Apparently articles about the fag-end of my buy-to-let (BTL) portfolio are very popular. I don’t really understand why. Voyeurism, maybe?

Well, if writing them puts even one potential landlord off from getting into BTL then I’m doing them a service.

If you’re new, you might enjoy my first article in this series, about my formative days as a landlord in the 1990s. Or try the second about my one remaining property in London.

The only other buy-to-let I have left – hopefully, the third is currently sold subject to contract – is a Victorian terrace in a pointless London commuter dormitory town.

It’s a two-up / two-down with a small garden, and, enticingly for this particular street, it has an upstairs’ bathroom.

Finumus’ folly

I bought this house in 2001, for about £60,000. The first tenant paid me about £450 per month rent. So did the second, who moved in during 2004.

That gave me a gross starting yield of about:

- £450*12 = £5,400 = 9%

I took out an 85% mortgage at around 6%, set to track 75bps over the bank base rate for 25 years.

My managing agent also charged me about 10%, leaving me with £4,860 net income annually.

That was set against my annual cost mortgage costs of…

- £60,000*0.85*6% = £3,060

… so after the mortgage I was left with…

- £4,860 – £3,060 = £1,800

…of cash leftover every year to go towards maintenance and repairs and so on, before I’d hit my cashflow breakeven point.

That was was all I needed really, since inflation would increase the rent and capital value over time.

And that’s where the profit comes from – in theory.

Rent reduction

The tenant from 2004 is still there. Which is why – spoiler alert – I’ve not sold the place.

Her initially fixed-term tenancy turned into a ‘periodic rolling tenancy’ after six months. And the rent, apart from one change in 2008, stayed the same until 2019.

That one change in 2008 was a reduction. The tenant lost her job and couldn’t afford the rent on benefits, so I lowered the rent.

Not by much mind, to £420 pm. It stayed there until 2019.

So no rent increase for 15 years.

Now on one level you might think that failing to raise the rent for 15 years is a bit of a landlording ‘skills issue’.

I’m aware that some landlords increase the rent by the maximum they think they can get away with every year. I am not one of those landlords, or at least I’m conditionally not one of those landlords.

The conditions are:

- I’m not making a cashflow loss

- You pay your rent on time

My tenant has paid the rent, on time, in full, every month for 20 years. I’m not going to do anything to upset such a tenant, while I can afford to.

I’ve experienced enough of the opposite variety – the tenant that pays no rent at all – thank you very much.

Near-zero gravity

Even though I was completely negligent in raising the rent for a decade and a half, it didn’t really matter from a cashflow perspective. Because in 2008, the Bank of England cut its base rate to near-zero. And it pretty much left it there until the post-Covid inflation wave.

With a base+75 bps tracker, I was paying only £600-700 per annum on the mortgage for more than a decade.

Yes, like £50 a month.

There was really no need to raise the rent from £420 per month when the mortgage was only costing me £50 a month, was there?

Well…

Costs and consequences

You might think generating some £300 p.m. of cashflow would make this property a compelling investment.

Not so much.

Old housing stock requires a lot of maintenance. There was always something, such as:

- Garden fence blown down in storm (about once a year)

- Garden shed collapses due to rot from the neighbours dumping plant material behind it

- Replace all windows with UPVC double glazing (because she can’t afford to heat the place in winter)

- Get a new front door because the old one is not secure

- Get a new boiler because the old one died

- Replace the electricity consumer unit because it’s not compliant

- Replace the downstairs flooring because a flood caused by a plumping leak

- Eventually replace washing machines, fridges, and so on

Also – you hear that dripping noise?

It’s surely only the sound of money steadily leaving my bank account, isn’t it?

Ahem.

The mould problem

This property has a small, downstairs ‘lean-to’ utility room and toilet out the back of the kitchen – along with the proper bathroom upstairs.

And the downstairs loo often suffered from mould on the walls.

I would find this out from my agent’s periodic inspection report, not because the tenant complained about it. I’d then immediately instruct the agent to send someone around to sort it out. I’m not the sort of landlord who wants to be letting sub-standard mouldy accommodation. This is far from my vibe.

Whomever the agent instructed would do something – I’m not sure what, but it cost me a couple of hundred quid anyway – to ‘sort it out’.

But inevitably on the next inspection report the mould would be back. And we’d go through the same cycle again.

This is all pretty normal. To be expected. Not a problem.

However the costs increased steadily over time – as you might expect, I guess – from £1-2,000 per annum at the start to a £3,000 run rate now.

Some years it’s a bit more. Some a bit less.

Economies of scale

Compounding this problem, the original letting agent – where I had known the principal – got sold to a larger group. Then that group got sold to an even larger group.

In theory this should have brought economies of scale. But in practice, you can probably guess what happened.

Service quality declined and my costs went up.

Although the core management fee remained the same, lots of other costs started appearing. Periodic inspections that used to be included in the management fee got an explicit charge. And the costs of their ‘independent’ contractors went up by a lot.

Section 24

Since we’re going chronologically, the government also introduced the Section 24 taxation treatment of interest expenses in 2017, staged over four years.

This made mortgage interest not fully tax-deductible. Essentially it meant that one now got taxed on turnover, not profit.

Since we didn’t really make a profit on this property anyway, we had to start paying a bit of tax on profits that we’d not made.

But with interest rates still very low, this didn’t – yet – make too much difference.

Banning tenant fees

The straw that finally broke the ‘not increasing the rent’ back was the banning of tenant fees in 2019.

These fees include things like reservation fees, credit reference fees, right-to-rent checks, and inventory fees. The sort of thing that, historically, landlords and agents had tried to stick on tenants at the beginning of a tenancy.

Now you might think these fees would be neither my nor my tenant’s problem, on account of the tenant having been there for 15 years?

I would agree with you. My agent though, not so much.

It decided to replace this revenue by applying a fixed surcharge on every tenancy of £15 per month (+ VAT).

This might not be a big deal if you’re letting somewhere for £2,000 a month. But with our £420 per month, that’s 4.2% of the rent.

I wasn’t happy about this. I even ended up having a chat with the CEO of the new-new merged agent about it. His point was, not completely unreasonably, that I was charging a massively below market rent anyway. There was no reason why I couldn’t just put it up by 5%.

With Section 24 also biting, I was set to lose about £500 to £1,000 a year on this property.

This is not much for a temporary bump in the cost of doing business, maybe. But the other problem was that house prices had stopped going up. In the absence of capital growth, I need the property to at least wash its face.

The other option, of course, is just evicting the tenant and selling it.

But was I really going to evict a single mother, with two kids in school – a reliable tenant, who has paid their rent on time every month for decades?

Honestly, I’d rather not.

Such are the unintended consequences of government policies to ‘crack down’ on greedy landlords.

Raising the rent

And so for the first time in 15 years, and with an immense amount of reluctance, I put the rent up.

Only by 5% mind. The agent feels you can’t really just double the rent to the market rent. You need to do it slowly.

The wisdom of just putting the rent up a little bit every year was starting to make a lot more sense now. In anticipation of interest rates rising at some point – and having crossed the Rubicon – I resolved to increase the rent by 5% a year until we got up to the market level. (The tenant was now in employment).

Since I’d just put her rent up, I decided to make a concerted effort to sort out the mould problem. And as I was between jobs, I took the time to go over there myself to take a look at it.

I unblocked the drain just outside the toilet in question. I removed a five-foot tree that was growing in the silted-up gutter pipe. Next I did a bit of repointing around the affected area. Then I replaced the tiles on the lean-to roof above. Lastly, on the internal wall, I stripped back all of the paint, all of the blown plaster, and re-plastered and repainted with the most toxic and reassuringly expensive anti-mould paint I could find.

It all took about a week of solid work. But I was quite pleased with the result, optimistic I’d sorted the issue out – at least for a while.

Of course on the next inspection the mould was back.

Show me the money

Finally, the post-Covid inflation arrives and I’m putting the rent up by 5% every year. Which for a while is actually a real-terms rent cut. 1

But this is fine, just so long as interest rates don’t go up…

…which of course they duly do:

From 2022 then, this investment has been making me a loss – even after I increased the rent.

