Monevator reader ‘Squirrel’ is only partway through her rather rocky path towards financial independence, so today’s postcard is from the journey rather than the destination. Be warned, it’s another lengthy – yet very readable – FIRE-side chat.

A place by the FIRE

Hello! How do you feel about taking stock of your financial life today?

Honestly, I’m thrilled!

I’m a lone personal finance enthusiast in a world of people who live on their overdrafts. Even those I know who are financially stable believe that ‘the stock market is gambling’, and interest on savings is ‘fun money’ for holidays.

This may turn out to be a very long chat, as I release years of pent-up obsession!

How old are you?

Didn’t your mother teach you that there are some questions you shouldn’t ask a lady? But since I’m anonymous: I turned 44 this month.

I’m not married. I was, for over a decade, to someone I’ll call X (for obvious reasons).

We met in our early 20s at university. By the time we were 28 we were married and looking for our first house.

X came from the same background as me – working-class parents, simple upbringing (no foreign holidays, no car), first person in the family to go to university.

We were both pretty frugal, too. We’d each show up at the supermarket with a pocket full of vouchers. But his dad died shortly before I met him, and this shaped his perspective on financial decisions. He developed a philosophy of ‘you can’t take it with you’.

Any money left over was spent. Saving was against his philosophy – unless it was saving for something he wanted. Even then he’d rather borrow.

That wasn’t why I divorced him – the real reason had high heels and a sports car – but I’d be lying if I said it wasn’t a factor. I derive the same satisfaction from contemplating my savings that Scrooge McDuck gets from diving into his pile of gold coins. It was almost physically painful to watch them disappear.

Several years on, I now have a partner (‘boyfriend’ sounds awkward applied to someone old enough to be worrying about pensions) who is a much better match.

He’s ten years older than me – although he asked me to mention he’s also handsome and charming – and he’s outgrown his splash-the-cash phase. (Though he’ll never outgrow his love of LEGO.)

Is he pursuing FIRE in his own right, or more not getting in your way?

He’s only just discovered FIRE and he’s like a kid with a new toy!

I don’t know if it will stick. But I’m happy with him not getting in my way! That’d be a big improvement over last time.

Do you have any dependents?

My son is 12, and growing so fast he’s costing me a fortune in shoes. Or he would be if I wasn’t a regular at outlet stores and Everything5Pounds.com.

My partner’s kid just turned 18. We’re learning our way around the university loan and fees system.

Where do you live?

I live out in the sticks, in the Frozen North of England.

My little town is ex-everything – ex-mining, ex-shipbuilding, ex-tourist-hotspot.

Living here has its ups and downs. Property is cheap still. The cost of living is low, and the scenery is gorgeous once you get past the betting shops and sticky-floored bars.

But there are no jobs. The schools aren’t impressive, and there are lots of tracksuits around.

On balance, I feel like I’m winning. I can live on next to nothing and have still been able to give my son a great life, with fresh air and places to play.

How close are you to Financial Independence?

I’m not there yet. I won’t be for another eight to ten years – with a good following wind.

By the time I’m 50 I hope I could possibly pull off a super-lean FIRE.

By 55 I should be completely comfortable about walking away from all my work commitments.

So early retirement is the plan?

Well you could say I’m already semi-retired, even though I haven’t got the FI element nailed yet.

I’m down to two days a week at work, and have been for a year. My line manager thinks it’s temporary, but it isn’t. Unless something goes horribly wrong, in which case I’ll have to get back into the rat race. Or my version of it, which is more of a hamster race.

If I’m honest, I haven’t relaxed into my partial retirement. I spent three years aiming for this and throwing everything at it. But changing gears has been hard.

I find myself sitting at my computer almost as much as before, only now I’m looking for interesting opportunities – and keeping up with Monevator – rather than working.

Assets: mostly under one roof

What’s your net worth?

I’d estimate that on my own I’m worth between £400,000 and £500,000.

I know that to those of you with millions in the bank that doesn’t sound impressive, but it amazes me every day.

Seriously, I really get a kick out of it. (Is this a sign of some kind of syndrome?)

I’ve actually considered investing in gold – even though I don’t really believe it’s sensible – just for the joy of rubbing my hands and contemplating my gold.

Maybe I’m part-dragon.

What are your main assets?

I have a house. It’s worth about £250,000 – maybe even £300,000 if the sun is shining when I put it on the market. I paid off the mortgages when I turned 40.

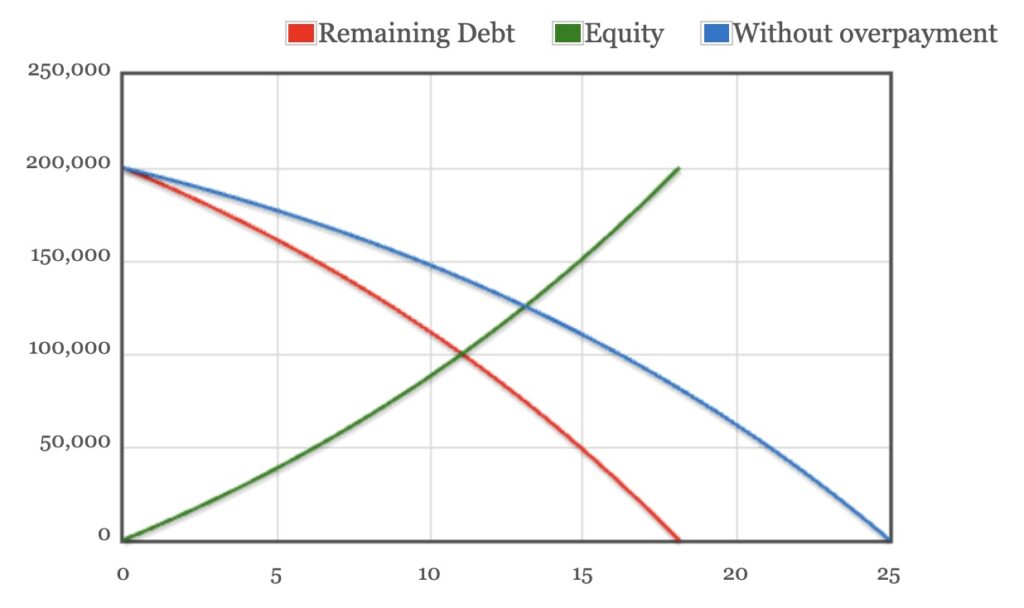

X and I bought this house shortly after we were married. He paid the regular mortgage payments, with his more consistent salary. My work fluctuated, so I overpaid when my salary allowed. He thought the overpayments were stupid but tolerated my quirk.

I wasn’t entirely convinced that paying off the mortgage was the smartest move either. Balancing it against the potential returns from investment, it may not have been.

But it was the smartest move I was allowed to make. Every time I saved money in the bank, X would say something like, “The front door needs replacing, and we can afford a good one since you’ve been saving!” So money I saved always vanished. But the overpayments mostly went under his radar.

X threw a pretty big spanner in the works at one point. He decided we needed to take out a second mortgage to build a kitchen extension. I argued we could save aggressively for three or four years to pay for it outright. He dismissed this. There was room in his salary due to a recent promotion for additional payments he said. He wanted a better kitchen NOW, not in four years.

So, as usual, I gave in. Obviously that was not a good call, because when he took off he left me holding two mortgages as well as the baby.

Yikes! Where did that leave you financially?

Essentially I started again from scratch. No savings in the bank, a pension that wouldn’t pay for a chocolate bar a month, and a job that didn’t cover two mortgage payments.

But I had the house.

Thanks to my ten years of dedicated overpaying, the first mortgage was nearly gone – and overtime was available. I knocked off that first mortgage as quickly as I could, then turned my attention to the second one. I paid them both off in less than two years.

Then I could breathe again. I was free – of a bad marriage, an unwanted second mortgage, and that first mortgage that was my project for a decade.

That was four years ago. Since then I’ve had a wonderful time. I don’t have much money to spare each month, but I have great fun playing with it.

