Who needs to make back-up plans when you’ve spent a decade writing about and otherwise pondering living off a portfolio in (early) retirement?

Surely I’ve thought of everything!

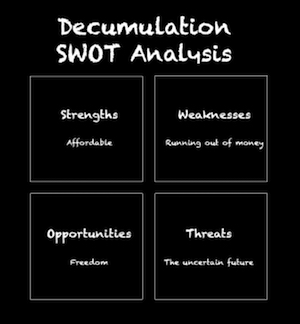

I mean, in part one of this series I outlined my decumulation plan in excruciating detail.

And part two saw me thrill you with an explanation of how I’ll use a dynamic system to manage my asset allocation and determine what we can withdraw to live on each year.

In short, I’ve put more thought into this than anything in my life before.

But what if I’ve miscalculated? Or what if we face market conditions that out-disaster any historical catastrophe?

Then we’re fu-

…then we’ll turn to Plan B.

My A-F of back-up plans

The ultimate plan B in decumulation is our house.

The Investor convinced me years ago that it’s rational to think of your house as an asset, even though that’s difficult emotionally.

If I really have to, I can convert my home’s estimated sale price into X years rental income, or X months in a care home.

Alternatively, it could provide an income injection via equity release.

We have other back-up plans, too.

Our State Pensions and Mrs A’s small DB pension are Plan C. These don’t come on stream for years but I haven’t included them in our SWR, so they’ll be a bonus when they do.

Plan D is working for money from time to time.

I want the option of never needing to work again. That doesn’t amount to a religious vow never to work again.

I’m happy to work on projects I think will be challenging in an enjoyable way. I just want the freedom to choose, and to walk away if need be.

Mrs Accumulator will also maintain part-time hours for now.

It’s good that we’re both keeping our hand in to some extent. Even a small amount of income takes huge pressure off our portfolio in the early years. This reduces the chance of us being forced back into the labour force from a position of weakness.

Plan E is annuities. At some point in our seventies there’s a good chance the mortality credits will make them a worthwhile hedge against longevity risk and portfolio volatility.

Annuities get a bad press. They make people bristle psychologically. Near-zero interest rates don’t help, but annuities are still a useful tool if you’ve got a long lifeline.

On that tip, Professor Moshe Milevsky, who’s done ground-breaking work in this area, recommended a biological age test as a way of taking a bearing on your longevity.

Check out his appearance on the excellent Rational Reminder podcast.

Just do it already

Plan F? I believe I covered that one at the start of this section.

You can’t escape the rat race by creating an adamantium-plated decumulation plan. You’ll never leave the grind.

I can conjure any number of phantoms if what I secretly want to do is to stay chained to my desk.

And whatever happens, I’ve still got my wits.

(“Oh dear. We’re fu-” – Mrs Accumulator)

The inflation problem revisited

The thing that almost keeps me up at night is inflation. It can be ruinous for unlucky retirees.

There are a couple of inflation beasties hiding under rocks that require consideration, beyond the threat of a reckless future government doing a ‘Weimar Germany’ or revisiting the stagflationary 1970s.

One is that your personal inflation rate doesn’t track CPI-inflation, nor even old granddaddy RPI.

There is in fact no chance that your personal inflation rate tracks the headline inflation rates exactly. So it’s worth getting a handle on it before you head into decumulation if your budget is relatively tight.

If our personal inflation rate goes wildly off-piste (which it has done in the past) then we’ll need to rein it in. Nominal asset returns and pension cost-of-living adjustments don’t give two hoots for our personal rate.

The second issue is hedonic inflation, which we’ve been warned about by Monevator reader ZXSpectrum48k.

Official measures of inflation don’t accurately measure rising living standards, as opposed to rising prices.

Nobody thought a mobile phone was a basic necessity 20 years ago. Or the Internet 30 years ago. Or anti-lock brakes on your car back in the Dark Ages.

ZX’s point is headline rates of inflation understate the prices we actually pay for items that are subject to hedonic adjustment, like a computer.

Technically the price of computing has plummeted in the last 25 years. Except that I pay more every time I upgrade, because my computer displays more colours than I can comprehend, and is so thin I could cut a house invader with it.

Maintaining your standard of living on this measure is under-researched (in fact I haven’t seen any research) and it could easily knock another percentage point off your SWR.

Which kinda drains the colour from my face.

No inflated expectations

I don’t want to end up like my gran who couldn’t afford a car until one of her sons was able to give her his.

On the other hand, my parents don’t understand the fuss about mobile phones. They have one each but they forget to charge it, or turn it on, so you think they must be dead.

They certainly haven’t found it necessary to figure out how mobiles work, despite having all the time in the world.

Then again, I can see why my retired parents, wafting around in full control of their personal agendas – and without any pressing need to be hyper-connected – don’t see smart phones as a fundamental human right.

Not every rise in living standards improves quality of life for everyone.

So while I’ll be gutted if I can’t afford the immortality drug available in Boots from 2045, I’m hopeful that we’ve got enough flexibility in our decumulation finances to afford those things we do need.

I see this problem as a chance to focus on what really matters. It’s just not worth spending another decade in the office trying to make ourselves bullet-proof.

We’ll live with less later if it means living more now.

Back-up plans aren’t foolproof

Do you trust your numbers? This is a psychological question more than a financial one. Decumulation looks like a high-wire act in comparison to the comparative cakewalk of accumulation.

Ultimately, you have to pick the numbers that let you sleep at night.

My decumulation plan is predicated on historical withdrawal rates crash-tested by two world wars, The Great Depression, and the turmoil of the 1970s. I find that pretty comforting.

Fair enough, I haven’t prepared the stables for the Four Horsemen Of The Apocalypse.

My plan won’t cope with:

- The breakdown of society

- World War III

- Fascist coup / Communist revolution / The rise of the robots / A takeover by the Tufty Club.

I guess I’ll just have to take my chances.

Wish me luck!

Take it steady,

The Accumulator

![Decumulation strategy: first withdrawal, tax-free cash and drawdown antics [Members] Portfolio before withdrawal](https://i0.wp.com/monevator.com/wp-content/uploads/2024/04/Portfolio-before-withdrawal.png?resize=150%2C150&ssl=1)

Comments on this entry are closed.

@TA:

Another great post.

Re: “Decumulation looks like a high-wire act in comparison to the comparative cakewalk of accumulation.”

IMO, that just about says it all!

FWIW, I suspect that you will probably spend the next few months (or possibly years) dreaming up new and ever more elaborate ways to measure your progress to ‘plan’, and adjusting your ‘plan’ as new information arrives, until – at some point – you will become more (or possibly less) comfortable with it all!

Please just take a few minutes and ask yourself this simple question:

“what did I think my life would be like the day I left school” and take a little time to reflect on your answer. Do you really think the next stage of your life will be any less likely to change over time?

Great post as ever, it it fascinating and educational to read your journey. Thanks for your fantastic site, it should be compulsory reading! Re Plan C, two state pensions and some small amount of DB will cover 100% of my projected living costs in quite a few years’ time, and allow any surplus from ISA/DC savings to start to accumulate a little from that point on. It’s not clear to me why you would not factor in these annuity-like income streams. I appreciate the belt-and-braces approach but doesn’t this add many years to your office chains?

Looks like a grand plan to me TA.

Enough money to allow flexibility.

Enough padding to weather most storms.

Enough contingencies to quell all but the most paranoid of fears.

Thanks for taking the brave step of exposing your inner most thoughts, fears, and workings to the collective scrutiny of the internet.

Some will praise and adore. Some will gibber and hurl excrement. The main thing is you (and more importantly Mrs TA) are comfortable taking the leap of faith into the next phase of your lives together. Best of luck with that grand adventure!

Interesting to read, all seems very sensible and you seem to be in a good spot given the previous posts.