And while Section 24 hasn’t helped, I would have been in the red anyway, on account of my costs and interest rates climbing:

Thankfully property is not my pension.

Shrug emoji

The zero net cashflow, the tax implications, the capital value of the house itself even, are not particularly large numbers in the overall balance sheet of the Finumus household.

It’s not causing me any great financial distress anyway. Which is fortunate for my tenant, I guess.

It does leave me feeling that providing free housing is not an optimal use of my capital. But here we are.

If things stay this way – they can’t, for reasons I’ll get to below – it would take about another five years of compounding 5% rent increases to get back to this house not losing money. (For what it’s worth, without S24 it would only be two years).

But there are a couple of other worries on the horizon.

The first is that my mortgage comes to the end of its term the year after next. Something will need to be done, likely something fairly binary. Either just paying it off or leveraging it up to the max loan-to-value.

I’m not sure which I should do. At some point I might need capital to fill ISAs. Leveraging up is a way of ensuring I have the capital to hand without evicting the tenant.

Secondly, there are quite a few policy risks floating about that could make things even worse.

Incoming!

The (hopefully) incoming Labour government will doubtless continue the trend set by the Tories of implementing economically-illiterate anti-landlord – and therefore anti-tenant – policies such as:

- Rent controls: in which case I’ll need to raise the rent to market levels immediately.

- Reduced repossession rights: in which case I’d likely have to evict the tenant and sell it.

- Possibly something on Energy Performance Certificates (EPCs) or similar.

- Slightly orthogonally: Labour could re-introduce the Pension Lifetime Allowance (LTA). This would cause me to reduce my pension contributions and raise my marginal tax rate, worsening my Section 24 problem. Though it would also see me retire earlier – which might fix my S24 problem.

None of which will help my tenant, mind you. But people respond to incentives, regardless of how much politicians like to pretend otherwise.

Cashing up

I’ve only made a few grand from annual cashflow on this investment so far – and even that will soon be wiped out.

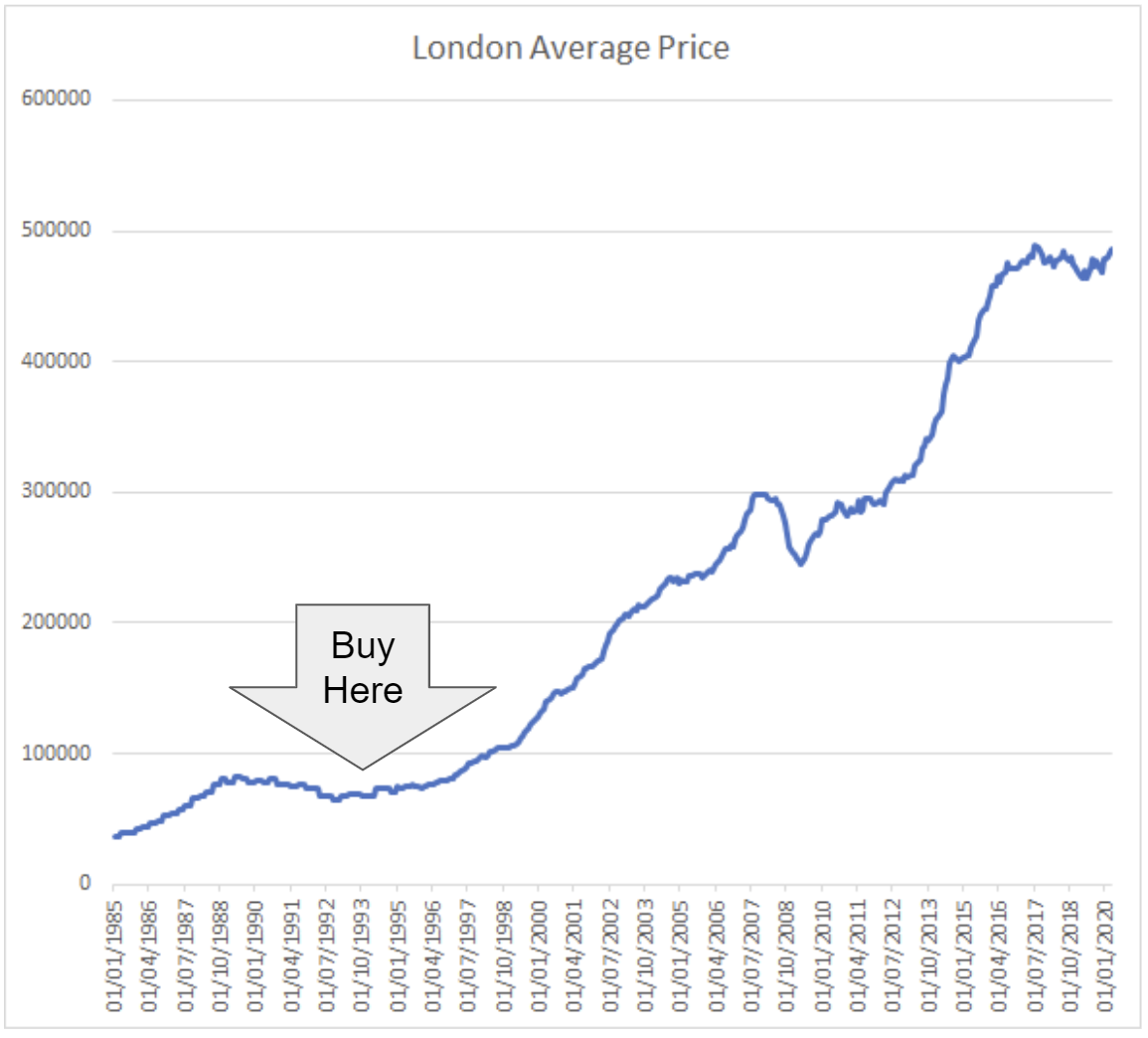

But how much capital gain have I made?

Zoopla reckons the house is now worth £210,000. But it has not seen the mould. Let’s conservatively assume the house is worth £180,000 after selling costs.

This would imply I’ve made 200% in 24 years. A pretty underwhelming CAGR of 4.9%.

However £60,000 in 2001 is £109,000 in today’s money. Hence in real terms – that is, after-inflation – the CAGR is only 2.2%.

Oh, we forgot the tax!

If I sold it I’d have to pay 24% capital gains tax.

- That’s £120,000 * 24% = £28,800 tax

So I’d enjoy a post-tax gain of:

- £120,000 – £28,800 = £91,200

(Sadly we have to pay CGT on nominal gains, not real terms ones.)

This all works out at a post-tax, real-terms CAGR of…drum roll… 1.43%.

Now you see why everyone thinks BTL is such a money spinner.

As an aside, these sums also suggests that – based on the Zoopla valuation estimate – the current gross yield is only:

- £6,432 / £210,000 = 3.06%

This at a time when 30-year gilts boast a 4.9% yield-to-maturity.

“MSCI are on the line about the mould again!”

Okay, you could argue that because I used leverage – and the tenant paid my mortgage interest for me – the actual capital invested is the deposit, not the purchase price.

The deposit was:

- 15% * £60,000 = £9,000

In reality there are a few more costs at procurement time – legal fees, new kitchen and so on. Let’s call those £6,000.

So £15,000 capital all-in.

This certainly makes the CAGR look much better. £15,000 in 2001 is £27,000 in today’s money. My £91,200 gain from £27,000 is a 6.7% real terms post-tax gain.

Not bad at all. But not great either, I’d argue.

Even with leverage we’re hardly knocking the covers off compared to the MSCI World index in GBP terms. And the MSCI World never calls to complain about the mould.

Certainly if I had the choice again in 2001 to do this or fill the ISAs (or was it still PEPs then?) it’s not obvious that BTL would have been the trade. Especially given the hassle. And this during a time when house prices were booming, apparently.

What’s more I’m not even sure whether working on the basis of the deposit is an entirely fair comparison.

Leverage increases risks, and I could have ended up underwater. Not something that would have happened in my ISA. [Well… – Editor, with a wry smile. But no, not underwater…]

Going forward, it’s hard to imagine house prices are going to rise in the next quarter of a century like they did in the last.