There’s around £65,000 in ISAs, divided between cash and shares. I pay voluntary contributions of 12% (taking the total to 20%) into my workplace pension through salary sacrifice. And I occasionally invest in more random stuff.

What’s your main residence?

Sorry but I can’t help laughing at the term ‘main residence’!

I have a house, and I live in it. I doubt I’ll ever find myself in a situation where I’ll have a ‘main residence’.

Having said that… my partner also owns a house. He’s renting it out while he lives with me. The rental income helps his child with university costs. That seems fair enough.

My partner pays half the bills in my house every month, so I have more financial headroom now. Though I was sad to lose my single person Council Tax discount!

My house is big. It was a fixer-upper, and finally it’s fixed up. It’s no mansion, but it has three floors and four big double bedrooms.

If you stand in the bay windows and look sideways, you can see the sea.

It’s not in the best area – our street has HMOs and antisocial behaviour – but that’s standard in my town.

Do you consider it an asset, an investment, or something else?

I’m glad you asked, because it’s recently become a key part of my future plans.

I’m frustrated that most of my wealth (don’t laugh – it feels like wealth to me) is locked up in this house. So recently my partner and I decided to sell it to buy somewhere together.

He has some savings, and I’m going to put in £100,000 from the house sale. This should leave me with at least £150,000 to feed into my ISA and pensions.

Maybe it’s a daft idea. But after so many years of money stress, it would mean a lot to have funds right where I can see them.

Your journey is unusual for Monevator, with that especially stressful beginning…

Yes, and this is a good place to point out how much easier things are when you’re not a single parent.

I was single for over three years, between kicking out my ex-husband and meeting my current partner. Financially it was horrendous. There was no safety net, no wiggle room, no help if I was ill.

Being with my current partner gives me options. We can pool our resources and work together to achieve things. We’re not at the point of having joint finances. Maybe we never will be – we’ve both been burned before. But regardless, it’s so much easier.

I absolutely believe women should be able to be independent. But the reality is if you’re a single parent on a low income, you’re screwed. So to any other single mothers out there, reading Monevator wistfully because they hope something will change someday, I’d say: hold on.

Time keeps moving, kids grow up – I’ve heard some eventually even help with the chores – and you may find allies in unlikely places.

When I was dating I found first-date questions about jobs and income off-putting. What advice would you give to readers looking for a financially like-minded partner?

Conversations like that never go well, do they? I met a few guys when I was single who were clearly fishing to find out whether I owned my house and whether I could support them on my salary.

I think questions about income and jobs are best avoided. Those things are subject to change anyway, and they don’t tell you all that much about a person.

But conversations about spending philosophy might have a role: “You’ve just won a million quid on the lottery – what’s the first thing you do?”

I’d find a man with a plan for a nicely-diversified investment portfolio pretty attractive!

What do you think of prenuptial agreements?

Divorce has a way of changing your views on things like that!

These days I’m in favour of prenups. When I went through my divorce I couldn’t afford a solicitor, so I had to act for myself on the financial settlement. It gave me sleepless nights for two years.

Of course, a prenup wasn’t even a consideration when my ex and I started out. We didn’t have much and you don’t think like that when you’re in your 20s and broke.

But if I did it again I’d be more open to the idea.

A prenup is not the most romantic way to approach marriage. But being trapped and financially dependent is even less romantic.

A prenup that protects both parties is an expression of love (although gentlemen please note: jewellery is too!)

Earning: notsoloadsamoney

What’s your job?

I tutor adults from home. I used to do more conventional teaching, alongside the tutoring. But when I became a parent I had to make changes.

My child was born with a disability. There was no chance of childcare, so I had to work around looking after him.

I’ve always enjoyed tutoring, actually. But I’ve been stuck for over a decade in a job with no promotion opportunities, at the bottom of a ladder with no rungs. It’s frustrating.

For me, the RE element of FIRE is not really about retiring – not yet, anyway.

It’s about the luxury of being able to walk away from guaranteed work without being irresponsible, and then taking time to re-skill or to look for more exciting opportunities.

What is your income?

Right now I’m not even paying tax, so that should give you a clue! But of course I’m only working two days a week.

However even at my peak, when I was working full time and doing as much overtime as I could scrounge, I wasn’t earning more than £38,000.

Talk of higher-rate tax brackets goes over my head, I’m afraid!

How has your salary progressed?

I didn’t earn a wage until I was 25. I did a PhD, which extended my student idleness by an extra four years. And then I had a studentship. They paid me £10,000 a year to research something I was interested in. A sweet deal!

After I graduated, I built what they nowadays call a ‘portfolio career’. I thought of it as a patchwork of jobs. A bit of invigilating, some exam marking gigs, a bit of teaching in local universities, and a small income from my drawing and graphic design hobby.

None of it brought in much. But I’d been living on a shoestring budget for years, so I didn’t feel the pinch. Anything above £10,000 a year felt like riches.

It was a very precarious life, though. So the idea of financial independence always represented safety and stability to me.

Did you learn anything in developing your career that you wished you’d known earlier?

Nope. I’ve never unlocked the secret of making money. I’m the person who ends up doing piles of unpaid work, because nobody else is going to do it. I say yes to things I should say no to.

People have told me to grow a backbone for years, but it’s hopeless!

My dad worked at a very low-paying manual job all his life and retired early due to ill health caused by workplace wear and tear.

My mother took odd jobs – cleaning, childminding, doing people’s ironing – for cash to supplement the little my dad made.

I grew up believing I would never be able to earn much money, so it was better to manage without. That philosophy has helped me resist the lifestyle creep that so many fall victim to. But it’s also limited me.

I’ve never had the confidence to pitch for high-paying jobs, because I can’t shake the belief that those jobs aren’t for people like me.

I’m trying to reprogram myself, though. Maybe someday I’ll figure it out!

Do you have any sources of income besides your main job?

I receive some Disability Living Allowance (DLA) for my son. A few years ago, when X took to his heels, that extra money was a lifeline. Without it, I think I would have lost the house.

But since I got back on my feet and don’t rely on it any more, the DLA money has become what we call the Magic Money Tree in our house. I opened a Vanguard S&S Junior ISA (heavily equity-weighted, between LS 80 and a Target Retirement accumulation fund with a very long date) for my son. All of the DLA money goes in there.

I get him to help me check its progress every couple of months, and we watch as the Magic Money Tree magically grows more money. We talk about compounding, saving, and investment. He’s learning about interest rates too.

It’s never going to be a huge pot – it’s sitting at around £13,000, and I’m aiming to reach £30,000 to £40,000 by the time he turns 18 – but it’s not a bad start. Hopefully he’ll have picked up enough financial awareness to manage it competently, or at least not blow it on something stupid.

I have the occasional side hustle. The legacy of an early ‘portfolio career’ is the confidence that you can always pick up a bit of extra money from somewhere.

At the moment I make a little passive income from selling designs on platforms like Redbubble – usually less than £500 a year. And sometimes people pay me a bit for designing logos for them, or making them a book cover, or writing some blurb for their website, or doing some research. It’s just pocket money and it’s not reliable. But it’s better than a slap in the face with a wet kipper, as my mother would say.

I enjoy it. One of my goals in chasing FIRE is to have more time for illustrating, because I’m never happier than when I’m curled up on a sofa with my sketchbook.

Illustrations by Squirrel

Has pursuing FIRE got in the way of your career?

There were times it kept me going.

One thing I have in common with lots of other Monevator readers, I’ve noticed, is I tend to struggle with authority.

I don’t like to be told what to do – especially by managers who don’t know the job like me. I don’t like training courses run by people with less experience than me. Or to be monitored as a box-ticking exercise.

I am, in short, not suited to employment. I should be in a Brideshead-style country house, eating delicate cakes and trying to decide whether to wear the blue hat or the green.

But since I do need to work, and since I need to tolerate a hierarchy which often makes very little sense, FIRE is my bright and twinkly light at the end of the tunnel.

Saving it: highly-rated

What is your annual spending? How has this changed?