I’m not sure these are really ‘back-up’ plans per se beyond perhaps return to work rather (b) and (c) are assets you haven’t factored into your SWR to be conservative and (e) being a purchase of a financial services product. (d) – just to query this, I would hazard a guess that if you find yourself needing to return to work it will be too late (i.e. 20 years down the road and you can’t really face it etc), so probably better off to do ad-hoc work now after a decent break and reduce your SWR in your early years. Generally good for your mental health if it’s enjoyable as well. So again…not really a back-up plan but just layering in support to your withdrawal rate.

Improvements in standards of living is an issue for SWR I agree although I feel it’s down to peoples personal wants and can be managed to a large degree. I’d still be largely fine with Nokia 6210 vs an iphone 11 but that’s just me.

Inflation is a risk…I would said Inflation with rising interest rates would be much worse particularly for those with bond heavy portfolios. In the 1950’s gilt yields were 2% by the 1970’s they were 15% (I recall from memory so not quite right) plus by then we had heavy inflation of course. different regime to what we have now but would be foolish to discount the possibility. Of course for those who held onto equities throughout that period the next two decades were fantastic but the 1970’s were tough.

I remain unconvinced by my psychological ability to withstand such a set of events as a retiree without tinkering negatively and even if I could – would it be a happy time? – occasionally checking out your portfolio to see it had declined again either nominally or in real terms. Last March and 2008 / 2009 aren’t really that kind of test tbh – it’s the decade suck out that worries me. It’s not that I have a view on markets – I have no clue – it’s the impact on your well being as you live through it! That’s what I really think FIRE types need to consider and there is so little precedent as annuities were the default choice up until a decade ago.

Plan E – naturally by waiting until your seventies to annuitise, the annual payout will be higher. However, I have several times read that the mortality credits are actually lower the later you annuitise, as you benefit less from the premiums of those who die much earlier than normal. If you think you will live longer than average, it is argued that you should annuitise early to maximise lifetime payout.

There is also the consideration that market performance that causes you to seek the secure income of an annuity will have depleted your portfolio and secure less income than you could have secured at an earlier age.

I am personally wrestling with this problem as I have cash sitting in my SIPP that I am unwilling to put into equity investments while I procrastinate about whether I will buy an annuity, while I am happy to invest rationally in my ISA and see the value fluctuate.

I thought I was a rational investor until I retired and realised that psychology dominates your decisions once no longer accumulating.

One concern I have about a sophisticated decumulation plan is my ability to manage it as cognitive deterioration inexorably creeps up on an unsuspecting ageing me.

It easy to think that we can always buy an annuity, for instance, when we no longer have the capacity to manage our financial plan competently. However, based on seeing how the ageing process affected some of my reasonably financially savvy relatives I think it’s likely that many of us will not recognise when that time is. The cognitive decline we experience impairs our ability to recognise what is happening, and as we deteriorate further some (many?) of us will become ever more convinced that we doing just fine.

There’s been some research on this and if I recall correctly the decline can be measured rather earlier than expected (or at least when I expected) and is clearly measurable in people in their 70’s.

@TA – Great post as always! Your master plan seems very reasonable to me. I hope to get there soon too. Best of luck!

@DavidV

If you don’t mind me asking, how long is it since you pulled the plug?

@The Crofter:

Re “research” see e.g. comment #109 at previous post in this series, at:

https://monevator.com/dynamic-asset-allocation-and-withdrawal-in-retirement/

@Seeking Fire:

Much to the amusement of family and friends I still use my Nokia 3109, which must now be about fourteen years old!

I have just looked it up on Google and noticed that such devices can change hands for non-trivial sums these days – might just be something to do with the size, battery life, screen robustness, and overall product longevity!!

You would all have had a good laugh at me last week struggling to get an iPhone to actually ring and rather foolishly (as it turns out) believing that mobile data off actually means what it says!!

IMO needing an internet connection and a browser to work out how to set-up and use a phone suggests either I am going senile, or there is something deeply wrong with the design of these devices, or possibly both, of course!!

I see what you are saying re ‘back-up plans’ per se, but IMO it is all part of the deeply personal journey to becoming comfortable with your own ‘plan’.

In my case I did loads of stuff to kind of get to that point, including some deeply analytical analysis of risks (both downside & upside). But, I think each to their own, as they see fit is probably an appropriate generalisation. That is, you cannot make any plan bomb proof – so, in reality, it is just about reaching the point where you can sleep well at night.

@Al Cam (8) Nearly four years ago at age 63. I was planning to retire at the traditional age of 65, but was incredibly lucky get voluntary redundancy 17 months before (with 18 months redundancy pay!). I lived off this until age 65 when I took my DB and state pensions. Again, I am fortunate that these more than meet my essential needs. I have invested into my ISA for many years (partly for fear of redundancy in my fifties) and my SIPP (currently in cash) is where I have consolidated my DC and personal pensions (SERPS opt-out for some years).

Another corking post TA, Especially “(“Oh dear. We’re fu-” – Mrs Accumulator)”.. I wept 🙂

Voltaire. Perfect is the enemy of (the) good.

Sounds like you are in for an adventure one way or the other, and if you get to plan F, we will all be in the SH.. with you. Good company

JimJim

@A1 Cam;

Thanks for the link. Interesting article.

Links to many other articles including one that suggests that financial literacy scores progressively reduce by 2% each year over the age of 60. Scary thought for us over 60’s!

@DavidV,

Sounds to me like you have no pressing need to make a decision. As usual, there are a lot of factors to consider. This paper might help:

“Optimal Asset Allocation and The Real Option to Delay Annuitization: It’s Not Now-or-Never,” Moshe A. Milevsky and Virginia R. Young Pensions Institute Discussion Paper PI-0211 (2002).

N.B. the paper is very much US based and things have evolved (not entirely favourably) since it was written too.

You say of your parents:

“They certainly haven’t found it necessary to figure out how mobiles work, despite having all the time in the world.

Then again, I can see why my retired parents, wafting around in full control of their personal agendas – and without any pressing need to be hyper-connected – don’t see smart phones as a fundamental human right.

Not every rise in living standards improves quality of life for everyone.“

The implication being that access to smartphones is a rise in living standards? I’m fairly certain my quality of life was better pre smartphone (and i’m 40, but then perhaps that is the problem as i’m entering the curmudgeon-zone)

However, assuming you plan to embrace new tech to the grave, it begs the question – how is the Monevator Tiktok account coming along?

Perhaps not a fair analogy, but my point is that i think you’re overestimating the personal inflation angle. It’s something that is present throughout life and so already factored in, surely?

@Al Cam (13) Thanks for the reference. Milevsky certainly seems to be the authority on annuities. I have read his book ‘Life Annuities: An Optimal Product for Retirement Income’. However, as you say, the financial environment has evolved and it’s always comforting to find recent information cognisant of the current environment to support your decision making. Not that it has any bearing on the future of course!

Actually, my asset allocation across my total portfolio is reasonably rational (substituting cash for bonds). It’s just that I have this mental bucketing that can’t bear the thought of my ‘pension’ going down in value while I procrastinate about an annuity, so that’s why the SIPP remains in cash and all the equities are in the ISA. Of course annuity rates have been going down all the time I have been procrastinating! First world problems, and I don’t expect any sympathy.

Great well thought out and pragmatic stuff. Voltaire’s “Don’t let best be the enemy of the good” seems particularly apt when it comes to decumulation planning. Decumulation success is heavily dependent upon the market and sequence of returns, and life has a habit of throwing spanners into the works of the best laid plans in any case. All we can do is to recognise that hiccups and spanners are likely and to handle them as best we can, without tearing up the plan when the spanners turn up.

Regarding backup plans, when I rethought our strategy last year I came up with a plan that incorporated a plan B portfolio. The main decumulation portfolio would be 80/20 equities/cash with an SWR of about 3%. Alongside it there would be a plan B pot invested for the long term in equities. The plan B pot would be drawn upon if the main portfiolio ran out, or emergency money was needed for some calamity. But if all went well, we would trim the plan B pot over time, McClung style, by giving bits away.

Some people might find this plan B portfolio approach helpful, but in the end I abandoned it as it all started becoming overly complicated. eg what investments were in plan B and where were they (SIPPs/ISAs/unsheltered accounts)? How would the investments be identified and what were the rules concerning trimming over time? Complicated spreadsheets loomed.