So when people ask me what I think about BTL – which weirdly, they do quite a lot – I just tell them not to bother.

Unless perhaps you have a thing for mould.

Follow Finumus on Twitter and read his other articles for Monevator.

- That is, after-inflation.[↩]

Good article!

V. entertaining and informative. Thanks @Finumus.

Guess which of these the BTL Landlord/ Tenant relationship now falls into 😉

I win / You win

I win / You lose

You win / I lose

I lose / You lose

Tomas Pueyo from Uncharted Territories had an excellent Substack on 26 April on why not to invest in real estate (IIRC, I dropped the link to that one into the comments on one of @TI’s early pieces on the woes of London property). Pueyo covered the macro, and your super piece above is an excellent complimentary to that for the micro scale.

Excellent story. I have never been tempted by BTL, despite ‘them down the pub’ explaining that it was money for old rope and a sure route to all those winter cruises in the Caribbean (the thought of which appals me – is it compulsory for people my age?). I did rent out my own property whilst doing a stint in Europe for the multinational I worked for, and even with the company underwriting costs and handling a lot of the management, it was an unpleasant enough experience to convince me that being a landlord was not my cup of tea.

I now advise social landlords on retrofitting their properties for low-carbon and energy efficiency, and I am glad they are looking after their tenants, not me!

Surprising read actually. I’ve been BTL landlording for around the same time, with 3 properties in s.London, all purpose built small flats, all unencumbered.

Looking at ROIs over the years, it’s been around 5-7% (real world numbers which include void periods, fees, repairs tax etc).

It’s lately been c.3.9%.

With all the hassle, restrictions, govt. interference, impending tenant rights basically meaning you might not have control of your property, it’s time to leave.

One gone and the other will be on the market once I can legally regain my flat and evict the non-paying, illegal tenants (no rent for several months).

It used to be a good investment but now, my advice is, put your cash in a decent ISA…. no hassle and you’ll certainly earn more than 3.9% !

Well done politicians… you’ve done both landlords & tenants a gross disservice.

Having eliminated it being caused by a plumbing fault or rain (including run-off from the ground outside), I would assume the mould is due to condensation. It’s a lean-to, so perhaps its walls are the coldest and therefore attract condensation. How is the ventilation and heating in that area?

Misery loves company – I’m a BTL landlord and tried to sell last year, only it turns out the block’s managing agents had quietly run it into the ground, focusing on petty BS like parking and bins instead of tackling the needed structural repairs. Bank refused to lend against it, so any chance of a sale cancelled for the foreseeable

Cherry on the cake is that now all owners need to pay around £50k each to have the entire block’s brickwork repointed. It’s a total shit show which basically wipes out the whole return up to this point.

While it’s obviously not great to experience, it is somewhat encouraging to hear that even a financial whizz like Finimus gets lured into this mess!

Good article and well done you for your sympathetic and unselfish approach to your long-term tenant. I have two flats and i feel like its more of a service i am providing than a selfish money making scheme.

You make amateur landlords sound professional, this is not the way to invest in BTL! The letting agent has rinsed you for over 20 years looking at those maintenance/.costs figures on the property you describe, and your logic on the rent you charge makes my head hurt.

BTL was profitable for a long time but those days are over, I’m nearly sold up now as it is the serious investors who actually enjoy the sector will take over and still do well but not like in the past 20 years.

Unless I missed something, you’re also not accounting for time spent administering your rental property – which I expect will put your annualised return firmly into the negative assuming you value your time properly.

I became a BTL landlord semi-accidentally, holding on to a couple of properties as I upsized. The change to mortgage tax was the main nail in the coffin financially though ultimately it was the annoyance of dealing with tenants’ issues (which always seemed to come up at the most awkward times) that caused us to divest last year. Best decision we ever made.

It sounds very much like you suffer from the same issue that I did during my years as a landlord and unfortunately it’s something that makes it very difficult to make money. The problem is that you actually give a s@#t about your tenants. It’s a major flaw.

The only people raking it in are those who expect their tenants to live in substandard conditions. Ironically enough it’s these same people who will just ignore the rules brought in to combat them, whilst the more conscientious out there will pay for their implementation and make it even more relatively profitable for the rogue landlords.

Landlords are hated as a class of people, probably second only to paedophiles, you’d have to be mad to want to join this group these days given the poor returns and hassle it involves.

Hmm, well my undying hatred of BTL landlords stretches from my days renting in London, I never ran into a good one. Running off in the middle of the night with my money, check. Repeated deposit theft, check. Lethal gas appliances, check. One sonofabtich wiring the electric shower to the lighting circuit so the T&E melted, check. Trumped up damages check.

It was this lowlife that caused me to perpetrate to greatest finacial mistake of my life so far, buying a house in 1989. Obvously the mistake was all mine but it was the desperation to get away from foul BTL landlords that clouded my judgement. And I was young and inexperienced. Yes, thirty-five years have rolled by and I still remember what Britain’s army of amateur BTL landlords were like.

Now I am sure that there are upstanding folks like Finimus, but I sure as hell didn’t run into any of these in seven years of London renting. So they’re thin on the ground IMO, and the sharks make up the majority. And these guys have been front-running first-time buyers with their privileges ever since BTL mortgage became a thing, particularly using tax breaks, which are slowly being whittled down to get some equity with the poor devils who want to buy a house to, y’know, actually live in it.

There are easier ways to make money from capital. And while Finimus can surely qualify risk because he’s a professional, the army of numpties on Homes under the Hammer and so many of the property is my pension brigade take on unspeakable concentration risk, honestly, if you went and said I am going to buy one single company’s shares in my SIPP people would holler diversify in your face but say I am buying one BTL and people clap you on the back. Fergus Wilson diversified the lumpy repair costs because he had hundreds of properties. Onesy-twosy BTLs don’t spread this. I’m sure the author has the capital to ride these, but many tyros don’t and come over all surprised when they discover it takes effort, skill and money to keep a house standing.

I hear only the tiniest violin here. Before I am treated to the specious argument that BTLers provide an essential service, I’m sure Peter Rachman said the same.

Great article which reinforces many of my ideas

Property is a constant (maintenance ) pain-once you have a warm place for your family out of the wind and rain-that’s it -keep the house as small as possible -running costs/rates etc

My little house is not worth a lot -just right now for a retired couple -3 kids all gone! (No room for them to come back!)

Property is illiquid-you cannot realise a bathroom or one bedroom if you suddenly need cash

Tenants and their demands-enough said!

Put as much of your spare money as you can into the stockmarket-via tax free and tax advantaged ISAs and Pensions (SIPPs) -use index trackers-simple ,easy to manage and understand,very liquid etc-not a very British investment policy unfortunately unlike our American cousins

Everyone has a house or rents one so is familiar with property-unlike shares-a little knowledge however breeds familiarity but not necessarily successful investing

Rather akin to market timing those who got in early and out in time in BTL did OK-market timing unfortunately not a skill most investors possess-well done those who did well

Perhaps there is a place for BTL for those who are so well off that ISAs and SIPPs are full and they still have excess monies trying to find a legal home -one member of my family in this happy position-going for capital gain?-eventually?

Property seems to rank as an alternative investment -not really a sensible proposition for the average investor

xxd09

@Ermine (#10)

Definitely agree with you on the quality of most small landlords. To my shame I spent a summer as an impoverished student as the in-house plumber, plasterer and decorator for a ‘professional’ landlord. You really don’t want to know!

Interesting article thanks. Find myself in a similar position where I have not increased the rent in over 10 years for someone who does a great job of looking after the place and has made it her home. Dont want to be a landlord but have remortgaged to get most of my equity out. Not looking forward to the time when the tough decision needs to be made.

I’ve nothing to add over and above the previous comments, having avoided BTL myself, except to say that was a very enjoyable and informative piece.

Yes, I also am gone from housing as an investment. Not because the numbers ever hurt, but because it was far too much hassle. It is easier to sit with equities, bonds and precious metals.

I think there are two times when BTL probably makes sense (outside a boom environment, which I completely missed out on for 20 years due to price fears in the second half even with residential, ho hum and bitter haha).