I spend between £8,000 and £10,000 a year, and I always have done. I know that seems implausible, with the rises in the cost of living – and having a child to support – but it’s true.

In my early days of Being A Grown-Up there were mortgage payments, house renovations, trips to visit in-laws 200 miles away… Life was more expensive, even if a loaf of bread wasn’t.

But now that I’ve paid off the mortgage, done most of the work on the house, found myself a job that doesn’t involve traveling, and don’t have a car, things have stabilised and I’ve been able to cut costs massively. So my annual spending really hasn’t budged.

Do you stick to a budget or otherwise structure your spending?

No. And being able to not do those things is a luxury to me. I’ve had to do so at various points, and that was fine and necessary. But now that I have a bit more wiggle room I find it a pleasure not to keep track. Sometimes I just buy something, without thinking about it for months!

I’m instinctively conscious that if I make an unplanned purchase one week, I shouldn’t again for another few weeks. But I don’t feel the need to check my bank balance obsessively.

What percentage of your gross income have you saved over the years?

Oof, that’s a tricky question!

There have been times when I’ve saved probably about 80% of my income, if you count overpaying the mortgage and pensions.

It’s never really dropped lower than about 40%.

Saving, for me, is one of the main reasons to earn. I’ll cut back on other things before cutting saving.

I made some tough choices to enable that. One was not to pay for childcare. When I was a kid my mother chose to stay home, look after the house and bring up my sister and me – and accepted the financial consequences. I wasn’t sure I wanted to do that. But in the event, that choice was made for me: first by my son’s needs, which made childcare pretty much impossible, even if I could afford it; and second, by becoming a single parent, which narrowed my options even further.

So I juggled working from home and full-time parenting, and I’m still doing that.

Even though it’s been an exhausting 12 years, I’m grateful I was in a position where I could work from home when necessary. Childcare would have eaten up any disposable income. There would have been no possibility of saving anything.

It seems odd to say I’ve been lucky. Most people reading this might not consider it lucky to spend years as a single parent, working through every night, and desperately hoping not to get sick and lose income.

But I was lucky. I had a workable option, and enough knowledge of financial products to take advantage when I could. Gradually my snowball started to get bigger.

Most people in my situation find themselves with much scarier problems.

What’s the secret to saving?

If you start out with good habits then don’t lose them, no matter what anybody says.

It doesn’t matter if they laugh at you. We’re a nation of eccentrics, so just roll with it!

I shop in charity shops. My clothes come from market stalls. I wear a pair of boots until they drop to bits – then I go to the market cobbler and get them re-soled. I put jumpers on instead of the heating. Multiple jumpers – and I’m not very tall so I definitely have a Wombles aesthetic.

I started like that because my family had no money and that’s how we lived. But I keep going because it makes me happy. I like rooting for bargains and buying second (or third) hand designer gear that’s out of fashion.

I don’t actually want to change my habits. Lifestyle creep makes no sense to me. I get more fun out of stashing money away than spending it.

If your salary goes up, keeping your cheap ways will make a huge difference – or at least I’d imagine it would!

My salary didn’t go up, but my financial obligations have gone down. That has a similar effect.

Any hints about spending less?

Walk a lot! It makes such a difference to my financial outgoings.

I walk everywhere I need to go. Where I live I’m lucky enough to be just a short walk from the shops, bank, beach, park (with squirrels), and pretty much everything else I need. Sometimes I do need to go into a city, which requires public transport. But I can go months between trips.

Find yourself a walkable town, and you’ll be saving more money than you know what to do with.

Do you have any passions, hobbies, or vices that eat up your income?

I do – but I choose to see those more as investments than vices.

I love to collect things, and I love a bargain. When I was younger I had a passion for antiques. I knew a great deal about them, so I could spot a bargain a mile away.

My house is full of what my neighbours call ‘old stuff’. Victorian beadwork, mahogany sideboards, Japanese lacquered cabinets, old Persian rugs.

But as the bargains have dried up over the last 15 years, my interests have narrowed. Instead of ‘old stuff’ I now pick up old books and art.

My antiquarian book collection is worth a lot. I don’t know how much, because it seems rude to put a value on friends. But a lot.

I rarely spend more than about £30 on a book. And old books are getting harder to find, so the value of my collection will only go up. That makes me feel less self-indulgent!

As for art: buy what you like, and buy direct from the artist when you can.

The most I’ve paid for a painting is £1,000. The painting was from the 1980s and it was used as the cover art for one of my favourite fantasy books when I was a teenager. When I saw it up for sale on the artist’s website, about four years ago, I had to have it. But still I spent a year thinking about it and trying to justify it to myself.

I reckon that if you buy what you like, someday you’ll be able to sell for profit to someone with similar tastes. In the meantime you have the joy of owning something you love.

I’m in the joy phase now. I fully recommend it!

Investing: steady as she goes

What kind of investor are you?

Passive. Absolutely, all the way – and that’s your fault!

I discovered Monevator early in my FIRE journey. I didn’t know anything about investing. The whole idea seemed impossible, like entering the world of the rich people without permission.

But the rationale of passive investing struck a chord. I’m not an expert in anything, but I do have determination. A buy-and-hold strategy played to my strengths. I knew I could ride out market fluctuations, as long as I was confident of my strategy.

What was your best investment?

Time will tell!

Maybe life will throw me a curveball, and my best investment will end up being my son. He might turn into a financial idiot in adulthood, of course, but I’m investing the time to teach him all the things I had to discover for myself through blogs and serendipity.

I learned them far too late to benefit fully. But he’s learning them as a child. Who knows what possibilities that might open up for him?

I’m not counting on him doing amazing things with his life – but there’s a chance he might…

Did you make any big mistakes on your investing journey?

Many! Didn’t we all?

My property was bought just before the 2008 crash, and it took ten years to get its value back. I started to fill my ISA allowance many years ago, but ended up taking the money out and using it. It took me too long to understand the power of compounding. And I didn’t opt into the work pension scheme early, at a time when I could have gained a defined benefit advantage.

Yes, I would like to kick Younger Me for all that. But I don’t blame her. She had absolutely no finance or investing education, no role models, no crystal ball, and no access to advice. She was stumbling and learning as she went. The right instincts, but none of the right tools. As soon as she picked up information, she applied it as best she could.

I wish I’d been around to help her, but I can’t blame her for the choices she made at the time.

What has been your overall return, as best you can tell?

I don’t really keep records. Maybe I should start? It’s always seemed irrelevant to me, because I’ve just been stumbling through and doing the best I could with limited options.

Overpaying the mortgages clearly saved me tens of thousands of pounds, so there’s that. And my house has gone up in value by about 60% in the 16 years since I bought it.

Investment-wise I’ve done okay. Things have gone up pretty steadily.

I’ve also been enjoying the 5% I’ve been getting on my cash over the last couple of years.

But overall return? Not a clue. There have been too many moving parts.

How much have you been able to fill your ISA and pension contributions?

I’ve prioritised ISAs over pensions in the last few years. My goal is to max out my ISA allowance for the next eight to ten years. Hopefully that will put me on a solid footing for drawing what I need until I hit state pension age.

Yes, there’s an argument for prioritising pensions. But financial safety nets are not to be sniffed at. I’ve been desperately in need of money at times. Anything locked in a pension is effectively out of reach. So I prioritise ISAs because in a pinch I can access the money.

To what extent did tax incentives and shelters influence your strategy?

Completely. I don’t have an accountant or any special financial expertise. I don’t have the faintest clue about the tax due on investments. The thought of trying to figure it out sends me into a cold sweat.

I have no way to mitigate tax, other than through tax shelters. So that’s what I use.

How often do you check your investments?

I check my savings and investments monthly – or more often if I need to cheer myself up.

Yes I’m a dork, but everything about passive investing makes me happy. I get a kick out of watching the graph go upwards! But I also like it when the market drops. I’m nowhere near cashing in my investment chips, so a market downturn means cheap bargains for me.