For us it just seemed simpler to have a single equity portfolio with a lower SWR, and a set of rules which enabled gifts over time if everything went well.

@JimJim, I see its not just me who thinks of Voltaire when it comes to living off your money!

@DavidV (#15)

Why sympathy?

Has your procrastination not had some beneficial outcome – in so far as you had substituted cash for bonds at a good time!

As always, the future is unknown and unknowable.

We all focus a lot on sequence risk, but the late Dirk Cotton wrote a post back in 2016 where he quotes evidence that sequence risk is almost never the reason for the failure of retirees’s decumulation plans. The most common reason is instead what he calls a spending shock that then spirals out of control over time due to positive feedback: a huge medical bill (he was American), divorce, identity theft, etc. Here’s the link: http://www.theretirementcafe.com/2016/01/why-retirees-go-broke_8.html?m=1

@ Tom-Baker…. (#19)

IIRC, Dirks post was about why elderly [US] folks are declared bankrupt.

@e17jack, smartphones are fantastic inventions (and I am older than you)! The important thing with technology and where many go wrong, is to make sure you are in control, not the other way round.

Agree with you about overestimating the personal inflation angle, especially for most readers of this blog. If you have managed to control it whilst accumulaing, the chances are you will be fine decumulatimg. I don’t recognise some of @TAs comments either. I spent over £2,500 on a PC in the 80s. That would get me a beast of a machine now, with far more firepower than I could possibly need. I just paid slightly over £200 for a new phone, better and about £150 less than the one I bought 3-4 years ago and I don’t need a camera any more. £6 a month gets me unlimited calls and all the data I need. Broadband is way cheaper than I used to pay 10-15 years ago and much faster.

I love the honest assessment of the decumulation plan. I think downsizing and or renting your house is a great option and I will consider that my plan as well. Not sure my wife will go for it but you never know! It is a backup to the backup plan after all.

I’m not quite sure I agree on the gadget inflation angle. The first new laptop – a top of the range Sony VAIO – I bought back in 99 was two grand in then money. My latest, a Macbook Air M1, was about 900 quid. It’s better in every way – even down to the case materials (then plastic, now aluminium). Personal communications technology seems have reached a sweet spot where it actually delivers more than expected – rather than barely skirting a visit from trading standards. Improvements seem to be incremental.

That said, I am expecting at least one revolutionary new must have thing per decade over the next few decades so worth having some budget for it.

@Al Cam (18) The not expecting sympathy comment was merely a recognition that, as my needs are well covered, I really don’t have any retirement income problems that justify my public agonising over what to do with the surplus assets.

@Naeclue:

Re “personal inflation angle”:

I agree totally with you and shared my concerns earlier this year with @TA in this post: https://monevator.com/personal-inflation-rate/

The majority of my concerns relate to the fundamentals of inflation rather than his (and others) anecdotal recollections though.

However, if it turns out that we are more correct (and we might not be) then this will be just another source of contingency in @TA’s ‘plan’ – so IMO not a biggie.

@DavidV:

I was only joshing with you!

It is interesting that you may have stumbled into a better overall allocation – even if only for the time being though.

@ Al Can(#20) – It is about US traditional retirees (over 65s) rather than FIRE retirees.

Your point about establishing your personal inflation rate is very well made indeed. I would add it’s incredibly useful to establish the categories of your spending. Fortunately for me, Mrs B is a demon for this kind of thing and has (handwritten) spreadsheets going back years. Now, thanks to excel, we are able to plot what we spend on, and how it is affected by our personal inflation rate. It also established what we spend less/more on after retirement than when working – the results were surprising.

I would recommend all those currently in accumulation to start tracking their spending sooner rather than later – it’s proved an invaluable tool.

Overall I’ll take the other side of this.

In the late 1990s, I was freelancing without a mobile phone. My first work-from-home computer was a first generation iMac.

In 2020 I’ll buy a new MacBook Air, I’ve just renewed to an iPhone 12 Mini (before anyone shouts at me I’ve jumped multiple generations, from an SE, so I was being vaguely on-brand) and I am about to hit a personal milestone target where I set an Apple Watch 6 as my reward. Which I’ll get with a slightly fancier leather strap.

In the late 1990s I was paying the TV license. I still am plus Netflix and Amazon Prime (though the latter is easily subsidised by all the cheap deliveries).

I am pretty stingy with my App purchasing and subscriptions, but I have Headspace, a plant identifying app, and an on-off premium subscription to Hinge (depending on the state of lockdown 😉 )

Far fewer magazines bought every month though. And I just pay for Spotify (£10 a month? I forget) versus at least two CDs a month (£25).

What the lord of the hedonistic treadmill gives with one hand, he takes away with the other.

It’s all going to be very personal and general, of course, but I believe the concept is real if you look across a household.

Of course how much of this (and whatever is coming down the pike) we actually *need*… but Western life long ago went beyond need.

Another back up plan that could be considered in decumulation is to switch investments to a portfolio of investment trusts and rely on their natural dividend yields. Dividend heroes or next generation dividend heroes, that have increased their dividends for 10 or more years in a row, and that yield more than the targeted withdrawal rate (e.g. 3.8%) could be used. This would involve active investing and greater risk so it’s not for everyone.

The big “gadget” I can see heading down the pipeline in a retired state (which I am not quite in yet) has to be an electric car. We will at full retirement go down to one car, whichever is the least clapped out (so far it looks like it might be the 15 year old Volvo that makes it, the 13 year old one is failing by the month) but at some point it will make sense to convert to electric. With an estimate quoted in a national paper this week at £14.60 for 1000 miles, charged off peak at home, in fuel – and cheaper maintenance costs, perhaps the day may come sooner than I had budgeted for. The other gadgets perhaps I could take or leave, I see many older retirees getting by without anything more than basic broadband, no subscriptions to streaming services, no apps, and , having shopped for a few in lock-down, I know damn well I could halve my current food bill and still live well. If push came to shove, our charitable donations could be trimmed. but that would not make too much difference and is a small concern.

Any new developments in technology start expensive, this gives them a reference to charge a little more for the mass market products that follow, which is usually where the bulk of the profit is. I’m further down the tube taking advantage of the life left in them in the second hand market, when the Jones’s upgrade 🙂

JimJim

JimJim

@Getting Minted, that isn’t a backup plan. If we get into the sort of situation we had in the 1970s with inflation rising to double digits, or a decade long bear market with falling real terms corporate profits, these investment trusts are not going to be able to keep up. There is a very good reason why there are dividend heroes around now – we have not had a truly long and terrible period in the stock market since the late 1960s to 1970s. This is the period that has forced MSWRs down to the 3.5-4% range. Over the last 40 years, MSWRs were much higher than 4%.

@32 – Naclue – Spot on

@31 – Getting minted – per above but your strategy still has merit if psychologically it will help you hold the course and not take action that will negatively impact your portfolio. As we’ve discussed (and I guess you might disagree with) – I think you pay for this strategy through a likely lower SWR based on historical numbers and through higher costs but if works for you fine.

@29 – Investor. Your comments are very interesting, valid and also illustrate that the hedonic adaption is a personal thing. The items you mention don’t interest me at all – I have bought a SUP though and they weren’t available a decade ago!

@9 – Al Cam – As ever your comments are pretty accurate and you seem to have a treasure trove of links to any topic. It’s all about creating a plan you are comfortable with. I suspect many people who are shooting for the simple 4% will run at the sight of a sustained bear market. You need something that you feel confident you’ll stay the course and that entails asking the question that has historical precedent which is how will I deal with a situation of like the 1970’s. I actually think a decade of low volatility and low returns (if that is what is coming) could be ok to deal with as although in real terms the portfolio would be likely declining you could see the CAPE also declining and therefore a sort of value adjusting SWR increasing as earnings rose / markets fell in real terms. It’s the massive volatility over a few years that will really kick you.