Firstly if you can and enjoy going hands-on. Both with property and with people. Ideally you’d be able to do lots of the work yourself (redecorating, handyman type fixes) etc. In this way you’re adding value directly that you can’t add to your ETF. Yes it’s costing your time — you could be doing it for a wage — but remember property is a levered investment, so your ‘notional wage’ is levered, say, 4x too. Albeit for extra risk.

Secondly, if you can’t buy your own home for some reason (maybe moving a lot or working abroad). Sitting out a property market for years is expensive (see above) and it’s very hard to keep up with leveraged gains. Buying a fair-priced property somewhere at least keeps your toe in the water.

Outside of that I suspect most of the big gains comes entirely down to leverage. Most of us can enjoy something similar by not paying off the mortgage on our own homes, and so effectively leveraging into investing:

https://monevator.com/pay-off-mortgage-or-invest/

After all, you will always be your best tenant:

https://monevator.com/why-you-might-be-your-own-diamond-of-a-dream-tenant/

Caveat: I’ve never owned a BTL so maybe I’m missing something. I rented for 25-odd years until 2018 though…

Sold mine with tenant in situ..yes had to sell reduced but for my mental health it was the right decision..could not evict an elderly tenant that always pays.. I could not count on the law backing me if there came any problems. Because they haven’t built enough social housing . Theres only so much you can put rent up and if he defaulted , where would I be. Too much responsibility and worry without a huge return. Air bnb short term let’s if you wanna do this. Proceeds from sale all in index funds and I’m a happy bunny.

Interesting article. Thanks.

I always thought BTL was too much trouble and not liquid which meant I put money into index funds in my SIPP instead. Looking back I’d say I was wrong because I know a few people who’ve done pretty well out of BTL.

Unless you’re the father of one or more of the kids in your tenanted house put the rent up.

Check rightmove and put rent to 10% below market value now and increase by 5% annually from there. Or get a second job to pay for your pretend family

The plan is simple. Force smaller BTL landlords out of the market with of a raft of legislation under the guise of protecting tenants. Landlords exit ensuring increased housing demand over supply, and higher rental yield. This will create the desired market conditions for the real intended beneficiaries: large build-to-rent developers ready to build for guaranteed demand and secure long-term income stream. Unfortunately this has never really been about tenant welfare and making housing more affordable.

Super entertaining as per usual Finumus.

I was an inadvertent landlord for a few years in the mid tens. Absolutely hated it. Not for me.

It’s a catch 22 that those least suitable to do the job are also the most profitable

Thanks for sharing, Finumus. I’ve had my BTL flat for 12 years now, done everything by the ‘good landlord’ book, current tenants (teacher and NHS worker) have lived there for the last 10 years and I’ve put up the rent just twice in that time, under market rate as they have always paid on time. Things that go wrong are fixed quickly. I don’t regret investing in this property but as soon as I am able to sell (it’s been 7 years since Grenfell yet my cladding issue still hasn’t been sorted), I will and I’d try to sell with tenants in situ.

I can’t hang around to see what new rule or regulation the government (of either flavour) will introduce in the future.

Brilliant article-hit the nail on the head-BTL buyer beware!

@ John M

I let to 2 of my daughters and agree – increase the rent, and regularly, unless it’s a family member and you can afford to subsidise.

Although I think you weren’t taking about adult children! Luckily, I suspect our spouses/partners don’t share our blog interests…

The fix for mould is ventilation & heating. Put in a bigger radiator and better extractor fan or a window vent. The bigger radiator will be appreciated, even though the tenant pays the heating bill.

Enjoyable article. And glad I never went there.

The other fix to condensation is better insulation. But given you have already stripped back and re-plastered you are probably not inclined to do the same but dry-line this time with a layer of insulating material.

I have 3 main points to make (I could make more but I’ll just leave it at 3):

(1) The main advantage of investing in housing is leverage. Taking out an 85% LTV mortgage is a bit over leveraged (ie risky) to me, but letting it get to less than 25% LTV is sort of neglecting the whole point of property as an asset class. When the house had doubled in value at £120k you could have taken out say £39k and then plugged that into another £120k property, with say 75% LTV on both, and then you’d be looking at capital appreciation on £240k of property instead of £120k. Or at the very least you could take out that money and put it in the stock market/ISAs etc.

(2) (I realise I’m going to sound a bit of a Scrooge when I say this but never mind…) Leaving the rent at much lower than market value is very admirable, but let me ask you this, if you were investing in a business and they sold products cheaply such that they weren’t making a profit, would you be happy with that situation? Or would you say that’s nice but I’m going to invest elsewhere? I’m not saying always go for the market rent, if you have a good tenant then it pays to charge a bit lower, but to leave rents really low whilst other costs are increasing (or are bound to increase in the future) just seems a bit negligent sorry. And then to suggest you didn’t make much of a return on investment, well yeah of course, that’s because you were charging way below market rate. If you really want to be charitable then give money to charity, not just one person who just happens to be your tenant and you know has a job (the unemployed period excepted) and can afford market rates. Ultimately when you own property it is a business and an investment, and I think a lot of landlords (and tenants for that matter) forget that.

(3) A good letting agent that you can trust and will reliably sort out problems and treat tenants fairly is worth their weight in gold. My letting agent is local and independent and does a really good job as far as I can tell. I have heard horror stories of national letting agents (cough Leaders cough) who are really crap, who say they’ve sorted out issues when they haven’t and so on, but it is up to the landlord to find a decent letting agent and maybe check in with the tenant every now and then to make sure they’re happy with how they’re being treated.

The decision not to increase the rent and actually decrease it is mindblowing. I would happily agree that there are many greedy landlords out there, and that it is great that you haven’t gone down that path.

But had you increased it each year by the rate of inflation you would have received nearly £200k more in rent over that period which really changes the maths on how good an investment this property was.

I hope that your tenant appreciates your subsidising her to the tune of a new house over the last 20 or so years!

Whoops, I assumed the rent was weekly rather than monthly! Still, it’s a subsidy of almost £50k to your tenant over the time period.

A very miss leading title.

BTL is not dead, your BTL is dead!

Great article. B2L is a crock now. I had two but have now exited the market. Used the capital released to implement a GILT ladder to fund 12 years of retirement (before needing to access my equities (if I last that long). So much more relaxing.

Very interesting article. Sort of agree with all the comments those pros / against BTL.

I have 3, combined they are <10% of total assets so it's not a major part of the portfolio but combined with the principal address it means my exposure to UK real estate is as high as I'd want it to be.

They've been good income producers but the capital gains has been woeful and actually whilst the tenants and flats themselves have by and large been ok overall, the main issue has been the mgt of the blocks, one of which is a particular problem.

Rents have gone up considerably. I set mine circa 5% below market rent to get lots of interest. Then generally don't increase. Have only once put the rent up for a tenant who was in situ and that was after a decade of them being there. Try to look after the properties, fix any issues immediately etc

Sometimes, I do look at buying more as I like the physical real estate aspect but I just cannot make the numbers work any more…..

Mind you, I have a friend…don't we all…who has a load and continues to add. But real estate is his game generally.

I do think as @TheInvestor says if you are in the trade, know the local market well, you can make it work.

I'm not convinced just comparing to the S&P 500 / global equities over the last decade is entirely valid. It's quite feasible that over the next decade the performance reverses.

Admittedly my only rationale now for holding is a combination of diversification, apathy, a reluctance to switch out a 5% yield to equities, reasonable inflation hedging through rental growth and a general tendency with everything to buy and hold for ever.

Been doing it for a decade now. Overall has it been a good investment…not really.

The investment principle is to regear and release equity “tax free” following periods of house price inflation. The past 3 years have seen higher mortgage rates but significant rent increases. Treat BTL as a business and you should still do ok.

Excellent explanation of what’s happened. In my opinion all governments have failed to sort out housing. Always blaming developers and private landlords for being greedy. As a result the various governments have introduced red tape and added taxes.

Often with the general public and rent payers believing government propaganda.

We now have a housing market in a total mess and your article perfectly explains why.

