £3,000 bonus in most of the country over the next few years, I’d have thought.

House price rises could soon leave your £15,000 saving scheme looking rather weedy.

Help To Buy: ISAs are better than nothing

Sadly, as ever in the UK it seems the best bold plan still appears to be to get a big mortgage as soon as you are able to, and to cross your fingers.

What’s really required though for first-time buyers is lower prices (or at the least flattened prices) due to far more supply – whether that comes from building more new homes where they’re needed, from encouraging people rattling around in too-big houses to downsize to free up the space, and/or from making being a landlord less financially attractive, and so removing some of the competition with less-affluent first-time buyers.

All themes touched on in my housing article and in the many excellent comments made by readers, incidentally, if you’re eager for more.

As for the Help To Buy: ISA, sure it is better than nothing, unless you’re a cynic – in which case it does seem like a pre-Election bung.

Better listen to us next time George old chap.

At least he’s followed up on my Northern supercity suggestion.

(Okay, so perhaps one or two other people have also had that idea… 😉 ).

Comments on this entry are closed.

I think on this one I must put my hat in with the “prop up” theory along with the other “help to buy” scheme. It’s just trying to increase demand when the focus should be on massively increased supply.

If I was looking to get on the housing ladder I would just vote for whoever promised to build the most houses!

All the while housing supply is constrained any extra money George makes available is just going to inflate prices.

We need more homes built and sadly I suspect this will only happen if the government starts building again, it doesn’t look like the private sector is going to do it.

A minor distraction that will push up prices at the lower end of the market, just like similar schemes have done elsewhere.

This also encourages savers to Cash ISAs with attendant low interest rates and admin costs, rather than take advantage of the £1000 tax free interest allowance and the high street competition for savings. Banks and other ISA providers could get away with offering virtually zero interest and the 20% bonus at the end would look good. Whereas regular savings accounts like those offered by First Direct offer 6% AER on regular savings. You’d hit a target of £15,000 before even getting close to the £1000 interest tax free threshold by rate tarting.

With no cash required by taxpayers, an individual saving £200 a month would have £15,000 in around 5-6 years via Stocks and Shares ISA at 4% nominal return, compared to just under 5 years at Cash ISA rates to save £12,000.

Government interference resulting in poor capital allocation and higher tax burden and limited benefit to first home buyers.

@UK Value Investor

“If I was looking to get on the housing ladder I would just vote for whoever promised to build the most houses!”

Indeed – the rest is just fiddling around at the edges (at best).

I have another objection as well. If the government of the day starts to use ISAs for political gain, then we’ll be open to risk to the whole simple ISA format. The whole point of an ISA is to keep the government out of your investments, Help to Buy welcomes them in.

How long before the government will consider lifetime allowances on ISA contributions, maximum tax free income and capital gains on ISA accounts, etc. etc?

This takes a relatively clean product and muddies the water.

I don’t see how “making being a landlord less financially attractive” is going to lead to “far more supply” as you suggest. Many houses where I live are rented out by the room to four or more young professionals. If landlords gave up these kinds of properties then, whilst a few more young couples would be able to get onto the ladder, you’d reduce the population density, making the housing shortage even more acute as the displaced renters would still have to live somewhere.

@BeatTheSeasons — I mean “more supply” in terms of more achievable supply to home buyers versus BTL buyers, not more overall supply. (It could conceivably reduce the latter, though I think there are other far more significant constraints on supply currently — the demand is clearly there).

Along with low rates, BTL is easily the biggest disruptive force for good or ill in the UK housing market over the past two decades. One estimate is that there are now £1 trillion buy-to-let homes out there (of £5 trillion total) which is a huge share of the proportion. (Source).

I was a fan of the BTL sector at first, but given the population growth in the meantime, the lack of new homebuilder, and the reality that most people want to own and ever fewer can and that I think for social reasons that’s more important than supporting a growing BTL sector, it is worth re-examining.

Thanks for this breakdown of your, I mean, the Chancellor’s idea for h2b ISAs.

I still think upping the ISA limit to £15000 was quite possibly a move to encourage savers away from Santander’s 123 account and try their hand at stocks and shares ISAs. Maybe it’s a silly thought but Santander were swallowing quite a lot of UK savers’ cash. Being half Spanish, I know how small (and shiny) our boots are.

I thought landlords were notorious for not renting to families as they can squeeze more out of a group of singles and couples? Anyway, I reckon an interest rate rise might discourage landlords from taking on more mortgages and property and that might open up the housing market to more families/couples and singles desperate to get onto the ladder, but a sale is a sale whoever it is to.

Thanks for another funny and astute post. 🙂

Cheap political gimmick two months before election, nothing to see here …move along

Real story is reduction in Lifetime Allowance to £1m linked to CPI

Yes. The reduction in lifetime allowance is a strange one. It puts a potentially very large tax bill in the hands of investment returns as you approach retirement. Clearly this is a ‘nice’ problem to have but I’m struggling to understand the reluctance to simply cap contributions rather than cap the size of your pot. Surely this would be ‘fairer’?

@All — I agree the lifetime allowance cut matters, though it’s somewhat softened by the index-linking, the lack of which has long seemed preposterous. With a bit of luck this might postpone further tinkering for a while?

The tax-free savings was an interesting tweak, too, though few seem to realize it doesn’t come in for a year. The attractiveness of rate-tarting, even in today’s low interest world, just moved up another notch, especially for those with modest savings/cash allocations.