Dirk Cotton – his relatively early death is I guess a statistic not the norm but a reminder not to hang around thinking about this for ever. I really enjoyed his articles, which were very intelligently written.

Attention to detail is certainly your strength TA…you’ve covered more angles than Alan McManus! I wish you and Mrs TA good luck and I hope it all goes according to plan.

You will no doubt have more time to crack on with that Monevator book 🙂

This is the first month of our five year plus retirement that I’ll actually engage our decumulation plan. My small bit of consulting (that I’m shutting down this month) was paying all our bills the last five years, so the portfolio just sat there and grew. We’ll be looking at a less than 1% withdrawal rate from here on, that should feasible even if market performance goes down or sideways for awhile. I expected this to be a jarring change, but I think it will actually feel better having a couple of direct deposits showing up in the checking account each month versus my very sporadic and delayed consulting fees. Now it is just a matter of lining up some more volunteer work.

@TA, I can’t see why state pensions and any DB pensions aren’t part of your Plan A. I don’t know (or possibly can’t remember from previous posts) what your target income is but they are predictable and will surely change your withdrawal needs and thus the risks to be mitigated.

@Seeking Fire (#33 and #4):

Re links: I am blessed / cursed – you choose – with quite a good memory for things that interest me. On the other hand, if the subject does not interest me – it will be gone in an instant!

Furthermore, I have searched high and low over a good few years trying to find that elusive “precedent” you mentioned. Up until relatively recently most of this was to be found in the US – which is not surprising given that they ditched DB schemes and fully embraced liberal DC schemes earlier and with much more enthusiasm (and less legal restrictions) than we did in the UK. We are clearly catching up here, but IMO there is still a way to go. Sites like Monevator are helping to lead the way.

Re: Dirk Cotton – I 100% agree with you. IMO his writing is full of both intelligence and compassion. BTW, he was a real gent too – I never met him f-2-f but I did corresponded with him a couple of times, and, entirely unprompted, he was kind enough to clarify some matters with his web of highly regarded academic contacts too.

@The Crofter #6

I can confirm cognitive deterioration can set in early. I’m 71 now, in my 13th year of retirement, and no longer fully understand spreadsheets I set up earlier to keep track of, and predict, income and spending. The headline figure, income exceeds spending is clear enough, but some of the other figures seem meaningless now.

The deterioration started in my 50s, with forgetting the arguments to a function, going to look them up, and forgetting what I’m trying to look up, resulting in much toing and froing between the program editor and the language reference. Now I have to carefully plan my day, and set reminders for everything, but I can still spew forth reams of trivia given the right trigger.

Following The Greybeard’s lead, about half of my ISAs are in Investment Trusts, giving a somewhat lumpy automatic monthly income, with the rest in VLS80. I’m not sure that I could handle selling down growth funds to give an annual income.

Fortunately the State Pension and small annuitised pension cover my basic needs, the rest is fun money.

@DavidV – if your secured income covers essential spending, why annuitise further? Just keep your invested portfolio in some easy moderate risk funds (Lifestrategy 60 or 40?) and pull down what you desire on a flexible basis for your discretionary spends…I suspect that will work out just fine, as spending tends to decline in retirement.

@TA. In your shoes I would view the SP and DB pensions as a deferred annuity. If they don’t cover essential spending I’d mentally ring fence an amount for annuitising that would. Then all you have to worry about is a 20 year time frame. Much easier to plan for than indefinite timeframes.

The more I think about this the more I feel that the real problem of retirement is how to allow enough spending in the fit and health years. Most retirees who are good at saving and hoarding tend to end up continuing being cautious, and reaching 80 with a big wadge that isn’t likely to be spent. I’m sure you can have some fun with charitable gifting at that point(!) but I think you need enough fun money in the 50s and 60s not to feel a bit regretful.

@EcoMiser — Thanks for sharing your experience of mental decline with respect to financial matters. It probably isn’t the easiest thing to discuss, and it certainly isn’t talked about enough by members of this community.

(Me included. I’ve written articles like this: https://monevator.com/great-investors-live-longer/).

Commendable – and I’d venture rare – self-awareness on your part. You’re clearly still doing plenty right! 😉

In terms of personal risk you haven’t mentioned the greatest wealth destroying event there is: divorce.

Buy more flowers.

@Vanguardfan:

Re your deferred annuity comment to @TA – that is a very neat idea!

RE “the more I think about this …”,

FWIW, I agree – see e.g. (#24) at:

https://monevator.com/dynamic-asset-allocation-and-withdrawal-in-retirement/

I suspect few [early] embarkees on this journey appreciate this is the most likely outcome. IMO, even Ermine is now firmly on this trajectory!

However, atychiphobia (fear of failure) is a very powerful emotion and, in some folks, it may even come on stronger after jumping ship!

@Vanguardfan (39) Thanks for your thoughts. During my ‘rational’ accumulation years, this is exactly what I would have told myself. Having been saving and investing for over thirty years, I now realise that I will find it difficult to sell down my portfolio to allow extra spending – exactly as you say further down your comment. I also have a completely different risk appetite for the money in my SIPP, which derives from various pension schemes, from the risk appetite for my other investments, ISA and unsheltered – again totally irrational. Furthermore, I have no dependants and no bequest motive, so I need to persuade myself to spend more in retirement. Annuitising the taxable 75% in my SIPP seems one way of encouraging this (if I don’t just save the income!) while mostly eliminating my risk aversion with investing the pension money. This amount is still only about 20% of my overall portfolio, so wouldn’t have a major impact on my remaining optionality. Before retiring I wouldn’t have believed how much psychology impacts your ability to invest and spend rationally.

@Various:

Top of page 13 “Key Findings” gives some interesting stats. Report dates from 2015 – but as most stats are expressed as percentages this may not be an issue:

https://ilcuk.org.uk/wp-content/uploads/2018/10/Understanding-Retirement-Journeys.pdf

@MrOptimistic — Neither TA or myself are married. And at least in my case that’s by design!

I’ve alluded in the past to a half-written post on this that I’m wary of posting.

I think it’s an immense risk that people are unbelievably cavalier about.

They micro-manage their SWR projections to two decimal places and then put half their wealth in hock to another person’s whims, in a world where roughly half of marriages end in divorce. (So it’s hardly an edge case, even though everyone acts like it is and that I’m a ludicrously pessimistic freak. 🙂 )

But it is all very controversial and definitely for another day, not this thread, I think. TA’s post deserves better. I’ll go toe-to-toe on it in the future. (There’s a reason I haven’t posted on it yet haha.)

@DavidV — You write:

Fully agree. Everyone should keep this in mind when we’re discussing competing strategies for living off capital in some form in retirement (running down capital to zero, living off dividends, being excessively cautious, putting a lot in property, deciding to spend most of it in the early years and live on the State Pension, etc etc).

The back data is the same, arguably, for all of us. (Arguably because statistics).

Our brains, emotions, tolerances, preferences, and motivations most definitely are not.

Regarding the psychology of hoarding (aka not being able to bring yourself to spend down the stash). I have a ‘fun money’ allowance which I ringfence each year, and give permission to myself to spend freely. (It hasn’t worked this year, sadly).

Generally though, it’s hard to undo a hardwired ‘scarcity’ mindset, or the weird personal rules we have about spending (unless that’s just me). I am frequently amused when I catch myself thinking very irrationally about spending decisions. For example, I have a clear mental (emotional) idea of how much is ‘acceptable’ to spend on particular items. It’s got very little relationship with what I can objectively afford. And some items I’m happy spending silly money on, some I absolutely am not. Why is that? I can rationalise it away as ‘personal values and priorities’ of course, but it’s really about meanings and identity. If we’ve spent a lifetime with our carefully constructed ‘good with money’ identity, it’s hard to throw caution to the winds.

I’m afraid many of us are destined to be rich in the graveyard.

Btw, not getting married for fear of adverse financial consequences strikes me as the ultimate tail wagging the dog. Money is there to support and enable how we choose to live life, not to dictate our choices. And having money of course doesn’t shield you from any of life’s potentially wealth destroying crises (divorce, illness, addiction, bereavement, crime, sick or disabled child, etc etc).