Whoever gets in needs to reverse taxation and red tape on landlords so they don’t leave. More importantly the government needs to talk to landlords and developers and actually build houses for people. Planning reform is top priority. All the big builders and government schemes are candy floss. We need big ideas and common sense.

So far no politicians have had any so it just gets worse.

Thanks to everyone, too numerous to call out, who offered advice on the mould situation. I think it’s possible that there being NO HEATING AT ALL in that end of the house, may be a contributory factor…

On the letting agent question, indeed, I get rinsed by them – started with a independent who got sold, ultimately, to yes, Leaders. I’m tempted to shop around, but last time I did this, my new letting agent ran off with several £10k’s of my money – which has kind of put me off.

@jds247 – You are absolutely right, I’ve not accounted for my own time dealing with stuff (not that I do much) – so if I included that my returns would almost certainly be negative.

@Adam – You’re right – I think structurally, bad landlords drive out good ones – it’s a sort of “market for Lemons” situation that the regulatory burden (which good landlords adhere to, and bad ones don’t) accentuates the problem.

@ermine – Agree that generally people’s mental model of housing as an investment is very rosy. In a sense it’s even worse for owner occupied housing, because people don’t even track the maintenance costs. (On the other hand, at least there’s no tax on imputed rent).

@weenie – Sorry to hear you have cladding issues. Fortunately I’ve dodged that bullet, by, with one exception, always buying freehold.

@Wephway – 1) Leverage – yeah. In actual fact I remortgaged a London BTL to raise the deposit for this purchase, I played that game for a while. Arguably, this property has “infinite” leverage. This stops working when house prices stop going up, and there are restrictions on finance. And…. they still need to individually make money on a cash-flow basis – you can’t make up for it w/ volume….

@SeekingFire – (And, indeed those who complain that I’m not being a harsh enough Landlord) – Yes, likewise all of our BTL’s don’t actually make up a significant fraction of our wealth, and, TBH, this is one reason I’ve not gone to the effort of squeezing my tenants to the max, or going self-managed. It’s just…. not going to make enough difference in the grand scheme of things.

Excellent article, more or less identical to my experiences, right down to reducing the rent to help a good tenant in financial difficulty. I also carried over 6 months of arrears during Covid, still being repaid now.

Also 200% capital appreciation, but over 30 years (northern seaside!) – little more than RPI inflation, but a £10k + CGT liability if I sell. Shows how unjust the removal of indexation was.

I bought mine as my pension when working for a charity which didn’t do staff pensions (the norm in the 90s). I had a small Norwich Union pension plan with extortionate fees (initial and annual), and a choice of about 6 NU funds. Annuity was the only option at the end, and ISAs, fund supermarkets, SIPPs, low cost index funds , pension freedom were still to be dreamed up. Hindsight is a wonderful thing, but it made sense at the time! Governments tell people to plan for the long term, then continually, and retrospectively, move the goalposts…

I also spent a few years as a landlord, holding on to a flat in central London when we moved away. We made a few thousand over the three years after accounting for tenants who didn’t pay rent, costs of repairs etc. Nothing approaching compensation for the amount of time and stress it took.

It’s much easier to put the same amount of money in a tracker fund and take the returns. CGT on that is much better than on property, and there’s no time investment!

BTL should be banned, along with second homes, holiday homes etc. If people want to go on holiday, stay in a hotel. Domestic property should not be an investment – it should be a home, and one that young people can afford. We need to add a 40% tax on all primary property sales (above a £300k cap) and a 100% tax on all second property inc. BTL.

Interesting article on experiences. Thanks for sharing.

I had a BTL for a while, it was suggested to me by a work colleague. I sold up a few years ago before the numbers stopped adding up. I am slowly feeding the money into my ISA and SIPP instead, which is a lower stress option.

Great article.

How does the tax-benefit compare against owing via a Ltd Company ?

Do the facts show that investing in say S&P 500 ETF via an ISA or SIPP produce better returns than Buy to Let properties?

@GenZ – As a matter of serious interest, where would people who either can’t, or don’t want to, own property live if there was no renting? I very much doubt my Ukrainian refugee tenants in London would be in a position to buy somewhere. Where do you want them to live?

@Sundar – The Ltd Company thing is not a panacea. There’s quite a lot of additional complexity, and mortgage rates are generally higher. And moving an existing property into the company doesn’t really work because of stamp etc. The one we’re currently selling is owned by a Ltd company – but we transferred (sold) it to it before the extra-stamp duty regime came in – and it doesn’t have a mortgage anyway.

@Metro historically with leverage on BTL mortgages, rates low and higher rental yields BTL was probably better. Now, I really doubt it, unless you are doing this at large scale in a ltd co structure.

@Metro – The problem is that there’s no “index” of BTL property returns, so you’re comparing an auditable track record (Equity Index ETF), with what a geezer down the pub “reckons”.

@Ian Morton #35

> the various governments have introduced red tape and added taxes.

Allow me to remind you from first-hand experience what renting was like in London three decades ago before all this effing red tape you speak of.

I was in a third-floor room it what would now be called a HMO in Earl’s Court Philbeach gardens, but back then was as simple as putting a Yale lock on the door and a coin-op gas and electric meter. Now 35 years ago gas appliances were somewhat more finicky than they are now, I will give you, but even my twenty-something self thought there was something rum about ‘oh you light the oven by throwing matches into the back’. No fire escape or whatever, we supplied ourselves with a blue knotted poly rope to have some chance.

Acton Town – The punk whose bodgers didn’t understand that a British lighting circuit was good for about 10A I think with 1.5mm^2 T&E. Plumb in a shower, and it’s easy to get power off the lighting circuit on the top floor. Natch you have to swap the 10A fuse for a 35 Job done. FFS the T&E starts to melt, you need about 6mm^2 to run a shower. I isolate this darn thing, no upper shower, lights don’t flicker, and I get serious earache for suggesting this is a fire hazard. I mean it’s his bloody house he’s trying to set fire to. My personal interest was not being the roast chicken in his oven. Deposit stolen. Asshole. Though it was the rule in those days, you needed to rent for a year (two successive STs, unlike today they gave you six months security from signing each time) to reduce the I will steal your deposit to just a 10% surcharge.

And those are just the worst cases. The washing machine that flooded the floor with water at live potential. Don’t touch the taps, lads, though we were young enough to take that sort of a hit. No RCDs in them days so until 13A passed through your flesh the power wouldn’t be iced, though as it is the 100k resistance of a youthful male body kept it down to 3mA which didn’t make it an emergency though it took the edge off your day. Yup. Terrible this regulation, I quite agree with you.You poor hard put upon BTL LLs under the cosh of too much red tape and regulation. I believe you actually have to have a working fire alarm nowadays. Dunno about electrics and bodgit and scarper.

@Finimus/GenZ > As a matter of serious interest, where would people who either can’t, or don’t want to, own property live if there was no renting?

In my grammar school half the kids lived on council estates. About a third of these kids’ parents were minor management white collar sorts, although many council estates had a terrible rep there were many for ordinary people. Britain knew how to do this before Thatcher’s purchase of votes through RTB, which often ended up in BTL. The corresponding the decline and fall of council housing article from UK gov may be of interest, at the high water mark just before Thatcher 5mn UK households rented from the council, to wit

I’ve never rented off the council and nor did my parents but I’ve known people who did and they were largely content. Some things were bonkers about council housing like children being able to inherit a tenancy, WTAF? but there’s a lot more that’s bonkers about BTL and the toxicity, because of the truth that dare not speak its name. To do really well out of BTL as @Rhino #22 said

> It’s a catch 22 that those least suitable to do the job are also the most profitable

Peter Rachman was damn good at turning a profit. I am a grizzled old git at the opposite end of the age spectrum from GenZ I imagine. But I feel for their POV, and I replay the history that Britain once did a better job of this before BTL property is my pension was a thing. At least in Rachman’s day LLs needed the capital to own their properties outright, which I believe was the case in the lowlifes I rented from apart from the subletter.

Those that leverage their advantageous ability to raise loan capital relative to a first time buyer should be run out of town ASAP. It’s bastard hard enough and hazardous enough to buy that first house without LLs inserting their vampire squid money funnel in front of you making it harder.