I make regular payments so I don’t have to think about anything. That makes me comfortable. I’ve set my course and now all I need to do – apart from very occasional rebalancing – is hold steady. That’s what I’m good at.

Wealth: nutty about saving

We know how you made your money, but how did you keep it?

When I was a kid, my little sister used to cheat at Monopoly by hiding £500 notes under the board. I often feel like I’m doing the same thing with life. I’m tucking my Monopoly money away, hoping nobody notices. Hoping I can win somehow.

It feels like cheating. And I have to keep it quiet.

I have a good friend who comes from the same sort of background but who has a much better-paid job than I do. She lives in a shared house, never climbs out of her overdraft, is always worried about money, and sees the future as impossibly bleak.

When my friend insists on buying me lunch because she earns more than me, how can I say that I’ve brought sandwiches from home because I’m saving my spare cash for a rare 300-year-old book – now that I’ve maxed out my ISA for the year and paid off my mortgages?

I have to fly under the radar, otherwise nobody in my current life would speak to me again.

I think of myself as a financial squirrel, scrounging nuts and hiding them for when the weather worsens. There’s no real plan. I just run on instinct and the small amount of knowledge I’ve managed to pick up, aiming for a level of financial stability that will allow me to work only when I feel like it.

Which is more important, saving or investing?

For me, saving is the fundamental thing. Ever since I was a kid, I knew that was the way out, the way to change my life. Discovering compound interest was like fireworks going off in my brain.

Investing is obviously the way to turbo-charge those savings but I’m conscious of the vagaries. Investing is like the camel that might carry you through the desert – or it might dump you on the sand, spit on you, and sneer at your gullibility. I love that Investment Camel, but I’m not going to give it all my savings. So I follow the savings interest rates and always have a sizeable proportion of my portfolio in cash.

Please note I’ve never seen a camel in real life. All camel analogies are based on Carry On Follow That Camel, and may not be entirely true to life.

Was achieving financial freedom ever a goal with a timeline?

I may have mentioned my ex-husband, who was the single biggest obstacle to everything I wanted to achieve.

Becoming a parent got in the way, too. Babies cost a lot!

Sometimes I think you just have to put your financial goals on hold for a few years and go into survival mode. I’ve done that twice – once when my son was born, and once when X left.

Yes, those times set me back considerably. But they were necessary and I don’t regret them. Financial freedom is important, but sometimes other things come first.

Unlike most FIRE-side chatters, you’re very much still growing your pot…

Yes, and I’m hoping that the next five years will be the time when my pot grows the fastest.

I’m saving as much as I can into my ISA. I’m also saving into my son’s ISA, and into my workplace pension. And I’ve talked my partner into prioritising his ISA too.

House prices in my area have been going up, so if I sell my house I might do well enough to give my pot a substantial boost. This is my moment in time, when all of my dreams are a heartbeat away. (I learned to play that song on the keyboard when I was eight, and it stuck).

Do you have any further financial goals?

Don’t laugh – but I haven’t given up on the idea of someday making proper money.

Yesterday I applied for the Perfect Job that, as well as being exactly in my wheelhouse, also happens to pay £150,000.

I’ll never get it. I won’t even get an interview. I’ve been here before.

But maybe one day the stars will align, and an opportunity will open up. If it does, I will jump at it like a rat up a drainpipe!

What would you say to other Monevator readers pursuing financial freedom?

Financial freedom seems like a big final reward – like when you’re playing Pass the Parcel, and you get to the last wrapping.

But actually there are lots of little rewards along the way. It’s more like the modern-day version of Pass the Parcel, with a lolly in each layer of paper so the kids don’t burst into tears.

First I was able to stop working extra hours; then I could invest in some things that I love; then I could cut down a bit at work. The last few years have been one little reward after another.

So I’d say remember to celebrate the small wins as well as the big one.

In the weeds

When did you first start thinking seriously about money and investing?

Oh, I think it’s always been there. When I was a little girl I had a Halifax money box in the shape of a house, and I would hoard my pocket money. A bit older, I discovered bank accounts paid interest – quite healthy interest, if I remember correctly, in the late 1980s – and I poured over my bank book to see the free money. Even doing my PhD I was also saving. I dreamt of owning a little flat with books and plants and a cat.

Then my ex-husband came along and everything got complicated. I’m pretty persuadable, and it was easier to let his preferences overrule my instincts.

But one day I picked up a free Kindle book for holiday reading. It was called How to Own the World, by Andrew Craig. All of a sudden my old obsessions came roaring back.

I needed to own the world! I needed to own inflation! And to put 20-30% into gold!

As I started to look into the things he mentioned – and stumbled across Monevator for the first time – I gradually developed my own take.

No, I didn’t really want to own gold, even though it sounded nice. Yes, I did need to start investing in equities and bonds – and I needed a Stocks and Shares ISA to do that.

That was where I ground to a halt.

I knew from reading Monevator (religiously, for months) where I wanted to start, to match my risk tolerance and my level of knowledge. I wanted to start with a Vanguard LifeStrategy 60/40 product in an ISA wrapper.

But how on earth could I do it?

There were platform fees and transaction fees and different brokers, and there were Financial Advisors but you shouldn’t really use them. The simple portfolios managed by the banks were too expensive, and everyone on the internet said ‘Do Your Own Research’…

I was on the way to concluding that a working-class girl like me – who didn’t know anyone in the world with an investment portfolio – might as well just stick to hiding money pound notes under the mattress.

Then something changed. Vanguard came to the UK, and opened its low-cost online platform for regular folks to invest directly.

That was the missing piece! Suddenly I could see how to do it.

According to my dashboard I opened my Vanguard account in 2017. I was very enthusiastic – too enthusiastic. I made the mistake of talking about it.

Two years later my ex-husband took everything I had in my accounts when he left, including the funds I’d built up in my S&S ISA. I was back to the start again.

But now I knew how to do it, and a few other things too. I was starting with knowledge, and a little bit of confidence. I read more widely, came up with a savings strategy for my son, figured out my appetite for risk in my changed circumstances, and I got back in the game.

Did any particular individuals inspire you to become financially free?

I suppose, if I think back, a dead guy called George.

In my mid-20s I was working at a university, and I shared an office with a huge stack of books that had belonged to George. I knew his name because I went through his books, and found lots of professional correspondence from editors and reviewers.

George had been a professor in the department before I got there. He’d retired, then he died soon afterwards and left his books to the university.

The university didn’t want them.

Nobody ever talked about George, except to roll their eyes and complain about the unwanted books. It was like he’d never existed. But he did, and he did everything right. He climbed the ladder, published his research, got promoted, made it to the top. He ticked every academic box and then some. Then all of a sudden he was dead, and his books were homeless.

Nothing George had done seemed to matter. Life just rolled right on over him.

I spent a lot of time sitting in my office, marking essays behind this giant stack of inconvenient books, and wondering what it was all for.

Yes, I could spend the next 40 years working evenings and weekends, going the extra mile, writing books that nobody would read. Pushing through one promotion board after another until I got to the top, like George had and then died.

But why? Would I be happy? Was George happy?

That year inspired my quest for financial freedom. George represented my alternate reality, in which I did everything by the book and threw all I had at my career. It turned out I didn’t want to be George. I wasn’t sure what I did want, but freedom was definitely going to be part of it.

Do you think George would do anything different next time – or are the likes of us just born this way?

I reckon he did exactly what he thought he should do. Given the chance, he’d probably do it all again.

Plenty of people around me are climbing the same ladder. But I’m not – and maybe that’s what attracted me to FIRE.

I remember when I came across the concept of F-U money, it hit me like a lightning bolt. That was what I needed! The freedom to walk away.

I don’t know what makes me different, or what makes any of us ‘FIRE people’ different. But I have a feeling we’ll survive the zombie apocalypse!

Can you recommend your favourite resources for anyone chasing the FIRE dream?

Monevator, obviously – and I’m not just saying that because I’m talking to you!

Specifically, I love your compound interest calculator. It’s my happy place. It’s done more to make the possibility of financial independence real to me than anything else.