@G. The fact that you bought a computer in 1999 at £2k and now many years later can buy a much better one at £900 is not relevant to what TA is saying.

CPI is calculated by “chaining” price changes. They might look at the price change on computer 1 for year T vs. T+1 and price change for computer 2 for T+1 vs. T+2 etc. Based on that you should have been paying say £100 for a new computer now of the same capability as the one you had in 1999. The fact that you paid just £900 is a reflection of the fact that you bought something far more capable. That is not taken account into CPI/RPI, it’s not part of the “cost of living”, it’s a “standard of living” (nebulous concept alert!) improvement.

That’s a problem with most inflation metrics. It’s not always possible to replicate them. The $1000 CRT TV you bought in 1995, might now only be meant to cost $50 and probably would only cost $50. Except you can’t buy it and you don’t want to buy it. You instead buy a $500 LED display.

The US statistics authority measures the “Consumer bundle”. That’s calculated as the annual US dollar value of what the average family pays for goods and services each year. It’s risen at around 1.5% more than CPI-U. That doesn’t mean CPI is wrong, just that people tend to consume more as their “standard of living” improves. But if you replace CPI-U with the Consumer bundle in a SWR calc, the US SWR drops from 3.8% to about 2.5%. Big change.

Now, of course, your spending doesn’t rise with the average. It may well lag and you may be totally comfortable with that. But you do need to accept that your “standard of living” (in relative terms to others, not in your personal view) could well deteriorate. Over a long retirement that impact could be large.

Think about some FIRE type in the UK who retired in 1969 at say 40. They decided to retire on the average UK salary (£962) and inflate that with RPI. By age 90 in 2019, they are living on £14,993. Except the average salary by then was £27,976, 87% higher. They may happy on £14,993 but they went from average to 30% percentile. Or someone who retired at 40 in 1950 on the average of £303. By 2000 they were living on £5,860/annum based on RPI increases. The average by then was £16,276, 178% more. They went from average to poverty. The pension triple lock exists for a reason. Over the long-term earnings tends to outstrip inflation, standards of living improve.

Hence why calculating your personal inflation rate matters. Using the generic CPI/RPI, you could be wrong enough to decimate the beloved SWR calculation.

On annuities I think you make a good point. Dirk Cotton was a strong advocate that they should be considered,

http://www.theretirementcafe.com/2019/12/evaluate-annuities-as-component-of-your.html

Elsewhere he argues that to serve its purpose an annuity must be inflation protected but apparently owing to lack of demand only a single US company provides a fully linked annuity.

I worry that MrsO might not be aware of the benefits an annuity could provide in later life ( say post 76) if I’m not around. I have heard talk of ‘deferred annuities’ in the US but I have never seen them offered here.

One final point. The option to work part time is a decaying asset unless you keep your hand in so to speak. How do you prevent your skill set and employment potential depreciating over the years?

@ZX. I’m not sure retrospectively (or contemporaneously) calculating personal inflation rate is going to solve the problem of lifestyle improvements over the next 3-5 decades. Surely part of the issue is that the future is unknowable? Or maybe I’m just lazy.

What about an alternative approach of using average growth in wages or GDP? (I know it doesn’t overcome the issue of the unknown future being different to the past, but surely a better simple approach than price inflation?)

Thanks @Al Cam (#44) for that report, it makes interesting reading. It seems to conclude that for most people with savings to fund retirement (including DC schemes and SIPPs) the best behavioural strategy would be to draw down quite generously for 10-15 years and then annuitise. But it doesn’t suggest how you could estimate at the outset how much of your savings needs to be earmarked for that annuity.

My wife and I have been trying hard to fit the category of “Extravagant Couple” in the report, though of course the last year has much limited our capacity for spending on entertainment and travel. But following an inheritance we don’t track our expenditure that closely – our carefully calculated drawdown plan from a few years back can be flexed without worry.

I am sure as well the analysis is right about how at older ages there isn’t the anticipated expenditure from savings. If my mother is typical, it certainly was the case that she was mentally unable to switch from “saving for a rainy day” to “spend because it is raining now”. Family tried hard to persuade her to use savings to increase the paid support she received in her own home, but with only modest success. I have no doubt she was a net saver right up to the point she had to go into a care home.

Slightly off-topic, another statistic in the report was the preference of the older group for saving in cash accounts despite low interest rates. Those savings aren’t benefitting the economy as much as they might. I can see that if constructed right a “recovery bond” if available retail at attractive rates (and preferably ISA tax benefits) via familiar institutions like building societies could harness investment.

@ZX:

I was with you until your final paragraph – IMO using the term “personal inflation rate” there is incorrect – what I believe you are talking about there is your personal standard of living expectation.

OOI, the ONS is part way through some experimental work on Household Costs Indices (HCIs) which are said to be a set of measures to reflect the change in costs as experienced by households.

@JonathanB. I reckon that a ‘floor and upside approach’ might be a good approach with the floor being eventually provided by an inflation proofed annuity. TA discussed this sometime ago I think in relation to investing for a relative. Alternatively

http://www.theretirementcafe.com/2018/01/unraveling-retirement-strategies-floor.html

@Jonathan (#51):

IMO it is a great report – and, most critically, it is UK-based. It took a bit of a knocking when it first appeared (in 2015) as there is a whole host of vested interests locked into peddling the story that retirement spending is U-shaped. Subsequent reports from the IFS came to pretty much the same conclusions as the ILC UK Report did.

Based on my observations – your mother is far from unusual. I am still sometimes surprised by elders behaviours in that arena, and I have been watching with interest for years too!

@Al Cam, the one thing I couldn’t see anywhere in the report is an explanation of what the “ILC” stands for or is. Given the front page showed it is co-sponsored by Prudential I wondered if the author had a particular slant.

My mother was obstinate about spending money. Her only justification was to leave it, but she also refused to recognise the cash value of her house and realise that she was already leaving a generous inheritance. And that any further savings would eventually be taxed at 40%

Here you go,

https://ilcuk.org.uk/

@MrOptimistic #41 and @others

Your mentioning of divorce prompts me to highlight an often not previously realised point, which is that the pension sharing which usually features in the financial settlement between the parties normally contains an element of actuarial adjustment. This adjustment recognises that on average women live longer than men, and means that the division of the capital value of any pension is unequal, the husband receiving more than the wife.

@Jonathan B. Re floor and upside

https://monevator.com/weekend-reading-three-graphs-that-boil-down-the-retirement-income-conundrum/

https://monevator.com/secure-retirement-income/

Interesting new mortgage product… https://inews.co.uk/inews-lifestyle/money/habitos-40-year-fixed-rate-mortgage-is-a-game-changer-for-borrowers-heading-for-retirement-904925

JimJim

@ZXspectrum48k, can you provide a link to this Consumer Bundle please? I had a look on the BLS web site and could not find any mention of it. Google didn’t help either.

@Al Cam, @Vanguardfan, @Jonathan B My wife and I have experienced difficulty getting a number of elderly relatives to spend on themselves. It can be immensely frustrating.

@Jonathan B, I am a little surprised that @TA did not include DB and state pensions as part of plan A as well. Especially as having this kind of secure income can alter the asset allocation – reducing the size of the bond portfolio. Maybe he just did this because for him these pensions are a long way off.

Thanks @Mr Optimistic for links.

And @Nseclue, probably my surprise at @TA (given his usually comprehensively considered approach) is from our own experience planning drawdown needs in relation to various DB pensions and state pension all coming in at different points. What we didn’t, and couldn’t at that point, take into account was our required contribution to our daughter’s university costs. Essentially that was always going to happen out of the money above the floor, though the inheritance mentioned above means it is no longer a weak point in our plan.

Het TA,

A great article. I sometimes get called too cautious when it comes to my own plans for FI and when I don’t agree with a 4% SWR that has no ability to lower expenses as it’s monthly outgoings are already to the bone.