We used to have a professional solution to rental for those too poor to buy. It doesn’t have to be councils. But mom and pop property is my pension amateurs aren’t the answer. Let’s say 1% are the kindly Finimuses of this world that make enough in the day job that they don’t care if the BTL is underwater in the big picture. It’s the rapacious 99% ruining innocent people’s lives that need to be reined in. The 1% sweethearts that don’t raise the rent for the single mums are charitable institutions that should be fostered, the Rachmans need to be offed ASAP. George Osborne signalled the direction of travel, a decade is long enough to GTFO of an immobile, indivisible asset nailed to the ground that has clearly been highlighted with the black spot. I really don’t understand the love for BTL personally, but in any asset class read the runes, and they’re not auspicious for this money tree at all. Presumably because GenZ and his cohort that have been drawing the short end of the stick will eventually wise up and will eventually overpower the BTLers in numbers. Your gold and your share certificates you can in principle spirit off to Switzerland. Your BTL HMO hovels, not so much.

Mene Mene Tekel Upharsin, BTListas. The wind is not in your favour

Re:@Finumus’ & @Adam’s point on BTL being a market for lemons & @ermine’s & ors bad experience of being a tenant: this underscores the concentration & liquidity risk of the BTL ‘transaction’.

The vendor (landlord) & buyer (tenant) have to each fork out an ungodly share of both their treasure & their time on a renting ‘transaction’ which, before the fact, neither knows is going to work out.

Bad things also happen in the market for publicly traded securities & funds of course. Think Bernie Madoff and Asil Nadir. However, provided that you’re well-diversified across asset classes, and in tracker funds, then you basically don’t even notice the hit when such disasters flare up.

A Poly Peck or a WeWork meltdown will be 0.1% or less. Barely a flea bite.

And if you need to exit, then you can, reliably and assuredly, and all at the speed of a sell trade order transmitted via fiber optic.

But, in the BTL world, if you’re a tenant faced with a Peter Rachman type as your new landlord, or a landlord who’s faced with someone like Vyvyan Bastard from The Young Ones as an incumbent tenant, then frankly you’re completely screwed.

You can’t size that risk appropriately, nor can you swifty exit the situation.

So if the worst does happen to you, be you a BTL landlord or a tenant, then it will take out a big chunk from your life. And it’s a chunk that you won’t ever get back.

Set against that, the ability to leverage the investment as a landlord doesn’t seem quite so great.

And then factor in secular trend for yield compression, refinance hikes off of the back of rate rises, S24 woes, & diminished prospects for capital gains etc – suddenly the alternative of filling the ISA or maxing the SIPP doesn’t look too unattractive on a relative basis.

We’ve sold all ours except 1 now. We had dozens over the years. Hmos, students, families, 6 beds, 1 beds you name it. No issues. None ever. Literally never set foot in some of them. No agents. Last one has same tenant for last 8 years. Never seen him. Never missed a payment. Don’t charge him in December. Never increased their rent even though could probably charge him £300-£400 pm more. Good ol days are over but wouldn’t put anyone off doing it if they do their research and still some interesting propositions if you know where to look.

Commercial property, a factory, has been good to me.

Owned it for over 30 years, rented it for the last 17, tenant has just renewed for another 10 years , on a repairing /insuring lease at 9%.

Minimal activity required. The value has increased at a little over inflation, despite the building aging there are very few freehold industrial properties/sites in the area, a sought after industrial estate with good traffic links.

Accidental landlord in a way ( I retired early ) but a very sound investment.

@Ermine, I agree with you on most topics but on this issue I think you go too far.

Standards are a lot better than they used to be, thanks to regulations as you say. I am in favour of greater regulation because it means the decent landlords are not undercut by rogue landlords.

There are ways for a tenant to complain now, eg via the local council and bad landlords can get big fines if their property isn’t up to scratch. I understand the new Rental Reform Bill will bring in an ombudsman which makes sense to me (it is a business as I say) and it will bring in a national landlord’s register which again I’m in favour as I think there are a lot of landlords who don’t pay the tax they should (and undercut others who do). I was in favour of forcing landlords to improve their EPC ratings as well so it’s disappointing they took that out of the bill.

One of my properties is a HMO, I bought the house that I lived in as a renter so I certainly don’t think it’s a hovel – a lot of renters like living in house shares. I do think all HMOs should have a communal area, ie not just a kitchen but a living room as well which I know a lot don’t (mine does). I had to submit a diagram of the property showing where fire/smoke alarms, emergency lighting, fire doors and so on would be to get the HMO license. And I have to get all these checked annually. I’m not complaining by the way, just saying I think there are more regulations on rental properties than there are on homeowner properties.

Regards first time buyers Vs BTL investors the odds are heavily stacked in the first time buyer’s favour. Take a £300k property for example, a BTL investor will need to put down a £75k deposit (ie 25%) plus £11,500 stamp duty, legal fees and mortgage rates tend to be higher, and then they’ll have to pay tax on rental income plus CGT when they come to sell. On the other hand a young couple buying their first home, pay zero stamp duty, zero tax on imputed rent (a subject for another time), zero CGT when they come to sell. And they can probably buy with say a 10% deposit.

I saw a recent article that said a third of all buyers at the moment are first time buyers, while over the last 7 years about 300k more rental properties have been sold than bought. Landlords are more punitively taxed now (since section 24) and it is has become a lot harder to make it worthwhile as the article and comments above suggest, even with the leverage advantage (it’s definitely not a passive investment, semi-passive maybe). But with lower supply of rentals comes higher rents, even Generation Rent are saying the recent reduction in CGT from 28% to 24% is bad if it means rentals get sold and there are fewer houses to rent.

I completely agree regards social housing which has been run into the ground thanks to Right to Buy and underfunding, indeed the worst landlords now seem to be local housing authorities and the companies they get to run things. See the case of Awaab Ishak.

I think a good rental sector would have a mix of social housing and private housing, where the social housing is decent enough and plentiful enough to make private housing up it’s game, and where regulations and an effective ombudsman prevents poor standards. I do think Right to Buy needs to be ended and a lot of problems go away if more houses are built.

Lastly I have heard some say it would be better if there were fewer small landlords and more big investor/institutional landlords. If that were the case you can say goodbye to below market rents. Big investors can afford better legal teams and pay for lobbyists too which further tips the power imbalance against renters. And big companies are generally more interested in profit and pleasing shareholders rather than customers or communities (see Thames Water). If we are moving in that direction (ie towards big investors over small investors) then I’m not convinced that’s a good thing.

If anyone asks me about BTL I refer them to this video, shot by the handyman who was sent to fix the damage to a nearby property. He relieved the landlord of c£20k…

https://www.youtube.com/watch?v=Wf1hzO7yGBA

for what it’s worth I largely agree with Wephway. We’re all a product of our experience…is that because I’m also a small time landlord…ermine had a shocking rental experience. I think my tenants would say I’m a B+ landlord.

More generally and in response to the GenZ post, which felt troll like in nature…there’s a view in the UK that private capital can step in where public capital will not. For good or bad (Thames Water?!).

public capital has stepped back massively over the last 40 years regarding housing across successive political parties i.e. the withdrawal of social housing kicked off by Maggie’s buy your council home / Tony Blair govt did nothing and very much encouraged BTL….

The conservative govt is kicking landlords to encourage withdrawal of private capital without providing public capital. Given that reduction in a supply of capital and a demand increase (a net circa 700k people came to the UK last year) that can only mean one thing for rents.

Large residential landlords owned by multi-national companies some of whom are offshore will be largely akin to a modern day feudal system.

Seems the Monevator readership are saints. Who’d have thunk it?

But there’s nothing wrong with BTL. Decent landlords provide a service.

We just need to redress the power imbalance.

– Ban no fault evictions.

– Link rent to the greater of increases to CPI and maybe some measure of change in local prices (to reflect changes in the neighbourhood), negative as well as positive.

– Allow rent increases above this to improvements in the property to incentivise landlords with a generous rate of return.

– Licensed landlords and properties.

– Mandatory local authority inspections and improvement notices with meaningful fines for non-compliance.