If you value your time, then the purported abolishing of the self-assessment tax return could be a big deal. In the days before I retained an accountant for other purposes, this could easily take me a day. Granted my affairs were not totally simple (self-employed, all kinds of income and capital gains to factor in, as per my ISA post the other day).

So 8 hours at say £40 an hour is £300+ hours saved. Plus fewer grey hairs!

@Minikins — Just wanted to say your various comments around the site especially on some of the older posts have cheered me up during a tough few weeks for finding time for blog writing. Glad you’re enjoying Monevator, and thank you for stopping by!

Is the increased ISA flexibility change worthy of a word TI?

@Topman — I didn’t give it a lot of thought to be honest. Effectively it just turns the first £15k of your cash allocation into an instant access equivalent, but things like Santander 1-2-3 are already competitive with cash ISAs at current rates anyway, even after tax. I suppose it is of appeal to some at the margin (I have to remind myself now and then that something like 9 million UK households have less than £250 in savings, not that it matters a jot to them) and will be positive if it gets more of them researching ISAs in the first place, but for most Monevator readers I imagine not particularly important, and there could even be a downside if it makes cash ISA money less sticky and thus worth a bit less to banks, and so very slightly notches down the already notched down interest rates?

It is throwing the young some bread crumbs and it is also a measure to “prop up the market”.

Economists and many others have criticised quantitive easing for making the rich richer and widening the gap between the poor and rich.

I see it more as a transfer of wealth from younger generation to older generations , basically making older people/baby boomers richer at the expense of young people.

Look how Q/E and loose monetary policy has caused the stock market to reach an all time high and property prices have been rising at over 10% (yet inflation is near nil and so is wage growth and business investment?)

Youngsters starting off in life don’t have many assets yet (possibly a house with a large mortgage and little in terms of pensions provisions), they acquire them over time, older people have their family home, pensions, ISAs and perhaps BTL property. So asset price rises benefit the older populace at the expense of the young. Q/E isn’t a transformation to make the rich richer, rather it enriches older people at the expense of the young.

Central banks have never before in history pursued loose monetary policy like they have since 2007 and look what its done to asset prices. The question is what happens next? Surely when monetary policy is eventually tightened asset prices will have to fall?*

We will eventually have another bust unless you belong to the school of economics of Gordon Brown who claimed to have “abolished boom and bust”.

This is what the young need.

@TI

Thanks. I guess for the prudent but subsequently “cash incontinent” savers, it gives them a buyer’s remorse opportunity to get back into the ISA wrapper before the fiscal year-end.

@Topman — When he first mentioned it my imagination raced away and I wondered if he was going to say you could take money in and out over *your lifetime* and somehow the amounts would be recorded. That way I could liquidate my ISAs and maybe even finally buy a house, and then restore them later from earnings.

As things stand though, ISAs are so phenomenal as tax-wrappers (although from email response to my last ISA article it seems some people *still* don’t get that) that I can’t bear to lose the allocation I’ve built up.

If the above sounds fanciful by the way, I believe it is how one of the major economy’s pension system works (Australia, off the top of my head).

Another great article, bringing together your musings and interpretation of the budget in your usual witty and concise style.

Despite the usual populist cynicism, I do believe the Help To Buy ISA is a genuine effort to help folk get on the housing ladder. Albeit the scale will be immaterial to buyers in some areas of the UK.

On balance I think I’ll still recommend my younger sister takes advantage of this, as well as filling a Santander 123 account of course!

I’ve mentioned this before I know, but I believe the Government need to do more to ensure private landlords are paying their fair share of taxes on the rental income. I believe tax evasion in this area is abundant.

Keep up the superb blogs!

“[…] our humble blog makes a bigger impact in the world.”

It certainly does make a big impact in my world! Thank you for writing and sharing with us!

“But I’m confused because I thought ISAs (or NISAs as we were supposed to call them after the revamp, and did for about 5 minutes) were now transferable back and forth between stocks and cash versions?

I’ve never done the conversion, however, so perhaps I’m not appreciating some nuance here?

If you can shed any light in the comments below, please do so!”

If you’re having trouble sleeping, HMRC produce a detailed set of guidance notes for ISA Managers:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/375474/isa-guidance-notes.pdf

Its 3.14 of this that explains the current “one-ISA-of each-type-a-tax-year” rule, though it seems a bit bonkers in the context of Help to Buy ISAs.

In short if you opened a Cash ISA and, in the same tax year, transferred it to a Stocks & Shares ISA you are treated as having opened a Stocks & Shares ISA. You’d then be in breach if you had already opened / tried to open a Stocks & Shares ISA (with a different provider), but would be free to open a new Cash ISA with someone else in the same year (subject to the financial limit).

If they follow through on treating the HtB ISA as a Cash ISA that will mean that if you have a HtB ISA running then you won’t be able to subscribe for (NB: subscribe for, not open) any Cash ISAs until you buy your house. What you can do though is put your £15k into a S&S ISA (leaving the money in cash if you want as there is no longer a requirement to invest within a S&S ISA) and then transfer that into a Cash ISA in the next financial year (or in fact into more than one Cash ISA as the 1 ISA per year rule is only for new subscriptions).

@LadsDad @Lusitania — Thanks very much.

@wysi — Thanks, that’s an… interesting… document! 😉

I guess the Government has six months to clarify how HtB ISAs will work more transparently, pending the election and so forth.