I aim to give plenty of buffer monthly so that during times of pullbacks, I can simply take less without much impact to my life. I also aim to use my state pension and public pension that will come at 68+ as an insurance policy along with a likely inheritance being the second so called insurance plan.

Great read as always

TFJ

@zxspectrum (#48)

I agree. The most important thing is to establish your own inflation rate. You cannot do this unless you itemise, characterize, and record your expenditure. And this over as many years as possible before retiring.

I cannot over-emphasise how valuable this data is in retirement planning.

Excellent thread, so many interesting thoughts and leads to follow up. Sorry I can’t contribute much at the mo, infernal work deadlines.

Fascinating to see so many takes on the personal psychology of decumulation. Self management seems far more important than any mathematical formula we can apply to this part of the journey.

Re: State Pensions and (very small) DB pension. I mentioned last post that not counting these as part of Plan A gives us a great deal of flexibility if any other calculation is off. They are near 20 years away but I know how much more I could spend now if I assumed everything goes like clockwork.

I’m doubtful everything will go like clockwork, so holding the pensions in reserve helps me sleep at night. I’ll also not sweat going over my SWR from time-to-time because I know we’ve got plenty of flexibility.

Like the deferred annuity mental framing.

@ DIY Investor – Haha. I finished drafting the Monevator book ages ago. I refer further enquiries to publisher-in-chief, The Investor.

@TA (#64):

Re: “Fascinating ……”

I suspect you are now starting to experience that transition for real, see, for example, (#123) to https://monevator.com/i-hit-my-fi-number/

@The Borderer (#63):

I agree that recording and analysing spending is very useful.

Sad git that I am, I have been doing this for more than 20 years. And as a resource it has been extremely useful. In fact, I had absolutely no idea how useful this information would become and only started doing it to help me answer the following simple question posed by a savvy acquaintance: do you know where all your money goes?

However, as I mentioned in (#25) above, any analysis you perform on this data can only explore the variations in your year-to-year spending, which fundamentally comprises a combination of: (a) price changes and (b) the inevitably highly variable consumption choices you make. Inflation is derived from (a), however, I would be extremely surprised if your data was not dominated by (b).

I did make a suggestion (see link at #25 above) about how to estimate your personal inflation rate. However, this approach requires, amongst other things:

1) you accept that you can only ever come up with an estimate – of unknown accuracy that varies year-to-year too

2) acceptance that the underlying ONS model is good;

3) categorisation of your spend using a set of defined groupings – which is not as simple as you might first imagine (e.g. who would intuit that kitchen rolls and paper tissues/toilet rolls are actually in different groups); and

4) tacit acknowledgment that not all of your spending contributes to inflation – e.g. council tax is in the UK CPIH but not CPI, and income tax and savings are in neither

So good to see that the last part of the trilogy is as good as the rest 😉

Enjoyed this. As someone who’s now over two years into seeing how my plans panned out – I can pretty much guarantee one thing. It won’t happen how you think – but you’ll be ok.

Flexibility & the ability to adapt do a ton more for making early retirement (43 for me) plans work than yet more ever detailed spreadsheets. They help to think things through, after that – it’s an educated leap of faith!

Cheers again for sharing – it helps a lot of people.

@Naeclue (32). Natural yield (30) is my alternative plan which has operated for seven years so far. It could be a backup plan so long as available yields exceed the required withdrawal rate. History, after the 1970’s at least, is supportive, I think. I agree that this plan would struggle with 1970’s inflation as would most strategies.

@Seeking Fire (33). My UK-centric income focused strategy has giving me a lower total return than a global growth strategy over the last seven years, but not necessarily a lower SWR over the long term. My costs are marginally higher but not necessarily significant overall. Time will tell. Opinions may differ.

@GettingMinted — Interesting seeing your comments, as I’ve been following your income strategy for a while. It’s certainly been a lackluster few years for UK equity income after many years of strong returns. At least dividends from the trusts I’d favour if I was pursuing such an approach have largely been held, however, and the outlook seems much rosier if the market keeps rotating away from high-growth as we emerge from the pandemic.

But all this is off-topic for this thread, really, so I’d say let’s not get into debates here and rather focus on the issues @TA raises in his article.

(I know I keep saying that when living off natural yield in retirement comes up, and I really do need to post my thoughts so we can have the ding-dong in its own place!)

@TI #40 Thanks for that, and thanks for this blog, which has massively shaped my decumulation portfolio, and helps keeps me aware and alert.

Fortunately my cognitive deterioration started from a fairly high point, and is somewhat selective. However there are probably lots (and definitely some) things I have forgotten completely, and won’t take into consideration at all until/unless I stumble upon them again.

@ Al Cam #66 and others

I have summarised monthly spending going back to 2012 on a spreadsheet (with detail available on other, annual, sheets). The year on year percentage increases appear almost completely random, being highly dependent on what I bought each year. The food category shows slight pattern, but still ranges from minus 8.1% to plus 18.6% (2020, when my nephew was bringing my food, and I was rounding up considerably to cover his costs/time, and I wasn’t taking advantage of reduced prices.) 2018 and 2019 were the next highest, this is where I had started realising I had spare money and so started using cafes and restaurants while out, instead of packing my own. It is only those three years, and only the food category that I can see any predictive power in the data, beyond very wide ranges of spending.

>I don’t want to end up like my gran who couldn’t afford a car until one of her sons was able to give her his.

The main change I’m planning in the next couple of years (before I retire) is to move somewhere where I am not car dependent. Having everything I depend on within a miles walk should make life easier if I find I can’t drive whether through lack of affordability or ill health.

@JimJim I do wonder if the option of running a cheap banger will disappear once we have transitioned to EV’s. The cost of a replacement battery might put a floor under prices.

@Vanguardfan. People should keep an eye on both CPI and earnings inflation. The last 30 years has been ideal for those in decumulation in the sense you’ve had asset prices rising well above inflation with average earnings below inflation.

The 1970s, however, provides a counterexample. Real returns on bonds of -35%, real returns on equities of -23%, so a big underperformance vs. inflation. Earnings growth, however, outstripped inflation by 21%. If you’d retired in the late 60s you’d not only have seen your portfolio drop in value, but you’d also find your annual drawing losing ground, in relative terms, to the earnings of the working population. A nasty pincer move for your relative standard of living.

Here are two links I found from someone in the FIRE community on the issue of lifestyle inflation/standard of living.

https://justusjp.medium.com/inflation-may-be-the-wrong-measure-for-early-retirees-8c78bd0b7283

https://justusjp.medium.com/safe-withdrawal-rates-with-a-different-measure-of-inflation-d11c19f9a8fd

I don’t know anything about this blogger so make what you will of them.

For the Consumer Bundle see the following site (https://www.measuringworth.com/). I don’t use it but it’s all I could find that’s free.

@EcoMiser(#70)

Thanks for sharing your data – which are not in any way surprising to me.

Spending and inflation are two separate – but related – things. I suspect some people, probably unintentionally, conflate the two of them.

OOI, the official categorisation of spending (COICOP) groups meals out in a restaurant as a different category to food bought in e.g. a supermarket.

I will dig out some comparable figures from my own records/analysis over a similar period and share them in due course.

Keeping track of regular expenses is helpful, as others point out. In my experience, however, most of the variation year-by-year arises from a single large unexpected item of expenditure – car needs to be replaced, roof needs to be fixed, water cylinder gives out (some of these can involve redecoration too). There is almost always something like this, especially if you’re a homeowner, so perhaps not really unexpected except in the sense of being a recurringly unwelcome large item of ‘non-recurring’ expenditure. One has to budget for this by keeping cash aside (around £5,000) and in one go it can add several hundred pounds to average monthly outgoings for the year.

@EcoMiser(#70):

As promised – some more details follow.

I have been tracking our inflation rate using the method I described above at (#66) for a handful of years now. Why and how I arrived at this method is a whole different story.

I have been tracking our spending for much longer – and like yourself – have various levels of details available in assorted formats.

Ultimately it is all pulled together in spreadsheets. Incidentally, I have consciously avoided programming using VBA or anything else.