The MoneySavingExpert weekly newsletter has also helped me a lot. In the days when things were really tight, I had to chase the discounts, vouchers and the best rates just to keep afloat. I would read that on my phone in the dark when I was trying to get my son to sleep, and make plans based on whatever was free or discounted.

I don’t read or watch a lot of FIRE-specific things, because mostly they don’t map onto my situation. Anything London-centric or Fat-FIRE is a world away from me.

But I do like to read the stories of people who’ve made it, regardless of how different they are. I feel like celebrating every time somebody makes it to the end of whatever challenge they set themselves.

What is your attitude towards charity and inheritance?

I shop in charity shops, because I like the little money I have to benefit both me and a charity.

I buy furniture secondhand. My cat is a rescue cat from a charity. I put my change into a charity pot when I see one. I believe in charity and in helping out where you can.

But I wouldn’t leave anything to charity in my will, I don’t think. There’s my son to provide for, and my partner’s child to consider (both are disabled in different ways, so they might struggle to find work when they’re older).

I’m an aunt too, so there are other little ones to look out for. Things are tough for the younger generation, so I always have one eye on their future.

What will your finances look like towards the end of your life?

I see myself, at the end of my life, looking out of the turret window of my castle at my descendants playing together in my beautifully manicured gardens as the sun sets behind the distant mountains of my Empire, and saying to myself, “I have done well”.

Failing that, I’d settle for having a bit to leave the kids – and the very-much-hypothetical grandkids. Although I’m not a big fan of inheritances. I’d be looking to give them what they need when they most need it, rather than encourage them to look forward with enthusiasm to the day I shuffle off this mortal coil…

My thanks to Squirrel, and to you for hearing us out. What do you think of this ‘work in progress’ FIRE-side chat? A nice change? Questions and reflections welcome, but remember Squirrel is a reader sharing her story, not a gnarly old blogger like me. Constructive feedback welcome. Personal attacks will be deleted. Do check out our other FIRE studies.

Really enjoyed reading this – great writing style. I identify with a lot of it! The female perspective is also welcome.

Thanks so much for sharing, it’s great to see different stories on here.

I’m raising a disabled daughter, and a lot of what you said rings true for me as well. We had a huge battle to find childcare for her, and though we’ve got there now the process (as well as the other stuff) knocked me for six and definitely hurt my earnings potential. People really have no idea how difficult it can be. The one difference for me is that I’ve really held back on the JISA, because I’m quite nervous about what her capacity will be to use it wisely – though she’s a lot younger so perhaps when she’s older I’ll have a better idea about that.

I also feel the constant push-pull of “earning more money will support her better in the future” vs “the more time I can spend with her now the better it will help her develop” – and there’s quite a big question of what those funds will be used for. House for all of us? Early retirement to support her better? Support her financially indefinitely? I have no idea, so my planning has to be quite broad. But certainly we are better off for doing that planning and being FIRE-inclined, even if early retirement isn’t what we end up with.

Wonderful story and truly impressive budgeting. Thank you for sharing. It was great to hear about someone else part way through the journey and having to navigate life’s mini-disasters on the way. Also nice to have a break from US-centric case studies elsewhere which seem to indicate you now need multiple millions to achieve FI.

Wonderfully written! I sense Squirrel may have another string to her financial bow in freelance feature writing 🙂

Her background and challenges resonated with my own northern working-class upbringing: no car, no foreign holidays, etc. I enjoyed her wry intelligence, and was touched by her constant apologies for the modest scale of her earnings/savings. On the contrary, I found her journey hugely impressive (and true of most of my extended family). The more stuff you’re lucky enough to be paid, receive or accumulate in this life, the more blasé you can become about the number of zeroes on the cheques you write, or on the tax bills you receive. The complacency of ample buffers. It’s a useful reminder that poop gets most real in finance when margins for error (and sickness) are razor thin, and young mouths still need feeding. To stick to those plans, and think long term throughout those slings and arrows, are more worthy of credit to me than my middle-aged self stomaching a little bit of red ink in my otherwise mature and diversified assets. Fair play to you woman!

Great article and a very pleasant change to read from the perspective of an ordinary Joe.

And this is me to a T “One thing I have in common with lots of other Monevator readers, I’ve noticed, is I tend to struggle with authority.

I don’t like to be told what to do – especially by managers who don’t know” their a**e from their elbow.

I was never interested in the RE bit, only ever the FI part.

What a great Fireside Chat!

Lovely to hear from a fellow female FIRE nerd who lives outside the London bubble, especially one with such a positive outlook.

More power to your arm Squirrel!

Loved this chat. Glad to hear from someone who can manage well on much less than some of the ridiculous figures out there for living ‘comfortably’. Interestingly, also identified with the authority issue!

A truly inspiring read that. I related heavily with almost all of the way you got into investing, hearing about investing, being bewildered by terminology and products/services and finding the fountain of knowledge that is Monevator, although my path to here came from reading Mr Money Moustache (a kindered spirit). As mentioned in the other comments, it was very pleasant to hear from someone not in London. Living in the North West of England (and previously Scotland, where I initially started saving and investing) you start to wonder whether you’ve stumbled upon something mysterious, as no one seems to know or talk about such topics.

As someone who grew up in my early years as technically part of the under class, graduating later in childhood to the lower echelons of the working class, a lot of your experiences resonate. I would say that in the world of work, the advantage that the middle and upper classes have is confidence and a sense of professional entitlement, which isn’t there as much for those from a working class background. But what I can tell you from my own experience is 2 slightly contradictory things. The first being that nobody does or doesn’t deserve a job based on their background, so throw off the shackles of how you grew up and think about it based on what you are – a very well educated person. Unfortunately the world is not a meritocracy, and I can say with certainty that rank and job title is not a reflection of competence (much the opposite in a lot of cases). But if you don’t have the confidence to see that you deserve it, nobody will come along and tell you that you do. The second is that whilst applying for £150k dream jobs is something that is good to aim for, it does seem like a moon shot at this stage. Would I consider someone with your work experience for a senior position? It is likely that your CV would be sifted out by recruitment before it got to me. But would I consider you for a more junior position that still pays well, absolutely. And you’d find that you would probably be promoted pretty quickly.

I also admire your desire to live within your means and take responsibility. I also grew up with not much but enough. I had food, shelter, education and health care, which means I was lucky. It’s not a popular view, but it’s based on experience, in that I see a lot (not all!) people who are struggling to be in a large part at fault themselves. We now have a society where people think they are entitled to have a car on HP, expensive mobile phone contracts and holidays abroad whilst bemoaning their finances and taking boxes from food banks. I grew up on an estate where this was rife, with very few people wanting or needing to work very much if at all. We lived within our means and that motivated me to strive for more, but much like yourself I never forgot the lesson of not spending money that you don’t have.

Brilliant – well written, interesting, moving and amusing… the first of these chats that has really chimed with me with a reality that is at the same scale of my life. thank you.

I have been following Monevator for years, have been a paid up member from the start, and a big fan of FIRE side chats but this is the first time I have felt compelled to leave a comment.

What a beautifully written and insightful piece this is. It resonates loudly with me as our financial, if not personal situations are similar and, most importantly, it has reminded me that even small steps can lead to big changes.

Choosing to be frugal now in order to provide some financial security later can be a strain on relationships, as so many people just don’t get it, my own partner (of 34 years) included. Until recently that is.

Earlier this year I was laid off with a number of colleagues from a firm that we had worked at for many years. It came out of the blue and was a big shock. Many of my colleagues had little or no financial cushion and big outgoings including car loans and credit card debt looming over them which has pushed them close to the edge. Some had to accept the first offer of employment that came along, regardless of suitability, whilst others are still out of work. It has been hard to watch.

For me, my own little pot of early retirement savings sprang to the rescue. I have been able to step back, take stock and allow myself time to plan my next move in the safe knowledge that I can cover my bills and day to day expenses for as long as it takes to retrain and find work. The comfort this has provided is hard to describe.

