What caught my eye this week.

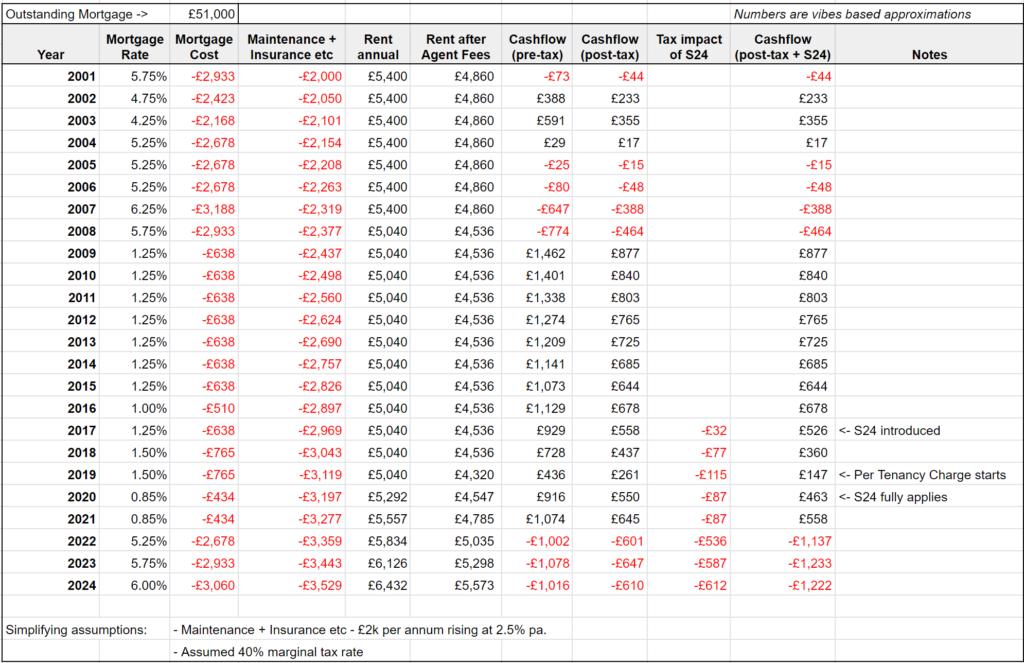

According to a report in the Financial Times [search result], just a handful of interest rate rises could eat up all the profits of higher rate tax paying landlords.

The FT cites research by the upmarket estate agent Hamptons, which sent freedom of information requests to HMRC. The data collected enabled Hamptons to estimate the pain points for landlords:

Landlords paying the 40% income tax rate would see their annual profits on a mortgaged buy-to-let home wiped out if UK interest rates rise by another two percentage points […] underlining the tightness of margins maintained by property investors.

For a higher-rate taxpayer with an average two-year fixed rate and a 75% loan-to-value interest-only mortgage — a common type of buy-to-let loan — a rise of two percentage points would eradicate their profits, while a single percentage point rise would halve them.

These are dramatically low margins of safety.

CPI inflation is already running at 7% and it is likely to rise further before it falls.

The Bank of England has barely started its rate-rise campaign in response, having taken Bank Rate to 0.75%.

More interest rate rises seem nailed-on. The buy-to-let business could thus be about to be become unprofitable for many wealthier landlords.

Buy-to-lose blues

Of course, those feeling the pinch have options.

Paying down an increasingly costly mortgage will look more attractive as rates rise and cheaper fixed-rate deals expire. Assets and income can be reshuffled.

Some landlords may choose to just eat the pain and subsidize their properties, trusting that eventually rents will catch up or rates fall. Property is a long-term game, after all.

The maths will also make buying rental properties through limited companies more attractive thanks to their more favourable tax treatment – even for those not yet paying higher rate taxes, considering how the income tax bands have been frozen. May as well be prepared.

Higher power

How much sympathy you have for buy-to-let landlords will mostly depend, I imagine, on whether you are one.

But it’s another canary in the coal mine. Higher rates aren’t just bad news for disruptive growth stock investors who’ve seen their shares crash or – at the other end of the spectrum – for those who owned too many long-dated bonds. There will be knock-on effects all over the place.

It’s a process we need to go through to return financial conditions back towards normalcy.

Everyone hated the near-zero-interest rate world. But escaping its feeble gravity will be bumpy.

Have a great long weekend!