Over the last four years (2017 to 2020, inclusive), our spending has been, by our previous performance, lower than normal and relatively constant. The min to max ratio being of the order of 1.0 to 1.2. Over the period since I started tracking our expenditure, after adjusting for inflation, it has been in the order of 1.0 to 2.0. The pattern of recent spending (2017 to 2020) may be a coincidence, but it may also be related to the fact that I jumped ship just over four years ago.

Over the period 2017 to 2020 our CPIH (annualised) has tracked official CPIH (annualised) very closely. Even on a month-by-month basis, the divergences between the two (both +ve & -ve) have been very small and almost certainly within the error bars of the respective values.

Official CPIH averaged over the four year period in question comes out at 1.9%, and our CPIH came out at 1.8%.

There is one weakness to your plan….

What if you get cognitively impaired. An awful lot of people suffer from dementia and even more from mild cognitive impairment as they get older..

Simplicity I think from mid 70’s onwards is important.

@Al Cam, I think it would be next to impossible to derive our personal inflation rate from our spending history. It would also be an incredibly tedious thing to attempt! Even if I got an estimate for it I am not sure what use it would be either as it would be backward looking. In our decumulation strategy I negate the need to know our personal inflation rate because we estimate our forward spending over the next 5 years, then divide that by 5 to get an average annual projected spend.

Before I switched strategy last year I carried out backtests against the FTSE allshare and MSCI World. I backtested using both RPI and UK average earnings as inflation measures and found that it made little difference to a strategy’s success or failure. The reason for this is that the MSWR is set by the worse case scenario and in the worse case scenario (starting at the end of 1968) it was the first few years of drawdown that determined success or failure. Across a few years the small differences in the inflation index (eg RPI vs earnings) did not matter a great deal.

@Getting minted, @TA’s strategy would have worked just fine over the last 7 years as well (actually it would have worked outstandingly well ;)). The point is though that it doesn’t matter much how well a strategy does in the good times, but how it works out in the bad. @TAs strategy would have worked ok in the 1970s, whereas it is unknown what would have happened with your strategy.

@Naeclue (#78):

I do not entirely disagree with you, and, at best, it is only ever an estimate.

I do it primarily as a by-product of something else I was investigating. I hinted at this in (#76) where I said “Why and how I arrived at this method is a whole different story.”

Without going into all the gory details what I was really exploring was the impact of a DB schemes revaluation regime being based on CPI rather than RPI, see also (#9) ” analysis of risks” above.

@ Ducknald Don, 71. Not something I had thought too hard about, the entry point to a sufficient second hand E.V. is the interesting thing, the overall running costs, if batteries prove as durable as advertised, is the calculation. As always in the used market, I look for quality and endurance compared with price and running costs. Bangernomics is a fun science, how E.V residuals will hold up depends upon availability and the rate of new (better) developments, the durability is, as yet, unproved but, as there are fewer working parts, perhaps it will be a step forward. I also wonder about the residuals of I.C.E cars, if the popularity of E.V’s take off, perhaps there will be some bargains out there. Who knows, the decision is taken at date of purchase and can be a five year one for me in my market.

The pandemic has seen our combined mileage drop 50% (MOT to MOT) This in itself slews the calculation as, fixed costs now weigh heavier than variable costs.

I will make the decision when the T5 bites the dust.

JimJim

I just dug out some of the backtests I did last year, which might be of interest. I was looking into equity heavy portfolios as this increases the median return, at the expense of increased risk of running out of money. For me the tradeoff was acceptable as we did not require a high decumulation rate.

For a 100% equities portfolio invested in the FTSE allshare, the 30 year MSWR was 3.6% when using RPI for inflation and 2.9% when using UK average earnings. So 0.7% lower when using earnings, despite the fact that earnings inflation averaged 2% more than RPI over this worst period, starting at the end of 1968.

In addition, earnings growth over RPI has slowed markedly since this period, with the trend inexorably downwards and from the GFC has been mostly negative.

For these reasons I concluded that different inflation measures were not something to be overly concerned about when designing a decumulation strategy.

@Naeclue:

I think I have seen something like this before.

A number of Q’s if I may:

a) I do not know how to do this, but a graph of both params and the FTSA all share over the period in Q would be useful, but failing that:

b) was UK average earnings (on average) > than average RPI for the whole period

c) did UK average earnings drop below RPI at any time during the whole period

@ Seeking Fire – “I would hazard a guess that if you find yourself needing to return to work it will be too late (i.e. 20 years down the road and you can’t really face it etc), so probably better off to do ad-hoc work now after a decent break and reduce your SWR in your early years. Generally good for your mental health if it’s enjoyable as well. “

I wholeheartedly agree! This is the approach I’m gonna take. Less need to worry about skills atrophying too.

Re: the decade suck. I hope that having a handle on market history and not anchoring too much on a long-gone historic high would fortify me during this period. Knowing that others have come through such periods is comforting, but I think I’d be doomed if I obsessed over what the portfolio ‘used to be worth’.

@ DavidV – the argument being that by annuitising late, most of what you’re getting is return of capital rather than mortality credits? If that’s the case, then that’s fine. Annuitising for me is a strategic move e.g. locking down an income floor later in life, simplifying in the face of cognitive decline, peace of mind. If I can get a better withdrawal rate from the annuity capital than I can from the market then I’m there. The research I’ve read suggests this is likely at some point in my 70s but I do need to investigate this more.

My personal experience of annuitising comes via a relative. Having reliable income was transformative for their peace of mind.

@ The Crofter – Not recognising the signs and therefore not taking action in the face of cognitive decline is a really interesting point.

My guess is that forewarned is forearmed to some degree. The Monevator community is hyper-aware of the danger, therefore more likely to look for the signs and admit that the time has come to take action.

Re: personal inflation. I think this is simpler and more valuable to monitor than some other commenters.

Careful as I am, being able to go back through years of spending across consistent categories is eye-opening. It’s revealed some vulnerabilities I need to be more alive to, and that’s coming from someone who consistently hit a 70% savings rate.

I can see on certain big-ticket items that the price is not falling. In line with ZX’s example, the last CRT TV I bought was £50. It was replaced with a flat-screen HDTV less than 2 years ago for £200.

During lockdown I upgraded to superfast broadband. It’s more, not less expensive than previous flavours. These are just a few counterpoint examples to offer food for thought.

@ ZX – thank you for those links. Those are very useful and EREVN’s backtest offers a SWR reduction in line with what you’ve previously mooted. EREVN is a good source.

@ MrOptimistic and The Investor – only on Monevator would we discuss the affairs of the heart as capital preservation strategy 😉

Look out for the official Monevator pre-nup available in the merch section soon!

Re: skills atrophying – I meant to say I’m not concerned about this because working again need not meaning working in the same industry or at anything like the same level.

Earning pocket money doing something new and relatively responsibility-free could take a lot of pressure off the portfolio at a later date.

I also see FIRE as a chance to learn new skills that someone may find valuable at some point. Let’s see what serendipity brings.

@TA (#84):

Re: “Re: personal inflation. I think this is simpler and more valuable …”

No argument that what you describe is very useful – but what you are observing is not inflation led but rather is dominated by your consumption choices . Conflating spending and inflation is erroneous.

This may be seen by some as perhaps a rather nit-picky point, but IMO the terminology matters. This is why from time to time I have been known to rail the against the SWR term, and, more often that not, refer to it as:

“the so-called SWR”!

Rant off!!

P.S. inflation uses a basket of goods and services concept that evolves over time – so pretty sure there are no CRT TV’s in there anymore. Rolling the clock back a few years to when I last bought a flat screen TV: I thought I must be the last person still using a CRT TV …… clearly I wasn’t!!!

I’d be interested in seeing that marriage / divorce risk article.

My problem with retirement is that I have difficulty spending. My withdrawal rate is just under 1%. I’m not depriving myself, but obviously I could spend more but it just doesn’t come naturally to me. I’ve always been a saver.

Oh dear, I have to confess I’m still using a CRT TV.