– A national register of landlords with a national record of complaints against them.

That should do it.

@ Brod

I agree with some:

1-Inspect properties that receive housing benefit, safety is important – random sample others

2- have a register of landlords who have tenants receiving housing benefit – we need correct taxes to be paid

3- prices cap, rent fixes just can’t and don’t work. Landlord profit is more linked to interest rates than inflation or unemployment

4- how can it be right to stop asset owners deciding what to do with their property

If you want to make real headway:

1-Encourage foreign nationals not paying enough tax to return home

2- stop tenancies for life in council/social housing. There are 20m unused bedrooms in the uk we need to use them fairly

3 – we need more lower quality housing, it’s cheaper and quicker to develop. Looking at what people live in abroad we shouldn’t expect everyone on to live in properties that cost £300k to build. If someone wrecks a house they should get another house.

4 pensioners should live in shared accommodation like under 35’s do

5- also happy to consider workhouses

Basically, there is no money left and expectations over living standards need to readjust. Too many passengers….

> ermine had a shocking rental experience

I had serial shocking rental experiences in London from when I left Imperial College halls of residence until I quit the city, basically because I couldn’t stand any more landlords and the evil power balance due to the insecurity of tenure. They were vile in different ways but they were all vile. The only non-vile landlord I had was the colleague I rented a room from in Suffolk for a couple of months until I stupidly bought a house at a market high because I was pig sick of landlords, still the #1 financial cockup of my entire life. Imperial College were fine too. It was all the little guys that were incredibly creative in their ways of screwing my twenty-something self – when they weren’t actually trying to kill me. As Mark Twain said about carrying a cat by its tail renting in London I was getting knowledge that was always going to be useful to me, and warn’t ever going to grow dim or doubtful.

That knowledge was never be the counterparty to a BTL LLs pension

@Wephway #50 I do take your point that not all LLs are like mine were. But there’s serious sample bias. On here and elsewhere the ‘good guys’ yell from the rooftops that there’s some good in BTL and maybe that’s the case. There’s much discontent in this space that indicates that these guys are probably not the majority, and the Rachmans of this world keep schtum and rake it in.

> I think there are more regulations on rental properties than there are on homeowner properties.

Well yes, that’s as it should be. A homeowner may electively choose to accept the risk, tenants have no option. Just like when I isolated that damn shower pulling 20A off a lighting circuit so that we could have non flickering lights and no house fire, that LL gave me no end of crap for breaking his shower. It was reversible – I simply lifted live from the chocblock, it’s not like I put a hammer through it. Tenants aren’t permitted to hang a picture never mind call someone in to fix dodgy electrickery.

I get it. Monevator readers with a dog in the race think that BTL is both socioeconomically neutral to benign and it’s A Good Thing and where would we be without it. Perhaps that’s right, but a much poorer Britain from the end of WW2 up to Thatcher (see the house of lords paper referred to before) had a workable solution for those too poor to buy a house that didn’t involve a small army of amateur landlords grifting on leveraged house price appreciation. A vibrant and non-horrible-to-tenants rental offering would be a much better match to modern working patterns than widespread home ownership. BTL amateurs just ain’t that offering.

“And the costs of their ‘independent’ contractors went up by a lot.”

Here’s a little anecdote for everyone about why contractor costs went up suddenly around 6-8ish years ago for many landlords.

I own a company that does work for a lot of letting agents. While most contractors are indeed independent (around here anyway, the same may not be true for the likes of London etc), a few years back there was a spate of letting agents getting far too greedy for their own good and trying to fleece some extra money from their contractors as well as the landlords.

After decades of working happily for several agents, we were sent new T&C documents out of the blue by a few of them. In the very, very small print was a clause telling us that the agent would now be taking 10% of the value of our invoices as an ‘arrangement surcharge’. So not only were they charging the landlord their management fee but they were also charging the contractors 10% for the gracious privilege of giving us their custom. They were basically charging us for enabling them to arrange the work that they were already being paid to arrange by the landlord.

This ended up going one of two ways, both of which only stuffed the landlords over in the end. Most decent independent contractors are busy people with stacked-out diaries, and several companies that we knew just decided not to work for the letting agents involved. Why accept a 10% pay cut when we have customers queuing out of the door for our business who are willing to pay our normal rates?

The other option was to start charging a different rate for letting agents, to cover the additional new overhead involved. This meant that the contractor earned about the same, the letting agent earned more, but the landlords got saddled with bigger invoices.

Essentially, the landlords ended up being double-charged by the agents without their knowledge. Once by the management fee and again by the contractor surcharge that was bundled into the invoices. And, to add insult to injury, they were getting a lower standard of work too, because many of the decent contractors kicked the letting agents way down the priority list or refused to work for them at all. That meant that the agents had to hire substandard and often unethical contractors, who regularly charged more for poor quality work which often needed more money to rectify later on.

We told the agents our opinion of this practice, and made sure that several local prominent landlords were ‘made aware’ of it, all of whom raised merry hell with the agents, much to our satisfaction. About a year after the surcharge was quietly brought in, it was just as quietly dropped.

We’re still working for most of the local letting agents, and thankfully none has had the nerve to try something similar since. I’m still amazed though at how many of the landlords that we work for think that the letting agents have their best interests at heart.

In fairness to @GenZ #39, I’d also be severely hacked off with the housing market generally and with private lettings in particular if I were the median GenZ. Just as @MRN #21 sees elements of a plan to “Force smaller BTL landlords out of the market with of a raft of legislation under the guise of protecting tenants” in order to help build to rent developers (all too plausible IMHO), so too will Generation Z look at the world and see the odds being deliberately stacked against them. There’s some good suggestions above from @Brod and @Boltt, but maybe the easiest and most impactful thing now is just to go back to building council housing for subsided rent.

@sarah I have a flat with a maintenance agreement for the block. It’s written into the maintenance agreement that the managing agent is able to keep any ‘discount’ offered by contractors. It’s pretty much acknowledged that they rake off 10% – when I negotiated external redecoration at £8k, I also negotiated a fixed fee of £150 for them acting as an escrow account. Plus they charge additional fees for managing any compliance work, such as fire precautions.

Had a BTL in a north-western town for a while, and it was common knowledge that the agent took 10% of the bill for repairs, in addition to a 10% + VAT management fee.

I am surprised nobody mentioned agent fees which I believe on average now between 12-18% +VAT. Which is kind of crazy. At the same time you can put your money in L&G property fund (as an example) for 0.75% fee and 4.5% yield.

There are of course articles about it why it maybe a better idea although owning land survives generations but I also wonder how fund can do it for 0.75 they must be using “same agents”. I guess the difference of course agents charge only on rent not the value. And that’s makes a huge difference.

10 years ago fully managed fees were 10% and I believe I was paying actually 8% and there were no all those extras with random pricing. Some agents were greedy some were okay. As in tenants would pay their fee for reference check and admin cost of the contract. But no renewal costs ( not you Foxtons at your 320 pounds fees for renewal for tenant back in 2008-2010). But overall I agree all those new regulations making only agents happy not landlords not tenants after all. Sad story to penalise those who took a risk.

#57

“easiest and most impactful thing now is just to go back to building council housing for subsided rent.”

Hear hear , along with banning other things like old age care , child care from private profit making companies, there simply some things like medical care , care in general, housing, utilities (Thames water), education that are simply not suitable for a private sector free market approach as there isn’t really a free market … you can’t really choose these things.

Returning to large scale council/social secure not for profit housing and ending right to buy and ending BTL mortgages seems the simplest way to sort the hoysing crises …. provides indirect rent controls to the private sector, but also allows choice if people want to pay more for better quality private rented housing they can.

I also believe this might help redirect the wasted capital tied up in housing BTL etc. towards more useful investments in R&D for example the UK is rapidly falling behind the rest of the developed and developing world.

Might be worth buying them a dehumidifier and paying some of the running costs for that for the sake of keeping mould at bay and preserving the property…

I bought “the wrong way round”:

BTL outside of London, while working and renting in the capital. Covid caused BTL equity to shoot up, and a drop in the area I was renting in, so I released a chunk of equity and bought my residential flat outright.