From Monevator

A book review of Just Keeping Buying – Monevator

Inflation hedges: what does and doesn’t work – Monevator

From the archive-ator: Vanguard LifeStrategy funds review – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 1

House prices up 12%, but rises expected to slow says Nationwide – BBC

US economy shrank by 1.4% to start the year as pandemic recovery takes a hit – CNBC

Most of UK’s extra inflation “caused by Brexit”, says former BOE official – ThisIsMoney

…and Brexit losses are more than 178 times greater than trade deal gains – Independent

Boris Becker jailed for two and a half years for flouting the terms of his bankruptcy – Sky News

The growing importance of intangible assets – Validea

Products and services

The best regular savings accounts are now paying between 2% to 3.5% – ThisIsMoney

Tech expert slays myth of energy-guzzling ‘vampire devices’ – Guardian

Open a SIPP with Interactive Investor and pay no SIPP fee for six months. Terms apply – Interactive Investor

State pension top-up system [reportedly] in ‘chaos’ – ThisIsMoney

“A mysterious stranger has trashed my credit rating” – Guardian

Will Virgin Media Stream save you money? – Be Clever With Your Cash

Homes for sale near wild swimming spots, in pictures – Guardian

Comment and opinion

I don’t know – Compound Advisers

The Bogleheads have launched a podcast [Podcast] – via Jon Luskin

Why aren’t rich people happier? – AWOCS

The pros and cons of market cap weighted index funds [Tax bit is U.S.] – Morningstar

A stock is not an index – Of Dollars and Data

Six reasons why high earners don’t get rich – Banker on FIRE

The rich and the wealthy – Morgan Housel

The second rule of FI Club – 3652 Days

Inheritance tax: the good, the bad, and what you can do about it [Search result] – FT

Jack Bogle and the spirit of punk – A Teachable Moment

A retiree looks back on the financial ups and downs of her life – Humble Dollar

Crypt o’ crypto

How the crypto market really works [Podcast] – Bloomberg Odd Lots via Apple

Bitcoin is not an investment – The Evidence-based Investor

‘Staggering’ crypto seizures have cops struggling to keep up – Advisor Perspectives

Incoherent doomsters with laser eyes – The Reformed Broker

Naughty corner: active antics

How wide moat stocks can reduce portfolio volatility – Morningstar

Mental health issues in the hyper-competitive investment industry – Institutional Investor

Three questions Warren Buffett won’t answer at this weekend’s Berkshire meeting – B.V.I.

The brutal bear market in disruptive high-growth stocks – The Irrelevant Investor

Market efficiency: active versus passive versus HFT – Klement on Investing

Bireme has re-upped on Netflix after the crash – Bireme Capital Q1 Letter

A soft profile of the British hedge fund legend Chris Hohn – Institutional Investor

Recession or no recession mini-special

Kenneth Rogoff: the growing threat of global recession – Project Syndicate

A groggy global economy has lost its mojo – David Smith

More losses for the British Pound as recession risks burn brighter, says Deutsche Bank – PSL

This doesn’t look very recessionary [US perspective] – TKer

Kindle book bargains

How Not To Worry by Paul McGee – £1.59 on Kindle

Shackleton’s Way: Leadership Lessons from the Antarctic Explorer by Margot Morrell – £0.99 on Kindle

Who Moved My Cheese? by Dr Spencer Johnson – £0.99 on Kindle

The Art of Gathering: How We Meet and Why It Matters by Priya Parker – £0.99 on Kindle

Environmental factors

The queen conch’s gambit: breeding an endangered delicacy – Hakai Magazine

‘Relentless’ destruction of rainforest continuing, despite Cop26 pledge – Guardian

Recycling shit – Aeon

Coral workshops help tell wild from farmed Indonesian corals – Reef Builders

Off our beat

As China looks on at a world opening up, can Xi Jinping survive zero-Covid? – Guardian

The right to free speech does not mean a right to AI amplification – David Meerman Scott

Netflix’s bad habits have caught up with it – Vulture

Aging clocks aim to predict how long you’ll live [couple of weeks old] – Technology Review

The greatest solo traveler you’ve never heard of – Afar

Which computational universe do we live in? – Quanta Magazine

The best midweek dinner recipes, according to The Eater’s editors – The Eater

“And then a fan’s ashes were scattered on stage! My night out with Half Man Half Biscuit’s fanatical followers” – Guardian

And finally…

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.”

– Charlie Munger via Value Investing: A Value Investor’s Journey

Like these links? Subscribe to get them every Friday! Note this article includes affiliate links, such as from Amazon and Interactive Investor. We may be compensated if you pursue these offers, but that will not affect the price you pay.

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

Not just landlords.