@Al Cam,

“was UK average earnings (on average) > than average RPI for the whole period”

Yes.

“did UK average earnings drop below RPI at any time during the whole period”

Yes

1976 -0.8%

1977 -6.7%

1995 -0.3%

After 1998 wage inflation frequently dipped below RPI and the difference between the geometric averages for 1998-2018 was only 0.18%. The difference leaps around quite a bit, here it is at successive 5 year periods (earnings-RPI):

1968-1973 3.98% (Note how this came at precisely the worst possible time!)

1973-1978 0.18%

1978-1983 2.04%

1983-1988 3.08%

1988-1993 1.40%

1993-1998 0.97%

And after the period end

1998-2003 1.64%

2003-2008 1.04%

2008-2013 -1.75%

2013-2018 -0.18%

Probably reasonable to sum up 2008 onwards in one word – Austerity!

The web site ZX linked to provides an index for the “Consumer Bundle”, which is a kind of keeping up with the Joneses measure of inflation. I will take a look at it later and compare it against US CPI and earnings inflation when calculating MSWRs. I suspect I will find a similar story to UK MSWRs.

If someone actually followed an MSWR precisely, then most of the time they end up with a surplus at the end of the period, it is just the worse case scenario when they end up with zero. Differences between various inflation measures will likely have a much bigger impact on the size of these legacies than they do on the actual MSWRs.

@AlCam. If we go back say to 1800 for earnings and RPI (using backbuilt data, the ONS wasn’t around!), then earnings have outperformed RPI by around 1.3%/annum.

Looking at 10-year rolling periods earnings inflation < RPI in 12% of observations. Only two decadal periods (1900-09, 2010-19) exhibit earnings inflation < RPI. It's notable that the end of the Gilded Age is very comparable to the post GFC period given their other similarities.

Pretty much every 10-year period where we saw earnings CPI doesn’t actually translate to a 1: 1 reduction in SWR since earnings inflation has tended to be positively correlated with equity outperformance (the workers get some benefit from companies doing better). This dampens the impact. The exception is again the last decade where earnings < CPI in many countries but asset performance was very strong.

My numbers suggest a suppression of SWRs since 1800 using earnings instead of RPI of up to 1% (from 3.0-3.3%). Not that anyone would use a 100% UK portfolio anymore. I'd argue moving from 3-3.3% to 2-2.3% is significant. It means going from a multiple of 33 to 50. Even a 0.7% decrease would be a 25% or so increase. It's easily comparable to or greater than the impact of asset allocation decisions. I don't feel it can be dismissed lightly as some clearly do.

@Naeclue (#78, #90), @ZX(#91)

Thanks for the info.

Back in the days when I thought the SWR construct had some merit I constructed my own tools that allowed me to explore the inner workings of the approach. I could then play with all sorts of things that the tools freely available at the time glossed over. I concluded that sequence of returns was dominant but was not the only factor at play. The overall sequence that really mattered was the combination of:

a) returns [inc. whose version of these, ],

b) inflation [inc. which index],

c) timing (yearly [start or end or ..], monthly [ …], and amount and “shape” of withdrawals [flat, rising, declining, cycling, etc],

d) costs,

e) etc.

Or, to put it another way, simplifying assumptions like level inflation and flat withdrawals probably hid some crucial details.

Lots of folks wax lyrical about the strengths and weaknesses of various SWR approaches, but often seem to overlook the critical inter-play of all the key parameters. Thus, I am not surprised that abbreviated descriptions of the set-up can sometimes fail to capture the probable outcome – the devil really is in the details.

Lastly, IMO, the so-called SWR approach is well iffy anyway, to use a colloquialism.

PS: @ZX:

Have you read about Bishop William Fleetwood’s Chronicon Precosium published in 1707?

@DavidV (#89):

I suspect I would be too had it not finally failed!

Interestingly, I bought my last CRT TV as a cheap interim measure until flat screens became cheaper – and it lasted far longer than I ever expected it too. IIRC, our penultimate CRT TV cost a small fortune and weighed a ton – and also gave very good service too!

What are we like??

@1% (#88):

Just being nosy – but does your 1% include or exclude fixed income sources like pensions and/or annuities?

@Al Cam (93) This TV is by far the most reliable I have ever owned – 18 years so far (it’s a JVC if anyone was wondering). It is flat screen though, just weighs a ton and has a depth about the same as its height.

It seems that we both don’t like to replace kit until it fails. I was conflicted though about my fridge-freezer which I finally replaced a year ago when it failed after about 30 years. I was keenly aware that such an old device was both environmentally unsound and costing much more to run that its replacement would.

Apologies everyone for straying somewhat from the topic of decumulation.

To bring the conversation back to actual vs hedonistic inflation, I seem to recall spending about £600 for my 18-year old TV. This is probably about the same amount I will plan to spend on its large-screen, UHD replacement when the time comes. So a real-terms reduction in price for a better specified product (who knows though about its longevity?).

@ Al Cam – we had a debate about calculating personal inflation here, and anyone who’s interested can see if anything useful came of it:

https://monevator.com/personal-inflation-rate/

On the wider point about definitions. I think this is worth picking up.

Definitions are often hazy. Terms that may have been tightly defined by a few specialists are used interchangeably within an industry or by the wider public.

For me, the overriding objective is to communicate. As we’re not specialists operating in a narrow field, I believe in using terms as they are commonly understood.

Intent is important and I think it’s better to focus on what people need to know than on debating definitions.

In the case of decumulation, the objective is to be able to withdraw an annual income that enables you to maintain an approximately constant standard of living. That’s the intention of adjusting your income by inflation.

If your cost of living increases faster than official inflation then that’s a potential problem. That cost of living increase is commonly known as personal inflation. Therefore I talk about personal inflation.

You make some brilliant contributions and I am truly grateful for your expertise. I enjoy hearing your perspective and learning from your immense store of knowledge. When you disagree, I’ll always ask you for your insight.

Sometimes a very precise definition matters and we can hash that out when it does. But once the point is made it’s better to move on. Because it’s ease-of-communication that matters when the intent is widely shared and understood.

@ ZX – really interesting. Are there a few nightmare years where the SWR goes as low as 2 to 2.3% or is it quite a common occurrence? Is there a particular set of circumstances that auger the minimum SWR? I’m minded of the inflationary ’70s setting up American retirees of the late ’60s to fail. And the inflationary years in the first 20 years or so of the 20th Century dooming UK investors to a 3% SWR.

Does it help much if you accept a 10% failure rate, or go 100% equities? And are your numbers for the classic 50:50 portfolio, 30-year retirement?

You’ve mentioned previously that RPI inflation may partially explain why UK SWRs are lower than for the US. I wonder if the fact that our historical data relies on the performance of undated and long bonds during inflationary periods has also contributed vs typically shorter US maturities.

Sorry for all the questions. Genuinely interested.

@TA (#97):

One final thought from me on this matter – please bear in mind that a lot of folks [around the globe] believe that their respective authorities are deliberately under-reporting inflation.

@TA. There aren’t many years where the earnings-adjusted SWR drops much below say 50-75bp of the RPI-adjusted SWR and nothing in the last 50 years or so (end of Bretton-Woods period). The worst period seems that 1900-09 decade (using a 30 to 40-year period with a 50/50 to 70/30 split). More equities helps since earnings inflation and equity returns have been normally been positively correlated (exception last two decades).

With regard to US vs. UK, I see the US as the anomaly more than the UK. SWR aficionados like to explain away sub 1% SWR results but, oddly, are happy to keep the US at 4%. Earnings growth in the US has outstripped CPI-U more than UK earnings vs. RPI. That could be a difference in metric (RPI being structurally higher) or it could be just that the US (as the winner of the 20th century) just saw larger standard of living improvements. My feeling though is that RPI is a more ‘conservative’ measure than CPI-U i.e. I feel more comfortable with a 3% UK rule than a 4% US rule.

@TA thanks for a great thought provoking series and best of luck on your Decumulating journey, hopefully some periodic updates to come on Monevator !!