I credit the FIRE movement in general and the wonderful resource that is Monevator in particular for giving me the skills and confidence needed to do this. Reading the experiences of others, such as Squirrel, is confirmation that I am not alone in overcoming obstacles whilst trying to stay on the right track.

I reckon I will need to work an extra year to replenish what I have taken from the pot. A small price to pay, I think.

During my unexpected down time over the summer, I remembered that as a child I always wanted to be a lorry or bus driver so I thought, now is my chance! I applied for my provisional licence, somehow scraped through the medical, and have just taken the first of the three theory tests. I can’t wait to start!

This is great, a lot of this resonates with me, especially the numbers, though I’m far enough down the line to have given up the day job. I can definitely identify with ‘flying under the radar’. Your level of spending is impressive and it sounds like you’re in a good position now, congratulations!

I couldn’t stop reading this once I’d started. Brilliantly written, Squirrel. Funny, moving, inspiring. It seems to me that any story is relatable when written as humanely as this. Late on, unless I’ve misunderstood, you reveal that your ex basically looted your investment accounts. If I’ve read that correctly then I’ve just got to say, what a f**kin’ lowlife. I also wish we could hear from George about what he thinks now. I love your description of your empire. I think anyone who has such a strong sense of who they really are will almost certainly end up as master of their own kingdom.

Nothing but huge admiration and respect, squirrel. A lot resonates. Even the book collecting – and need to keep quiet from peers. A spendthrift sibling recently found out via my Dad, and I think it was a total shock to her as I think they’d assumed we were poorer (no car, shabby clothes, rare holidays etc).

If you are able to live on very low amounts, it can be a huge boost to the pension to salary sacrifice as much as possible. For a time, I was living on less than minimum wage while working full-time in a well paid job – and my pension benefitted enormously. Eventually, my company said I could no longer be paid less than minimum wage, but it had done its job.

I grew up as part of the underclass, and suppose now because of career, paid off house and being FI am well and truly out of it. Old habits die hard though. Even today, I was volunteering at a local community farm and came away super happy with the big bag of veg I was unexpectedly given.

A really great read, and very inspirational.

I just wanted to pick up on Eric’s comment. Raising disabled children comes with huge challenges.

One being their situation when transitioning to adulthood:

i) DLA is replaced by PIP (and I would suggest the writer / her son get help from a local advice charity with the form)

https://www.citizensadvice.org.uk/benefits/sick-or-disabled-people-and-carers/pip/

ii) If working is likely to be problematic for the writer’s son then consider eligibility for benefits such as Universal Credit. This is means tested and has a savings limit of £16k. The JISA counts towards savings, and will prevent a UC application until it is whittled down to under the £16k limit.

It’s a real conundrum, (which I’ve seen volunteering at Citizens Advice) but worth looking into now. Parents want to provide for their disabled child, but then run the risk of running foul of the DWP’s rules.

A friend (whose daughter suffers severe social anxiety and autism) has decided against a JISA, but keeps savings in her name that will be used to support her daughter in the future.

I hope readers will be tolerant of this post, which strays away from the FIRE aspect of such a great article.

Yes, I really enjoyed this chat. Both that it was from a non high earner and I also enjoyed hearing from someone still working towards FI.

“I’ve never had the confidence to pitch for high-paying jobs, because I can’t shake the belief that those jobs aren’t for people like me.”

This comment rang true with me too, hence my need to try and find a different way to financial freedom instead of getting a well paid job, that I’d never hack even if I did get it.

Wonderfully written and inspiring stuff. Thank you for sharing your story, squirrel. Keep riding that Investment Camel and I’m confident that great things are ahead for you and your loved ones.

This was such a good read – thank you Squirrel!

Great to read a such a relatable voice in FIRE-side, and also good to read from a fellow traveller on the long FI path.

I thoroughly enjoyed reading this as I found it the most relatable of similar interviews. The need to stay under the radar and difficult family circumstances really resonated. I am inspired by the perseverance in spite of all the curveballs. I do believe you can get a better paying job though. More power to you Squirrel!

Great. Really good to get a perspective from a “ordinary” background and that you have the confidence that you’ll get there in 10ish years. Plus whisper it because there might be southerners around but you know you’ve already won in lifestyle because of the natural delights of the frozen north.

A great read. Relatable to me as a 40-something woman, in Scotland in my case, also never having scaled the peaks of ambition and achieved a fat salary, but who nonetheless aspires to the FIRE lifestyle. Your sacrifices to maximise saving by keeping spending very low really demonstrates what is possible. I would be interested to hear more about the ISA v pension route, as this is something I am trying to weigh up myself, and don’t quite understand how you can use up the 20k ISA allowance while earning under the tax threshold? Probably just my lack of knowledge there.

Just an addendum while I feel that X is probably a bit of a manchild (unless you were the one led astray by the high heels and sportscars) did he really loot your ISAs ? Or was that part of the divorce settlement while you kept the equity in the house.

Whatever it shows that bad relationships can really impact our long term (financial) health and that good ones can give the confidence to progress. Well done.

Hi all!

I just wanted to say how much I appreciate all the warm comments – and how great it is to see other people in similar situations and from similar backgrounds! We’re all pretty amazing, I reckon!

@Eric, you hit the nail on the head – people really don’t know how difficult it can be. I didn’t really go into the details of managing with a disabled child (my ramblings were already quite long enough!), but you’ll know yourself that however hard things are, there’s always someone in your disability network who is going through very much worse, and who is fighting an impossible battle with a system that refuses to help. It can be terrifying.

@Alice_Holt – food for thought: thank you! I actually hadn’t considered the implications of a JISA for Universal Credit, and I really appreciate the tip – which is timely since I haven’t yet gone over the 16k.

@Tricky – your story really reminds me of why I became interested in FIRE in the first place. Just the idea of having a safety net was always so comforting – particularly when everyone around me seemed just one bump away from disaster! Good for you!

Great to see all the working class northerners coming out of the woodwork to give a wave. We’re like a secret society!

@Cinnamon Whirl – you’re quite right, I can’t fill up the ISA allowance on my current salary! I’ve managed it up to now because I only gave up full-time work a year ago, so I had a bit put away to filter into the ISA; but now I’ve run out. However, if I sell the house and have some money spare from the house sale, that could potentially fund ISA contributions for the next 7 or even 8 years. So that’s my focus. I’ve decided to leave the pension to sort itself out – I’m making additional contributions every month, and I think that’ll do. In an ideal world I’d love to fill up both – but in an ideal world I’d also have a flying pony and be living in the Disney castle!

@TA and BBBobbins – my ex didn’t exactly loot my investment accounts. It was more the case that he refused to leave unless I gave him enough money for a comfortable deposit on a house for himself – which took everything I had and then some. It’s much harder to kick out a no-good spouse than people think!

@G – I’m a big fan of salary sacrifice too. It appeals to my frugality and my need for secrecy, I suppose! It’s another thing I found out about through blogs – and in my real life I’ve never encountered another person who’s even heard of it.

Squirrel thanks for sharing your story. I just wanted to give you a few things to think about in relation to your son, having had to do similar thinking for my daughter recently.

Some benefits have a taper relating to a claimant’s capital between £6000 or £10000 up to £16000 – so the value of your son’s investments may already be eroding some of the benefits he might get. Turn2us is a useful website where you can model different scenarios to see what sort of benefits he might be able to claim when he’s older.

You might want to consider a trust for him at some stage (and definately in your will). Mencap run regular online seminars on these issues which are worth looking at. Mencap also have their own trust company which is useful if you don’t have friends or family who could act as trustees.

It’s really important to have a will and clear instructions on who will act as his guardian. Lots to think about here, but given all your hard work in building your FIRE position, I’m sure you’ll want your son to benefit rather than X or the state. Good luck.

Tremendous. More of this, please.

Thank you, Squirrel, for sharing. And thanks again to TI for facilitating and for providing this excellent platform.