I still make a healthy gross return… But last year made a small net loss due to repair costs. My net profit will likely halve when I remortgage in Jan 2026, if rates don’t drop to where they were in 2020.

On a cash flow basis it’s not the massive net return some promise, but the luck of the capital return has landed in my favour.

With a bit of luck I won’t have a big repair bill this year, so 10% gross, 6.3%net.

I should point out that as I bought non ltd, I face a hefty CGT bill if I sell up. I don’t plan to sell until retirement, and am a good while away from that – 28 years until state pension…

The number of BTL Landlords on this thread frankly saddens me. However, I am delighted to hear that so many of you are getting out. Perhaps now the young will have a chance of buying a home, not an investment vehicle, of their own.

Yes, we do need a rental sector, perhaps even a small private one to accompany a well provisioned social one. But we don’t need closing on 3m people with access to cheap lending scarfing up all of the first time buyer properties, driving up their prices so said first time buyers can no longer afford them – and then have to rent from said landlords. A disgusting state of affairs. Pure exploitation. You can couch in whatever financial jargon you like, but that’s what it is. You are strip mining the young while providing an utterly shit service. We wouldn’t accept it in other essential utilities, we shouldn’t accept it for housing. Grow a conscience and get out.

My experience of renting was the same as Ermine’s. All of the London landlords were terrible, and so were nearly all of the ones outside of London. It seems like all of the good ones in the UK are on this thread. Slow hand clap for you.

The mould issue will be the result of poor ventilation/lack of heating. I doubt said tenant will be able to afford to heat it adequately due to the generally terrible housing stock in the UK.

Thank you for the frank and analytical article.

The implicit conclusion seems to be that one should not go into letting (or any business venture) unless one has a business-like attitude. Without the will to manage the asset in an economically-efficient way, it will not be a good investment.

The issue is not with the asset class but with the investment structure which is not diversified, not tax efficient, not cost efficient and time consuming.

Among institutional capital, the Private Rented Sector (PRS) sector is very much in vouge. You have very stable cashflows much less sensitive to the wider economy (cf. office/retail/industrial) with predictable rental growth given lack of supply.

You can see below that yields for this kind of product in central London are ~4% plus say 3% rental growth gets you to 7% unlevered returns.

https://www.knightfrank.com.ro/research/uk-residential-investment-yield-guide-april-2024-11140.aspx

@G should I sell up and go into equities? And who should I sell to? My tenants can’t afford to buy it so will be made homeless? We need practical solutions.

@ian

Hmm, it would be interesting if the govt allowed CGT to be given to current tenants as a discount/deposit. (Or split is 80:20 tenant:LL)

How do I get a job in a think tank, I’m wasted at home…..

@Boltt do you mean net profit of the sale? Or the tenants get the capital gain tax on the sale? If the former, do the tenants suffer and negative equity risk?

In my 5 second brain fart I intended the landlord to be no worse off.

Whatever the CGT was due to be paid to HMRC this would be available to the tenant in way of a deposit to help them buy the property (they currently live in) off their LL. (clearly t&c would apply eg up to 10% of the purchase price or similar).

Using one of my BTLs as an example – currently value £260k, purchase price £157k, CGT due on £100k – CGT owed £24,000. (Before anyone gets excited there’s barely any real terms gain in the property value).

If the HMRC would like to pass this £24k to the tenant it would be close to a 10% deposit.

All buyers are subject to negative equity risk.

I thought the big issue was saving for a deposit. The govt could sweeten the deal for LL’s by making x% of the gain tax free to incentivise sale (this would come from the tenants “gift”)

I’ve not found a number for the CGT that would be lost, plus it’s hard to calculate with the CGT tax free allowance. Would you be worried this could stoke house prices as it would make it easier to buy?

Agree, estimating the lost revenue to HRMC would be difficult. The govt could even claim the forgone tax is a loan to the tenant – better than the help to buy schemes.

I see this as a supply incentive to landlords – encouraging them to sell up hence increasing supply and not increasing prices. Can’t see it stoking price through higher demand as there can only be a sale if the landlord wants to sell – and there’s only one potential buyer.

@Boltt: “How do I get a job in a think tank”: I believe there’s a Senior Policy Advisor role going with Angela Rayner, Shadow Secretary of State for Levelling Up, Housing and Communities 😉

@Ian #66 > And who should I sell to? My tenants can’t afford to buy it so will be made homeless? We need practical solutions.

Swimming my way to the surface of the pool of crocodile tears, we had a perfectly practical solution, before BTL mortgages were a thing and before the pernicious favouring of LLs in offsetting the mortgage interest against tax. It’s always going to be tougher for the FTBuyers because they are usually early in their working life, they can’t go interest-only like landlords and there may be the pram in the hallway. Actually favouring the landlords in the rented money market a.k.a. mortgages was a really sick move. Blair should have shot that fox in his first term, apparently BTL mortgages were a construct of the previous dying Major administrations.

The solution used to be the open market for residential houses, without landlords front-running first-time buyers with borrowed money. And a social housing sector that wasn’t forced to sell to tenants below market rents, getting on for half of these RTB houses are in the hands of BTL landlords now. Not all council housing was homes fit for heroes, but there was less pain when it was a big part of the mix, and house building.

The issue isn’t all leveraged BTLers – you can also charge the population increase due to legal migration – the boats people don’t really shift the needle on the dial – and the concentration of work in urban areas. But this army of amateurs LLs don’t help. While you no doubt are a fine upstanding BTL LL enough of them seem to do revenge evictions and other nasty behaviour, despite all the dreadful regulation. The council actually used to fix stuff, yes, people couldn’t choose the colour of their doors but repairs happened. I know BTLers are putting about conspiracy theories about being driven out to make way for professional landlords, but councils were professional landlords, and there was more peace in the rental market when professionals were doing most of the landlordism.

GOD isn’t building more land – overpopulation and lack of housing/rental properties is only going to push prices up AND UP – i see a a massive increase in prices in 20 years. Its a good investment for capital gain – not for a p/m income like you say.

Very interesting read given I have been considering a cheap BTL in the north-east where many properties are going on the cheap. Had a look at a couple with tenants in situ and it was like being a sounding board for their woes! One old guy was living in such vile poverty I was staggered it hadnt been reported to social services. So, I then looked at an intriguing proposition, a company operating the NE that acquires these cheap properties, refurbishes them, brings them up to energy rating C, finds a tenant and GUARANTEES rents for five years at 6/7%. It is really handoff, hassle free, they even refurnbish them and carry out repairs during the length of the agreement. The only downside is that some ofthe locations are real s*ithole streets and the sell on price to the investor are over market value. ie a two bed worth 7ok on the market is sold to the investor for 80k. That is a big consideration so the question is whether this free from problems and expenses proposition is worth paying over the odds?

@HMJ

My FiL was involved with these about 20 years ago in the Newcastle areas. They did up properties with a budget of ~£2k per property. Investments were funded from southern money who couldn’t belief the house prices and perhaps sold high yields…

There was loads of money sloshing around, range rovers galore, £10k holidays to the best sales people etc etc.

Finally it popped and various people went to prison . My FiL retired soon after, it was the best money he’d ever earned (he was a joiner /trades person/bodger) – never quite got used to being poor again…

Wouldn’t touch it with someone else’s money personally- good luck

I’m afraid you only have yourself to blame. Being a landlord isn’t a game, it’s a business. If you don’t have a clue about business then you’re better to leave. I’ve got several properties that provide me with a good pension. My properties are all well maintained, happy tenants and market rents.

I have no sympathy for this guy, he simply hasn’t approached BTL in a professional manner, no wonder the Gov want his like squeezed out.

Buy local property in good locations, where you can keep an eye on it.

Preferably, as we have for 37 years, fully manage it yourself to avoid dodgy agents.

Increase rents each fixed AST and avoid rolling periodic tenancies, which then allows proper maintenance [including Glixtone anti-mould paint that works every time] and occasional refurbs.

The list could go on, but stick to what you’re good at and avoid bandwagons unless you take it up seriously and measure your performance critically.

Only mugs lose/fail to make good money on property in the long term.