A lot of new home owners/first time buyers are highly leveraged with huge mortgages.

A 2% in base rate is triple what it is right now and renewal rates could cripple them.

However none of that matters when the BOE is “protecting” the economy.

I remember back in 87 when they put my mortgage up to 14%. Talk was of 20% and higher. The effect on us was devastating at the time

I have a small number of properties which are financed on 5 year fixes. Affordability testing at the time of mortgaging is more strenuous on <5 year fixes so most landlords will only feel the impact incrementally as they have to re-fix. In the meantime rents are climbing.

Most investors (other than accidental landlords) seem to already have structured their investments to shield themselves from the interest deductibility restrictions.

Typically fantastic article from Morgan Housel, incredibly thought provoking.

Personally I often feel as though I’ve always been a spender. I’ve never had debt problems but I’m certainly not frugal. I am however concerned with perceived value, and since reading about FIRE several years ago I have been more concerned with “buying” my independence than stuff.

This raises a lot of questions for me, not just about how much will be enough, but also as MH touched on, the role status will play on the final phase of my career. If “one more year” syndrome will take over or if the allure of compounding a full FI number for another few years will see a return to buying stuff for me. As usual with these types of articles more questions than answers.

@Rosario — Agreed with the Morgan Housel piece. Almost made it the main article subject, but we could do that every week and become Morgan Housel groupies 😉

What’s so impressive is how he empathizes with these kids born into immense wealth and doesn’t really judge. Obviously he doesn’t think it’s the way to go, but he didn’t say “they were all idiots”. Well, no, there’s probably something more situational going on right.

@TI absolutely agree. Common trait of his I suppose with it also running through Psychology of money. Isn’t there even a chapter named “there are no crazy people”?

This example is the far end of the curve but it does spark lots of thought about how to bring up children enjoying the fruits of your labours whilst also fostering a sense of value.

I didn’t even mention this topic in my first comment, it’s a whole other subject in itself. Just goes to show the depth of MH’s writing.

Somehow I missed the half man half biscuit article in the guardian. Thanks for sharing it really rolled back some years. As a solid radio 6 listener I rarely hear the band even through Steve Lamac seems a fan. I now need to fit in a gig before the sands of time run out. Landlords well I never wanted to be one. I just cant step away from people living in a house I own and treat it as a commercial thing. Making renting become a ltd company driven thing will change the political conversation. There are too many individual landlords and 2nd home owners imho to drive through changes in housing.

I don’t think it will be BTL mortgages that cause the upset this time. Most of these are on fairly long fixes

I would shine a spotlight on margin loans. These have moved from being products for the truly wealthy to the merely well off

When coupled with illiquid and concentrated asset backing that really has has the potential to create an upset when interest rates rise because margin requirements can be changed at short notice in tandem

I see people using these products on the internet and I wonder how widespread they are

It’s always on the murky unregulated edges of the financial system the upsets occur

@ Neverland

Agree re margin loan rates moving upwards.

I’ve had 2 lifetime tracker mortgages (since ~2008) base rate +.25% and +.9%. It was a tough decision whether to take a 5 year fix at under 1.6% recently – with hindsight it feels like a missed opportunity (assuming I’d pass the underwriting).

So I wonder how many lifetime tracker customers there are out there who will bear the immediate brunt of rising base rates. A cooling of the housing market to the tune of -30% seems sensible, but also seems unimaginable- I recall housing almost halving in the Nwest in the early 90’s

B

Affordability checks in recent times were supposed to check that rises of a few percentage points or more would not lead to immediate troubles. Further, the buy-to-let owners have the property, so if the worst happens they can serve the notice and sell the property, and in such cases it is the actual renters I feel sorry for. Most recent buy to let mortgages in recent times require the owner to put some non-trivial capital payment down, the days of 100% mortgage on buy-to-let are pretty much over as far as most banks are concerned.

If anything, I feel less sorry for buy-to-let investors, as no one would bat an eyelid if stocks plummeted 20%+ as equity investors know the risks, it is not reasonable to think that anyone with property portfolios should be immune to losses or difficulties, whether via property value falls or due to changing economic circumstances.

It actually is really intresting how property is often viewed as ‘safe’ as it really shouldn’t be viewed as such unless you only need to live in it and have paid the mortgage, in which case, rising rates or even a huge drop in value of property more generally is not an immediate emergency for anyone who still plans to live in that same place. If you view property instead as an investment to earn from, then that immediately should come along with thoughts about risk, and I am not sure everyone shares this view.