Great to hear from a ‘regular’ person and a woman – inspiring stuff! You definitely have a way with words 🙂

Hi Secret Squirrel

You’ve had a seriously impressive journey with all the obstacles you have faced and you have done well to amass your net worth despite coping on your own with a disabled child and a F*wit of an ex taking your money! But I’d say don’t talk yourself or your achievements down (even though maybe partly in jest/tongue in cheek). To be able to battle on regardless takes some serious determination/courage which you should be proud of.

You clearly are very capable and also clearly a good writer – you have an engaging/amusing/entertaining style which keeps us wanting to read more. Your illustrations are also extraordinarily good.

Your feelings on authority are exactly mine which is why I gave up being employed at 24 – some 30 years ago – couldn’t hack it and couldn’t get motivated working for others (so went self employed for quite a while and then ran a small company).

I’m 100% with you on saving & investing (and pre-nups). I always have been since as early as I can remember – say age of 5 when I started primary. Father used to give me small amount of money each week to put in the school bank and from that day I always saved, never spent it down – so have always had plenty savings throughout my life. My father didn’t believe in borrowing/HP/credit or whatever and neither do I – he always said “Why would you want to give your money away to those making an easy living at others’ expense.” That’s why I saved and bought my semi house for cash with no mortgage as I didn’t believe in it. (I was a bit older and also live in the cheaper “Frozen North” – in Yorkshire to be exact.)

Your annual spending is also mega impressive – especially in these times – since we came out of covid I thought I’d woke up in a different era with the bloody prices of everything. I used to go in a cafe and get a meal & drink for a fiver. Now everything’s tripled/quadrupled in price. I’ve also always been frugal and shop around and frequent the bargain stores. I’ve always thought – I’ll save for later life/retirement but one thing I have learnt in my life as time progressed is that that day might not come. What I am going through now I know that health is the most important thing – money just eases things and provides security/choices and a degree of freedom as not having to work or worry about bills is a real bonus. I started with some health conditions in my 40’s, including auto immune disease (my consultant thought likely triggered via a flu virus) which have ravaged me and had to give up work at 50. Now my plans are knackered somewhat and travel is not really a possibilty. I’ve also had a couple of friends die in their early 50’s (one with the auto immune disease I have) and many close family members pass away – one with brain tumor and others with various cancers, kidney disease and strokes/haemorrhages. Father died of covid in 2020. Many of these, including my mother/father, had saved a reasonable amount and not had chance to really enjoy it – my mother and father lived frugally but for what exactly in the end?? So although I have been frugal I now believe in treating myself now and then and my advice would be to enjoy yourself a little along the way – you have to think of yourself sometimes as well and live and enjoy some of your fruits to some degree – even if you do want to leave some to your heirs, as you obviously do. So with all this in mind I decided I will be buying myself a brand new car quite soon – just because I’d like one for a change – not to be flashy as I don’t believe in all that shallow b**locks anyway – it’s only a Renault anyhow, so hardly a “flashy” top of the range motor but will be the best one I have ever had! But it definitely won’t be on finance and I’ll still be haggling for the best deal.

BTW, I’m with you on working out your taxes on investments – what an unimaginable ball ache! I’m just attempting my tax return now having sold quite a few investments in trading accounts in the last tax year – some of which I’d bought into a few times in accumulation units and switched some to income units – so involves the old section 104 malarkey with all the adjustments – complete and utter nightmare! But I’ll get there – definitely won’t be paying accountants – paid enough of them when had a company and most were fairly hopeless.

Much praise to you though for being brave enough to do one of these fire-side chats – not something I could really ever do – even if it is anonymous! (I’m a rubbish writer anyway as you can probably tell.)

All the best to you – keep squirrelling those nuts away and you’ll soon get there.

What a super FIREside chat – the best one to date (and I really liked the others). For me, not only does Squirrel have a very engaging writing style, but she has the most relatable circumstances. My family has for the last two generations, including me, been hanging onto the very bottom rung of middle class & before that it was very definitely working class.

No one else in my family appears to have the desire/ability to save, never mind invest so I have had to act on my own instincts over the years to, firstly stay out of debt and secondly save and latterly invest. Hat tip here to Monevator, MMM, Ermine & the much missed SHMD.

My pot will certainly never be FatFIRE sized, especially by the standards of some regular commenters here. By some standards it’ll be closer to pocket change! But I’ve done my calculations and in 6 or 7 years with a fair wind it should be enough for me. All power to you Squirrel, and the hidden minority like us.

Hi Squirrel!

Thank you for a remarkable story. Your resilience and ability to fight your way through a set of circumstances that would have sunk many people are an inspiration. As the parent of a disabled child, I know what the fight can be like. I wish our society was a bit more accepting of the need for a safety net. It is one of the features of a civilised society and sometimes I wonder about ours.

What it brings home to me is how astoundingly lucky I have been. I might have been fighting some of the same battles, but from a much more secure position. And I realise there may have been a small amount of talent involved, but also a bucket-load of good fortune.

You should be immensely proud of what you have achieved. I wish you every good fortune in your future.

This was a really relatable and interesting piece – best so far. Totally relate to the lots of education/little money dynamic (although not exactly the same circumstances- I live cheap due to short-term contracts) and also the book collecting. Similar to your George realisation, I read a book about what stress does to your telomeres and pretty much decided to quit striving right then. You end up in the same place in the end…

What a lovely report from the trenches. Knowing what you stand for and what you really value is a key part on staying the course. It’s also good to hear a female perspective and one from the large part of the country outside the Great Wen for a change,

The only part that gave me pause was the cash holdings, that 5% interest isn’t real when 20% of the real value of cash has fallen off the back of a lorry over the last three years due to inflation. The Bank of England inflation calculator has the gory details.

I do agree everybody needs some cash float, but it’s worth asking yourself what you are trying to hedge to set an upper limit on this, directing the rest to productive assets (equity funds/shares for most of us)

Sounds like you’re on the right track, and wishing you the very best with your FI/RE journey.

“What do you think of this ‘work in progress’ FIRE-side chat? A nice change?”

Honestly, this has been my favourite out of *all* the FIRE-side chats so far! Squirrel is very relatable, in a number of ways both quirk and mindset-related. And her writing style was a joy to experience. Hopefully there are many more like this to follow!

A fascinating read, which is very well written and probably resonates with a great number of Monevator followers. It provided a candid and open insight to what can be done in difficult circumstances. Our lives are all different but we all take varying paths to get where we want to go.

I admired your tenacity and determination to carry on towards your destination, despite setbacks and obstacles that cause us all to change course at different stages of our journey.

From the support of a fellow northerner who has gradually progressed on a similar path to retirement I can assure you that keeping faith in the developed world and passively investing with the bulk of your excess monies, you will get your reward and the peace of mind that comes with it

Keep squirrelling away keep focused but most of all enjoy the ride to freedom!

I’ll add one other thing, relating to well paid jobs and being someone from the working class who doesn’t feel like they deserve it/can do them.

If you haven’t done so already, look up imposter syndrome and ways to counteract it. You are absolutely entitled to apply and do these jobs.

So much of success in life, however, you define it relates to having the right collection of mindsets or as I like to think of it brain operating system upgrades. This in itself is a useful framing as it implies changing how you think is easily possible – and often it is, you simply have to decide you are going to do so. The working class comes with many fine brain operating system defaults, but is also missing a few updates that other classes have installed during childhood. Without them, it can hold us back. You’ve obviously accessed many of the financial ones in your FIRE journey!

Very impressive story of financial progress in spite of some serious curveballs that could have derailed a weaker person

This story will make the more fortunate appreciate their currently happier positions and much more importantly greatly encourage others in less fortunate situations to dig in and keep going

Squirrel’s story shows the way ahead- it can be done

xxd09

Thanks so much for this FIRE-side chat, Squirrel. I learn something from every interview, but yours really resonated with me. I’m a few years behind you in the investment journey (I’m literally at the stage of reading MoneySavingExpert on my phone in the dark while trying to get my daughter to sleep!) and I come from quite a similar background. It’s really inspiring to see how well you’ve done and it’s given me an extra little push to keep going! Thank you.

Super post.

Well done and best of luck.

A fascinating, humane and funny account of making plans against the odds. In the face of circumstances where most would say, “what’s the point of pursuing these goals?”, you’ve decided, instead, that you must. I think you’ll be happier in your circumstances and what you achieve than the “retired man with Bond Villain Lair/Yacht” crowd that you more often hear from. Also, your years in academia have somehow left your ability to write with humour and clarity completely unscathed. Good luck to you and your kid.

I can only agree with most of the above comments!! You will be elated to read them all.

Well done Squirrel. One of the best ever FIRE-side chats.

I’m still seething at the audacity of your ex, for stealing your Vanguard pot.

Best of luck for the rest of your journey.

@ Squirrel – what do you think of your work / life balance now it’s down to two days a week? Does RE seem less important now you’ve got your paid employment down to that level? Or is it more the nature of the work that matters?

@all — Thanks for giving @Squirrel such a warm welcome. I was very excited to publish this FIRE-side chat but I also wasn’t sure how the ‘on the journey’ aspect would go. I’m delighted it’s hit the spot.

I’d echo those who are saying we need more Squirrel in the Monevator diet, too. Fingers crossed!

With that said I would like to put in a good word for the previous FIRE-side chats while I’m at it. 🙂

Appreciate that everyone’s circumstances are different, and also that @Squirrel’s story is a breath of fresh air.

However I think every one of the previous chatters were brave to share their story, achieved something worth telling us about, and had lessons for all of us.

To echo one of the comments above, putting yourself in a mental ‘money bracket’ can be as limiting to your financial future as how miserly your boss is or what happens with house prices.

So let’s all keep learning from everyone, whatever their circumstances, and take people who come to the FIRE-side as we find them. 🙂

Finally, thanks again to @Squirrel for sharing so generously.

What an interesting chat & a great lady too who has done so well with all you have had to deal with.

You say “Don’t laugh……..” a few times – about wealth, getting better jobs etc. but nobody’s laughing – you’ve done very well and no doubt with your mindset you will continue from strength to strength.

Life’s not just about having the largest pot anyway and doesn’t necessarily make you happy if you do. I know a few with plenty of cash who are far from happy with their lot.

Just for comparison, my partner is older than you, 49 and has worked all her life (currently NHS) and no children (or mortgage as she lives in my home) and even though I’ve encouraged her to save/invest and put into her pension – her net worth is only about a third of yours. So I hear you about a good trait in a partner is a desire for a well diverisifed portfolio. I would like that too.

I also concur with you about prenups if I ever was to marry. It might not be romantic but may save you from the worst trauma you have ever faced. I learnt the hard way, when younger, when a girlfriend I was with for some time, suddenly upped and left completely out of the blue without any reason given. That taught me a valuable lesson that I am now grateful for – “Once bitten twice shy.” Luckily we weren’t living together/financially tied but I could so easily have been without thinking about it. I also have a few other really bad cautionary tales of family members/friends that have been through hell due to this – my uncle ended up in a mental unit for a long time because of what his ex-wife put him through when she just left unannounced taking all the money, furniture and 2 kids. He knew nothing about it in advance.

So now my current partner who I’ve lived with for about 27 years – we are not married/don’t have children and have our finances separate – just a joint account to pay the bills from. But saying that it’s not a cold hearted relationship in that we just pay for all our own stuff – we both treat each other and I pay for some meals out, holidays etc. and even a car and she treats me but as I have more I expect to treat her more which I don’t mind. I also paid for the house which is in my name and so she has never had to pay towards a mortgage. Apart from the household bills her money is hers – I just wish she had saved and invested a bit more of it over the years but convincing people who are not naturally born with the saving ethic is quite difficult I think. I think I was born with it – a bit like someones aptitude for art or maths.

Keep on going as you are Squirrel – and you will get your castle with manicured gardens in the not too distant future.

Wishing you all the best.

An inspiring story Squirrel. You’ve got a great writing style with a lovely turn of phrase. I’d read more of what you have to say!

I think I was an early saver. Besides my parents encouraging me to save up some pocket money, my primary school had some sort of tie-in with the TSB. Those children that were interested were were given a small TSB pass book. Once a week we handed over some money from our parents or our pocket money. This was collected by the teacher and written in the book. Interest was added. We could all see the money mounting up! I believe this simple idea fuelled my imagination as to what can be achieved by saving.

@Squirrel. Thanks for your comment @24

I thought it might be useful to highlight some good online resources about benefits which you may want to look at in preparation for when your son turns 19.

Citizen Advice has an extensive website – For instance a page on UC:

https://www.citizensadvice.org.uk/benefits/universal-credit/if-youre-sick-or-disabled/getting-universal-credit-if-youre-sick-or-disabled/

The LCWRA info may be relevant to your son, I’d advise getting help with the UC50 form when the time comes from your local Welfare Rights / Citizens Advice.

If you need to renew the DLA or when moving to PIP or completing a UC50 form, this is a really good site (but has a modest c.£20 membership fee):

https://www.benefitsandwork.co.uk/

Also this site has info about the appeal process (should it be needed):

https://www.advicenow.org.uk/topics/benefits

Another helpful site is https://contact.org.uk/

Again, I hope TI and readers will be ok with this post, which moves away from the FIRE aspect of such a great article.

Thanks all – it’s been such a pleasure to read the comments!

@TA – I’m still trying to figure out how I feel about my work/life balance. It’s lovely to have the flexibility to go for a walk in the middle of the work day, or to take a day off to do some early Christmas shopping – but that notional ‘two days a week’ seems to be expanding to fill the space in a sneaky way that I don’t entirely appreciate! So the RE pull hasn’t vanished for me.

@ermine – you’ve hit my weak spot! Mention of inflation makes me put my fingers in my ears and hum really loudly. I know it’s out there lurking – but also I don’t feel secure without my cash reserves. Hopefully someday, if I survive long enough to become a confident investor, I’ll be able to ditch the security blanket… but for now, I’ll keep on humming!

I wish I could reply to everyone – I’ve learned a lot from these comments, and it’s lovely to find that I’m not quite so alone on my odd journey as I thought I was!

Dear Squirrel, you have all my respect for your “life-path”.

I wish you all the…”best FIRE achievement” 🙂

A big “Ciao!” from Italy,

SirRik

@Squirrel – re: your response to @ermine on cash and inflation – your cash buffer (emergency fund) is a vital part of being able to sleep at night. Yes, it is steadily losing value to inflation (most of the time), but that is not its purpose. It is there to see you through difficult times, and its size is very personal – what makes you feel comfortable.

One of the comments on my story, was “how can you feel comfortable with such a small cash buffer?” The answer is, I don’t know. It just feels like what I would need instantly available to deal with the sorts of crisis, I can imagine.

You have been close to the edge. You know what level of cash buffer gives you confidence you could weather a storm. We all know by holding cash we are holding a steadily depleting asset, but that is not what it is for. It is not for growth it is for piece of mind and everyone’s piece of mind lies at a different point.

By all means check your thinking periodically, but only you know that critical number, and it is gut thinking, not rational.

@squirrel, thanks so much for putting the effort into writing this.

Others have already commentated on your great writing style, I’ll just add my praise for your illustration. Check out books like the “Paper Magician” by Charlie N. Holmberg and you’ll find a rich seam of fantasy writers using a silhouetted style that I’m sure would be a format you could dive into. Maybe “perfect jobs” will finally arrive from many directions!

Whatever happens, I’m inspired by your resilience in the face of so much already…..it must surely be your turn for a run of good things.

Love, love, love your story! Inspiring, humble and light hearted. You have shown huge courage, resilience and determination. As a father of a young family I really cannot even begin to imagine the challenges of being a single mother – just surviving would be amazing but to thrive like you have, really is impressive. You’re an inspiration. Bravo!

Wishing you and your son the very best for the future and if he’s taken after his mum he certainly has a very bright future ahead of him.

@squirrel @old_eyes