It possibly is time to see the downside of buy-to-let. I am not in this area myself but given how many people around me seem to be all over it thinking it is easy money, I will not be surprised if things come crashing down for many, as some of these people do not even seem to have realistically considered the potential risks involved. Most will be ok, the market maybe just needs a bit of a reset.

I note AJ Bell have just launched a new app only trading platform, “dodl” – Seems to offer a limited selection of 50 uk based shares and 30 funds.

What makes it interesting is the low platform fees (0.15%) – which covers lifetime isas. From what I can tell, that makes it the cheapest Lisa platform.

I think it’s worth including in your broker comparison table.

@Neverland:

Good point. Will be interesting to see how this pans out for DB funds that implement liability matching with leverage.

Thanks for reminding me that the ReformedBroker is always worth reading.

It’s not just interest rate rises that are a concern for BTL landlords. Frozen income tax thresholds, higher financing costs, potential EPC costs, annual maintenance, safety checks, rent guarantee insurance etc.

All the above items add up and are making some landlords consider their positions. Will house prices continue to rise so lower net rental income can be offfset by increasing asset prices ? Who really knows. Will the renter reform bill actually remove section 21 and what might replace it ?

My (ex) tenant thought the rent he paid me was pure profit and unearned income. The tax and increasing costs made the property uneconomic at the old rent levels and I got fed up with the hassle so I took back possession. The rent now charged on comparable properties is almost double the amount I was previously charging.

However, I’m holding it empty for a while to see how the market develops.

Banker On Fire’s piece and number “6” chimes with me

#6: You Only Have One Source Of Income

Fortunately in my career I work for an American company that is pretty flexible. They do not allow me to work for a competitor and want consultation if I was to ever end up on a board of another company.

I did create another company, and for the most part there isn’t any conflict, but the worse thing is my “career job” used to want me to fly out somewhere at a moment’s notice which wasn’t great for the side hustle, but it wasn’t like I didn’t know that would sometimes occur, so you take the rough with the smooth.

The side hustle has given me options – not to FIRE but lifestyle, and I really enjoy the strategy side of running my own company. So from a motivational, and fulfilling perspective (opposed to raw money) it has benefits too.

Banker on Fire has some odd views for a banker: “A well paid 9-5 job can and will allow you to accumulate a decent chunk of initial capital. But the ONLY WAY you will ever get rich is to re-deploy that capital into attractive, growing businesses where you have proper skin in the game and full equity upside.”

I’ve known many people over my career who do an 8-4 job that easily pays enough to be rich (top 0.1% in wealth terms), despite them never investing a penny of that money, never building a business, never having skin in the game. Spending, for them, is a easy as drinking a glass of water. What do they do? Banking! At $5mm a year, you don’t really need to invest …

@ ZXSpectrum48k There’s a guy working in my office, on my floor in fact, who nonchalantly told me during a long and winding discussion that he owns 13 properties. He’s still working 9-5 though, well in to his mid-50s, so I’m not sure I envy him.

I’ve recently come to the conclusion I’ve come to the FIRE and investing game too late. At 36 the best I can hope for is a mortgage-free modest retirement by 60.

@Andrew – I heard about the movement aged 50 so you’re ahead of me!

I’ll never be MMM or retire that early but I have acted and am in a better place (pension, conscious spending etc) than I would otherwise have been.

When I read Morgan Housel’s definition of what it meant to be wealthy as opposed to rich, I couldn’t help remembering Chris Rock’s 2004 standup show Never Scared. He said the same thing then, only funnier 😉

https://youtu.be/W726xNPtEbQ

I was going to refrain from posting anything here to avoid anything contentious. However, I simply encourage anyone who thinks they are hard struggling to get by, to look where their income is on the UK income distribution and also ask could they sell their home tomorrow and buy somewhere much cheaper. More interestingly, could they combine all their wealth (maybe after downsizing etc) and at a 4% withdrawal rate still be in the tails of the UK income distribution (or even way above the median). If the answer is yes, then you are already much better off than the majority of people in the country and I would guess many readers of this site will be, including some of the same people who think they are struggling.

I appreciate that everyone would like to think they are worth more than they are/receive in income payments, but it does no harm to appreciate when you already are in a better place than the vast majority of the country and already in the tails of income/wealth distributions.

Anyone who does not even see their income on the distribution curve of the UK because they are so far in the tails probably should understand that if they are not making good progress towards retirement then it is not the income side of the equation that is the problem. The expenses side of the equation is the easiest one to fix, as millions of people manage day to day by working on this since they don’t have the same options on the income side that others do.

It never does any harm to appreciate what we have already.